Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Wickham reveals an overall ranking slightly below national averages considering recent, and medium term trends

The Wickham (WA) statistical area (Lv2) has an estimated population of around 2,256 as of Nov 2025. This reflects a growth of 234 people since the 2021 Census, which reported a population of 2,022. The increase is inferred from AreaSearch's estimation following examination of the latest ERP data release by the ABS (June 2024) and address validation since the Census date. This level of population equates to a density ratio of 133 persons per square kilometer in the Wickham (WA) (SA2). The area's growth rate of 11.6% since the 2021 census exceeded the national average of 9.7%. Natural growth contributed approximately 59.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises the growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections (released in 2023, based on 2022 data). According to aggregated SA2-level projections, the Wickham (WA) (SA2) is expected to grow by 267 persons to reach a total population of around 2,523 by 2041. This reflects an increase of approximately 8.8% over the 17-year period.

Frequently Asked Questions - Population

Development

The level of residential development activity in Wickham is very low in comparison to the average area assessed nationally by AreaSearch

AreaSearch analysis of ABS building approval numbers shows Wickham recorded around 10 residential property approvals each year over the past five financial years. This totals an estimated 52 homes. So far in FY26, 2 approvals have been recorded. On average, 0.5 new residents per year per dwelling constructed were added between FY21 and FY25.

New supply is keeping pace with or exceeding demand, offering ample buyer choice and capacity for population growth beyond current forecasts. The average value of new dwellings developed is $1,190,000, indicating a focus on the premium segment with upmarket properties. This financial year has seen $34,000 in commercial approvals, suggesting a predominantly residential focus.

Compared to Rest of WA, Wickham has slightly more development, totalling 39.0% above the regional average per person over the five-year period. Building activity has slowed in recent years but maintains buyer choice while supporting current property values. All new construction has been standalone homes, maintaining the area's traditional low density character with a focus on family homes appealing to those seeking space. Developers are constructing more detached housing than the existing pattern implies (74.0% at Census), reflecting strong demand for family homes amid densification trends. The estimated population per dwelling approval is 4344, indicating a quiet, low activity development environment. Looking ahead, Wickham is expected to grow by 198 residents through to 2041, with current development rates comfortably meeting demand and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Wickham has limited levels of nearby infrastructure activity, ranking in the 17thth percentile nationally

No changes can significantly affect a region's performance like alterations to local infrastructure, major projects, and planning initiatives. AreaSearch has identified zero projects that are expected to impact this area. Notable projects include Perdaman Urea Project - Project Destiny, Pilbara Green Link, Rio Tinto Pilbara Rail Network Expansion (AutoHaul), and Pilbara Energy Transmission and Storage Infrastructure, with the following list highlighting those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

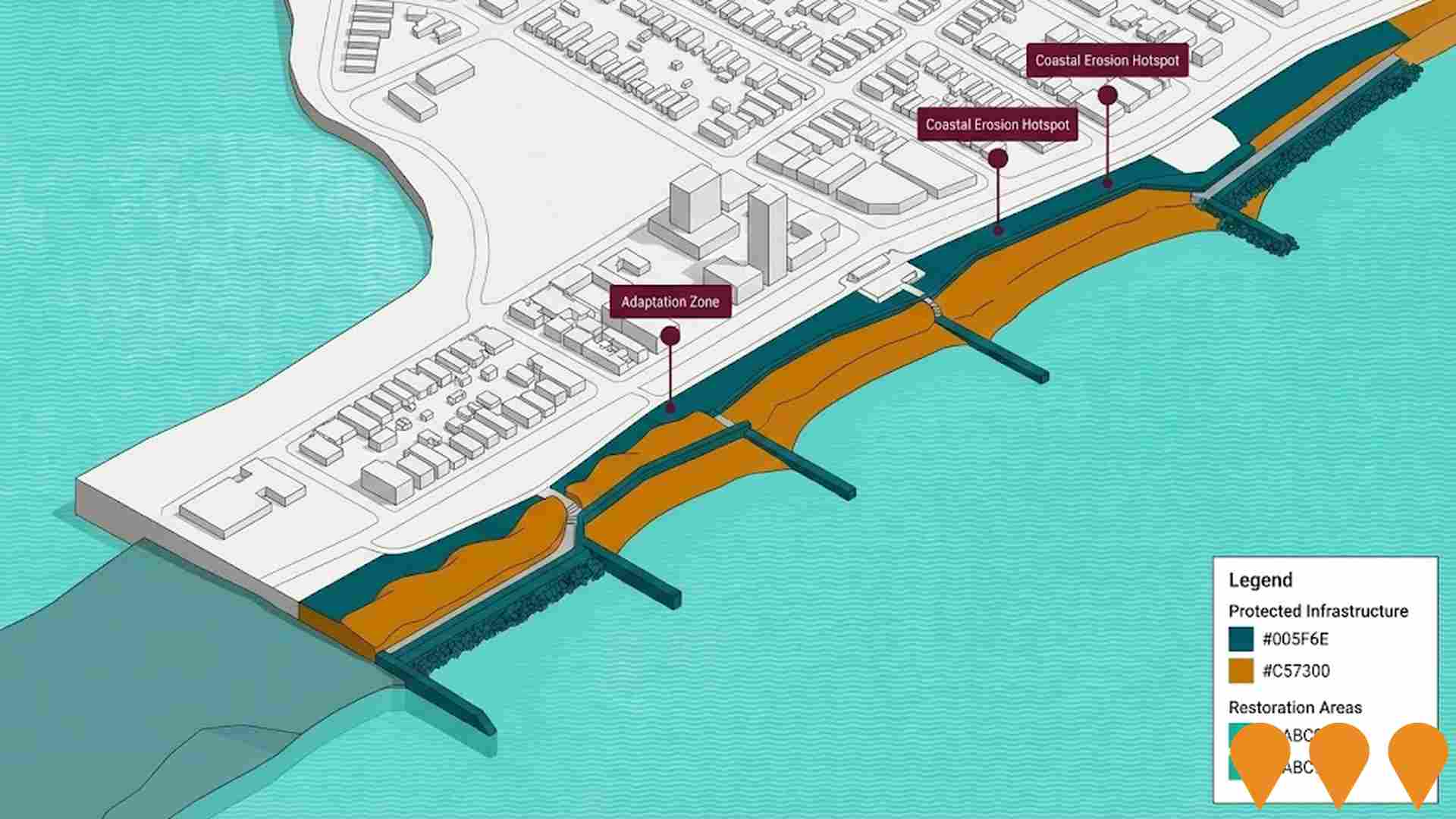

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Resources Community Investment Initiative

A $750 million partnership between the WA Government and major resource companies (Rio Tinto, BHP, Woodside Energy, Chevron, Mineral Resources, Fortescue, Roy Hill) to fund community, social, and regional infrastructure. Key allocated projects include the $150.3 million Perth Concert Hall redevelopment and the $20 million Paraburdoo Hospital upgrade.

Rio Tinto Pilbara Rail Network Expansion (AutoHaul)

The world's first fully autonomous, long-distance heavy-haul rail network, spanning approximately 1,700km. The system utilizes Hitachi Rail technology to connect 17 mines to port facilities at Port Hedland and Cape Lambert. The network features over 220 trains monitored from a central Operations Centre in Perth, improving safety and operational efficiency by approximately 6%. Ongoing updates in 2026 focus on software optimization, predictive maintenance, and the integration of locally manufactured rail cars.

Fortescue Decarbonisation Plan

Fortescue's Pilbara Decarbonisation Plan is a long term program to eliminate fossil fuel use and achieve Real Zero scope 1 and 2 emissions across its Australian iron ore operations by 2030. The company has committed about US$6.2 billion (around A$9.5 billion) to deploy 2 to 3 GW of new wind and solar generation, large scale battery storage and an integrated 220 kV transmission network linking mine, rail and port sites across the Pilbara. Current works include a 190 MW solar farm at Cloudbreak, which is more than one third through construction and forms part of the Pilbara Solar Innovation Hub, together with multiple 220 kV transmission line packages connecting sites such as Solomon, Eliwana, Cloudbreak and Christmas Creek. Construction ramped up from 2024 and is expected to continue in stages through to 2030 as the renewable grid and electrified mining fleet are progressively delivered.

National EV Charging Network (Highway Fast Charging)

Partnership between the Australian Government and NRMA to deliver a backbone EV fast charging network on national highways. Program funds and co-funds 117 DC fast charging sites at roughly 150 km intervals to connect all capital cities and regional routes, reducing range anxiety and supporting EV uptake.

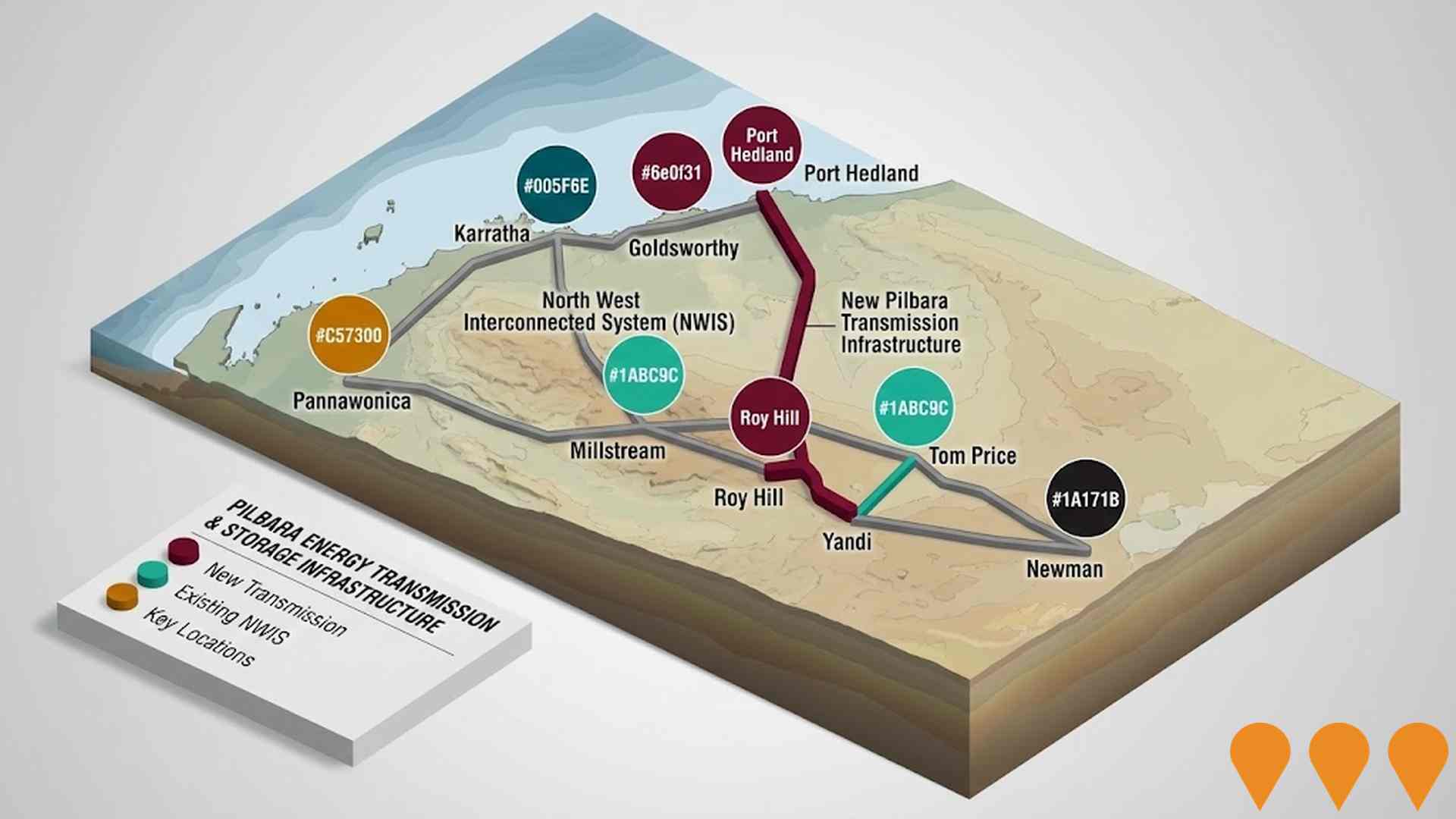

Pilbara Energy Transmission and Storage Infrastructure

State-led program to develop common-use transmission and storage infrastructure across the Pilbara to connect renewable generation to demand centers, lower energy costs and emissions, and support emerging industries including green hydrogen. Early work includes Burrup Common User Transmission Infrastructure linking Maitland SIA to Burrup, and planning for the Pilbara Green Link and other priority corridors under the Pilbara Energy Transition Plan.

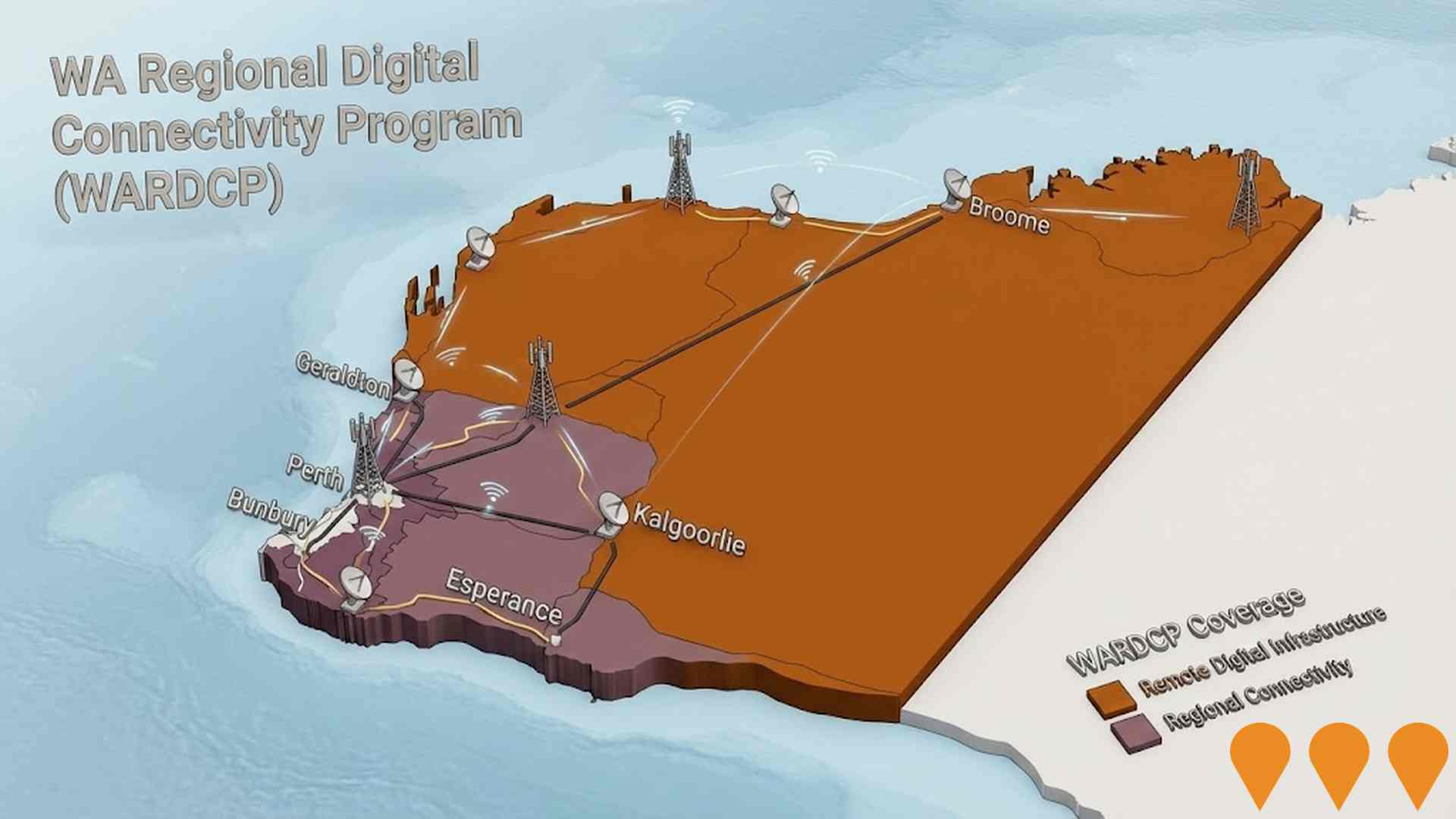

WA Regional Digital Connectivity Program (WARDCP)

Statewide co-investment program delivering new and upgraded mobile, fixed wireless and broadband infrastructure to improve reliability, coverage and performance for regional and remote Western Australia. Current workstreams include the Regional Telecommunications Project, State Agriculture Telecommunications Infrastructure Fund, and the WA Regional Digital Connectivity Program (WARDCP).

Perdaman Urea Project - Project Destiny

Perdaman Chemicals & Fertilisers is developing a A$6 billion urea plant in Karratha, Western Australia.

Pilbara Green Link

The Pilbara Green Link is a proposed expansion to the North-West Interconnected System, linking the existing network to the Australian Renewable Energy Hub and other major generation projects. It includes the installation of approximately 550 kilometres of 330-kilovolt transmission lines and associated infrastructure. It will also connect to existing iron ore mines in the Pilbara region to facilitate decarbonisation of the sector. The project is being tendered in two works packages (Link 1 and Link 2) through a fixed lump sum price Engineering, Procurement, Construction (EPC) contract selected via Early Contractor Involvement (ECI).

Employment

AreaSearch analysis places Wickham well above average for employment performance across multiple indicators

Wickham's workforce is balanced across white and blue collar jobs. Manufacturing and industrial sectors are prominent, with an unemployment rate of 2.7% and stable employment over the past year (AreaSearch data).

As of September 2025, 1,230 residents are employed, with an unemployment rate of 0.6% below Rest of WA's 3.3%. Workforce participation is high at 69.7%, compared to Rest of WA's 59.4%. Dominant employment sectors include mining, healthcare & social assistance, and education & training. Mining is particularly strong, with an employment share five times the regional level (0%).

Agriculture, forestry & fishing is under-represented, at 0% versus Rest of WA's 9.3%. Local employment opportunities appear limited based on Census data comparison. Over September 2024 to September 2025, labour force levels increased by 0.3%, while employment declined by 0.3%, causing unemployment to rise by 0.6 percentage points (AreaSearch analysis). In contrast, Rest of WA saw employment growth of 1.4% and a labour force expansion of 1.2%, with unemployment falling by 0.2%. Jobs and Skills Australia's national employment forecasts from May-25 suggest potential future demand within Wickham. National employment is projected to expand by 6.6% over five years and 13.7% over ten years, but growth rates vary significantly between sectors. Applying these projections to Wickham's employment mix indicates local employment should increase by 4.1% over five years and 10.8% over ten years (note: this is a simple weighting extrapolation for illustrative purposes).

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

According to AreaSearch's aggregation of ATO data released for financial year 2023, Wickham had a median income of $97,917 and an average income of $112,006. These figures are exceptionally high nationally compared to Rest of WA's median of $59,973 and average of $74,392. Based on Wage Price Index growth of 9.62% since financial year 2023, current estimates for Wickham would be approximately $107,337 (median) and $122,781 (average) as of September 2025. According to the 2021 Census, household, family, and personal incomes in Wickham rank highly nationally, between the 98th and 99th percentiles. Income distribution shows that 39.8% of locals earn $4000 or more per week (897 people), differing from the broader area where the predominant category is $1,500 - 2,999 at 31.1%. Higher earners make up a substantial presence in Wickham, with 61.5% earning over $3,000 weekly. After housing costs, residents retain 96.6% of their income, reflecting strong purchasing power. The area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Wickham is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

The latest Census evaluated Wickham's dwelling structure as 74.2% houses and 25.8% other dwellings (semi-detached, apartments, 'other' dwellings). Non-Metro WA had 81.0% houses and 19.0% other dwellings. Home ownership in Wickham was at 2.0%, with mortgaged dwellings at 3.6% and rented ones at 94.4%. The median monthly mortgage repayment was $790, lower than Non-Metro WA's average of $2,000. Median weekly rent in Wickham was $115, compared to Non-Metro WA's $220. Nationally, Wickham's mortgage repayments were significantly lower at $790 compared to the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Wickham features high concentrations of family households, with a higher-than-average median household size

Family households account for 77.3% of all households, composed of 50.1% couples with children, 19.6% couples without children, and 6.0% single parent families. Non-family households make up the remaining 22.7%, with lone person households at 21.9% and group households comprising 1.7% of the total. The median household size is 2.9 people, which is larger than the Rest of WA average of 2.8.

Frequently Asked Questions - Households

Local Schools & Education

Wickham faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 14.5%, significantly lower than the Australian average of 30.4%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 10.7%, followed by graduate diplomas (2.3%) and postgraduate qualifications (1.5%). Trade and technical skills are prominent, with 54.8% of residents aged 15+ holding vocational credentials - advanced diplomas (8.9%) and certificates (45.9%).

Educational participation is high, with 42.4% of residents currently enrolled in formal education. This includes 18.7% in primary education, 11.6% in secondary education, and 2.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Wickham has two active public transport stops operating, both serving buses. These stops are covered by two different routes, together offering 20 weekly passenger trips. The accessibility of these services is rated as moderate, with residents typically living 585 meters away from the nearest stop.

On average, there are two trips per day across all routes, which translates to about ten weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Wickham's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Wickham shows excellent health outcomes with low prevalence of common conditions across all ages. Private health cover is high at approximately 72% of the total population (1,616 people), compared to the national average of 55.7%.

Asthma and mental health issues are most common, affecting 6.8% and 5.7% respectively. 80.9% report no medical ailments, close to Rest of WA's 81.3%. The area has 2.7%, or 60 people, aged 65 and over. Seniors' health outcomes align with the general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Wickham records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Wickham's cultural diversity aligns with its wider region, with 75.0% citizens, 82.5% born in Australia, and 88.5% speaking English only at home. Christianity is the predominant religion, at 34.8%. Judaism is overrepresented, comprising 0.3%, compared to 0.1% regionally.

For ancestry, Australian (31.1%), English (25.3%), and Australian Aboriginal (9.4%) are top groups. Notable differences exist for Maori (2.6% vs 2.0%), South African (1.1% vs 0.7%), and Filipino (2.2% vs 2.1%).

Frequently Asked Questions - Diversity

Age

Wickham hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Wickham's median age is 31 years, which is lower than the Rest of WA average of 40 years and Australia's average of 38 years. Compared to the Rest of WA, Wickham has a higher percentage of residents aged 35-44 (22.3%), but fewer residents aged 65-74 (2.3%). This concentration of residents aged 35-44 is significantly higher than the national average of 14.2%. Between the 2021 Census and the present, the percentage of Wickham's population aged 35 to 44 has increased from 20.1% to 22.3%, while the percentage of residents aged 5 to 14 has decreased from 18.7% to 17.2%. Population forecasts for the year 2041 suggest substantial demographic changes in Wickham, with the strongest projected growth occurring in the 25-34 age cohort, which is expected to grow by 26%, adding 110 residents and reaching a total of 535. Conversely, population declines are projected for the 15-24 and 5-14 age cohorts.