Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Eden reveals an overall ranking slightly below national averages considering recent, and medium term trends

Eden's population was around 3,563 as of November 2025. This reflected an increase of 138 people since the 2021 Census, which reported a population of 3,425. The change was inferred from the estimated resident population of 3,460 in June 2024 and an additional 60 validated new addresses since the Census date. This resulted in a density ratio of 37 persons per square kilometer. Eden's growth rate of 4.0% since the 2021 census exceeded the SA3 area's growth rate of 2.6%. The population growth was primarily driven by interstate migration, contributing approximately 70.0% of overall population gains during recent periods.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered, NSW State Government's SA2 level projections were used, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations were applied to all areas for years 2032 to 2041. According to this methodology, the area's population is expected to decline by 280 persons by 2041. However, specific age cohorts are anticipated to grow, notably the 85 and over age group, projected to increase by 95 people.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Eden recording a relatively average level of approval activity when compared to local markets analysed countrywide

Eden has recorded approximately 14 residential properties granted approval per year over the past five financial years, totalling 71 homes. In FY-26 so far, 1 approval has been recorded. On average, 1.8 people moved to the area for each dwelling built between FY-21 and FY-25. However, this figure has eased to 0.9 people per dwelling over the past two financial years. New properties are constructed at an average value of $368,000.

This year, $9.6 million in commercial approvals have been registered, indicating steady commercial investment activity. Compared to Rest of NSW, Eden shows around 75% of the construction activity per person and places among the 79th percentile nationally, though building activity has accelerated recently. New development consists of 71.0% detached dwellings and 29.0% townhouses or apartments, preserving Eden's low density nature.

With approximately 148 people per approval, Eden reflects a low density area. Population projections indicate stability or decline, suggesting reduced housing demand pressures, which could benefit potential buyers.

Frequently Asked Questions - Development

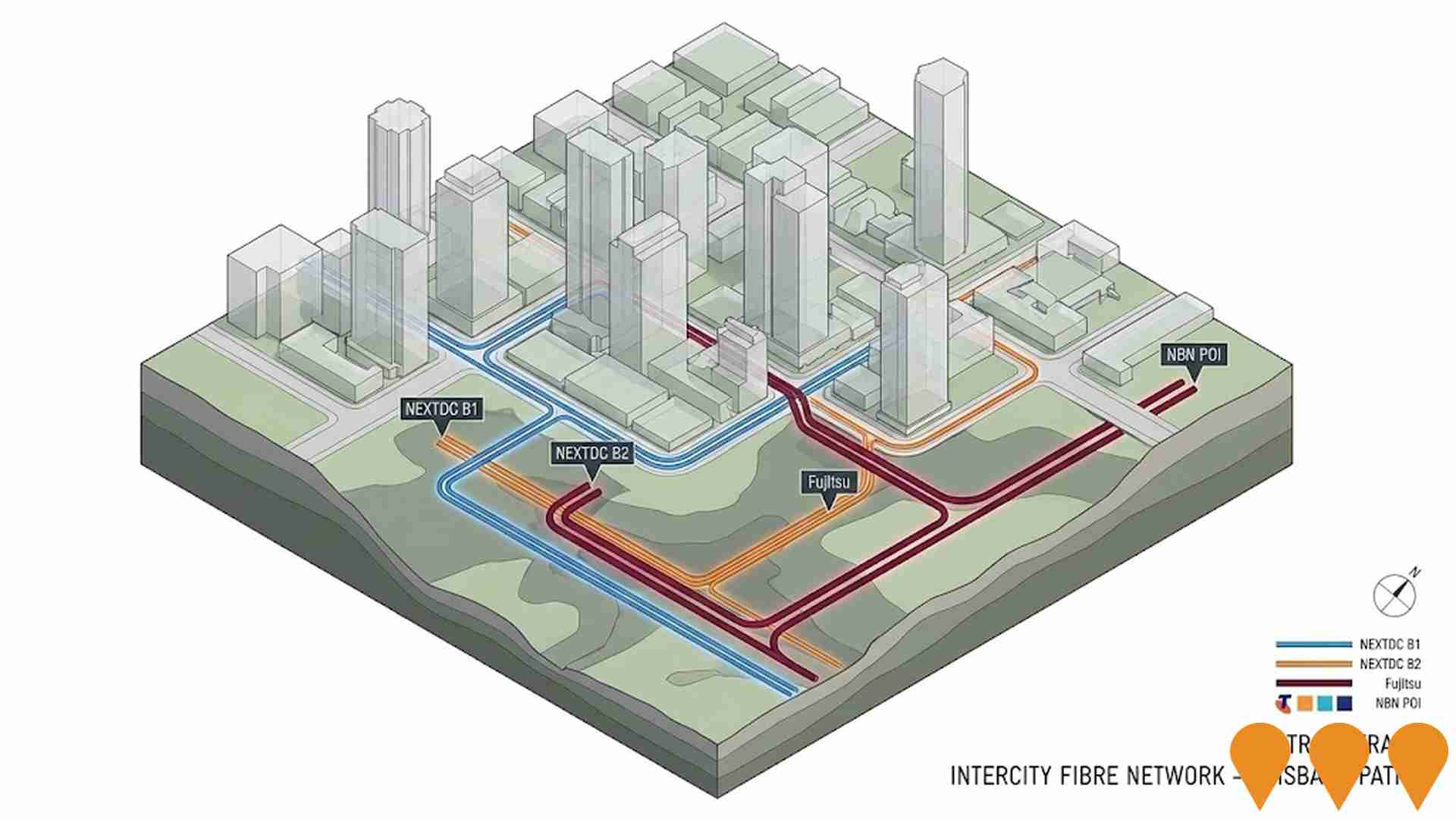

Infrastructure

Eden has emerging levels of nearby infrastructure activity, ranking in the 27thth percentile nationally

Changes in local infrastructure significantly impact an area's performance. AreaSearch identified ten projects likely to affect this region. Notable projects are Eden Town Centre Revitalisation, Fenbury - Eden (Cattle Bay), Sapphire of Eden, and Storey Avenue and Princes Highway Roadworks. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

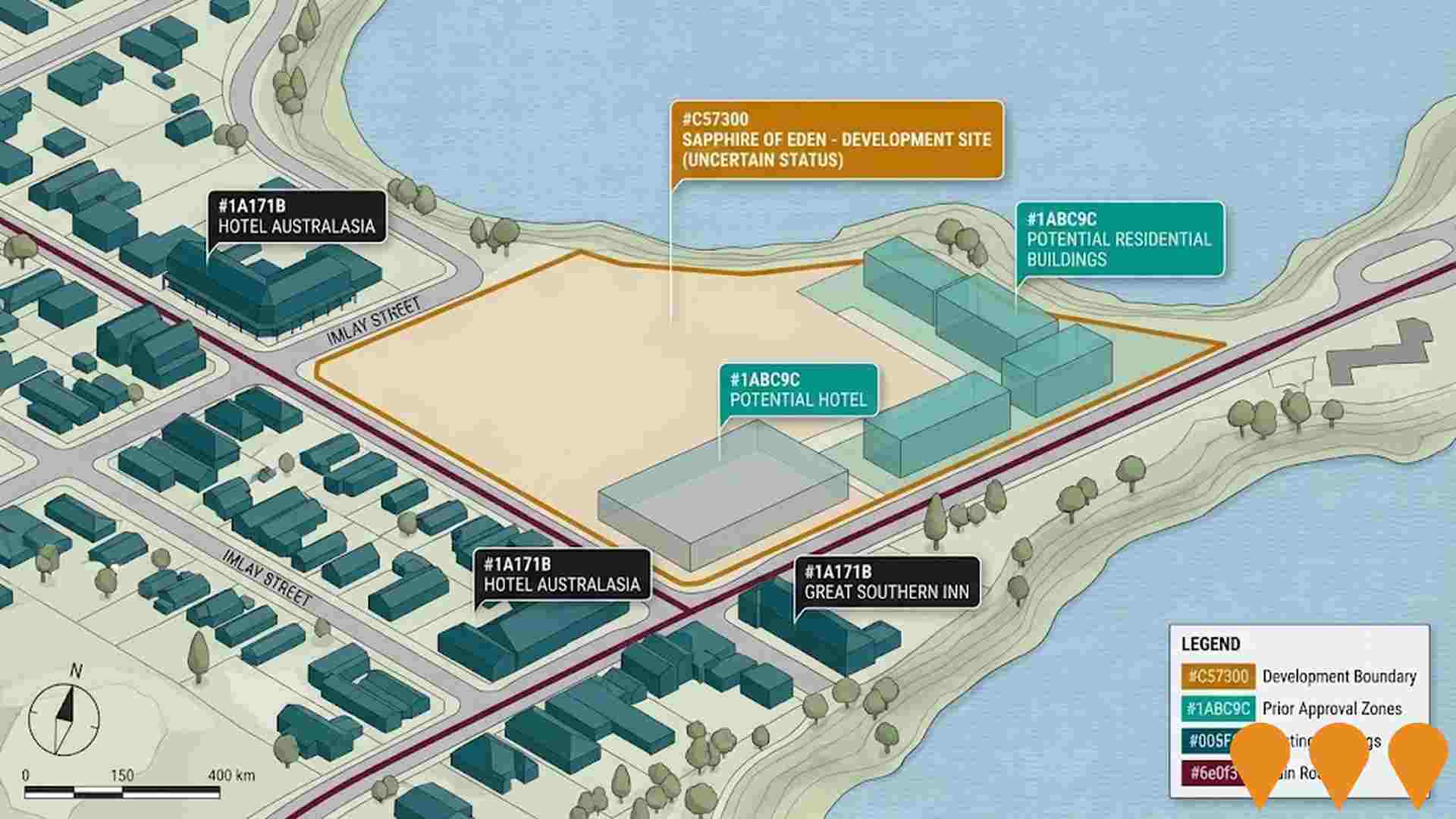

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

Fenbury - Eden (Cattle Bay)

Mixed-use tourism and maritime precinct at Cattle Bay, Eden. The approved works include a 154-berth marina with wave attenuator, car parking and supporting landside facilities. The broader Fenbury vision promotes a 4.5-star hotel, 103 serviced apartments and a conference and events centre at the adjoining Eden Point precinct.

Sapphire of Eden

Mixed-use scheme on a prominent corner site in Eden with prior DA approvals for three residential buildings (86 apartments) and a 78-room 5-star hotel. Original proponent Core Asset Development entered provisional liquidation in Feb 2025 and the site was subsequently sold by mortgagee in possession in mid-2025. Current owner has not been publicly announced; future delivery pathway is uncertain and any prior approvals should be verified for currency.

Eden Breakwater Wharf Extension

A $44 million State Significant Infrastructure project to extend the Breakwater Wharf at the Port of Eden, allowing larger cruise ships to berth directly in Snug Cove. Original extension (110m wharf face, dolphins, dredging) completed in August 2019. Modification 3 (approved May 2024) removes the seasonal cruise visit cap, permits overnight/24-hour berthing, increases maximum vessel length to ~370m, and includes minor additional works (one extra mooring dolphin and catwalk extension). Enables visits by larger vessels such as Ovation of the Seas (348m) and supports ongoing economic growth in the region through increased cruise tourism.

Eden Town Centre Revitalisation

Council-led upgrades to Eden's main street and public realm in line with the Eden CBD Landscape Master Plan. Current works include pavement renewal and resealing on Imlay Street between Chandos Street and Albert Terrace, with related town centre activation and heritage planning to support local business and pedestrian access.

Storey Avenue and Princes Highway Roadworks

Night roadworks involving stormwater and road upgrades along Storey Avenue and parts of the Princes Highway to improve road surface and safety. Scheduled for July 2025.

Allera Mixed-Use Development

Allera has partnered with a major private landowner to deliver a mixed-use development in Eden, NSW, located at Snug Cove Marina precinct on Twofold Bay. The project includes luxury waterfront residences, curated retail to complement the Cruise Wharf Terminal, a waterfront park, and a pedestrian promenade. Allera manages feasibility analysis, design, development, and town planning to enhance the local community and create a unique visitor destination. The project is in the planning stages, with expressions of interest invited from potential buyers and tenants.

Eden Cove Estate

A land subdivision project with lots for sale, positioned as a premium residential estate. The site is noted as being suitable for development of up to 4 units on some lots and is located close to the town centre with potential for water views.

Employment

Employment conditions in Eden face significant challenges, ranking among the bottom 10% of areas assessed nationally

Eden has an employment mix that includes both white and blue collar jobs, with tourism and hospitality sectors notably present. As of September 2025, the unemployment rate is 6.4%.

In comparison to Rest of NSW's rate of 3.8%, Eden's unemployment rate is 2.6% higher. Workforce participation in Eden stands at 44.4%, significantly lower than Rest of NSW's 56.4%. The dominant employment sectors among residents are health care & social assistance, retail trade, and accommodation & food. Notably, accommodation & food has a strong presence with an employment share of 1.6 times the regional level.

However, health care & social assistance has limited presence at 14.1%, compared to the regional average of 16.9%. Labour force levels in Eden decreased by 5.4% over the 12 months to September 2025, accompanied by a 5.5% employment decline, leading to an unemployment increase of 0.1 percentage points. In contrast, Rest of NSW saw employment fall by 0.5%, labour force contract by 0.1%, and unemployment rise by 0.4 percentage points. Statewide, NSW employment contracted by 0.03% (losing 2,260 jobs) as of 25-Nov, with an unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Eden's employment mix suggests local employment could grow by 6.0% over five years and 12.6% over ten years, though this is a simplified extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

AreaSearch's latest postcode level ATO data for financial year 2022 shows Eden SA2 had a median income of $41,129 and an average income of $51,051. These figures are lower than the national averages. For comparison, Rest of NSW had a median income of $49,459 and an average income of $62,998 in the same period. Based on Wage Price Index growth of 12.61% since financial year 2022, estimated incomes for Eden SA2 as of September 2025 would be approximately $46,315 (median) and $57,489 (average). Census data indicates that household, family, and personal incomes in Eden fall between the 3rd and 8th percentiles nationally. Income distribution shows that 30.6% of residents earn between $400 - 799 per week, differing from broader area patterns where earnings between $1,500 - 2,999 dominate with 29.9%. The prevalence of lower-income residents (40.1% earning less than $800/week) suggests constrained household budgets across much of the area. Housing affordability pressures are severe in Eden, with only 84.3% of income remaining after housing costs, ranking at the 5th percentile nationally.

Frequently Asked Questions - Income

Housing

Eden is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

The latest Census showed that in Eden, 79.3% of dwellings were houses, with the remaining 20.7% being semi-detached, apartments, or other types. In comparison, Non-Metro NSW had 84.3% houses and 15.7% other dwellings. Home ownership in Eden was at 47.4%, with mortgaged dwellings at 21.4% and rented ones at 31.2%. The median monthly mortgage repayment in Eden was $1,517, aligning with Non-Metro NSW's average. The median weekly rent in Eden was $270, compared to Non-Metro NSW's $320. Nationally, Eden's median mortgage repayments were lower at $1,517 than the Australian average of $1,863. Eden's median weekly rents were also lower at $270 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Eden features high concentrations of lone person households, with a fairly typical median household size

Family households account for 63.2% of all households, including 17.4% couples with children, 33.2% couples without children, and 11.6% single parent families. Non-family households constitute the remaining 36.8%, with lone person households at 33.9% and group households comprising 2.7% of the total. The median household size is 2.2 people, which aligns with the Rest of NSW average.

Frequently Asked Questions - Households

Local Schools & Education

Eden faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 14.5%, significantly lower than the NSW average of 32.2%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 10.4%, followed by graduate diplomas (2.2%) and postgraduate qualifications (1.9%). Trade and technical skills are prominent, with 40.8% of residents aged 15+ holding vocational credentials - advanced diplomas (10.0%) and certificates (30.8%).

Educational participation is high, with 26.3% of residents currently enrolled in formal education. This includes 10.2% in primary education, 7.8% in secondary education, and 1.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Eden's public transport analysis shows 55 active stops in operation, serving a mix of bus routes. These stops are covered by 22 individual routes, offering a total of 332 weekly passenger trips. Transport accessibility is rated good, with residents typically located 219 meters from the nearest stop.

Service frequency averages 47 trips per day across all routes, equating to approximately 6 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Eden is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Eden faces significant health challenges with various conditions affecting both younger and older residents. Approximately 46% (~1,653 people) have private health cover, lower than the national average of 55.3%.

The most prevalent medical conditions are arthritis (affecting 12.7% of residents) and mental health issues (8.6%), while 57.3% claim to be free from medical ailments, compared to 59.6% in Rest of NSW. Eden has a higher proportion of seniors aged 65 and over at 33.5% (1,193 people) than Rest of NSW's 31.7%. Health outcomes among seniors present challenges but perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Eden is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Eden's population shows lower cultural diversity, with 87.7% citizens, 87.2% born in Australia, and 96.4% speaking English only at home. Christianity is the predominant religion in Eden at 50.2%, compared to 49.0% across Rest of NSW. The top three ancestry groups are English (33.4%), Australian (28.9%), and Irish (8.4%).

Notably, Australian Aboriginal representation in Eden is higher at 5.9% (regional average: 3.6%), French at 0.6% (vs regional 0.4%), and Hungarian at 0.3% (vs regional 0.2%).

Frequently Asked Questions - Diversity

Age

Eden ranks among the oldest 10% of areas nationwide

Eden's median age in 2021 was 53, significantly higher than the Rest of NSW's figure of 43 and substantially exceeding the national norm of 38. Compared to Rest of NSW, Eden had a higher concentration of residents aged 65-74 (17.0%), but fewer residents aged 25-34 (7.7%). This 65-74 concentration was well above the national figure of 9.4%. Between the 2016 and 2021 censuses, Eden's population aged 75 to 84 grew from 9.6% to 12.4%, while the 45 to 54 cohort declined from 12.0% to 10.4% and the 65 to 74 group dropped from 18.4% to 17.0%. By 2041, demographic projections indicate significant shifts in Eden's age structure. The 85+ group is projected to grow by 68%, reaching 243 people from 144. This growth will be driven entirely by the aging population dynamic, with those aged 65 and above comprising all of the projected growth. Conversely, both the 25 to 34 and 0 to 4 age groups are projected to decrease in number.