Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Wyongah is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Wyongah's population, as estimated by AreaSearch based on ABS updates and new addresses validated since Nov 2025, stands at approximately 2,093. This figure shows a rise of 73 individuals from the 2021 Census total of 2,020, reflecting a growth rate of 3.6%. The estimated resident population of 2,032 in Jun 2024, along with two validated new addresses since the Census date, supports this increase. This results in a population density ratio of 1,956 persons per square kilometer, exceeding national averages assessed by AreaSearch. Wyongah's growth rate since the census mirrors that of its SA4 region at 3.7%, indicating strong fundamental growth factors. Overseas migration primarily drove this growth.

For projections until 2041, AreaSearch uses ABS/Geoscience Australia data released in 2024 with a base year of 2022 for covered areas, and NSW State Government's SA2-level projections from 2022 with a base year of 2021 for uncovered areas. Considering these projections, Wyongah is expected to increase by approximately 119 persons by 2041, reflecting a total growth rate of around 3.3% over the 17-year period.

Frequently Asked Questions - Population

Development

The level of residential development activity in Wyongah is very low in comparison to the average area assessed nationally by AreaSearch

AreaSearch analysis of ABS building approval numbers shows Wyongah recorded approximately 4 residential properties granted approval per year over the past 5 financial years ending June 2021, totalling an estimated 22 homes. As of July 2026, 1 approval has been recorded. Population decline in recent years has maintained adequate housing supply relative to demand, resulting in a balanced market with good buyer choice. New properties are constructed at an average value of $205,000, below regional norms, offering more affordable housing options.

This financial year, Wyongah has seen $1.2 million in commercial approvals, indicating minimal commercial development activity. Compared to Greater Sydney, Wyongah records significantly lower building activity, 50.0% below the regional average per person. This limited new supply generally supports stronger demand and values for established properties. Activity is also under the national average, suggesting the area's established nature and potential planning limitations. New development consists of 40.0% detached dwellings and 60.0% townhouses or apartments, indicating a shift from Wyongah's existing housing composition, currently 99.0% houses. With around 817 people per dwelling approval, Wyongah reflects a highly mature market. According to the latest AreaSearch quarterly estimate, Wyongah is expected to grow by 69 residents through to 2041.

Current construction levels should adequately meet demand, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Wyongah has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified one major project likely affecting this region. Key projects include Wyong Hospital Redevelopment, The Sanctuary Estate Hamlyn Terrace, Yeramba Estates Central Coast Development, and Cedarwood Estate. Details about these projects are listed below.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Mardi Water Treatment Plant Upgrade

An $82.5 million major upgrade to the Mardi Water Treatment Plant to enhance drinking water quality and security for over 210,000 residents. Key works include the construction of a new Dissolved Air Flotation (DAF) clarifier, flocculation tanks, and upgraded chemical dosing facilities to handle poor raw water conditions such as algal blooms and high turbidity. The project will ensure a reliable supply of up to 160 million litres of water per day.

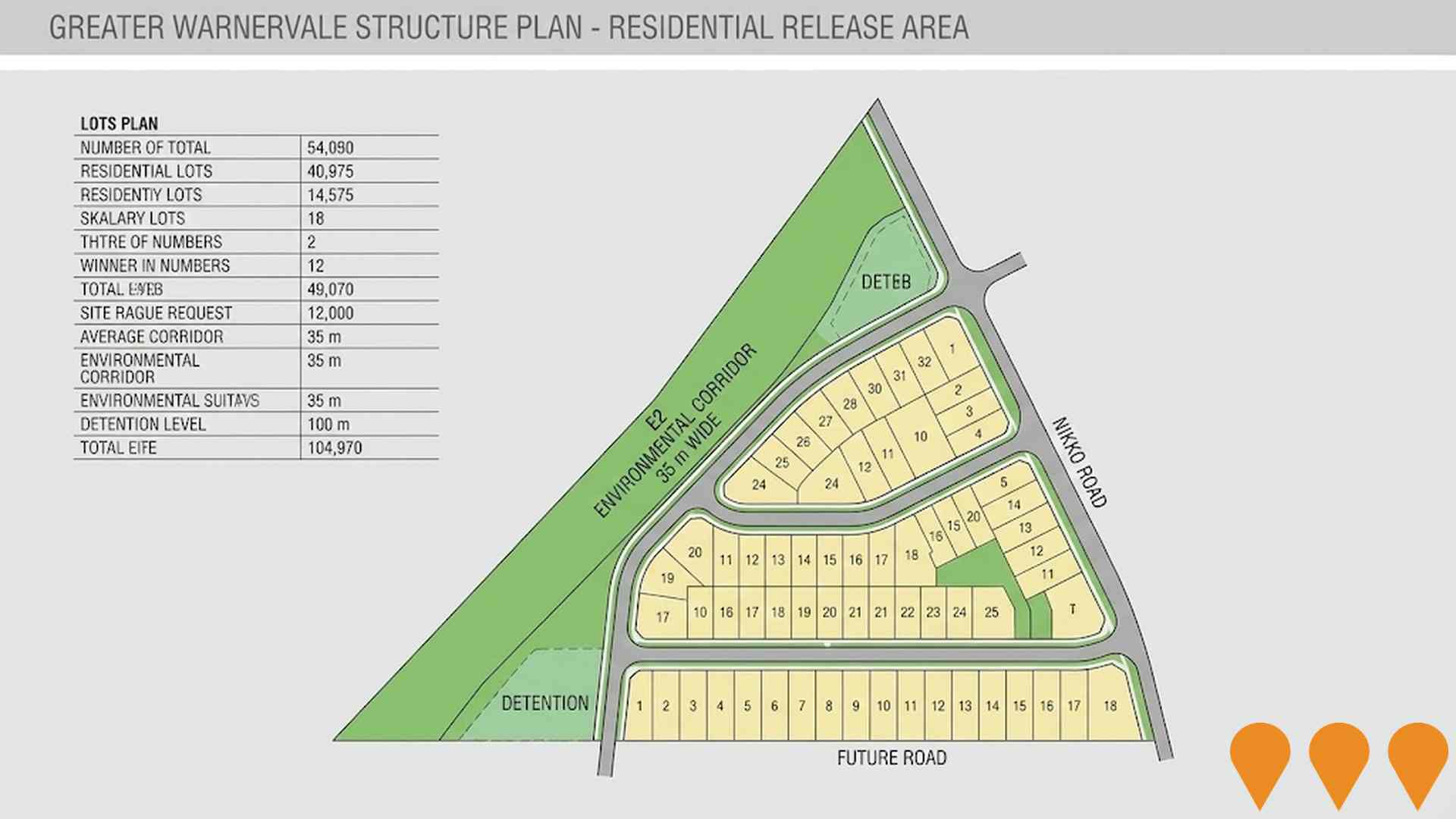

Greater Warnervale Structure Plan

A long-term strategic framework adopted by Central Coast Council in July 2024 to manage growth in the northern Central Coast over the next 20 years. The plan facilitates an expected population increase from 20,000 to approximately 57,000 residents, supported by 10,130 new dwellings. Key features include the establishment of two neighborhood centres, employment land development, and significant environmental protections for Porters Creek Wetland. As of 2026, the plan serves as the primary guidance for ongoing precinct-level rezonings and local infrastructure priority lists.

Toukley Desalination Water Treatment Plant

A proposed 30 ML/day reverse osmosis desalination plant to be built adjacent to the existing Toukley Sewage Treatment Plant. The project is a key drought response initiative under the Central Coast Water Security Plan, designed to be 'plan ready' with approvals in place for rapid construction if dam levels fall below critical triggers (currently 45% storage). It features a direct ocean intake structure located offshore between Noraville and Magenta to minimize beach impact and will provide a climate-independent water supply for up to 250,000 residents.

High Speed Rail - Newcastle to Sydney (Stage 1)

The first stage of Australia's High Speed Rail network involves a 194km dedicated rail line connecting Newcastle to Sydney. The project features trains reaching speeds of 320 km/h on surface sections and 200 km/h in tunnels, aiming to reduce travel time to approximately one hour. Following the 2025 business case evaluation, the project has moved into a two-year Development Phase focusing on design refinement (to 40% maturity), securing planning approvals, and corridor preservation. The route includes approximately 115km of tunneling and six planned stations: Broadmeadow, Lake Macquarie, Gosford, Sydney Central, Parramatta, and Western Sydney International Airport.

Warnervale Water and Sewer Infrastructure Program

A multi-stage infrastructure program by Central Coast Council to support the Greater Warnervale growth corridor. The program includes the completed 9.4km Mardi to Warnervale Pipeline, ongoing water and sewer network extensions for the Warnervale Town Centre, and a major $82.5 million upgrade of the Mardi Water Treatment Plant. The plant upgrade involves new flocculation and Dissolved Air Flotation (DAF) systems to increase capacity to 160 million litres per day and improve water quality during poor raw water conditions.

Central Coast Airport Precinct Development

The development aims to upgrade the general aviation facility at Warnervale into a regional hub for aviation, education, and emergency services. Following the adoption of the Central Coast Airport Masterplan on 25 February 2025, the project focuses on upgrading the runway to Code 1B standards (maintaining the 1200m length), installing night lighting, and establishing a Biodiversity Stewardship Agreement for the Porters Creek Wetland. The precinct will include an aviation business park, hangars, and a relocation of emergency services to improve local accessibility and support a Bachelor of Aviation program.

Wyong Hospital Redevelopment

The $200 million Wyong Hospital Redevelopment (completed 2021-2022) delivered a new six-storey clinical services building (Block H) with expanded emergency department, ICU, paediatrics, medical imaging (including the hospital's first MRI), additional inpatient beds, and a medical assessment unit; plus refurbishment of existing facilities adding operating theatre capacity, expanded medical day unit, transit lounge, and cancer day unit expansion. The project significantly increased healthcare capacity for the Central Coast community.

Yeramba Estates Central Coast Development

New estate development by Yeramba Estates, with over 60 years experience developing quality residential land estates. Located in convenient Central Coast location, halfway between Sydney and Newcastle, designed for modern living with community facilities.

Employment

Wyongah shows employment indicators that trail behind approximately 70% of regions assessed across Australia

Wyongah has a balanced workforce with representation across white and blue collar jobs, particularly in essential services. The unemployment rate was 6.7% as of an unspecified past year, with estimated employment growth of 2.1%.

As of September 2025, 1,024 residents were employed while the unemployment rate stood at 2.5%, higher than Greater Sydney's rate of 4.2%. Workforce participation was 62.9%, slightly above Greater Sydney's 60.0%. The leading employment industries among Wyongah residents are health care & social assistance, construction, and retail trade. Notably, health care & social assistance has a significant presence with an employment share 1.3 times the regional level.

Conversely, professional & technical services have limited representation at 3.9%, compared to the regional average of 11.5%. The area appears to offer limited local employment opportunities based on Census data comparing working population and resident population. Over a 12-month period ending in an unspecified date, employment increased by 2.1% alongside labour force growth of 3.1%, leading to a rise in unemployment rate by 0.9 percentage points. Comparing this with Greater Sydney, employment grew by 2.1%, labour force expanded by 2.4%, and unemployment rose by 0.2 percentage points. State-level data up to 25-Nov shows NSW employment contracted slightly by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. Nationally, the unemployment rate was 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years for national employment. Applying these projections to Wyongah's employment mix suggests local employment should increase by 6.5% over five years and 13.7% over ten years, assuming no changes in population projections.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

Wyongah's median income among taxpayers is $55,019 according to AreaSearch data from the ATO for financial year 2023. The suburb's average income stands at $66,055 in this period. In comparison, Greater Sydney's median and average incomes are $60,817 and $83,003 respectively during the same time frame. Based on Wage Price Index growth of 8.86% since financial year 2023, Wyongah's estimated median income is approximately $59,894 by September 2025, with an average income of around $71,907 during the same period. Census data from 2021 indicates that incomes in Wyongah rank modestly, between the 33rd and 42nd percentiles for household, family, and personal incomes. Income analysis shows that 39.1% of Wyongah's population falls within the $1,500 - $2,999 income range, which is similar to the metropolitan region where 30.9% of individuals occupy this bracket. Housing affordability pressures are severe in Wyongah, with only 83.5% of income remaining, ranking at the 42nd percentile.

Frequently Asked Questions - Income

Housing

Wyongah is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Wyongah's dwellings were 99.0% houses and 1.0% other dwellings as of the latest Census, compared to Sydney metro's 83.2% houses and 16.7% other dwellings. Home ownership in Wyongah was 32.4%, with mortgaged dwellings at 41.1% and rented ones at 26.5%. The median monthly mortgage repayment was $1,733, lower than Sydney metro's $1,900 but higher than the national average of $1,863. Median weekly rent in Wyongah was $390, slightly above Sydney metro's $385 and the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Wyongah has a typical household mix, with a higher-than-average median household size

Family households account for 75.1% of all households, including 28.4% that are couples with children, 25.1% that are couples without children, and 19.4% that are single parent families. Non-family households make up the remaining 24.9%, with lone person households at 22.3% and group households comprising 2.5%. The median household size is 2.7 people, larger than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Wyongah shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area has university qualification rates at 13.2%, significantly lower than Greater Sydney's average of 38.0%. Bachelor degrees are the most common at 8.9%, followed by graduate diplomas (2.2%) and postgraduate qualifications (2.1%). Vocational credentials are prominent, with 43.0% of residents aged 15+ holding them, including advanced diplomas (10.1%) and certificates (32.9%). Educational participation is high at 28.7%, with 9.8% in primary education, 8.4% in secondary education, and 3.3% pursuing tertiary education.

Educational participation is notably high, with 28.7% of residents currently enrolled in formal education. This includes 9.8% in primary education, 8.4% in secondary education, and 3.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Wyongah has 19 operational public transport stops. These are served by buses from 14 different routes, offering a total of 388 weekly passenger trips. The average distance to the nearest stop for residents is 118 meters.

On average, there are 55 trips per day across all routes, equating to about 20 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Wyongah is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Wyongah faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is approximately 53% of the total population (~1,110 people), leading that of the average SA2 area but slightly higher than Greater Sydney's 50.4%.

Mental health issues affect 10.1% of residents, while asthma impacts 9.2%. A total of 64.7% of residents declare themselves completely clear of medical ailments, compared to 61.5% across Greater Sydney. The area has 15.3% of residents aged 65 and over (320 people), which is lower than the 22.3% in Greater Sydney. Health outcomes among seniors are above average and perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Wyongah is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Wyongah's population was found to be less culturally diverse, with 90.1% born in Australia, 93.3% being citizens, and 96.0% speaking English only at home. Christianity is the dominant religion, comprising 51.0%. Judaism, however, is overrepresented at 0.2%, compared to Greater Sydney's 0.1%.

The top three ancestry groups are English (32.3%), Australian (30.9%), and Irish (8.1%). Notably, Maltese people are overrepresented at 0.8% in Wyongah versus the regional 1.0%, Macedonian people are overrepresented at 0.3% compared to 0.1%, and Australian Aboriginal people are slightly underrepresented at 4.4% versus 4.5%.

Frequently Asked Questions - Diversity

Age

Wyongah's population is slightly younger than the national pattern

Wyongah has a median age of 37, matching Greater Sydney's figure of 37 years and closely resembling Australia's median age of 38 years. The 15-24 age group constitutes 16.3% of Wyongah's population, higher than Greater Sydney's percentage. Conversely, the 35-44 cohort makes up 11.0%. Between 2021 and now, the 15 to 24 age group has increased from 15.5% to 16.3%, while the 55 to 64 cohort has decreased from 13.3% to 12.5%. By 2041, demographic projections indicate significant shifts in Wyongah's age structure. The 45-54 group is projected to grow by 16 people, reaching 346 from 299. The aging population trend is evident, with those aged 65 and above accounting for 52% of the projected growth. Meanwhile, the 15 to 24 and 0 to 4 age groups are expected to experience population declines.