Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Toronto - Awaba reveals an overall ranking slightly below national averages considering recent, and medium term trends

Toronto Awaba's population is 14,266 as of November 2025. This figure shows a 305 person increase since the 2021 Census, which reported a population of 13,961. The change was inferred from an estimated resident population of 14,125 in June 2024 and additional validated new addresses since the Census date. This results in a density ratio of 326 persons per square kilometer. Toronto Awaba's growth rate of 2.2% since census is within 2.9 percentage points of non-metro areas (5.1%), indicating competitive growth fundamentals. Interstate migration contributed approximately 60.2% of overall population gains recently.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For uncovered areas, NSW State Government's SA2 level projections are used, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future demographic trends suggest a population increase just below the regional median nationally, with Toronto Awaba expected to increase by 1,868 persons to 2041 based on latest annual ERP population numbers, reflecting an 11.8% total increase over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Toronto - Awaba according to AreaSearch's national comparison of local real estate markets

Toronto Awaba has averaged approximately 46 new dwelling approvals annually. Over the past five financial years, from FY21 to FY25, a total of 231 homes were approved, with an additional 9 approved in FY26 as of now. The average number of people moving to the area for each dwelling built over these years is 0.9 per year.

This indicates that new supply is meeting or exceeding demand, providing ample buyer choice and creating capacity for population growth beyond current forecasts. The average construction value of new properties is $326,000. In this financial year, $5.3 million in commercial approvals have been registered, reflecting the area's primarily residential nature. Compared to the rest of NSW, Toronto Awaba records significantly lower building activity, at 63.0% below the regional average per person. This constrained new construction typically reinforces demand and pricing for existing homes. Nationally, the level is also lower, suggesting market maturity and possible development constraints.

The current new building activity comprises 65.0% standalone homes and 35.0% attached dwellings, indicating an expanding range of medium-density options that cater to various price brackets. The estimated population density in Toronto Awaba is 741 people per dwelling approval, reflecting its quiet, low-activity development environment. By 2041, the area is projected to grow by 1,677 residents, according to the latest AreaSearch quarterly estimate. Construction activity is maintaining a reasonable pace with this projected growth, but buyers may face increasing competition as the population expands.

Frequently Asked Questions - Development

Infrastructure

Toronto - Awaba has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

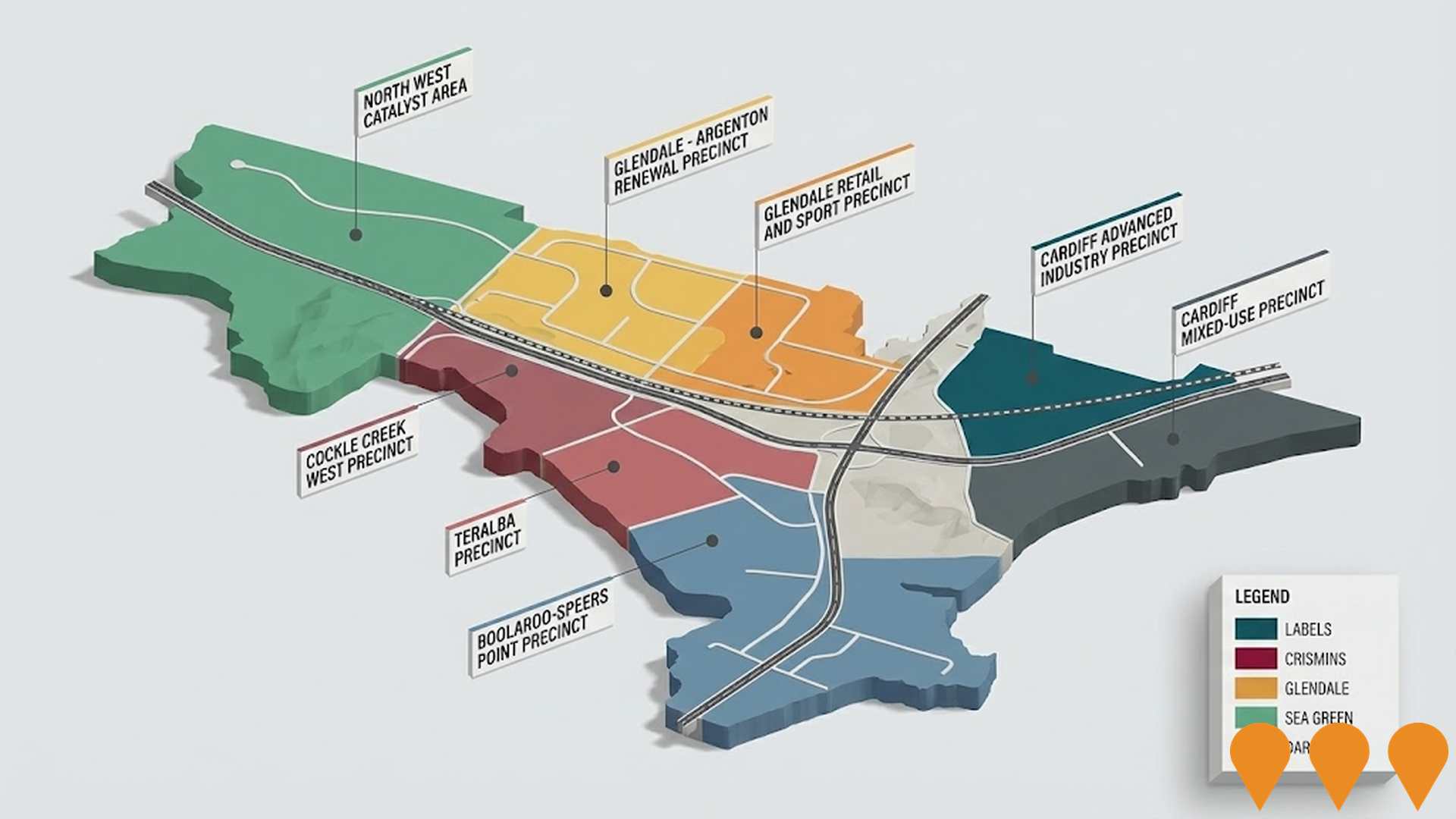

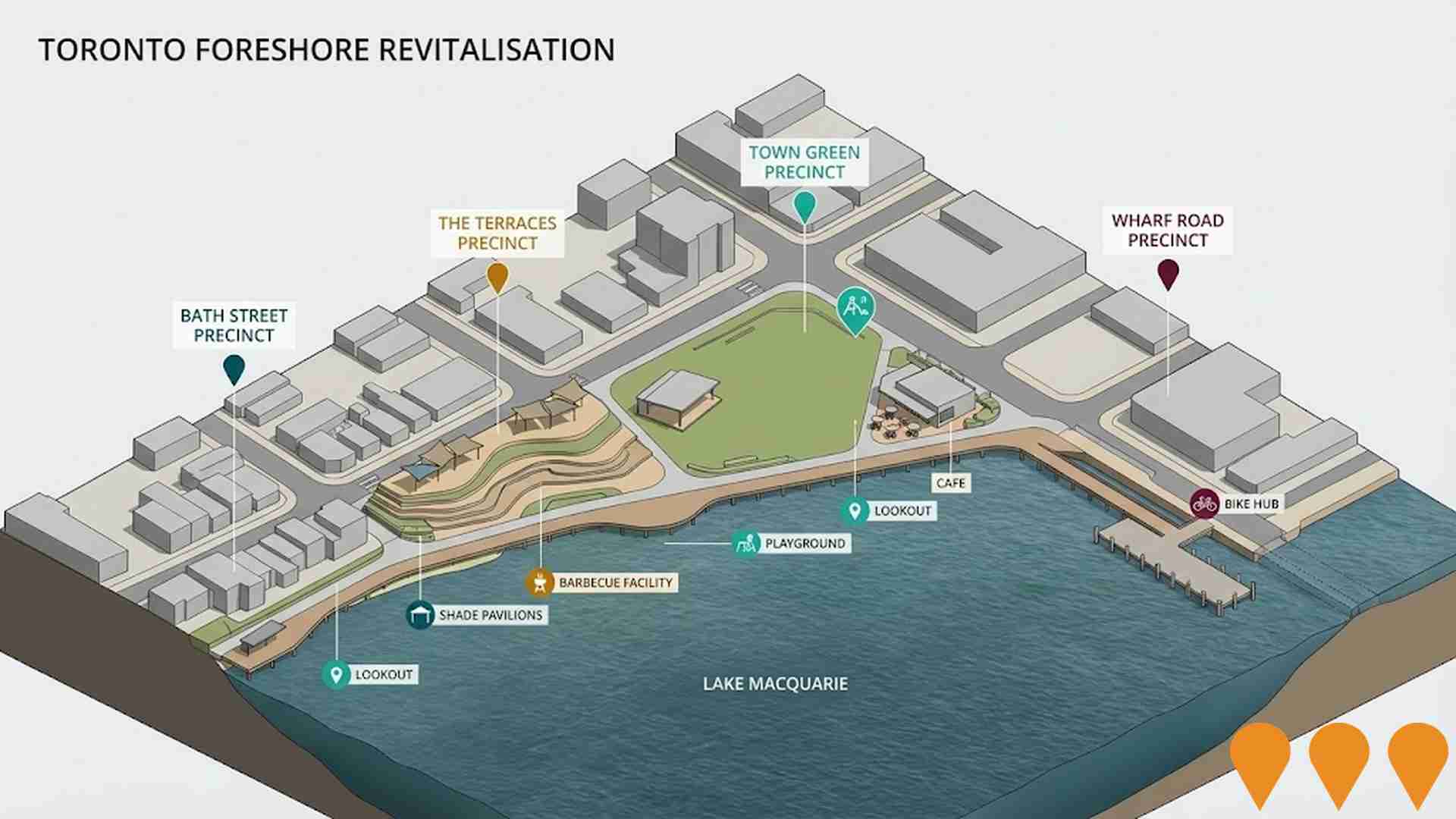

AreaSearch has identified 13 projects that may impact the area, with key initiatives including Toronto Foreshore Revitalisation, 114-120 Cary Street Mixed Use Development, 136-138 Brighton Avenue Apartment Development, and Rathmines Park Transformation. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Costco Lake Macquarie Warehouse

The Costco Lake Macquarie Warehouse is a 14,000 sqm retail facility and fuel station located on the former Pasminco smelter site in Boolaroo, NSW. It opened on September 21, 2021, providing bulk retail services, contributing to local employment with over 225 jobs, and supporting the area's redevelopment.

Eraring Battery Energy Storage System

Large-scale battery energy storage system (BESS) at Origin Energy's Eraring Power Station, being built in multiple stages to support NSW grid reliability. Stage 1 (460 MW / 1073 MWh) targeting commercial operation by end of 2025. Stage 2 (240 MW / 1030 MWh) under construction, with delivery expected by early 2027. Stage 3 approved to extend storage duration of the overall system to approximately four hours across 700 MW and about 2800 MWh. Key delivery partners include Wartsila (battery systems), Enerven (balance of plant) and Lumea (HV substation).

Mount Hutton Precinct Area Plan

A planning framework adopted by Lake Macquarie City Council to guide the future infrastructure, built environment, and conservation of the Mount Hutton area. It supports medium density housing, improved connectivity, and ecological rehabilitation, and is part of the Lake Macquarie Development Control Plan 2014.

Rathmines Park Transformation

Comprehensive redevelopment of Rathmines Park into a regional recreation destination. Features a $2+ million transformation including Lake Macquarie's biggest skate park, new pump track, youth activity areas, upgraded playground equipment, new playground, learn-to-ride area, youth hub, sports facilities, walking trails, and waterfront amenities. Enhanced connection to Lake Macquarie foreshore with improved accessibility and parking.

Toronto Foreshore Revitalisation

A $10 million transformation of the Toronto foreshore featuring continuous waterfront pathway, expanded playground, new town green, improved connections, expanded caf' area, boardwalk connections, extended shared pathway, bike hub, new lookout locations, shade pavilion and barbecue facilities. The project is being delivered across four precincts with Town Green Precinct completed in 2022.

Lake Macquarie High School HPGE Upgrades

Facility upgrades at Lake Macquarie High School under the NSW High Potential and Gifted Education (HPGE) Partner School program. Scope includes a school entrance refresh; upgrades to food technology into a VET hospitality classroom; upgrades to two woodwork rooms and one design technology room; upgrades to an art room and a music recording space; new shade structure over the sports court with sports upgrades; and provision of a marine studies laboratory and workshop. Stage 1 works were contracted and commenced in mid-2025, with Stage 2 planned for the 2025-26 summer period continuing into 2026.

114-120 Cary Street Mixed Use Development

Five-storey twin towers mixed-use development featuring 108 residential units, commercial premises, and basement parking.

Speers Point Transport Improvements

A $16 million upgrade to the Speers Point transport network aimed at reducing travel times, improving safety, cutting congestion, and enhancing pedestrian and cycling connections. The key focus is improving the roundabout at Five Islands Road, T C Frith Avenue, and The Esplanade, and includes roundabout metering with traffic lights, dedicated turning lanes, and potential upgrades to nearby intersections. The concept design was open for community feedback until July 28, 2025, and preliminary investigations are underway.

Employment

The labour market performance in Toronto - Awaba lags significantly behind most other regions nationally

Toronto's Awaba region has a skilled workforce with notable representation in essential services sectors. The unemployment rate was 5.4% as of September 2025, with an estimated employment growth of 2.2% over the past year.

As of that date, 6,282 residents were employed while the unemployment rate stood at 1.5% higher than Rest of NSW's rate of 3.8%. Workforce participation in Awaba was lower at 50.9%, compared to Rest of NSW's 56.4%. Key industries for employment among Awaba residents are health care & social assistance, construction, and retail trade.

Conversely, agriculture, forestry & fishing showed lower representation at 0.5% versus the regional average of 5.3%. Employment opportunities locally appear limited, as indicated by the count of Census working population vs resident population. Over the 12 months to September 2025, employment increased by 2.2%, while labour force increased by 3.3%, causing the unemployment rate to rise by 1.0 percentage points. In contrast, Rest of NSW experienced an employment decline of 0.5% and a labour force decline of 0.1%, with a 0.4 percentage point rise in unemployment. State-level data to 25-Nov shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. This compares favourably to the national unemployment rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that national employment is forecast to expand by 6.6% over five years and 13.7% over ten years, with growth rates differing significantly between industry sectors. Applying these projections to Awaba's employment mix suggests local employment should increase by 6.6% over five years and 13.9% over ten years.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

AreaSearch's latest postcode level ATO data for financial year 2022 shows that Toronto - Awaba SA2 had a median income among taxpayers of $48,449 and an average of $68,865. This was above the national average. The Rest of NSW had a median income of $49,459 and an average of $62,998 during the same period. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates suggest approximately $54,558 (median) and $77,549 (average) as of September 2025. According to Census 2021 income data, household, family, and personal incomes in Toronto - Awaba rank modestly, between the 23rd and 28th percentiles. Income distribution shows that 28.8% of locals (4,108 people) fall into the $1,500 - $2,999 category, which is similar to the surrounding region where this cohort represents 29.9%. Housing affordability pressures are severe in the area, with only 84.6% of income remaining, ranking at the 29th percentile. The area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Toronto - Awaba is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Toronto - Awaba, as per the latest Census, consisted of 84.2% houses and 15.8% other dwellings such as semi-detached homes, apartments, and 'other' dwellings. In contrast, Non-Metro NSW had 89.7% houses and 10.2% other dwellings. Home ownership in Toronto - Awaba stood at 42.2%, with the rest of dwellings either mortgaged (31.9%) or rented (25.8%). The median monthly mortgage repayment in the area was $1,733, lower than Non-Metro NSW's average of $1,900. The median weekly rent figure was recorded at $340, compared to Non-Metro NSW's $380. Nationally, Toronto - Awaba's mortgage repayments were below the Australian average of $1,863, and rents were less than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Toronto - Awaba has a typical household mix, with a lower-than-average median household size

Family households account for 69.7% of all households, including 24.0% couples with children, 31.5% couples without children, and 13.3% single parent families. Non-family households constitute the remaining 30.3%, with lone person households at 28.4% and group households comprising 1.9%. The median household size is 2.4 people, which is smaller than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Toronto - Awaba fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 20.3%, significantly lower than the NSW average of 32.2%. Bachelor degrees are most common at 14.0%, followed by postgraduate qualifications (4.2%) and graduate diplomas (2.1%). Vocational credentials are prevalent, with 41.4% of residents aged 15+ holding them. Advanced diplomas account for 11.4%, while certificates make up 30.0%.

A total of 24.9% of the population is actively engaged in formal education. This includes 8.8% in primary, 6.7% in secondary, and 3.3% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 114 active public transport stops operating within Toronto-Awaba, consisting of a mix of train and bus services. These stops are served by 95 individual routes, collectively offering 3,126 weekly passenger trips. Transport accessibility is rated as good, with residents typically located 209 meters from the nearest stop.

Service frequency averages 446 trips per day across all routes, equating to approximately 27 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Toronto - Awaba is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Health challenges significantly impact Toronto-Awaba across various age groups. Approximately 54% (~7,660 individuals) have private health cover, compared to 51.5% in the Rest of NSW.

The most prevalent conditions are arthritis (11.3%) and mental health issues (10.5%). About 57.9% report no medical ailments, slightly lower than the 60.3% in the Rest of NSW. Seniors aged 65 and over comprise 27.2% (3,878 individuals) of the population, higher than the 21.9% in the Rest of NSW. Health outcomes among seniors generally align with those of the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Toronto - Awaba is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Toronto was found to have lower cultural diversity compared to the average, with 88.3% of its population born in Australia, 92.7% being citizens, and 96.0% speaking English only at home. Christianity is the predominant religion in Toronto Awaba, comprising 52.9% of the population, slightly lower than the 54.0% across Rest of NSW. The top three ancestry groups are English (33.0%), Australian (30.1%), and Scottish (8.8%).

Notably, Welsh (0.9%) is overrepresented compared to the regional average (0.7%), while Australian Aboriginal (4.6%) and Samoan (0.2%) have similar representation to their respective regional averages of 4.5% and 0.3%.

Frequently Asked Questions - Diversity

Age

Toronto - Awaba hosts an older demographic, ranking in the top quartile nationwide

Toronto's median age is 47 years, which is significantly higher than the Rest of NSW average of 43 and exceeds the national average of 38. The age profile shows that those aged 65-74 make up a prominent 14.6%, while those aged 5-14 constitute only 11.1%. This concentration of individuals aged 65-74 is notably higher than the national figure of 9.4%. Between 2021 and present, the population aged 35 to 44 has grown from 9.5% to 11.4%, while those aged 45 to 54 have declined from 12.3% to 11.0%. By 2041, Toronto is expected to experience significant demographic shifts. Notably, the population aged 35 to 44 is projected to grow by 29% (469 people), reaching a total of 2,094 from its current figure of 1,624. Meanwhile, the populations aged 65 to 74 and 55 to 64 are expected to decrease.