Chart Color Schemes

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Penola is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Penola's population was 3,107 as of the 2021 Census. By Nov 2025, it had increased to around 3,205, a rise of 98 people (3.2%). This growth is inferred from ABS estimates and validated new addresses. The population density in Penola was 2.1 persons per square kilometer as of Nov 2025. Between the Census date and June 2024, natural growth contributed approximately 57.1% of overall population gains. AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022.

For areas not covered by this data and years post-2032, the SA State Government's Regional/LGA projections are adopted with adjustments made using weighted aggregation methods. Based on demographic trends, Australia's regional areas are expected to have lower quartile growth. Penola is projected to increase by 68 persons to 2041, reflecting a total increase of 1.7% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Penola, placing the area among the bottom 25% of areas assessed nationally

Penola has averaged approximately six new dwelling approvals per year over the past five financial years, totalling 33 homes. As of FY-26, four approvals have been recorded. On average, 1.1 people have moved to the area annually for each dwelling built between FY-21 and FY-25, indicating a balanced supply and demand market with stable conditions. New homes are being constructed at an average expected cost of $346,000.

This financial year has seen $5.4 million in commercial development approvals, reflecting the area's residential character. Compared to the rest of South Australia, Penola has significantly less development activity, 58.0% below the regional average per person. This constrained new construction typically reinforces demand and pricing for existing properties, which is also under the national average, suggesting an established nature with potential planning limitations. All new construction in Penola has been detached dwellings, preserving its low-density character and attracting space-seeking buyers. The estimated population per dwelling approval is 583 people, reflecting a quiet development environment.

Future projections estimate Penola will add 55 residents by 2041, with current development rates comfortably meeting demand and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Penola has limited levels of nearby infrastructure activity, ranking in the 5thth percentile nationally

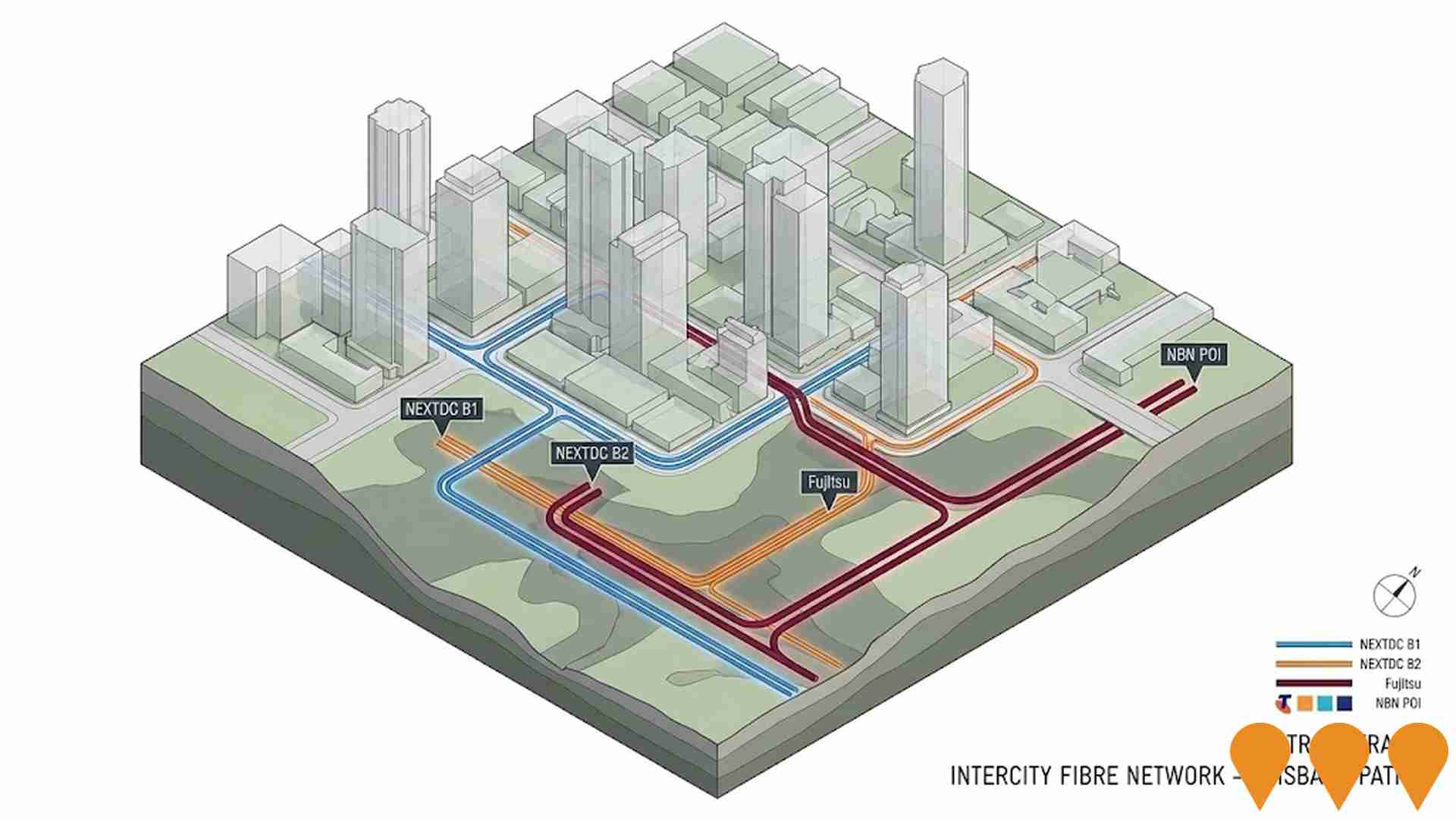

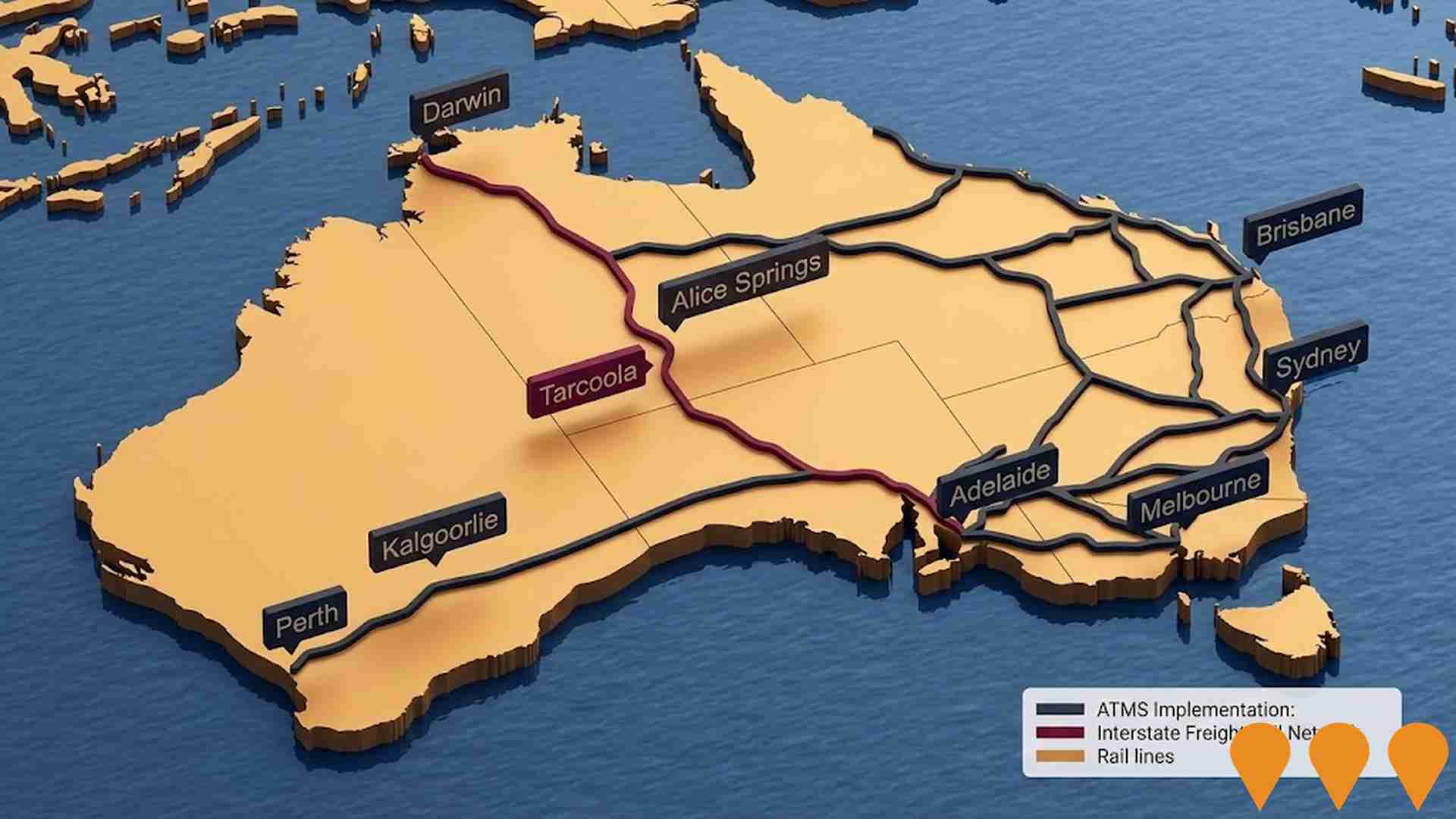

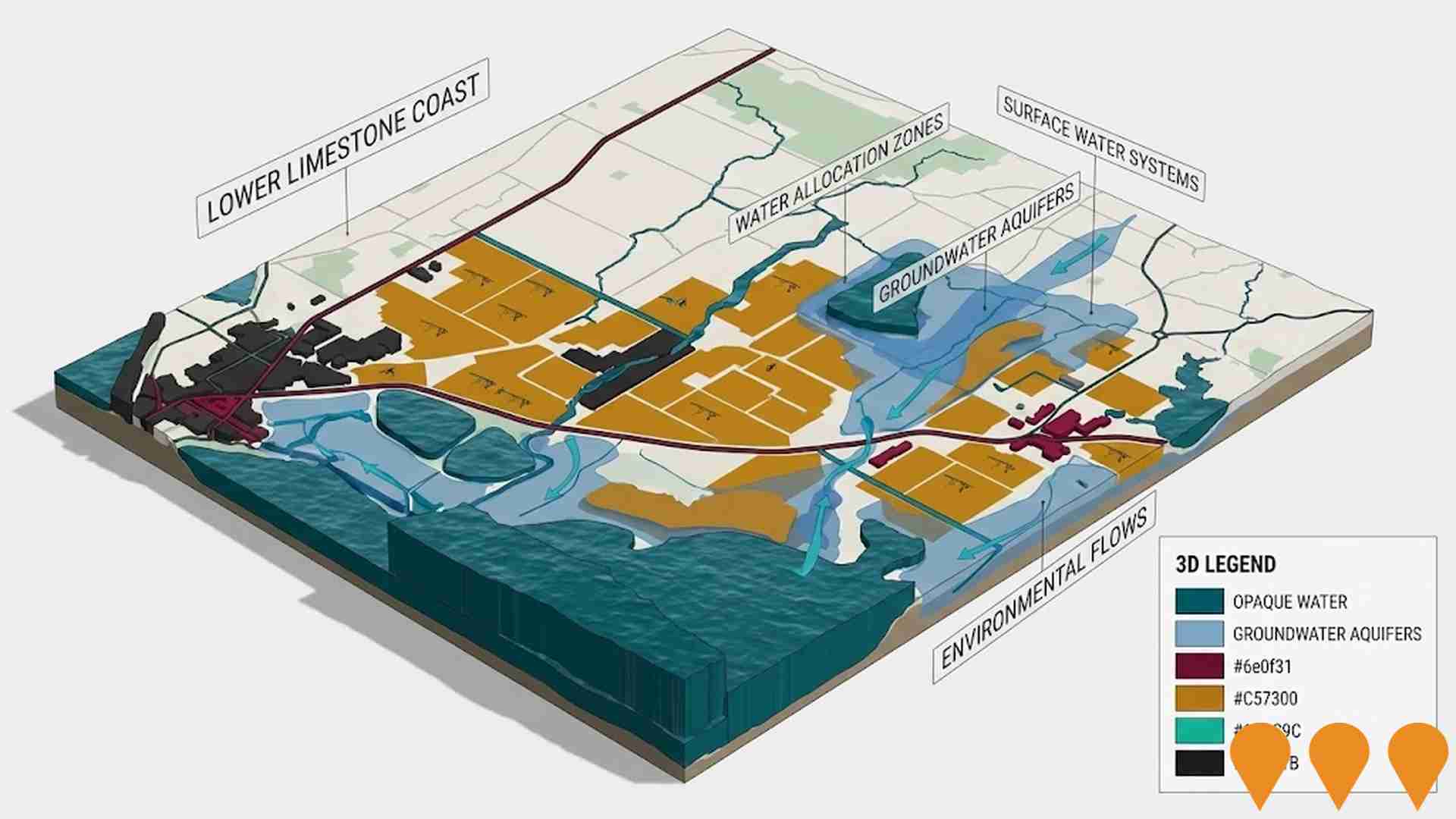

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified one major project likely impacting the region. Key projects include the Lower Limestone Coast Water Allocation Plan, Limestone Coast Energy Park, Wattle Range Council General Code Amendment, and Melbourne To Adelaide Freight Rail Improvements. The most relevant projects are detailed below.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

Victorian Renewable Energy Zones

VicGrid, a Victorian Government agency, is coordinating the planning and staged declaration of six proposed onshore Renewable Energy Zones (plus a Gippsland shoreline zone to support offshore wind). The 2025 Victorian Transmission Plan identifies the indicative REZ locations, access limits and the transmission works needed to connect new wind, solar and storage while minimising impacts on communities, Traditional Owners, agriculture and the environment. Each REZ will proceed through a statutory declaration and consultation process before competitive allocation of grid access to projects.

Enabling Infrastructure for Hydrogen Production

Australia has completed the National Hydrogen Infrastructure Assessment (NHIA) to 2050 and refreshed its National Hydrogen Strategy (2024). The programmatic focus has shifted to planning and enabling infrastructure through measures such as ARENA's Hydrogen Headstart and the Hydrogen Production Tax Incentive (from April 2025). Round 2 of Hydrogen Headstart consultation occurred in 2025. Collectively these actions aim to coordinate investment in transport, storage, water and electricity inputs linked to Renewable Energy Zones and priority hubs, supporting large-scale renewable hydrogen production and future export supply chains.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

Wattle Range Council General Code Amendment

Comprehensive rezoning initiative affecting 9 sites across Wattle Range Council area (originally 10, with Site 8 Beachport removed following community feedback). The amendment includes rezoning of the Railway Precinct, Southern Ports Highway, and Employment Zones on Mount Gambier Road in Millicent, plus sites in Penola, Beachport, and Glencoe. This code amendment aligns with the Council's 25-year Strategic Land Use Plan adopted in August 2022, designed to facilitate sustainable residential, employment, and neighbourhood development while protecting agricultural land. Public consultation opened on August 29, 2025, with community drop-in sessions held throughout September 2025.

Regional Housing Fund (Victoria)

A $1 billion Homes Victoria program delivering around 1,300 new social and affordable homes across at least 30 regional and rural LGAs, using a mix of new builds, purchases in new developments, renewals and refurbishments. Delivery commenced in late 2023 with early completions recorded; overall fund completion is targeted for 2028.

Lower Limestone Coast Water Allocation Plan

A water allocation plan setting rules for groundwater management in the Lower Limestone Coast, ensuring long-term sustainability and security of the water resource for environmental, social, cultural, and economic needs.

Limestone Coast Energy Park

The Limestone Coast Energy Park includes two co-located batteries totaling 500 MW / 1,500 MWh in South Australia's Limestone Coast area.

Employment

AreaSearch analysis indicates Penola maintains employment conditions that align with national benchmarks

Penola has a balanced workforce with representation across white and blue collar jobs. The manufacturing and industrial sectors are prominent.

As of June 2025, the unemployment rate is 2.7%. In June 2025, 1,691 residents are employed, with an unemployment rate of 1.9% lower than Rest of SA's rate of 4.6%. Workforce participation in Penola is 60.4%, exceeding Rest of SA's 54.1%. Employment is concentrated in agriculture, forestry & fishing, manufacturing, and health care & social assistance.

Penola has a particular employment specialization in agriculture, forestry & fishing, with an employment share 2.2 times the regional level. Health care & social assistance employs 8.1% of local workers, below Rest of SA's 13.9%. Many residents commute elsewhere for work based on Census working population to local population count. Between June 2024 and June 2025, Penola's labour force decreased by 2.2%, with employment decreasing by 3.0%, leading to a rise in unemployment rate of 0.7 percentage points. In contrast, Rest of SA experienced an employment decline of 1.2% and labour force growth of 0.1%, with a 1.2 percentage point rise in unemployment rate. Jobs and Skills Australia's national employment forecasts from May-25 suggest potential future demand within Penola. Over five years, national employment is forecast to expand by 6.6%, and over ten years by 13.7%. Applying these projections to Penola's employment mix suggests local employment should increase by 4.0% over five years and 10.0% over ten years.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Penola SA2 had a median income among taxpayers of $48,199 and an average of $61,003. This was lower than the national average. The Rest of SA had a median income of $46,889 and an average of $56,582. Based on Wage Price Index growth of 12.83% since financial year 2022, current estimates for Penola would be approximately $54,383 (median) and $68,830 (average) as of September 2025. Census data indicates household, family, and personal incomes in Penola rank modestly, between the 21st and 35th percentiles. Income analysis reveals that 30.1% of locals (964 people) fall into the $1,500 - 2,999 income category, similar to the broader regional trend of 27.5%. Housing costs are manageable with 91.6% retained, but disposable income is below average at the 31st percentile.

Frequently Asked Questions - Income

Housing

Penola is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Penola's dwelling structures, as per the latest Census evaluation, consisted of 94.8% houses and 5.2% other dwellings (semi-detached, apartments, 'other' dwellings). Non-Metro SA had 87.6% houses and 12.5% other dwellings. Home ownership in Penola was at 44.0%, with mortgaged dwellings at 33.5% and rented ones at 22.5%. The median monthly mortgage repayment in Penola was $896, lower than Non-Metro SA's average of $1,083. Weekly rent median figure in Penola was $181, compared to Non-Metro SA's $205. Nationally, Penola's mortgage repayments were significantly lower at $896 versus Australia's average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Penola features high concentrations of lone person households, with a fairly typical median household size

Family households account for 66.2% of all households, including 24.1% couples with children, 32.5% couples without children, and 9.4% single parent families. Non-family households constitute the remaining 33.8%, with lone person households at 31.3% and group households comprising 2.3%. The median household size is 2.3 people, which aligns with the Rest of SA average.

Frequently Asked Questions - Households

Local Schools & Education

Penola faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 15.4%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 11.2%, followed by graduate diplomas (2.3%) and postgraduate qualifications (1.9%). Vocational credentials are prevalent, with 34.9% of residents aged 15+ holding them - advanced diplomas at 8.0% and certificates at 26.9%. Educational participation is high, with 27.1% currently enrolled in formal education: 13.8% in primary, 6.7% in secondary, and 1.9% in tertiary education.

Educational participation is notably high, with 27.1% of residents currently enrolled in formal education. This includes 13.8% in primary education, 6.7% in secondary education, and 1.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Penola is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Penola faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is relatively low at approximately 50% of the total population (~1,602 people), compared to the national average of 55.3%.

The most common medical conditions in the area are arthritis and mental health issues, impacting 10.1 and 8.5% of residents respectively, while 64.7% declare themselves completely clear of medical ailments, compared to 65.5% across Rest of SA. The area has 24.9% of residents aged 65 and over (797 people), which is higher than the 23.3% in Rest of SA. Health outcomes among seniors are above average, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Penola is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Penola's cultural diversity was found to be below average. Its population was predominantly citizens, with 88.8% holding citizenship. Birthplace-wise, 90.2% were born in Australia.

English was the primary language spoken at home by 96.7%. Christianity was the dominant religion, practiced by 44.7%, slightly higher than the regional average of 42.9%. Ancestry-wise, Australian (34.5%), English (31.3%), and Scottish (9.6%) were the top three represented groups. Notably, German ancestry was overrepresented at 6.1% compared to the regional figure of 6.4%, while Dutch ancestry stood at 1.3% versus a regional average of 1.7%.

Frequently Asked Questions - Diversity

Age

Penola hosts an older demographic, ranking in the top quartile nationwide

The median age in Penola is 48 years, similar to the Rest of South Australia's average of 47 years, which is well above the national norm of 38 years. Compared to the Rest of SA average, the 45-54 age cohort is notably over-represented in Penola at 13.9%, while the 25-34 age group is under-represented at 8.6%. Between 2021 and present, the 75 to 84 age group has grown from 6.9% to 8.3% of the population, while the 15 to 24 cohort increased from 9.2% to 10.2%. Conversely, the 5 to 14 age group has declined from 13.0% to 10.8%. Population forecasts for 2041 indicate substantial demographic changes for Penola. The 75 to 84 age cohort shows the strongest projected growth at 31%, adding 83 residents to reach 350. Senior residents aged 65 and above will drive 97% of population growth, underscoring trends towards an aging population. Conversely, both the 0 to 4 and 25 to 34 age groups are projected to see reduced numbers.