Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Port Macquarie - East reveals an overall ranking slightly below national averages considering recent, and medium term trends

Port Macquarie - East's population was 11,928 as of November 2025, reflecting a 164-person increase since the 2021 Census. This increase represents a 1.4% rise from the previous population count of 11,764 people. The change is inferred from ABS's estimated resident population of 11,823 in June 2024 and an additional 161 validated new addresses since the Census date. This results in a density ratio of 1,682 persons per square kilometer, higher than the average seen across national locations assessed by AreaSearch. Overseas migration primarily drove population growth, contributing approximately 73.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future population dynamics anticipate an increase just below the median of non-metropolitan areas nationally, with the area expected to increase by 1,207 persons to 2041 based on the latest annual ERP population numbers, reflecting a total increase of 9.2% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Port Macquarie - East according to AreaSearch's national comparison of local real estate markets

Port Macquarie - East averaged approximately 39 new dwelling approvals annually over the past five financial years, totalling 197 homes. As of FY26, there have been 5 approvals recorded so far. The average number of new residents per year arriving per new home in this area between FY21 and FY25 was 0.3, indicating that new supply is keeping pace with or exceeding demand. This offers ample buyer choice and creates capacity for population growth beyond current forecasts.

The average construction value of these properties was $437,000, which is moderately above regional levels, suggesting an emphasis on quality construction. In the current financial year, $2.0 million in commercial development approvals have been recorded, indicating minimal commercial development activity compared to residential development. Relative to the rest of NSW, Port Macquarie - East records markedly lower building activity, with 58.0% fewer approvals per person than the regional average. This scarcity of new homes typically strengthens demand and prices for existing properties, reflecting the area's established nature and suggesting potential planning limitations. Recent construction in the area comprises approximately 38.0% detached dwellings and 62.0% attached dwellings. This skew towards compact living offers affordable entry pathways and attracts downsizers, investors, and first-time purchasers, marking a significant departure from existing housing patterns which are currently 55.0% houses. This shift may be due to diminishing developable land availability and evolving lifestyle preferences and housing affordability needs.

The location has approximately 398 people per dwelling approval, reflecting an established area with steady population growth. Future projections show Port Macquarie - East adding 1,091 residents by 2041, according to the latest AreaSearch quarterly estimate. Present construction rates appear balanced with future demand, fostering steady market conditions without excessive price pressure.

Frequently Asked Questions - Development

Infrastructure

Port Macquarie - East has limited levels of nearby infrastructure activity, ranking in the 12thth percentile nationally

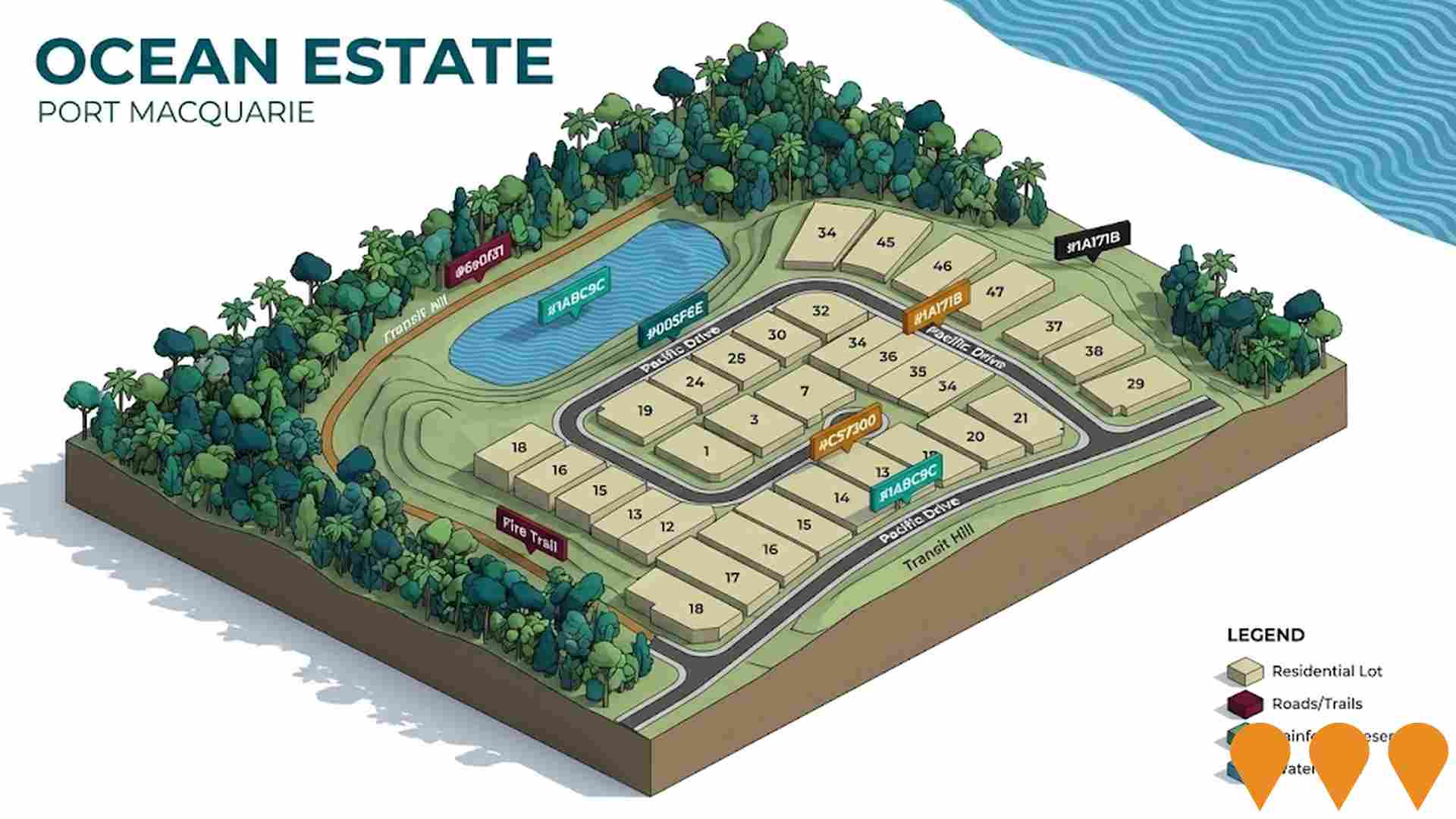

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 11 projects likely to impact the area. Key projects include Ocean Estate Port Macquarie, Port Macquarie Aquatic Facility, Hastings Residences Port Macquarie, and Port Macquarie Southern Breakwall Repair. The following list details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Port Macquarie Base Hospital Redevelopment Stage 2

The $265 million Stage 2 redevelopment of Port Macquarie Base Hospital delivers expanded Emergency Department, new inpatient unit including maternity and paediatric services, upgraded operating theatres, new medical imaging department and expanded ambulatory care services. Construction commenced in late 2025 following appointment of ADCO Constructions as head contractor.

Port Macquarie Aquatic Facility

Major regional aquatic facility at Macquarie Park. Development Application approved by Northern Regional Planning Panel in November 2024. Features include a 50m outdoor pool, 25m pool with transparent roof, 20m indoor pool, gym, splash pad, and 170 parking spaces. Stage 1 and 2 valued at $67 million. Federal funding application for $13.6m was declined in January 2025; Council is pursuing alternative funding strategies.

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

Ocean Drive Duplication

Major infrastructure project to duplicate 3.4km of Ocean Drive from two lanes to four divided travel lanes between Green Meadows Drive (South) and Matthew Flinders Drive/Emerald Drive. The $111 million project is in its final stages as of late 2025, with asphalting, line marking, and traffic signal commissioning underway. Key features include the upgrade of five intersections, shared user paths, on-road cycle lanes, koala exclusion fencing, fauna underpasses, and a new water trunk main. Construction is managed by Ditchfield Contracting and is on track for practical completion by late 2025, significantly improving traffic flow and safety for the region's motorists.

Salt Town Beach

A masterpiece in contemporary design, its gentle curves harmonising with the adjacent rolling surf. Recognising the significance of the 'SALT' project, multi award-winning developers Harbourland harnessed the acclaimed skills of architects King + Campbell to create a centre of residential excellence with 15 luxury three-bedroom + study apartments offering uninterrupted coastal views.

Tara Port Macquarie

Tara delivers exceptional luxury, comfort and craftsmanship to the dramatic coastal landscape of Port Macquarie's cosmopolitan Town Beach precinct. Just footsteps from the surf, this architecturally designed boutique building encompasses a collection of 24 wonderfully generous, beautifully appointed two and three-bedroom apartments inspired by the natural elements of their surroundings.

Akoya Apartments

Modern apartment development featuring luxury residential units with ocean views and premium amenities. From acclaimed developer Bloc, this grand landmark of forty premium two and three-bedroom apartments is purpose-designed to embrace a magnificent panorama of nearby harbour foreshores and far northern waterways.

Port Macquarie Southern Breakwall Repair

Critical repair work to 600 metres of the southern breakwall along the river section, maintenance of the breakwall head, installation of a new five-metre-wide footpath with improved disability access, safety features, lighting, seating, viewing platforms, and landscaping with over 6000 plants and 43 mature trees. Project has obtained approval to proceed but is facing ongoing delays due to site access issues.

Employment

The labour market in Port Macquarie - East demonstrates typical performance when compared to similar areas across Australia

Port Macquarie - East has a well-educated workforce with essential services sectors well represented. As of September 2025, the unemployment rate is 3.2%.

Over the past year, employment stability has been relatively consistent. In comparison to Rest of NSW's unemployment rate of 3.8%, Port Macquarie - East's rate is 0.7% lower. Workforce participation stands at 59.5%, slightly higher than Rest of NSW's 56.4%. Key industries include health care & social assistance, education & training, and accommodation & food, with a particular strength in health care & social assistance (1.3 times the regional level).

Agriculture, forestry & fishing is under-represented, accounting for only 0.7% of the workforce compared to Rest of NSW's 5.3%. While local employment opportunities exist, many residents commute elsewhere for work based on Census data analysis. Over a 12-month period ending September 2025, labour force increased by 0.0%, while employment decreased by 0.4%, leading to an unemployment rate rise of 0.5 percentage points. In contrast, Rest of NSW experienced an employment decline of 0.5% and a labour force decline of 0.1%, with a 0.4 percentage point rise in unemployment rate. State-level data from 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. National employment forecasts from Jobs and Skills Australia project a 6.6% expansion over five years and 13.7% over ten years. Applying these projections to Port Macquarie - East's employment mix suggests local employment should increase by 7.2% over five years and 14.7% over ten years, assuming constant population projections for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

AreaSearch's aggregation of latest postcode level ATO data released for financial year 2022 shows Port Macquarie - East SA2 had a median income among taxpayers of $46,603. The average income stood at $61,152. This is below the national average and compares to levels of $49,459 and $62,998 across Rest of NSW respectively. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates would be approximately $52,480 (median) and $68,863 (average) as of September 2025. According to 2021 Census figures, household, family and personal incomes in Port Macquarie - East rank modestly, between the 28th and 40th percentiles. Distribution data shows 28.3% of the population (3,375 individuals) fall within the $1,500 - 2,999 income range, mirroring regional levels where 29.9% occupy this bracket. Housing affordability pressures are severe, with only 82.5% of income remaining, ranking at the 26th percentile and the area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Port Macquarie - East displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

Dwelling structure in Port Macquarie - East, as per the latest Census, consisted of 54.6% houses and 45.4% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro NSW had 75.9% houses and 24.1% other dwellings. Home ownership in Port Macquarie - East was at 34.1%, with the rest being mortgaged (24.9%) or rented (41.0%). The median monthly mortgage repayment was $1,753, higher than Non-Metro NSW's average of $1,733. Median weekly rent in Port Macquarie - East was $350, compared to Non-Metro NSW's $375. Nationally, mortgage repayments were lower at $1,863 and rents were less than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Port Macquarie - East features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households constitute 62.2% of all households, including 21.6% couples with children, 28.8% couples without children, and 11.1% single parent families. Non-family households comprise the remaining 37.8%, with lone person households at 33.9% and group households making up 3.9%. The median household size is 2.2 people, which is smaller than the Rest of NSW average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Port Macquarie - East aligns closely with national averages, showing typical qualification patterns and performance metrics

Educational attainment in Port Macquarie - East is notable. As of 2016, 28.8% of residents aged 15 years and over held university qualifications, surpassing the SA4 region's 16.9% and the SA3 area's 19.8%. Bachelor degrees were most common at 19.9%, followed by postgraduate qualifications (5.9%) and graduate diplomas (3.0%). Vocational credentials were also prevalent, with 37.2% of residents aged 15 years and over holding such qualifications - advanced diplomas accounted for 11.8% and certificates for 25.4%.

Educational participation was high in the area, with 27.9% of residents enrolled in formal education as of 2016. This included 9.1% in primary education, 7.6% in secondary education, and 5.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Port Macquarie - East has 97 active public transport stops. These are served by a mix of buses along 100 different routes. This results in 1,285 weekly passenger trips.

Residents enjoy excellent transport accessibility, with an average distance of 147 meters to the nearest stop. Service frequency is high, averaging 183 trips per day across all routes, which equates to around 13 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Port Macquarie - East is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Port Macquarie - East faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is relatively low at approximately 50% of the total population (~5,964 people), compared to the national average of 55.3%.

Mental health issues and arthritis are the most common medical conditions in the area, impacting 9.6 and 9.4% of residents respectively. 64.7% of residents declare themselves completely clear of medical ailments, compared to 59.9% across Rest of NSW. The area has 23.9% of residents aged 65 and over (2,849 people), which is lower than the 28.7% in Rest of NSW. Health outcomes among seniors are above average, performing better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Port Macquarie - East ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Port Macquarie - East has a lower level of cultural diversity, with 84.7% of its residents born in Australia, 90.2% being citizens, and 94.6% speaking English only at home. The predominant religion is Christianity, which accounts for 51.4% of the population. This figure is lower than the 57.5% recorded across Rest of NSW.

In terms of ancestry, the top three groups in Port Macquarie - East are English (32.2%), Australian (28.0%), and Irish (10.8%). There are notable differences in the representation of certain ethnic groups: Scottish is overrepresented at 8.8% compared to the regional average of 8.3%, French at 0.6% versus 0.4%, and Australian Aboriginal at 3.0% compared to 3.8%.

Frequently Asked Questions - Diversity

Age

Port Macquarie - East hosts an older demographic, ranking in the top quartile nationwide

Port Macquarie - East's median age is 46, which is higher than Rest of NSW's figure of 43 and significantly above the national norm of 38. The 45-54 age group comprises 13.6%, compared to Rest of NSW, while the 15-24 cohort makes up 10.4%. Post-2021 Census data shows the 25 to 34 age group grew from 9.8% to 11.7%. Conversely, the 55 to 64 group declined from 15.1% to 13.2%. By 2041, Port Macquarie - East's age composition is expected to shift notably. The 25 to 34 group is projected to grow by 33%, reaching 1,858 people from 1,399. Meanwhile, the 15-24 and 65-74 cohorts are anticipated to experience population declines.