Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Grant has seen population growth performance typically on par with national averages when looking at short and medium term trends

Grant's population was approximately 6,497 as of November 2025. This figure represents an increase of 359 people, a growth rate of 5.8%, since the 2021 Census which reported a population of 6,138. The change is inferred from the estimated resident population of 6,445 in June 2024 and an additional 53 validated new addresses since the Census date. This results in a population density ratio of 3.8 persons per square kilometer. Grant's growth rate of 5.8% since the 2021 census exceeded the SA3 area average of 5.4%, indicating it as a region with significant growth. Interstate migration contributed approximately 41.4% of overall population gains during recent periods, although all factors including overseas migration and natural growth were positive contributors.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, the SA State Government's Regional/LGA projections by age category are adopted, based on 2021 data and adjusted using a method of weighted aggregation of population growth from LGA to SA2 levels. Future population projections anticipate lower quartile growth for Australia's regional areas, with Grant expected to expand by 247 persons to reach approximately 6,744 by 2041 based on the latest annual ERP population numbers, reflecting a total gain of 3.0% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Grant recording a relatively average level of approval activity when compared to local markets analysed countrywide

Grant has averaged approximately 30 new dwelling approvals annually over the past five financial years from FY-21 to FY-25, totaling 150 homes approved. In FY-26, 9 dwellings have been approved so far. Each year, an average of 1.6 people moved to the area for each dwelling built during these five years, indicating a balanced supply and demand market with stable conditions.

The average construction cost value of new homes was $277,000. This financial year has seen $19.2 million in commercial approvals, reflecting moderate levels of commercial development. Grant maintains similar construction rates per person compared to the Rest of SA, contributing to regional market stability.

The building activity comprises 95.0% detached houses and 5.0% medium and high-density housing, preserving the area's low density nature and attracting space-seeking buyers with around 222 people per dwelling approval. By 2041, Grant is projected to grow by 195 residents based on AreaSearch's latest quarterly estimate. Current development patterns suggest that new housing supply should readily meet demand, offering favorable conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Grant has limited levels of nearby infrastructure activity, ranking in the 7thth percentile nationally

Changes in local infrastructure significantly impact an area's performance. AreaSearch has identified 28 projects likely to affect the area. Notable ones include Limestone Estate Residential Development, Lakes Park Estate, Blue Lake Solar Lighting Renewal Project, and Blue Lake Sports Park Master Plan Implementation. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Mount Gambier Hospital Redevelopment

A $24 million redevelopment of the Mount Gambier and Districts Health Service. The project includes a recently completed $8 million Emergency Department Short Stay Unit, a new six-bed Mental Health Sub-Acute and Rehabilitation Service (Wari-ngu), and a two-bed Drug and Alcohol Withdrawal Unit. The upgrade also features an expansion of the SA Pathology service and a new Cancer Care Centre.

Wulanda Recreation and Convention Centre

State-of-the-art multi-purpose sport, aquatic and conference facility featuring 25m indoor pool, 50m outdoor pool, six multi-purpose courts, convention facilities for 1000+ people, and health club. Council's largest ever infrastructure project valued at $57 million.

CBD Master Planning and Activation

Strategic revitalisation of the Mount Gambier CBD aimed at activating the city centre through short-term initiatives and long-term infrastructure improvements. The project involves the completion of a detailed Master Plan, Commercial Street pedestrianisation concepts, and better integration with key precincts like the Railway Lands. It aligns with the 'Mount Gambier 2035' community vision and the Council's 2024-2028 Strategic Plan.

Mount Gambier Technical College & Research Education Training Precinct

New $35 million purpose-built Technical College with short-stay accommodation for 40 students, featuring integrated industry-specific workshops for agri-tech, health, early childhood education and multi-trades. Part of $59 million Research, Education and Training Precinct.

Forestry Centre of Excellence

Construction of a $16 million world-class forestry research facility at the Mount Gambier Research, Education and Training Precinct. The Centre will focus on sustainable plantation management, fire detection, and timber processing innovation. It is a collaborative project between the State Government, UniSA, and the forestry industry, co-located with the new Mount Gambier Technical College.

Blue Lake Sports Park Master Plan Implementation

Development of regional sports complex featuring multi-use oval, athletics track, netball courts, pavilion facilities, and spectator amenities. Designed to host regional and state-level sporting events and community programs.

Limestone Estate Residential Development

One of the largest residential land division projects across Limestone Coast region, delivering 350+ residential allotments along with a commercial complex. Located on the western fringe of Mount Gambier, less than 5 minutes drive from CBD. Developed by Capital Investments & Developments (Melbourne).

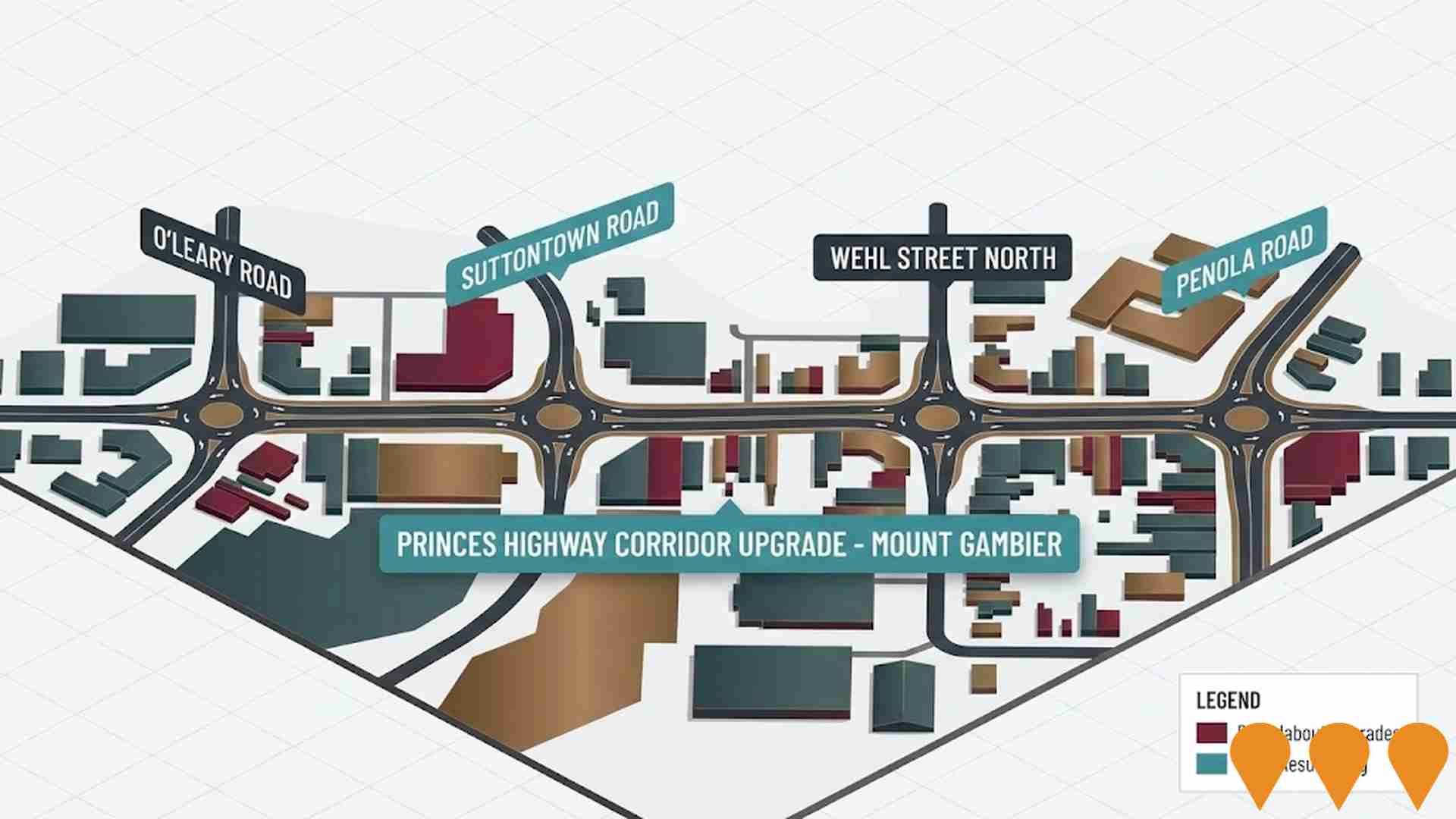

Road Infrastructure Reconstruction Program

Major road network upgrades including Bay Road reconstruction, Commercial Street improvements, roundabout installations, and cycling infrastructure. Focus on traffic flow optimization and pedestrian safety improvements.

Employment

Employment conditions in Grant demonstrate strong performance, ranking among the top 35% of areas assessed nationally

Grant's workforce comprises an equal mix of white and blue-collar jobs, with diverse industry representation. As of September 2025, its unemployment rate is 2.0%, with an estimated employment growth of 0.7% over the past year.

In Grant, 3,239 residents are employed, while the unemployment rate is 3.4% lower than Rest of SA's rate of 5.3%. Workforce participation in Grant is similar to Rest of SA's 54.1%. The leading employment industries among Grant's residents include agriculture, forestry & fishing, health care & social assistance, and construction. Notably, agriculture, forestry & fishing has employment levels at 1.8 times the regional average.

However, health care & social assistance is under-represented in Grant, with only 10.4% of its workforce compared to Rest of SA's 13.9%. The area offers limited local employment opportunities, as indicated by the count of Census working population vs resident population. Between September 2024 and September 2025, employment levels increased by 0.7%, and labour force increased by 1.6% in Grant, causing the unemployment rate to rise by 0.9 percentage points. In comparison, Rest of SA saw employment grow by 0.3%, labour force expand by 2.3%, and unemployment rise by 1.9 percentage points. Jobs and Skills Australia's national employment forecasts from May-25 offer further insight into potential future demand within Grant. These projections suggest that national employment should increase by 6.6% over five years and 13.7% over ten years, with varying growth rates across industry sectors. Applying these industry-specific projections to Grant's employment mix indicates that local employment should increase by 5.1% over five years and 11.3% over ten years.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

The median taxpayer income in Grant SA2 was $51,355 and the average was $63,892 according to AreaSearch's postcode level ATO data for financial year 2022. This is slightly lower than national averages, with Rest of SA having a median income of $46,889 and an average income of $56,582. By September 2025, estimates suggest the median would be approximately $57,944 and the average around $72,089, factoring in Wage Price Index growth since financial year 2022. Census 2021 data shows incomes in Grant rank modestly, with household income at the 43rd percentile, family income at the 45th, and personal income at the 47th percentile. The $1,500 - $2,999 income bracket dominated with 34.8% of residents (2,260 people), similar to regional levels where 27.5% fell into this bracket. Housing costs were manageable with 90.4% retained, but disposable income was below average at the 48th percentile.

Frequently Asked Questions - Income

Housing

Grant is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The latest Census evaluation showed that 96.2% of dwellings in Grant were houses, with the remaining 3.8% being other types such as semi-detached homes, apartments, and others. This is compared to Non-Metro SA's figures of 87.6% houses and 12.5% other dwellings. Home ownership in Grant stood at 44.9%, with mortgaged dwellings accounting for 42.3% and rented dwellings making up 12.8%. The median monthly mortgage repayment in the area was $1,300, which is higher than Non-Metro SA's average of $1,083. The median weekly rent figure in Grant was recorded at $200, compared to Non-Metro SA's figure of $205. Nationally, Grant's mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Grant has a typical household mix, with a higher-than-average median household size

Family households account for 76.2% of all households, including 31.8% couples with children, 36.6% couples without children, and 7.2% single parent families. Non-family households constitute the remaining 23.8%, with lone person households at 22.2% and group households making up 1.4%. The median household size is 2.5 people, larger than the Rest of SA average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Grant faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 12.3%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 9.6%, followed by graduate diplomas (1.4%) and postgraduate qualifications (1.3%). Vocational credentials are prevalent, with 38.6% of residents aged 15+ holding them, including advanced diplomas (7.7%) and certificates (30.9%). Educational participation is high at 36.7%, with 16.5% in primary education, 11.1% in secondary education, and 1.9% pursuing tertiary education.

Educational participation is notably high, with 36.7% of residents currently enrolled in formal education. This includes 16.5% in primary education, 11.1% in secondary education, and 1.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health outcomes in Grant are marginally below the national average with common health conditions slightly more prevalent than average across both younger and older age cohorts

Grant's health indicators show below-average results with common health conditions slightly more prevalent than average across both younger and older age groups.

Approximately 51% (~3,326 people) have private health cover, which is slightly lower than the average SA2 area. The most frequent medical conditions are arthritis (9.1%) and asthma (7.7%), while 68.9% of residents report no medical ailments, compared to 65.5% in Rest of SA. The area has 21.6% (1,401 people) aged 65 and over, lower than the 23.3% in Rest of SA. Health outcomes among seniors are particularly strong, outperforming those of the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Grant placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Grant was found to be below average in terms of cultural diversity, with 79.5% of its population being citizens, 91.4% born in Australia, and 97.8% speaking English only at home. The main religion in Grant is Christianity, which makes up 42.8% of people in Grant, compared to 42.9% across the Rest of SA. In terms of ancestry, the top three represented groups in Grant are Australian (33.7%), English (32.0%), and Scottish (9.0%).

Notably, German is overrepresented at 6.9% in Grant versus 6.4% regionally, Dutch at 1.8% versus 1.7%, and South African at 0.3% versus 0.2%.

Frequently Asked Questions - Diversity

Age

Grant hosts a notably older demographic compared to the national average

Grant has a median age of 45, which is slightly lower than the Rest of SA figure of 47 but notably higher than Australia's 38 years. Compared to the Rest of SA average, Grant has an over-representation of the 45-54 age cohort (14.5% locally) and an under-representation of the 75-84 year-olds (6.8%). Between 2021 and the present, the 75-84 age group has increased from 5.3% to 6.8% of Grant's population. Conversely, the 5-14 age cohort has declined from 12.1% to 10.8%. Looking ahead to 2041, demographic projections indicate significant shifts in Grant's age structure. The 75-84 age cohort is projected to grow by 148 people (33%), increasing from 445 to 594. Senior residents aged 65 and above will drive 88% of population growth, highlighting demographic aging trends. In contrast, population declines are projected for the 0-4 and 5-14 age cohorts.