Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Bundall are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch since the Census Bundall's population is estimated at around 5087 as of November 2025. This reflects an increase of 192 people (3.9%) since the 2021 Census, which reported a population of 4895 people. The change is inferred from the resident population of 5080, estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024, and an additional 14 validated new addresses since the Census date. This level of population equates to a density ratio of 1301 persons per square kilometer, which is above the average seen across national locations assessed by AreaSearch. Population growth for the Bundall statistical area (Lv2) was primarily driven by overseas migration that contributed approximately 71% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections, released in 2023 and based on 2021 data, are adopted. These state projections do not provide age category splits; hence AreaSearch applies proportional growth weightings in line with the ABS Greater Capital Region projections for each age cohort, released in 2023 based on 2022 data. Considering projected demographic shifts, a significant population increase in the top quartile of non-metropolitan areas nationally is forecast for the Bundall (SA2), expected to increase by 1184 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of 23.1% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Bundall according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers in Bundall shows an average of around 13 new dwelling approvals per year over the past five financial years, totalling an estimated 69 homes. In FY26 so far, 9 approvals have been recorded. This results in approximately 1.7 new residents per year per dwelling constructed between FY21 and FY25, indicating balanced supply and demand with stable market dynamics. The average construction value of new properties is $1,513,000, reflecting a focus on the premium segment.

In this financial year, $98,000 in commercial approvals have been registered, highlighting Bundall's residential nature. New development consists of 57.0% detached houses and 43.0% attached dwellings, marking a shift from existing housing patterns which are currently 74.0% houses. This suggests decreasing developable land availability and responding to changing lifestyle preferences and affordability needs.

With around 282 people per dwelling approval, Bundall exhibits characteristics of a low density area. According to the latest AreaSearch quarterly estimate, Bundall is projected to add 1,177 residents by 2041. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Bundall has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch identified 11 projects that could impact the area. Notable ones include Cross River Rail - New Gold Coast Stations, UNIQ Bundall, Sunlight Lifestyle Precinct, and Elements Budds Beach. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

The Landmark

The Landmark is a $2.5 billion masterplanned mixed-use precinct by Aniko Group located on a 1.3-hectare site in Mermaid Beach. The development features four architecturally striking towers ranging from 25 to 53 storeys. It includes approximately 900 to 973 luxury residences, a 5-star international hotel with branded residences, and over 10,000sqm of A-grade office and medical space. The project offers extensive resort-style amenities on a one-hectare recreation podium, including a lagoon pool, lap pool, pickleball court, and a ground-level dining and retail plaza. Construction is being delivered in stages by Aniko's in-house construction arm.

Pindara Private Hospital Stage 3 Expansion

The Stage 3 expansion of Pindara Private Hospital involved the southern extension of the Dr David Lindsay Wing, adding two luxurious wards with spacious private ensuited rooms and two new cutting-edge operating theatres. This increased the total licensed beds to 348, enhanced medical services, and expanded capacity for Day Infusion and Renal Dialysis Services.

Gold Coast Light Rail Stage 3 (Broadbeach South to Burleigh Heads)

A 6.7-kilometre dual-track extension of the G:link light rail network from Broadbeach South to Burleigh Heads. The $1.549 billion project adds eight new stations, five additional light rail vehicles, and involves an upgrade to the existing Southport depot. Major construction commenced in July 2022. As of early 2026, the project has reached significant milestones with tram testing and commissioning underway in the northern sections. Once operational, the total network will span 27km from Helensvale to Burleigh Heads, significantly improving public transport accessibility and supporting the region's growth ahead of the 2032 Olympic Games.

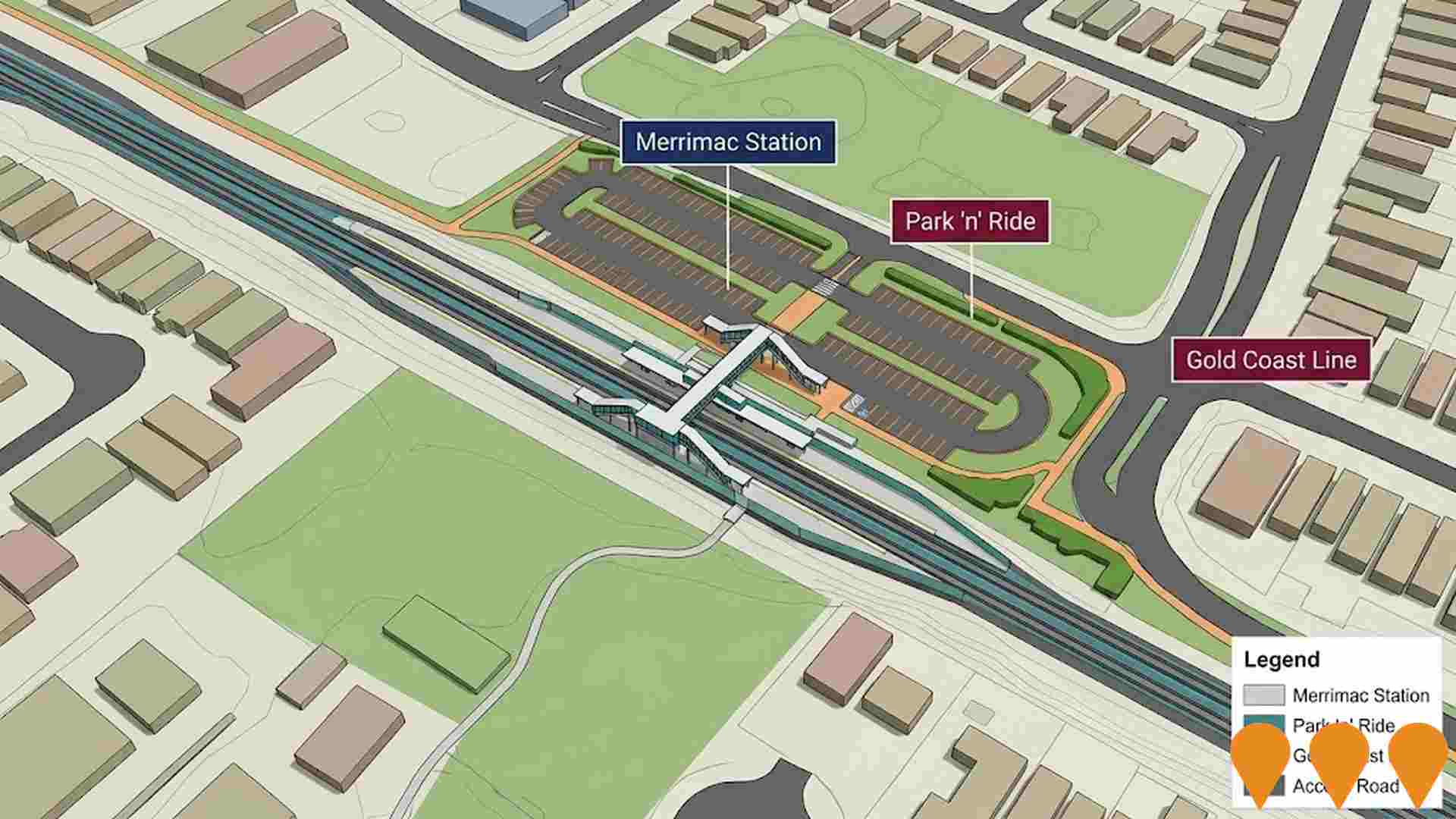

Cross River Rail - New Gold Coast Stations

Three new stations are being delivered on the Gold Coast line at Pimpama, Hope Island and Merrimac by the Cross River Rail Delivery Authority. Each station includes parking and set-down areas, accessible lifts and wayfinding, pedestrian and cycle connections, public transport integration and upgraded lighting and CCTV. Major construction is underway at all three sites, with ADCO Constructions delivering Pimpama, Acciona Georgiou JV delivering Hope Island and Fulton Hogan delivering Merrimac.

Benowa Gardens Redevelopment

Major mixed-use redevelopment of the existing Benowa Gardens Shopping Centre into a vibrant vertical village. The impact-assessable development application proposes three residential towers (up to 13 storeys) delivering 441 apartments and 41 short-term accommodation units above a revitalised retail and commercial podium of approximately 10,000 sqm GFA retail and 3,000 sqm office/medical suites, with three levels of basement parking.

Gold Coast Regional Botanic Gardens Biodiversity Centre

A new biodiversity centre within the Gold Coast Regional Botanic Gardens offering a mountains to mangroves journey through interactive displays and gardens, focusing on local flora, fauna, history, and culture. It includes exhibition spaces, flexible areas for conferences, teaching, and functions, a cafe, merchandise shop, administration, amenities, plaza spaces, additional car parking, pathways, and lighting.

Coomera Connector Stage 1 South

Stage 1 South delivers a new four lane motorway from Smith Street Motorway to Nerang-Broadbeach Road, including a new grade separated interchange at Southport-Nerang Road, a new intersection at Nerang-Broadbeach Road, and an approx. 300 m bridge over the Nerang River. Early works are underway and the main construction contract has been awarded, with construction commenced mid 2025.

Merrimac Railway Station

New railway station on the Gold Coast Line, part of the Cross River Rail project. Located between Nerang and Robina stations, serving Merrimac, Worongary, and Carrara suburbs. Constructed by Fulton Hogan, it features accessible design, passenger amenities, and improved connectivity for southern Gold Coast communities.

Employment

Employment conditions in Bundall demonstrate exceptional strength compared to most Australian markets

Bundall has an educated workforce with significant representation in professional services. In September 2025, its unemployment rate was 2.4%, with estimated employment growth of 1.9% over the previous year.

AreaSearch aggregated statistical area data shows that 2,843 residents were employed, with a participation rate of 64.3%. The dominant sectors are health care & social assistance, construction, and accommodation & food. Professional & technical services show strong specialization at twice the regional level, while agriculture, forestry & fishing has lower representation at 0.4% compared to the regional average of 4.5%. There were 1.5 workers per resident as of the Census, indicating Bundall functions as an employment hub attracting workers from surrounding areas.

In the year to September 2025, employment levels increased by 1.9%, and labour force grew by 2.0%, causing unemployment to rise slightly to 1.6%. By comparison, Rest of Qld recorded employment growth of 1.7% with unemployment rising by 0.3 percentage points. State-level data up to 25-Nov-25 shows Queensland's employment contracted by 0.01%, losing 1,210 jobs, with an unemployment rate of 4.2%. National employment forecasts from Jobs and Skills Australia indicate growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Bundall's employment mix suggests local employment should increase by 6.9% over five years and 13.9% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income levels align closely with national averages, indicating typical economic conditions for Australian communities according to AreaSearch analysis

According to AreaSearch's aggregation of latest postcode level ATO data released on 30 June 2023, Bundall had a median income among taxpayers of $52,364 and an average income of $86,678. These figures are among the highest in Australia, compared to $53,146 median and $66,593 average incomes across Rest of Qld. Based on Wage Price Index growth of 9.91% since financial year 2023, current estimates for Bundall would be approximately $57,553 (median) and $95,268 (average) as of September 2025. From the 2021 Census, incomes in Bundall cluster around the 65th percentile nationally. Income analysis reveals that 29.1% of Bundall's population, consisting of 1,480 individuals, fall within the $1,500 - 2,999 income range, similar to the metropolitan region where 31.7% occupy this bracket. Higher earners represent a substantial presence with 31.4% exceeding $3,000 weekly. High housing costs consume 18.2% of income, but strong earnings place disposable income at the 59th percentile nationally. The area's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Bundall is characterized by a predominantly suburban housing profile, with strong rates of outright home ownership

The dwelling structure in Bundall, as evaluated at the latest Census, comprised 73.7% houses and 26.3% other dwellings including semi-detached, apartments, and 'other' dwellings. The level of home ownership within Bundall was 35.5%, with 38.0% of dwellings mortgaged and 26.6% rented. The median monthly mortgage repayment in the area was $2,600, while the median weekly rent figure was recorded at $480. Nationally, Bundall's mortgage repayments are significantly higher than the Australian average of $1,863, while rents are substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Bundall features high concentrations of group households, with a median household size of 2.6 people

Family households compose 75.0% of all households, including 32.9% couples with children, 29.3% couples without children, and 11.5% single parent families. Non-family households constitute the remaining 25.0%, with lone person households at 20.6% and group households comprising 4.6% of the total. The median household size is 2.6 people.

Frequently Asked Questions - Households

Local Schools & Education

Bundall demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Educational attainment in Bundall is notable, with 32.8% of residents aged 15 and above holding university qualifications, compared to 20.6% in the rest of Queensland and 25.4% in the SA4 region. Bachelor degrees are most prevalent at 23.9%, followed by postgraduate qualifications (6.5%) and graduate diplomas (2.4%). Vocational credentials are also prominent, with 33.2% of residents aged 15 and above holding such qualifications - advanced diplomas account for 12.8% and certificates for 20.4%. Educational participation is high, with 31.2% of residents currently enrolled in formal education.

This includes 10.0% in secondary education, 9.7% in primary education, and 5.4% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates nine active transport stops in Bundall, all of which are bus stops. These stops are served by five unique routes that collectively facilitate 938 weekly passenger trips. Transport accessibility is moderate, with residents on average located 530 meters from the nearest stop.

Service frequency averages 134 trips daily across all routes, equating to approximately 104 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Bundall's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Bundall shows excellent health outcomes, with low prevalence of common conditions across all ages. Private health cover is high at approximately 62%, compared to the national average of 55.7%.

The most prevalent conditions are arthritis (6.9%) and asthma (5.9%). A majority (74.8%) report no medical ailments, contrasting with 0% in Rest of Qld. Bundall has 14.9% residents aged 65+, with strong health outcomes among seniors, similar to the general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Bundall was found to be above average when compared nationally for a number of language and cultural background related metrics

Bundall's population was found to be more culturally diverse than most local markets, with 18.8% speaking a language other than English at home as of the latest data from 20XX-20XY. Additionally, 33.0% were born overseas in that same period. Christianity was the predominant religion in Bundall, accounting for 53.8% of its population.

However, Judaism stood out with an overrepresentation of 0.5%, compared to None% across Rest of Qld during this timeframe. In terms of ancestry, the top three groups were English at 28.7%, Australian at 20.0%, and Irish at 9.3%. Notably, Hungarian was overrepresented at 0.6% in Bundall versus None% regionally, Spanish at 0.8% (versus None%), and French at 0.8% (versus None%).

Frequently Asked Questions - Diversity

Age

Bundall's median age exceeds the national pattern

Bundall has a median age of 40, close to Rest of Qld's figure of 41 but exceeding the national norm of 38. The 45-54 age group is strongly represented at 14.7%, compared to Rest of Qld, while the 65-74 cohort is less prevalent at 8.6%. According to the 2021 Census, the 35 to 44 age group grew from 13.4% to 14.9%, and the 15 to 24 cohort increased from 12.0% to 13.1%. Conversely, the 65 to 74 cohort declined from 10.1% to 8.6%. Demographic modeling suggests Bundall's age profile will significantly evolve by 2041. Leading this shift, the 35 to 44 group is projected to grow by 36%, reaching 1,032 people from 757.