Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Jordan Springs lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

As of Nov 2025, the estimated population for the Jordan Springs statistical area (Lv2) is around 13,974. This reflects an increase of 2,202 people since the 2021 Census, which reported a population of 11,772. The change is inferred from the resident population of 13,650 estimated by AreaSearch following examination of the latest ERP data release by the ABS (June 2024) and an additional 178 validated new addresses since the Census date. This level of population equates to a density ratio of 1,436 persons per square kilometer, which is above the average seen across national locations assessed by AreaSearch. The Jordan Springs (SA2)'s 18.7% growth since the 2021 census exceeded the SA4 region's 6.3%, marking it as a growth leader in the region. Population growth was primarily driven by natural growth contributing approximately 43.0% of overall population gains during recent periods, although all drivers including interstate migration and overseas migration were positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Based on aggregated SA2-level projections, the Jordan Springs (SA2) is expected to expand by 1,479 persons to 2041, reflecting an increase of 5.9% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential approval activity sees Jordan Springs among the top 30% of areas assessed nationwide

AreaSearch analysis of ABS building approval numbers indicates Jordan Springs averaged approximately 94 new dwelling approvals annually over the past five financial years, totalling an estimated 471 homes. As of FY26, 22 approvals have been recorded. On average, 7.3 new residents arrived per year for each dwelling constructed between FY21 and FY25, suggesting demand significantly exceeds supply. New properties are constructed at an average value of $504,000, indicating a focus on the premium segment with upmarket properties.

In FY26, $9.4 million in commercial development approvals have been recorded, suggesting balanced commercial development activity. Compared to Greater Sydney, Jordan Springs shows moderately higher construction activity, balancing buyer choice while supporting current property values. Recent construction comprises 31% detached houses and 69% townhouses or apartments, indicating a shift from the area's existing housing composition of 90% houses. With around 641 people per dwelling approval, Jordan Springs reflects a highly mature market. Future projections estimate Jordan Springs to add 829 residents by 2041, with current development rates suggesting new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Future projections show Jordan Springs adding 829 residents by 2041 (from the latest AreaSearch quarterly estimate). At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Jordan Springs has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 20 projects likely affecting the region. Notable initiatives include the New High School for Jordan Springs, Ropes Crossing Estate - Remaining Stages (Final Residential Lots), Jordan Springs Regional Open Space, and Ropes Crossing Village Shopping Centre Mixed-Use Redevelopment. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

The Quarter - Penrith Health & Education Precinct

The Quarter is a 400-hectare specialized health and education precinct in Western Sydney, integrating Nepean Public and Private Hospitals, Western Sydney University, and TAFE NSW. Current major activity includes the $1 billion Nepean Hospital Redevelopment, with Stage 2 construction of a new seven-story clinical services building featuring an ICU, medical imaging, and renal dialysis scheduled for completion in late 2026. The precinct aims to generate 6,000 additional jobs and support 25,000 students by 2036.

Nepean Hospital Redevelopment

A $1 billion multi-stage expansion of Nepean Hospital. Stage 1 delivered a 14-storey tower with a new ED and 18 birthing suites. Stage 2, currently in the final year of construction, adds a new seven-storey clinical building featuring an Intensive Care Unit, medical imaging, renal dialysis, and a new hospital main entry. The project also includes a new Adolescent Mental Health Unit and a community health centre at Soper Place.

Box Hill Release Area Development

The Box Hill and Box Hill Industrial precincts are part of the NSW Government's North West Growth Area, designed to deliver over 16,000 homes and employment land for 16,000 workers. As of early 2026, approximately 70% of the total residential yield has been approved, with over 6,200 dwellings completed. Key active infrastructure includes the Box Hill Village shopping centre (slated for Q2 2027), the Water Lane Reserve Sports Complex, and various road upgrades including Terry Road and Annangrove Road. The area includes a new town centre, primary and secondary schools, and extensive open space reserves to support a forecast population of over 22,000 residents by 2026.

Ropes Crossing Village Shopping Centre Mixed-Use Redevelopment

A two-stage mixed-use redevelopment of the existing Ropes Crossing Village neighbourhood retail hub. The project includes a 712sqm expansion of the existing Coles supermarket, 525sqm of new commercial/medical suites, and additional specialty retail. The residential component features 128 apartments across three 6-storey buildings with basement parking for approximately 468 cars, designed to increase housing diversity and activate the pedestrian environment in the village centre.

Nepean Business Park

Transformation of a 47ha degraded former quarry site into a productive business park, providing local jobs while protecting and enhancing the environment, located 2km from Penrith CBD.

Cambridge Park North Precinct Rezoning

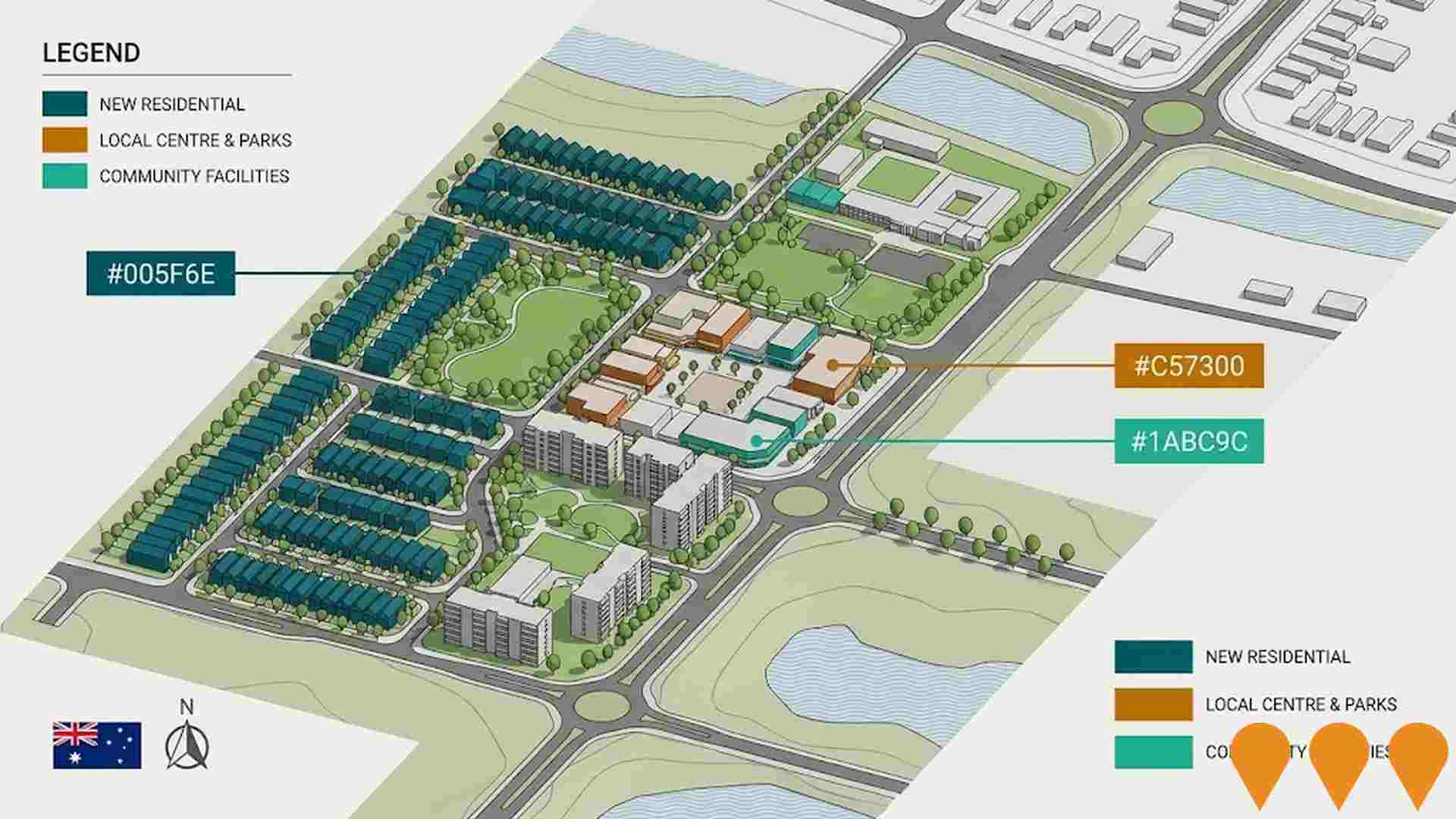

Major rezoning of approximately 50 hectares in Cambridge Park North to deliver up to 1,800 new dwellings, new local centre, parks and community facilities as part of the Glenmore Park to St Marys growth corridor.

New High School for Jordan Springs

The new high school for Jordan Springs is scheduled to open on Day 1, Term 1, 2027, initially for Year 7 and 8 students, expanding annually to a full Year 7-12 cohort by 2031. It will accommodate at least 1,000 students with modern classrooms, support spaces, library, administration facilities, specialist workshops for science, wood and metal work, covered outdoor learning area, canteen, multipurpose hall for sports and performances, sports courts, playing field, and landscaping. The design connects to Wianamatta Regional Park and includes provisions for future expansion. Principal to be appointed late 2025.

Village Park Jordan Springs

A circa 1.2 ha community park at the Jordan Springs Village Centre providing a community activation shelter with kitchen, BBQs, toilets and stage, a kick-about lawn, tiered amphitheatre, bio-retention / rain garden and landscaping upgrades.

Employment

The exceptional employment performance in Jordan Springs places it among Australia's strongest labour markets

Jordan Springs has a well-educated workforce with essential services sectors well represented. Its unemployment rate is 1.6%, according to AreaSearch's aggregation of statistical area data.

As of September 2025, there are 7,827 residents in work, and the unemployment rate is 2.6% lower than Greater Sydney's rate of 4.2%. Workforce participation is high at 76.0%, compared to Greater Sydney's 60.0%. Employment is concentrated in health care & social assistance, retail trade, and construction. The area shows strong specialization in public administration & safety, with an employment share 1.5 times the regional level.

Professional & technical services are under-represented, at 6.1% compared to Greater Sydney's 11.5%. Local employment opportunities appear limited based on Census data comparing working population and resident population. Between September 2024 and September 2025, Jordan Springs' labour force decreased by 3.6%, while employment declined by 3.2%, reducing the unemployment rate by 0.4 percentage points. In contrast, Greater Sydney experienced employment growth of 2.1% and labour force growth of 2.4%, with a slight rise in unemployment. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Jordan Springs' employment mix suggests local employment should grow by 6.6% in five years and 13.6% in ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

The suburb of Jordan Springs had one of the highest income levels in Australia according to AreaSearch data based on latest ATO figures for financial year 2023. The median income among taxpayers was $70,191 and the average income stood at $79,257, compared to Greater Sydney's figures of $60,817 and $83,003 respectively. As of September 2025, estimates based on Wage Price Index growth of 8.86% would be approximately $76,410 (median) and $86,279 (average). Census data shows household, family and personal incomes all rank highly in Jordan Springs, between the 85th and 90th percentiles nationally. The income bracket of $1,500 - 2,999 dominated with 43.6% of residents (6,092 people), consistent with broader trends across the broader area showing 30.9% in the same category. A substantial proportion of high earners, at 35.6%, indicated strong economic capacity throughout the area. High housing costs consumed 21.3% of income, yet strong earnings placed disposable income at the 83rd percentile and the area's SEIFA income ranking placed it in the 8th decile.

Frequently Asked Questions - Income

Housing

Jordan Springs is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Jordan Springs' dwellings, as per the latest Census, consisted of 90.3% houses and 9.6% other types (semi-detached, apartments, 'other'). This contrasts with Sydney metro's 77.4% houses and 22.6% other dwellings. Home ownership in Jordan Springs was at 7.6%, with mortgaged dwellings at 57.8% and rented ones at 34.5%. The median monthly mortgage repayment was $2,600, higher than Sydney metro's average of $2,167. Median weekly rent was $530, compared to Sydney metro's $400. Nationally, Jordan Springs' mortgage repayments were significantly higher at $1,863 and rents substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Jordan Springs features high concentrations of family households, with a higher-than-average median household size

Family households account for 88.0% of all households, consisting of 55.2% couples with children, 20.2% couples without children, and 11.5% single parent families. Non-family households comprise the remaining 12.0%, with lone person households at 9.8% and group households making up 2.2%. The median household size is 3.2 people, larger than the Greater Sydney average of 2.8.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Jordan Springs exceeds national averages, with above-average qualification levels and academic performance metrics

Education in Jordan Springs shows a notable advantage with 32.1% of residents aged 15+ holding university qualifications, surpassing the SA3 area's 21.4% and the SA4 region's 23.9%. Bachelor degrees are most common at 20.9%, followed by postgraduate qualifications (9.2%) and graduate diplomas (2.0%). Vocational credentials are also prominent, with 34.3% of residents aged 15+ holding these, including advanced diplomas (12.9%) and certificates (21.4%). Educational participation is high, with 32.9% of residents currently enrolled in formal education, comprising 13.5% in primary, 7.1% in secondary, and 4.3% in tertiary education.

Educational participation is notably high, with 32.9% of residents currently enrolled in formal education. This includes 13.5% in primary education, 7.1% in secondary education, and 4.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 41 active transport stops in Jordan Springs, offering a mix of bus services. These stops are served by 20 unique routes, collectively facilitating 401 weekly passenger trips. Transport accessibility is rated excellent, with residents typically located 198 meters from the nearest stop.

Service frequency averages 57 trips per day across all routes, equating to approximately 9 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Jordan Springs's residents boast exceedingly positive health performance metrics with common health conditions somewhat prevalent across both younger and older age cohorts

Health outcomes data shows notable results across Jordan Springs, with common health conditions being somewhat prevalent amongst both younger and older age cohorts. Private health cover rates are very high at approximately 58% of the total population (~8,137 people), compared to 55.2% across Greater Sydney.

The most common medical conditions in the area are asthma and mental health issues, affecting 7.1 and 6.6% of residents respectively. Meanwhile, 79.2% of residents declare themselves completely clear of medical ailments, compared to 69.5% across Greater Sydney. As of June 30, 2021, the area has 6.3% of residents aged 65 and over (880 people), which is lower than the 14.1% in Greater Sydney. Health outcomes amongst seniors present some challenges requiring more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Jordan Springs was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Jordan Springs has a high level of cultural diversity, with 32.7% of its population born overseas and 33.6% speaking a language other than English at home. The dominant religion in Jordan Springs is Christianity, comprising 47.7% of the population. Hinduism is notably overrepresented, making up 12.2%, compared to the Greater Sydney average of 3.6%.

In terms of ancestry, Australians make up 22.9% of the population, English comprise 19.0%, which is lower than the regional average of 24.2%, and Other groups account for 13.9%. There are significant differences in the representation of certain ethnic groups: Filipino is overrepresented at 5.6% (regional average 2.1%), Indian at 10.0% (regional average 3.0%), and Maltese at 2.4% (regional average 2.9%).

Frequently Asked Questions - Diversity

Age

Jordan Springs hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Jordan Springs's median age is 31 years, which is lower than the Greater Sydney average of 37 years and the Australian median of 38 years. Compared to Greater Sydney, Jordan Springs has a higher proportion of residents aged 35-44 (21.7%) but fewer residents aged 55-64 (5.3%). This concentration of 35-44 year-olds is notably higher than the national average of 14.2%. Between 2021 and present, the proportion of residents aged 35 to 44 has increased from 20.0% to 21.7%, while the 15 to 24 age group has risen from 10.7% to 12.2%. Conversely, the 25 to 34 age group has decreased from 20.7% to 15.9%, and the 0 to 4 age group has dropped from 12.4% to 10.4%. By 2041, demographic modeling suggests that Jordan Springs's age profile will change significantly. The 15 to 24 age cohort is projected to grow steadily, increasing by 580 people (34%) from 1,704 to 2,285. Conversely, the 5 to 14 and 0 to 4 age cohorts are expected to experience population declines.