Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Lloyd lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

As of Nov 2025, the estimated population for the Lloyd statistical area (Lv2) is around 1,672, reflecting an increase of 163 people since the 2021 Census. This growth represents a 10.8% increase from the previously reported population of 1,509 people. The change is inferred from AreaSearch's resident population estimate of 1,660, based on examination of the latest ERP data release by the ABS (June 2024) and an additional 70 validated new addresses since the Census date. This level of population results in a density ratio of 357 persons per square kilometer, indicating significant space per person and potential room for further development. The Lloyd's growth rate of 10.8% since the 2021 census exceeded both the SA3 area (3.9%) and the SA4 region, marking it as a growth leader in the region. Natural growth contributed approximately 57.99999999999999% of overall population gains during recent periods for the Lloyd (SA2).

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with a base year of 2021. Examining future population trends, the Lloyd (SA2) is expected to grow by 87 persons to 2041 based on aggregated SA2-level projections. This reflects an expected decrease of 3.2% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Lloyd recording a relatively average level of approval activity when compared to local markets analysed countrywide

Based on AreaSearch analysis, Lloyd has recorded approximately 32 residential properties granted approval annually. Over the past five financial years, from FY-21 to FY-25, around 164 homes were approved, with a further 5 approved in FY-26 so far. On average, about 0.2 new residents arrive per year for each new home over these five years, indicating that new supply is meeting or exceeding demand.

The average construction value of new properties is $393,000. This financial year has seen $2.6 million in commercial approvals, suggesting the area's residential character. Compared to the Rest of NSW, Lloyd shows 337.0% higher development activity per person, reflecting strong developer confidence in the area. Recent construction comprises 60.0% standalone homes and 40.0% medium and high-density housing, indicating an expanding range of medium-density options. This represents a notable shift from the current housing mix, which is 95.0% houses. Lloyd has around 161 people per approval, reflecting its developing status.

Despite stable or declining population forecasts, this may result in less housing pressure and favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Lloyd has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Area infrastructure changes significantly impact performance. Four relevant projects identified by AreaSearch are Lake Albert Water Sports and Event Precinct, Glenfield Road Upgrades (Wagga Wagga), Wagga Wagga Special Activation Precinct, and Hungry Jack's Glenfield Park.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Rowan Village

Rowan Village is a $2.5 billion master-planned community spanning 220 hectares within Wagga Wagga's Southern Growth Area. The development is set to deliver approximately 2,100 homes, featuring a diverse mix of housing types including detached dwellings, terraces, and a dedicated seniors' living component in partnership with Ingenia. Key features include a central Village Centre with a supermarket, medical centre, and childcare, along with a new primary school, a 1,500sqm multipurpose community hub, and over 10km of shared cycleways. The project emphasizes environmental sustainability through the restoration of riparian corridors and 85 hectares of open space. Development is structured across 20 stages, with construction forecast to commence in 2027 following expected rezoning and approvals in mid-2026.

Southern Growth Area

An 844.8ha urban growth precinct south of Wagga Wagga, divided into four zones to accommodate long-term housing needs. Zone 1 (341.6ha, comprising Rowan Village and Sunnyside) is currently under active rezoning (Planning Proposal LEP24/0003, on public exhibition until December 2025) for approximately 2,900 dwellings plus supporting infrastructure, commercial areas, and open space. Zones 2-4 are in early strategic planning. The precinct addresses regional housing shortages and is proponent-led in Zone 1 by private developers in partnership with Wagga Wagga City Council.

Tolland Renewal Project

Major $500 million estate renewal delivering 500 new mixed-tenure homes including 180 social housing units, alongside affordable and private housing. Led by NSW Land and Housing Corporation (Homes NSW) in partnership with the Argyle Consortium (Argyle Housing, BlueCHP, Birribee Housing) and Wagga Wagga City Council. Includes upgraded community infrastructure, roads, utilities, landscaped parks, and recognition of First Nations history. Masterplan approved May 2024, with planning agreements signed in December 2024 and February 2025. First residents expected to move in 2027.

Riverina Intermodal Freight and Logistics (RiFL) Hub

Multi-million dollar intermodal freight and logistics hub at Bomen in Wagga Wagga (45km from Griffith) featuring a 4.6 kilometre rail master siding connecting to the main southern railway and intermodal terminal. Part of the Wagga Wagga Special Activation Precinct with over $137 million NSW Government investment. Major freight terminal development connecting road and rail networks to support agricultural exports and regional freight distribution with container handling facilities and logistics warehouses.

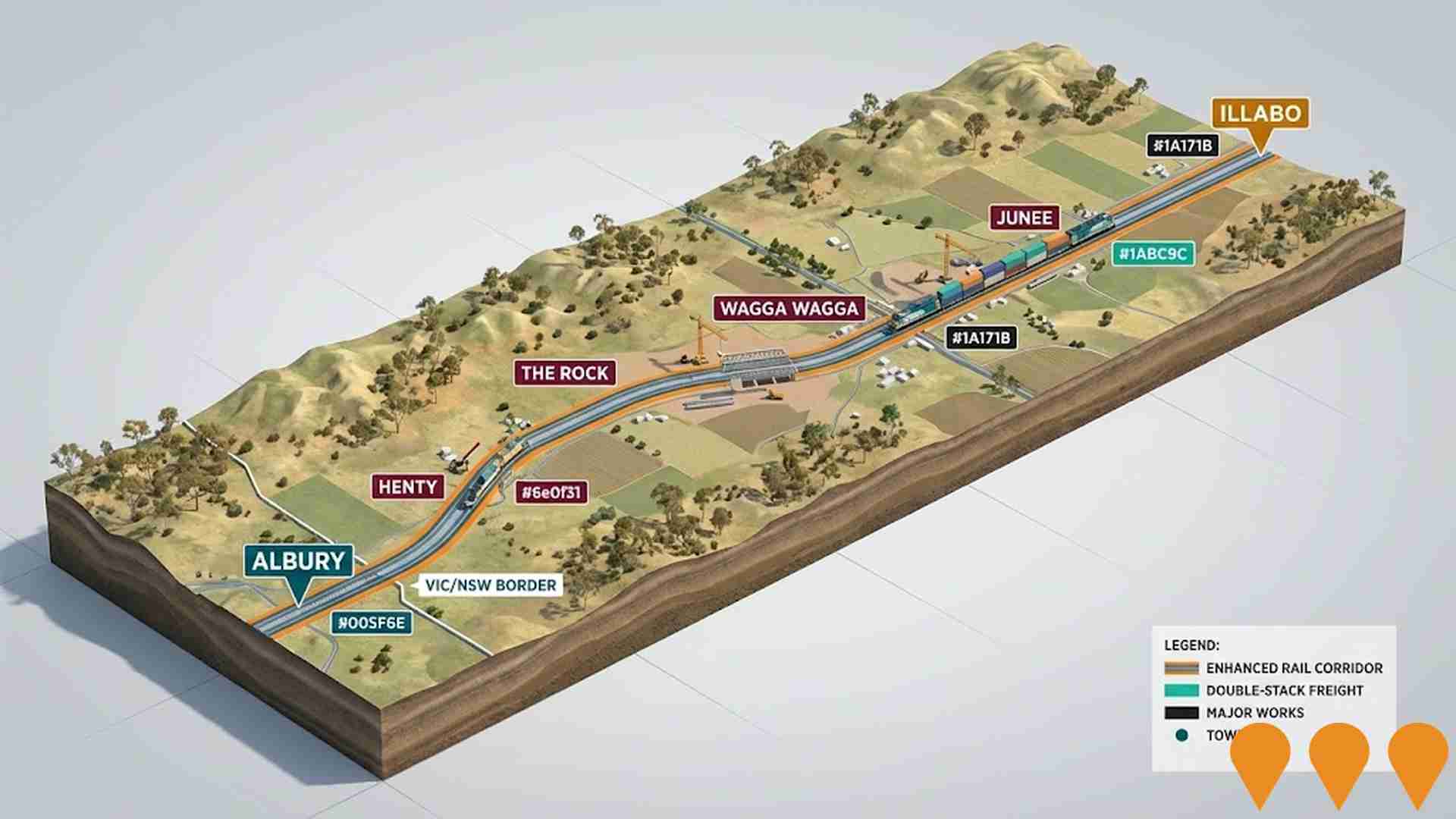

Inland Rail - Albury to Illabo

Enhancements along approximately 185km of existing rail corridor from the Victoria-NSW border to Illabo to enable double-stacked freight trains. Works include track upgrades, bridge modifications, level crossing improvements, and other structural enhancements. NSW planning approval granted October 2024. Project in detailed design, early works and construction phase as of November 2025, with major construction activities underway and targeted completion by 2027.

HumeLink

HumeLink is a new 500kV transmission line project connecting Wagga Wagga, Bannaby, and Maragle, spanning approximately 365 km. It includes new or upgraded infrastructure at four locations and aims to enhance the reliability and sustainability of the national electricity grid by increasing the integration of renewable energy sources such as wind and solar.

Olympic Highway Safety Improvements

Comprehensive safety upgrade works along the Olympic Highway corridor from Cowra to Table Top, supported by a $26 million funding injection. The project involves overtaking lanes, intersection improvements, shoulder sealing, road widening, and the installation of flexible safety barriers. Recent works have focused on sections near Cowra and Young to reduce crash rates and improve regional traffic flow.

Wagga Wagga Special Activation Precinct

NSW Government's $212 million investment in the 4,500 hectare Wagga Wagga Special Activation Precinct focusing on high value agriculture, manufacturing, freight and logistics, renewable energy and recycling industries. Features master planning, enabling infrastructure, accelerated planning pathways and business concierge services. Creation of a dedicated agribusiness and food processing hub including upgraded rail infrastructure, new road network, industrial land development, water and sewer infrastructure. The precinct will create up to 6,000 new jobs across a range of industries. Major $137 million Special Activation Precinct covering 4,500 hectares including industrial land, freight rail links, digital connectivity and streamlined planning. Expected to create 6,000 jobs and includes specialized manufacturing and logistics hub with advanced manufacturing facilities, renewable energy integration, research and development spaces, and supporting commercial areas. The precinct includes the Riverina Intermodal Freight and Logistics Hub (RiFL) and focuses on advanced manufacturing, agribusiness, and freight logistics with fast-tracked planning approvals.

Employment

The labour market in Lloyd shows considerable strength compared to most other Australian regions

Lloyd has a skilled workforce with essential services sectors well represented. The unemployment rate was 2.7% in the past year, with an estimated employment growth of 4%.

As of September 2025911 residents were employed, with an unemployment rate of 1.2% below Rest of NSW's rate of 3.8%. Workforce participation was 76.7%, compared to Rest of NSW's 56.4%. Leading employment industries included health care & social assistance, public administration & safety, and retail trade. The area had a particular specialization in public administration & safety, with an employment share 1.7 times the regional level.

Agriculture, forestry & fishing was under-represented, with only 1.2% of Lloyd's workforce compared to 5.3% in Rest of NSW. Many residents commuted elsewhere for work based on Census data. In the 12 months prior, employment increased by 4.0%, while labour force increased by 5.0%, causing the unemployment rate to rise by 0.9 percentage points. This contrasted with Rest of NSW where employment contracted by 0.5%. State-level data to 25-Nov showed NSW employment contracted by 0.03% (losing 2,260 jobs), with a state unemployment rate of 3.9%, compared to the national rate of 4.3%. National employment forecasts from May-25 projected growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Lloyd's employment mix suggested local employment should increase by 6.6% over five years and 13.8% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

According to AreaSearch's aggregation of the latest postcode level ATO data released on June 30, 2023, the suburb of Lloyd had a median income among taxpayers of $73,332 with the average level standing at $89,451. These figures are among the highest in Australia compared to levels of $52,390 and $65,215 across Rest of NSW respectively. Based on Wage Price Index growth of 8.86% since financial year 2023, current estimates would be approximately $79,829 (median) and $97,376 (average) as of September 2025. Census data from 2021 shows household, family and personal incomes in Lloyd rank highly nationally, between the 80th and 85th percentiles. In terms of income distribution, 44.7% of individuals in Lloyd earn between $1,500 and $2,999 weekly, which is consistent with broader trends across the metropolitan region showing 29.9% in the same category. Notably, 30.3% of residents earn above $3,000 weekly. Housing accounts for 14.4% of income while strong earnings rank residents within the 81st percentile for disposable income. The area's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Lloyd is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Dwelling structure in Lloyd, as evaluated at the latest Census, comprised 95.4% houses and 4.6% other dwellings. In comparison, Non-Metro NSW had 88.4% houses and 11.7% other dwellings. Home ownership in Lloyd was 22.5%, with mortgaged dwellings at 55.7% and rented ones at 21.8%. The median monthly mortgage repayment in Lloyd was $1,803, higher than Non-Metro NSW's average of $1,430. Median weekly rent in Lloyd was $420, compared to Non-Metro NSW's $280. Nationally, Lloyd's mortgage repayments were lower than the Australian average of $1,863, while rents were substantially higher at $375.

Frequently Asked Questions - Housing

Household Composition

Lloyd has a typical household mix, with a higher-than-average median household size

Family households constitute 74.9% of all households, including 39.4% couples with children, 26.0% couples without children, and 8.7% single parent families. Non-family households comprise the remaining 25.1%, with lone person households at 22.1% and group households making up 2.6%. The median household size is 2.7 people, larger than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Lloyd demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Educational qualifications in the Lloyd Trail region lag behind NSW state benchmarks. As of 2021, 23.5% of residents aged 15+ hold university degrees compared to 32.2% in NSW. The most common qualification is bachelor degrees at 16.9%, followed by postgraduate qualifications (3.8%) and graduate diplomas (2.8%). Vocational credentials are also prevalent, with 40.1% of residents aged 15+ holding such qualifications - advanced diplomas account for 12.2%, while certificates make up 27.9%.

Educational participation is high, with 31.1% of residents currently enrolled in formal education as of the 2020-2021 academic year. This includes 10.5% in primary education, 9.0% in secondary education, and 4.4% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates five active stops operating within Lloyd, offering a mix of bus services. These stops are served by fifteen unique routes, collectively facilitating 264 weekly passenger trips. Transport accessibility is assessed as good, with residents typically situated 208 meters from the nearest transport stop.

Service frequency averages 37 trips per day across all routes, translating to roughly 52 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Lloyd is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Lloyd demonstrates superior health outcomes, with both younger and older age groups experiencing low prevalence rates for common health conditions. The rate of private health cover stands at approximately 62%, covering 1040 people, which is notably higher than the Rest of NSW average of 51.5%. Nationally, this figure stands at 55.7%.

Asthma and mental health issues are the most prevalent medical conditions in Lloyd, affecting 9.6% and 8.4% of residents respectively. Conversely, 70.7% of residents report being completely free from medical ailments, compared to 64.5% across Rest of NSW. The area has a lower proportion of seniors aged 65 and over, with 10.2% (170 people) compared to the Rest of NSW average of 19.6%. Despite this, health outcomes among seniors in Lloyd are above average and largely align with those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Lloyd ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Lloyd's population showed low cultural diversity, with 86.8% born in Australia, 94.2% being citizens, and 87.6% speaking English only at home. Christianity was the predominant religion, accounting for 63.4%, compared to 64.3% across Rest of NSW. The top three ancestry groups were Australian (30.5%), English (28.9%), and Irish (9.9%).

Dutch individuals were overrepresented at 1.7% in Lloyd versus 0.8% regionally, as were Samoan at 0.5% versus 0.1%, and Australian Aboriginal at 3.4% versus 4.5%.

Frequently Asked Questions - Diversity

Age

Lloyd hosts a very young demographic, ranking in the bottom 10% of areas nationwide

The median age in Lloyd is 33 years, which is lower than Rest of NSW's average of 43 years and also substantially under the national average of 38 years. Compared to the Rest of NSW average, the 5-14 cohort is notably over-represented at 16.3% locally, while the 65-74 year-olds are under-represented at 7.2%. Post-2021 Census data shows that the 45 to 54 age group has grown from 11.7% to 13.6%, and the 15 to 24 cohort increased from 13.1% to 14.6%. Conversely, the 25 to 34 cohort has declined from 18.4% to 14.7%, and the 0 to 4 group dropped from 8.4% to 7.2%. Population forecasts for 2041 indicate substantial demographic changes for Lloyd. Leading this shift, the 25 to 34 age group is projected to grow by 12 people, reaching 276 from 245. However, both the 65 to 74 and 45 to 54 age groups are expected to see reduced numbers.