Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Ashmont has shown very soft population growth performance across periods assessed by AreaSearch

As of November 2025, the estimated population for the Ashmont statistical area (Lv2) is around 3,775. This figure reflects an increase of 28 people since the 2021 Census, which reported a population of 3,747. The change is inferred from AreaSearch's estimation of the resident population at 3,715 as of June 2024, along with validation of five new addresses since the Census date. This results in a population density ratio of 1,553 persons per square kilometer, higher than the average seen across national locations assessed by AreaSearch. Overseas migration contributed approximately 82.0% of overall population gains during recent periods for the Ashmont (SA2).

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2-level projections, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future population trends suggest lower quartile growth for Australian non-metropolitan areas, with the Ashmont (SA2) expected to increase by 115 persons to reach a total of 3,890 by 2041, reflecting a gain of 0.5% over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Ashmont is very low in comparison to the average area assessed nationally by AreaSearch

AreaSearch analysis of ABS building approval numbers shows Ashmont has received approximately 9 dwelling approvals annually over the past five financial years. This totals an estimated 48 homes. In FY26, 8 approvals have been recorded to date. The area's population decline suggests new supply has likely kept pace with demand, offering good choice for buyers.

New properties are constructed at an average value of $451,000, indicating a focus on the premium segment. Additionally, $18.5 million in commercial development approvals have been recorded this financial year, suggesting balanced commercial development activity. Compared to Rest of NSW, Ashmont records roughly half the building activity per person and places among the 40th percentile nationally, suggesting limited buyer options but strengthening demand for established properties. This is under the national average, indicating the area's established nature and potential planning limitations. Recent construction comprises 62.0% standalone homes and 38.0% townhouses or apartments, offering choices across price ranges from spacious family homes to more affordable compact options.

This represents a shift from the existing housing stock (currently 83.0% houses), indicating decreasing availability of developable sites and reflecting changing lifestyles. With around 411 people per dwelling approval, Ashmont shows a developed market. Looking ahead, Ashmont is expected to grow by 17 residents through to 2041, with new housing supply comfortably meeting demand at current development rates. This provides good conditions for buyers and potentially supports growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Ashmont has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

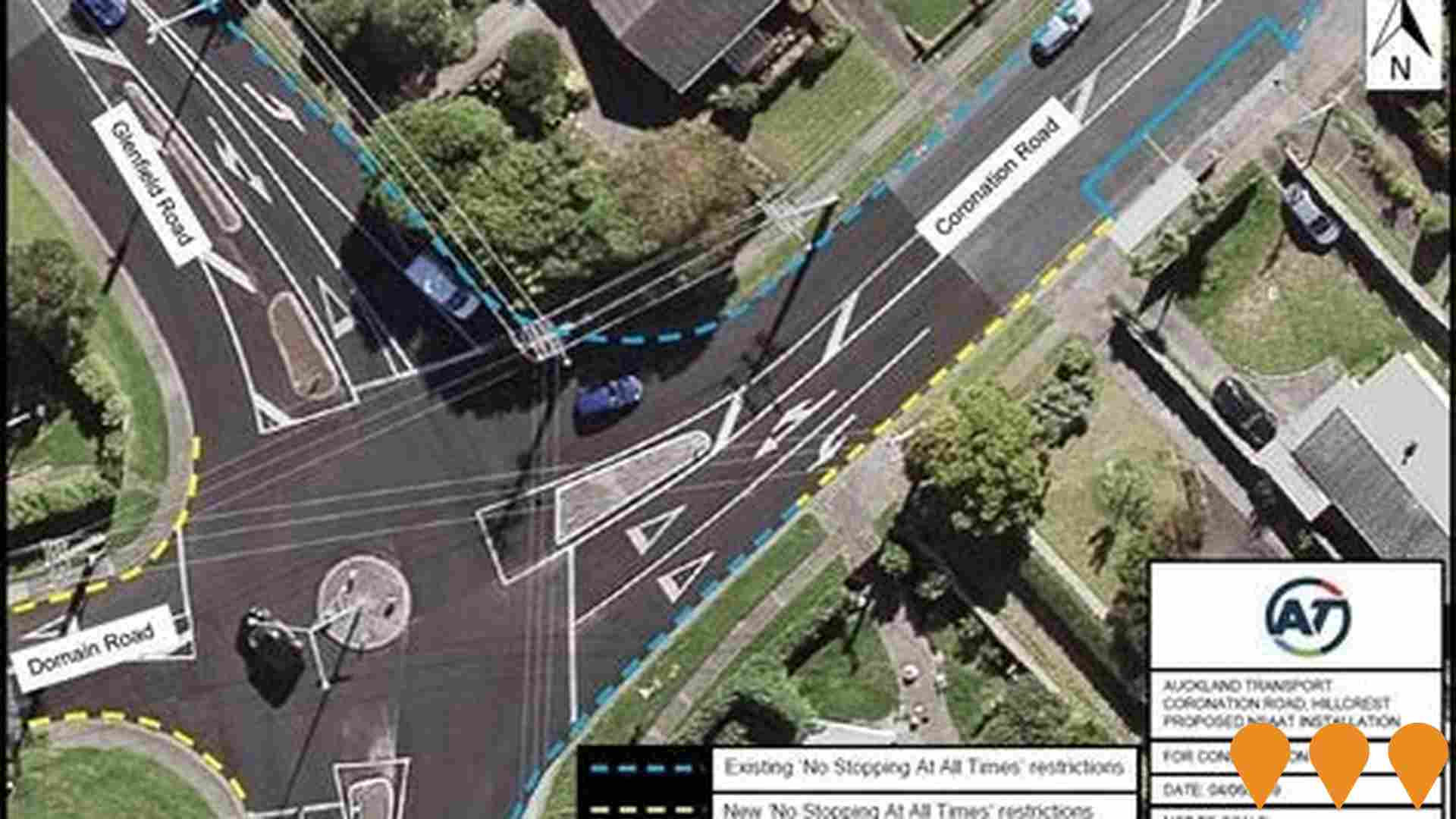

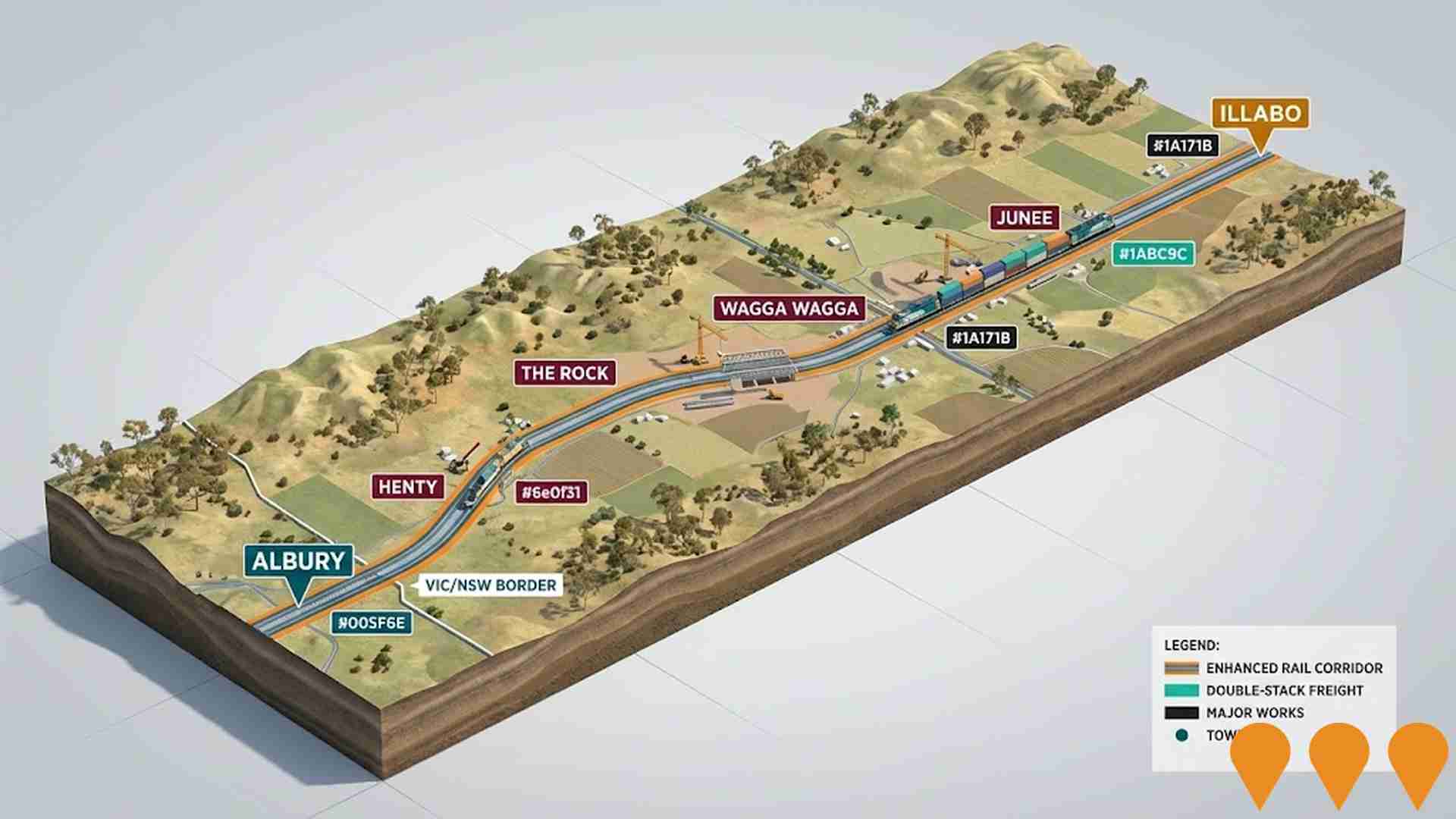

Six projects identified by AreaSearch are expected to impact the area, with key projects including Tolland Renewal Project, Inland Rail from Albury to Illabo, Veale Street Residential Subdivision, and Glenfield Road Upgrades in Wagga Wagga. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Rowan Village

Rowan Village is a $2.5 billion master-planned community spanning 220 hectares within Wagga Wagga's Southern Growth Area. The development is set to deliver approximately 2,100 homes, featuring a diverse mix of housing types including detached dwellings, terraces, and a dedicated seniors' living component in partnership with Ingenia. Key features include a central Village Centre with a supermarket, medical centre, and childcare, along with a new primary school, a 1,500sqm multipurpose community hub, and over 10km of shared cycleways. The project emphasizes environmental sustainability through the restoration of riparian corridors and 85 hectares of open space. Development is structured across 20 stages, with construction forecast to commence in 2027 following expected rezoning and approvals in mid-2026.

Southern Growth Area

An 844.8ha urban growth precinct south of Wagga Wagga, divided into four zones to accommodate long-term housing needs. Zone 1 (341.6ha, comprising Rowan Village and Sunnyside) is currently under active rezoning (Planning Proposal LEP24/0003, on public exhibition until December 2025) for approximately 2,900 dwellings plus supporting infrastructure, commercial areas, and open space. Zones 2-4 are in early strategic planning. The precinct addresses regional housing shortages and is proponent-led in Zone 1 by private developers in partnership with Wagga Wagga City Council.

Tolland Renewal Project

Major $500 million estate renewal delivering 500 new mixed-tenure homes including 180 social housing units, alongside affordable and private housing. Led by NSW Land and Housing Corporation (Homes NSW) in partnership with the Argyle Consortium (Argyle Housing, BlueCHP, Birribee Housing) and Wagga Wagga City Council. Includes upgraded community infrastructure, roads, utilities, landscaped parks, and recognition of First Nations history. Masterplan approved May 2024, with planning agreements signed in December 2024 and February 2025. First residents expected to move in 2027.

Inland Rail - Albury to Illabo

Enhancements along approximately 185km of existing rail corridor from the Victoria-NSW border to Illabo to enable double-stacked freight trains. Works include track upgrades, bridge modifications, level crossing improvements, and other structural enhancements. NSW planning approval granted October 2024. Project in detailed design, early works and construction phase as of November 2025, with major construction activities underway and targeted completion by 2027.

Riverina Intermodal Freight and Logistics (RiFL) Hub

Multi-million dollar intermodal freight and logistics hub at Bomen in Wagga Wagga (45km from Griffith) featuring a 4.6 kilometre rail master siding connecting to the main southern railway and intermodal terminal. Part of the Wagga Wagga Special Activation Precinct with over $137 million NSW Government investment. Major freight terminal development connecting road and rail networks to support agricultural exports and regional freight distribution with container handling facilities and logistics warehouses.

HumeLink

HumeLink is a new 500kV transmission line project connecting Wagga Wagga, Bannaby, and Maragle, spanning approximately 365 km. It includes new or upgraded infrastructure at four locations and aims to enhance the reliability and sustainability of the national electricity grid by increasing the integration of renewable energy sources such as wind and solar.

Wagga Wagga Special Activation Precinct

NSW Government's $212 million investment in the 4,500 hectare Wagga Wagga Special Activation Precinct focusing on high value agriculture, manufacturing, freight and logistics, renewable energy and recycling industries. Features master planning, enabling infrastructure, accelerated planning pathways and business concierge services. Creation of a dedicated agribusiness and food processing hub including upgraded rail infrastructure, new road network, industrial land development, water and sewer infrastructure. The precinct will create up to 6,000 new jobs across a range of industries. Major $137 million Special Activation Precinct covering 4,500 hectares including industrial land, freight rail links, digital connectivity and streamlined planning. Expected to create 6,000 jobs and includes specialized manufacturing and logistics hub with advanced manufacturing facilities, renewable energy integration, research and development spaces, and supporting commercial areas. The precinct includes the Riverina Intermodal Freight and Logistics Hub (RiFL) and focuses on advanced manufacturing, agribusiness, and freight logistics with fast-tracked planning approvals.

Lake Albert Water Sports and Event Precinct

Major redevelopment of Lake Albert foreshore creating a world-class water sports facility with boat ramps, sailing club facilities, boardwalks, event spaces and enhanced recreational areas

Employment

Employment conditions in Ashmont face significant challenges, ranking among the bottom 10% of areas assessed nationally

Ashmont has a diverse workforce with both white and blue-collar jobs, prominent in essential services sectors. The unemployment rate was 10.4% as of September 2025.

Employment growth over the past year was estimated at 0.8%. Residents face higher unemployment (6.6%) compared to Rest of NSW's 3.8%, indicating room for improvement. Workforce participation is lower, at 48.3% versus Rest of NSW's 56.4%. Key employment industries include health care & social assistance, retail trade, and construction.

Retail trade is particularly strong, with an employment share 1.4 times the regional level. However, education & training is under-represented, with only 5.6% of Ashmont's workforce compared to Rest of NSW's 9.6%. Local employment opportunities appear limited, as shown by Census data comparing working population to resident population. Between September 2024 and September 2025, employment levels increased by 0.8%, while the labour force rose by 3.7%, leading to a 2.6 percentage point rise in unemployment rate. In contrast, Rest of NSW saw employment decline by 0.5% and labour force decline by 0.1%, with a 0.4 percentage point rise in unemployment rate. State-level data from 25-Nov-25 shows NSW employment contracted by 0.03%, losing 2,260 jobs, with an unemployment rate of 3.9%. National unemployment rate was 4.3%. Jobs and Skills Australia's national employment forecasts for May-25 project national growth at 6.6% over five years and 13.7% over ten years. Applying these projections to Ashmont's employment mix suggests local growth should be around 6.1% over five years and 13.1% over ten years, though these are simple extrapolations for illustrative purposes only and do not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

According to AreaSearch's aggregation, the latest postcode level ATO data released for financial year 2023 shows Ashmont had a median income among taxpayers of $38,962 and an average level of $47,526. This is lower than national averages, which stood at $52,390 and $65,215 for Rest of NSW respectively. Based on Wage Price Index growth of 8.86% since financial year 2023, current estimates as of September 2025 would be approximately $42,414 (median) and $51,737 (average). Census data reveals household, family and personal incomes in Ashmont all fall between the 3rd and 9th percentiles nationally. Income brackets indicate that 31.1% of locals (1,174 people) predominantly earn within the $800 - 1,499 category, unlike regional trends where 29.9% fall within the $1,500 - 2,999 range. Housing affordability pressures are severe in Ashmont, with only 81.9% of income remaining after housing costs, ranking at the 4th percentile nationally.

Frequently Asked Questions - Income

Housing

Ashmont is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

The latest Census showed that in Ashmont, 82.7% of dwellings were houses, with the remaining 17.3% being semi-detached homes, apartments, and other types of dwellings. In comparison, Non-Metro NSW had 88.4% houses and 11.7% other dwellings. Home ownership in Ashmont stood at 22.2%, with mortgaged properties at 25.9% and rented ones at 51.9%. The median monthly mortgage repayment was $1,103, lower than Non-Metro NSW's average of $1,430. The median weekly rent in Ashmont was $220, compared to $280 in Non-Metro NSW. Nationally, Ashmont's mortgage repayments were significantly lower at $1,103 versus the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Ashmont features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 62.4% of all households, including 17.6% couples with children, 20.3% couples without children, and 22.6% single parent families. Non-family households comprise the remaining 37.6%, with lone person households at 34.3% and group households making up 3.1%. The median household size is 2.3 people, smaller than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Ashmont faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 9.5%, significantly lower than the NSW average of 32.2%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most prevalent at 6.6%, followed by postgraduate qualifications (1.5%) and graduate diplomas (1.4%). Vocational credentials are prominent, with 39.6% of residents aged 15+ holding them, including advanced diplomas (6.2%) and certificates (33.4%).

Educational participation is high, with 30.5% of residents currently enrolled in formal education, comprising 12.2% in primary, 8.4% in secondary, and 2.6% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Ashmont has 28 operational public transport stops, all of which are bus stops. These stops are served by 30 different routes that together facilitate 557 weekly passenger trips. The accessibility of transport in Ashmont is rated as good, with residents on average being located 205 meters away from the nearest transport stop.

Across all routes, there is an average service frequency of 79 trips per day, which equates to approximately 19 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Ashmont is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Ashmont faces significant health challenges, with various conditions affecting both younger and older age groups. Private health cover is low at approximately 46% (~1,729 people), compared to 51.5% across Rest of NSW and a national average of 55.7%. Mental health issues and asthma are the most common medical conditions, impacting 12.8% and 12.1% of residents respectively.

However, 54.4% of residents report having no medical ailments, compared to 64.5% across Rest of NSW. As of 2021, 16.6% (~626 people) of Ashmont's population is aged 65 and over, lower than the 19.6% in Rest of NSW. Health outcomes among seniors present challenges broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Ashmont is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Ashmont had a below average cultural diversity, with 86.3% of its population being Australian citizens, born in Australia (92.7%), speaking English only at home (94.9%). Christianity was the predominant religion, at 58.5%, compared to 64.3% across Rest of NSW. The top three ancestry groups were Australian (31.4%), English (29.5%), and Australian Aboriginal (13.8%), which was significantly higher than the regional average of 4.5%.

Some ethnic groups had notable differences: Macedonian at 0.1% in Ashmont vs 0% regionally, French at 0.4% vs 0.3%, and Irish at 8.0% vs 9.9%.

Frequently Asked Questions - Diversity

Age

Ashmont's population is slightly younger than the national pattern

Ashmont's median age is 35 years, which is significantly below the Rest of NSW average of 43 and somewhat younger than Australia's median of 38. The 25-34 cohort is notably over-represented in Ashmont at 16.3%, compared to the Rest of NSW average, while the 75-84 year-olds are under-represented at 4.1%. Following the census on 2021/08/10, younger residents shifted the median age down by 1.1 years to 35. The 25 to 34 age group grew from 13.0% to 16.3%, and the 0 to 4 cohort increased from 7.6% to 8.9%. Conversely, the 55 to 64 cohort declined from 11.4% to 9.7%, and the 45 to 54 group dropped from 11.3% to 9.9%. Demographic modeling suggests Ashmont's age profile will evolve significantly by 2041/06/30. The 25 to 34 cohort shows the strongest projected growth at 19%, adding 116 residents to reach 732. Conversely, the 45 to 54 and 75 to 84 cohorts are expected to experience population declines.