Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Deagon reveals an overall ranking slightly below national averages considering recent, and medium term trends

Deagon's population is approximately 4,000 as of November 2025. This figure represents an increase of 227 people since the 2021 Census, which recorded a population of 3,773. The growth is inferred from ABS data showing an estimated resident population of 3,977 in June 2024 and an additional 34 validated new addresses since the Census date. This results in a population density ratio of 1,418 persons per square kilometer, higher than the average across national locations assessed by AreaSearch. Deagon's growth rate of 6.0% since the census is within 1.0 percentage point of the SA3 area's growth rate of 7.0%. Interstate migration contributed approximately 39.5% of overall population gains in recent periods, with all drivers including overseas migration and natural growth being positive factors.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 based on 2022 data. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. However, these state projections do not provide age category splits, so AreaSearch applies proportional growth weightings in line with ABS Greater Capital Region projections released in 2023 based on 2022 data for each age cohort. Looking ahead, lower quartile growth is anticipated nationally, with Deagon expected to grow by 177 persons to reach a population of approximately 4,177 by 2041 based on the latest annual ERP population numbers, reflecting an overall gain of 3.9% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Deagon according to AreaSearch's national comparison of local real estate markets

Deagon has seen approximately 19 new homes approved annually. Over the past five financial years, from FY-21 to FY-25, around 99 homes were approved, with an additional 5 approved so far in FY-26. On average, about 1.4 people have moved to the area each year for every dwelling built over these five financial years. However, this figure has increased to 4.3 people per dwelling over the past two financial years, suggesting growing popularity and potential undersupply.

The average construction cost value of new homes is around $327,000. This year alone, approximately $1.4 million in commercial development approvals have been recorded, highlighting the area's residential focus. Compared to Greater Brisbane, Deagon has 68.0% more building activity per person, offering buyers greater choice. All recent building activity consists of detached dwellings, maintaining the area's traditional suburban character and appealing to those seeking family homes with space.

With around 247 people per dwelling approval, Deagon exhibits characteristics of a low-density area. According to AreaSearch's latest quarterly estimate, Deagon is projected to gain approximately 154 residents by 2041. Given current development patterns, new housing supply should meet demand, providing good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Deagon has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified five projects likely to affect the region. Notable ones are Taigum Gardens Estate (Stages 3 & 4), Lomandra Park Estate, Gateway Motorway, Bracken Ridge to Pine River Upgrade, and Bridgeman Downs Neighbourhood Plan. The following details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Brisbane Metro Northern Extension (Northern Metro)

Extension of the Brisbane Metro rapid bus transit system north from the Brisbane CBD to Carseldine (officially referred to as Northern Metro), delivering high-frequency, high-capacity fully electric metro services via dedicated infrastructure. The corridor includes new or extended stations at Lutwyche, Kedron, Chermside, Aspley and Carseldine, linking Moreton Bay communities to Brisbane employment centres ahead of the 2032 Olympic and Paralympic Games. A joint Brisbane City Council and Queensland Government project, supported by the Federal Government, currently in rapid business case phase with $50 million federal funding allocated for the business case.

Taigum Square Shopping Centre Redevelopment

Taigum Square is a single level sub regional shopping centre located on the corner of Church and Beams Roads in Taigum, approximately 15 kilometres north of the Brisbane CBD. The centre is owned and managed by Vicinity Centres and is anchored by Big W and Woolworths, supported by around 45 specialty stores and several freestanding tenancies. The most recent major redevelopment of the centre was completed in 2001, with the asset continuing to serve as a key local retail hub for Brisbane's northern suburbs.

Bridgeman Downs Neighbourhood Plan

Comprehensive 10+ year neighbourhood planning framework adopted by Brisbane City Council. Guides future development, transport, community facilities and environmental protection for sustainable growth.

Northern Brisbane Green Corridors

Environmental conservation and enhancement project creating connected green spaces, wildlife corridors, and improved biodiversity across northern Brisbane suburbs including areas adjacent to Wavell Heights.

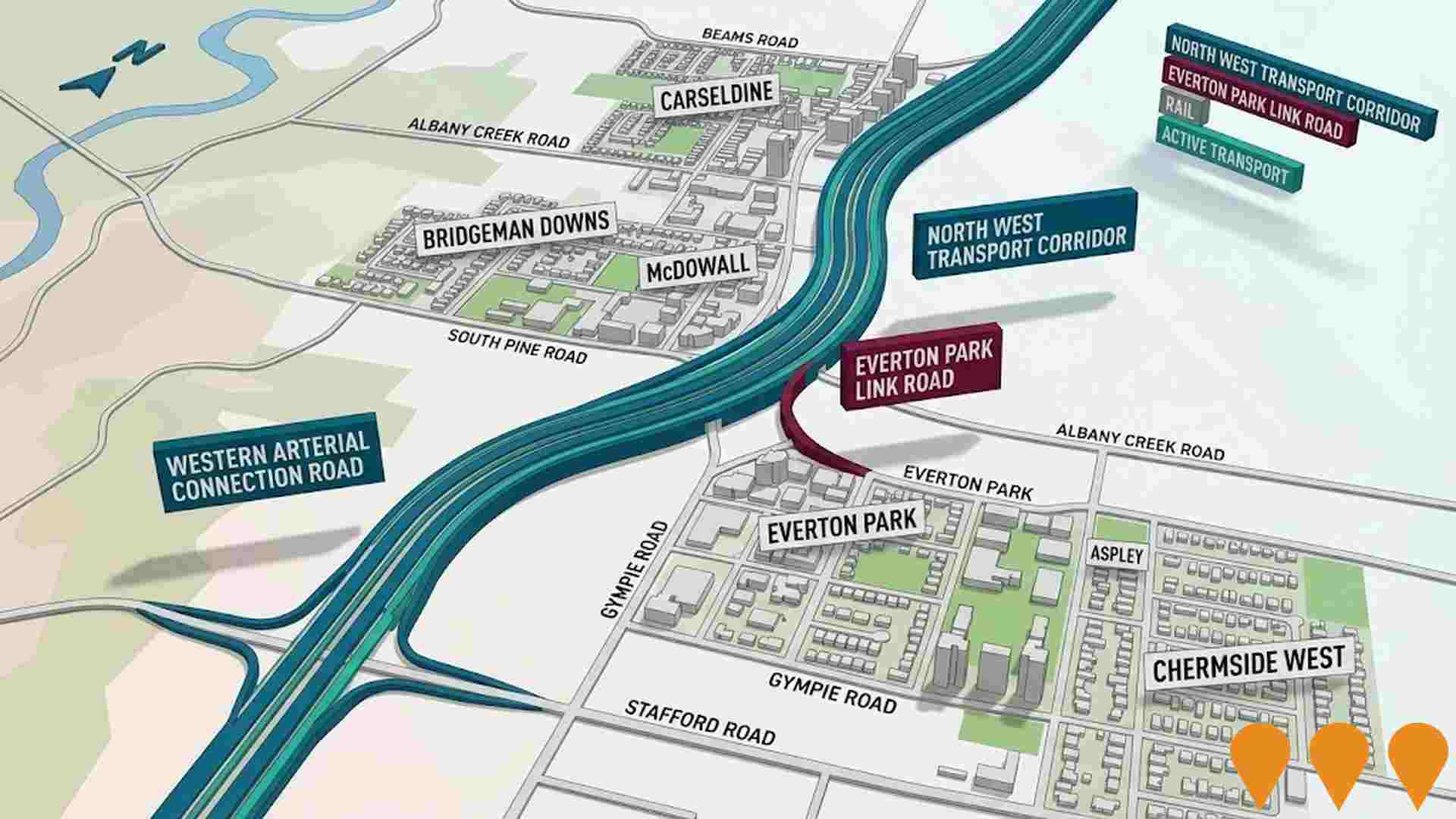

North West Transport Corridor

Integrated 9km transport corridor between Carseldine and Everton Park via Aspley area, preserved since the 1980s. $20 million business case study examining road, rail and active transport options to address growing congestion in northern Brisbane. Includes new arterial roads, public transport infrastructure, cycling and pedestrian paths. Various alignment options being considered including busway, rail, and tunnel solutions.

Gympie Road Bypass Tunnel

Proposed ~7km tolled twin-lane-each-way bypass tunnel between Kedron and Carseldine to remove through traffic from the Gympie Road corridor and integrate with Brisbane's existing tunnel network. Responsibility transitioned from North Brisbane Infrastructure (QIC) to Queensland's Department of Transport and Main Roads (TMR) on 1 July 2025. Queensland Government allocated $318 million over three years for planning, approvals and pre-construction investigations. Early geotechnical, traffic and ecological surveys are underway.

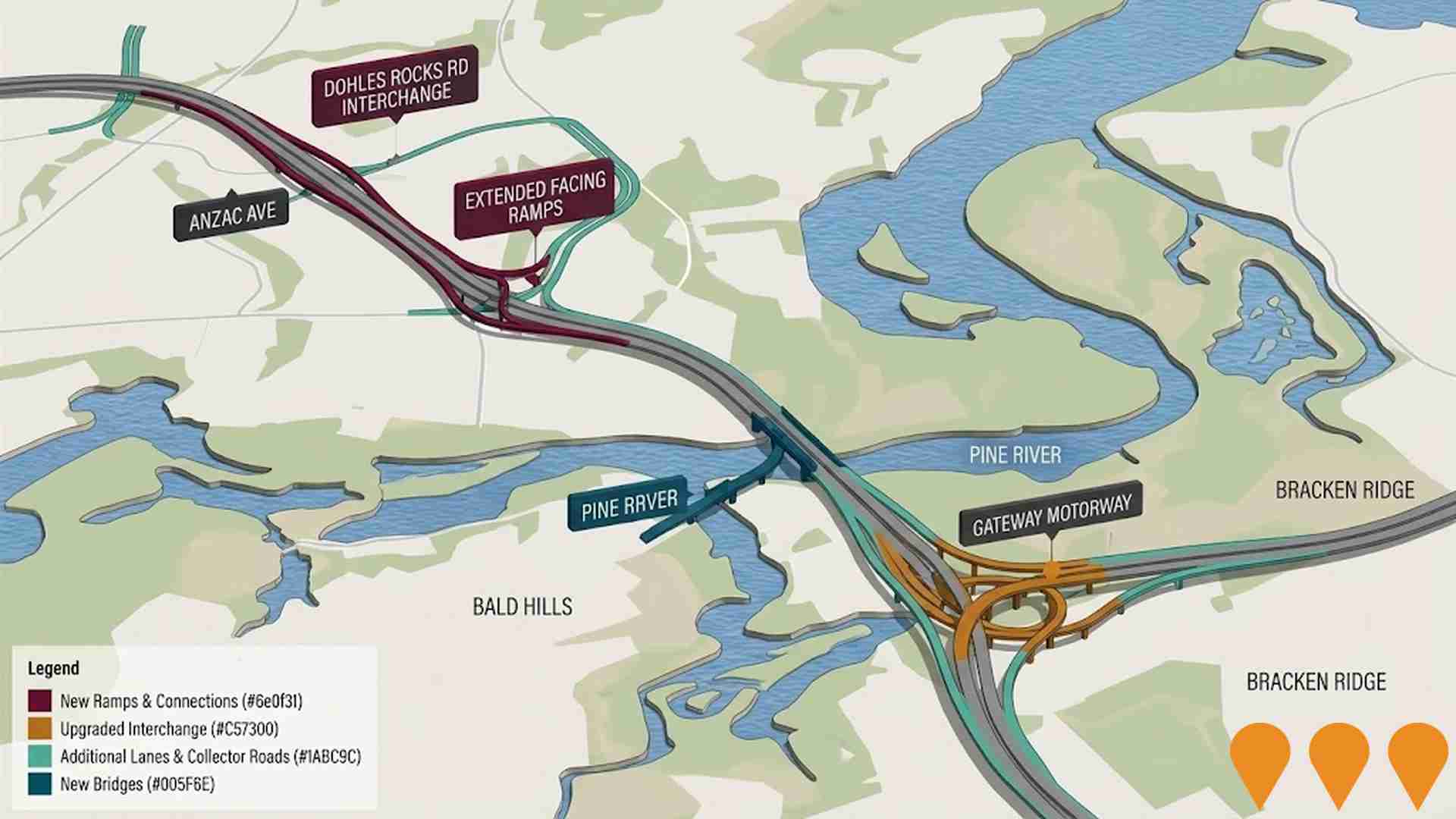

Bruce Highway Gateway Motorway to Dohles Rocks Road Upgrade Stage 1

Major upgrade of Bruce Highway including extended north-facing ramps from Dohles Rocks Road to Anzac Avenue, collector-distributor roads, additional lanes, and improved interchange at Gateway Motorway/Bruce Highway/Gympie Arterial Road. Joint funded by Australian and Queensland governments to enhance traffic flow and capacity along one of Queensland's key transport corridors.

Gateway Motorway, Bracken Ridge to Pine River Upgrade

Upgrade of the Gateway Motorway between Bracken Ridge and the Pine River interchange to improve capacity, safety and network reliability. This section is being packaged and delivered with the Bruce Highway (Gateway Motorway to Dohles Rocks Road, Stage 1) as the Gateway to Bruce Upgrade (G2BU). TMR indicates procurement for a design-and-construct contractor is underway, with design activities preceding a construction start targeted from 2026.

Employment

The employment landscape in Deagon shows performance that lags behind national averages across key labour market indicators

Deagon's workforce is skilled with well-represented essential services sectors. The unemployment rate was 5.8% as of September 2024, experiencing a 12.0% employment growth over the past year.

As of September 2025, 2,276 residents are employed while the unemployment rate is 1.8% higher than Greater Brisbane's rate of 4.0%. Workforce participation is similar to Greater Brisbane's 64.5%. Leading industries include health care & social assistance, construction, and public administration & safety. Construction shows strong specialization with an employment share 1.3 times the regional level.

Conversely, professional & technical services show lower representation at 7.4% compared to the regional average of 8.9%. Employment opportunities locally appear limited as indicated by Census data. Over the year to September 2025, employment increased by 12.0% while labour force grew by 10.7%, reducing unemployment by 1.0 percentage points. Greater Brisbane recorded lower growth rates with employment increasing by 3.8%. Statewide in Queensland, employment contracted slightly by 0.01% between November 2024 and November 2025, losing 1,210 jobs, with the unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Deagon's employment mix suggests local employment should increase by 6.5% over five years and 13.5% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows that median income in Deagon SA2 is $56,530 and average income stands at $67,648. This contrasts with Greater Brisbane's median income of $55,645 and average income of $70,520. Based on Wage Price Index growth of 13.99% since financial year 2022, estimated current incomes would be approximately $64,439 (median) and $77,112 (average) as of September 2025. Census 2021 income data shows that household, family, and personal incomes in Deagon rank modestly between the 41st and 55th percentiles. Income brackets indicate that 29.4% of individuals earn $1,500 - $2,999, aligning with the metropolitan region where this cohort represents 33.3%. Housing affordability pressures are severe, with only 82.5% of income remaining, ranking at the 40th percentile. The area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Deagon is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Dwelling structure in Deagon, as evaluated at the latest Census, consisted of 87.9% houses and 12.2% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Brisbane metro had 75.4% houses and 24.7% other dwellings. Home ownership in Deagon was at 28.6%, similar to Brisbane metro's level. The remaining dwellings were either mortgaged (41.4%) or rented (30.0%). The median monthly mortgage repayment in the area was $1,846, higher than Brisbane metro's average of $1,800. The median weekly rent figure in Deagon was recorded at $350, compared to Brisbane metro's $375. Nationally, Deagon's mortgage repayments were lower than the Australian average of $1,863, while rents were less than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Deagon features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households account for 64.2% of all households, including 27.7% couples with children, 22.3% couples without children, and 12.3% single parent families. Non-family households constitute the remaining 35.8%, with lone person households at 32.3% and group households comprising 3.9%. The median household size is 2.3 people, which is smaller than the Greater Brisbane average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Deagon aligns closely with national averages, showing typical qualification patterns and performance metrics

Educational qualifications in Deagon trail regional benchmarks: 25.2% of residents aged 15+ hold university degrees compared to 33.8% in SA4 region. This gap suggests potential for educational development and skills enhancement. Bachelor degrees are the most common at 17.4%, followed by postgraduate qualifications (4.6%) and graduate diplomas (3.2%). Trade and technical skills are prominent, with 36.7% of residents aged 15+ holding vocational credentials – advanced diplomas (10.6%) and certificates (26.1%).

Educational participation is high, with 26.7% of residents currently enrolled in formal education: 8.9% in primary education, 8.1% in secondary education, and 5.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Deagon has 27 active public transport stops. These include both train and bus services. There are 19 different routes operating in total.

Each week, these routes facilitate 1,815 passenger trips. The average distance from residents to the nearest transport stop is 187 meters. On average, there are 259 trips per day across all routes, which equates to approximately 67 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Deagon is lower than average with prevalence of common health conditions notable across both younger and older age cohorts

Deagon experiences significant health challenges with common health conditions prevalent among both younger and older age cohorts.

Approximately 53% (~2,136 people) of the total population has private health cover. The most frequent medical conditions are mental health issues affecting 10.1% of residents and asthma impacting 9.3%. A majority, 64.9%, report no medical ailments compared to 67.8% in Greater Brisbane. Among the 19.3% (772 people) aged 65 and over, health outcomes present some challenges broadly aligned with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Deagon ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Deagon's population shows low cultural diversity, with 80.7% born in Australia, 89.4% being citizens, and 92.8% speaking English only at home. Christianity is the predominant religion, accounting for 48.2%. The category 'Other' comprises 0.7%, compared to 3.7% across Greater Brisbane.

In ancestry, the top three groups are English (29.7%), Australian (27.0%), and Irish (10.3%). Notably, New Zealanders make up 1.6% of Deagon's population versus 1.1% regionally, Maori represent 1.0% compared to 0.9%, and Samoans account for 0.5% versus 0.6%.

Frequently Asked Questions - Diversity

Age

Deagon's median age exceeds the national pattern

Deagon's median age is 42 years, significantly higher than Greater Brisbane's average of 36 and Australia's median of 38. Compared to Greater Brisbane, Deagon has an over-representation of the 45-54 cohort (16.4%) and an under-representation of the 25-34 cohort (10.7%). Post-2021 Census, the 75-84 age group increased from 5.5% to 7.3%, while the 65-74 cohort decreased from 10.6% to 9.3%. By 2041, demographic modeling projects significant changes in Deagon's age profile. The 75-84 cohort is expected to grow by 56%, adding 162 residents to reach 456. Residents aged 65 and older are projected to represent 70% of the population growth, while declines are anticipated for the 5-14 and 65-74 cohorts.