Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Chisholm lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

The population of the Chisholm (NSW) statistical area (Lv2) is estimated to be around 7,070 as of November 2025. This figure reflects an increase of 2,493 people since the 2021 Census, which reported a population of 4,577. The change is inferred from AreaSearch's estimation of the resident population at 6,792 following examination of the latest ERP data release by the ABS in June 2024 and an additional 867 validated new addresses since the Census date. This level of population equates to a density ratio of 952 persons per square kilometer. The Chisholm (NSW) (SA2)'s growth rate of 54.5% since the 2021 census exceeded both the non-metro area's 5.7% and the state's growth rates, marking it as a growth leader in the region. Population growth was primarily driven by interstate migration contributing approximately 71.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area released in 2024 with 2022 as the base year, and NSW State Government's SA2 level projections released in 2022 with 2021 as the base year for areas not covered by this data. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. According to demographic trends, exceptional growth is predicted over the period, with the area expected to grow by 5,665 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of 57.1% in total over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Chisholm was found to be higher than 90% of real estate markets across the country

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, Chisholm averaged approximately 241 new dwelling approvals per year over the past five financial years, totalling an estimated 1,208 homes. As of FY-26 so far, 99 approvals have been recorded. On average, 1.4 new residents were associated with each dwelling constructed between FY-21 and FY-25. The supply and demand appear well-balanced, creating stable market conditions, while new properties are constructed at an average expected cost of $393,000.

This financial year has seen approximately $4.4 million in commercial approvals, indicating limited commercial development focus compared to residential. Compared to the Rest of NSW, Chisholm records 344.0% more development activity per person, offering greater choice for buyers despite recent moderation in development activity. This is well above the national average, reflecting strong developer confidence in the area. New building activity shows approximately 75.0% detached dwellings and 25.0% attached dwellings, maintaining Chisholm's traditional low density character with a focus on family homes appealing to those seeking space. This represents a considerable change from the current housing mix, which is currently 100.0% houses, reflecting reduced availability of development sites and shifting lifestyle demands and affordability requirements. With approximately 27 people per approval, Chisholm reflects a developing area.

Population forecasts indicate that Chisholm will gain an estimated 4,039 residents through to 2041 based on the latest AreaSearch quarterly estimate. Given current development patterns, new housing supply should readily meet demand, offering good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Chisholm has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Eleven projects identified by AreaSearch are expected to impact the area significantly, with key ones including Chisholm Plaza, Raymond Terrace and Heatherbrae Strategy 2020-2040, Sophia Waters Estate, and Sophia Waters Sportsground. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Raymond Terrace and Heatherbrae Strategy 2020-2040

A comprehensive 20-year strategic framework for the revitalization of Raymond Terrace and Heatherbrae. Key initiatives include the award-winning Public Domain Plan (PDP), town centre streetscape upgrades on William and Adelaide Streets, and the creation of a community civic hub. The strategy aims to deliver approximately 2,500 new homes by 2041, supported by $50 million in proposed stormwater upgrades and significant infrastructure projects like the M1 Pacific Motorway extension to Heatherbrae.

Maitland Local Housing Strategy 2041

The Maitland Local Housing Strategy 2041 is a comprehensive framework adopted by Council in June 2023 and endorsed by the NSW Government in September 2024. It manages residential growth to accommodate a projected population increase of 54,800 residents by 2041. The strategy prioritizes housing diversity, infill development, and the '15-minute neighborhood' concept, aiming to deliver approximately 25,200 additional dwellings. Recent implementation milestones include the adoption of the Residential Density Guide in October 2025 to support affordable housing delivery.

East Maitland Catalyst Area

The East Maitland Catalyst Area (EMCA) is a strategic growth precinct focused on housing acceleration and health service expansion. The project centers on the draft EMCA Structure Plan, which outlines changes to land use and zoning to support approximately 3,000 to 4,000 new dwellings and 6,500 additional residents by 2045. Key anchors include the new Maitland Hospital, Maitland Private Hospital, and Stockland Green Hills. The plan emphasizes infill development, medium-density housing within walking distance of transport, and improved infrastructure to manage regional growth.

Stony Pinch Urban Development

A major long-term urban transformation project involving the post-mining rehabilitation of the 3,600-hectare Bloomfield Colliery site. The conceptual masterplan envisions a significant mixed-use precinct comprising up to 19,200 dwellings, a dedicated town centre, employment lands, and extensive recreation facilities, while preserving substantial bushland corridors. The site is strategically located near the intersection of the Pacific Highway and New England Highway, identified as a future freight and employment hub. Current operations at the colliery are approved until 2030, with a pending modification to extend mining activities to 2035 to facilitate a stable final landform for future urban use.

M1 Pacific Motorway Extension to Raymond Terrace

A $2.1 billion, 15-kilometre dual carriageway motorway extension from Black Hill to Raymond Terrace, bypassing Hexham and Heatherbrae. As of early 2026, the project is over 70% complete, with all bridge foundations finished and the 2.6-kilometre viaduct over the Hunter River seeing significant progress. Key features include four new interchanges and the widening of the Hexham Straight. The extension is designed to remove up to 25,000 vehicles per day from local congestion points and reduce travel times by up to nine minutes.

Raymond Terrace Housing Delivery Program

A comprehensive Council-led urban renewal initiative aimed at delivering 11,100 new dwellings by 2041. The program focuses on increasing housing diversity and affordability through the Raymond Terrace and Heatherbrae Strategy. Key components include the Raymond Terrace Sub-Precincts Master Plan, developed in collaboration with Homes NSW to accelerate affordable housing supply, and a Public Domain Plan for the town centre. Recent updates in 2025/2026 highlight Council's success in exceeding development application targets and maintaining the fastest DA processing times in the Hunter region.

Chisholm Plaza

Chisholm Plaza is a $180 million neighbourhood shopping centre currently under construction in the Waterford Estate. The 15,000 sqm development is triple-anchored by Woolworths, Aldi, and Dan Murphys, and will include over 50 specialty stores. The precinct features a 112-place childcare centre, swim school, gym, medical centre, and a dining precinct with a tavern. The project targets a 4-star Green Star rating and will provide over 600 car spaces to support the growing Maitland region.

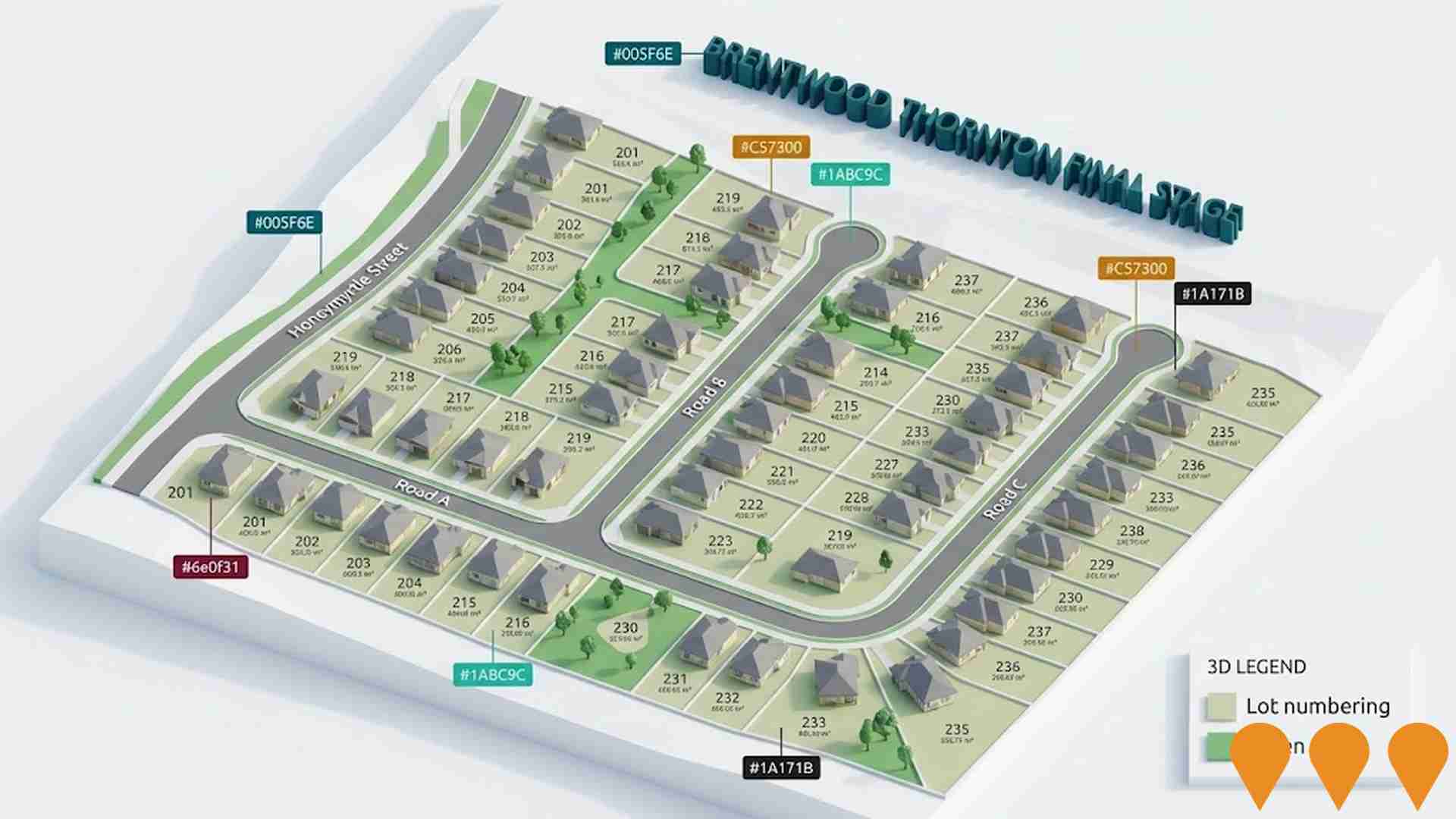

Sophia Waters Estate

Sophia Waters Estate is a major master-planned residential development in Chisholm near Maitland, featuring over 1500 planned dwellings across multiple stages. The estate emphasizes open spaces, extensive landscaping, and community amenities including a new $10 million Maitland Council sportsground scheduled for completion in late 2026. Located in the picturesque Hunter Valley with easy access to Newcastle, Lake Macquarie, and Port Stephens.

Employment

AreaSearch analysis of employment trends sees Chisholm performing better than 90% of local markets assessed across Australia

Chisholm has a skilled workforce with 2,962 residents employed as of September 2025. The unemployment rate is 0.6%.

This is lower than the Rest of NSW's rate of 3.8%, and workforce participation is higher at 78.0% compared to 56.4%. Key employment industries include health care & social assistance, education & training, and construction. Mining has a notable concentration with employment levels at 2.0 times the regional average. Agriculture, forestry & fishing have limited presence with 0.4% employment compared to 5.3% regionally.

Over the 12 months to September 2025, labour force levels decreased by 1.6%, alongside a 1.4% employment decline, resulting in an unemployment rate fall of 0.2 percentage points. This contrasts with Rest of NSW where employment contracted by 0.5%, the labour force fell by 0.1%, and unemployment rose by 0.4 percentage points. State-level data to 25-Nov shows NSW employment contracted by 0.03% (losing 2,260 jobs), with a state unemployment rate of 3.9%. National employment forecasts from May-25 suggest national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Chisholm's employment mix suggests local employment should increase by 6.5% over five years and 13.6% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch released postcode level ATO data for financial year 2023. Chisholm suburb had a median income among taxpayers of $68,549 and an average of $79,813, ranking high nationally compared to Rest of NSW's median of $52,390 and average of $65,215. By September 2025, estimates project a median income of approximately $74,622 and an average of $86,884 based on Wage Price Index growth since financial year 2023. The 2021 Census shows household, family, and personal incomes in Chisholm rank highly nationally, between the 89th and 94th percentiles. Income distribution indicates that 39.0% of locals (2,757 people) earn between $1,500 - 2,999, similar to the surrounding region at 29.9%. Economic strength is evident with 43.3% of households earning high weekly incomes exceeding $3,000, supporting elevated consumer spending. High housing costs consume 16.0% of income, but strong earnings place disposable income at the 94th percentile nationally. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Chisholm is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

In Chisholm, as per the latest Census evaluation, 99.6% of dwellings were houses, with the remaining 0.4% comprising semi-detached homes, apartments, and other types of dwellings. This is in contrast to Non-Metro NSW's dwelling structure, which consisted of 87.1% houses and 13.0% other dwellings. Home ownership in Chisholm stood at 18.9%, with mortgaged dwellings making up 61.7% and rented ones comprising 19.4%. The median monthly mortgage repayment in the area was $2,344, exceeding Non-Metro NSW's average of $1,862. The median weekly rent figure in Chisholm was recorded at $550, compared to Non-Metro NSW's $375. Nationally, Chisholm's mortgage repayments were significantly higher than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Chisholm features high concentrations of family households, with a higher-than-average median household size

Family households constitute 92.2% of all households, including 56.5% couples with children, 28.4% couples without children, and 6.2% single parent families. Non-family households account for the remaining 7.8%, with lone person households at 6.6% and group households comprising 1.7% of the total. The median household size is 3.2 people, which is larger than the Rest of NSW average of 2.7.

Frequently Asked Questions - Households

Local Schools & Education

Chisholm shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Chisholm's residents aged 15+ have a higher proportion of university qualifications (27.3%) compared to the broader SA4 region (15.2%) and SA3 area (17.6%). Bachelor degrees are most common at 19.0%, followed by postgraduate qualifications (5.4%) and graduate diplomas (2.9%). Vocational credentials are also prominent, with 42.0% of residents holding them, including advanced diplomas (13.5%) and certificates (28.5%). Educational participation is high at 34.3%, with 14.0% in primary education, 8.1% in secondary education, and 4.4% pursuing tertiary education.

Educational participation is notably high, with 34.3% of residents currently enrolled in formal education. This includes 14.0% in primary education, 8.1% in secondary education, and 4.4% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Chisholm has 26 active public transport stops, all of which are bus stops. These stops are served by 48 different routes that together offer 365 weekly passenger trips. The transport system in Chisholm is rated as good, with residents on average located 271 meters from the nearest stop.

On average, there are 52 trips per day across all routes, which equates to approximately 14 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Chisholm's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Health outcomes data shows excellent results across Chisholm, with younger cohorts experiencing particularly low prevalence of common health conditions. The rate of private health cover stands at approximately 58% of the total population (4,131 people), compared to 54.8% across Rest of NSW.

Mental health issues and asthma are the most prevalent medical conditions in the area, affecting 9.1 and 8.1% of residents respectively. A significant 73.7% of residents report being completely clear of medical ailments, higher than the 63.4% reported across Rest of NSW. The area has 8.0% of residents aged 65 and over (565 people), which is lower than the 15.4% in Rest of NSW. While health outcomes among seniors are above average, they require more attention compared to the broader population.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Chisholm records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Chisholm's population, born in Australia, is 84.1%, with 92.6% being citizens and 87.0% speaking English only at home, aligning with the wider region's averages. Christianity is the predominant religion in Chisholm at 60.7%, slightly higher than the Rest of NSW average of 57.0%. The top three ancestry groups in Chisholm are Australian (30.4%), English (29.4%), and Scottish (6.9%).

Notably, Korean (0.7% vs regional 0.1%) and Indian (4.3% vs regional 0.8%) groups are overrepresented in Chisholm, while Welsh representation is similar to the region at 0.6%.

Frequently Asked Questions - Diversity

Age

Chisholm hosts a very young demographic, ranking in the bottom 10% of areas nationwide

The median age in Chisholm is 32 years, which is notably lower than Rest of NSW's average of 43 and also substantially under the Australian median of 38. Relative to Rest of NSW, Chisholm has a higher concentration of residents aged 35-44 at 20.9%, but fewer residents aged 65-74 at 5.3%. This concentration of residents aged 35-44 is well above the national average of 14.2%. According to data from the 2021 Census, the proportion of residents aged 35 to 44 has grown from 19.4% to 20.9%, while the proportion of residents aged 55 to 64 has declined from 8.2% to 6.8%. By the year 2041, Chisholm is expected to see notable shifts in its age composition, with the 35 to 44 age group projected to grow by 66%, adding 972 people and reaching a total of 2,450 residents from the current figure of 1,477.