Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Broome are slightly above average based on AreaSearch's ranking of recent, and medium term trends

Broome's population was around 16,607 as of November 2025. This reflected an increase of 1,947 people since the 2021 Census, which reported a population of 14,660 people. The change was inferred from the estimated resident population of 16,238 in June 2024 and an additional 119 validated new addresses since the Census date. This level of population resulted in a density ratio of 331 persons per square kilometer. Broome's growth rate of 13.3% since the 2021 census exceeded the national average of 8.9%. Natural growth contributed approximately 52.3% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and post-2032 estimates, AreaSearch uses growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections (released in 2023, based on 2022 data). Future population dynamics anticipate an above median growth for Australia's non-metropolitan areas. The area is expected to increase by 2,187 persons to 2041, reflecting a total increase of 10.9% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Broome among the top 25% of areas assessed nationwide

Broome granted approval for approximately 73 residential properties annually over the past five financial years, totalling 366 homes. As of FY26, 38 approvals have been recorded. On average, 3 people move to the area per new home constructed each year between FY21 and FY25, reflecting strong demand for housing. The average construction value of new homes is $366,000, slightly above the regional average.

In FY26, commercial approvals totalled $59.5 million, indicating significant commercial development activity. Compared to the rest of WA, Broome records 66.0% more new home approvals per person, offering greater choice for buyers. Recent construction comprises 93.0% standalone homes and 7.0% townhouses or apartments, maintaining the area's low-density nature. This focus on detached housing reflects persistent strong demand for family homes despite densification trends.

Broome has approximately 204 people per approval, indicating a developing area. By 2041, Broome is expected to grow by 1,818 residents. With current construction levels, housing supply should meet demand, creating favourable conditions for buyers and potentially enabling growth that exceeds forecasts.

Frequently Asked Questions - Development

Infrastructure

Broome has emerging levels of nearby infrastructure activity, ranking in the 32ndth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 20 projects expected to influence the area. Notable ones include Walmanyjun Cable Beach Foreshore Redevelopment, Yinajalan Ngarrungunil Health and Wellbeing Campus, Broome Boating Facility, and Broome North - Waranyjarri Estate. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Chinatown Revitalisation Project

A comprehensive urban renewal initiative transforming Broome's historic Chinatown precinct into a vibrant tourism, business, retail, and entertainment destination. The project delivered streetscape enhancements to Carnarvon Street, Dampier Terrace, Short Street, and Napier Terrace, including public realm improvements, public art installations, shade structures, outdoor dining areas, enhanced lighting, event spaces, improved pedestrian access, and cultural interpretation. Stage 1 was completed in September 2019, with Stage 2 officially opened in November 2021. The revitalisation preserves Chinatown's rich multicultural heritage while creating climate-responsive public spaces that celebrate Traditional Owners and diverse cultural groups.

Broome North - Waranyjarri Estate

Waranyjarri Estate is the first residential neighborhood in the 700 hectare Broome North master planned community, planned to deliver up to 4,800 new homes for about 13,000 residents. It is Western Australias only EnviroDevelopment and Waterwise accredited regional housing project, with climate smart design, high speed fibre internet, parks, bushland corridors and a direct link to Cable Beach via the Tanami Drive extension. Current stages 11 to 13 are delivering new residential lots, including social and key worker housing, alongside a new 103 place childcare centre at the corner of Yako Mall and Shingoro Street.

Walmanyjun Cable Beach Foreshore Redevelopment

Once-in-a-generation transformation of the iconic Walmanyjun Cable Beach foreshore into a world-class waterfront precinct. Stage 1 (Southern Precinct) completed in May 2025 and officially opened in June 2025, delivering dune restoration, new beach access stairs/ramps, youth space with basketball court and skate park, upgraded car park, promenade, and improved drainage. Stage 2 (Northern and Central Precincts) underway since June 2025, including community plaza, water splash park, inclusive playground, amphitheatre, enhanced event spaces, additional beach access, coastal protection, and shaded amenities. Completion targeted for mid-late 2026.

Broome Boating Facility

Proposed construction of a safe and accessible boating facility at the existing boat ramp site at Entrance Point, Broome. The project, led by the Department of Transport, is designed to address safety and access issues due to large tides, strong currents, waves, and wind. The design includes a four-lane boat ramp, two finger jetties, two groynes, an offshore breakwater, and associated public amenity infrastructure. The approvals process is currently on hold due to new heritage considerations raised during public submissions in 2021, and the proponent continues to engage with Traditional Owners to refine the concept.

Town Beach Cafe Redevelopment

The redevelopment of the iconic Town Beach Cafe site into a new multimillion-dollar restaurant/cafe. The old building has been demolished (June 2025) and the Shire of Broome is actively seeking a commercial operator to design, build, and operate a new, larger facility on the site under a long-term lease. In the interim, the site will be activated with mobile food vendors.

Broome Health Campus Redevelopment

Eight-year phased construction completed March 2016. $8.6 million major upgrade of Emergency Department expanding to 15 acute bays, new operating theatres, consulting rooms, public dental surgery, refurbished maternity unit, and new Acute Psychiatric Unit - first of its kind in Western Australia's north.

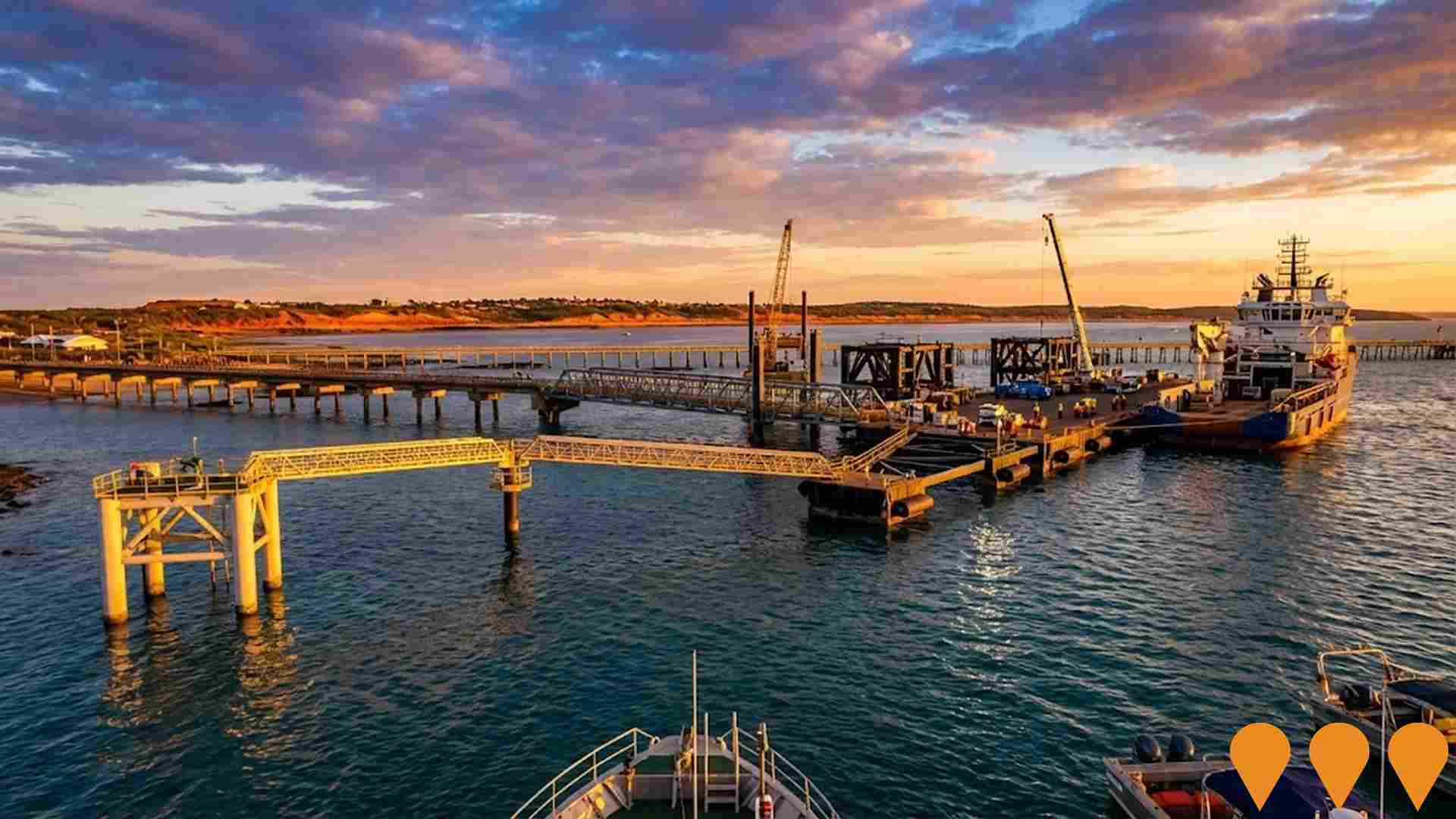

Kimberley Marine Support Base

Development of a modern marine logistics facility with a floating wharf connected to a fixed causeway, designed for 24/7 tide-independent operations at the Port of Broome. The facility is expected to service industries including agriculture, general cargo, tourism (cruise ships), and roll-on roll-off cargo, supporting over 500 permanent jobs in Broome and more than 1,500 state-wide. The facility was officially launched on September 12, 2025.

Walmanyjun Cable Beach Foreshore Redevelopment

A multi-stage foreshore renewal led by the Shire of Broome to transform the Walmanyjun/Cable Beach foreshore into a world-class coastal precinct. Stage 1 is complete and open. Stage 2 works commenced on 3 June 2025 and are scheduled to continue through mid/late 2026. Key features include an enlarged amphitheatre and event lawn, new promenade and viewing areas, upgraded public amenities and beach access, water play, market and activation spaces, landscaping with cultural interpretation, and coastal protection upgrades.

Employment

Broome has seen below average employment performance when compared to national benchmarks

Broome has a well-educated workforce with significant representation in essential services sectors. The unemployment rate was 4.0% as of September 2025, with an estimated employment growth of 0.8% over the past year.

In September 2025, 9,122 residents were employed, and the unemployment rate was 0.8% higher than Rest of WA's rate of 3.3%. Workforce participation in Broome was 66.6%, compared to Rest of WA's 59.4%. The leading employment industries among residents included health care & social assistance, education & training, and accommodation & food. Health care & social assistance had a particularly strong presence with an employment share 1.7 times the regional level, while mining had limited presence at 3.1% compared to the regional average of 11.7%.

Employment opportunities exist locally, but many residents commute elsewhere for work based on Census data. Over the 12 months to September 2025, employment increased by 0.8%, and labour force increased by 1.0%, resulting in a rise in unemployment rate by 0.2 percentage points. In comparison, Rest of WA recorded employment growth of 1.4% and a fall in unemployment rate by 0.2 percentage points. Jobs and Skills Australia's national employment forecasts from May-25 suggest potential future demand within Broome. These projections estimate that national employment will expand by 6.6% over five years and 13.7% over ten years, with varying growth rates between industry sectors. Applying these projections to Broome's employment mix suggests local employment should increase by 6.7% over five years and 13.9% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch released postcode level ATO data for financial year 2022 on June 15, 2023. Broome SA2 had a median income among taxpayers of $61,902 and an average of $72,750. Nationally, the median was $48,363 with an average of $68,748. In Rest of WA, the median was $57,323 and the average was $71,163. By September 2025, estimated incomes would be approximately $70,692 (median) and $83,080 (average), based on a 14.2% Wage Price Index growth since financial year 2022. The 2021 Census ranked Broome's household, family, and personal incomes between the 79th and 89th percentiles nationally. Distribution data showed that 35.0% of residents earned $1,500 - $2,999 weekly, aligning with the surrounding region at 31.1%. This suburb demonstrated affluence with 32.5% earning over $3,000 per week. Housing accounted for 14.9% of income, and residents ranked in the 79th percentile for disposable income. The area's SEIFA income ranking placed it in the 6th decile.

Frequently Asked Questions - Income

Housing

Broome is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Broome, as per the latest Census evaluation, 77.6% of dwellings were houses with the remaining 22.4% comprising semi-detached units, apartments, and other types of dwellings. In comparison, Non-Metro WA had 79.3% houses and 20.7% other dwellings. Home ownership in Broome stood at 15.8%, with mortgaged properties at 30.7% and rented ones at 53.5%. The median monthly mortgage repayment was $2,167, aligning with the Non-Metro WA average, while the median weekly rent was $330 compared to Non-Metro WA's $200. Nationally, Broome's mortgage repayments were higher at $2,167 against the Australian average of $1,863, and rents were lower at $330 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Broome features high concentrations of group households, with a lower-than-average median household size

Family households account for 70.6% of all households, including 31.3% couples with children, 24.7% couples without children, and 13.4% single parent families. Non-family households make up the remaining 29.4%, with lone person households at 24.3% and group households comprising 5.1% of the total. The median household size is 2.7 people, which is smaller than the Rest of WA average of 2.8.

Frequently Asked Questions - Households

Local Schools & Education

Broome shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

Broome has a notably high educational attainment among residents aged 15 and above, with 29.3% holding university qualifications compared to the broader benchmarks of 17.6% in the rest of Western Australia and 20.5% in the SA4 region. Bachelor degrees are the most common at 20.2%, followed by postgraduate qualifications (5.2%) and graduate diplomas (3.9%). Vocational credentials are also prominent, with 40.9% of residents holding such qualifications - advanced diplomas account for 12.0% and certificates for 28.9%. Educational participation is high, with 37.3% of residents currently enrolled in formal education.

This includes 15.6% in primary education, 10.6% in secondary education, and 3.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Broome's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Broome exhibits excellent health outcomes, with a low prevalence of common health conditions across all age groups. Private health cover is high at approximately 56% of the total population (~9,299 people), compared to 53.4% across the rest of WA.

Mental health issues and asthma are the most prevalent medical conditions in the area, affecting 5.9 and 5.6% of residents respectively. A significant portion, 79.2%, of Broome's residents report being completely clear of medical ailments, compared to 79.9% across the rest of WA. The percentage of seniors aged 65 and over in Broome is 6.6% (1,089 people). Health outcomes among seniors are particularly strong and align with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Broome records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Broome's cultural diversity aligns with the wider region's average, with 78.7% of its population being citizens, 82.1% born in Australia, and 87.2% speaking English only at home. Christianity is the dominant religion in Broome, comprising 39.9%. Buddhism is slightly overrepresented, making up 1.5%, compared to 1.1% regionally.

The top three ancestry groups are Australian (25.0%), English (23.7%), and Australian Aboriginal (17.0%). Notably, French (0.6%) and Filipino (1.5%) ethnicities are overrepresented in Broome compared to regional averages of 0.5% and 1.1%, respectively. South African ethnicity is also slightly higher at 0.5%.

Frequently Asked Questions - Diversity

Age

Broome hosts a young demographic, positioning it in the bottom quartile nationwide

Broome's median age is 33 years, which is considerably lower than the Rest of WA average of 40 years, and substantially under the Australian median of 38 years. Relative to the Rest of WA, Broome has a higher concentration of 25-34 year-olds at 19.5%, but fewer 65-74 year-olds at 4.8%. Between the 2021 Census and the present, the 25 to 34 age group has grown from 17.1% to 19.5% of the population, while the 35 to 44 cohort increased from 16.5% to 17.7%. Conversely, the 5 to 14 age group has declined from 16.1% to 14.1%, and the 45 to 54 group dropped from 14.2% to 12.7%. Demographic modeling suggests that Broome's age profile will evolve significantly by 2041. The 25 to 34 cohort shows the strongest projected growth at 34%, adding 1,093 residents to reach 4,334. In contrast, both the 65 to 74 and 75 to 84 age groups will see reduced numbers.