Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

West Wimmera has shown very soft population growth performance across periods assessed by AreaSearch

West Wimmera's population is approximately 2,698 as of November 2025. This figure represents a decrease of 68 people from the 2021 Census count of 2,766, indicating a 2.5% decline since that date. The change is inferred from an estimated resident population of 2,680 in June 2024 and the addition of 3 validated new addresses post-census. This results in a population density ratio of 0.50 persons per square kilometer. West Wimmera's population decline since the census is similar to the SA3 area average (-0.2%), suggesting comparable population challenges across the region. Overseas migration was the primary driver of population growth in recent periods for West Wimmera.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch employs VIC State Government's Regional/LGA projections from 2023, adjusting using weighted aggregation methods to SA2 levels. Growth rates by age group are applied across all areas for the years 2032 to 2041. According to these projections, West Wimmera's population is expected to decrease by 856 persons by 2041.

Frequently Asked Questions - Population

Development

The level of residential development activity in West Wimmera is very low in comparison to the average area assessed nationally by AreaSearch

West Wimmera had minimal construction activity between 2013 and 2017 with only 2 new dwellings approved annually on average. This resulted in a total of 13 dwelling approvals over the five-year period. The low development levels reflect the rural nature of the area, where housing needs are typically specific to local requirements rather than broad market demand.

It is important to note that with such low approval numbers, yearly growth figures and relativities can vary considerably based on individual projects. West Wimmera naturally has much lower development activity compared to Rest of Vic.. This activity level is similarly below national patterns. Recent development in the area has been entirely comprised of detached houses, reflecting its rural character where larger properties and space are typical.

Between 2013 and 2017, there were an estimated 718 people per dwelling approval in West Wimmera, indicating a quiet, low activity development environment. With population expected to remain stable or decline in the area, West Wimmera should see reduced pressure on housing, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

West Wimmera has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

No changes can significantly affect a region's performance like modifications to its local infrastructure, major projects, and planning initiatives. AreaSearch has identified zero projects that could potentially impact this area. Notable projects include the Lower Limestone Coast Water Allocation Plan, Limestone Coast Energy Park, Melbourne To Adelaide Freight Rail Improvements, and Victorian Renewable Energy Zones. The following list outlines those projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

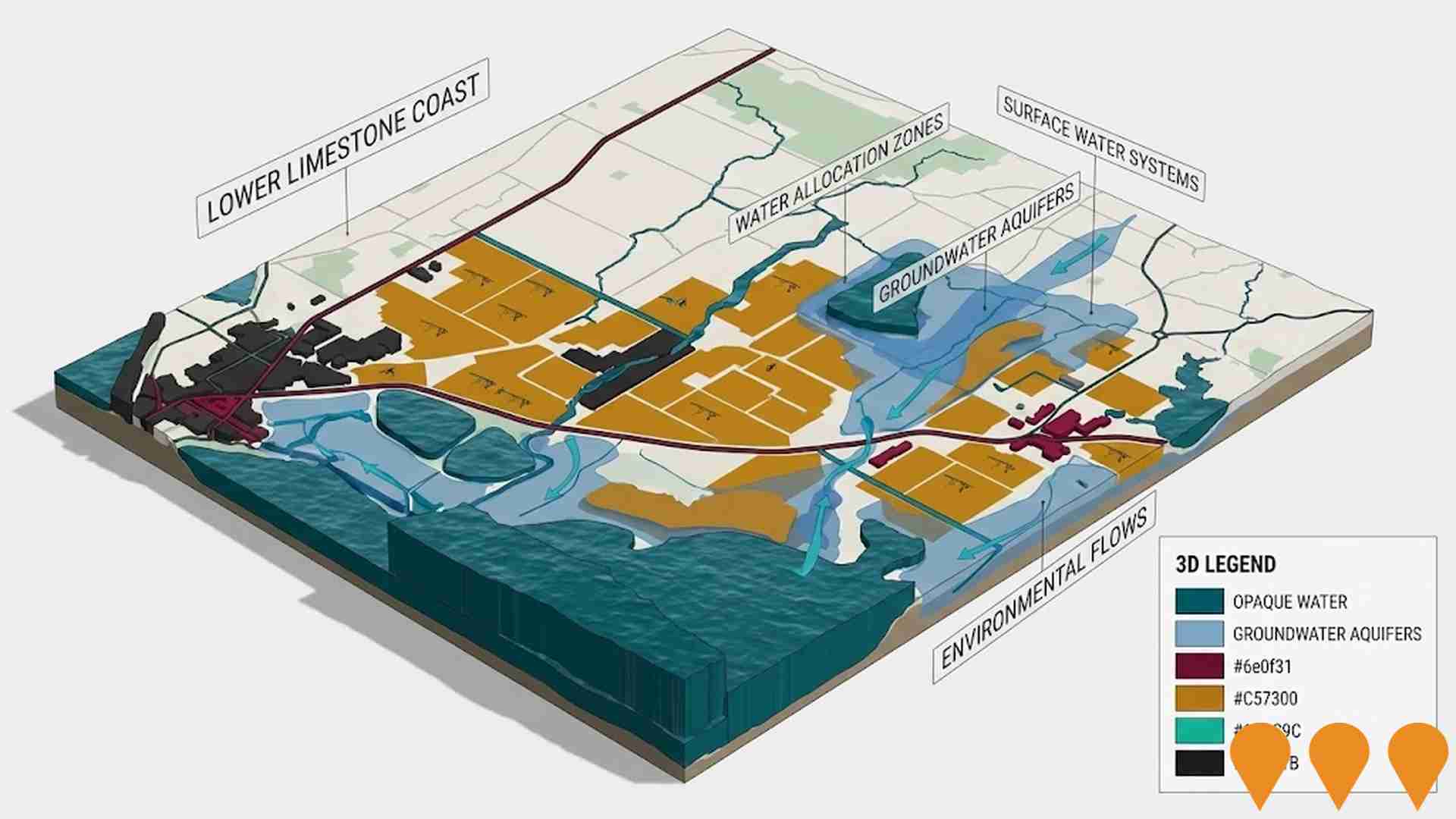

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

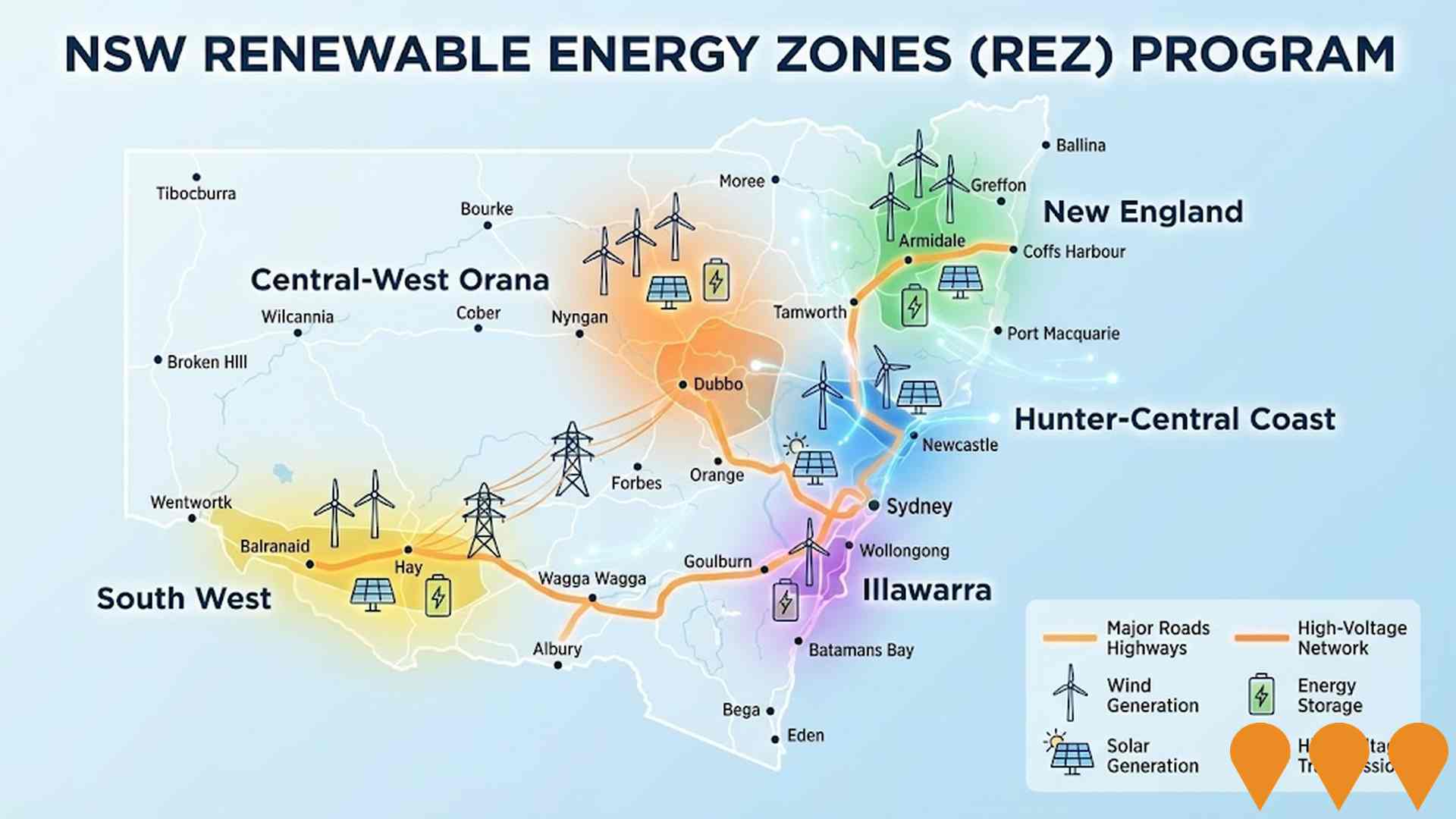

NSW Renewable Energy Zones (REZ) Program

NSW is delivering five Renewable Energy Zones (Central-West Orana, New England, South West, Hunter-Central Coast and Illawarra) to coordinate new wind and solar generation, storage and high-voltage transmission. The program is led by EnergyCo NSW under the Electricity Infrastructure Roadmap. Construction of the first REZ (Central-West Orana) transmission project commenced in June 2025, with staged energisation from 2028. Across the program, NSW targets at least 12 GW of new renewable generation and 2 GW of long-duration storage by 2030.

Victorian Renewable Energy Zones

VicGrid, a Victorian Government agency, is coordinating the planning and staged declaration of six proposed onshore Renewable Energy Zones (plus a Gippsland shoreline zone to support offshore wind). The 2025 Victorian Transmission Plan identifies the indicative REZ locations, access limits and the transmission works needed to connect new wind, solar and storage while minimising impacts on communities, Traditional Owners, agriculture and the environment. Each REZ will proceed through a statutory declaration and consultation process before competitive allocation of grid access to projects.

EnergyConnect

Australia's largest energy transmission project. A new ~900km interconnector linking the NSW, SA and VIC grids. NSW-West (Buronga to SA border and Red Cliffs spur) was energised in 2024-2025, connecting the three states via the expanded Buronga substation. NSW-East (Buronga-Dinawan-Wagga Wagga) is under active construction with substation upgrades at Wagga Wagga completed in June 2025 and works well advanced at Dinawan and Buronga. Full 800MW transfer capability is targeted after completion of the eastern section and inter-network testing, expected by late 2027.

Regional Housing Fund (Victoria)

A $1 billion Homes Victoria program delivering around 1,300 new social and affordable homes across at least 30 regional and rural LGAs, using a mix of new builds, purchases in new developments, renewals and refurbishments. Delivery commenced in late 2023 with early completions recorded; overall fund completion is targeted for 2028.

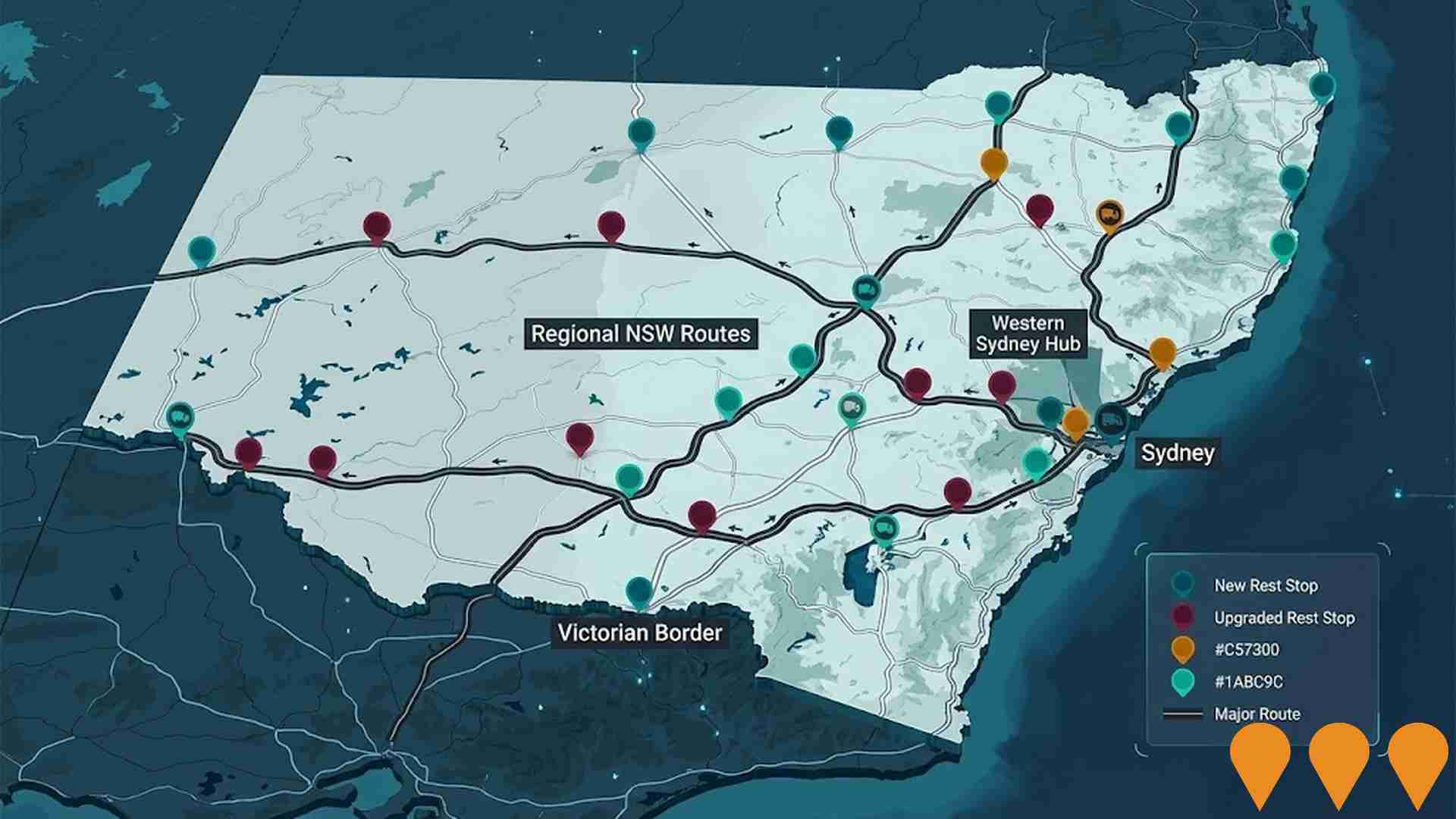

NSW Heavy Vehicle Rest Stops Program (TfNSW)

Statewide Transport for NSW program to increase and upgrade heavy vehicle rest stopping across NSW. Works include minor upgrades under the $11.9m Heavy Vehicle Rest Stop Minor Works Program (e.g. new green reflector sites and amenity/signage improvements), early works on new and upgraded formal rest areas in regional NSW, and planning and site confirmation for a major new dedicated rest area in Western Sydney. The program aims to reduce fatigue, improve safety and productivity on key freight routes, and respond to industry feedback collected since 2022.

Lower Limestone Coast Water Allocation Plan

A water allocation plan setting rules for groundwater management in the Lower Limestone Coast, ensuring long-term sustainability and security of the water resource for environmental, social, cultural, and economic needs.

Limestone Coast Energy Park

The Limestone Coast Energy Park includes two co-located batteries totaling 500 MW / 1,500 MWh in South Australia's Limestone Coast area.

Melbourne To Adelaide Freight Rail Improvements

Enhancing the Melbourne to Adelaide freight rail to allow double-stacked containers by addressing 1,020 clearance obstructions, potentially reducing costs by 6% and increasing capacity by 48%.

Employment

Employment conditions in West Wimmera demonstrate strong performance, ranking among the top 35% of areas assessed nationally

West Wimmera has a balanced workforce with both white and blue collar jobs, diverse sector representation, and an unemployment rate of 1.6% as of September 2025. The area employs 1,392 residents, with an unemployment rate that is 2.2% lower than the Rest of Vic.'s rate of 3.8%.

Workforce participation is similar to Rest of Vic., at 57.4%. Key industries include agriculture, forestry & fishing, health care & social assistance, and education & training. The area has a strong specialization in agriculture, forestry & fishing, with an employment share 6.4 times the regional level. Conversely, construction shows lower representation at 4.1% compared to the regional average of 10.4%.

Many residents commute elsewhere for work based on Census data. Between September 2024 and September 2025, labour force decreased by 4.7%, employment declined by 3.0%, leading to a 1.7 percentage point drop in unemployment rate. In comparison, Rest of Vic. had an employment decline of 0.7% and labour force decline of 0.6%. State-level data from 25-Nov-25 shows VIC employment grew by 1.13%, adding 41,950 jobs, with state unemployment rate at 4.7% compared to national rate of 4.3%. Jobs and Skills Australia's forecasts suggest national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to West Wimmera's employment mix suggests local employment should increase by 4.7% over five years and 11.0% over ten years, though this is a simple extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

The West Wimmera SA2 had a median taxpayer income of $46,752 and an average income of $58,832 in the financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This was lower than national averages, with Rest of Vic.'s median income being $48,741 and average income $60,693. By September 2025, based on Wage Price Index growth of 12.16%, estimated incomes would be approximately $52,437 (median) and $65,986 (average). In Census 2021 income data, personal income ranked at the 27th percentile ($698 weekly), while household income was at the 11th percentile. Income analysis showed that 25.7% of residents (693 people) fell into the $1,500 - $2,999 bracket, reflecting regional patterns where 30.3% occupied this range. Housing costs were modest with 94.4% of income retained. However, total disposable income ranked at just the 22nd percentile nationally and the area's SEIFA income ranking placed it in the 4th decile.

Frequently Asked Questions - Income

Housing

West Wimmera is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in West Wimmera, as per the latest Census, consisted of 96.4% houses and 3.7% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro Vic.'s 93.0% houses and 6.9% other dwellings. Home ownership in West Wimmera stood at 60.1%, with mortgaged dwellings at 23.7% and rented ones at 16.2%. The median monthly mortgage repayment was $758, lower than Non-Metro Vic.'s average of $1,043. The median weekly rent figure in West Wimmera was recorded at $150, compared to Non-Metro Vic.'s $215. Nationally, West Wimmera's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

West Wimmera features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 60.8% of all households, including 20.7% couples with children, 32.9% couples without children, and 6.7% single parent families. Non-family households constitute the remaining 39.2%, with lone person households at 36.4% and group households comprising 2.8%. The median household size is 2.1 people, which is smaller than the Rest of Vic. average of 2.2.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in West Wimmera fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 16.3%, significantly lower than Victoria's average of 33.4%. Bachelor degrees are the most common at 11.8%, followed by graduate diplomas (2.4%) and postgraduate qualifications (2.1%). Vocational credentials are prevalent, with 38.0% of residents aged 15+ holding them, including advanced diplomas (11.1%) and certificates (26.9%). Educational participation is high, with 25.6% of residents currently enrolled in formal education: 11.4% in primary, 6.5% in secondary, and 1.5% in tertiary education.

Educational participation is notably high, with 25.6% of residents currently enrolled in formal education. This includes 11.4% in primary education, 6.5% in secondary education, and 1.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates four active transport stops operating within West Wimmera. These stops serve a mix of bus routes, with one individual route providing service collectively resulting in ten weekly passenger trips. Transport accessibility is rated as limited, with residents typically located 3367 meters from the nearest transport stop.

Service frequency averages one trip per day across all routes, equating to approximately two weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in West Wimmera is well below average with prevalence of common health conditions notable across both younger and older age cohorts

West Wimmera faces significant health challenges, with common conditions prevalent across both younger and older age groups. Approximately 49% (~1,324 people) have private health cover, lower than the national average of 55.3%.

The most frequent medical issues are arthritis (12.4%) and mental health problems (7.7%). 64.4% report no medical ailments, compared to 61.2% in Rest of Vic. The area has a higher proportion of seniors aged 65 and over at 29.5% (795 people), compared to 25.2% in Rest of Vic. Despite this, health outcomes among seniors are above average, outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees West Wimmera placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

West Wimmera had a lower cultural diversity, with 87.6% citizens, 92.1% born in Australia, and 97.2% speaking English only at home. Christianity was the main religion, comprising 57.7%. This compares to 51.6% across Rest of Vic..

The top three ancestry groups were English (32.3%), Australian (32.2%), and Irish (9.6%). Notably, German was overrepresented at 6.9% (vs regional 6.6%), Scottish at 9.4% (vs 9.0%), and Samoan at 0.2% (vs 0.1%).

Frequently Asked Questions - Diversity

Age

West Wimmera ranks among the oldest 10% of areas nationwide

West Wimmera's median age is 51 years, which is significantly higher than the Rest of Vic. average of 43 and considerably older than the Australian median of 38. The 65-74 cohort is notably over-represented in West Wimmera at 16.4%, compared to the Rest of Vic. average, while those aged 15-24 are under-represented at 7.6%. This concentration of the 65-74 age group is well above the national average of 9.4%. Post-2021 Census data shows that the 25 to 34 age group has grown from 8.7% to 10.0%, and the 35 to 44 cohort increased from 9.4% to 10.5%. Conversely, the 55 to 64 cohort has declined from 17.9% to 15.8%, and the 45 to 54 group dropped from 12.9% to 10.8%. By 2041, West Wimmera is expected to see notable shifts in its age composition, with the 85+ group projected to grow by -15 people (-15%), reaching 101 from 119. Population declines are also projected for those aged 0 to 4 years.