Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Acacia Gardens has shown very soft population growth performance across periods assessed by AreaSearch

Acacia Gardens' population, as of November 2025, is approximately 3,714. This figure represents an increase of 46 people since the 2021 Census, which recorded a population of 3,668. The growth from June 2024's estimated resident population of 3,714 and 17 validated new addresses is inferred. This results in a population density of 3,909 persons per square kilometer, placing Acacia Gardens in the top 10% of national locations assessed by AreaSearch. Overseas migration contributed approximately 57.4% of overall population gains recently.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered, NSW State Government's SA2 level projections from 2022 with a base year of 2021 are utilized. Growth rates by age group are applied to all areas for years 2032 to 2041. By 2041, Acacia Gardens' population is projected to decline by 104 persons overall, while the 85 and over age group is expected to expand by 141 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Acacia Gardens is very low in comparison to the average area assessed nationally by AreaSearch

Acacia Gardens has seen approximately 6 new homes approved each year. Over the past five financial years, from FY-21 to FY-25, around 30 homes were approved, with an additional 1 approval so far in FY-26.

The population has fallen during this period, suggesting that new supply has likely kept pace with demand, providing good options for buyers. The average expected construction cost value of new dwellings is $228,000, which is below regional levels, indicating more affordable housing choices for buyers. Compared to Greater Sydney, Acacia Gardens records significantly lower building activity, at 93.0% below the regional average per person. This limited new supply generally supports stronger demand and higher values for established properties. The recent development has been entirely comprised of detached dwellings, sustaining the area's suburban identity with a concentration of family homes suited to buyers seeking space.

As of now, Acacia Gardens has approximately 2226 people per dwelling approval, demonstrating an established market. With population expected to remain stable or decline in the future, Acacia Gardens should see reduced pressure on housing, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

Acacia Gardens has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

No projects have been identified by AreaSearch that are likely to impact the area. Key projects include Blacktown and Mount Druitt Hospitals Expansion Stage 2, Securing Our Water Supply - Quakers Hill to Prospect, Bella Vista and Kellyville TOD Accelerated Precincts, and Marayong South Urban Renewal Precinct.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

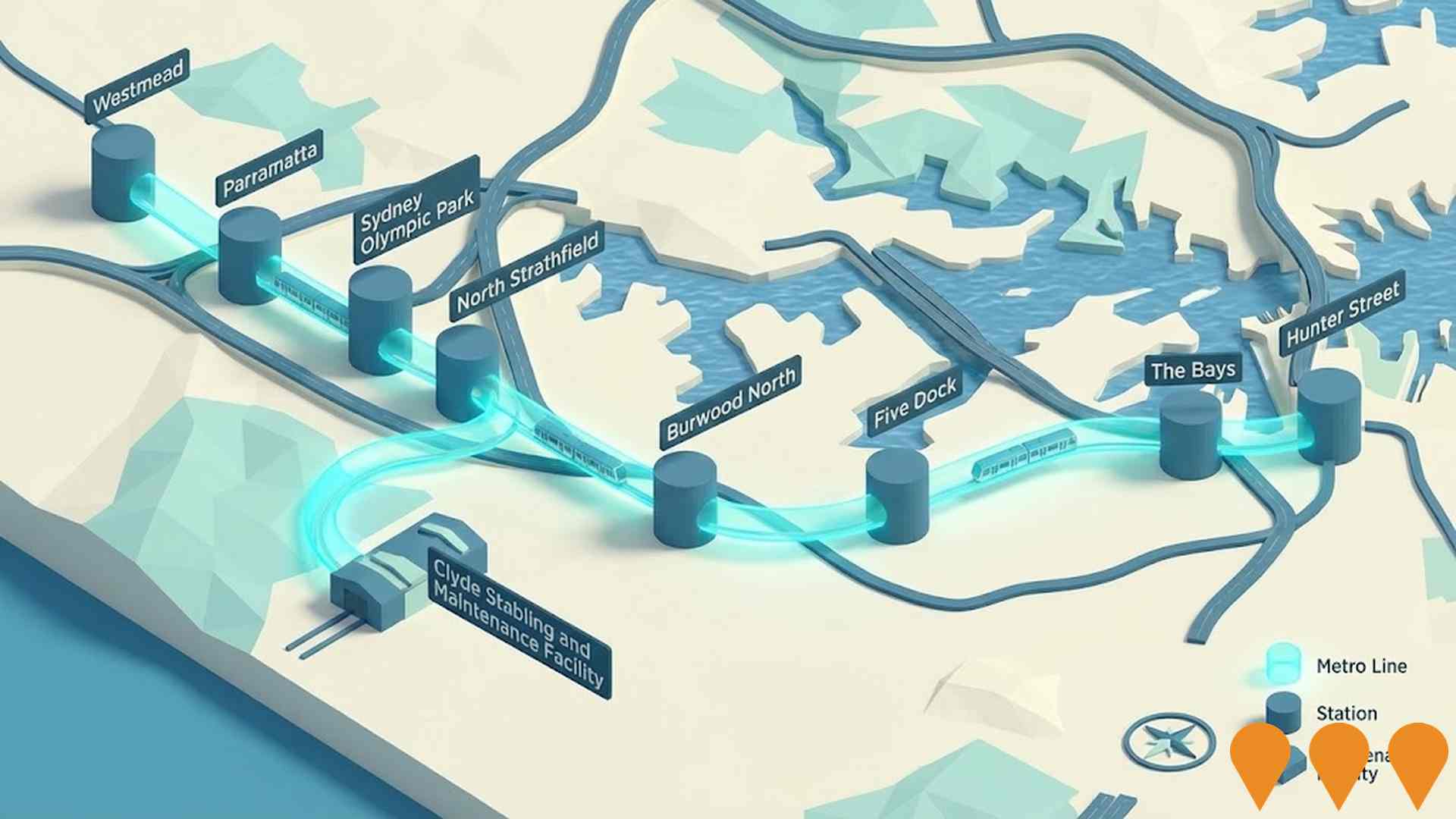

Sydney Metro West

A $27 billion, 24-kilometre underground metro railway doubling rail capacity between Greater Parramatta/Westmead and the Sydney CBD. Features 9 fully accessible, air-conditioned, driverless stations: Westmead, Parramatta, Sydney Olympic Park, North Strathfield, Burwood North, Five Dock, The Bays, Pyrmont, and Hunter Street. Tunneling on the western section (Pyrmont to Westmead) is complete, as of December 2025, with final TBMs heading towards Hunter Street. The project is supporting employment growth and is targeting a 2032 opening.

Blacktown and Mount Druitt Hospitals Expansion Stage 2

Stage 2 expansion and redevelopment of Blacktown and Mount Druitt Hospitals delivering a new clinical services building at Blacktown Hospital with approximately 200 additional inpatient beds, expanded emergency department, new operating theatres, interventional suites, medical imaging, ambulatory care, and paediatric services. Mount Druitt Hospital receives satellite upgrades including expanded cancer and renal services. Part of a $1.1 billion total investment across both stages (Stage 1 completed 2022).

Securing Our Water Supply - Quakers Hill to Prospect

Sydney Water project to deliver purified recycled water for drinking by expanding the Quakers Hill Water Recycling Plant, building a new advanced water treatment plant, and constructing pipelines to Prospect Reservoir. Will provide a climate-independent water source supporting up to 25% of Greater Sydney's needs by 2056 and enhancing drought resilience.

Securing Our Water Supply - Quakers Hill to Prospect (Purified Recycled Water Scheme)

Sydney Water is delivering advanced treatment upgrades at Quakers Hill Water Resource Recovery Facility and a new Purified Recycled Water (PRW) plant. Treated water will be transferred via a new pipeline to Prospect Reservoir to supplement Sydney's drinking water supply. The project is a key drought and climate-resilient water security initiative for Greater Sydney.

Lakeview Private Hospital

Premier multidisciplinary private hospital located on the shore of Norwest Lake in Northwest Sydney, providing exceptional patient-centered care including inpatient and day program rehabilitation, comprehensive surgical services, and specialist treatments. Established in 2015 and owned by specialist doctors with a 'Patients First' philosophy. In February 2025, a brand new Cancer Care and Infusion Centre was opened, offering advanced anti-cancer therapies and infusions.

Rouse Hill Hospital

New $910 million public hospital serving Sydney's north-west growth corridor. 300+ beds, emergency department, maternity, ICU, operating theatres, paediatrics, renal dialysis, medical imaging and integrated digital health. First major adult public hospital built in Western Sydney in over 40 years. SSDA for main works lodged and on public exhibition until 10 December 2025. Early works contractor appointment imminent. Main construction expected to start late 2025/early 2026, with staged opening from 2028.

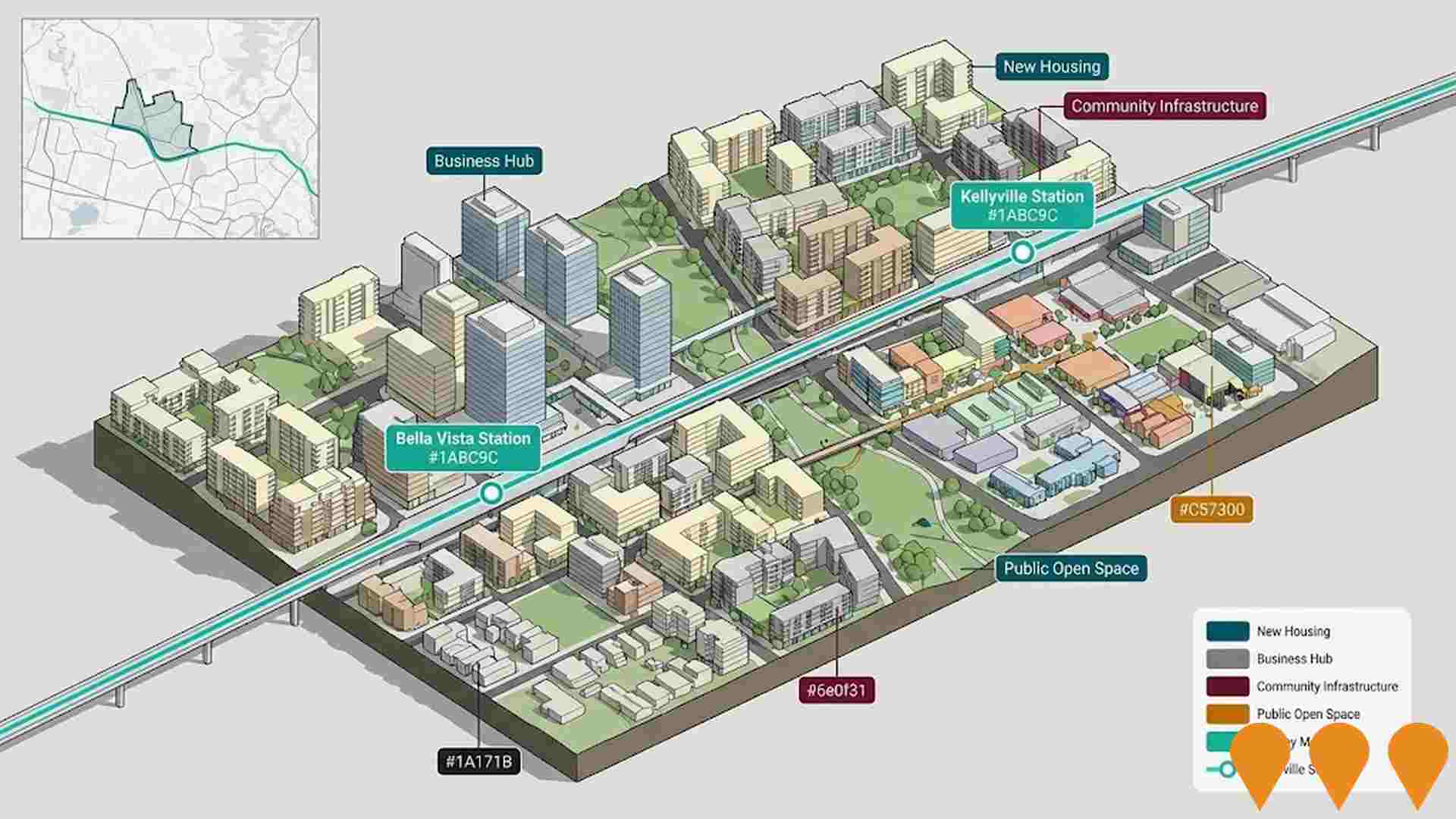

Bella Vista and Kellyville TOD Accelerated Precincts

State-led Transport Oriented Development (TOD) Accelerated Precinct enabling capacity for 4,600 new homes and 3,800 jobs around Bella Vista and Kellyville Metro stations. Rezoning effective 27 November 2024 includes mandatory affordable housing contributions of 3-10%, new public open spaces, active transport links, community infrastructure, a flagship business hub at Bella Vista, and a local neighbourhood centre at Kellyville.

Blacktown City Council WestInvest Program

Blacktown City Council is delivering a $150 million portfolio of community infrastructure projects funded through the NSW Government's WestInvest program. Projects include new and upgraded sports facilities, parks, community centres, libraries, aquatic facilities, cycleways and road upgrades across the entire Blacktown Local Government Area to meet the needs of one of Australia's fastest-growing communities.

Employment

AreaSearch analysis of employment trends sees Acacia Gardens performing better than 90% of local markets assessed across Australia

Acacia Gardens has a highly educated workforce with professional services well represented. Its unemployment rate is 1.5%, lower than Greater Sydney's 4.2%.

Employment growth over the past year was estimated at 4.3%. As of September 2025, 2,474 residents are employed, with an unemployment rate of 2.7% below Greater Sydney's rate. Workforce participation is high at 72.8%, compared to Greater Sydney's 60.0%. Leading employment industries include health care & social assistance, retail trade, and professional & technical services.

The area has a specialization in public administration & safety, with an employment share of 1.4 times the regional level. However, professional & technical services have limited presence at 8.9% compared to the regional 11.5%. Employment opportunities locally may be limited, as indicated by the Census working population vs resident population count. In the 12-month period ending September 2025, employment increased by 4.3%, labour force by 4.1%, reducing the unemployment rate by 0.1 percentage points. In contrast, Greater Sydney had employment growth of 2.1% and labour force growth of 2.4%, with a 0.2 percentage point rise in unemployment. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03%, losing 2,260 jobs, with the state unemployment rate at 3.9%. National unemployment is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project total employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Acacia Gardens' employment mix suggests local employment should increase by 6.6% over five years and 13.6% over ten years, though this is a simple extrapolation for illustrative purposes and does not account for local population projections.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 indicates Acacia Gardens SA2 had a median taxpayer income of $59,977 and an average of $69,267. Nationally, the median was lower at $54,813 with an average of $76,411. As of September 2025, estimates based on Wage Price Index growth suggest median income could be approximately $67,540 and average income around $78,002. According to the 2021 Census, incomes in Acacia Gardens ranked highly nationally, between the 83rd and 95th percentiles for household, family, and personal incomes. Income distribution showed that 33.8% of locals (1,255 people) earned between $1,500 and $2,999 weekly, similar to surrounding regions at 30.9%. High earnings were evident with 45.3% of households earning over $3,000 weekly, supporting strong consumer spending despite high housing costs consuming 15.9% of income. The area's SEIFA income ranking placed it in the 9th decile nationally, reflecting its relatively high disposable income at the 94th percentile.

Frequently Asked Questions - Income

Housing

Acacia Gardens is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Acacia Gardens' dwelling structure, as per the latest Census, consisted of 85.6% houses and 14.4% other dwellings (semi-detached, apartments, 'other'). This compares to Sydney metro's figures of 84.9% houses and 15.1% other dwellings. Home ownership in Acacia Gardens was at 21.3%, with mortgaged dwellings at 58.2% and rented ones at 20.5%. The median monthly mortgage repayment was $2,484, lower than Sydney metro's average of $2,700. Median weekly rent in Acacia Gardens was $540, matching Sydney metro's figure but higher than the national average of $375. Nationally, Acacia Gardens' median mortgage repayments were significantly higher at $2,484 compared to Australia's average of $1,863.

Frequently Asked Questions - Housing

Household Composition

Acacia Gardens features high concentrations of family households, with a lower-than-average median household size

Family households account for 89.2% of all households, including 57.6% couples with children, 19.1% couples without children, and 11.0% single parent families. Non-family households make up the remaining 10.8%, composed of 9.4% lone person households and 1.2% group households. The median household size is 3.2 people, which is smaller than the Greater Sydney average of 3.3.

Frequently Asked Questions - Households

Local Schools & Education

Acacia Gardens shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's educational profile is notable regionally, with university qualification rates of 39.5% among residents aged 15+, surpassing the Australian average of 30.4% and the NSW figure of 32.2%. Bachelor degrees are the most prevalent at 26.2%, followed by postgraduate qualifications (11.0%) and graduate diplomas (2.3%). Vocational credentials are also prominent, with 29.0% of residents aged 15+ holding such qualifications – advanced diplomas account for 11.2%, while certificates make up 17.8%.

Educational participation is high, with 30.5% of residents currently enrolled in formal education. This includes 10.9% in primary education, 8.5% in secondary education, and 5.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transportation in Acacia Gardens shows that there are currently twenty active transport stops operating within the area. These stops primarily serve bus routes with thirty individual routes in total. The combined weekly passenger trips facilitated by these routes amount to 1,197.

Residents enjoy excellent transport accessibility, with an average distance of 132 meters to the nearest transport stop. On a daily basis, service frequency averages at 171 trips across all routes, which translates to approximately fifty-nine weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Acacia Gardens's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Acacia Gardens shows excellent health outcomes, with younger groups having low prevalence of common conditions. Private health cover stands at approximately 54% (~2,020 people), compared to Greater Sydney's 58.5%.

Asthma and diabetes are the most prevalent conditions, affecting 6.4 and 5.2% respectively, while 77.4% report no medical ailments, slightly lower than Greater Sydney's 80.0%. The area has 11.6% of residents aged 65 and over (430 people), higher than Greater Sydney's 7.8%. Health outcomes among seniors require more attention compared to the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Acacia Gardens is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Acacia Gardens has a high level of cultural diversity, with 45.5% of its population born overseas and 47.9% speaking a language other than English at home. Christianity is the predominant religion in Acacia Gardens, making up 49.7% of its population. Hinduism is notably overrepresented compared to Greater Sydney, comprising 15.7% of Acacia Gardens' population versus 20.2%.

The top three ancestry groups are Other (21.1%), Australian (15.9%), and Indian (14.2%). Some ethnic groups have notable differences in representation: Filipino is overrepresented at 5.1% compared to the regional average of 6.2%, Spanish at 1.1% versus 0.6%, and Maltese at 2.5% versus 1.7%.

Frequently Asked Questions - Diversity

Age

Acacia Gardens's population is slightly younger than the national pattern

Acacia Gardens has a median age of 36 years, nearly matching Greater Sydney's average of 37 years, which is slightly below Australia's median age of 38 years. Compared to Greater Sydney, Acacia Gardens has a higher proportion of residents aged 35-44 (18.1%) but fewer residents aged 25-34 (10.9%). Between the 2021 Census and the present, the population aged 15-24 has increased from 12.6% to 14.6%, while the 75-84 age group has grown from 2.3% to 4.1%. Conversely, the 25-34 age group has decreased from 13.2% to 10.9%, and the 5-14 age group has dropped from 15.5% to 13.9%. By 2041, demographic modeling projects significant changes in Acacia Gardens' age profile. The 85+ cohort is expected to grow by 330%, adding 131 residents to reach a total of 171. Residents aged 65 and above will drive 82% of population growth, indicating a trend towards demographic aging. Meanwhile, the 65-74 and 25-34 age groups are projected to experience population declines.