Chart Color Schemes

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Thornton - Millers Forest lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Thornton-Millers Forest's population was around 19,866 as of November 2025. This figure reflects a growth of 3,967 people (25.0%) since the 2021 Census, which recorded a population of 15,899. The increase is inferred from ABS's estimated resident population of 19,023 in June 2024 and an additional 1,191 validated new addresses since the Census date. This results in a density ratio of 314 persons per square kilometer. Thornton-Millers Forest's growth rate exceeded non-metro areas (5.1%) and the state average. Interstate migration contributed approximately 70.7% to overall population gains during recent periods, with natural growth and overseas migration also being positive factors.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections are used, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future trends predict exceptional growth, placing Thornton-Millers Forest in the top 10 percent of Australia's non-metropolitan areas. By 2041, the area is expected to expand by 19,535 persons based on latest annual ERP population numbers, reflecting a gain of 94.1% over 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Thornton - Millers Forest was found to be higher than 90% of real estate markets across the country

Thornton-Millers Forest has seen approximately 347 new homes approved annually. Over the past five financial years, from FY21 to FY25, around 1,738 homes were approved, with an additional 105 approved in FY26 so far. On average, each dwelling constructed over these years brought in about 3.3 new residents per year.

This has led to a significant demand exceeding supply, typically resulting in price growth and heightened buyer competition. New dwellings are developed at an average cost of $393,000, which is below regional levels, suggesting more affordable housing options for buyers. In FY26, there have been $4.9 million worth of commercial approvals, indicating the area's predominantly residential nature. Compared to the Rest of NSW, Thornton-Millers Forest exhibits 82.0% higher construction activity per person, offering ample choice for buyers, although recent activity has eased somewhat. This level of activity is notably above the national average, reflecting strong developer confidence in the area. The new building activity comprises approximately 74.0% detached houses and 26.0% attached dwellings, maintaining the area's traditional low-density character focused on family homes.

This shift from the existing housing composition (currently 95.0% houses) suggests decreasing availability of developable sites and a changing demand for more diverse and affordable housing options. With around 64 people per approval, Thornton-Millers Forest is reflective of an evolving area. According to the latest AreaSearch quarterly estimate, the area is projected to add approximately 18,692 residents by 2041. Development appears to be keeping pace with projected growth, but increasing competition among buyers may arise as the population expands.

Frequently Asked Questions - Development

Infrastructure

Thornton - Millers Forest has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

Infrastructure changes significantly influence an area's performance. AreaSearch identified 24 projects likely impacting the area. Notable ones include Raymond Terrace and Heatherbrae Strategy (2020-2040), Chisholm Plaza, Thornton Rail Bridge Duplication, and Sophia Waters Estate. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Raymond Terrace and Heatherbrae Strategy 2020-2040

A long-term strategic plan to revitalise Raymond Terrace into a strong regional centre. The strategy includes the Raymond Terrace Public Domain Plan, mixed-use precincts, town centre streetscape upgrades, and the delivery of approximately 2,500 new homes by 2041 to support population growth.

East Maitland Catalyst Area

The East Maitland Catalyst Area (EMCA) is a NSW Government-priority precinct for housing acceleration and health services growth. It is planned to deliver up to 4,815 new dwellings over the next 20 years, supported by the new Maitland Hospital (completed 2022), Maitland Private Hospital expansion, and Stockland Green Hills regional shopping centre. A Place Strategy and structure planning are currently underway, funded by the NSW Government's Housing Accelerator Fund and Priority Precincts program.

Stony Pinch Urban Development

Long-term conceptual urban development proposal for the post-mining rehabilitation of the Bloomfield Colliery site in Ashtonfield, lower Hunter Valley. The site spans approximately 3,600 hectares and is envisioned to accommodate up to 19,200 dwellings along with employment lands, town centre, recreation facilities and preserved bushland. The Bloomfield Colliery is currently operational with mining approval until 2035. Specific development timelines and details for the urban transformation remain subject to mine rehabilitation completion and future planning approvals under the Stony Pinch consortium and Ashtonfields Agreement.

Chisholm Plaza

Chisholm Plaza is a $180 million neighbourhood shopping centre in Chisholm, NSW, currently under construction. The centre features triple supermarket anchors (Woolworths, Aldi and Dan Murphys), more than 50 specialty stores, a 112-place childcare centre, swim school, gym, medical centre, dining precinct and tavern. The development provides approximately 15,000 sqm of retail space and over 600 car spaces, targeting a 4-star Green Star rating.

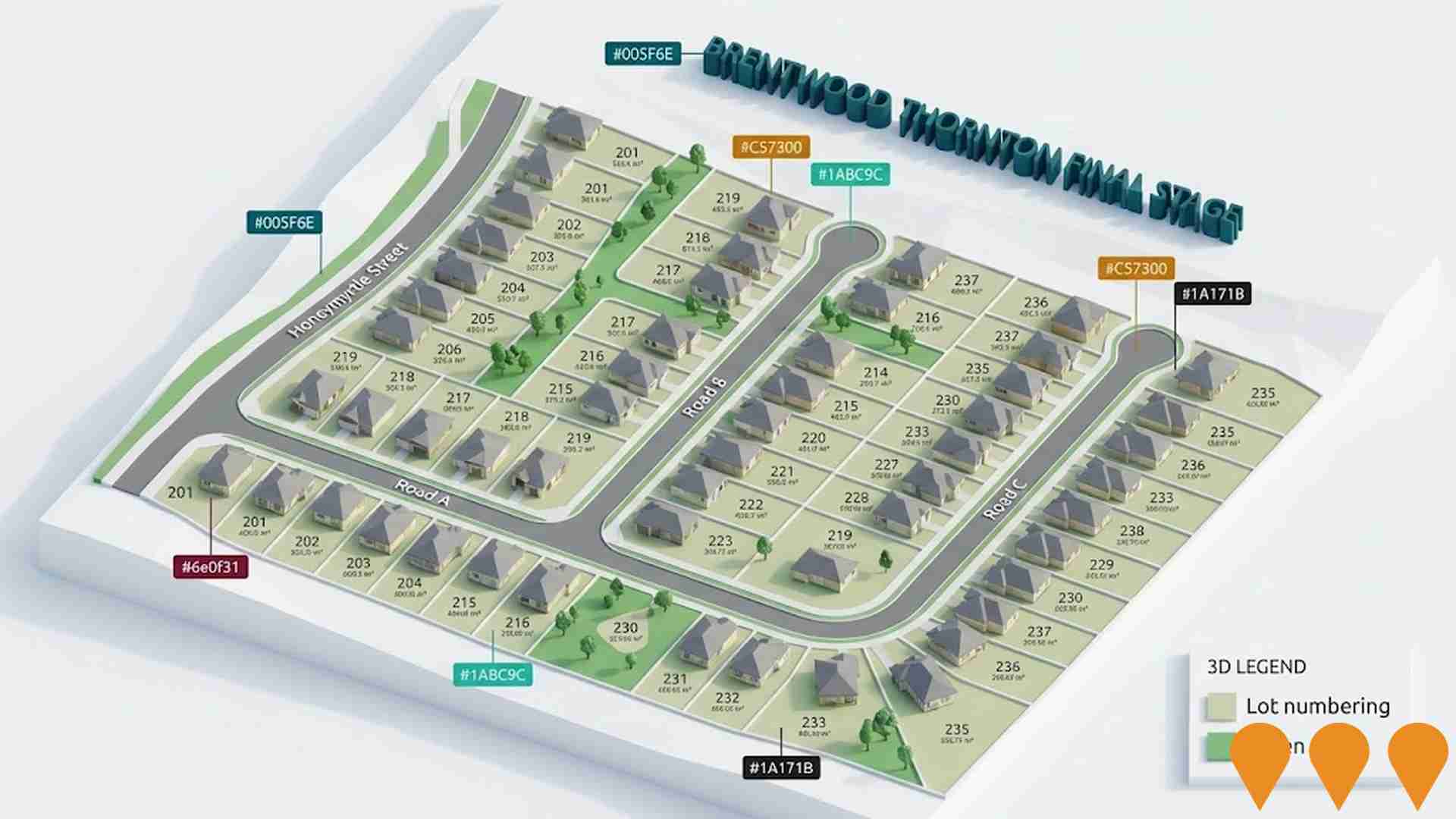

Sophia Waters Estate

Sophia Waters Estate is a major master-planned residential development in Chisholm near Maitland, featuring over 1500 planned dwellings across multiple stages. The estate emphasizes open spaces, extensive landscaping, and community amenities including a new $10 million Maitland Council sportsground scheduled for completion in late 2026. Located in the picturesque Hunter Valley with easy access to Newcastle, Lake Macquarie, and Port Stephens.

Sophia Waters Sportsground

New neighbourhood sportsground in Sophia Waters, Chisholm. Scope includes two mixed sports fields, turf cricket wicket, amenities building with accessible facilities, canteen and storage, irrigation and field lighting, fencing, over 100 parking spaces, and an adjacent playspace. Council started works in May 2025 with completion targeted for late 2026.

Thornton Rail Bridge Duplication

Duplication of the existing Thornton rail bridge to alleviate peak hour congestion and provide a flood-free route connecting northern Maitland to the M1, Pacific Highway and Hunter Expressway. Transport for NSW is currently undertaking early works including road surface surveys to inform design solutions. The project will ease congestion for the 7000 new residents and 3500 new jobs expected in the region over the next 20 years.

Wirraway Thornton

A completed 511-lot residential development spanning 58 hectares in the lower Hunter Valley, creating a parkland community with quality homes for Defence families and the public. Features 16 hectares of open spaces, cycle tracks, Wirraway Park with aviation-themed playground, half-sized basketball court, fitness station, and community amenities. Now home to over 500 families including 250 Defence families.

Employment

Employment conditions in Thornton - Millers Forest demonstrate exceptional strength compared to most Australian markets

Thornton - Millers Forest has an unemployment rate of 2.0% as of June 2025, with 9,695 residents employed. This is 1.7% lower than the Rest of NSW's rate of 3.7%.

The workforce participation rate in Thornton - Millers Forest is 72.2%, compared to Rest of NSW's 56.4%. Employment is concentrated in health care & social assistance, public administration & safety, and retail trade. Public administration & safety employs a particularly high share at 1.3 times the regional level, while agriculture, forestry & fishing employs only 0.9% of local workers, below Rest of NSW's 5.3%. Labour force decreased by 4.2% over a 12-month period ending in June 2025, with employment decreasing by 4.4%, causing unemployment to rise slightly.

In contrast, the Rest of NSW saw employment contract by 0.1%, labour force grow by 0.3%, and unemployment rise by 0.4 percentage points during this period. State-level data from Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. National employment forecasts from May-25 suggest national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Thornton - Millers Forest's employment mix indicates local employment should increase by approximately 6.3% over five years and 13.3% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

The area exhibits notably strong income performance, ranking higher than 70% of areas assessed nationally through AreaSearch analysis

Thornton-Millers Forest SA2 had an average national income level according to ATO data aggregated by AreaSearch for FY 2022. The median income among taxpayers was $55,417 and the average income stood at $64,523, compared to Rest of NSW's figures of $49,459 and $62,998 respectively. By September 2025, estimates suggest the median income would be approximately $62,405 and the average $72,659, based on Wage Price Index growth of 12.61% since FY 2022. According to 2021 Census figures, incomes in Thornton-Millers Forest rank highly nationally, between the 72nd and 78th percentiles for household, family, and personal incomes. Income analysis shows that 40.7% of residents (8,085 individuals) earn $1,500-$2,999 weekly, consistent with broader metropolitan trends at 29.9%. High housing costs consume 15.4% of income, but strong earnings place disposable income at the 78th percentile nationally. The area's SEIFA income ranking places it in the 6th decile.

Frequently Asked Questions - Income

Housing

Thornton - Millers Forest is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Thornton-Millers Forest's dwelling structures, as per the latest Census, consisted of 94.8% houses and 5.3% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro NSW's 87.1% houses and 13.0% other dwellings. Home ownership in Thornton-Millers Forest stood at 23.9%, with mortgaged dwellings at 46.2% and rented ones at 29.9%. The median monthly mortgage repayment was $2,015, higher than Non-Metro NSW's average of $1,862. The median weekly rent in the area was $420, compared to Non-Metro NSW's $375. Nationally, Thornton-Millers Forest's mortgage repayments were higher at $2,015 versus Australia's average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Thornton - Millers Forest features high concentrations of family households, with a higher-than-average median household size

Family households account for 84.4% of all households, including 43.2% couples with children, 29.4% couples without children, and 10.9% single parent families. Non-family households constitute the remaining 15.6%, with lone person households at 12.9% and group households making up 2.8%. The median household size is 2.9 people, larger than the Rest of NSW average of 2.7.

Frequently Asked Questions - Households

Local Schools & Education

Thornton - Millers Forest shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's university qualification rate is 18.8%, significantly lower than the NSW average of 32.2%. This indicates a need for targeted educational initiatives. Bachelor degrees are most common at 13.6%, followed by postgraduate qualifications (3.4%) and graduate diplomas (1.8%). Trade and technical skills are prevalent, with 42.8% of residents aged 15+ holding vocational credentials - advanced diplomas (10.9%) and certificates (31.9%).

Educational participation is high at 30.8%, including 11.1% in primary education, 7.8% in secondary education, and 4.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Thornton-Millers Forest has 114 active public transport stops offering a mix of train and bus services. These stops are served by 107 unique routes, facilitating 5,276 weekly passenger trips in total. Residents enjoy good transport accessibility, with an average distance of 235 meters to the nearest stop.

Service frequency stands at 753 trips per day across all routes, translating to approximately 46 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Thornton - Millers Forest's residents are relatively healthy in comparison to broader Australia with the level of common health conditions among the general population somewhat typical, though higher than the nation's average among older cohorts

Thornton-Millers Forest's health metrics are close to national benchmarks.

Common health conditions among its general population are somewhat typical but higher than the nation's average among older cohorts. The rate of private health cover is approximately 52% of the total population (~10,310 people), slightly leading that of the average SA2 area. Mental health issues and asthma are the most common medical conditions in the area, impacting 10.7 and 9.6% of residents respectively. About 67.4% of residents declare themselves completely clear of medical ailments compared to 63.4% across Rest of NSW. The area has 11.5% of residents aged 65 and over (2,276 people), which is lower than the 15.4% in Rest of NSW. Health outcomes among seniors present some challenges requiring more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Thornton - Millers Forest ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Thornton-Millers Forest, surveyed in 2016, had 88.5% of its population born in Australia, with 93.3% being citizens and 91.9% speaking English only at home. Christianity was the predominant religion, accounting for 56.9%. This is similar to Rest of NSW's 57.0%.

The top three ancestry groups were Australian (32.5%), English (30.4%), and Scottish (7.1%). Notably, Australian Aboriginals were overrepresented at 4.4% compared to the regional average of 5.1%. Welsh (0.6%) and Korean (0.3%) populations also differed from their respective regional averages of 0.6% and 0.1%.

Frequently Asked Questions - Diversity

Age

Thornton - Millers Forest's young demographic places it in the bottom 15% of areas nationwide

The median age in Thornton-Millers Forest is 33 years, which is significantly lower than the Rest of NSW average of 43 and also substantially under the national average of 38. Compared to the Rest of NSW average, the 25-34 age cohort is notably over-represented at 17.6% locally, while the 65-74 year-olds are under-represented at 7.1%. Post-2021 Census data shows that the 35 to 44 age group has increased from 14.6% to 16.0% of the population. Conversely, the 55 to 64 cohort has decreased from 10.4% to 8.9%, and the 45 to 54 age group has dropped from 11.7% to 10.5%. Population forecasts for 2041 indicate significant demographic changes in Thornton-Millers Forest, with the 35 to 44 age group projected to grow by 102%, reaching 6,423 people from the current 3,182.