Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Acacia Gardens has shown very soft population growth performance across periods assessed by AreaSearch

Based on ABS population updates and AreaSearch validation, as of November 2025, Acacia Gardens statistical area's (Lv2) population is estimated at around 3,744. This reflects an increase of 76 people since the 2021 Census, which reported a population of 3,668. The change is inferred from AreaSearch's estimate of 3,714 residents following examination of ABS's latest ERP data release in June 2024 and an additional 17 validated new addresses since the Census date. This results in a population density ratio of 3,744 persons per square kilometer, placing Acacia Gardens (SA2) in the upper quartile nationally according to AreaSearch assessments. Overseas migration primarily drove recent population growth, contributing approximately 56.99999999999999% of overall gains.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future population trends indicate an overall decline, with Acacia Gardens (SA2)'s population expected to contract by 104 persons by 2041. However, growth across specific age cohorts is anticipated, notably the 85 and over age group projected to increase by 141 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Acacia Gardens is very low in comparison to the average area assessed nationally by AreaSearch

AreaSearch analysis of ABS building approval numbers allocated from statistical area data shows Acacia Gardens averaged around 6 new dwelling approvals per year over the past 5 financial years, totalling an estimated 30 homes. As of FY-26, 1 approval has been recorded. Population decline in the area suggests new supply has likely kept up with demand, offering good choice to buyers.

New properties are constructed at an average value of $1,050,000, indicating developers target the premium market segment with higher-end properties. All new construction has comprised detached dwellings, sustaining the area's suburban identity with a concentration of family homes suited to buyers seeking space.

With around 1235 people per approval, Acacia Gardens exhibits characteristics of a mature, established area. Stable or declining population forecasts may suggest less housing pressure in the future, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Acacia Gardens has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

No changes can significantly impact an area's performance like modifications to local infrastructure, major projects, and planning initiatives. AreaSearch has identified zero projects that might affect this area. Notable projects include Blacktown and Mount Druitt Hospitals Expansion Stage 2, Securing Our Water Supply - Quakers Hill to Prospect, Securing Our Water Supply - Quakers Hill to Prospect (Purified Recycled Water Scheme), and Bella Vista and Kellyville TOD Accelerated Precincts. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

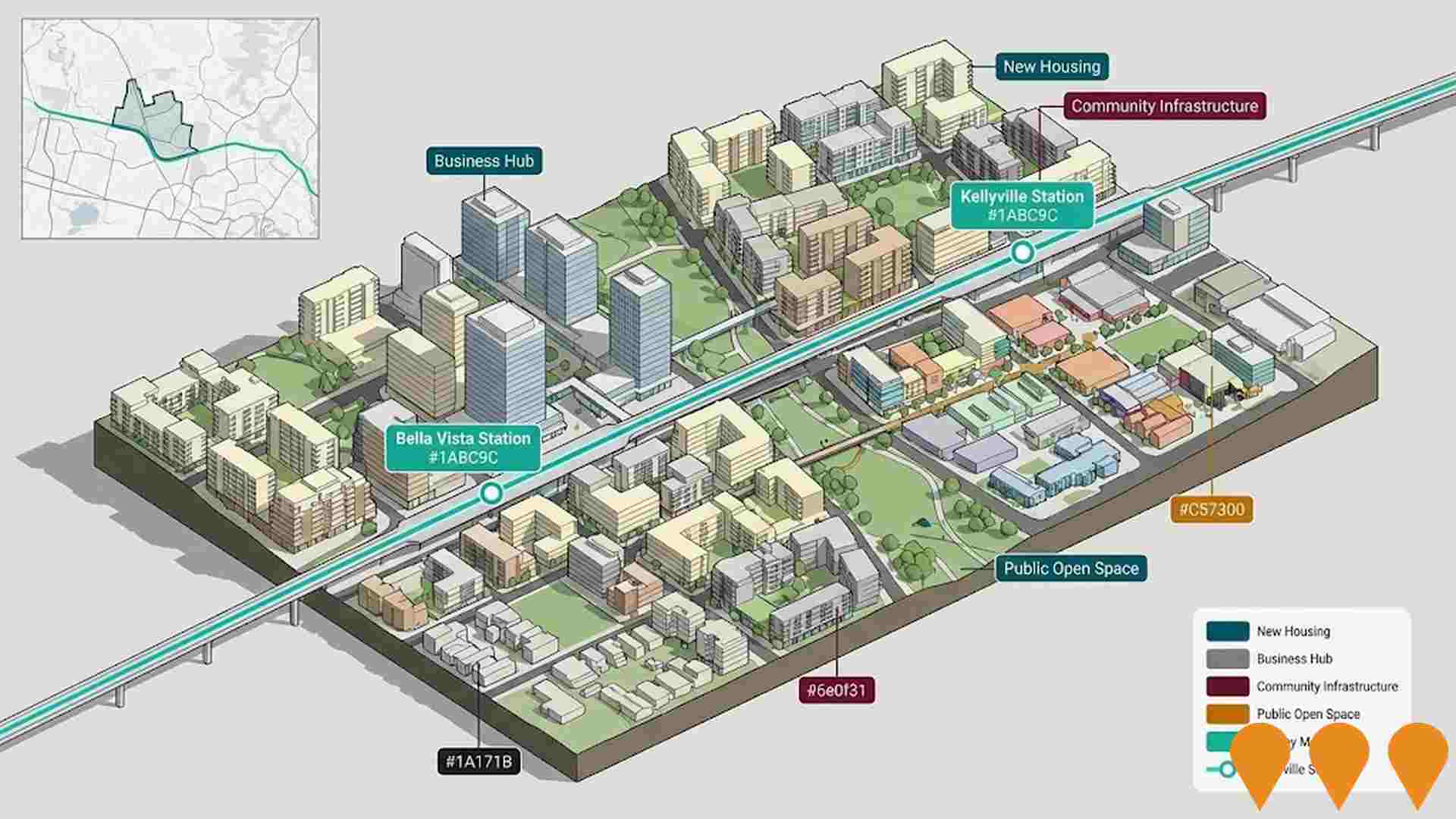

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

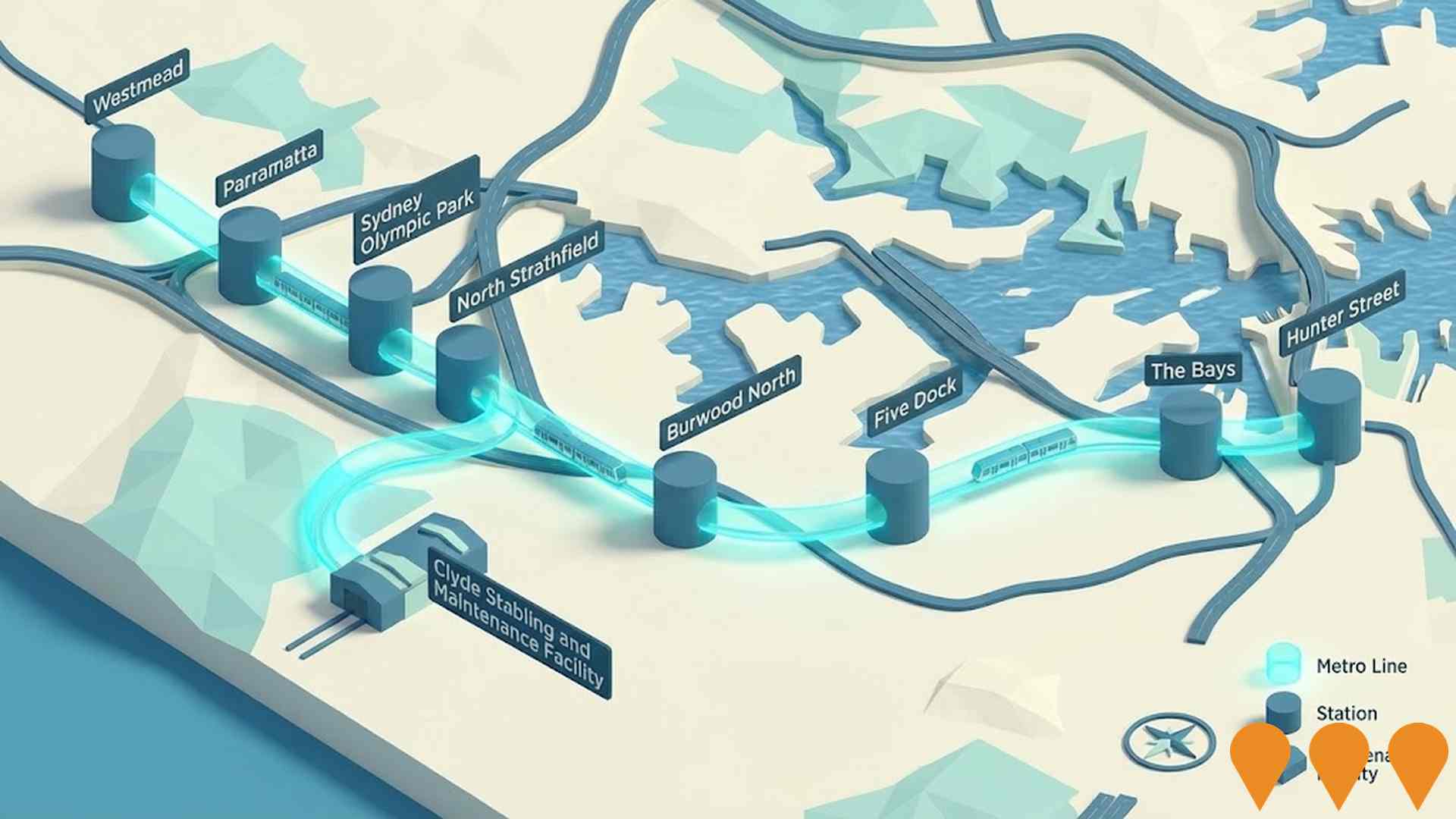

Sydney Metro West

A $27-$29 billion, 24-kilometre underground metro railway doubling rail capacity between Greater Parramatta/Westmead and the Sydney CBD. The project features 9 fully accessible, driverless stations and aims to support employment growth with a targeted 2032 opening. As of 2026, major contract signings have progressed, including the Linewide Package for track and rail systems, and the TSMO contract for 16 next-generation AI-powered trains. Tunnelling is complete on the western section, and station construction is accelerating at sites like Westmead and Hunter Street.

Blacktown and Mount Druitt Hospitals Expansion Stage 2

The Stage 2 expansion transforms Blacktown Hospital into a major metropolitan facility while upgrading Mount Druitt Hospital. Key features include a new clinical services building at Blacktown with an expanded emergency department, new operating theatres, and ICU. A fast-tracked 'Additional Beds' project is currently adding 60 contemporary acute inpatient beds (30 at each campus) to address growing demand in Western Sydney, with completion expected in late 2026.

Securing Our Water Supply - Quakers Hill to Prospect

A State Significant Infrastructure project by Sydney Water to produce purified recycled water (PRW) for Greater Sydney. The scheme involves upgrading the Quakers Hill Water Resource Recovery Facility, constructing a new Advanced Water Treatment Plant (AWTP), and laying pipelines to transfer purified water to Prospect Reservoir. It aims to provide up to 25% of Sydney's water needs by 2056, enhancing climate resilience and drought security.

Securing Our Water Supply - Quakers Hill to Prospect (Purified Recycled Water Scheme)

Sydney Water is delivering advanced treatment upgrades at the Quakers Hill Water Resource Recovery Facility and a new Purified Recycled Water (PRW) plant. The scheme involves treating water using ultrafiltration, reverse osmosis, and advanced oxidation to meet strict drinking standards, then transferring it via a new pipeline to Prospect Reservoir. This project is a key climate-resilient water security initiative for Greater Sydney, designed to supplement the city's drinking water supply regardless of rainfall and support future population growth.

Lakeview Private Hospital

A premier multidisciplinary private hospital in Norwest, Sydney, established in 2015 and operated by a specialist doctors group. The facility provides comprehensive surgical services, inpatient and day rehabilitation, and a large hydrotherapy pool. In February 2025, it officially launched its new Cancer Care and Infusion Centre, offering advanced therapies, chemotherapy, and cold cap therapy. Recent 2025 updates include green initiatives such as LED lighting upgrades and the reintroduction of sustainable patient water systems.

Rouse Hill Hospital

A new $910 million state-of-the-art public hospital designed to support Sydney's rapidly growing North West. The facility features a digital-first approach with 300+ beds, a comprehensive emergency department, and birthing services. Key architectural features include a 'care arcade' for retail and cafes, multi-storey parking, and integrated green spaces. The project is a joint venture between the NSW and Commonwealth Governments, serving as a vital health hub connected to the broader Western Sydney health network.

Bella Vista and Kellyville TOD Accelerated Precincts

A State-led Transport Oriented Development (TOD) program transforming 52 hectares around Bella Vista and Kellyville Metro stations. The initiative fast-tracks rezoning to enable 4,600 additional homes and 3,800 jobs, supported by a $520 million state investment in community infrastructure. Key features include a flagship business hub at Bella Vista, a local neighborhood center at Kellyville, and mandatory affordable housing contributions of 3-10%. Major sub-projects like Landen's 444-home development on Memorial Avenue are slated to begin construction in mid-2026.

Blacktown City Council WestInvest Program

The Blacktown City Council WestInvest Program (now known as the Western Sydney Infrastructure Grants Program) is a $150 million portfolio of 14 transformational community projects. Key initiatives include the $35.8 million Seven Hills Community Hub, the $77 million Blacktown Aquatic Centre expansion, and the Leo Kelly Blacktown Arts Centre redevelopment. The program focuses on modernising libraries, sports facilities, and aquatic centres while delivering climate-resilient 'cool centres' and splash pads to support one of Australia's fastest-growing LGAs.

Employment

The exceptional employment performance in Acacia Gardens places it among Australia's strongest labour markets

Acacia Gardens has a highly educated workforce with strong representation in professional services. Its unemployment rate is 1.5%, lower than Greater Sydney's 4.2%.

Employment growth over the past year was estimated at 4.3%. As of September 2025, 2,474 residents are employed, with an unemployment rate of 2.7% below Greater Sydney's rate and a workforce participation rate of 72.8%, compared to Greater Sydney's 60.0%. Key industries include health care & social assistance, retail trade, and professional & technical services. The area shows strong specialization in public administration & safety (1.4 times the regional level) but lower representation in professional & technical services (8.9% vs regional average of 11.5%).

Employment opportunities appear limited locally, as indicated by Census data comparing working population to resident population. Between September 2024 and September 2025, employment increased by 4.3%, labour force by 4.1%, and unemployment fell by 0.1 percentage points. In comparison, Greater Sydney recorded employment growth of 2.1% and unemployment rose by 0.2 percentage points. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%, compared to the national rate of 4.3%. National employment forecasts from Jobs and Skills Australia project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Acacia Gardens' employment mix suggests local employment should increase by 6.6% over five years and 13.6% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch aggregated latest postcode level ATO data released for financial year 2023. Acacia Gardens' median taxpayer income was $59,977 and average income was $69,267. Nationally, the median income was $60,817 and average income was $83,003 in Greater Sydney. As of September 2025, estimated incomes are approximately $65,291 (median) and $75,404 (average), based on Wage Price Index growth of 8.86%. Census data shows Acacia Gardens' household, family, and personal incomes rank between the 83rd and 95th percentiles nationally. Income distribution indicates that 33.8% earn $1,500 - $2,999 weekly (1,265 residents), consistent with metropolitan trends at 30.9%. Notably, 45.3% earn above $3,000 weekly. High housing costs consume 15.9% of income, but strong earnings place disposable income at the 94th percentile. The area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Acacia Gardens is characterized by a predominantly suburban housing profile

Acacia Gardens' dwellings, as per the latest Census, consisted of 85.6% houses and 14.4% other dwellings such as semi-detached homes, apartments, and others. Home ownership in Acacia Gardens stood at 21.3%, with 58.2% of dwellings mortgaged and 20.5% rented. The median monthly mortgage repayment was $2,484, and the median weekly rent was $540. Compared nationally, Acacia Gardens' mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Acacia Gardens features high concentrations of family households, with a median household size of 3.2 people

Family households constitute 89.2% of all households, including 57.6% couples with children, 19.1% couples without children, and 11.0% single parent families. Non-family households make up the remaining 10.8%, with lone person households at 9.4% and group households comprising 1.2%. The median household size is 3.2 people.

Frequently Asked Questions - Households

Local Schools & Education

Acacia Gardens shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's educational profile is notable regionally with university qualification rates at 39.5% of residents aged 15+, surpassing the Australian average of 30.4% and NSW's rate of 32.2%. Bachelor degrees are most prevalent at 26.2%, followed by postgraduate qualifications (11.0%) and graduate diplomas (2.3%). Vocational credentials are also prominent, with 29.0% of residents aged 15+ holding these, including advanced diplomas (11.2%) and certificates (17.8%).

Educational participation is high, with 30.5% of residents currently enrolled in formal education. This includes primary education (10.9%), secondary education (8.5%), and tertiary education (5.3%).

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Acacia Gardens indicates that there are currently 27 operational transport stops. These stops serve a variety of bus routes, totalling 30 individual routes. The combined weekly passenger trips facilitated by these routes amount to 1,312.

Residents enjoy excellent accessibility to transport services, with an average distance of 131 metres from their homes to the nearest stop. On average, there are 187 trips per day across all routes, translating to approximately 48 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Acacia Gardens's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Acacia Gardens' health outcomes data shows impressive results, with younger age groups having a very low prevalence of common health conditions.

Approximately 54% (~2,033 individuals) have private health cover, which is quite high. The most prevalent medical conditions are asthma and diabetes, affecting 6.4 and 5.2% of residents respectively. A significant majority, 77.4%, reported having no medical ailments, compared to 0% in Greater Sydney as a whole. The area has an 11.6% senior population (434 people), with health outcomes among seniors being above average but requiring more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Acacia Gardens is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Acacia Gardens has a high level of cultural diversity, with 45.5% of its population born overseas and 47.9% speaking a language other than English at home. The predominant religion in Acacia Gardens is Christianity, accounting for 49.7% of the population. Hinduism is notably overrepresented, comprising 15.7% compared to None% across Greater Sydney.

The top three ancestry groups are Other (21.1%), Australian (15.9%), and Indian (14.2%). There are also notable divergences in the representation of Filipino (5.1%), Spanish (1.1%), and Hungarian (0.5%) ethnic groups compared to None% regionally.

Frequently Asked Questions - Diversity

Age

Acacia Gardens's population is slightly younger than the national pattern

Acacia Gardens's median age is 36 years, closely matching Greater Sydney's average of 37 years, which is slightly below Australia's median age of 38 years. Compared to Greater Sydney, Acacia Gardens has a higher proportion of residents aged 35-44 (18.1%) but fewer residents aged 25-34 (10.9%). Between the 2021 Census and the present, the population aged 15-24 increased from 12.6% to 14.6%, while those aged 75-84 grew from 2.3% to 4.1%. Conversely, the proportion of residents aged 25-34 decreased from 13.2% to 10.9%, and those aged 5-14 dropped from 15.5% to 13.9%. By 2041, Acacia Gardens's age profile is projected to change significantly. The population aged 85+ is expected to grow by 313%, adding 128 residents to reach a total of 170. Residents aged 65 and above will drive 83% of the population growth, highlighting demographic aging trends. Meanwhile, the populations aged 65-74 and 25-34 are projected to decline.