Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Mount Austin is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Based on ABS population updates and AreaSearch validations, as of Nov 2025, Mount Austin's estimated population is around 4,121. This reflects an increase of 86 people since the 2021 Census, which reported a population of 4,035. The change is inferred from AreaSearch's resident population estimate of 4,076 in Jun 2024 and additional validated new addresses. This results in a density ratio of 1,585 persons per square kilometer, above the national average assessed by AreaSearch. Over the past decade, Mount Austin has shown resilient growth patterns with a 0.7% compound annual growth rate, outpacing its SA4 region. Natural growth contributed approximately 57.99999999999999% of overall population gains recently.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a 2022 base year. For areas not covered by this data, NSW State Government's SA2 level projections released in 2022 with a 2021 base year are used. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future population trends suggest an increase just below the median of non-metropolitan areas nationally, with Mount Austin expected to grow by 386 persons to 2041, reflecting a gain of 11.6% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Mount Austin according to AreaSearch's national comparison of local real estate markets

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, Mount Austin has averaged around 7 new dwelling approvals each year. Over the past 5 financial years (between FY-21 and FY-25), an estimated 38 homes were approved, with 1 so far in FY-26. On average, 4.5 people have moved to the area for each dwelling built over these years, indicating significant demand exceeding new supply.

New homes are being constructed at an average expected cost of $393,000. This financial year (FY-26), $1.1 million in commercial approvals have been registered, reflecting the area's residential nature. Compared to Rest of NSW, Mount Austin records markedly lower building activity, 63.0% below the regional average per person, which typically strengthens demand and prices for existing properties. This level is also under the national average, suggesting the area's established nature and potential planning limitations. New development consists of 62.0% detached houses and 38.0% townhouses or apartments, marking a significant shift from existing housing patterns (currently 90.0% houses), possibly due to diminishing developable land availability and evolving lifestyle preferences. With around 763 people per dwelling approval, Mount Austin reflects a highly mature market.

According to the latest AreaSearch quarterly estimate, Mount Austin is expected to grow by 478 residents through to 2041. Should current construction levels persist, housing supply could lag population growth, likely intensifying buyer competition and underpinning price growth.

Frequently Asked Questions - Development

Infrastructure

Mount Austin has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Eight projects have been identified by AreaSearch as potentially impacting the area. These include the Wagga Wagga Special Activation Precinct, Riverina Intermodal Freight and Logistics Hub (RiFL), Gissing Oval Amenities Upgrade, and Wagga Wagga Health Service Redevelopment Stage 3. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

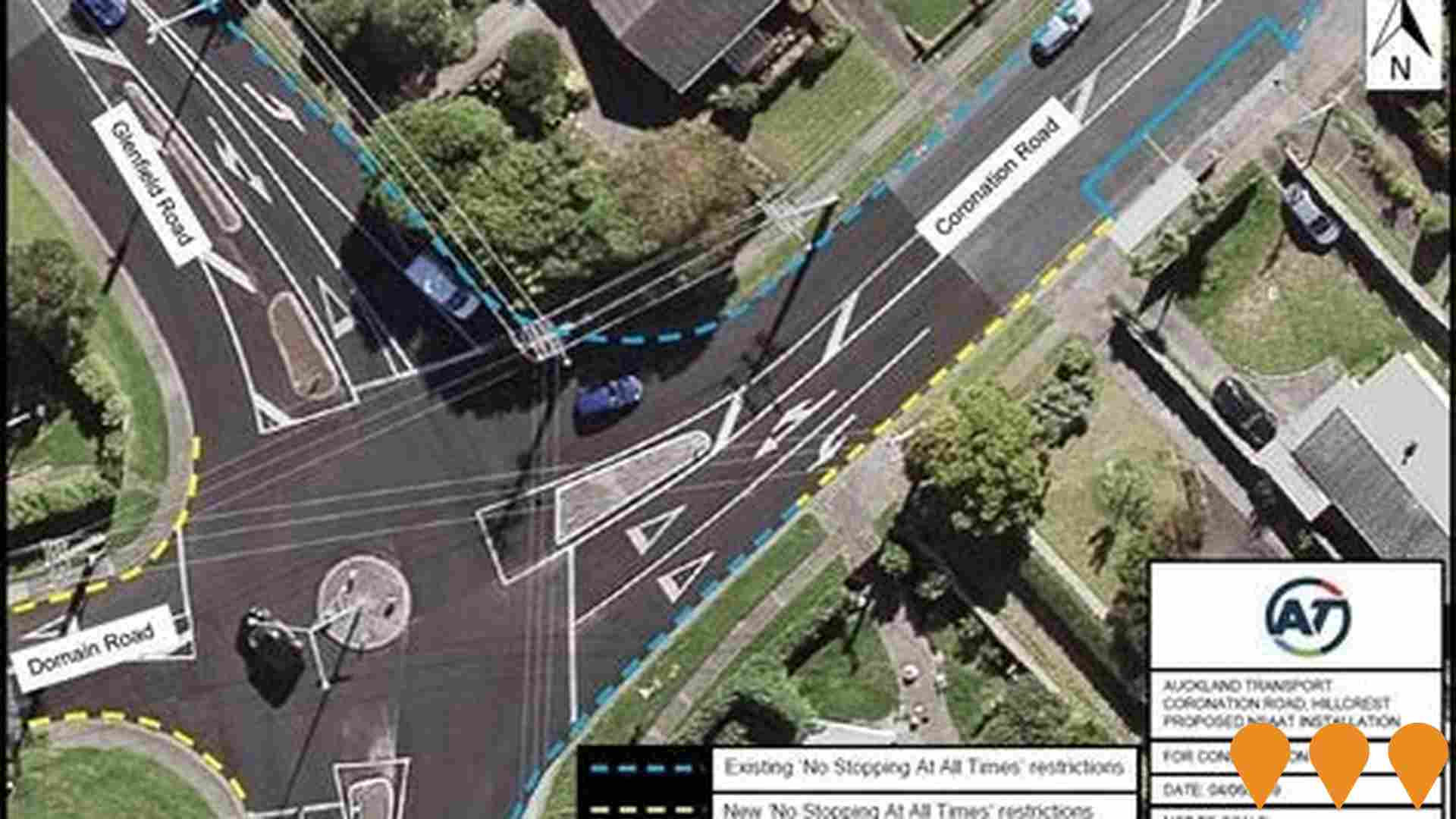

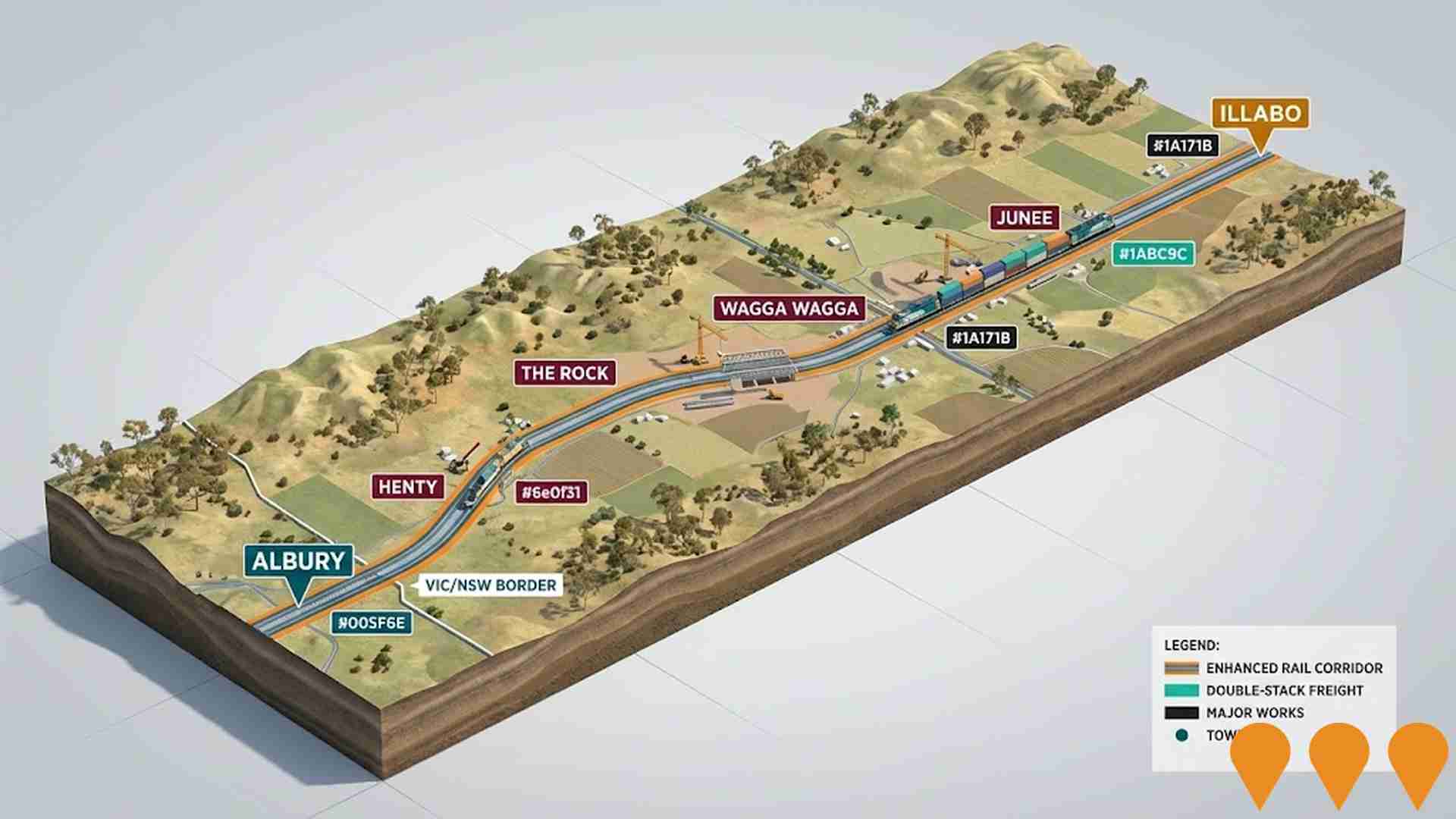

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Wagga Wagga Health Service Redevelopment Stage 3

Stage 3 of the Wagga Wagga Health Service Redevelopment featured the construction of a new six-storey ambulatory care building, known as the Health Services Hub. The facility consolidated sub-acute, ambulatory, community, and primary health services into a single site. Key features include 28 aged care beds, 24 rehabilitation beds, a 24-bed mental health inpatient unit, a 20-chair renal dialysis unit, an oral health clinic, and a dedicated education area with a library and lecture theatre. The project also included the relocation of BreastScreen NSW to the city centre and the completion of a multi-storey car park in 2023.

Rowan Village

Rowan Village is a $2.5 billion master-planned community spanning 220 hectares within Wagga Wagga's Southern Growth Area. The development is set to deliver approximately 2,100 homes, featuring a diverse mix of housing types including detached dwellings, terraces, and a dedicated seniors' living component in partnership with Ingenia. Key features include a central Village Centre with a supermarket, medical centre, and childcare, along with a new primary school, a 1,500sqm multipurpose community hub, and over 10km of shared cycleways. The project emphasizes environmental sustainability through the restoration of riparian corridors and 85 hectares of open space. Development is structured across 20 stages, with construction forecast to commence in 2027 following expected rezoning and approvals in mid-2026.

Southern Growth Area

An 844.8ha urban growth precinct south of Wagga Wagga, divided into four zones to accommodate long-term housing needs. Zone 1 (341.6ha, comprising Rowan Village and Sunnyside) is currently under active rezoning (Planning Proposal LEP24/0003, on public exhibition until December 2025) for approximately 2,900 dwellings plus supporting infrastructure, commercial areas, and open space. Zones 2-4 are in early strategic planning. The precinct addresses regional housing shortages and is proponent-led in Zone 1 by private developers in partnership with Wagga Wagga City Council.

Riverina Intermodal Freight and Logistics (RiFL) Hub

Multi-million dollar intermodal freight and logistics hub at Bomen in Wagga Wagga (45km from Griffith) featuring a 4.6 kilometre rail master siding connecting to the main southern railway and intermodal terminal. Part of the Wagga Wagga Special Activation Precinct with over $137 million NSW Government investment. Major freight terminal development connecting road and rail networks to support agricultural exports and regional freight distribution with container handling facilities and logistics warehouses.

Tolland Renewal Project

Major $500 million estate renewal delivering 500 new mixed-tenure homes including 180 social housing units, alongside affordable and private housing. Led by NSW Land and Housing Corporation (Homes NSW) in partnership with the Argyle Consortium (Argyle Housing, BlueCHP, Birribee Housing) and Wagga Wagga City Council. Includes upgraded community infrastructure, roads, utilities, landscaped parks, and recognition of First Nations history. Masterplan approved May 2024, with planning agreements signed in December 2024 and February 2025. First residents expected to move in 2027.

Inland Rail - Albury to Illabo

Enhancements along approximately 185km of existing rail corridor from the Victoria-NSW border to Illabo to enable double-stacked freight trains. Works include track upgrades, bridge modifications, level crossing improvements, and other structural enhancements. NSW planning approval granted October 2024. Project in detailed design, early works and construction phase as of November 2025, with major construction activities underway and targeted completion by 2027.

Wagga Wagga Special Activation Precinct

NSW Government's $212 million investment in the 4,500 hectare Wagga Wagga Special Activation Precinct focusing on high value agriculture, manufacturing, freight and logistics, renewable energy and recycling industries. Features master planning, enabling infrastructure, accelerated planning pathways and business concierge services. Creation of a dedicated agribusiness and food processing hub including upgraded rail infrastructure, new road network, industrial land development, water and sewer infrastructure. The precinct will create up to 6,000 new jobs across a range of industries. Major $137 million Special Activation Precinct covering 4,500 hectares including industrial land, freight rail links, digital connectivity and streamlined planning. Expected to create 6,000 jobs and includes specialized manufacturing and logistics hub with advanced manufacturing facilities, renewable energy integration, research and development spaces, and supporting commercial areas. The precinct includes the Riverina Intermodal Freight and Logistics Hub (RiFL) and focuses on advanced manufacturing, agribusiness, and freight logistics with fast-tracked planning approvals.

Lake Albert Water Sports and Event Precinct

Major redevelopment of Lake Albert foreshore creating a world-class water sports facility with boat ramps, sailing club facilities, boardwalks, event spaces and enhanced recreational areas

Employment

Employment conditions in Mount Austin face significant challenges, ranking among the bottom 10% of areas assessed nationally

Mount Austin's workforce comprises both white and blue-collar jobs, with prominent sectors being essential services. The unemployment rate in the area is 6.9%, with an estimated employment growth of 2.3% over the past year, according to AreaSearch data aggregation.

As of September 2025, there are 1,775 employed residents, and the unemployment rate stands at 3.1%, which is higher than Rest of NSW's rate of 3.8%. Workforce participation in Mount Austin is lower at 50.0% compared to Rest of NSW's 56.4%. Key industries include health care & social assistance, retail trade, and accommodation & food, with accommodation & food being particularly strong at 1.4 times the regional level. Conversely, agriculture, forestry & fishing employs only 1.7% of local workers, lower than Rest of NSW's 5.3%.

Over a 12-month period ending in September 2025, employment increased by 2.3%, while labour force grew by 4.7%, leading to an unemployment rate rise of 2.2 percentage points. In contrast, Rest of NSW saw employment fall by 0.5% and unemployment rise by 0.4 percentage points during the same period. State-level data from 25-Nov-25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia forecasts national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Mount Austin's industry mix suggests local employment should increase by 6.2% over five years and 13.3% over ten years, though these are simple extrapolations for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

AreaSearch's aggregation of latest postcode level ATO data released for financial year 2023 shows Mount Austin had a median taxpayer income of $41,287 and an average income of $50,361. These figures are lower than the national averages of $52,390 and $65,215 for Rest of NSW respectively. Based on Wage Price Index growth of 8.86% since financial year 2023, current estimates suggest a median income of approximately $44,945 and an average income of around $54,823 as of September 2025. According to the 2021 Census, incomes in Mount Austin fall between the 8th and 13th percentiles nationally for households, families, and individuals. Income distribution data indicates that 28.3% of locals (1,166 people) earn between $800 - $1,499, unlike surrounding regions where 29.9% fall within the $1,500 - $2,999 range. Housing affordability pressures are severe in Mount Austin, with only 82.8% of income remaining after housing costs, ranking at the 9th percentile nationally.

Frequently Asked Questions - Income

Housing

Mount Austin is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Mount Austin's dwelling structure, as per the latest Census, comprised 90.0% houses and 10.0% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro NSW's 88.4% houses and 11.7% other dwellings. Home ownership in Mount Austin was at 24.2%, with the rest being mortgaged (28.7%) or rented (47.1%). The median monthly mortgage repayment was $1,148, below Non-Metro NSW's average of $1,430 and Australia's national average of $1,863. The median weekly rent in Mount Austin was $250, lower than Non-Metro NSW's $280 and the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Mount Austin features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households account for 58.7% of all households, including 20.2% couples with children, 20.3% couples without children, and 17.4% single parent families. Non-family households make up the remaining 41.3%, with lone person households at 36.8% and group households comprising 4.3%. The median household size is 2.3 people, which is smaller than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Mount Austin faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 11.5%, significantly lower than the NSW average of 32.2%. Bachelor degrees are most common at 8.5%, followed by postgraduate qualifications (1.5%) and graduate diplomas (1.5%). Vocational credentials are prevalent, with 41.1% of residents aged 15+ holding them, including advanced diplomas (8.3%) and certificates (32.8%). Educational participation is high, with 32.7% currently enrolled in formal education, comprising 11.1% in primary, 7.9% in secondary, and 3.5% in tertiary education.

Educational participation is notably high, with 32.7% of residents currently enrolled in formal education. This includes 11.1% in primary education, 7.9% in secondary education, and 3.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Mount Austin has 20 operational public transport stops. These are served by buses along 32 different routes, offering a total of 719 weekly passenger trips. Residents enjoy good accessibility to these services, with an average distance of 238 meters to the nearest stop.

On average, there are 102 daily trips across all routes, resulting in approximately 35 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Mount Austin is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Mount Austin faces significant health challenges affecting both younger and older age groups. Private health cover is low at approximately 47% (around 1,933 people), compared to 51.5% across Rest of NSW and the national average of 55.7%. The most prevalent medical conditions are asthma (11.3%) and mental health issues (11.1%).

Conversely, 57.5% reported no medical ailments, lower than the 64.5% in Rest of NSW. Mount Austin has a higher proportion of seniors aged 65 and over at 21.5% (886 people), compared to 19.6% in Rest of NSW. The health outcomes among seniors are broadly similar to those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Mount Austin ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Mount Austin showed lower cultural diversity, with 83.1% citizens, 86.9% born in Australia, and 88.4% speaking English only at home. Christianity dominated at 55.2%. The 'Other' religion category was overrepresented at 5.4%, compared to Rest of NSW's 1.5%.

In ancestry, Australian (30.9%), English (28.8%), and Other (8.8%) were the top groups. Notably, Australian Aboriginal (7.2% vs 4.5%), Samoan (0.2% vs 0.1%), and German (4.0% vs 3.9%) showed higher representation than regional averages.

Frequently Asked Questions - Diversity

Age

Mount Austin's population is slightly younger than the national pattern

The median age in Mount Austin is 37 years, which is lower than the Rest of NSW average of 43 years and close to the national average of 38 years. The age profile shows that individuals aged 25-34 are prominent, making up 14.6% of the population, while those aged 45-54 make up a smaller proportion at 8.0%, compared to Rest of NSW. Between 2021 and present, the percentage of individuals aged 15-24 has increased from 13.0% to 14.1%, and those aged 25-34 have risen from 13.5% to 14.6%. Conversely, the percentage of individuals aged 5-14 has decreased from 12.9% to 11.8%, and those aged 45-54 have dropped from 9.1% to 8.0%. Looking ahead to 2041, demographic projections indicate significant shifts in Mount Austin's age structure. The number of individuals aged 75-84 is projected to rise substantially by 55%, from 300 to 466 people. Conversely, both the 65-74 and 5-14 age groups are expected to see reduced numbers.