Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Lithgow has shown very soft population growth performance across periods assessed by AreaSearch

Based on analysis of ABS population updates for the Lithgow statistical area (Lv2), and new addresses validated by AreaSearch since the Census, Lithgow's population is estimated at around 5007 as of November 2025. This reflects an increase of 51 people (1.0%) since the 2021 Census, which reported a population of 4956 people. The change is inferred from the resident population of 4873, estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024, and an additional 37 validated new addresses since the Census date. This level of population equates to a density ratio of 837 persons per square kilometer, which is relatively in line with averages seen across locations assessed by AreaSearch. Lithgow's 1.0% growth since census positions it within 1.6 percentage points of the SA3 area (2.6%), demonstrating competitive growth fundamentals. Population growth for the area was primarily driven by overseas migration, which was essentially the sole driver of population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, AreaSearch is utilising the NSW State Government's SA2 level projections, as released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are also applied to all areas for years 2032 to 2041. Over this period, projections indicate a decline in overall population, with the Lithgow (SA2) population expected to shrink by 106 persons by 2041 according to this methodology. However, growth across specific age cohorts is anticipated, led by the 75 to 84 age group, which is projected to grow by 63 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Lithgow is very low in comparison to the average area assessed nationally by AreaSearch

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, Lithgow averaged approximately 11 new dwelling approvals annually. Over the past five financial years, between FY2021 and FY2025, around 59 homes were approved, with an additional 5 approved so far in FY2026. Despite a falling population during this period, development activity has been relatively adequate, which could be seen as positive for buyers.

The average value of new homes being built is $431,000, moderately above regional levels, indicating a focus on quality construction. In the current financial year, $4.3 million in commercial development approvals have been recorded, reflecting Lithgow's primarily residential nature. Compared to the Rest of NSW, Lithgow shows roughly half the construction activity per person and ranks among the 17th percentile nationally, suggesting limited buyer options but strengthening demand for established properties. This lower-than-average national activity could be attributed to the area's maturity and potential planning constraints. Recent construction comprises 67% standalone homes and 33% attached dwellings, indicating an expanding range of medium-density options, catering to various price brackets from traditional family housing to more affordable compact alternatives.

This shift reflects reduced availability of development sites and evolving lifestyle demands and affordability requirements, marking a significant change from the current housing mix, which is predominantly houses (82%). The estimated population per dwelling approval in Lithgow is 888 people, suggesting a quiet, low activity development environment. With population expected to remain stable or decline, there may be reduced pressure on housing, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

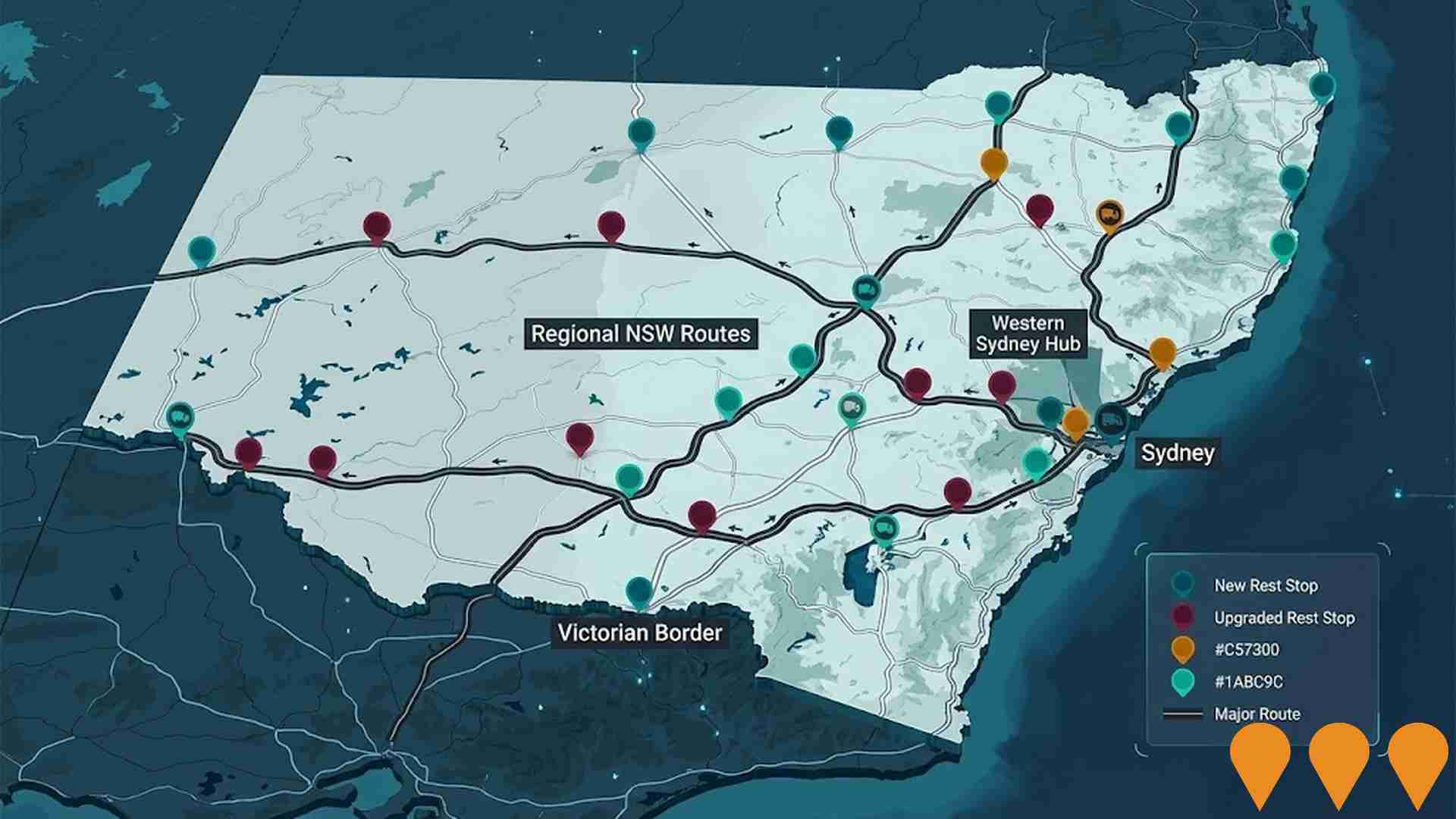

Lithgow has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

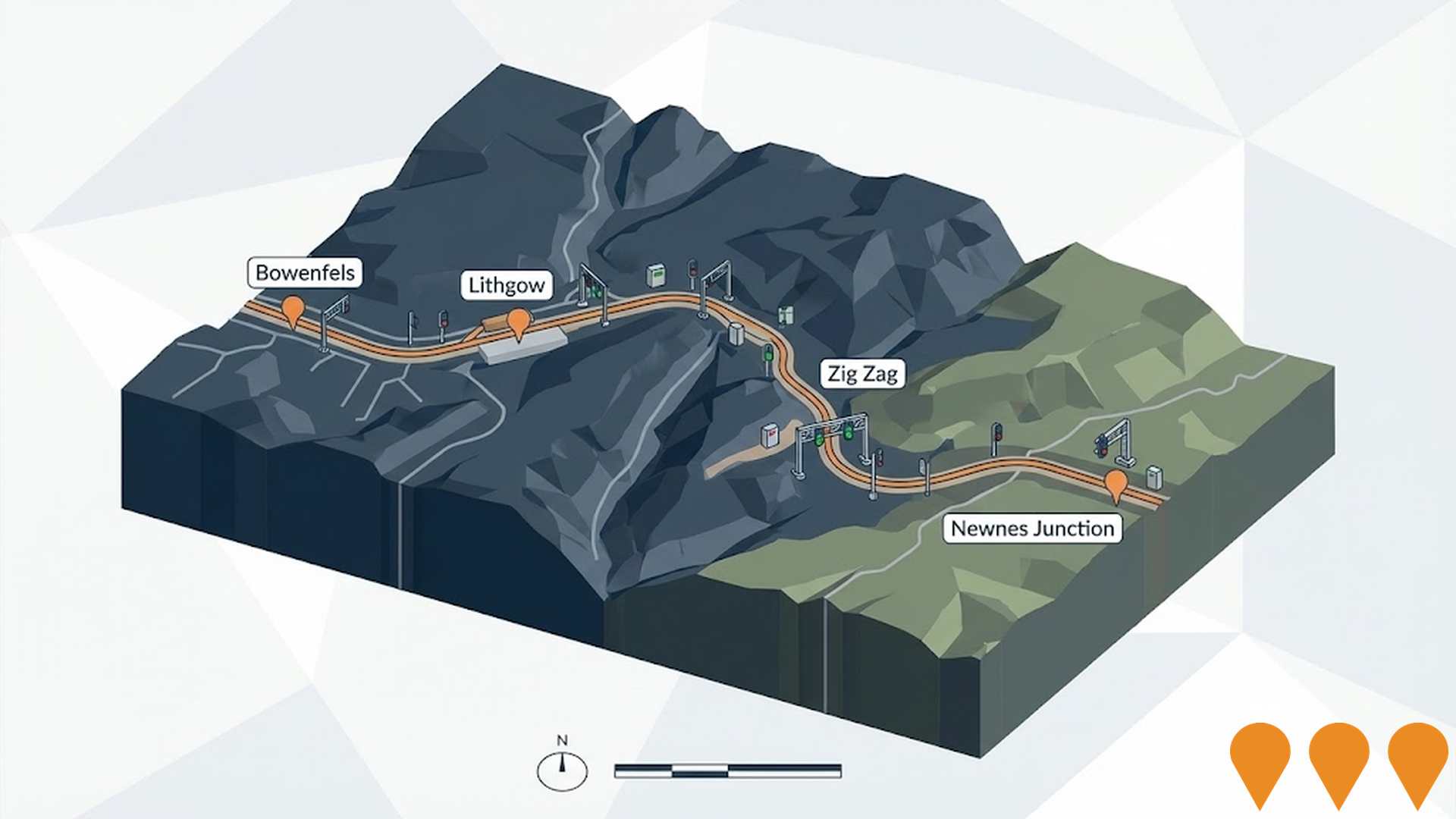

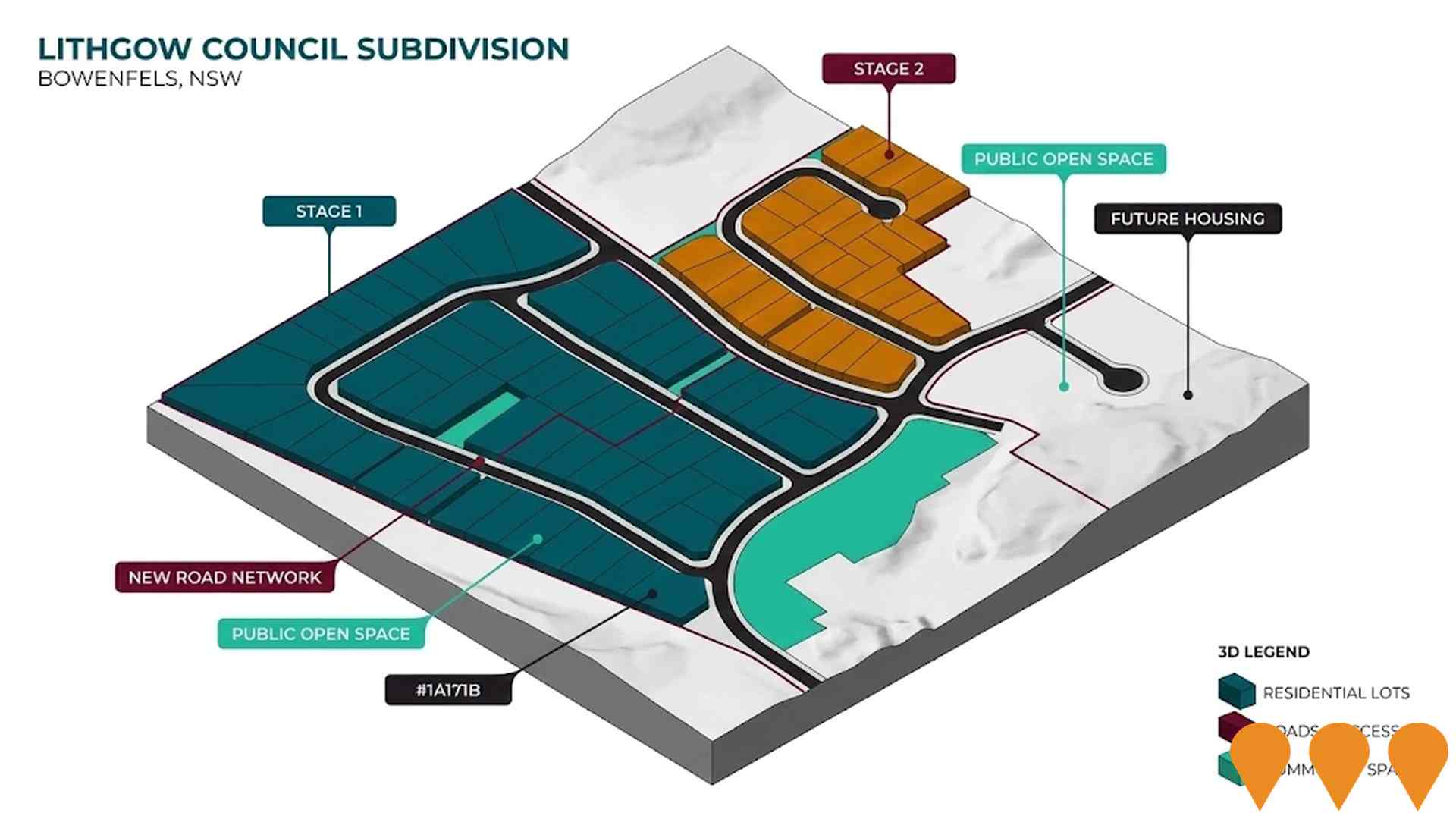

The performance of an area is significantly influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified four projects that are expected to impact the area. Among these key projects are Lithgow Area Resignalling (Stage 2), Lithgow Council Subdivision 47 Allotments, Great Western Highway Upgrade Program (West Section: Little Hartley to Lithgow), and Bowenfels Rail Viaducts. The following list provides details on those considered most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Central-West Orana Renewable Energy Zone (REZ) Transmission Project

Australia's first coordinated Renewable Energy Zone transmission project. It involves the delivery of 90km of 500kV and 150km of 330kV transmission lines, along with energy hubs at Merotherie and Elong Elong. The project will initially unlock 4.5 GW of network capacity, increasing to 6 GW by 2038. ACEREZ (Acciona, Cobra, Endeavour Energy) is the Network Operator responsible for design, construction, and 35 years of maintenance. Major construction is currently ramping up with a 1,200-bed workforce camp at Merotherie and a 600-bed site at Cassilis supporting thousands of local jobs.

Former Wallerawang Power Station Redevelopment

A 620-hectare transformation of the former Wallerawang Power Station into a multi-use precinct. The masterplan includes 1,260 dwellings, employment zones for 3,500 jobs, a gigawatt-scale data centre campus, and the Wallerawang 9 Battery (600MW/1,800MWh). The project retains iconic infrastructure like the Unit 8 Cooling Tower and leverages a 4,300ML water capacity from Lake Wallace. As of early 2026, the project is progressing through the State Significant Rezoning Policy pathway with the planning proposal having undergone public exhibition and rezoning outcomes anticipated mid-2026.

Lake Lyell Pumped Hydro Energy Storage Project

A 385 MW pumped hydro energy storage project (expandable to 430 MW for short durations) located near Lithgow, NSW. The project utilizes the existing Lake Lyell as the lower reservoir and a new 4.4 GL upper reservoir behind Mount Walker. It features an underground powerhouse 170m below ground with two reversible pump-turbine units providing 3,080 MWh (8 hours) of storage. Declared as Critical State Significant Infrastructure (CSSI), it is a joint venture between EnergyAustralia (25%) and EDF Power Solutions Australia (75%). The project aims to stabilize the NSW grid by storing excess renewable energy and dispatching it during peak demand.

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

Wallerawang 9 Battery Energy Storage System

The Wallerawang 9 Battery Energy Storage System (BESS) is a utility-scale project located on 20 hectares of the decommissioned Wallerawang Power Station site. Shell Energy acquired the development rights in early 2023 and is currently progressing a modification to the existing State Significant Development (SSD) approval to increase capacity to 600MW / 1,800MWh. The project connects to the adjacent 330kV Transgrid Wallerawang Substation to provide grid stability and firming for renewable energy. Subject to a Final Investment Decision (FID) following grid connection approvals in 2025, construction is expected to create 100 peak jobs and take approximately 20 months to complete.

Great Western Highway Upgrade - Katoomba to Lithgow

Targeted upgrades on the Great Western Highway between Katoomba and Lithgow to improve safety, traffic flow and resilience. Active works in 2023-2025 include the Medlow Bath Upgrade (1.2 km widening to four lanes and a new pedestrian bridge with lifts) and the Coxs River Road Upgrade at Little Hartley (2.4 km four-lane realignment and new grade-separated interchange). The Medlow Bath pedestrian bridge opened in April 2025; the road works and Coxs River Road Upgrade are expected to complete in late 2025. Broader duplication proposals, including the Blackheath to Little Hartley tunnel, remain paused pending funding.

Lithgow Council Subdivision 47 Allotments

Council-owned land subdivision into 47 residential allotments developed in 2 construction stages. The project includes new roads, supporting infrastructure, and bulk earthworks to create housing opportunities in the growing Bowenfels area. This development addresses the increasing housing demand in the Lithgow region, particularly in anticipation of population growth from the Western Sydney Airport development.

Employment

AreaSearch assessment indicates Lithgow faces employment challenges relative to the majority of Australian markets

Lithgow has a balanced workforce across white and blue collar jobs, with essential services well represented. Its unemployment rate is 5.1%, according to AreaSearch's statistical area data aggregation.

As of September 2025, 2,172 residents are employed, with an unemployment rate at 1.2% above Rest of NSW's rate of 3.8%. Workforce participation in Lithgow lags behind the region at 47.2%, compared to Rest of NSW's 56.4%. Key employment sectors for Lithgow residents include health care & social assistance, accommodation & food services, and retail trade. The area specializes in mining, with an employment share 2.7 times higher than the regional level, while agriculture, forestry & fishing has limited presence at 0.4% compared to the region's 5.3%.

Between August 2024 and September 2025, Lithgow's labour force decreased by 3.4%, with employment declining by 5.2%, resulting in an unemployment rate rise of 1.8 percentage points. In contrast, Rest of NSW saw a 0.5% employment drop, a 0.1% labour force contraction, and a 0.4% increase in unemployment over the same period. Statewide, NSW experienced a 0.03% employment contraction between November 2024 and November 2025, losing 2,260 jobs, with an unemployment rate of 3.9%. Nationally, the unemployment rate was 4.3% during this period. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Lithgow's employment mix suggests local employment should grow by 6.0% over five years and 12.9% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

AreaSearch's data for financial year 2023 shows Lithgow's median income is $48,159 and average income is $60,708. This is below the national average and Rest of NSW's median ($52,390) and average ($65,215). By September 2025, estimated incomes would be approximately $52,426 (median) and $66,087 (average), based on an 8.86% Wage Price Index growth since financial year 2023. Lithgow's household, family, and personal incomes fall between the 3rd and 12th percentiles nationally. Most locals (31.1%, or 1,557 people) earn $400 - 799 weekly, differing from the region where the $1,500 - 2,999 category is predominant at 29.9%. The concentration of 41.4% in sub-$800 brackets indicates economic challenges for a significant portion of Lithgow's community. Housing affordability pressures are severe, with only 83.0% of income remaining after housing costs, ranking at the 5th percentile nationally.

Frequently Asked Questions - Income

Housing

Lithgow is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Lithgow's dwelling structure, as per the latest Census, comprised 81.9% houses and 18.1% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro NSW had 91.0% houses and 9.0% other dwellings. Home ownership in Lithgow was at 41.0%, similar to Non-Metro NSW's rate. The remaining dwellings were either mortgaged (23.4%) or rented (35.6%). The median monthly mortgage repayment in the area was $1,326, lower than Non-Metro NSW's average of $1,600. The median weekly rent figure was recorded at $280, compared to Non-Metro NSW's $300. Nationally, Lithgow's mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Lithgow features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 53.6% of all households, including 15.4% couples with children, 23.7% couples without children, and 13.3% single parent families. Non-family households account for the remaining 46.4%, with lone person households at 43.7% and group households comprising 3.0%. The median household size is 2.0 people, smaller than the Rest of NSW average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Lithgow faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 15.2%, significantly lower than the NSW average of 32.2%. Bachelor degrees are most common at 11.0%, followed by postgraduate qualifications (2.4%) and graduate diplomas (1.8%). Vocational credentials are prevalent, with 40.5% of residents aged 15+ holding them, including advanced diplomas (9.5%) and certificates (31.0%). In total, 24.2% of the population is engaged in formal education.

This comprises 9.1% in primary education, 6.4% in secondary education, and 2.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Lithgow's public transport system comprises 100 active stops, offering a mix of train and bus services. These stops are served by 61 individual routes, facilitating 1,742 weekly passenger trips in total. Residents enjoy excellent transport accessibility, with an average distance of 124 meters to the nearest stop.

Across all routes, service frequency averages 248 trips per day, equating to approximately 17 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Lithgow is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Lithgow faces significant health challenges, with various conditions affecting both younger and older residents.

Approximately 51% (~2,552 people) have private health cover, which is relatively low. The most prevalent medical conditions are arthritis (affecting 13.4% of residents) and mental health issues (impacting 11.0%). Conversely, 55.1% report no medical ailments, compared to 62.9% in the rest of NSW. Lithgow has a higher proportion of seniors aged 65 and over at 29.3% (1,467 people), compared to 23.1% in the rest of NSW. The health outcomes among seniors generally align with those of the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Lithgow ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Lithgow's cultural diversity was found to be below average, with 89.5% of its population being citizens, 86.4% born in Australia, and 93.6% speaking English only at home. The predominant religion in Lithgow is Christianity, accounting for 56.8% of the population, compared to 59.9% across the Rest of NSW. The top three ancestry groups in Lithgow are English (30.9%), Australian (30.4%), and Irish (9.0%).

Notably, Welsh ethnicity is overrepresented at 1.0%, compared to 0.5% regionally, while Australian Aboriginal ethnicity stands at 4.7% (vs 4.9%) and Scottish ethnicity is at 8.2% (vs 7.9%).

Frequently Asked Questions - Diversity

Age

Lithgow hosts an older demographic, ranking in the top quartile nationwide

Lithgow's median age is 49, surpassing the Rest of NSW figure at 43 and Australia's at 38. The 65-74 cohort is notably over-represented in Lithgow at 15.2%, compared to the Rest of NSW average, while those aged 5-14 are under-represented at 9.8%. This concentration of the 65-74 age group is higher than the national figure of 9.4%. Between 2021 and present, the population share of the 35 to 44 age group has increased from 9.6% to 10.7%, while the 55 to 64 cohort has decreased from 14.7% to 13.3%. By 2041, demographic projections indicate significant shifts in Lithgow's age structure. The 85+ age group is projected to grow by 46 people (27%), from 175 to 222, with senior residents aged 65 and above driving 79% of population growth. Conversely, population declines are projected for the 0-4 and 25-34 age cohorts.