Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Highland Park is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Highland Park's population, as of November 2025, is estimated at around 6,855 people. This reflects an increase of 279 individuals since the 2021 Census, which reported a population of 6,576 people. The current resident population estimate of 6,850 by AreaSearch considers the latest ERP data release by the ABS in June 2024 and four additional validated new addresses since the Census date. This results in a population density ratio of 1,726 persons per square kilometer, higher than average national locations assessed by AreaSearch. Highland Park's growth rate of 4.2% since the census is within 1.5 percentage points of the SA3 area (5.7%), indicating competitive growth fundamentals. Natural growth primarily drove this population increase, contributing approximately 56.00000000000001% of overall gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections from 2023 based on 2021 data are used, applying proportional growth weightings aligned with ABS Greater Capital Region projections released in 2023 using 2022 data. Future population projections indicate an increase just below the median of regional areas nationally by 2041, with Highland Park expected to gain 510 persons, reflecting a total growth of 7.5% over 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Highland Park according to AreaSearch's national comparison of local real estate markets

Highland Park has averaged approximately five new dwelling approvals annually. Between the financial years 2021 and 2025, an estimated twenty-five homes were approved, with one more approved so far in 2026. On average, each newly constructed dwelling brings in about eleven-point-seven new residents per year over these past five years.

This high demand relative to new supply typically drives price growth and increased buyer competition. The average construction cost for new dwellings is $458,000, slightly above the regional average, indicating a focus on quality developments. In 2026, there have been $2.0 million in commercial approvals, reflecting the area's residential nature. Compared to the rest of Queensland, Highland Park has significantly less development activity, at seventy-one-point-zero percent below the regional average per person. This scarcity of new properties often strengthens demand and prices for existing properties.

Recent building activity consists solely of detached houses, preserving Highland Park's suburban character and attracting space-seeking buyers. With around eight-hundred-fifty-three people per dwelling approval, Highland Park demonstrates a highly mature market. According to the latest AreaSearch quarterly estimate, Highland Park is projected to add five-hundred-fifteen residents by 2041. At current development rates, housing supply may struggle to keep pace with population growth, potentially intensifying buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Highland Park has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified four projects that could impact this region. Notable initiatives include Hinkler Drive Retail Showroom Complex, Mooyumbin Creek Riparian Restoration, Highland Park Investigation Area, and The Summit Highland Park.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on energy affordability and reliability. Key initiatives include a $1.6 billion Electricity Maintenance Guarantee to extend the life of state-owned coal assets until at least 2046 and a $400 million Queensland Energy Investment Fund to catalyze private sector investment. Major infrastructure priorities include the delivery of the CopperString Eastern Link (330kV) by 2032 and a 400MW Central Queensland Gas Power Tender to be operational by 2032. The plan replaces the former Energy and Jobs Plan and shifts from renewable targets to Regional Energy Hubs and emission reduction goals.

Brisbane to Gold Coast Transport Corridor Upgrades (Corridor Program)

A transformative multi-modal program upgrading the critical link between Brisbane and the Gold Coast. Key components include the $5.75 billion Logan and Gold Coast Faster Rail project, which is doubling tracks from two to four between Kuraby and Beenleigh, and the $3.5 billion Coomera Connector (M9) motorway. The program aims to increase rail capacity, remove five level crossings, and provide a new 16km motorway corridor to relieve M1 congestion, supporting the 2032 Olympic and Paralympic Games.

Hinkler Drive Retail Showroom Complex

Redevelopment of a significant 5.2-hectare site bordering the M1 into a five-building retail showroom complex. The project, proposed by Look Enterprises, focuses on large-format retail and bulky goods to serve the growing Gold Coast corridor. It is situated adjacent to the SkyRidge master-planned community and aims to capitalize on high visibility from the Pacific Motorway.

Gold Coast Light Rail Stage 4

Proposed 13km southern extension of the Gold Coast Light Rail from Burleigh Heads to Coolangatta via Gold Coast Airport. The project was intended to include 14 new stations and bridges over Tallebudgera and Currumbin Creeks. Following a Queensland Government review and community consultation in early 2025, official planning for the light rail extension was stopped on 1 September 2025 due to community opposition and escalating cost estimates reaching up to $9.85 billion. The government has shifted focus to a multi-modal regional transport study and accelerated bus service enhancements for the southern Gold Coast.

Coomera Connector (Second M1)

The Coomera Connector (M9) is a 45km north-south motorway being delivered to provide an alternative to the M1 Pacific Motorway. Stage 1 (16km) is a $3.02 billion project connecting Coomera to Nerang. Stage 1 North (Coomera to Helensvale) opened to traffic in December 2025. Construction is currently active on Stage 1 Central (Helensvale to Molendinar) and Stage 1 South (Molendinar to Nerang), featuring major bridge structures over the Coomera and Nerang Rivers and an 8km active transport path.

Pacific Motorway (M1) Upgrades

Rolling upgrades to the Pacific Motorway (M1) corridor between Brisbane and the Gold Coast to improve safety, capacity and travel time reliability. Current focus areas include Eight Mile Plains to Daisy Hill (Stage 2, multi-package works), Varsity Lakes to Tugun (VL2T, packages B and C opening progressively from 2024), plus planning for Daisy Hill to Logan Motorway (Stage 3). Works include additional lanes, interchange upgrades, widened creek bridges, active transport links and smart motorway systems.

Gold Coast Desalination Plant Expansion

Expansion of the existing desalination plant to increase water supply capacity in response to population growth and climate change, including potential booster pump stations.

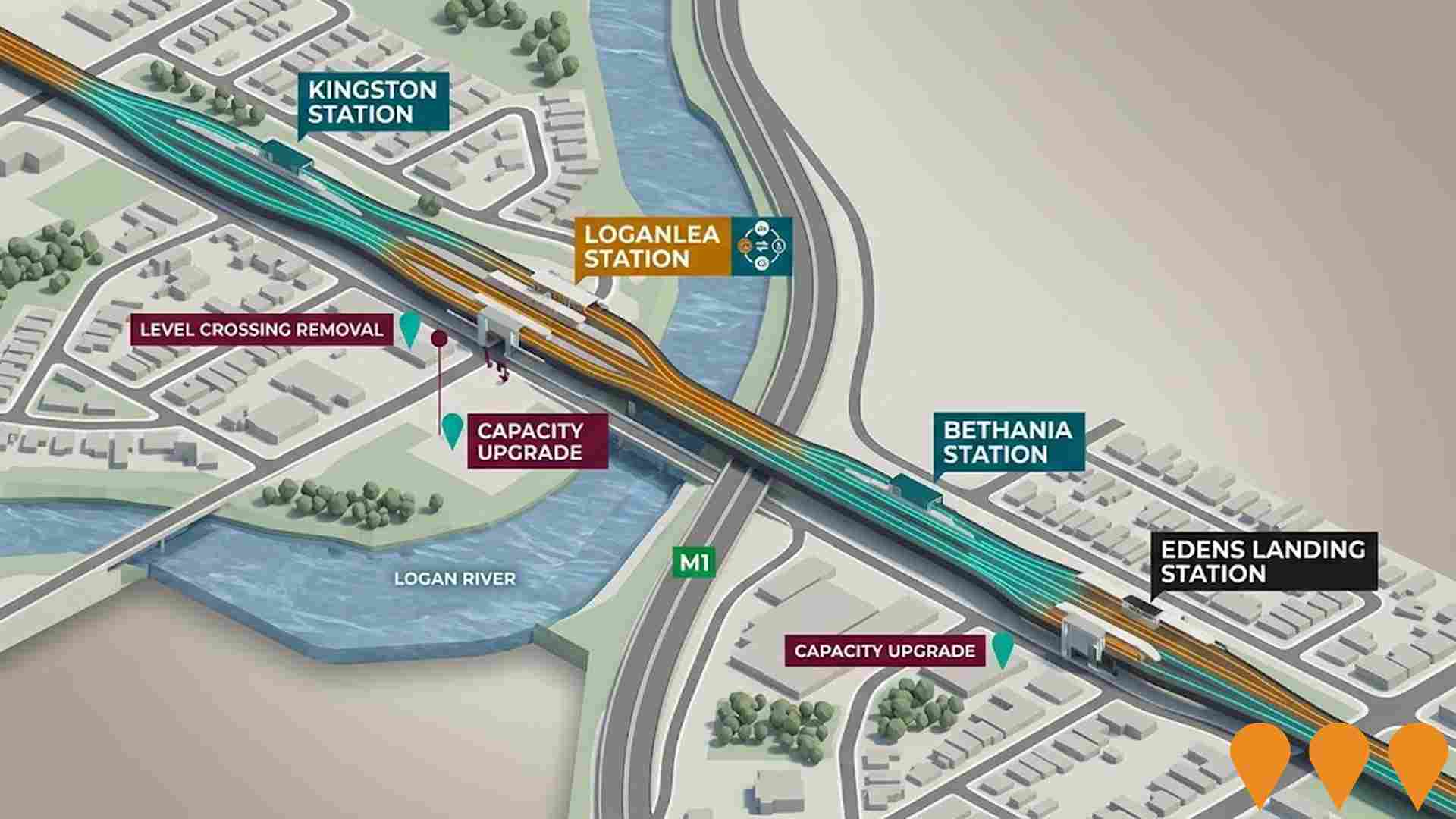

Logan and Gold Coast Faster Rail

Major rail infrastructure project to deliver more frequent and reliable train services between Brisbane, Logan, and Gold Coast. The $5.75 billion project will double tracks from two to four between Kuraby and Beenleigh over 20km, remove 5 level crossings, upgrade 9 stations (Kuraby, Trinder Park, Woodridge, Kingston, Loganlea, Bethania, Edens Landing, Holmview, Beenleigh), and improve accessibility and connectivity. Part of South East Queensland rail network improvements supporting Brisbane 2032 Olympic and Paralympic Games. Jointly funded 50:50 by Australian and Queensland Governments.

Employment

AreaSearch analysis indicates Highland Park maintains employment conditions that align with national benchmarks

Highland Park has a skilled workforce with essential services sectors well represented. The unemployment rate in the area was 4.1% over the past year, with an estimated employment growth of 2.1%.

As of September 2025, 3,576 residents were employed, with the unemployment rate aligning with Rest of Qld's rate of 4.1%. Workforce participation stood at 62.4%, slightly higher than Rest of Qld's 59.1%. Major employment sectors include health care & social assistance, construction, and retail trade. Construction particularly stands out with employment levels at 1.3 times the regional average.

Conversely, agriculture, forestry & fishing has limited presence with only 0.3% employment compared to the region's 4.5%. The area appears to offer limited local employment opportunities as indicated by the Census working population vs resident population count. Over a 12-month period, employment increased by 2.1% while labour force grew by 2.0%, keeping the unemployment rate relatively stable. This contrasts with Rest of Qld where employment rose by 1.7%, labour force grew by 2.1%, and unemployment rose by 0.3 percentage points. State-level data up to 25-Nov shows Queensland's employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, broadly in line with the national rate of 4.3%. Job and Skills Australia's national employment forecasts from May-25 suggest potential future demand within Highland Park. These projections estimate national employment growth of 6.6% over five years and 13.7% over ten years, but growth rates differ significantly between industry sectors. Applying these projections to Highland Park's employment mix suggests local employment should increase by approximately 6.5% over five years and 13.5% over ten years, although these are simple extrapolations for illustrative purposes and do not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

Highland Park's median income among taxpayers was $49,781 and average income was $62,246 in financial year 2023, according to AreaSearch data sourced from the ATO. This compares with Rest of Qld's figures of $53,146 and $66,593 respectively. By September 2025, estimates suggest median income will be approximately $54,714 and average income will be around $68,415, based on a 9.91% Wage Price Index growth since financial year 2023. Census data shows Highland Park's incomes rank modestly, with household, family and personal incomes between the 32nd and 42nd percentiles. The largest income bracket comprises 33.1% earning $1,500 - $2,999 weekly (2,269 residents), consistent with broader area trends showing 31.7% in the same category. Housing affordability pressures are severe, with only 82.9% of income remaining after housing costs, ranking at the 41st percentile. The suburb's SEIFA income ranking places it in the fifth decile.

Frequently Asked Questions - Income

Housing

Highland Park is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Highland Park's dwelling structures, as per the latest Census data, consisted of 85.1% houses and 14.9% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro Qld's 71.9% houses and 28.1% other dwellings. Home ownership in Highland Park stood at 34.6%, with mortgaged dwellings at 47.7% and rented ones at 17.8%. The median monthly mortgage repayment was $1,800, lower than Non-Metro Qld's average of $1,950. The median weekly rent figure in Highland Park was $430, slightly higher than Non-Metro Qld's $435. Nationally, Highland Park's mortgage repayments were below the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Highland Park features high concentrations of family households, with a lower-than-average median household size

Family households account for 77.5% of all households, including 34.0% couples with children, 30.1% couples without children, and 12.5% single parent families. Non-family households constitute the remaining 22.5%, with lone person households at 19.0% and group households comprising 3.1% of the total. The median household size is 2.7 people, which is smaller than the Rest of Qld average of 2.8.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Highland Park fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 19.0%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common, at 13.6%, followed by postgraduate qualifications (3.4%) and graduate diplomas (2.0%). Vocational credentials are prevalent among residents aged 15+, with 42.1% holding such qualifications, including advanced diplomas (13.5%) and certificates (28.6%). Educational participation is high, with 26.9% of residents currently enrolled in formal education, comprising 9.5% in primary, 7.9% in secondary, and 3.9% in tertiary education.

Educational participation is notably high, with 26.9% of residents currently enrolled in formal education. This includes 9.5% in primary education, 7.9% in secondary education, and 3.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Highland Park has 12 operational public transport stops, serving a variety of bus routes. These stops are served by four distinct routes that facilitate a total of 355 weekly passenger trips. The accessibility of these services is rated as moderate, with residents generally situated approximately 414 meters away from the nearest stop.

On average, there are 50 daily trips across all routes, translating to roughly 29 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health outcomes in Highland Park are marginally below the national average with common health conditions slightly more prevalent than average across both younger and older age cohorts

Health indicators suggest below-average outcomes in Highland Park.

Common health conditions are slightly more prevalent than average across both younger and older age cohorts. The rate of private health cover is relatively low at approximately 52% of the total population, which totals ~3,555 people. The most common medical conditions are arthritis and asthma, impacting 9.4 and 7.9% of residents respectively. 67.2% of residents declare themselves completely clear of medical ailments, compared to 69.5% across Rest of Qld. The area has 20.2% of residents aged 65 and over (1,384 people), higher than the 16.7% in Rest of Qld. Health outcomes among seniors are above average, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Highland Park was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Highland Park's cultural diversity is above average, with 10.3% speaking a language other than English at home and 27.8% born overseas. Christianity is the main religion, comprising 50.6%. Judaism is overrepresented at 0.2%, compared to 0.2% in Rest of Qld.

The top three ancestry groups are English (31.5%), Australian (24.1%), and Other (8.1%). Notably, New Zealanders comprise 1.7% vs regional 1.8%, Maori 1.9% vs 1.9%, and French 0.7% vs regional 0.5%.

Frequently Asked Questions - Diversity

Age

Highland Park's median age exceeds the national pattern

The median age in Highland Park is 41 years, matching Rest of Qld's average of 41, but it is somewhat older than Australia's average age of 38 years. Compared to Rest of Qld, Highland Park has a higher proportion of residents aged 35-44 (14.1%) but fewer residents aged 65-74 (10.0%). According to the 2021 Census, the population aged 35 to 44 grew from 13.0% to 14.1%, while the 45 to 54 age group declined from 13.2% to 12.0%. The 55 to 64 age group also decreased, from 13.1% to 11.9%. By 2041, demographic projections indicate significant shifts in Highland Park's age structure. Notably, the 25 to 34 age group is expected to grow by 26%, reaching a population of 1,073 from 850. Conversely, the 15 to 24 and 55 to 64 age groups are projected to experience population declines.