Chart Color Schemes

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Somerset is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Based on analysis of ABS population updates for Somerset, Tasmania, and new addresses validated by AreaSearch, as of November 2025, the suburb's estimated population is around 4,242. This reflects an increase of 175 people since the 2021 Census, which reported a population of 4,067. The change is inferred from AreaSearch's estimation of the resident population at 4,229 following examination of the latest ERP data release by the ABS in June 2024, along with an additional 49 validated new addresses since the Census date. This level of population equates to a density ratio of 157 persons per square kilometer. Somerset's growth rate of 4.3% since the 2021 census exceeded that of the SA3 area at 4.1%, marking it as a growth leader in the region. Population growth was primarily driven by interstate migration, contributing approximately 83.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data and to estimate growth by age group post-2032, Tasmania State Government's Regional/LGA projections are adopted with adjustments made employing a method of weighted aggregation from LGA to SA2 levels. As we examine future population trends, projections indicate an overall decline in the suburb's population, expected to contract by 357 persons by 2041 according to this methodology. However, growth across specific age cohorts is anticipated, led by the 75 to 84 age group, projected to expand by 180 people.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Somerset according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers allocated from statistical area data indicates Somerset has seen approximately 12 new homes approved annually. Over the past five financial years, between FY-21 and FY-25, around 60 homes were approved, with an additional two approved in FY-26 so far. This suggests solid demand for housing, supporting property values.

The average value of new homes being built is $569,000, indicating a focus on the premium segment with upmarket properties. There have also been $554,000 in commercial approvals this financial year, predominantly residential. Compared to Rest of Tas., Somerset records about three-quarters the building activity per person and places among the 35th percentile nationally, resulting in relatively constrained buyer choice and interest in existing dwellings. This level is below average nationally, reflecting the area's maturity and possible planning constraints.

New construction has been entirely comprised of detached dwellings, preserving the area's low density nature with an emphasis on detached housing attracting space-seeking buyers. The estimated count of 467 people per dwelling approval reflects its quiet, low activity development environment. Population projections show stability or decline in Somerset, indicating reduced housing demand pressures and benefiting potential buyers.

Frequently Asked Questions - Development

Infrastructure

Somerset has emerging levels of nearby infrastructure activity, ranking in the 21stth percentile nationally

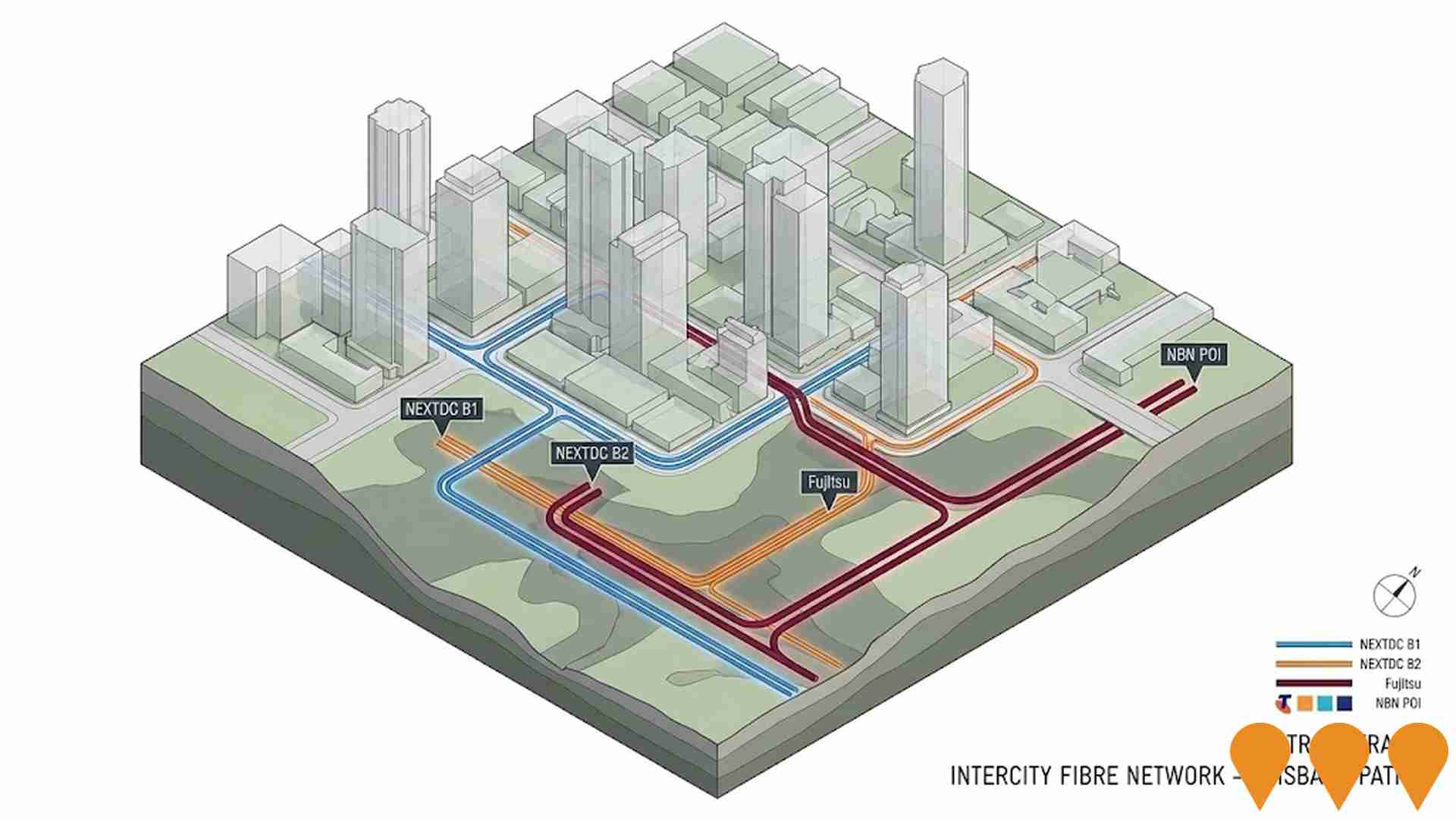

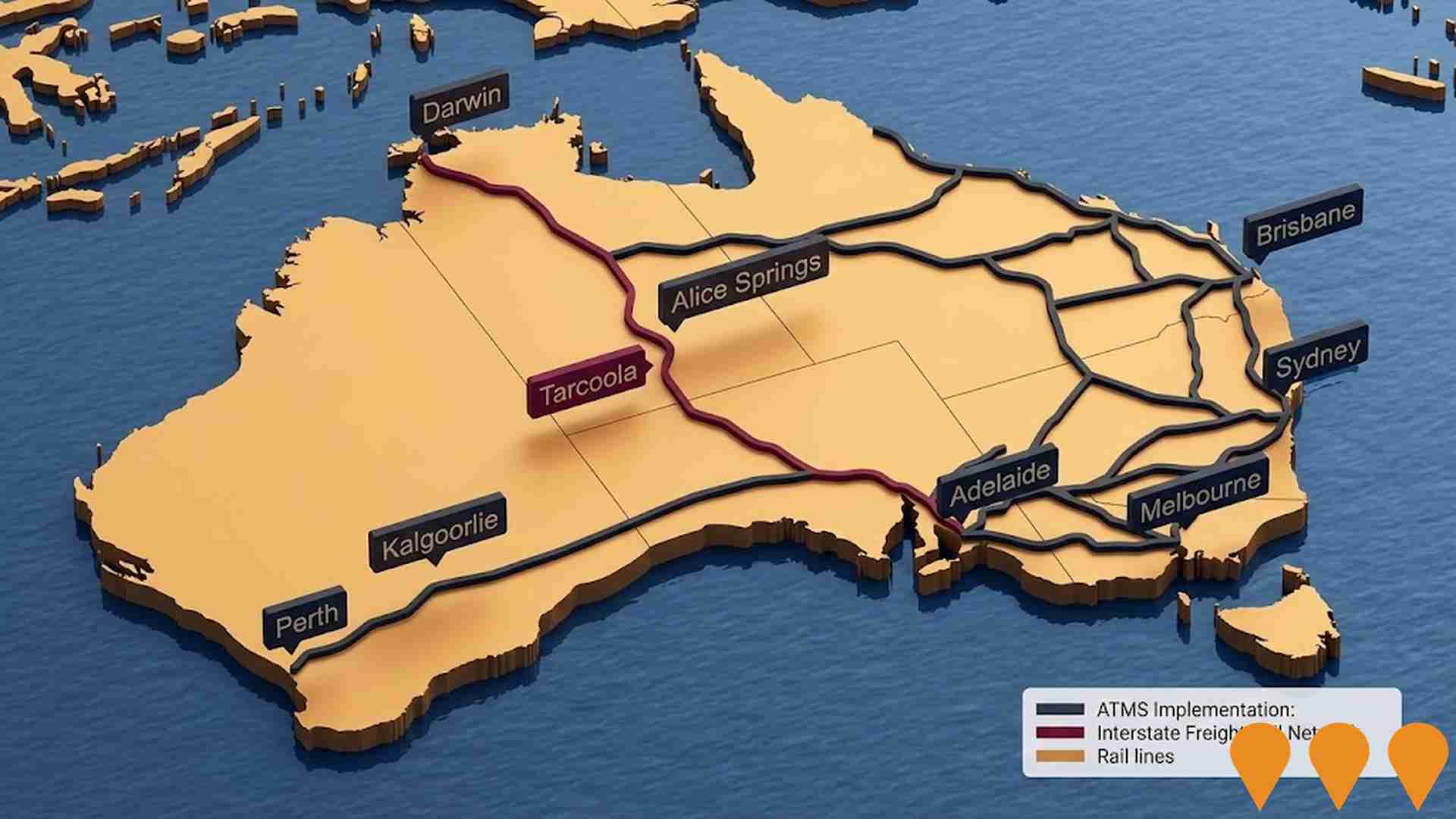

The performance of an area is significantly influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified three projects that are expected to impact the area. These key projects include the Langley Park Clubroom Redevelopment and Amenities Upgrade, Draft Outline Development Plan - Malakoff Street, North West Coastal Pathway - Wynyard to Burnie Section, and Marinus Link. The following list details those projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Marinus Link

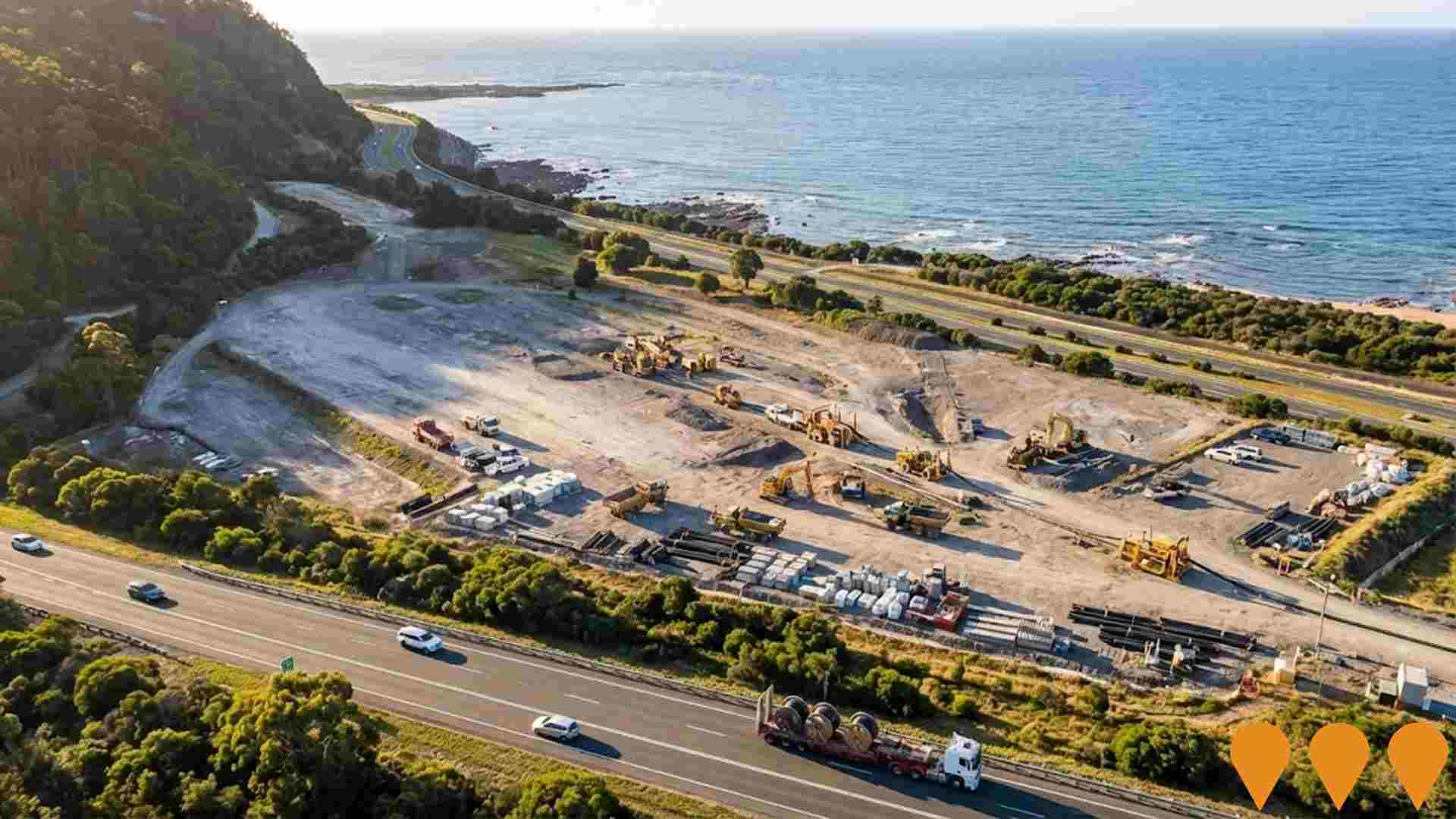

Marinus Link is a 1,500 MW (2 x 750 MW) high-voltage direct current (HVDC) electricity and telecommunications interconnector between north-west Tasmania and the Latrobe Valley in Victoria. Stage 1 (750 MW) comprises approximately 255 km of subsea HVDC cable across Bass Strait and 90 km of underground HVDC cable in Gippsland, with converter stations at Heybridge (TAS) and Hazelwood (VIC). Early works and major procurement contracts are in place, with main construction now underway for a target energisation in 2030.

Marinus Link Stage 1

Marinus Link Stage 1 is a proposed 750 MW high-voltage direct current (HVDC) electricity interconnector between North West Tasmania and Victoria. It comprises approximately 255 km of undersea HVDC cable across Bass Strait and 90 km of underground HVDC cable in Gippsland, Victoria. The project received Australian Government approval in September 2025 and is targeting Final Investment Decision in late 2025, with construction expected to commence in 2026-2027 and commissioning by 2030.

Enabling Infrastructure for Hydrogen Production

Australia has completed the National Hydrogen Infrastructure Assessment (NHIA) to 2050 and refreshed its National Hydrogen Strategy (2024). The programmatic focus has shifted to planning and enabling infrastructure through measures such as ARENA's Hydrogen Headstart and the Hydrogen Production Tax Incentive (from April 2025). Round 2 of Hydrogen Headstart consultation occurred in 2025. Collectively these actions aim to coordinate investment in transport, storage, water and electricity inputs linked to Renewable Energy Zones and priority hubs, supporting large-scale renewable hydrogen production and future export supply chains.

North West Transmission Developments

240km of new and upgraded transmission lines and energy infrastructure to increase Tasmania's electricity network capacity. Supporting infrastructure for Marinus Link. The North West Transmission Developments (NWTD) are intended to support Tasmania's renewable energy future. Main construction anticipated to commence in 2026 following final investment decision.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

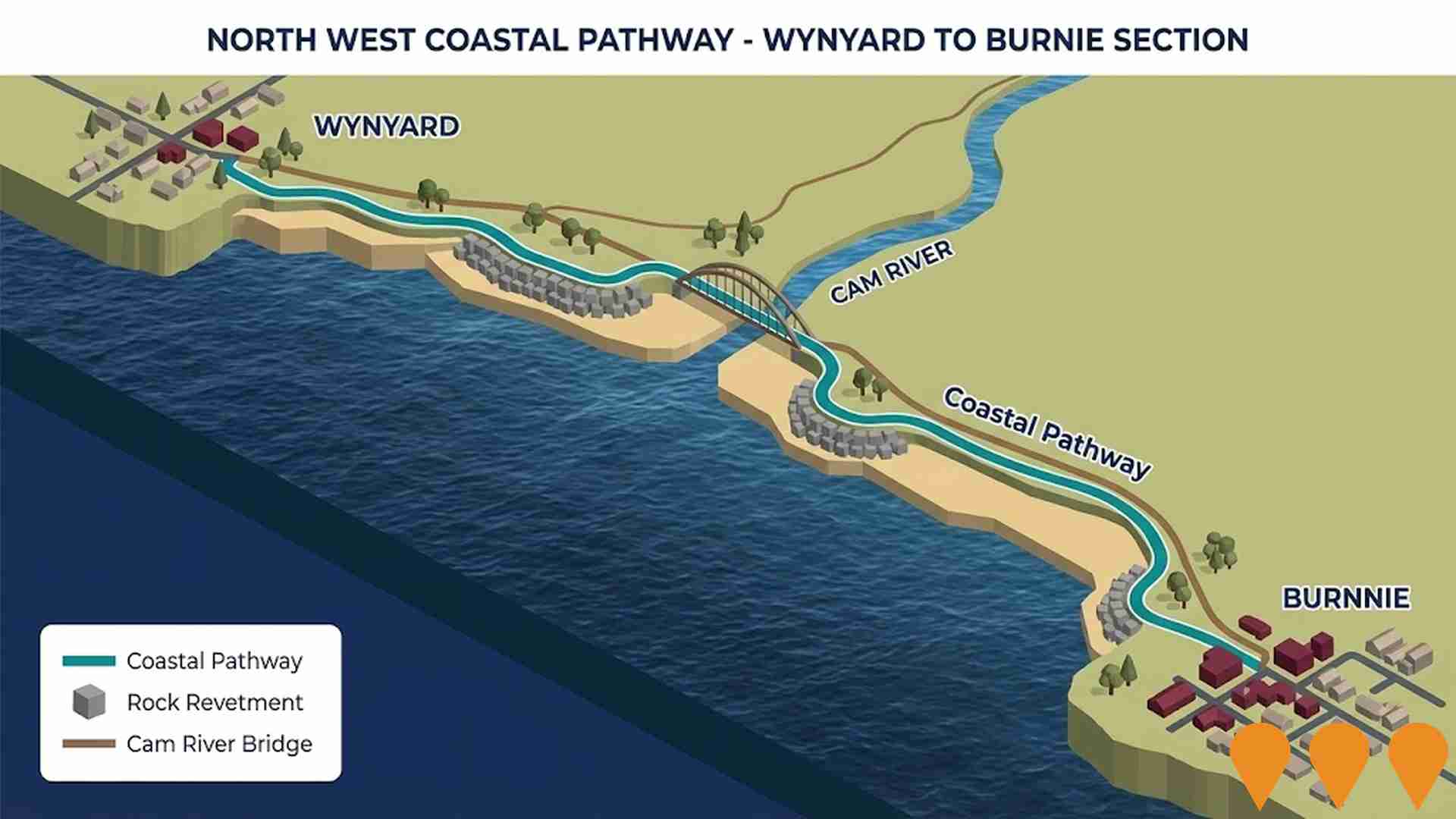

North West Coastal Pathway - Wynyard to Burnie Section

The North West Coastal Pathway is a 13.2 km shared coastal pathway that runs between Burnie and Wynyard. The project involved transforming a disused rail line into a path for cycling and walking, and included the construction of seven rock revetment structures to prevent coastal erosion. The path features a new walking and cycling bridge over the Cam River and a 2.6m wide asphalt surface. Landscaping works are ongoing with planting to be completed by the end of April 2025.

Bass Highway Wynyard to Marrawah Corridor Strategy

The Bass Highway Wynyard to Marrawah Corridor Strategy focuses on addressing current and future road demands and the condition of the highway. It includes road realignments, new overtaking lanes, junction upgrades, and other improvements to enhance safety, improve travel time, and support growth.

Langley Park Clubroom Redevelopment and Amenities Upgrade

The project involves the redevelopment and upgrade of the Langley Park clubrooms and amenities as part of the Somerset Sporting Precinct Master Plan. The lighting upgrade for the sporting precinct is already complete. Further improvements are planned for the next year.

Employment

Employment performance in Somerset has been broadly consistent with national averages

Somerset has a diverse workforce with both white and blue collar jobs, notably in essential services. Unemployment stands at 3.6%, with an estimated employment growth of 2.4% over the past year (AreaSearch data).

As of June 2025, 1,910 residents are employed, with an unemployment rate of 0.3% lower than Rest of Tas.'s 3.9%. Workforce participation is at 52.6%, compared to Rest of Tas.'s 55.7%. Key industries include health care & social assistance, retail trade, and education & training. Mining is particularly strong, with an employment share 3.2 times the regional level.

Conversely, agriculture, forestry & fishing is under-represented at 2.5% compared to Rest of Tas.'s 8.4%. Employment opportunities locally may be limited, as indicated by Census data. Between June 2024 and June 2025, employment levels increased by 2.4%, labour force by 2.2%, reducing the unemployment rate by 0.2 percentage points. In contrast, Rest of Tas. saw employment fall by 0.5% and labour force contract by 0.6%. Jobs and Skills Australia's forecasts from Sep-22 suggest national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Somerset's industry mix, local employment is expected to grow by 6.2% over five years and 13.4% over ten years.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows income in Somerset is below the national average. The median income is $49,921 and the average income stands at $58,506. This contrasts with Rest of Tas.'s figures where the median income is $47,358 and the average income is $57,384. Based on Wage Price Index growth of 13.83% since financial year 2022, current estimates for Somerset would be approximately $56,825 (median) and $66,597 (average) as of September 2025. Census 2021 income data shows household, family and personal incomes in Somerset all fall between the 7th and 12th percentiles nationally. The earnings profile indicates that 29.7% of locals (1,259 people) predominantly earn within the $400 - $799 category, unlike regional trends where 28.5% fall within the $1,500 - $2,999 range. After housing costs, 86.2% of income remains, ranking at only the 10th percentile nationally.

Frequently Asked Questions - Income

Housing

Somerset is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Somerset's dwelling structures, as per the latest Census, comprised 89.9% houses and 10.1% other dwellings. In comparison, Non-Metro Tas. had 90.3% houses and 9.7% other dwellings. Home ownership in Somerset stood at 41.1%, with mortgaged dwellings at 30.7% and rented ones at 28.2%. The median monthly mortgage repayment was $1,192, lower than Non-Metro Tas.'s average of $1,200. The median weekly rent in Somerset was $240, matching Non-Metro Tas.'s figure but significantly lower than the national average of $375. Nationally, mortgage repayments were higher at $1,863 compared to Somerset's figures.

Frequently Asked Questions - Housing

Household Composition

Somerset features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 65.1% of all households, including 20.7% couples with children, 31.7% couples without children, and 12.2% single parent families. Non-family households constitute the remaining 34.9%, with lone person households at 32.8% and group households comprising 2.2% of the total. The median household size is 2.2 people, which is smaller than the Rest of Tas. average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Somerset faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 12.6%, significantly lower than the Australian average of 30.4%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 8.8%, followed by postgraduate qualifications (2.3%) and graduate diplomas (1.5%). Trade and technical skills are prominent, with 39.7% of residents aged 15+ holding vocational credentials - advanced diplomas (8.8%) and certificates (30.9%).

A total of 24.7% of the population is actively pursuing formal education, including 10.1% in primary, 7.6% in secondary, and 2.8% in tertiary education. The area has two schools - Somerset Primary School and Australian Christian College - Burnie, serving a combined total of 378 students, with an ICSEA score of 948 indicating varied educational conditions. There is one primary school and one K-12 school in the area. The school places per 100 residents (8.9) are below the regional average (16.2), suggesting some students may attend schools in nearby areas.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Somerset has 32 active public transport stops. These are bus stops serviced by 86 routes. Weekly, these routes facilitate 9720 passenger trips.

Residents' average distance to the nearest stop is 241 meters. Daily service frequency averages 1388 trips across all routes, equating to around 303 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Somerset is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Somerset faces significant health challenges, with various conditions affecting both younger and older residents.

Approximately half of its population (around 2,136 people) has private health cover. The most prevalent medical conditions are arthritis (affecting 11.0% of residents) and mental health issues (impacting 10.6%). Conversely, 58.9% of residents claim to be free from medical ailments, compared to 60.3% in the Rest of Tas.. The area has a higher proportion of seniors aged 65 and over, at 26.6% (1,128 people), than the Rest of Tas., which stands at 24.7%. Health outcomes among seniors present challenges similar to those faced by the general population.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Somerset placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Somerset had a lower than average cultural diversity, with 91.5% of its population born in Australia, 92.5% being citizens, and 97.6% speaking English only at home. The predominant religion was Christianity, comprising 43.1% of Somerset's population. Judaism was not represented in Somerset, mirroring the 0.0% figure across Rest of Tas..

The top three ancestry groups were Australian (35.0%), English (34.8%), and Irish (7.7%). Some ethnic groups had notable differences: Australian Aboriginal was slightly overrepresented at 5.7%, Dutch at 1.5%, and Welsh at 0.5%.

Frequently Asked Questions - Diversity

Age

Somerset hosts an older demographic, ranking in the top quartile nationwide

Somerset has a median age of 48, which is higher than the Rest of Tasmania's figure of 45 and well above the national average of 38. The 55-64 age group constitutes 16.2% of Somerset's population, compared to the Rest of Tasmania, while the 25-34 cohort makes up 10.0%. Post the 2021 Census, the 55-64 age group has increased from 15.3% to 16.2%, and the 5-14 age group has decreased from 11.0% to 9.9%. By 2041, demographic modeling indicates Somerset's age profile will change significantly. The 75-84 age cohort is projected to grow by 160 people (43%), from 377 to 538. Notably, the combined 65+ age groups are expected to account for 100% of total population growth, reflecting the area's aging demographic profile. Conversely, population declines are projected for the 45-54 and 0-4 age cohorts.