Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Merimbula - Tura Beach are above average based on AreaSearch's ranking of recent, and medium to long-term trends

Based on AreaSearch's analysis, Merimbula - Tura Beach's population is around 11,635 as of Nov 2025. This reflects an increase of 122 people since the 2021 Census, which reported a population of 11,513 people. The change is inferred from the estimated resident population of 11,617 from the ABS as of June 2024 and an additional 80 validated new addresses since the Census date. This level of population equates to a density ratio of 119 persons per square kilometer. Over the past decade, Merimbula - Tura Beach has demonstrated resilient growth patterns with a compound annual growth rate of 1.0%, outpacing the SA3 area. Population growth for the area was primarily driven by interstate migration that contributed approximately 62.6% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, AreaSearch is utilising the NSW State Government's SA2 level projections, as released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are also applied to all areas for years 2032 to 2041. Looking at population projections moving forward, an above median population growth of non-metropolitan areas nationally is projected, with the area expected to grow by 1,781 persons to 2041 based on the latest annual ERP population numbers, reflecting a gain of 15.1% in total over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Merimbula - Tura Beach when compared nationally

Merimbula - Tura Beach has seen approximately 50 dwelling approvals annually over the past five financial years, totaling 253 homes. As of FY-26, 13 approvals have been recorded. On average, 1.4 new residents per year per dwelling constructed were noted between FY-21 and FY-25, indicating a balanced supply and demand market with stable conditions. The average construction value for new dwellings was $387,000.

This financial year has also seen $12.6 million in commercial approvals, demonstrating moderate commercial development levels compared to the rest of NSW. Merimbula - Tura Beach shows around 75% of the construction activity per person and ranks among the 71st percentile nationally. Recent years have seen intensified construction activity, with a shift towards medium and high-density housing (51%) over detached dwellings (49%). This change marks a departure from the current housing pattern of 75% houses, suggesting diminishing developable land availability and responding to evolving lifestyle preferences and affordability needs. The area has approximately 206 people per dwelling approval, indicating a low density market.

According to AreaSearch's latest quarterly estimate, Merimbula - Tura Beach is projected to grow by 1,762 residents by 2041. Development activity is keeping pace with this projected growth, though increasing competition among buyers may arise as the population expands.

Frequently Asked Questions - Development

Infrastructure

Merimbula - Tura Beach has limited levels of nearby infrastructure activity, ranking in the 16thth percentile nationally

Changes to local infrastructure significantly affect an area's performance. AreaSearch has identified 14 projects that could impact this region. Notable ones include Templo Merimbula, Club Sapphire Hotel and Conference Centre, Lakewood Lifestyle Village, and Supercheap Auto and BCF Merimbula. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

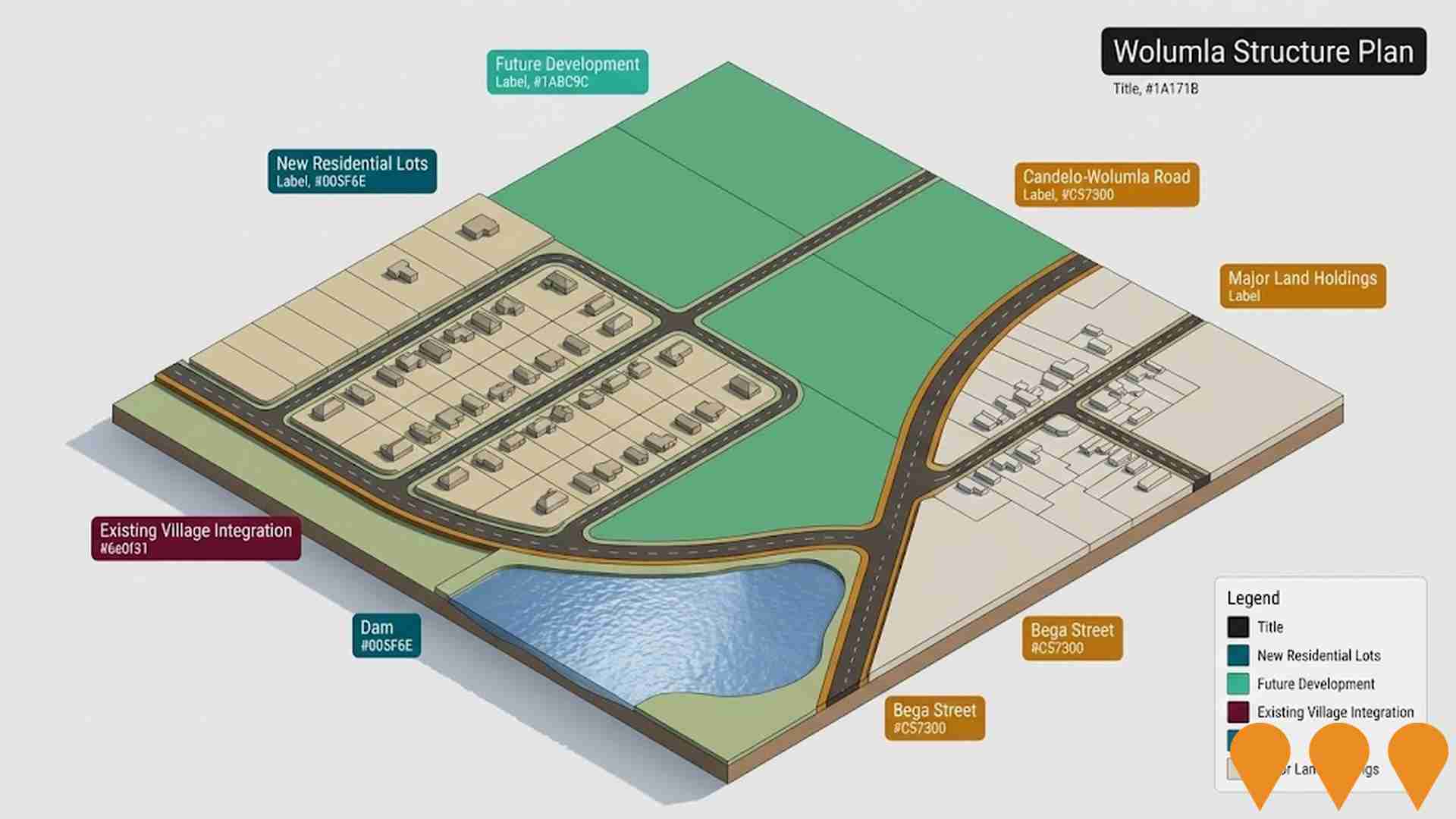

Wolumla Structure Plan

Adopted structure plan providing a strategic framework for the development of approximately 1,096 new dwellings across three major land holdings in Wolumla. The plan guides infrastructure provision including transport networks, utilities, and community facilities to integrate new residential areas with the existing village. Council secured $50,380 in funding in July 2025 to prepare an infrastructure contributions plan. The development will effectively triple Wolumla's population over an estimated 25-year timeframe and addresses housing shortage in the Bega Valley Shire.

Lakewood Lifestyle Village

An 86-unit seniors housing facility in Merimbula approved by the NSW Land and Environment Court following a deemed refusal by the Bega Valley Shire Council. The amended proposal includes independent living units, communal and recreational facilities, parking, and landscaping, with a reduced scale to address community concerns about height, bulk, and visual impact.

Club Sapphire Hotel and Conference Centre

Proposal for a 100-room, four-plus star hotel and conference facility, approximately five to seven storeys, to be built atop the existing Club Sapphire. The development is part of the club's strategy to diversify income streams and reduce reliance on gaming revenue. It requires a planning proposal to amend the maximum building height on the site from 16m to 21m or 26m. The concept development application (DA) is on hold pending the finalisation of the planning proposal.

Templo Merimbula

A luxury short stay hotel precinct, renamed 'Mati' by the developer, consisting of a hotel and 14 townhouses, plus a restaurant. The design uses the natural slope of the emerald hill to maximize ocean views from the living spaces, and incorporates endemic planting and durable materials to blend with the coastal environment. The project was Development Application approved in 2024.

Ocean Drive Townhouse and Apartment Complex

Development Application (DA2021.365) to be determined by the Southern Regional Planning Panel (PPSSTH-173) for a complex of 27 townhouses and 32 apartments with basement parking on a site at 63 Ocean Drive and 460 Arthur Kane Drive, Merimbula. Concerns have been raised regarding density, bulk, and scale of the development. Council assessment staff provided non-support of the application and requested it be withdrawn as of May 2023. A Public Determination Meeting was scheduled for July 28, 2023.

Mirador Residential Development Stages 8, 9 and 13

The proposed action is the final stages (8, 9, and 13) of the Mirador residential development, involving the clearing of approximately 21.39 ha of native vegetation on a 52.5 ha site for low-density housing lots and associated infrastructure. The development is subject to a Federal environmental assessment due to potential significant impacts on threatened species and habitat, including the long-nosed potoroo and Merimbula Star-hair. The development is anticipated to accommodate between 126 and 252 residents upon completion and has an estimated start date of January 2025.

Shearwater Estate

New residential land subdivision and construction of homes in central Tura Beach. The estate offers spacious residential lots ranging from 900m2 to 1500m2 on level ground. Infrastructure like roads, power, water, and sewage are being installed, and new homes are being built/sold, indicating the project is in the construction phase.

Club Sapphire Residential Development (DA Approved - Site For Sale)

A previously approved residential development for a four-storey complex with 40 luxury apartments and 68 car spaces on a 4,084sqm site. The project was put on hold due to rising construction costs and the site is currently being advertised for sale by the developer. The site has Development Approval (DA) for the 40-unit residential flat building and strata subdivision.

Employment

Despite maintaining a low unemployment rate of 2.5%, Merimbula - Tura Beach has experienced recent job losses, resulting in a below average employment performance ranking when compared nationally

Merimbula - Tura Beach had an unemployment rate of 2.5% as of September 2025, with 5,093 residents employed. This rate was 1.3% lower than the Rest of NSW's rate of 3.8%.

Workforce participation in Merimbula - Tura Beach was 49.5%, compared to 56.4% in the Rest of NSW. Key industries for employment among residents were health care & social assistance, accommodation & food, and retail trade. The area had a particularly strong specialization in accommodation & food, with an employment share 1.7 times the regional level, while mining showed lower representation at 0.2%. Over the 12 months prior to September 2025, labour force decreased by 5.4% alongside a 5.7% employment decline, causing unemployment rate to rise by 0.2 percentage points.

In contrast, Rest of NSW saw employment contract by 0.5%, labour force fall by 0.1%, and unemployment rise by 0.4 percentage points. As of 25-November 2025, NSW employment had contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. National unemployment rate was 4.3%. Jobs and Skills Australia's national employment forecasts from May-2025 projected national employment to expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Merimbula - Tura Beach's employment mix suggested local employment should increase by 6.4% over five years and 13.3% over ten years, though this was a simple weighting extrapolation for illustrative purposes and did not take into account localised population projections.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

The Merimbula - Tura Beach SA2 had a lower than average income level nationally according to ATO data aggregated by AreaSearch for the financial year ending 30 June 2022. The median income among taxpayers was $44,236 and the average income stood at $57,377. In comparison, Rest of NSW's figures were $49,459 and $62,998 respectively. By September 2025, estimated incomes would be approximately $49,814 (median) and $64,612 (average), based on Wage Price Index growth of 12.61% since the financial year ending 30 June 2022. Census data shows that household, family, and personal incomes in Merimbula - Tura Beach fall between the 15th and 24th percentiles nationally. Income distribution data indicates that the $1,500 - $2,999 earnings band captures 28.7% of the community (3,339 individuals), which is consistent with broader trends across the surrounding region showing 29.9% in the same category. After housing costs, 86.0% of income remains, ranking at the 18th percentile nationally. The area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Merimbula - Tura Beach is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

In Merimbula-Tura Beach, as per the latest Census, 74.7% of dwellings were houses while 25.4% comprised semi-detached homes, apartments, and other types. This contrasts with Non-Metro NSW's 84.3% houses and 15.7% other dwellings. Home ownership in Merimbula-Tura Beach stood at 51.3%, similar to Non-Metro NSW, with the rest being mortgaged (26.3%) or rented (22.4%). The median monthly mortgage repayment in the area was $1,600, higher than Non-Metro NSW's average of $1,517. The median weekly rent was $340, compared to Non-Metro NSW's $320. Nationally, Merimbula-Tura Beach's mortgage repayments were lower than the Australian average of $1,863, and rents were less than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Merimbula - Tura Beach features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 64.9% of all households, including 19.4% couples with children, 37.3% couples without children, and 7.8% single parent families. Non-family households account for the remaining 35.1%, with lone person households at 32.5% and group households comprising 2.5%. The median household size is 2.1 people, which is smaller than the Rest of NSW average of 2.2.

Frequently Asked Questions - Households

Local Schools & Education

Merimbula - Tura Beach shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

Merimbula's residents aged 15+, as of a recent report, have 23.2% with university degrees, compared to NSW's 32.2%. Among Merimbula's degree holders, bachelor's are most common at 15.6%, followed by postgraduate qualifications (4.1%) and graduate diplomas (3.5%). Vocational credentials are held by 40.3% of residents aged 15+, with advanced diplomas at 11.3% and certificates at 29.0%. Currently, 22.1% of the population is actively engaged in formal education, including 8.2% in primary, 6.9% in secondary, and 2.1% in tertiary education.

A substantial 22.1% of the population actively pursues formal education. This includes 8.2% in primary education, 6.9% in secondary education, and 2.1% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Merimbula - Tura Beach shows that there are 202 active transport stops currently operating. These stops serve a mix of bus routes, totalling 43 individual routes. Together, these routes facilitate 542 weekly passenger trips.

The accessibility to transport is rated as excellent, with residents typically located just 164 meters from the nearest transport stop. On average, there are 77 trips per day across all routes, which equates to approximately two weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Merimbula - Tura Beach is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Health data shows significant challenges for Merimbula - Tura Beach, with high prevalence of common conditions across both younger and older age groups. Private health cover stands at approximately 48% (around 5,619 people), lower than the national average of 55.3%.

The most prevalent medical conditions are arthritis (12.6%) and mental health issues (8.4%). Around 59.9% of residents report no medical ailments, similar to Rest of NSW at 59.6%. The area has a higher proportion of residents aged 65 and over, at 34.0% (3,959 people), compared to 31.7% in Rest of NSW.

Frequently Asked Questions - Health

Cultural Diversity

Merimbula - Tura Beach is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Merimbula-Tura Beach showed cultural diversity below average levels, with 84.5% of residents born in Australia, 91.1% being citizens, and 96.0% speaking English only at home. Christianity was the predominant religion, at 48.0%. Judaism, however, was overrepresented at 0.1%, compared to 0.1% across Rest of NSW.

The top three ancestry groups were English (34.5%), Australian (29.0%), and Irish (9.4%). Notably, Dutch ethnicity was slightly higher than regional averages at 1.6%. Scottish and Welsh ethnicities also showed slight overrepresentation at 8.7% and 0.6%, respectively.

Frequently Asked Questions - Diversity

Age

Merimbula - Tura Beach ranks among the oldest 10% of areas nationwide

Merimbula - Tura Beach has a median age of 53, which is higher than Rest of NSW's figure of 43 and substantially exceeds the national norm of 38. Compared to Rest of NSW, Merimbula - Tura Beach has a higher concentration of residents aged 65-74 (17.6%) but fewer residents aged 5-14 (9.0%). This concentration of 65-74 year-olds is well above the national figure of 9.4%. Between the 2021 Census and present, the population aged 75 to 84 has grown from 10.9% to 12.2%, while the 35 to 44 cohort increased from 8.7% to 9.9%. Conversely, the 55 to 64 cohort declined from 16.3% to 14.3%, and the 65 to 74 group dropped from 18.7% to 17.6%. By 2041, demographic projections show significant shifts in Merimbula - Tura Beach's age structure. The 85+ group is projected to grow by 101%, reaching 973 people from 484. Meanwhile, the 15 to 24 cohort is projected to decline by 26 people.