Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Glenwood is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Glenwood's population, as of November 2025, is approximately 16,005. This figure represents an increase of 176 people since the 2021 Census, which recorded a population of 15,829. The increase is inferred from ABS estimates; Glenwood had an estimated resident population of 16,005 in June 2024 and 7 new addresses were validated after the Census date. This results in a population density ratio of 3,126 persons per square kilometer, placing Glenwood in the upper quartile nationally according to AreaSearch's assessments. Overseas migration contributed approximately 74.4% of recent population gains.

AreaSearch uses ABS/Geoscience Australia projections for SA2 areas, released in 2024 with a base year of 2022, and NSW State Government projections for uncovered areas, released in 2022 with a base year of 2021. Growth rates by age group are applied to all areas from 2032 to 2041. Based on these projections, Glenwood's population is expected to increase by 275 persons to 2041, reflecting an overall increase of approximately 1.7%.

Frequently Asked Questions - Population

Development

The level of residential development activity in Glenwood is very low in comparison to the average area assessed nationally by AreaSearch

Glenwood has averaged approximately eight new dwelling approvals annually over the past five financial years, totalling 40 homes. As of FY-26 so far, zero approvals have been recorded. The population has fallen during this period. Despite this, development activity has been adequate relative to the population decline, which is positive for buyers.

New homes are being built at an average expected construction cost value of $373,000. This financial year, $100,000 in commercial development approvals have been recorded, indicating minimal commercial development activity compared to previous years. Glenwood records markedly lower building activity than Greater Sydney overall, which generally supports stronger demand and values for established properties due to limited new supply. This activity is also below the national average, reflecting the area's maturity and possible planning constraints. Recent development has consisted entirely of detached houses, maintaining the area's traditional suburban character focused on family homes appealing to those seeking space.

Glenwood has approximately 2290 people per dwelling approval, indicating an established market. According to the latest AreaSearch quarterly estimate, Glenwood is projected to add 275 residents by 2041. With current construction levels, housing supply should adequately meet demand, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Glenwood has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified 33 projects that could impact this region. Notable projects include Norwest City, Norwest Private Hospital, Norwest Quarter, and Essentia Smart Townhomes by Mulpha Norwest. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

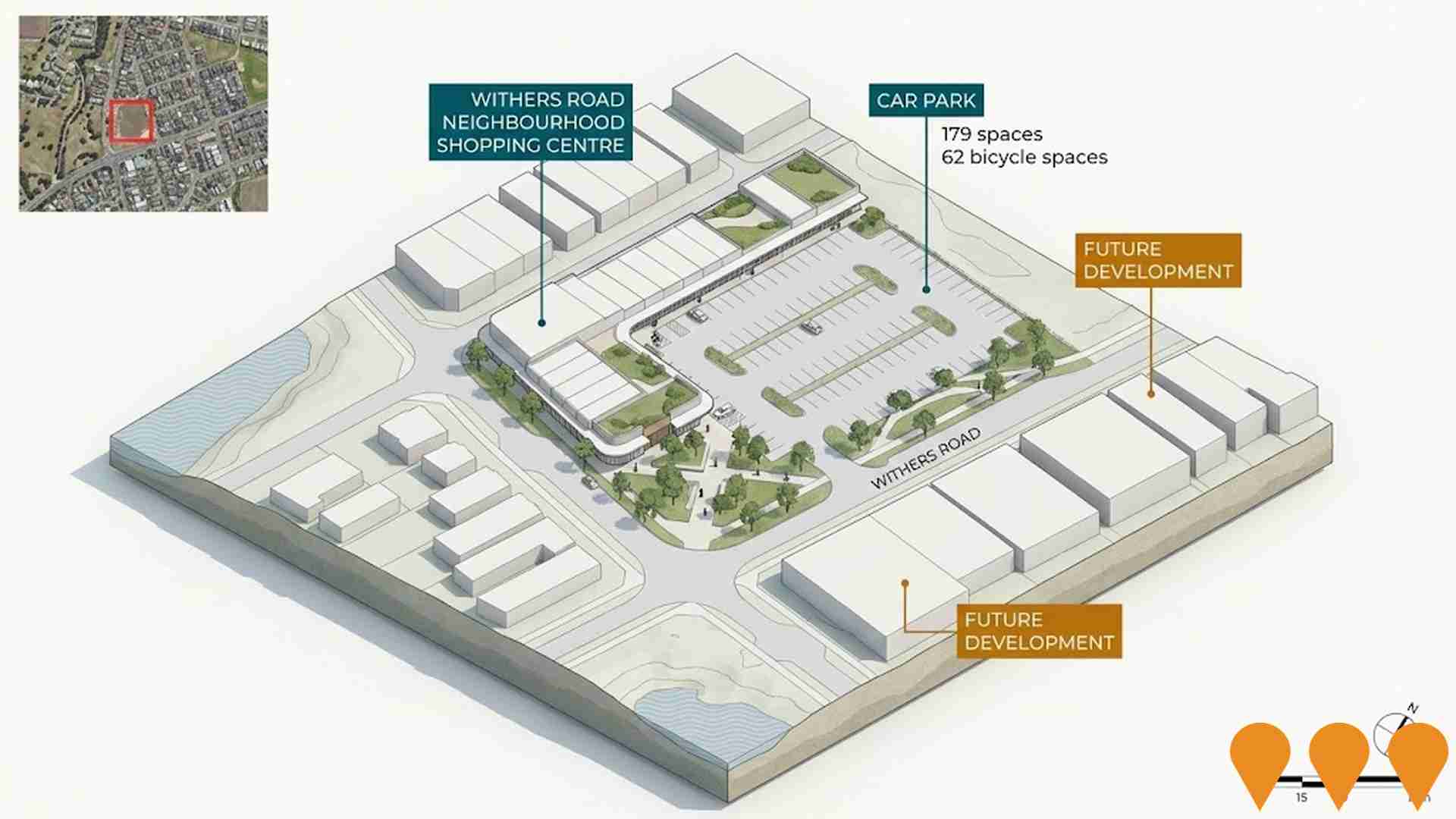

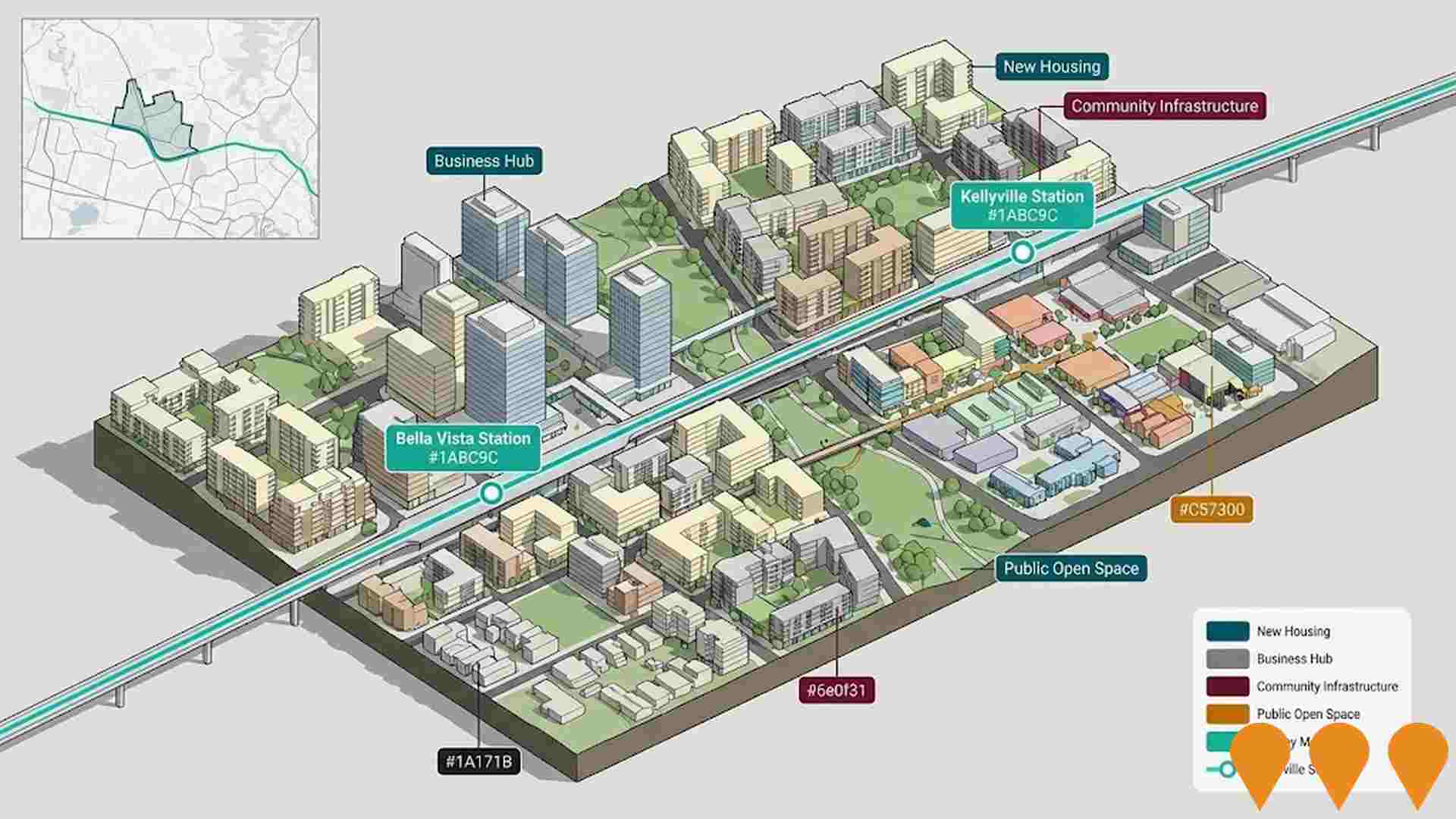

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Norwest City

Mulpha's $3+ billion masterplanned transformation of the 377-hectare Norwest Business Park into Norwest City - Australia's flagship smart city and innovation hub. Multi-decade staged redevelopment delivering commercial precincts, residential communities (including Norwest Quarter zero-carbon neighbourhood and The Greens), expanded Norwest Marketown town centre, hotel, public parks, precinct-wide LoRaWAN smart infrastructure, sustainability programs and integrated transport. Current employment 30,000+ workers across 800+ businesses, targeting 60,000+ workers and significant residential population by 2040s.

Norwest Private Hospital

277-bed private hospital facility operated by Healthscope with comprehensive medical services including emergency care, surgery, maternity and specialist services. Features digital operating theatres, ICU, CCU and birthing suites. The operator Healthscope entered receivership in 2025, but the hospital continues operations during the sale process.

Bella Vista and Kellyville TOD Accelerated Precincts

State-led Transport Oriented Development (TOD) Accelerated Precinct enabling capacity for 4,600 new homes and 3,800 jobs around Bella Vista and Kellyville Metro stations. Rezoning effective 27 November 2024 includes mandatory affordable housing contributions of 3-10%, new public open spaces, active transport links, community infrastructure, a flagship business hub at Bella Vista, and a local neighbourhood centre at Kellyville.

Bella Vista Transport Oriented Development Precinct

State-led Transport Oriented Development precinct around Bella Vista Station delivering a minimum of 3,800 new homes, approximately 151,000 m2 commercial GFA, up to 15,000 m2 retail GFA and 56,000 m2 of public open space including a new district park. Rezoning completed November 2024 under the TOD Accelerated Precincts Program. Landcom divested the first major parcel to Urban Property Group in early 2025 with staged Development Applications now being prepared for submission from late 2025 onward.

Norwest Marketown Precinct

15-year masterplanned redevelopment of the existing Norwest Marketown shopping centre and surrounding lands into a vibrant mixed-use precinct. Delivering approximately 850 apartments, build-to-rent housing, office space for 3,000 workers, expanded retail, hotel, community facilities and a new 6,000sqm lakefront park on Norwest Lake.

Norwest Quarter

World-leading $1 billion zero-carbon sustainable mixed-use precinct by Mulpha featuring approximately 935 apartments across nine towers with 70% landscaping, open-air plaza, retail, dining, and resort-style amenities. Stage 1 includes Banksia and Lacebark buildings with 196 apartments, NatHERS 8.1+ rating, 100% renewable energy, and zero waste targets. Located 9 minutes walk from Norwest Metro Station.

Essentia Smart Townhomes by Mulpha Norwest

Premium development of 74 four-bedroom smart townhomes and 33 large land homesites on 6.96 hectares. Features smart home technology, contemporary design, landscaped parks, and proximity to Norwest Metro Station. Includes community facilities, resident-only Wellness Centre with heated pool, spa, gym, and communal dining. Fully integrated solar systems with embedded network forecast to cut energy bills by over 65%.

Norwest Station Precinct Development

Mixed-use development at 25-31 Brookhollow Avenue providing office and retail space, short-term accommodation, and public plaza. 52,000my of non-residential floor space supporting estimated 2,800 new local jobs. Features underground pedestrian link to Norwest Marketown Shopping Centre. Mulpha appointed as developer.

Employment

AreaSearch analysis of employment trends sees Glenwood performing better than 90% of local markets assessed across Australia

Glenwood's workforce is highly educated with significant representation in professional services. The unemployment rate was 1.5% as of September 2025.

Employment growth over the past year was estimated at 4.2%. There were 10,367 residents employed by September 2025, with an unemployment rate of 2.7%, below Greater Sydney's rate of 4.2%. Workforce participation in Glenwood was 69.1%, higher than Greater Sydney's 60.0%. Leading industries among residents were health care & social assistance, professional & technical services, and retail trade.

Finance & insurance had employment levels at 1.3 times the regional average. However, construction was under-represented with only 5.8% of Glenwood's workforce compared to Greater Sydney's 8.6%. Employment opportunities locally may be limited as indicated by the Census working population vs resident population count. Between September 2024 and September 2025, employment increased by 4.2%, labour force increased by 4.0%, and unemployment fell by 0.2 percentage points in Glenwood. In Greater Sydney, employment grew by 2.1%, labour force expanded by 2.4%, and unemployment rose by 0.2 percentage points during the same period. State-level data to 25-Nov-25 showed NSW employment contracted by 0.03% (losing 2,260 jobs), with a state unemployment rate of 3.9%. National employment forecasts from May-25 suggest national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Glenwood's employment mix suggests local employment should increase by 6.9% over five years and 14.1% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not account for localised population projections.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

Glenwood SA2's median income among taxpayers was $63,726 and average income stood at $77,044 in financial year 2022. These figures were higher than Greater Sydney's respective median of $56,994 and average of $80,856. Based on Wage Price Index growth of 12.61% since financial year 2022, estimated incomes as of September 2025 would be approximately $71,762 (median) and $86,759 (average). Census data shows household incomes rank at the 97th percentile ($3,068 weekly). Distribution data reveals that 31.7% of individuals earn $4,000 or more, contrasting with regional levels where the $1,500 - 2,999 bracket leads at 30.9%. Higher earners make up a substantial presence, with 51.5% exceeding $3,000 weekly. Housing accounts for 14.6% of income, and residents rank within the 97th percentile for disposable income. The area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Glenwood is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Glenwood's dwelling structure, as assessed in the latest Census, consisted of 97.4% houses and 2.7% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Sydney metro's 84.9% houses and 15.1% other dwellings. Home ownership in Glenwood stood at 24.9%, with mortgaged dwellings at 55.3% and rented ones at 19.8%. The median monthly mortgage repayment was $2,600, below Sydney metro's average of $2,700. Median weekly rent in Glenwood was $590, compared to Sydney metro's $540. Nationally, Glenwood's mortgage repayments were higher at $1,863 and rents substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Glenwood features high concentrations of family households, with a higher-than-average median household size

Family households comprise 91.8% of all households, including 64.0% couples with children, 17.6% couples without children, and 9.3% single parent families. Non-family households account for 8.2%, with lone person households at 7.0% and group households comprising 1.3%. The median household size is 3.5 people, larger than the Greater Sydney average of 3.3.

Frequently Asked Questions - Households

Local Schools & Education

Glenwood shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Educational attainment in Glenwood is notably high with 43.7% of residents aged 15 and above holding university qualifications. This exceeds the national average of 30.4% and the NSW average of 32.2%. Bachelor degrees are most common at 27.7%, followed by postgraduate qualifications (13.8%) and graduate diplomas (2.2%). Vocational pathways account for 23.9% of qualifications, with advanced diplomas at 10.5% and certificates at 13.4%.

Educational participation is high, with 34.1% of residents currently enrolled in formal education. This includes 11.0% in primary education, 10.3% in secondary education, and 7.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Glenwood has 69 active public transport stops, all of which are bus stops. These stops are served by 38 different routes that together facilitate 3,601 weekly passenger trips. The average distance between residents and the nearest transport stop is 174 meters, indicating excellent accessibility.

On average, there are 514 trips per day across all routes, which amounts to approximately 52 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Glenwood's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Health outcomes data shows excellent results across Glenwood with very low prevalence of common health conditions across all age groups.

The rate of private health cover is very high at approximately 58% of the total population (~9,250 people). The most common medical conditions in the area are asthma and diabetes, impacting 6.1 and 5.6% of residents respectively. 77.7% of residents declare themselves completely clear of medical ailments compared to 80.0% across Greater Sydney. As of 30 June 20XX, Glenwood has 11.7% of its residents aged 65 and over (1,867 people), which is higher than the 7.8% in Greater Sydney. Health outcomes among seniors require more attention than those of the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Glenwood is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Glenwood has a high level of cultural diversity, with 54.7% of its population speaking a language other than English at home and 51.0% born overseas. Christianity is the predominant religion in Glenwood, making up 43.8% of its population. The most notable overrepresentation is seen in Other religions, comprising 12.2% of the population, which is significantly higher than the Greater Sydney average of 7.0%.

In terms of ancestry, the top three groups are Other (23.9%), Indian (17.4%), and Australian (13.1%). Some other ethnic groups show notable differences in representation: Filipino at 4.9% compared to the regional average of 6.2%, Sri Lankan at 1.5% versus 0.9%, and Spanish at 0.8% compared to 0.6%.

Frequently Asked Questions - Diversity

Age

Glenwood's population is slightly younger than the national pattern

Glenwood's median age stands at 37 years, matching Greater Sydney's figure and closely resembling Australia's median age of 38 years. The 15-24 age group constitutes a strong 18.1% of Glenwood's population, surpassing Greater Sydney's percentage but falling short of the national average of 12.5%. Between 2021 and present, the 15-24 age group has risen from 15.4% to 18.1%, while the 75-84 cohort has increased from 2.7% to 4.0%. Conversely, the 5-14 age group has decreased from 15.9% to 14.2%, and the 35-44 age group has dropped from 16.8% to 15.4%. By 2041, Glenwood's demographic projections indicate significant shifts in its age structure. The 75-84 age group is expected to grow by 66%, adding 424 people and reaching a total of 1,070 from the previous 645. The aging population trend is evident, with those aged 65 and above accounting for 80% of projected growth. Meanwhile, the 0-4 and 15-24 age groups are anticipated to experience population declines.