Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Collingwood lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

As of Nov 2025, the estimated population of the Collingwood (Vic.) statistical area (Lv2) is around 11,160, reflecting a growth of 1,981 people (21.6%) since the 2021 Census which reported a population of 9,179. This increase is inferred from AreaSearch's resident population estimate of 11,145, based on examination of ABS' latest ERP data release in June 2024 and validation of an additional 122 new addresses since the Census date. The area's population density ratio is 8,787 persons per square kilometer, placing it within the top 10% nationally according to AreaSearch. This growth exceeds both national (9.7%) and state averages, marking Collingwood as a regional growth leader. Overseas migration contributed approximately 75.0% of overall population gains during recent periods, with other drivers such as interstate migration and natural growth also being positive factors. AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in 2024 using 2022 as the base year.

For areas not covered by this data, AreaSearch utilises VIC State Government's Regional/LGA projections released in 2023 with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. Growth rates by age group are applied across all areas for years 2032 to 2041. Exceptional growth is predicted over the period, with the area expected to grow by 6,881 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of 61.5% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Collingwood recording a relatively average level of approval activity when compared to local markets analysed countrywide

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, Collingwood has experienced around 41 dwellings receiving development approval per year over the past five financial years. This totals an estimated 208 homes between FY-21 and FY-25. So far in FY-26, one approval has been recorded. With an average of 6.3 people moving to the area for each dwelling built over these five years, supply is substantially lagging demand, leading to heightened buyer competition and pricing pressures.

New properties are constructed at an average value of $1,543,000, indicating a focus on the premium segment with upmarket properties. Additionally, $182.3 million in commercial development approvals have been recorded this financial year, demonstrating high levels of local commercial activity. When measured against Greater Melbourne, Collingwood has around two-thirds the rate of new dwelling approvals per person and places among the 9th percentile of areas assessed nationally, resulting in relatively constrained buyer choice and supporting interest in existing dwellings. New building activity shows 4.0% standalone homes and 96.0% townhouses or apartments, focusing on higher-density living which creates more affordable entry points and suits downsizers, investors, and first-home buyers.

This results in around 1966 people per dwelling approval, reflecting a highly mature market. Looking ahead, Collingwood is expected to grow by 6,866 residents through to 2041 based on the latest AreaSearch quarterly estimate. At current development rates, housing supply may struggle to match population growth, potentially heightening buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Collingwood has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified 45 projects expected to impact this region. Notable projects include Cambridge Street Collingwood Development, Derby Street Apartment Development, 21 Northumberland Street Mixed-Use Development, and 240 Wellington Street Public Housing Renewal. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Brenan Place

A 12-level, 12,096sqm A-Grade medical office and life sciences building located within the St Vincent's Hospital precinct. The project integrates the restored heritage-listed Brenan Hall into a modern facility providing administrative, clinical, and research support spaces. It is 100% electric and targets 5-Star Green Star and 5.5-Star NABERS Energy ratings. St Vincent's Health Australia is the anchor tenant, occupying 40% of the building.

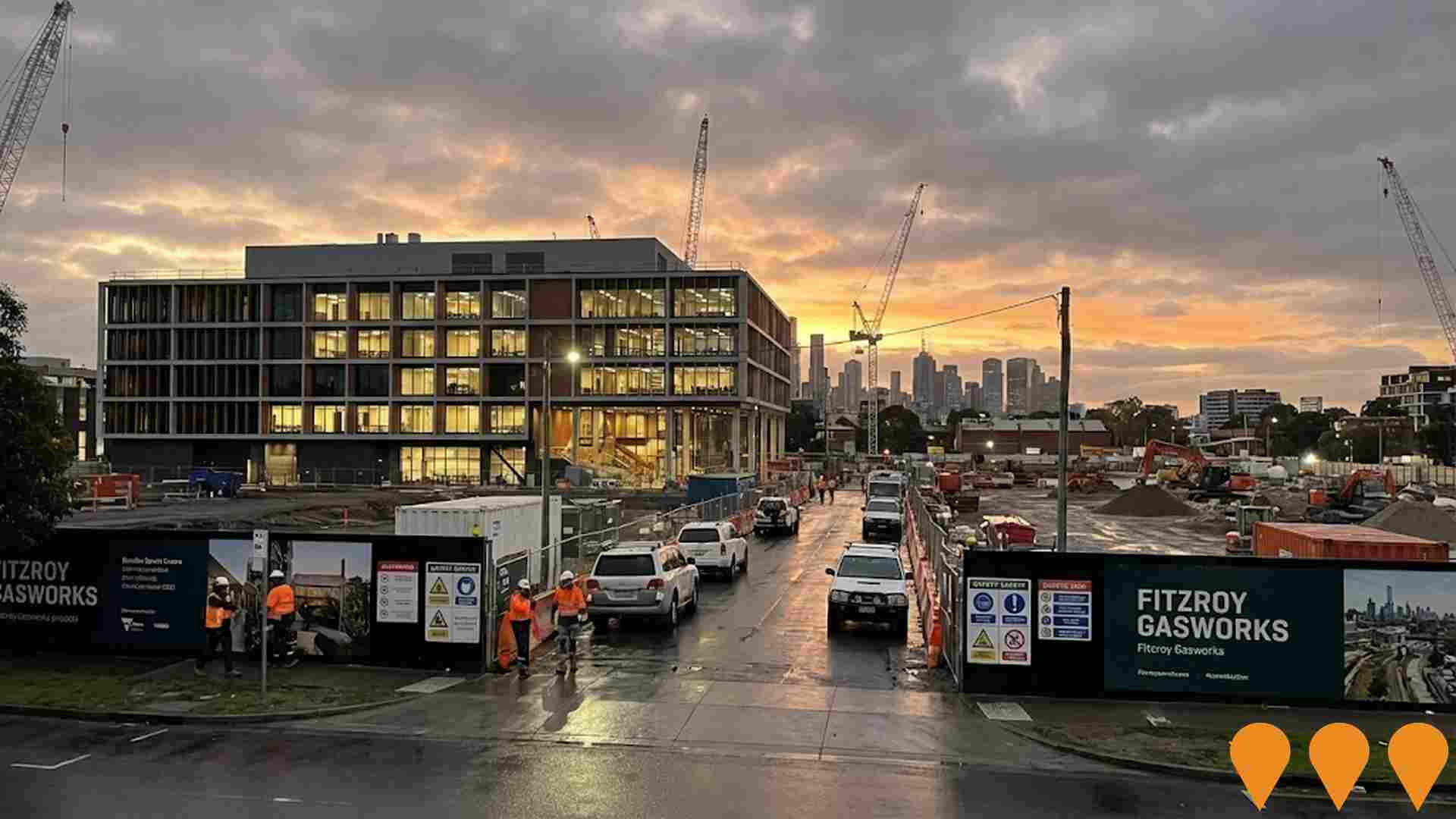

Fitzroy Gasworks

The Fitzroy Gasworks is a 3.9-hectare urban renewal project transforming a former industrial site into a sustainable mixed-use precinct. The masterplan now delivers approximately 1,400 new homes across three parcels, with at least 20% dedicated to affordable housing. Key components include the operational Wurun Senior Campus, the Bundha Sports Centre (opening February 2026), and extensive public open space. Local: Residential was appointed in late 2025 to develop Parcel A (360 build-to-rent homes), while the Inner North Collective JV (Assemble, Milieu, Hickory) is responsible for Parcels B and C (1,052 homes).

Victoria and Vine

A $280 million luxury residential and retail precinct spanning an entire suburban block. Nine distinct buildings featuring 219 apartments, penthouses, retail spaces, and amenities inspired by New York's Greenwich Village and Meatpacking District. The development includes 11 retail tenancies at ground level with 200m of street frontage, community spaces, and premium amenities. Designed by Cox Architecture for developer Gurner.

T3 Collingwood

Melbourne's tallest mass timber office building featuring 15 levels with cross-laminated timber construction. A sustainable commercial development by Hines featuring 18,200m2 of net lettable area, targeting 6 Star Green Star rating and 5.5 Star NABERS energy rating. The building combines a 5-level brick and concrete podium with a lightweight mass timber structure above, designed by Jackson Clements Burrows Architects.

Cambridge Street Collingwood Development

A planned residential development on Cambridge Street in Collingwood featuring modern apartment living with sustainable design and community amenities.

Walk Up Village

A 13-storey mixed-use development inspired by Mediterranean hilltop villages. Features twin interconnected towers with a 118-key hotel, creative co-working spaces, retail, artist studios, galleries, community spaces, cinema, restaurants and a rooftop garden. Designed by London-based 6a architects with Dan Pearson Studio landscaping.

55 Emma Street Collingwood

A nine-storey apartment building in Collingwood featuring 37 one, two and three-bedroom residences. The development draws inspiration from Collingwood's built heritage with a contemporary brick podium and white upper levels, designed by SGKS Architects.

21 Northumberland Street Mixed-Use Development

Amendment to permit residential uses within development at 21 Northumberland Street and 26 Wellington Street. Heritage-listed Victoria Distillery building conversion featuring warehouse-style apartments.

Employment

Employment performance in Collingwood has been below expectations when compared to most other areas nationally

Collingwood's workforce is highly educated with strong representation in professional services. The unemployment rate was 9.0% as of an unspecified past year.

Employment growth over the previous year was estimated at 4.6%. As of September 2025, 7,443 residents were employed while the unemployment rate was 4.4%, above Greater Melbourne's rate of 4.7%. Workforce participation in Collingwood was 74.8% compared to Greater Melbourne's 64.1%. Leading employment industries among residents included professional & technical, health care & social assistance, and education & training.

The area showed strong specialization in professional & technical services with an employment share of 2.1 times the regional level. Conversely, construction had lower representation at 4.0% compared to the regional average of 9.7%. There were 1.5 workers for every resident as per the Census data, indicating that Collingwood functions as an employment hub hosting more jobs than residents and attracting workers from surrounding areas. Over a 12-month period ending in September 2025, employment increased by 4.6% while labour force grew by 5.4%, causing the unemployment rate to rise by 0.7 percentage points. In contrast, Greater Melbourne experienced employment growth of 3.0% and labour force growth of 3.3%, with a 0.3 percentage point rise in unemployment rate during this period. State-level data up to 25-Nov showed that Victoria's employment grew by 1.13% year-on-year, adding 41,950 jobs, with the state unemployment rate at 4.7%. National employment forecasts from Jobs and Skills Australia projected national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Collingwood's employment mix suggested local employment should increase by 7.4% over five years and 14.9% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's aggregation of ATO data for financial year 2023 shows Collingwood had a median taxpayer income of $70,312 and an average of $89,360. Nationally, these figures are high compared to Greater Melbourne's median of $57,688 and average of $75,164. By September 2025, adjusted for Wage Price Index growth of 8.25%, estimated incomes would be approximately $76,113 (median) and $96,732 (average). According to the 2021 Census, Collingwood's individual earnings at the 95th percentile nationally are $1,338 weekly. Income analysis reveals that 32.2% of residents (3,593 people) fall into the $1,500 - 2,999 bracket, consistent with regional trends showing 32.8%. Economic strength is evident with 33.1% of households earning over $3,000 weekly, supporting high consumer spending. High housing costs consume 18.6% of income, but strong earnings place disposable income at the 69th percentile. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Collingwood features a more urban dwelling mix with significant apartment living, with a higher proportion of rental properties than the broader region

In Collingwood, as per the latest Census, 5.8% of dwellings were houses while 94.2% consisted of other types such as semi-detached homes, apartments, and 'other' dwellings. This contrasts with Melbourne metro's figures which showed 12.8% houses and 87.2% other dwellings. Home ownership in Collingwood stood at 11.0%, with mortgaged properties at 23.2% and rented ones at 65.8%. The median monthly mortgage repayment in the area was $2,167, lower than Melbourne metro's average of $2,326. The median weekly rent figure for Collingwood was $425, compared to Melbourne metro's $451. Nationally, Collingwood's mortgage repayments were higher at $2,167 versus the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Collingwood features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households account for 46.6% of all households, including 8.9% couples with children, 29.3% couples without children, and 7.0% single parent families. Non-family households constitute the remaining 53.4%, with lone person households at 42.6% and group households comprising 10.8%. The median household size is 1.9 people, which is smaller than the Greater Melbourne average of 2.0.

Frequently Asked Questions - Households

Local Schools & Education

Collingwood shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

Collingwood's residents aged 15 and above have a notably higher level of educational attainment compared to broader national and state averages. Specifically, 60.2% of Collingwood residents possess university qualifications, surpassing Australia's 30.4% and Victoria's 33.4%. This significant educational advantage indicates strong potential for knowledge-based opportunities in the area. The distribution of university qualifications among Collingwood residents aged 15 and above is as follows: bachelor degrees lead at 38.0%, postgraduate qualifications account for 17.8%, and graduate diplomas make up 4.4%.

Vocational pathways are also pursued by a notable proportion of Collingwood's population, with 18.5% of residents aged 15 and above holding such qualifications. This includes advanced diplomas (8.7%) and certificates (9.8%). Educational participation is high in Collingwood, with 26.3% of residents currently enrolled in formal education. This comprises 12.1% in tertiary education, 4.7% in primary education, and 3.1% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Collingwood has 20 active public transport stops operating within its boundaries. These stops offer a mix of light rail and bus services, with a total of 30 individual routes in operation. The combined weekly passenger trips facilitated by these routes amount to 9,893.

Residents enjoy excellent transport accessibility, with an average distance of 177 meters to the nearest stop. Service frequency across all routes averages 1,413 trips per day, equating to approximately 494 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Collingwood's residents are extremely healthy with both young and old age cohorts seeing low prevalence of common health conditions

Analysis of health metrics shows strong performance throughout Collingwood. Both young and old age cohorts have low prevalence of common health conditions. The rate of private health cover is exceptionally high at approximately 62% of the total population (6,923 people), compared to 71.3% across Greater Melbourne and a national average of 55.7%.

The most common medical conditions in the area are mental health issues and asthma, impacting 12.6 and 9.4% of residents respectively. Seventy-one point four percent of residents declare themselves completely clear of medical ailments, compared to 70.6% across Greater Melbourne. Seven point seven percent of residents are aged 65 and over (859 people), lower than the 12.1% in Greater Melbourne. Health outcomes among seniors are particularly strong, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Collingwood was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Collingwood's cultural diversity is notable, with 26.6% of its residents speaking a language other than English at home and 37.4% born overseas. The dominant religion in Collingwood is Christianity, comprising 21.8% of the population. Judaism is overrepresented compared to Greater Melbourne, making up 0.8% versus 0.8%.

The top three ancestry groups are English (22.4%), Australian (15.7%), and Other (14.7%). Some ethnic groups have notable differences in representation: Vietnamese at 3.2% (regional average 2.4%), French at 0.8%, and Polish at 1.0%.

Frequently Asked Questions - Diversity

Age

Collingwood's young demographic places it in the bottom 15% of areas nationwide

Collingwood's median age is 33, which is younger than Greater Melbourne's figure of 37 and Australia's national average of 38 years. Compared to Greater Melbourne, Collingwood has a higher percentage of residents aged 25-34 (34.8%) but fewer residents aged 5-14 (5.3%). This concentration of 25-34 year-olds is significantly higher than the national average of 14.5%. Between the 2021 Census and now, the 35 to 44 age group has increased from 19.1% to 20.3% of Collingwood's population. Conversely, the 25 to 34 age cohort has decreased from 36.4% to 34.8%. Population forecasts for 2041 suggest substantial demographic changes in Collingwood, with the 25 to 34 age group projected to grow by 38%, adding 1,461 residents to reach a total of 5,345.