Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Port Macquarie - West lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Based on AreaSearch's analysis, Port Macquarie - West's population is around 24,089 as of Nov 2025. This reflects an increase of 2,942 people (13.9%) since the 2021 Census, which reported a population of 21,147 people. The change is inferred from the estimated resident population of 23,575 from the ABS as of June 2024 and an additional 1,276 validated new addresses since the Census date. This level of population equates to a density ratio of 444 persons per square kilometer, providing significant space per person and potential room for further development. Port Macquarie - West's 13.9% growth since the 2021 census exceeded the SA4 region (4.7%), along with the non-metro area, marking it as a growth leader in the region. Population growth for the area was primarily driven by interstate migration that contributed approximately 90.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, AreaSearch is utilising the NSW State Government's SA2 level projections, as released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are also applied to all areas for years 2032 to 2041. Moving forward with demographic trends, a significant population increase in the top quartile of non-metropolitan areas nationally is forecast, with the area expected to increase by 5,884 persons to 2041 based on the latest annual ERP population numbers, reflecting recording a gain of 21.5% in total over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Port Macquarie - West was found to be higher than 90% of real estate markets across the country

Port Macquarie - West averaged approximately 299 new dwelling approvals annually. Between FY-21 and FY-25, 1,495 homes were approved, with an additional 130 approved in FY-26 so far. Each year, around 2.5 new residents are gained per dwelling built during these years.

The average construction cost value of new homes is $311,000. This financial year has seen $79.0 million in commercial development approvals, indicating high local commercial activity. Compared to the Rest of NSW, Port Macquarie - West shows 77.0% higher building activity per person. New development consists of 71.0% standalone homes and 29.0% townhouses or apartments, maintaining the area's traditional low density character. There are approximately 94 people per dwelling approval in the location.

Port Macquarie - West is expected to grow by 5,184 residents through to 2041, with current construction levels likely meeting demand and potentially enabling growth exceeding current forecasts.

Frequently Asked Questions - Development

Infrastructure

Port Macquarie - West has emerging levels of nearby infrastructure activity, ranking in the 26thth percentile nationally

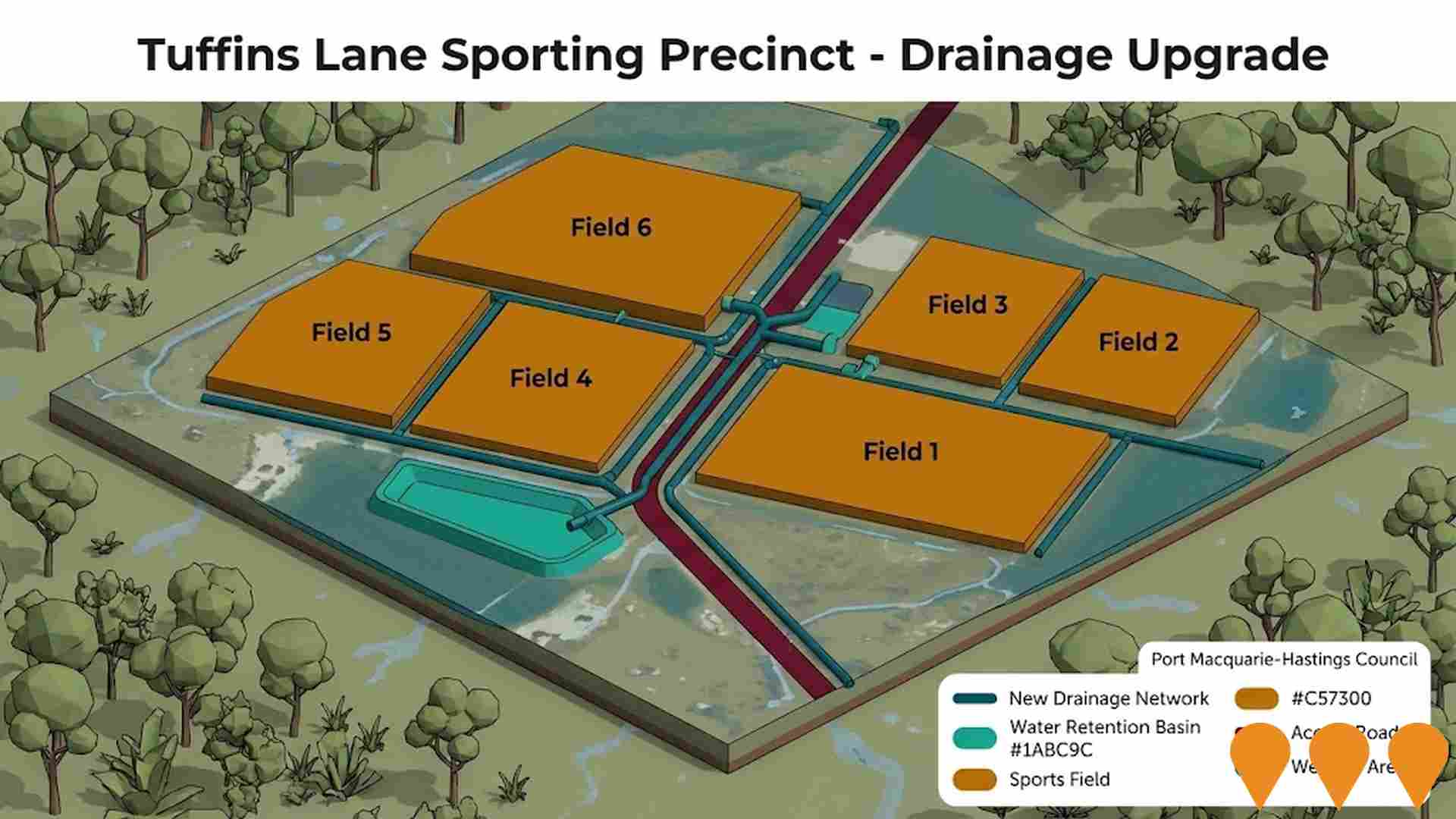

Infrastructure changes significantly impact an area's performance. AreaSearch identified 21 projects likely affecting the region. Notable initiatives include Port Macquarie Base Hospital Redevelopment Stage 2, Pacific Highway - Oxley Highway Interchange Upgrade, Ocean Drive Duplication, and Tuffins Lane Sporting Precinct Drainage. The following list details those expected to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

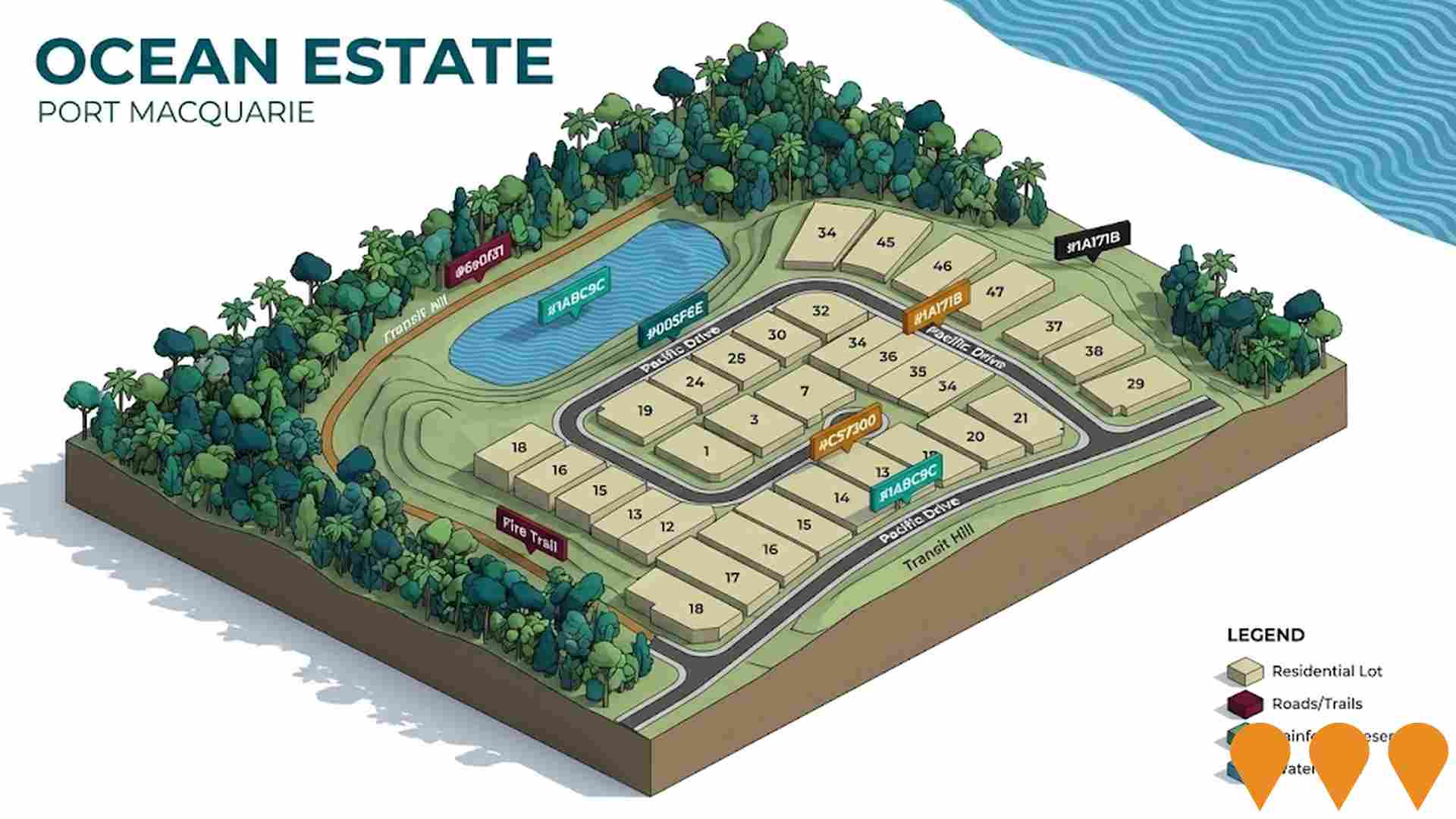

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sovereign Hills Master Planned Community

A $1 billion+ premier master-planned community by Lewis Land Group in Thrumster, Port Macquarie. Up to 2,000 home lots (over 1,100 sold/built as of 2025), growing Sovereign Place Town Centre ($500m+ vision including retail, business & technology park, health & wellbeing precinct, entertainment areas), schools, childcare, extensive parks and recreational facilities. Expected to support a population of 7,000-8,000 residents.

Port Macquarie Base Hospital Redevelopment Stage 2

The $265 million Stage 2 redevelopment of Port Macquarie Base Hospital delivers expanded Emergency Department, new inpatient unit including maternity and paediatric services, upgraded operating theatres, new medical imaging department and expanded ambulatory care services. Construction commenced in late 2025 following appointment of ADCO Constructions as head contractor.

Port Macquarie Aquatic Facility

Major regional aquatic facility at Macquarie Park. Development Application approved by Northern Regional Planning Panel in November 2024. Features include a 50m outdoor pool, 25m pool with transparent roof, 20m indoor pool, gym, splash pad, and 170 parking spaces. Stage 1 and 2 valued at $67 million. Federal funding application for $13.6m was declined in January 2025; Council is pursuing alternative funding strategies.

Ocean Drive Duplication

Major infrastructure project to duplicate 3.4km of Ocean Drive from two lanes to four divided travel lanes between Green Meadows Drive (South) and Matthew Flinders Drive/Emerald Drive. The $111 million project is in its final stages as of late 2025, with asphalting, line marking, and traffic signal commissioning underway. Key features include the upgrade of five intersections, shared user paths, on-road cycle lanes, koala exclusion fencing, fauna underpasses, and a new water trunk main. Construction is managed by Ditchfield Contracting and is on track for practical completion by late 2025, significantly improving traffic flow and safety for the region's motorists.

Thrumster Business Park

Port Macquarie's first master-planned, eco-friendly industrial business park. The project offers over 60 fully serviced lots from 1,200 to 4,800 sqm across two precincts: one for community-friendly businesses (Precinct 1) and one for traditional industrial uses (Precinct 2). Stage 1 is registered and ready for development, with Stage 2 and 3 civil construction well underway. A planning proposal is also seeking an E3 zone amendment to allow for mixed-uses including 170 residential units, retail, and commercial spaces in Precinct 1.

Fernbank Creek and Sancrox Structure Plan

A strategic planning document that makes land use planning recommendations for the Fernbank Creek and Sancrox area, outlining a vision for sustainable conservation and development as a network of well-serviced villages. It proposes a potential dwelling yield of 4,500 homes across four precincts (including East Sancrox and Fernbank Creek) and guides future rezoning and infrastructure planning to support long-term growth near Thrumster. This plan is a key part of the Port Macquarie-Hastings Local Housing Delivery Plan which was adopted in August 2024.

Salt Town Beach

A masterpiece in contemporary design, its gentle curves harmonising with the adjacent rolling surf. Recognising the significance of the 'SALT' project, multi award-winning developers Harbourland harnessed the acclaimed skills of architects King + Campbell to create a centre of residential excellence with 15 luxury three-bedroom + study apartments offering uninterrupted coastal views.

Sovereign Place Town Centre

The commercial heart of the Sovereign Hills master planned community. Stage One is complete. The Town Centre is planned to expand to over 60,000sqm, incorporating diverse retail, a Business and Technology Park, a Health and Wellbeing Precinct, commercial offices, and a community library/town green.

Employment

Employment conditions in Port Macquarie - West remain below the national average according to AreaSearch analysis

Port Macquarie-West has a skilled workforce with well-represented essential services sectors. Its unemployment rate is 3.3%.

Employment stability has been relative over the past year. As of September 2025, 10,886 residents are employed, with an unemployment rate of 3.3%, which is 0.5% below Rest of NSW's rate of 3.8%. Workforce participation in Port Macquarie-West is 49.9%, compared to Rest of NSW's 56.4%. Residents' employment is concentrated in health care & social assistance, retail trade, and accommodation & food.

Health care & social assistance has a particularly strong presence with an employment share 1.4 times the regional level. Agriculture, forestry & fishing has limited presence at 0.9% compared to the regional average of 5.3%. The ratio of workers to residents is 0.7, indicating above-normal local employment opportunities. Between September 2024 and September 2025, employment levels increased by 0.0%, while labour force increased by 0.8%, leading to a rise in unemployment rate by 0.7 percentage points. In comparison, Rest of NSW saw employment fall by 0.5%, labour force contract by 0.1%, and unemployment rise by 0.4 percentage points. State-level data from 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with an unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 estimate that national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Port Macquarie-West's employment mix suggests local employment should increase by 7.1% over five years and 14.6% over ten years, based on simple weighting extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Port Macquarie - West SA2 had a median income of $46,603 and an average of $61,152 among taxpayers. This is lower than the national average. For comparison, Rest of NSW had a median of $49,459 and an average of $62,998. Based on Wage Price Index growth since financial year 2022, current estimates for Port Macquarie - West would be approximately $52,480 (median) and $68,863 (average) as of September 2025. According to the 2021 Census, incomes in Port Macquarie - West fall between the 12th and 18th percentiles nationally. The earnings profile shows that 27.3% of locals earn between $800 and $1,499 annually, unlike regional trends where 29.9% earn between $1,500 and $2,999. Housing affordability pressures are severe, with only 79.5% of income remaining after housing costs, ranking at the 10th percentile.

Frequently Asked Questions - Income

Housing

Port Macquarie - West displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

Port Macquarie - West's dwelling structure, as per the latest Census, consisted of 64.4% houses and 35.7% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro NSW had 75.9% houses and 24.1% other dwellings. Home ownership in Port Macquarie - West stood at 38.9%, with mortgaged dwellings at 25.1% and rented ones at 36.0%. The median monthly mortgage repayment was $1,820, higher than Non-Metro NSW's average of $1,733. The median weekly rent figure was $385, compared to Non-Metro NSW's $375. Nationally, Port Macquarie - West's mortgage repayments were lower than the Australian average of $1,863, while rents exceeded the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Port Macquarie - West features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 63.4% of all households, including 19.9% couples with children, 30.5% couples without children, and 12.0% single parent families. Non-family households comprise the remaining 36.6%, with lone person households at 33.0% and group households at 3.6%. The median household size is 2.2 people, which is smaller than the Rest of NSW average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Port Macquarie - West shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's university qualification rate is 18.2%, significantly lower than the NSW average of 32.2%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most common at 12.8%, followed by postgraduate qualifications (3.6%) and graduate diplomas (1.8%). Vocational credentials are prominent, with 41.0% of residents aged 15+ holding them - advanced diplomas comprise 11.0% and certificates make up 30.0%.

Educational participation is high, with 27.7% of residents currently enrolled in formal education. This includes 8.6% in primary education, 7.1% in secondary education, and 5.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Port Macquarie - West has 134 active public transport stops, all of which are bus stops. These stops are served by 129 different routes that together facilitate 2,129 weekly passenger trips. The area's transport accessibility is rated as good, with residents on average located just 223 meters from the nearest stop.

Across all routes, there are an average of 304 trips per day, which translates to about 15 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Port Macquarie - West is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Port Macquarie - West faces significant health challenges with various conditions affecting both younger and older age groups. Approximately half of its total population (~12,044) has private health cover, lower than the national average of 55.3%.

The most prevalent medical conditions are arthritis (11.6%) and mental health issues (10.5%), with 57.5% reporting no medical ailments, compared to 59.9% in Rest of NSW. Around 27.7% of residents are aged 65 and over (6,682 people). Health outcomes among seniors present some challenges despite performing better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Port Macquarie - West ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Port Macquarie-West had a cultural diversity below average, with 84.4% of its population born in Australia, 89.8% being citizens, and 93.4% speaking English only at home. Christianity was the main religion, comprising 57.6% of people in Port Macquarie-West, similar to the 57.5% across Rest of NSW. The top three ancestry groups were English (32.4%), Australian (30.1%), and Irish (8.6%).

Notably, Australian Aboriginal was overrepresented at 4.7%, compared to 3.8% regionally; Maltese was also slightly higher at 0.5% vs 0.4%; Filipino was overrepresented at 0.9% compared to the regional average of 0.5%.

Frequently Asked Questions - Diversity

Age

Port Macquarie - West hosts an older demographic, ranking in the top quartile nationwide

Port Macquarie - West has a median age of 46, which is slightly higher than Rest of NSW's figure of 43 and significantly higher than the national norm of 38. The 75-84 age group shows strong representation at 10.5%, compared to Rest of NSW, while the 55-64 cohort is less prevalent at 10.3%. Post-2021 Census data shows that the 15 to 24 age group has grown from 11.7% to 13.2% of the population, and the 25 to 34 cohort increased from 11.3% to 12.6%. Conversely, the 55 to 64 cohort has declined from 11.5% to 10.3%, and the 65 to 74 group dropped from 14.1% to 13.0%. By 2041, Port Macquarie - West is expected to see notable shifts in its age composition, with the 25 to 34 group growing by 38% (1,161 people), reaching 4,197 from 3,035. Meanwhile, the 55 to 64 cohort grows by a modest 5% (116 people).