Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in The Entrance reveals an overall ranking slightly below national averages considering recent, and medium term trends

The Entrance's population is approximately 16,192 as of November 2025. This figure represents an increase of 353 people (2.2%) since the 2021 Census, which reported a population of 15,839. The change is inferred from the estimated resident population of 16,155 in June 2024 and an additional 87 validated new addresses since the Census date. This results in a population density ratio of 1,168 persons per square kilometer, which aligns with averages seen across locations assessed by AreaSearch. Over the past decade, The Entrance has shown resilient growth patterns with a compound annual growth rate of 0.8%, outperforming the SA4 region. Population growth was primarily driven by overseas migration, contributing approximately 75.6% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch uses NSW State Government's SA2 level projections, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. By 2041, the area's population is projected to decline by 786 persons according to this methodology. However, growth across specific age cohorts is anticipated, with the 75 to 84 age group expected to increase by 691 people.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within The Entrance when compared nationally

The Entrance has seen approximately 100 new homes approved annually over the past five financial years, totalling 504 homes. As of FY26, 73 approvals have been recorded. On average, 0.5 new residents arrive per year for each new home built between FY21 and FY25, indicating that supply is meeting or exceeding demand. The average construction value of these new homes is $409,000.

In FY26, $2.3 million in commercial development approvals have been recorded. Compared to Greater Sydney, The Entrance has seen elevated construction activity, with 47.0% above the regional average per person over the past five years. New building activity consists of 32.0% detached dwellings and 68.0% attached dwellings, marking a shift from existing housing patterns which are currently 47.0% houses. This trend towards denser development caters to downsizers, investors, and entry-level buyers. The location has approximately 151 people per dwelling approval, indicating a low density market.

With stable or declining population projections, The Entrance may experience reduced pressure on housing, potentially presenting buying opportunities.

Frequently Asked Questions - Development

Infrastructure

The Entrance has emerging levels of nearby infrastructure activity, ranking in the 26thth percentile nationally

Nine projects identified by AreaSearch are expected to impact the area, significantly influencing its performance. Key projects include Vera's Water Garden Upgrade, The Grant McBride Baths Upgrade, Lakeside Shopping Centre Redevelopment, and The Entrance Waterfront Plaza Accessible Playspace. The following list details those projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

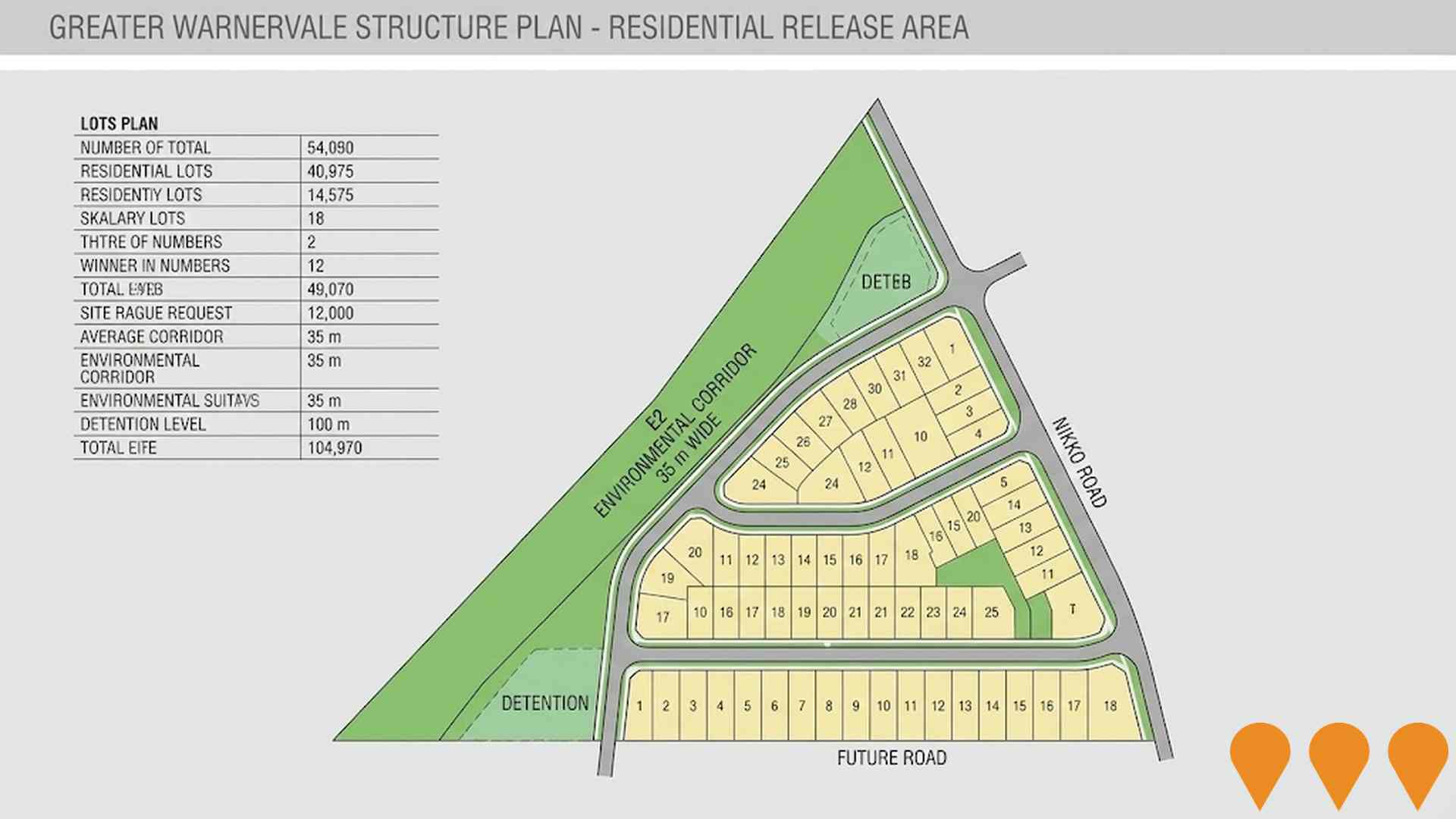

Greater Warnervale Structure Plan

Long-term strategic framework adopted by Central Coast Council in July 2024 to guide sustainable growth in the Greater Warnervale area over the next 20+ years. The plan supports population growth from approximately 20,000 to 57,000 residents through new residential release areas, two new neighbourhood centres, employment lands, community facilities and environmental protection measures.

Central Coast Desalination Plant

A proposed 30 ML/day reverse osmosis desalination plant to be built adjacent to the existing Toukley Sewage Treatment Plant. The project will provide a climate-independent water supply for the Central Coast region during severe drought, using a direct ocean intake between Jenny Dixon Beach and Pelican Point Beach and discharging brine via the existing Norah Head ocean outfall. The plant is designed to improve water security and system resilience for up to 250,000 residents.

Warnervale Water and Sewer Infrastructure Program

Central Coast Council's multi-stage water and sewer infrastructure program to support growth in the Warnervale area. Includes the completed Mardi to Warnervale Pipeline (2023), ongoing sewer rising main upgrades, water and sewer network extensions in Warnervale Town Centre, and a major upgrade and expansion of Mardi Water Treatment Plant to increase capacity.

Wyong Hospital Redevelopment

The $200 million Wyong Hospital Redevelopment (completed 2021-2022) delivered a new six-storey clinical services building (Block H) with expanded emergency department, ICU, paediatrics, medical imaging (including the hospital's first MRI), additional inpatient beds, and a medical assessment unit; plus refurbishment of existing facilities adding operating theatre capacity, expanded medical day unit, transit lounge, and cancer day unit expansion. The project significantly increased healthcare capacity for the Central Coast community.

Tumbi Umbi/Killarney Vale Priority Growth Precinct (Planning Proposal)

Central Coast Council-identified priority growth precinct for future medium-density housing and mixed-use development along Wyong Road to accommodate population growth. The project is a Planning Proposal for a Strategic Growth Corridor, which is a key component of the region's overall planning framework to deliver housing, jobs, and infrastructure. It is currently in the Planning stage, consistent with the Central Coast Regional Plan 2036.

Killarney Vale Masterplan Community - Eastern Release Area

A large master-planned residential community on the eastern side of Wyong Road featuring over 400 completed homes, parks, and community facilities developed by multiple builders.

Red Bus Planning Proposal - 682A Coleridge Road Rezoning

Rezoning of a 5.26ha former bus depot to enable housing. The proposal seeks to rezone the majority of the site from SP2 Infrastructure to R1 General Residential and a small portion to C3 Environmental Management; apply a 450m2 minimum lot size, 9.5m building height and 0.6:1 FSR to R1 land; and include 'transport depot' as an additional permitted use to allow ongoing bus operations until redevelopment. The Gateway determination (May 2024) indicates capacity for up to 70 dwellings and requires exhibition with a site-specific DCP.

Vera's Water Garden Upgrade

Upgrading Vera's Water Garden to a zero-depth design to improve safety, accessibility, and reduce ongoing maintenance.

Employment

The Entrance shows employment indicators that trail behind approximately 70% of regions assessed across Australia

The Entrance has a skilled workforce with essential services sectors well represented. The unemployment rate was 6.1% as of the past year, with an estimated employment growth of 2.8%.

As of September 2025, 7,312 residents are employed while the unemployment rate is 1.9% higher than Greater Sydney's rate of 4.2%. Workforce participation in The Entrance lags at 49.5%, compared to Greater Sydney's 60.0%. Key industries of employment among residents include health care & social assistance, construction, and retail trade. Construction is particularly specialized with an employment share 1.6 times the regional level.

Conversely, professional & technical services show lower representation at 4.7% versus the regional average of 11.5%. Employment opportunities locally appear limited as indicated by Census data comparing working population to resident population. During the year to September 2025, employment levels increased by 2.8%, and labour force grew by 3.5%, causing unemployment to rise by 0.6 percentage points. In Greater Sydney, employment grew by 2.1% with a labour force expansion of 2.4%, leading to an unemployment rate increase of 0.2 percentage points. State-level data as of 25-Nov-25 shows NSW employment contracted by 0.03%, losing 2,260 jobs, with the state unemployment rate at 3.9%. This compares favourably to the national unemployment rate of 4.3%. National employment forecasts from Jobs and Skills Australia, as of May-25, project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to The Entrance's employment mix suggests local employment should increase by 6.6% over five years and 13.8% over ten years.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

The Entrance SA2 had median assessed income of $47,094 and average income of $58,556 in financial year 2022. This is below national averages of $56,994 (median) and $80,856 (average). Greater Sydney's figures were higher at median income of $56,994 and average income of $80,856. By September 2025, estimated incomes would be approximately $53,033 (median) and $65,940 (average), based on Wage Price Index growth of 12.61%. The Entrance's incomes from the 2021 Census ranked between 11th and 21st percentiles nationally for households, families, and individuals. Most residents earned $800 - $1,499 weekly (4,274 residents), contrasting with broader area where $1,500 - $2,999 bracket led at 30.9%. Housing affordability pressures were severe in The Entrance, with only 78.2% of income remaining, ranking at the 8th percentile nationally.

Frequently Asked Questions - Income

Housing

The Entrance displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

The Entrance's dwelling structure, as recorded in the latest Census, consisted of 47.0% houses and 53.0% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Sydney metro had 83.2% houses and 16.7% other dwellings. Home ownership in The Entrance was at 34.7%, with mortgaged dwellings at 21.3% and rented ones at 44.0%. The median monthly mortgage repayment in the area was $1,950, higher than Sydney metro's average of $1,900. The median weekly rent figure in The Entrance was $365, compared to Sydney metro's $385. Nationally, The Entrance's mortgage repayments were higher at $1,950 than the Australian average of $1,863, while rents were lower at $365 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

The Entrance features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 58.2 percent of all households, including 17.8 percent couples with children, 25.7 percent couples without children, and 13.7 percent single parent families. Non-family households comprise the remaining 41.8 percent, with lone person households at 37.9 percent and group households at 3.8 percent of the total. The median household size is 2.1 people, which is smaller than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in The Entrance fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area has university qualification rates at 18.4%, significantly lower than Greater Sydney's average of 38.0%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common with 13.0%, followed by postgraduate qualifications (3.4%) and graduate diplomas (2.0%). Trade and technical skills are prominent, with 40.7% of residents aged 15+ holding vocational credentials - advanced diplomas at 11.6% and certificates at 29.1%.

A total of 24.9% of the population is actively pursuing formal education, including 8.1% in primary, 6.8% in secondary, and 3.3% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The Entrance has 94 active public transport stops, all of which are bus stops. These stops are served by 77 different routes that together facilitate 1,827 weekly passenger trips. The public transport accessibility is excellent, with residents on average being located 179 meters from the nearest stop.

On a daily basis, there are an average of 261 trips across all routes, which equates to approximately 19 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in The Entrance is well below average with prevalence of common health conditions notable across both younger and older age cohorts

The Entrance faces significant health challenges, with common conditions prevalent across both younger and older age groups. Private health cover is relatively low at approximately 49%, covering around 7,950 people, compared to the national average of 55.3%.

The most common medical conditions are arthritis (11.2%) and mental health issues (9.9%). Around 60.1% report no medical ailments, slightly lower than Greater Sydney's 61.5%. In terms of age distribution, 29.0% of residents are aged 65 and over (4,689 people), higher than Greater Sydney's 22.3%. Health outcomes among seniors present some challenges but perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The Entrance ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

The Entrance's population showed low cultural diversity, with 88.1% being citizens, 84.5% born in Australia, and 92.1% speaking English only at home. Christianity was the dominant religion, practiced by 59.4%, compared to 56.2% in Greater Sydney. The top three ancestry groups were English (30.0%), Australian (28.7%), and Irish (9.8%).

Notably, Maltese were overrepresented at 1.2% (vs regional 1.0%), Australian Aboriginal at 3.8% (vs 4.5%), and Samoan at 0.2% (vs 0.1%).

Frequently Asked Questions - Diversity

Age

The Entrance hosts an older demographic, ranking in the top quartile nationwide

The Entrance's median age is 48 years, which is significantly higher than Greater Sydney's average of 37 years, and also older than Australia's median age of 38 years. The age profile shows that the 65-74 year-old group comprises 15.0% of the population, while the 25-34 year-old group makes up only 9.7%. This concentration of 65-74 year-olds is higher than the national average of 9.4%. Between 2021 and present, the 75 to 84 age group has increased from 8.3% to 10.3%, while the 5 to 14 age group has decreased from 9.3% to 8.4%. By 2041, population forecasts indicate that the 75 to 84 age group will grow by 37%, adding 612 residents to reach a total of 2,274. Senior residents aged 65 and above will account for all population growth, emphasizing demographic aging trends. Conversely, population declines are projected for the 65-74 and 45-54 age groups.