Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Oberon reveals an overall ranking slightly below national averages considering recent, and medium term trends

Oberon's population was approximately 5,014 as of November 2025. This figure represents an increase of 180 people since the 2021 Census, which reported a population of 4,834. The change is inferred from the estimated resident population of 4,925 in June 2024 and an additional 61 validated new addresses since the Census date. This results in a population density ratio of 1.7 persons per square kilometer. Oberon's growth rate of 3.7% since the 2021 census exceeded the SA4 region's growth rate of 2.9%. Population growth was primarily driven by overseas migration.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections were used, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. By 2041, the area is projected to expand by 248 persons based on the latest annual ERP population numbers, reflecting an increase of 1.6% in total over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Oberon according to AreaSearch's national comparison of local real estate markets

Oberon has seen approximately 20 new homes approved annually. Over the past five financial years, from FY-21 to FY-25, around 102 homes were approved, with an additional 13 approved so far in FY-26. On average, about 0.4 people have moved to the area per dwelling built over these years, indicating that new supply has kept pace with or exceeded demand.

This offers ample buyer choice and creates capacity for population growth beyond current forecasts. The average expected construction cost value of new dwellings is $498,000, suggesting developers are focusing on the premium market with high-end developments. In terms of commercial approvals, Oberon has registered around $4.7 million this financial year, reflecting its primarily residential nature.

Compared to the rest of NSW, Oberon maintains similar development levels per person, indicating a balanced market consistent with the broader area. New development consists predominantly of detached dwellings (89.0%) and attached dwellings (11.0%), preserving the area's traditional low-density character and appealing to those seeking space in family homes. With approximately 258 people per dwelling approval, Oberon indicates a low-density market. According to the latest AreaSearch quarterly estimate, Oberon is expected to grow by around 78 residents through to 2041. At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Oberon has moderate levels of nearby infrastructure activity, ranking in the 48thth percentile nationally

Area infrastructure performance is significantly influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified 11 such projects that could impact the area. Notable ones include Bracken Estate, Oberon, Yetholme Village Plan, Mount Lambie Wind Farm, and McKanes Bridge Upgrade. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

Wallerawang 9 Battery Energy Storage System

A 500MW/1,000MWh Battery Energy Storage System to be developed in two stages (Stage 1: 300MW/2hrs, Stage 2: 300MW/4hrs) on the site of the former Wallerawang Power Station. The BESS will connect to the adjacent 330kV TransGrid Wallerawang Substation to provide grid stability, firming capacity for renewable energy, and frequency control ancillary services. Shell Energy acquired development rights from Greenspot in January 2023 and is progressing grid connection approvals and modifications to the existing development approval. Construction is scheduled to begin from 2025 onwards, subject to Final Investment Decision. The project will create up to 100 construction jobs during peak construction period and up to 5 operational jobs.

Lake Lyell Pumped Hydro Energy Storage Project

A pumped hydro energy storage project near Lithgow, NSW, using Lake Lyell as the lower reservoir and a new upper reservoir behind the southern ridge of Mount Walker. Originally proposed at 335 MW, value engineering increased capacity to approximately 385 MW with up to 8 hours of storage (÷3,080 MWh). The underground powerhouse is located 170m below ground with two reversible pump-turbine units. The project, a joint venture between EnergyAustralia (25%) and EDF Power Solutions Australia (75%), has been declared Critical State Significant Infrastructure (CSSI) by the NSW Government. It remains in the Prepare EIS phase, with EIS submission targeted for 2025, approvals 2026, construction 2027-2031, and operations from 2031. The project supports NSW's renewable energy transition by storing excess renewable generation and dispatching during peak demand.

Mount Lambie Wind Farm

A 200 MW wind generation project with 100 MW battery energy storage system (BESS) capable of powering approximately 115,000 homes annually. The project will connect to the existing transmission network to supply clean energy to the National Electricity Market, contributing to NSW Government's target to halve emissions by 2030 and achieve net zero by 2050. Located near the retiring Mt Piper and former Wallerawang coal-fired power stations, the project features up to 20 wind turbines spread over a 12-kilometer radius and will generate significant investment and economic benefits for the Lithgow region. Expected to create up to 150 jobs during construction and operate for 25-35 years.

Limerick Wind Farm

Proposed wind farm with 80-100 turbines being developed by Stromlo Energy in partnership with TagEnergy. Project includes overhead connection line to 500kV transmission infrastructure.

Great Western Highway Upgrade - Katoomba to Lithgow

Targeted upgrades on the Great Western Highway between Katoomba and Lithgow to improve safety, traffic flow and resilience. Active works in 2023-2025 include the Medlow Bath Upgrade (1.2 km widening to four lanes and a new pedestrian bridge with lifts) and the Coxs River Road Upgrade at Little Hartley (2.4 km four-lane realignment and new grade-separated interchange). The Medlow Bath pedestrian bridge opened in April 2025; the road works and Coxs River Road Upgrade are expected to complete in late 2025. Broader duplication proposals, including the Blackheath to Little Hartley tunnel, remain paused pending funding.

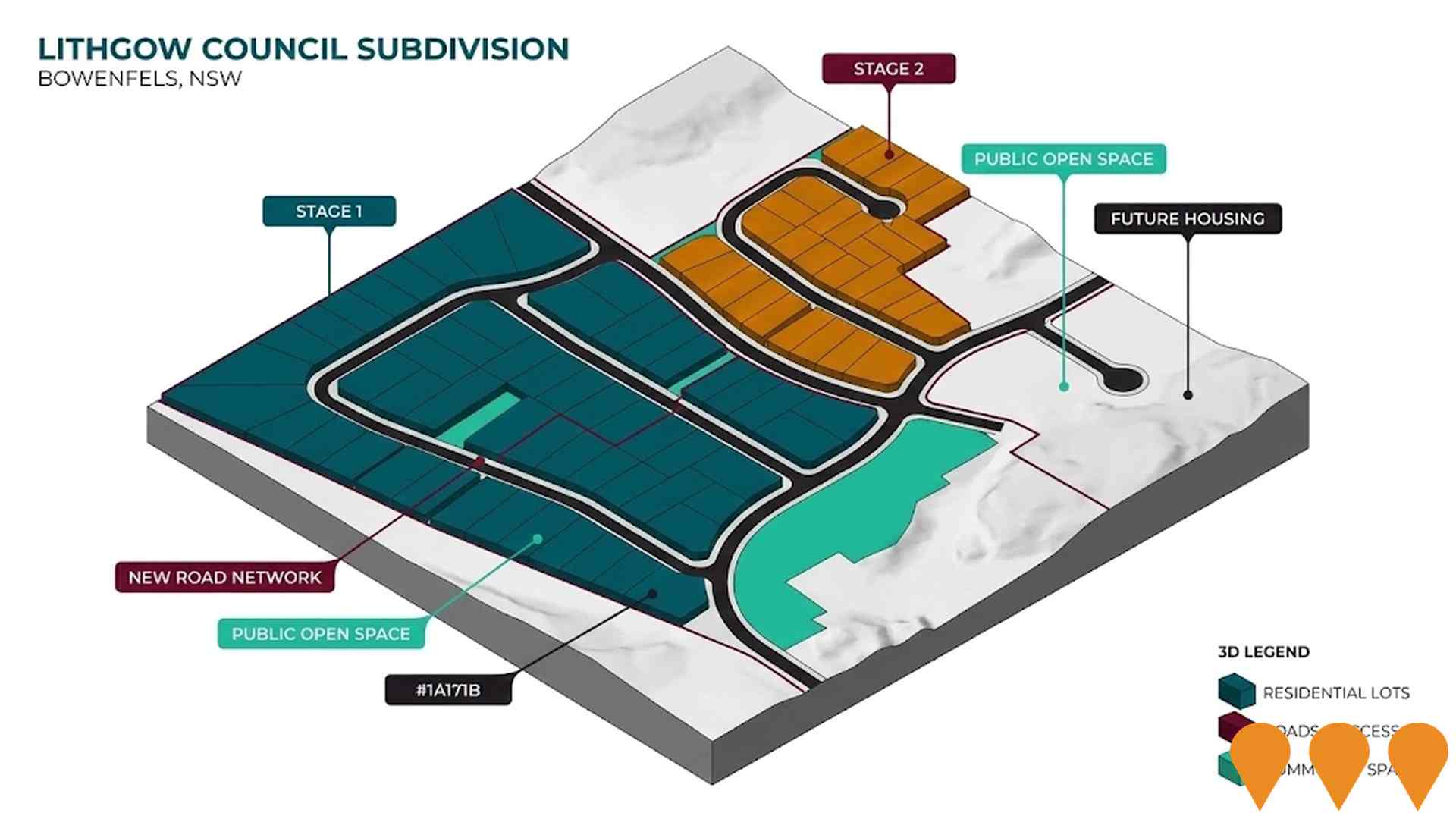

Lithgow Council Subdivision 47 Allotments

Council-owned land subdivision into 47 residential allotments developed in 2 construction stages. The project includes new roads, supporting infrastructure, and bulk earthworks to create housing opportunities in the growing Bowenfels area. This development addresses the increasing housing demand in the Lithgow region, particularly in anticipation of population growth from the Western Sydney Airport development.

Bracken Estate, Oberon

Final stage of a rural residential subdivision offering large lots approximately 2 ha each near Oberon township, with sealed road access, full fencing, and three-phase power. Lots are currently available for sale, priced from $470,000 to $495,000.

Employment

AreaSearch analysis places Oberon well above average for employment performance across multiple indicators

Oberon has a skilled workforce with manufacturing and industrial sectors prominently represented. Its unemployment rate is 1.6%.

As of September 2025, 2,580 residents are employed, while the unemployment rate is 2.3% lower than Rest of NSW's 3.8%. Workforce participation in Oberon is somewhat below standard at 53.4%, compared to Rest of NSW's 56.4%. Leading employment industries include manufacturing, agriculture, forestry & fishing, and health care & social assistance. Manufacturing stands out with employment levels at 3.4 times the regional average.

However, health care & social assistance has a limited presence, with 10.2% employment compared to the regional average of 16.9%. Many residents commute elsewhere for work based on Census data. Between September 2024 and September 2025, Oberon's labour force decreased by 3.7%, employment declined by 4.1%, leading to a rise in unemployment rate by 0.4 percentage points. In comparison, Rest of NSW saw employment fall by 0.5% and unemployment rise by 0.4 percentage points. Statewide, NSW employment contracted by 0.03% between November 2024 and November 2025, with an unemployment rate of 3.9%. Nationally, the unemployment rate was 4.3% during this period. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Oberon's employment mix suggests local employment could grow by 4.7% in five years and 11.1% in ten years, though these are simple extrapolations for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

AreaSearch's latest postcode level ATO data for financial year 2022 shows that Oberon SA2 has lower income compared to national averages. The median income is $50,854 and the average is $60,246. In contrast, Rest of NSW has a median income of $49,459 and an average income of $62,998. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates suggest the median income is approximately $57,267 and the average is $67,843 as of September 2025. Census data indicates that household, family, and personal incomes in Oberon rank modestly, between the 26th and 35th percentiles. Income distribution shows that the largest segment comprises 31.4% earning $1,500 - $2,999 weekly (1,574 residents), which is similar to the regional pattern where 29.9% fall within this range. Housing costs are manageable with 87.2% retained, but disposable income is below average at the 31st percentile.

Frequently Asked Questions - Income

Housing

Oberon is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Dwelling structure in Oberon, as evaluated at the latest Census, comprised 93.5% houses and 6.6% other dwellings. In comparison, Non-Metro NSW had 86.1% houses and 13.9% other dwellings. Home ownership in Oberon was 44.9%, with the rest either mortgaged (31.6%) or rented (23.4%). The median monthly mortgage repayment was $1,517, below Non-Metro NSW's average of $1,733 and the national average of $1,863. The median weekly rent in Oberon was $280, compared to Non-Metro NSW's $315 and the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Oberon features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 67.0% of all households, consisting of 21.9% couples with children, 33.1% couples without children, and 11.4% single parent families. Non-family households account for the remaining 33.0%, with lone person households at 30.7% and group households comprising 2.5% of the total. The median household size is 2.3 people, which is smaller than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Oberon faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 16.6%, significantly lower than the NSW average of 32.2%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 12.0%, followed by postgraduate qualifications (3.2%) and graduate diplomas (1.4%). Trade and technical skills are prominent, with 42.9% of residents aged 15+ holding vocational credentials – advanced diplomas (9.3%) and certificates (33.6%).

Educational participation is high, with 30.4% of residents currently enrolled in formal education. This includes 12.6% in primary education, 8.6% in secondary education, and 2.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Oberon has 170 active public transport stops, all of which are bus stops. These stops are served by 21 different routes that together offer 235 weekly passenger trips. The city's public transport accessibility is rated as good, with residents typically living 307 meters away from the nearest stop.

On average, there are 33 trips per day across all routes, which equates to approximately one weekly trip per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Oberon is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Oberon faces significant health challenges, with common conditions prevalent across both younger and older age groups. Private health cover is relatively low at approximately 50%, covering around 2,481 people, compared to the national average of 55.3%.

The most frequent medical conditions are arthritis (affecting 10.6% of residents) and asthma (8.5%). A total of 62.8% of residents report no medical ailments, slightly lower than Rest of NSW's 63.5%. Oberon has a higher proportion of seniors aged 65 and over at 26.9%, with around 1,348 people falling into this age group, compared to the Rest of NSW average of 19.4%. Despite this, health outcomes among seniors in Oberon are notably strong, outperforming the general population in various health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Oberon is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Oberon has a below average cultural diversity, with 82.4% citizens, 87.4% born in Australia, and 94.0% speaking English only at home. Christianity is the main religion, comprising 65.8%, compared to 61.6% across Rest of NSW. The top three ancestries are English (31.5%), Australian (30.4%), and Irish (11.7%).

Notably, Australian Aboriginal (3.5%) and Maltese (0.5%) are overrepresented in Oberon compared to regional averages of 4.6% and 0.4%, respectively. Hungarian ancestry is also slightly higher at 0.3%.

Frequently Asked Questions - Diversity

Age

Oberon hosts an older demographic, ranking in the top quartile nationwide

Oberon's median age was 48 years as of the census data, which is older than Rest of NSW's 43 years and significantly higher than Australia's median age of 38 years. The age profile showed that the 75-84 year-olds made up 9.9% of Oberon's population, while the 25-34 group constituted only 9.8%. Post-2021 Census data indicated a growth in the 75 to 84 age group from 8.4% to 9.9%, while the 65 to 74 cohort declined from 15.7% to 13.9% and the 5 to 14 age group dropped from 12.0% to 10.9%. Demographic modeling suggests that Oberon's age profile will evolve significantly by 2041, with the 85+ age cohort projected to expand by 86 people (56%), from 153 to 240. Conversely, population declines are projected for the 15-24 and 55-64 cohorts.