Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Mount Cotton are slightly above average based on AreaSearch's ranking of recent, and medium term trends

Based on analysis of ABS population updates for the Mount Cotton statistical area (Lv2), and new addresses validated by AreaSearch, the population is estimated at around 7,597 as of Nov 2025. This reflects an increase of 295 people since the 2021 Census, which reported a population of 7,302 people in Mount Cotton (SA2). The change is inferred from the resident population of 7,582 estimated by AreaSearch following examination of the latest ERP data release by the ABS on Jun 2024 and an additional 1 validated new address since the Census date. This level of population equates to a density ratio of 177 persons per square kilometer in Mount Cotton (SA2). Population growth was primarily driven by natural growth contributing approximately 66.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. These state projections do not provide age category splits; hence proportional growth weightings in line with the ABS Greater Capital Region projections released in 2023 based on 2022 data are applied where utilised. Looking at population projections moving forward, lower quartile growth of Australian statistical areas is anticipated for Mount Cotton (SA2), with an expected expansion by 36 persons to 2041 based on aggregated SA2-level projections, reflecting a gain of 0.7% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Mount Cotton according to AreaSearch's national comparison of local real estate markets

Mount Cotton has seen approximately five dwellings approved for development annually. From the financial years 2021 to 2025, about 26 homes were approved, with six more in 2026 so far.

Each dwelling built attracted an average of 6.2 people over these years. The supply has not kept pace with demand, indicating intense buyer competition and price pressures.

Developers target the premium market segment, with new dwellings valued at approximately $646,000 on average. Recent development consists solely of detached houses, maintaining Mount Cotton's low-density character focused on family homes. As of now, there are an estimated 892 people per dwelling approval in the area. By 2041, Mount Cotton is projected to add 55 residents according to AreaSearch's latest quarterly estimate. Given current development rates, new housing supply should comfortably meet demand, offering favourable conditions for buyers and potentially supporting population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Mount Cotton has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Nine projects were identified by AreaSearch as potentially impacting the area. These include Southern Thornlands Priority Development Area, Redlands Satellite Health Centre (Talwalpin Milbul), Redlands Coast Regional Sport and Recreation Precinct, Logan Hyperdome Shopping Centre. The following list details those considered most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Redlands Satellite Health Centre (Talwalpin Milbul)

The Redlands Satellite Health Centre, co-named Talwalpin Milbul ('Redland Bay Active' in Jandai), provides community-based healthcare. It features a walk-in Minor Injury and Illness Clinic for non-life-threatening conditions, operating 8am to 10pm daily. The facility also offers appointment-only specialist services including kidney dialysis, cancer day therapy, mental health support, and allied health. Renamed from Satellite Hospital to Health Centre in March 2025 to better reflect its clinical service model.

Brisbane to Gold Coast Transport Corridor Upgrades (Corridor Program)

A transformative multi-modal program upgrading the critical link between Brisbane and the Gold Coast. Key components include the $5.75 billion Logan and Gold Coast Faster Rail project, which is doubling tracks from two to four between Kuraby and Beenleigh, and the $3.5 billion Coomera Connector (M9) motorway. The program aims to increase rail capacity, remove five level crossings, and provide a new 16km motorway corridor to relieve M1 congestion, supporting the 2032 Olympic and Paralympic Games.

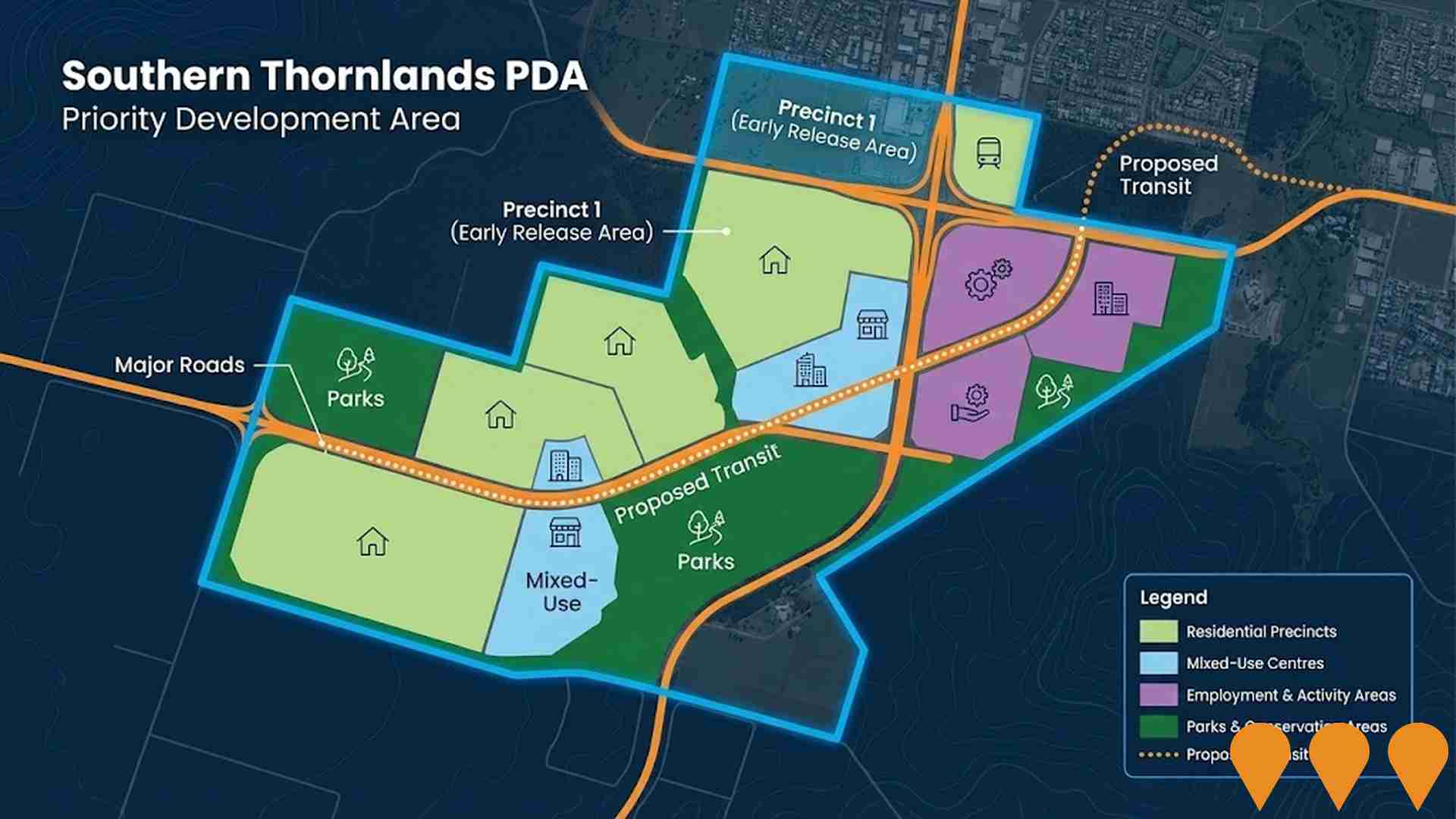

Southern Thornlands Priority Development Area

The Southern Thornlands Priority Development Area (PDA) is a massive 890-hectare urban growth project managed by Economic Development Queensland (EDQ). Declared on April 4, 2025, the project aims to deliver approximately 8,000 new dwellings for 20,000 residents by 2046. In October 2025, the first major development application (DEV2025/1656) by Urbex was approved for rezoning, clearing the path for 800-900 homes in Precinct 1 (Early Release Area). This initial phase includes a $4 million upgrade to the Springacre and Boundary Roads intersection, with construction expected to commence in Q1 2026. The wider PDA will feature mixed-use activity centres, integrated transport networks, and preserved environmental corridors along Eprapah Creek.

Hyperdome Redevelopment (Loganholme)

Ongoing redevelopment and upgrades to Hyperdome (Logan City's largest centre) including The Market Room fresh food precinct, northern mall refurbishment and tenant remix, and a ~5MW rooftop solar PV installation to reduce operating emissions and improve customer experience.

Redlands Coast Regional Sport and Recreation Precinct

Council-led regional sport and recreation precinct on a 159 ha site at Mount Cotton. The Revised 2023 Master Plan protects about 80% of the site as natural area and focuses Stage 1 on 13 touch football fields, 3 rugby league fields, two clubhouses and ~800 car parks, with spaces reserved for future recreation elements such as play, pump tracks and picnicking. Following an EPBC Act 'controlled action' determination in 2023, the project remains under Federal environmental assessment. Council endorsed a Significant Contracting Plan in Dec 2024 and dissolved its 2022/23 construction contract with Alder Constructions pending approvals. Road upgrades along Heinemann Road are planned outside the EPBC referral area.

Logan Hyperdome Shopping Centre

Major regional shopping centre expansion and renovation including new retail spaces, dining precincts, entertainment facilities and improved parking. One of Logan's largest retail and commercial developments.

Birkdale Community Precinct

A 62-hectare community precinct transforming former Commonwealth land into a regional destination. Includes seven hubs: Cultural Hub, Willards Farm Food Hub, Innovation Hub, Entertainment Hub, Communications Hub (WWII Radio Receiving Station), Recreation & Adventure Sports Hub (with public lagoon and proposed Redland Whitewater Centre for Brisbane 2032 Olympics), and Conservation Hub with 2.8km walking trails and enhanced koala habitat. Features mixed-use development with residential, retail, and community facilities, restored 1870s Willards Farm, WWII heritage commemoration, a swimming lagoon, adventure playground, and 40 hectares of protected bushland.

Redland Whitewater Centre

Olympic-standard whitewater venue integrated within the Birkdale Community Precinct to host Canoe Slalom for Brisbane 2032. Legacy-first design with ~8,000 temporary seats and an integrated warm-up channel, year-round community recreation, athlete training and swift-water rescue training for emergency services. Owned and operated by Redland City Council, with planning and delivery led by the Queensland Government (GIICA).

Employment

The exceptional employment performance in Mount Cotton places it among Australia's strongest labour markets

Mount Cotton has a skilled labor force with significant representation in essential services sectors. Its unemployment rate is 0.9%, lower than the Greater Brisbane average of 4.0%.

Employment growth over the past year was estimated at 6.2%. As of September 2025, there are 4,925 employed residents, with an unemployment rate of 3.1% and workforce participation at 78.3%, higher than Greater Brisbane's 64.5%. Leading industries include construction, health care & social assistance, and education & training. Construction is particularly strong, with an employment share 1.6 times the regional level.

Health care & social assistance has lower representation, at 13.0% compared to the regional average of 16.1%. Employment opportunities locally may be limited, as indicated by the Census working population vs resident population count. Between September 2024 and September 2025, employment increased by 6.2%, while labor force grew by 6.0%, reducing the unemployment rate by 0.2 percentage points. In comparison, Greater Brisbane saw employment grow by 3.8% and unemployment fall by 0.5 percentage points. State-wide, Queensland's employment contracted by 0.01% (losing 1,210 jobs) as of 25-Nov, with an unemployment rate of 4.2%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia forecasts national employment growth at 6.6% over five years and 13.7% over ten years. Applying these projections to Mount Cotton's employment mix suggests local employment should increase by 6.2% over five years and 13.0% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch released postcode-level ATO data for Mount Cotton in financial year 2023. The suburb's median income among taxpayers was $61,160, with an average of $72,931. This is above the national average and compares to Greater Brisbane's median of $58,236 and average of $72,799. Based on Wage Price Index growth of 9.91% since financial year 2023, current estimates for Mount Cotton would be approximately $67,221 (median) and $80,158 (average) as of September 2025. According to the 2021 Census, household, family, and personal incomes in Mount Cotton rank highly nationally, between the 86th and 93rd percentiles. The earnings profile shows that 39.7% of residents earn $1,500 - 2,999 weekly (3,016 residents), consistent with broader trends across the surrounding region showing 33.3% in the same category. Mount Cotton demonstrates considerable affluence with 39.6% earning over $3,000 per week, supporting premium retail and service offerings. Housing accounts for 14.8% of income while strong earnings rank residents within the 92nd percentile for disposable income. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Mount Cotton is characterized by a predominantly suburban housing profile

Mount Cotton's dwellings were 99.7% houses and 0.3% other types as recorded in the latest Census. Home ownership stood at 19.3%, with 67.0% of dwellings mortgaged and 13.8% rented. The median monthly mortgage repayment was $2,100, and the median weekly rent was $475. Nationally, Mount Cotton's mortgage repayments were higher than the Australian average of $1,863, and rents were above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Mount Cotton features high concentrations of family households, with a median household size of 3.1 people

Family households compose 89.9% of all households, including 54.6% couples with children, 26.2% couples without children, and 8.8% single parent families. Non-family households constitute the remaining 10.1%, with lone person households at 8.8% and group households comprising 1.2% of the total. The median household size is 3.1 people.

Frequently Asked Questions - Households

Local Schools & Education

Mount Cotton shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Educational qualifications in Mount Cotton trail regional benchmarks, with 23.0% of residents aged 15+ holding university degrees compared to 30.5% in Greater Brisbane. This gap highlights potential for educational development and skills enhancement. Bachelor degrees lead at 16.2%, followed by postgraduate qualifications (4.2%) and graduate diplomas (2.6%). Trade and technical skills feature prominently, with 44.5% of residents aged 15+ holding vocational credentials – advanced diplomas (14.7%) and certificates (29.8%).

Educational participation is notably high, with 32.3% of residents currently enrolled in formal education. This includes 13.0% in primary education, 8.9% in secondary education, and 3.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Mount Cotton has twelve active public transport stops, all of which are bus stops. These stops are served by a single route, offering 148 weekly passenger trips in total. The accessibility of these services is limited, with residents typically living 662 meters away from the nearest stop.

On average, there are twenty-one trips per day across all routes, translating to about twelve weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Mount Cotton's residents are extremely healthy with younger cohorts in particular seeing very low prevalence of common health conditions

Analysis of health metrics shows strong performance throughout Mount Cotton with younger cohorts in particular seeing very low prevalence of common health conditions.

The rate of private health cover is very high at approximately 56% of the total population (~4261 people). The most common medical conditions in the area are mental health issues and asthma, impacting 8.8 and 8.3% of residents respectively. 73.8% of residents declare themselves completely clear of medical ailments compared to 0% across Greater Brisbane. As of July 2021, 9.7% of residents are aged 65 and over (736 people).

Frequently Asked Questions - Health

Cultural Diversity

Mount Cotton ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Mount Cotton's cultural diversity was found to be below average, with 80.2% of its population born in Australia, 92.0% being citizens, and 94.2% speaking English only at home. Christianity was the main religion in Mount Cotton, comprising 45.9% of people. However, the most notable overrepresentation was in Other religions, which comprised 0.6% of the population compared to None% across Greater Brisbane.

The top three represented ancestry groups were English (33.2%), Australian (27.4%), and Scottish (8.0%). Notably, South African ancestry was overrepresented at 1.4%, New Zealand at 1.2%, and German at 4.7%.

Frequently Asked Questions - Diversity

Age

Mount Cotton hosts a young demographic, positioning it in the bottom quartile nationwide

Mount Cotton has a median age of 34, which is slightly lower than Greater Brisbane's figure of 36 and significantly under Australia's national average of 38 years. Compared to Greater Brisbane, Mount Cotton has a higher proportion of residents aged 5-14 (17.9%) but fewer residents aged 25-34 (10.8%). This concentration of 5-14 year-olds is notably higher than the national figure of 12.2%. Between the 2021 Census and the present, the proportion of Mount Cotton's population in the 75 to 84 age group has increased from 1.8% to 3.5%. Conversely, the proportion of residents aged 25 to 34 has decreased from 13.2% to 10.8%. By 2041, Mount Cotton's population is projected to undergo substantial demographic changes. The 75 to 84 age group is forecasted to grow by 60%, adding 160 residents and reaching a total of 426. This growth will contribute significantly to the overall aging trend in Mount Cotton, with residents aged 65 and older representing 54% of anticipated population growth. However, the 5 to 14 age group and the 0 to 4 age group are expected to experience population declines.