Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Kyogle is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Based on AreaSearch's analysis of ABS population updates and new addresses validated since the Census, Kyogle statistical area (Lv2) had an estimated population of around 2,332 as of November 2025. This reflects a growth of 84 people, representing a 3.7% increase from the 2021 Census figure of 2,248. The change is inferred from AreaSearch's estimation of the resident population at 2,267 in June 2024, following an examination of the latest ERP data release by the ABS and validation of an additional 20 new addresses since the Census date. This results in a density ratio of 77 persons per square kilometer, indicating significant space per person and potential room for further development. Kyogle's growth rate exceeded that of its SA3 area (0.5%), positioning it as a growth leader in the region. Overseas migration contributed approximately 51% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data, NSW State Government's SA2 level projections are utilized, released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. According to projections, the area's population is expected to decline by 168 persons by 2041. However, specific age cohorts such as the 85 and over group are anticipated to grow, with a projected increase of 84 people.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Kyogle according to AreaSearch's national comparison of local real estate markets

Kyogle has received approximately six dwelling approvals per year based on AreaSearch analysis of ABS building approval numbers. Over the past five financial years, from FY21 to FY25, around 30 homes were approved, with eight more approved in FY26 so far. On average, about 1.9 new residents arrived per new home annually over these five years, indicating balanced supply and demand conditions. However, this figure has eased to 1.3 people per dwelling over the past two financial years, suggesting better supply availability.

The average construction value of new properties is $571,000, reflecting a focus on premium developments. Commercial approvals registered in FY26 totalled $1.5 million, indicating a predominantly residential focus. Kyogle's construction rates per person are similar to the rest of NSW but lower than national levels, suggesting market maturity and possible development constraints. Recent construction comprises 86% standalone homes and 14% medium and high-density housing, maintaining Kyogle's traditional low density character.

With around 254 people per dwelling approval, Kyogle exhibits characteristics of a low density area. Population projections indicate stability or decline, which may reduce housing demand pressures and benefit potential buyers in the area.

Frequently Asked Questions - Development

Infrastructure

Kyogle has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified zero projects expected to affect this area. Notable initiatives include Queensland Energy Roadmap 2025, Inland Rail - Queensland Sections, Queensland Energy Roadmap 2025, and Building Future Hospitals Program. Relevant projects are detailed below.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Queensland Energy Roadmap 2025

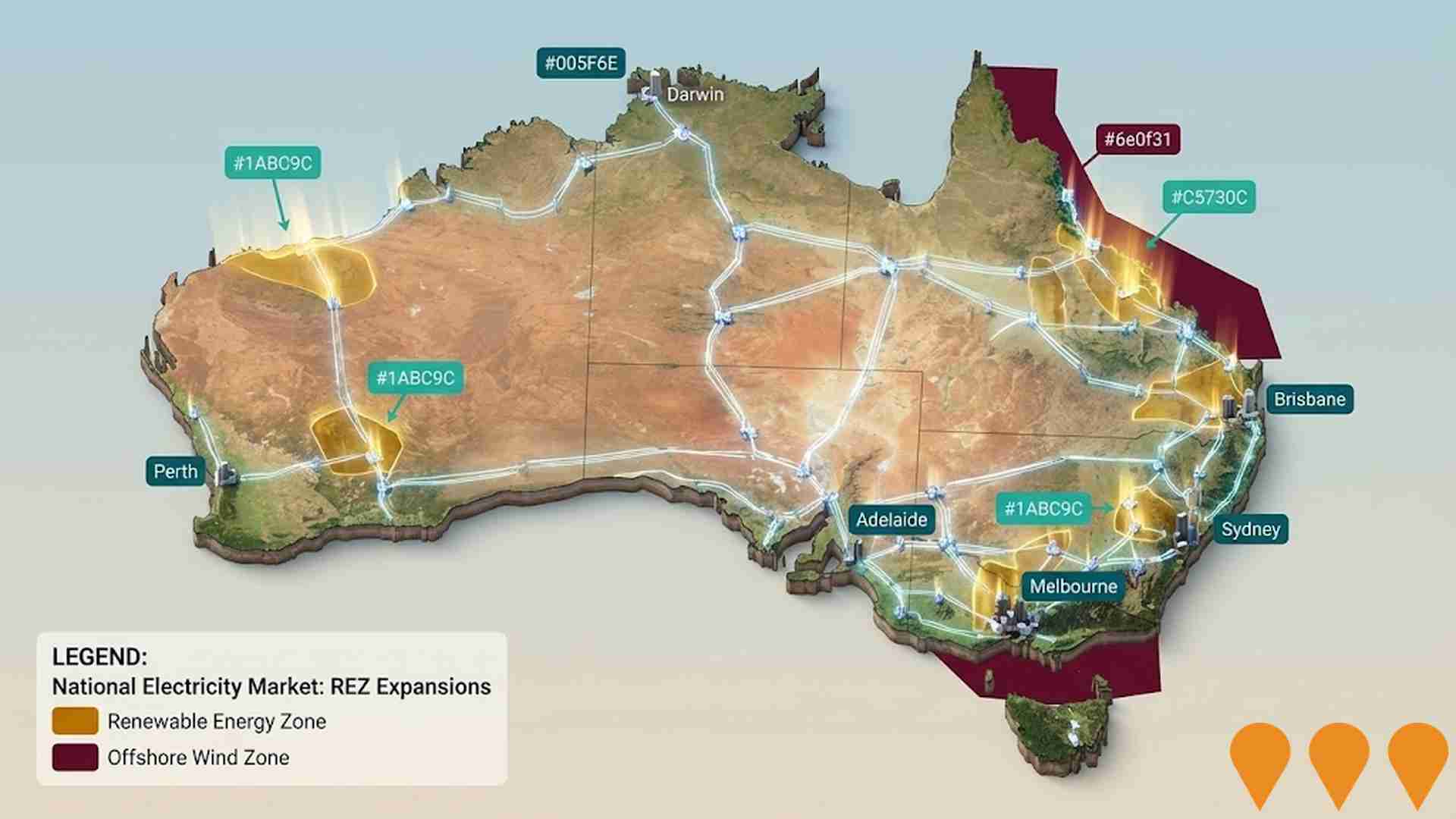

The Queensland Energy Roadmap 2025 is a strategic framework focused on energy affordability and reliability. Key initiatives include a $1.6 billion Electricity Maintenance Guarantee to extend the life of state-owned coal assets until at least 2046 and a $400 million Queensland Energy Investment Fund to catalyze private sector investment. Major infrastructure priorities include the delivery of the CopperString Eastern Link (330kV) by 2032 and a 400MW Central Queensland Gas Power Tender to be operational by 2032. The plan replaces the former Energy and Jobs Plan and shifts from renewable targets to Regional Energy Hubs and emission reduction goals.

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on energy affordability, reliability, and sustainability, replacing the previous 2022 Energy and Jobs Plan. Key initiatives include a $400 million Energy Investment Fund, a $1.6 billion Electricity Maintenance Guarantee for existing assets, and a new Regional Energy Hubs framework. The plan targets 6.8 GW of new wind/solar and 3.8 GW of storage by 2030 through private sector investment. It also prioritizes the CopperString Eastern Link (330kV) to be delivered by 2032 and a 400MW gas-fired generation tender in Central Queensland. The Energy Roadmap Amendment Act 2025, passed in December 2025, formally repealed previous renewable energy targets while maintaining a net zero by 2050 commitment.

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on delivering affordable, reliable, and sustainable energy through 2035. Key initiatives include a $1.6 billion Electricity Maintenance Guarantee for existing assets, a $400 million Energy Investment Fund to catalyze private sector renewables (solar, hydro) and storage, and a mandate for at least 2.6 GW of new gas generation by 2035. The plan formally repealed previous state renewable energy targets via the Energy Roadmap Amendment Act 2025 while maintaining a net-zero by 2050 commitment. It prioritizes the CopperString transmission project and renames Renewable Energy Zones to 'Regional Energy Hubs' to facilitate market-led development.

Building Future Hospitals Program

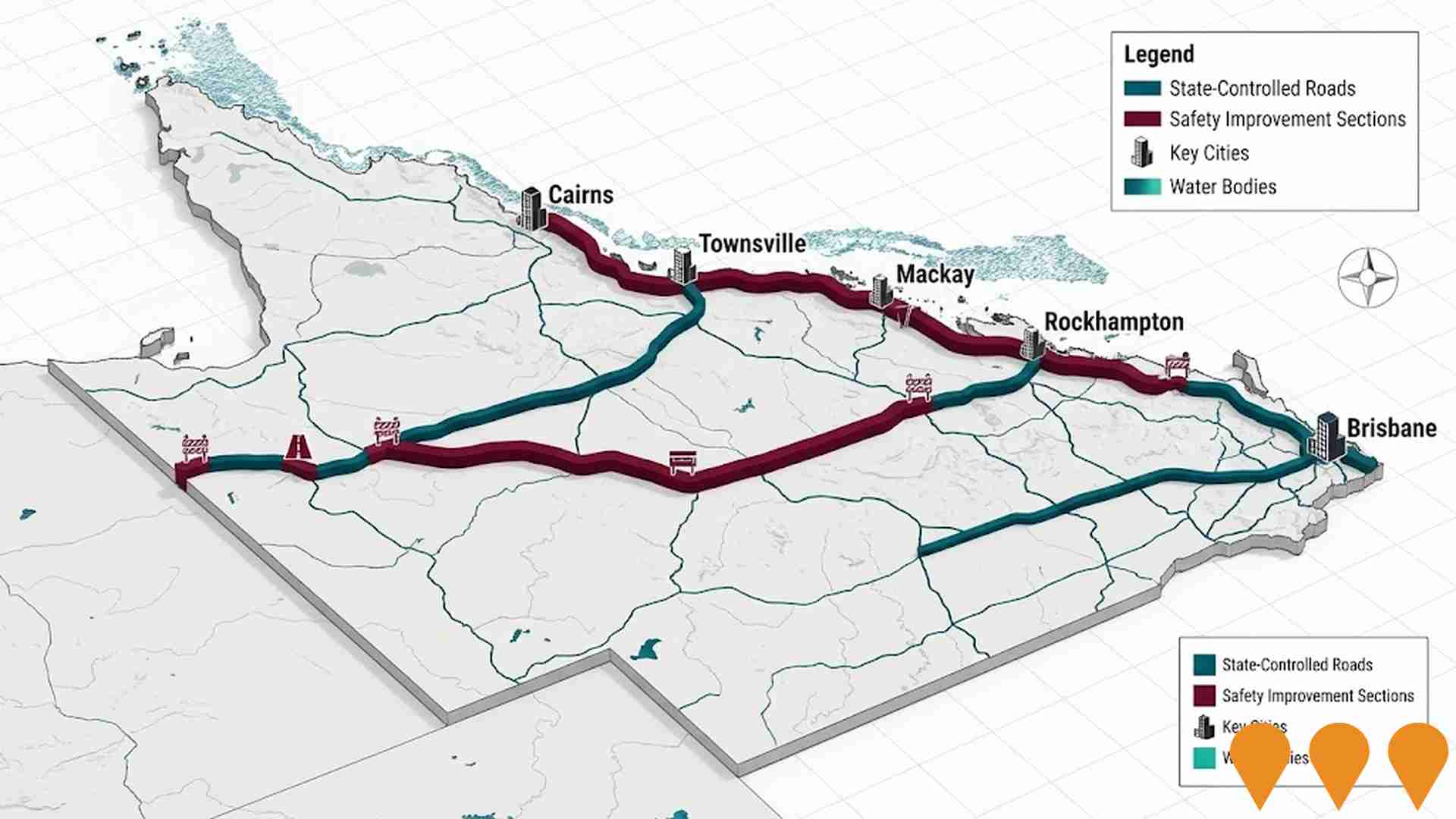

Queensland's Hospital Rescue Plan is a landmark $18.5 billion infrastructure initiative delivering over 2,600 new and refurbished public hospital beds by 2032. The program includes the construction of three new hospitals in Coomera, Bundaberg, and Toowoomba, alongside major expansions at Ipswich (Stage 2), Logan, Princess Alexandra, and Townsville University hospitals. It also encompasses satellite hospitals and a statewide cancer network to address the needs of a growing and aging population.

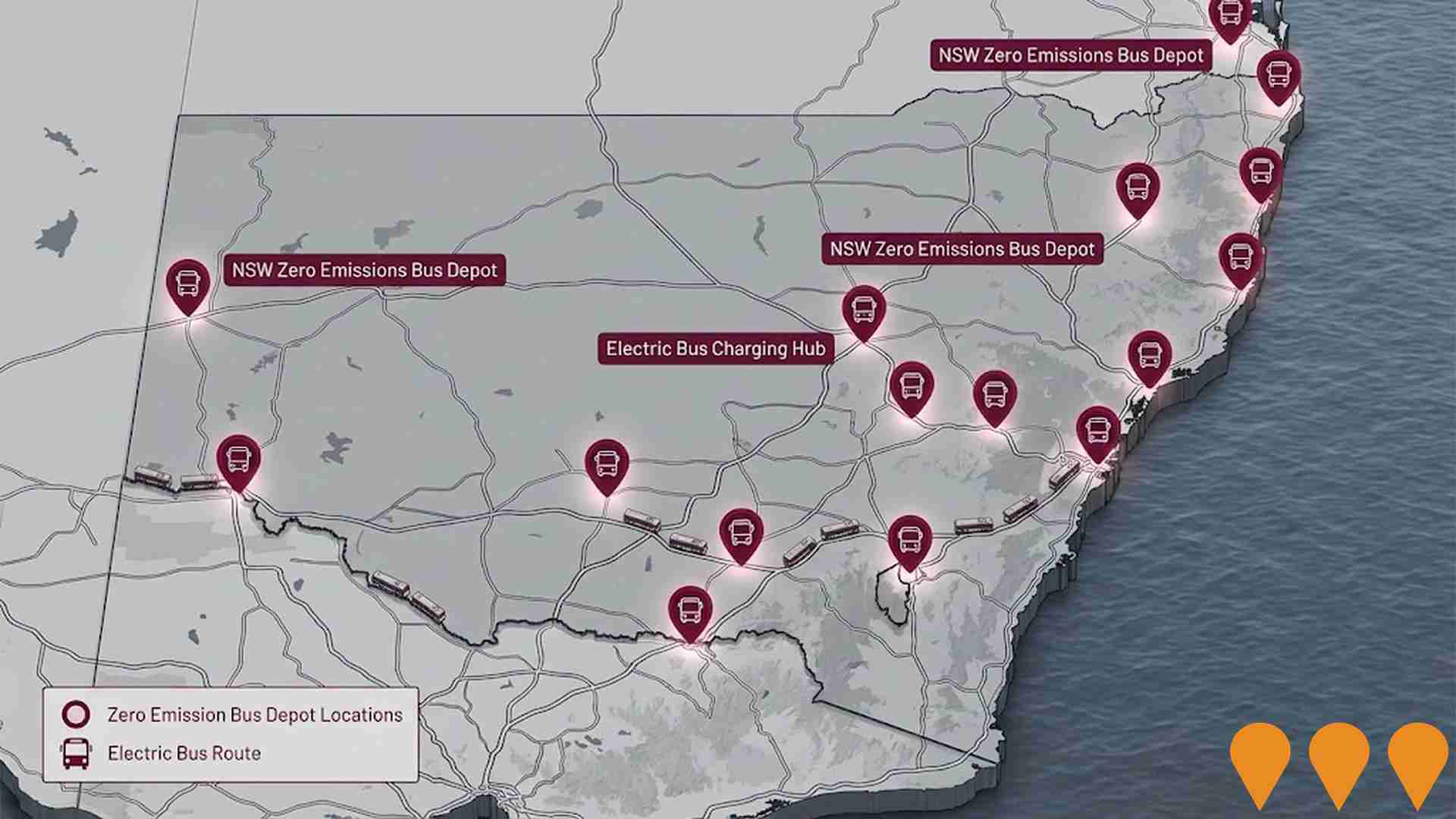

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

Inland Rail - Queensland Sections

The Queensland sections of Inland Rail comprise several key projects including Gowrie to Helidon, Helidon to Calvert, and Calvert to Kagaru. These sections involve building approximately 128km of new dual-gauge track, including a 6.2km tunnel through the Toowoomba Range and a 985m tunnel through the Teviot Range. As of February 2026, the Queensland sections remain in the planning and environmental assessment phase. The Queensland Coordinator-General recently extended the project declaration lapse dates to November 2029 while additional Environmental Impact Statement (EIS) information is being prepared. The project will connect to a proposed intermodal terminal at Ebenezer and then to the interstate network at Kagaru.

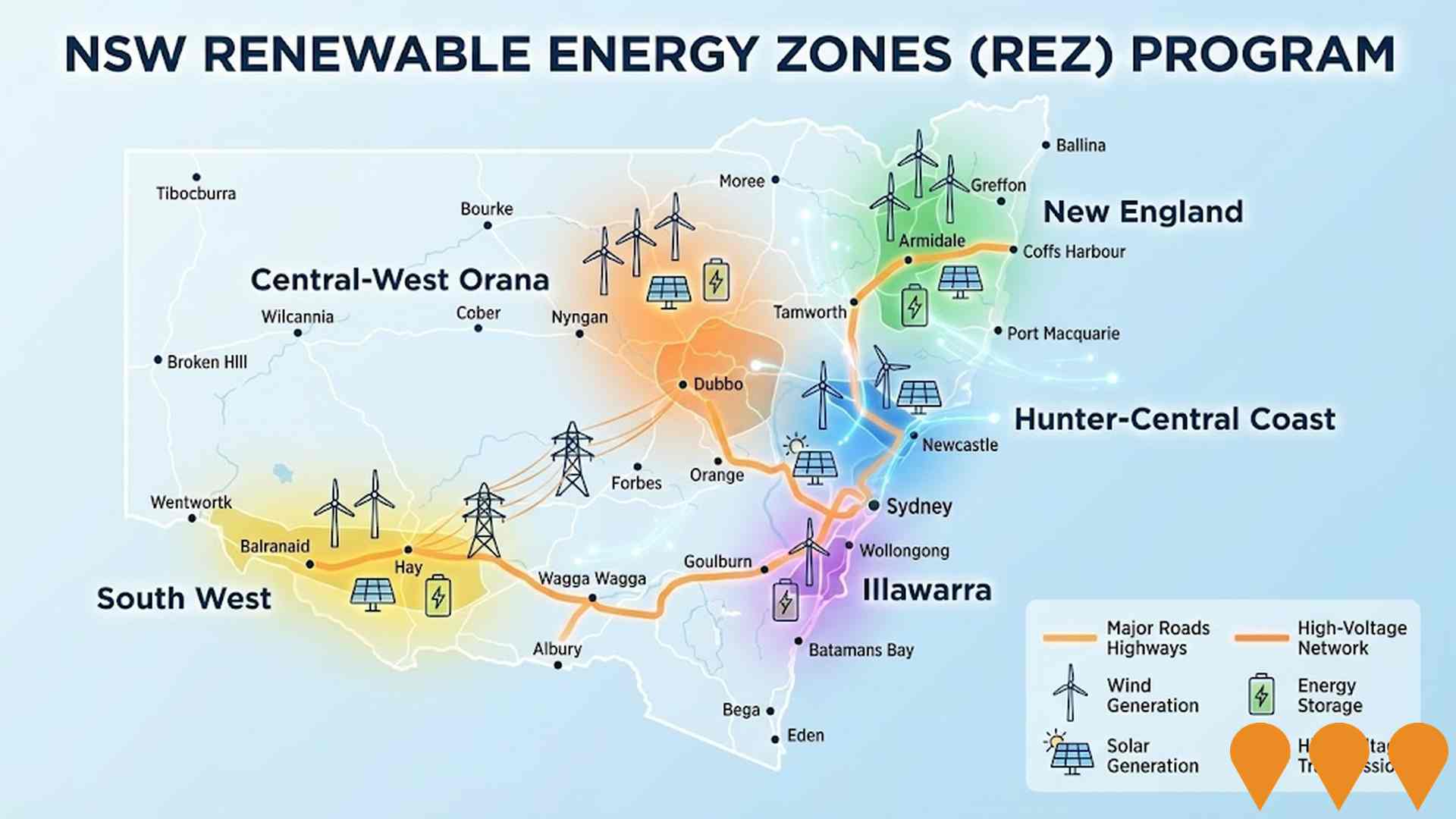

NSW Renewable Energy Zones (REZ) Program

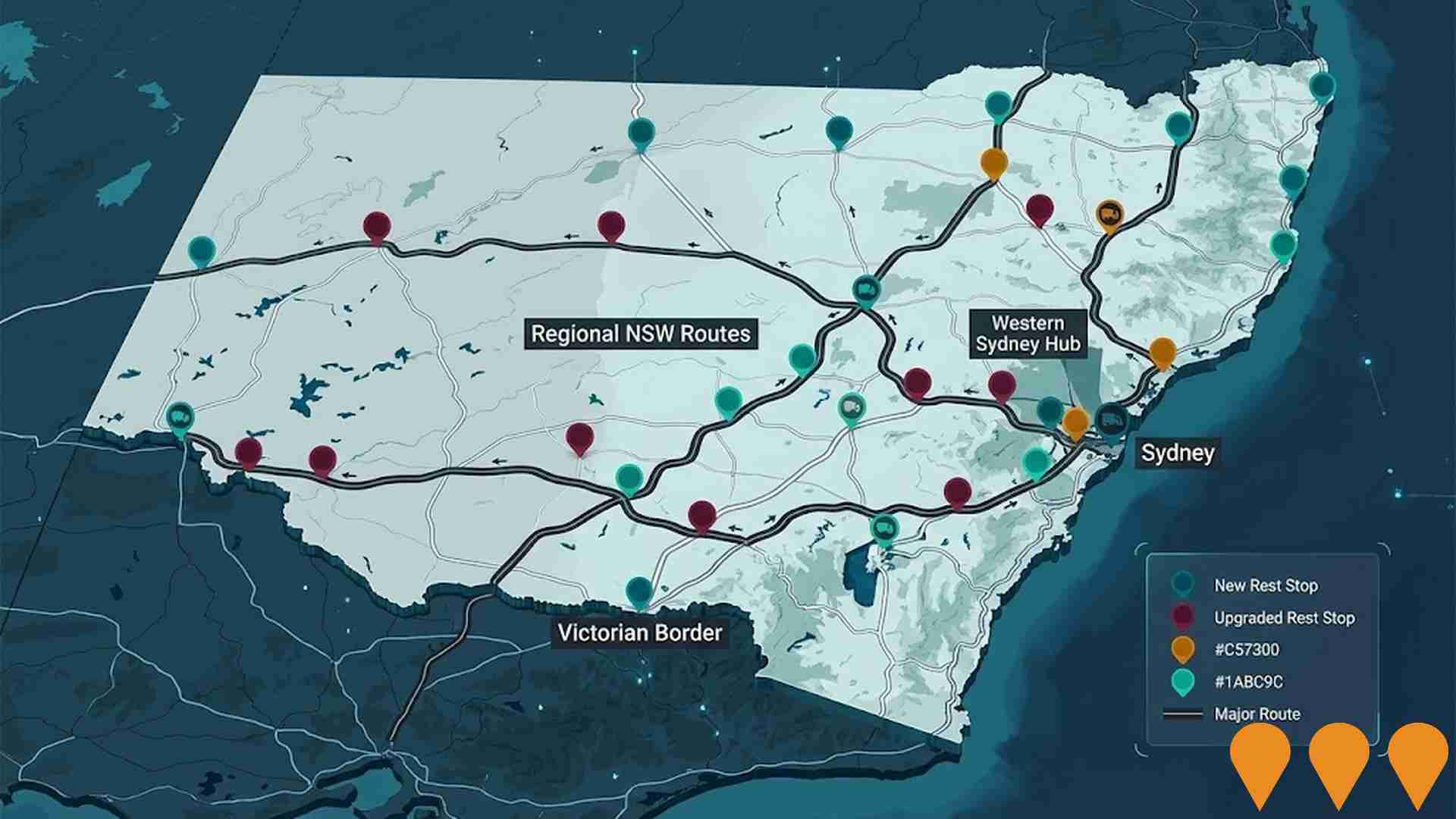

NSW is delivering five Renewable Energy Zones (Central-West Orana, New England, South West, Hunter-Central Coast, and Illawarra) to coordinate wind and solar generation, storage, and high-voltage transmission. Led by EnergyCo NSW under the Electricity Infrastructure Roadmap, the program targets at least 12 GW of new renewable generation and 2 GW of long-duration storage by 2030. Major construction of the first REZ (Central-West Orana) transmission project began in June 2025, involving 90km of 500kV and 150km of 330kV lines. As of February 2026, the project reached a milestone with the Australian Energy Regulator's final decision on network revenue determinations, and significant progress has been made on temporary worker accommodation and road upgrades between the Port of Newcastle and the Central-West Orana region.

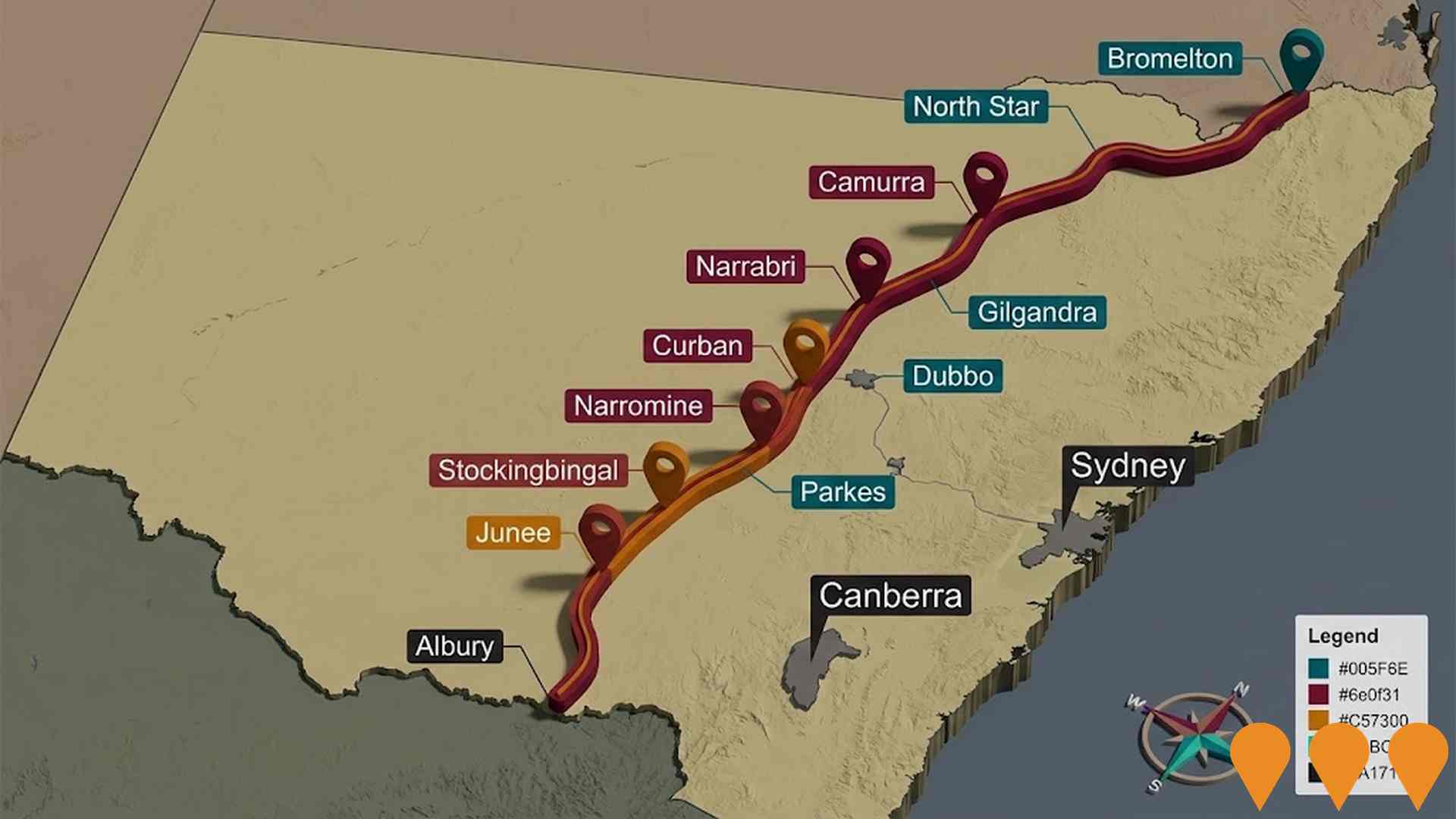

Queensland New South Wales Interconnector

The proposed Queensland New South Wales Interconnector (QNI Connect) aims to link New England's power to Queensland over approx. 600km, enhancing network capacity by up to 1,700 MW, with anticipated completion by FY2030-31.

Employment

The labour market performance in Kyogle lags significantly behind most other regions nationally

Kyogle has a balanced workforce with representation from both white and blue collar jobs, particularly in essential services sectors. The unemployment rate was 6.5% as of September 2025, showing relative employment stability over the past year based on AreaSearch's statistical area data aggregation.

As of this date, 830 residents were employed while the unemployment rate was 2.7% higher than Rest of NSW's rate of 3.8%. Workforce participation in Kyogle lagged significantly at 43.5%, compared to Rest of NSW's 56.4%. Employment among residents is concentrated in health care & social assistance, retail trade, and construction. Notably, health care & social assistance employs 1.3 times the regional average.

In contrast, public administration & safety employed only 5.0% of local workers, below Rest of NSW's 7.5%. The area appears to offer limited employment opportunities locally, as indicated by the difference between Census working population and resident population counts. From September 2024 to September 2025, Kyogle's labour force decreased by 2.3% and employment decreased by 0.5%, causing unemployment to fall by 1.6 percentage points. In comparison, Rest of NSW recorded an employment decline of 0.5%, a labour force decline of 0.1%, with unemployment rising by 0.4 percentage points. State-level data as of 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. Nationally, the unemployment rate was 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that national employment should expand by 6.6% over five years and 13.7% over ten years. However, growth rates differ significantly between industry sectors. Applying these industry-specific projections to Kyogle's employment mix indicates that local employment should increase by 6.4% over five years and 13.7% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not consider localised population projections.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

According to AreaSearch's aggregation of ATO data released for financial year ended June 2023, Kyogle had a median income among taxpayers of $37,693 with an average level of $46,141. These figures are below the national average and compare to levels of $52,390 and $65,215 across Rest of NSW respectively. Based on Wage Price Index growth of 8.86% since financial year ended June 2023, current estimates would be approximately $41,033 (median) and $50,229 (average) as of September 2025. Census data reveals household incomes in Kyogle fall between the 1st and 6th percentiles nationally. Distribution data shows 34.1% of the population falls within the $400 - $799 income range, contrasting with the region where the $1,500 - $2,999 bracket leads at 29.9%. Lower income households are notably prevalent, with 43.3% earning below $800 weekly, indicating affordability pressures for many residents. Housing affordability pressures are severe, with only 83.6% of income remaining, ranking at the 4th percentile nationally.

Frequently Asked Questions - Income

Housing

Kyogle is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Kyogle's dwelling structures, as per the latest Census, consisted of 89.7% houses and 10.4% other dwellings (semi-detached, apartments, 'other' dwellings). This is compared to Non-Metro NSW's 86.8% houses and 13.2% other dwellings. Home ownership in Kyogle was at 43.4%, with mortgaged dwellings at 25.0% and rented ones at 31.6%. The median monthly mortgage repayment in the area was $1,142, below Non-Metro NSW's average of $1,452. Median weekly rent in Kyogle was recorded at $280, compared to Non-Metro NSW's $300. Nationally, Kyogle's median monthly mortgage repayment is significantly lower than the Australian average of $1,863, and rents are substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Kyogle features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households constitute 58.2% of all households, including 17.6% couples with children, 22.4% couples without children, and 17.3% single parent families. Non-family households comprise the remaining 41.8%, with lone person households at 37.9% and group households at 3.8%. The median household size is 2.2 people, smaller than the Rest of NSW average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Kyogle faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 14.7%, significantly lower than the NSW average of 32.2%. Bachelor degrees are most common at 11.3%, followed by postgraduate qualifications (1.7%) and graduate diplomas (1.7%). Vocational credentials are prevalent, with 40.8% of residents aged 15+ holding them, including advanced diplomas (11.4%) and certificates (29.4%). Educational participation is high, with 31.2% of residents currently enrolled in formal education, comprising 13.8% in primary, 7.6% in secondary, and 3.2% in tertiary education.

Educational participation is notably high, with 31.2% of residents currently enrolled in formal education. This includes 13.8% in primary education, 7.6% in secondary education, and 3.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Kyogle has 50 active public transport stops, offering a mix of train and bus services. These stops are served by 24 individual routes, providing a total of 336 weekly passenger trips. The average distance to the nearest transport stop for residents is 139 meters, indicating excellent accessibility.

On average, there are 48 trips per day across all routes, equating to approximately 6 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Kyogle is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Critical health challenges are evident across Kyogle, with various health conditions impacting both younger and older age cohorts. The rate of private health cover is extremely low at approximately 45% of the total population (~1,055 people), compared to the national average of 55.7%.

The most common medical conditions in the area are arthritis and mental health issues, affecting 12.7 and 9.9% of residents respectively. Conversely, 57.1% of residents declare themselves completely clear of medical ailments, slightly lower than the 61.9% across Rest of NSW. The area has a higher proportion of seniors aged 65 and over at 30.4% (708 people), compared to 22.9% in Rest of NSW. Health outcomes among seniors present some challenges, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Kyogle is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Kyogle had a cultural diversity below average, with 89.8% citizens, 91.3% born in Australia, and 94.8% speaking English only at home. Christianity was the main religion, comprising 54.0% of Kyogle's population, compared to 52.4% across Rest of NSW. The top three ancestry groups were Australian (31.6%), English (29.8%), and Irish (11.7%).

Notable divergences included Scottish at 8.8%, Samoan at 0.3%, and Australian Aboriginal at 4.3%.

Frequently Asked Questions - Diversity

Age

Kyogle hosts an older demographic, ranking in the top quartile nationwide

Kyogle's median age is 47 years, which is significantly higher than the Rest of NSW average of 43 years and substantially exceeds the national average of 38 years. The age profile shows that those aged 85+ are particularly prominent at 5.6%, while the 25-34 age group is comparatively smaller at 7.8% compared to the Rest of NSW. Between 2021 and present, the 65-74 age group has increased from 13.8% to 14.9% of the population. Conversely, the 55-64 age group has declined from 14.1% to 12.5%. By 2041, Kyogle is expected to see notable shifts in its age composition. The 85+ group will grow by 59%, reaching 207 people from 130. The aging population dynamic is clear, with those aged 65 and above comprising 100% of projected growth. Conversely, population declines are projected for the 35-44 and 0-4 age groups.