Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Morpeth lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

The Morpeth statistical area's population was estimated at around 1,948 as of Nov 2025. This figure reflects an increase of 262 people since the 2021 Census, which reported a population of 1,686 people in the area. The change is inferred from the resident population of 1,916 estimated by AreaSearch following examination of the latest ERP data release by the ABS (June 2024) and an additional 16 validated new addresses since the Census date. This level of population equates to a density ratio of 423 persons per square kilometer in the Morpeth SA2. The area's 15.5% growth since the 2021 census exceeded the non-metro area (5.7%) and the state, marking it as a growth leader in the region. Population growth for the area was primarily driven by interstate migration contributing approximately 47.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections released in 2022 with 2021 as the base year. Considering these projections, a significant population increase in the top quartile of regional areas across the nation is forecast for the Morpeth SA2, expecting an expansion by 500 persons to 2041 based on aggregated SA2-level projections, reflecting a total increase of 23.7% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Morpeth recording a relatively average level of approval activity when compared to local markets analysed countrywide

Morpeth has averaged approximately 7 new dwelling approvals per year over the past five financial years, totalling an estimated 36 homes. In FY26, 2 approvals have been recorded to date. Assuming an average of 4 new residents per home built between FY21 and FY25, demand significantly outstrips supply, typically leading to price growth and increased buyer competition. The average construction cost value for new homes is $401,000, slightly above the regional average, indicating a focus on quality developments.

This financial year has seen $298,000 in commercial approvals, reflecting the area's residential nature. Compared to Rest of NSW, Morpeth shows significantly reduced construction activity (68.0% below the regional average per person), which generally supports stronger demand and values for established dwellings. New building activity is split evenly between detached dwellings (50.0%) and medium to high-density housing (50.0%), marking a shift from existing housing patterns, which are currently 65.0% houses. This trend suggests diminishing developable land availability and responds to evolving lifestyle preferences and housing affordability needs. The estimated population density in Morpeth is 423 people per dwelling approval, reflecting its quiet development environment. According to the latest AreaSearch quarterly estimate, Morpeth is projected to grow by 461 residents through to 2041.

If current development rates continue, housing supply may not keep pace with population growth, potentially increasing buyer competition and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Morpeth has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified one major project likely affecting the region: East Maitland Catalyst Area, Raymond Terrace and Heatherbrae Strategy (2020-2040). Other notable projects include Stony Pinch Urban Development and Maitland Local Housing Strategy (2041), with the latter two potentially having the most relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Hunter-Central Coast Renewable Energy Zone

The Hunter-Central Coast Renewable Energy Zone (REZ) is a critical infrastructure project designed to transition the region from coal-based power to renewable energy. The project involves upgrading approximately 85km of existing 132kV sub-transmission lines between Kurri Kurri and Muswellbrook, constructing two new substations (Sandy Creek and Antiene), and modernizing existing network assets. These upgrades will provide an additional 1GW of network transfer capacity by 2028, enabling the connection of large-scale wind, solar, and battery storage projects. Ausgrid, as the appointed network operator, is responsible for the design, financing, and construction, with early works beginning in 2025 and major construction commencing in early 2026.

Raymond Terrace and Heatherbrae Strategy 2020-2040

A comprehensive 20-year strategic framework for the revitalization of Raymond Terrace and Heatherbrae. Key initiatives include the award-winning Public Domain Plan (PDP), town centre streetscape upgrades on William and Adelaide Streets, and the creation of a community civic hub. The strategy aims to deliver approximately 2,500 new homes by 2041, supported by $50 million in proposed stormwater upgrades and significant infrastructure projects like the M1 Pacific Motorway extension to Heatherbrae.

Maitland Local Housing Strategy 2041

The Maitland Local Housing Strategy 2041 is a comprehensive framework adopted by Council in June 2023 and endorsed by the NSW Government in September 2024. It manages residential growth to accommodate a projected population increase of 54,800 residents by 2041. The strategy prioritizes housing diversity, infill development, and the '15-minute neighborhood' concept, aiming to deliver approximately 25,200 additional dwellings. Recent implementation milestones include the adoption of the Residential Density Guide in October 2025 to support affordable housing delivery.

East Maitland Catalyst Area

The East Maitland Catalyst Area (EMCA) is a strategic growth precinct focused on housing acceleration and health service expansion. The project centers on the draft EMCA Structure Plan, which outlines changes to land use and zoning to support approximately 3,000 to 4,000 new dwellings and 6,500 additional residents by 2045. Key anchors include the new Maitland Hospital, Maitland Private Hospital, and Stockland Green Hills. The plan emphasizes infill development, medium-density housing within walking distance of transport, and improved infrastructure to manage regional growth.

Hunter Transmission Project

A critical 500 kV overhead transmission line project spanning approximately 110 km between Bayswater Power Station and a new switching station in Olney State Forest. The project serves as the northern section of the 'Sydney Ring' high-capacity network, designed to transfer up to 5 GW of energy from the Central-West Orana and New England Renewable Energy Zones (REZs) to the NSW grid. Key infrastructure includes new switching stations at Bayswater South and Olney, and upgrades to existing substations at Bayswater and Eraring. The project is vital for grid reliability as NSW coal-fired power stations retire.

Low and Mid-Rise Housing Policy

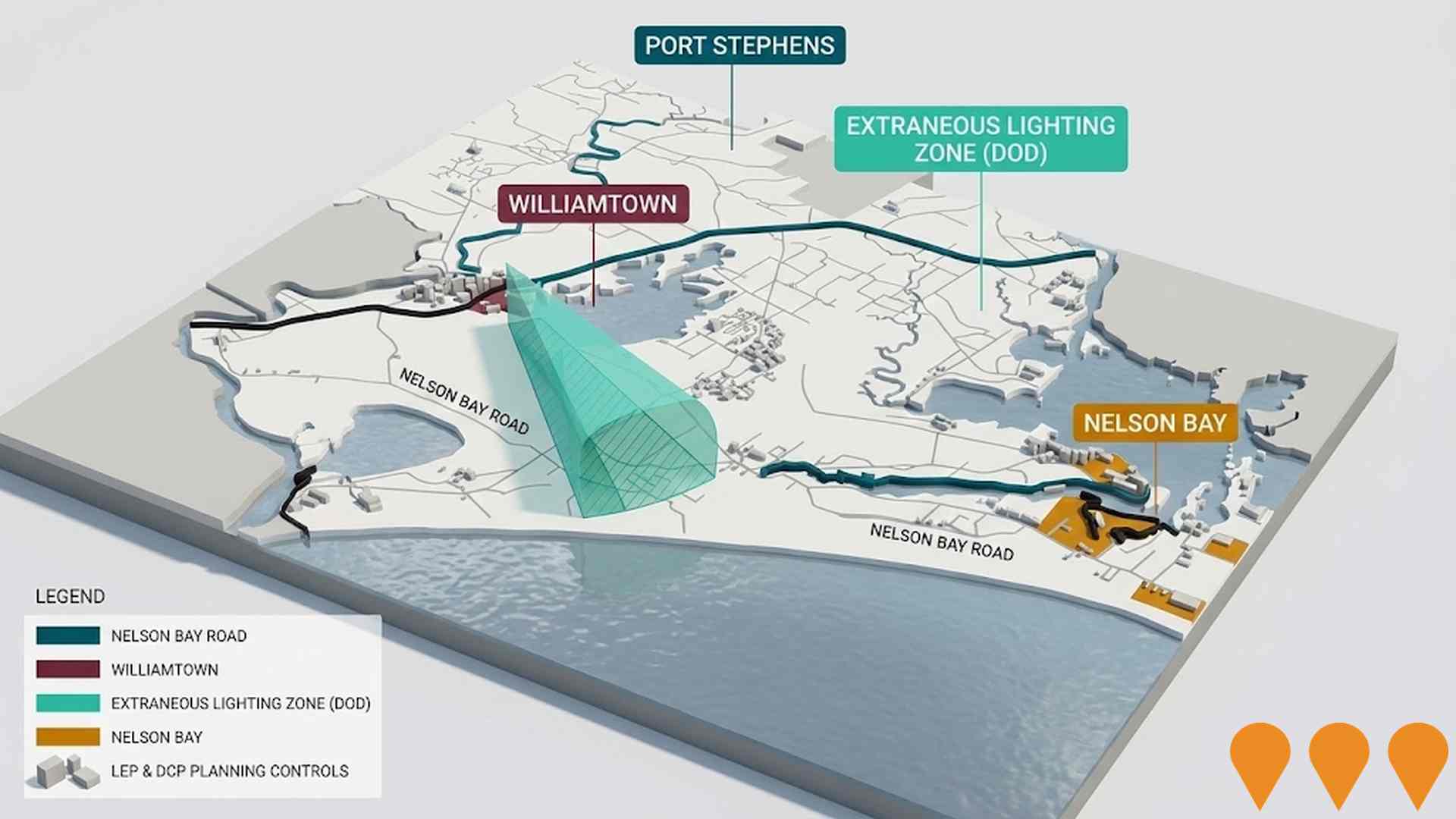

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

Stony Pinch Urban Development

A major long-term urban transformation project involving the post-mining rehabilitation of the 3,600-hectare Bloomfield Colliery site. The conceptual masterplan envisions a significant mixed-use precinct comprising up to 19,200 dwellings, a dedicated town centre, employment lands, and extensive recreation facilities, while preserving substantial bushland corridors. The site is strategically located near the intersection of the Pacific Highway and New England Highway, identified as a future freight and employment hub. Current operations at the colliery are approved until 2030, with a pending modification to extend mining activities to 2035 to facilitate a stable final landform for future urban use.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

Employment

Despite maintaining a low unemployment rate of 2.9%, Morpeth has experienced recent job losses, resulting in a below average employment performance ranking when compared nationally

Morpeth has a skilled workforce with essential services sectors well represented. The unemployment rate is 2.9%, according to AreaSearch's aggregation of statistical area data.

As of September 2025762 residents are employed while the unemployment rate is 0.9% below Rest of NSW's rate of 3.8%. Workforce participation stands at 45.0%, significantly lower than Rest of NSW's 56.4%. Key industries of employment among residents include health care & social assistance, education & training, and construction. Morpeth shows strong specialization in mining with an employment share twice the regional level, while agriculture, forestry & fishing has a lower representation at 1.2% versus the regional average of 5.3%.

The area may offer limited local employment opportunities, as indicated by the census working population vs resident population count. In the 12-month period ending September 2025, labour force decreased by 1.9% and employment declined by 1.7%, causing unemployment to fall by 0.2 percentage points. This contrasts with Rest of NSW where employment contracted by 0.5%, labour force fell by 0.1%, and unemployment rose by 0.4 percentage points. State-level data as of 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that while overall employment is expected to expand by 6.6% over five years and 13.7% over ten years, growth rates vary significantly between industry sectors. Applying these projections to Morpeth's employment mix indicates local employment should increase by approximately 6.5% over five years and 13.5% over ten years, though these are simple extrapolations for illustrative purposes only and do not account for localized population projections.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

The suburb of Morpeth had a median income among taxpayers of $45,912 and an average income of $56,255 in the financial year 2023. These figures were lower than those for Rest of NSW, which were $52,390 and $65,215 respectively. By September 2025, estimates based on Wage Price Index growth of 8.86% suggest median income will be approximately $49,980 and average income will be around $61,239. Census data indicates that household, family and personal incomes in Morpeth fall between the 8th and 16th percentiles nationally. Income distribution shows that 28.4% of individuals earn between $800 - 1,499, differing from patterns across the surrounding region where earnings between $1,500 - 2,999 dominate at 29.9%. Housing affordability pressures are severe in Morpeth, with only 82.6% of income remaining after housing costs, ranking at the 9th percentile nationally. The suburb's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Morpeth displays a diverse mix of dwelling types, with above-average rates of outright home ownership

Morpeth's dwelling structures, as per the latest Census, consisted of 65.2% houses and 34.8% other dwellings (semi-detached, apartments, 'other' dwellings). Non-Metro NSW had 87.1% houses and 13.0% other dwellings. Home ownership in Morpeth was 50.8%, with mortgaged dwellings at 29.1% and rented ones at 20.2%. The median monthly mortgage repayment was $1,788, lower than Non-Metro NSW's average of $1,862. The median weekly rent in Morpeth was $370, compared to Non-Metro NSW's $375. Nationally, Morpeth's mortgage repayments were lower at $1,788 versus the Australian average of $1,863, and rents were also less at $370 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Morpeth features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 64.1% of all households, including 19.1% couples with children, 35.1% couples without children, and 8.9% single parent families. Non-family households account for the remaining 35.9%, with lone person households at 33.8% and group households comprising 1.7%. The median household size is 2.1 people, which is smaller than the Rest of NSW average of 2.7.

Frequently Asked Questions - Households

Local Schools & Education

Morpeth performs slightly above the national average for education, showing competitive qualification levels and steady academic outcomes

The area's educational profile is notable regionally with university qualification rates at 24.8%, exceeding the SA4 region average of 15.2%. Bachelor degrees are most prevalent at 16.8%, followed by postgraduate qualifications (4.9%) and graduate diplomas (3.1%). Vocational credentials are also prominent, with 39.2% of residents aged 15+ holding them, including advanced diplomas (14.0%) and certificates (25.2%).

A significant 23.4% of the population is actively pursuing formal education, with 9.5% in primary, 5.7% in secondary, and 3.4% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Morpeth shows that there are 19 active transport stops currently operating. These stops serve a mix of bus routes, with a total of 29 individual routes providing service to the area. The collective weekly passenger trips facilitated by these routes amount to 221.

The accessibility of transport is rated as excellent, with residents typically located just 115 meters from their nearest transport stop. On average, there are 31 trips per day across all routes, which equates to approximately 11 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Morpeth is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Morpeth faces significant health challenges, with various conditions affecting both younger and older residents. Private health cover stands at approximately 49% (around 959 people), lower than Rest of NSW's 54.8%, and the national average of 55.7%. The most prevalent conditions are arthritis (15.8%) and mental health issues (8.9%).

Conversely, 54.2% report no medical ailments, compared to Rest of NSW's 63.4%. Morpeth has a higher proportion of seniors aged 65 and over at 36.3% (707 people), compared to Rest of NSW's 15.4%. Despite this, health outcomes among seniors in Morpeth are better than the general population.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Morpeth placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Morpeth, as per the census conducted on 27 June 2016, had a population with 91.6% born in Australia, 94.0% being citizens, and 98.3% speaking English only at home. Christianity was the predominant religion, accounting for 66.1% of Morpeth's population, compared to 57.0% across the Rest of NSW. The top three ancestry groups were English (34.4%), Australian (29.1%), and Scottish (11.0%).

Notably, Welsh (0.9%) and Irish (10.0%) ethnicities were overrepresented in Morpeth compared to regional averages of 0.6% and 7.8%, respectively. Russian ancestry was also slightly higher at 0.3%.

Frequently Asked Questions - Diversity

Age

Morpeth ranks among the oldest 10% of areas nationwide

The median age in Morpeth is 54 years, which is significantly higher than Rest of NSW's average of 43 and considerably older than the national norm of 38. Compared to Rest of NSW, the 75-84 cohort is notably over-represented at 14.6% locally, while the 15-24 age group is under-represented at 7.8%. This concentration of the 75-84 cohort is well above the national average of 6.0%. Between 2021 Census and present, the 35 to 44 age group has grown from 9.1% to 10.1%, while the 65 to 74 cohort has declined from 18.2% to 17.1%. By 2041, Morpeth's population is expected to see notable shifts in its age composition. The 75-84 age cohort is projected to grow steadily, expanding by 78 people (28%) from 284 to 363. In contrast, the 15-24 age group shows minimal growth of just 5% (8 people).