Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Cleveland are slightly above average based on AreaSearch's ranking of recent, and medium term trends

As of Nov 2025, Cleveland's population is estimated at around 17,561. This reflects an increase of 1,711 people since the 2021 Census, which reported a population of 15,850. The change was inferred from AreaSearch's estimate of the resident population at 16,769 following examination of ABS data released in June 2024 and an additional 280 validated new addresses since the Census date. This level of population equates to a density ratio of 1,492 persons per square kilometer. Cleveland's growth rate of 10.8% since the 2021 census exceeded both the SA4 region at 8.2% and the national average. Overseas migration contributed approximately 57.99999999999999% of overall population gains during recent periods for Cleveland (Qld) statistical area (Lv2).

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. Considering projected demographic shifts, the Cleveland (Qld) (SA2) is expected to increase by 2,547 persons to 2041, reflecting an increase of 10.0% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Cleveland among the top 25% of areas assessed nationwide

AreaSearch analysis of ABS building approval numbers shows Cleveland recorded approximately 130 residential property approvals per year over the past five financial years, totalling an estimated 651 homes. As of FY26110 approvals have been recorded. The average population growth per dwelling built between FY21 and FY25 was 1.4 people, indicating balanced supply and demand with stable market conditions. Developers target the premium market segment with new homes averaging $562,000 in construction cost value.

In FY26, Cleveland has registered $42.0 million in commercial approvals, reflecting high local commercial activity. Compared to Greater Brisbane, Cleveland has 18.0% less building activity per person but ranks among the 82nd percentile nationally. New building activity comprises 41.0% standalone homes and 59.0% townhouses or apartments, promoting higher-density living for affordability and lifestyle demands. This marks a shift from the current housing mix of 60.0% houses due to reduced development sites availability. Cleveland has approximately 128 people per dwelling approval, suggesting an expanding market.

By 2041, AreaSearch projects Cleveland's population to grow by 1,755 residents, with current development patterns expected to meet demand and potentially facilitate further growth beyond projections.

Frequently Asked Questions - Development

Infrastructure

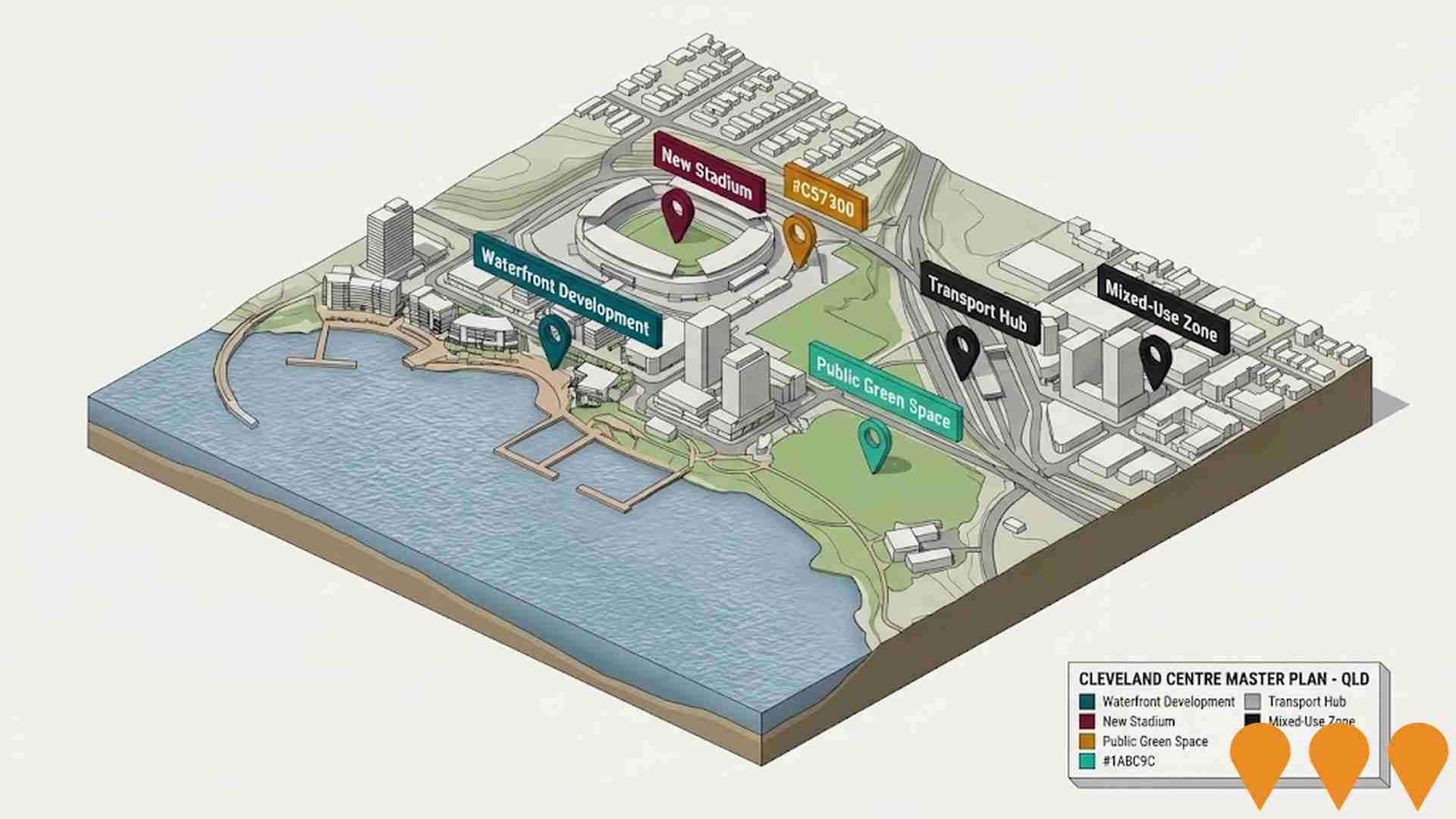

Cleveland has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 15 projects that may impact the area. Notable ones are Redland Hospital Expansion, Redlands Coast Smart and Connected City Strategy, Redlands Health and Wellness Precinct, and Redlands Research Station Expansion. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Redland Hospital Expansion

Multi-stage expansion of Redland Hospital. Stage 1 ($78M) delivered a new clinical services building with a 12-bed ICU and 37 inpatient beds, opening as the Amity Ward in mid-2025. This stage won the 2025 Health Facilities Award. Current Stage 2 ($150M) involves the construction of a new 43-bed Mental Health and sub-acute building (providing 20 net new beds). Once the new mental health facility is complete, the old building will be demolished to facilitate future master plan expansions. Additional completed works include a 1,000+ space multi-level car park and the 28-bed Lagoon Ward.

Redlands Health and Wellness Precinct

The Redlands Health and Wellness Precinct is a master-planned healthcare hub focused on the multi-stage expansion of Redland Hospital and its integration with Mater Private Hospital Redland. Key components include a $78 million Stage 1 expansion delivering a new ICU and 37 inpatient beds (Amity Ward opened June 2025), and a $150 million Stage 2 expansion featuring a new 20-bed mental health facility and clinical ward. The precinct also integrates Mater Private's recent $70 million surgical upgrade and aims to incorporate aged care, research, and education facilities to support the region's growing population.

Cleveland Line Duplication (Park Road to Cleveland)

Major rail capacity project involving the partial duplication of the Cleveland Line, specifically focusing on the single-track sections between Lindum and Cleveland. The project aims to improve service frequency to 15-minute intervals and enhance reliability in coordination with the Cross River Rail network integration. Key works include track doubling, station accessibility upgrades at Lindum and other precincts, level crossing removals, and the implementation of advanced signalling systems to support the Brisbane 2032 Olympic and Paralympic Games.

Toondah Harbour Priority Development Area

Walker Corporation is progressing a revised 'land-side only' concept plan for the Toondah Harbour PDA as of early 2026. This follows the 2024 withdrawal of the original $1.39 billion masterplan due to federal environmental concerns regarding Ramsar wetlands. The new draft concept is significantly scaled back to approximately 900 apartments, 50% more free public parking, and essential ferry terminal upgrades. The proposal avoids development in GJ Walter Park and focuses on revitalising the existing port and waterfront footprint to ensure environmental protection of Moreton Bay while maintaining its role as the gateway to North Stradbroke Island (Minjerribah).

RPAC Forecourt Redevelopment

An exciting $3 million transformation of the Redland Performing Arts Centre (RPAC) forecourt to improve accessibility and create a welcoming entrance. The project includes a revitalised entrance, covered alfresco area, permanent seating, small outdoor performance deck, improved accessibility, increased lighting, new ramp and stair access, garden areas, and better linkage to Cleveland CBD.

Redlands Coast Smart and Connected City Strategy

Ongoing multi-year initiative by Redland City Council to enhance liveability, prosperity, and sustainability through smart solutions, including digital infrastructure, IoT sensors, smart traffic systems, and data-driven management. Focus areas include liveability, productivity, innovation, sustainability, and governance. Examples of initiatives: RACQ Smart Shuttle driverless bus trial, smart koala monitoring, and intelligent water monitoring programs. The strategy supports regional collaboration, such as the SEQ Smart Region Digital Plan.

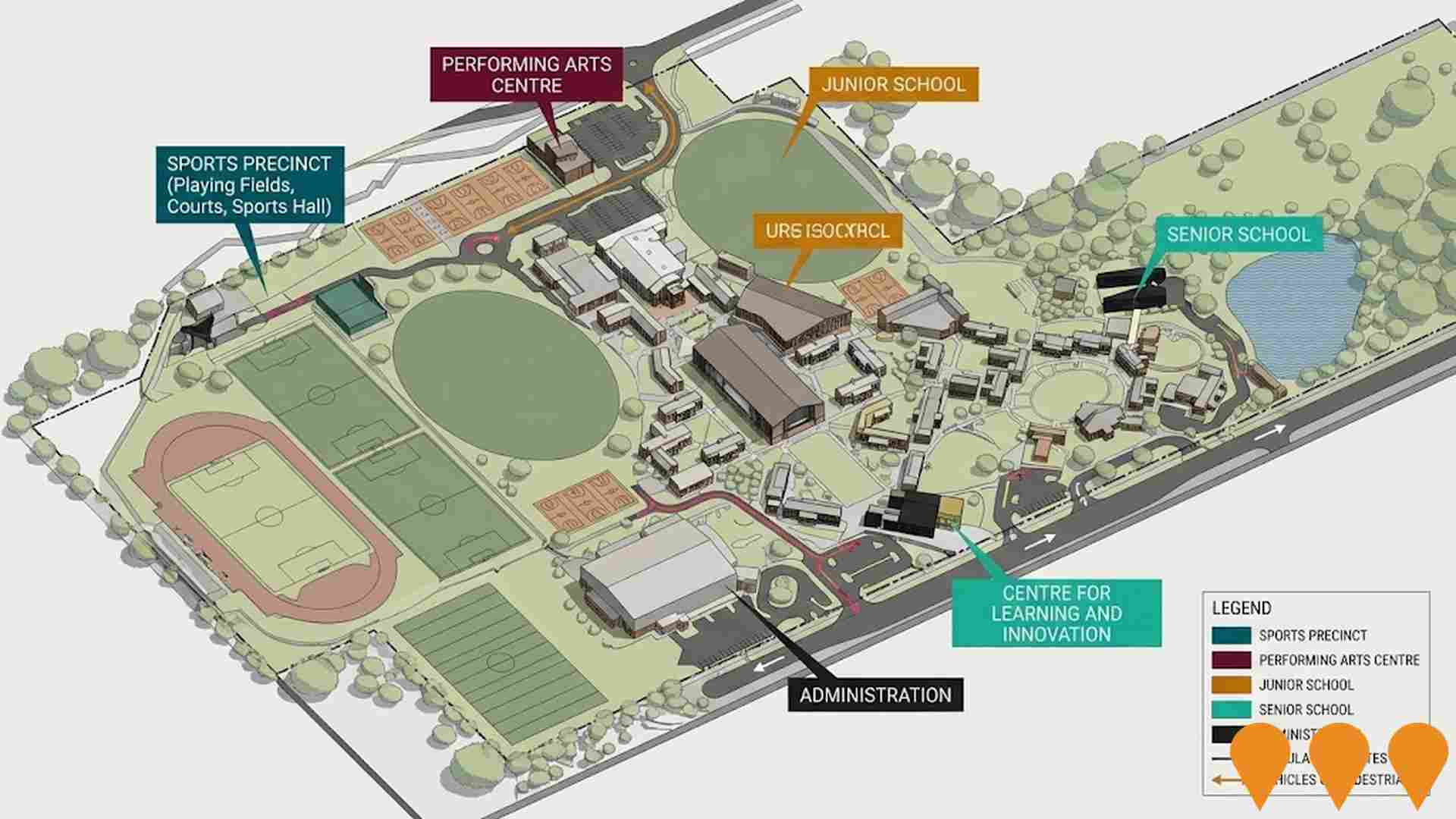

Ormiston College Master Plan Redevelopment

Multi-stage campus expansion including new Performing Arts Centre, STEM facilities and sports precinct upgrades, currently under construction.

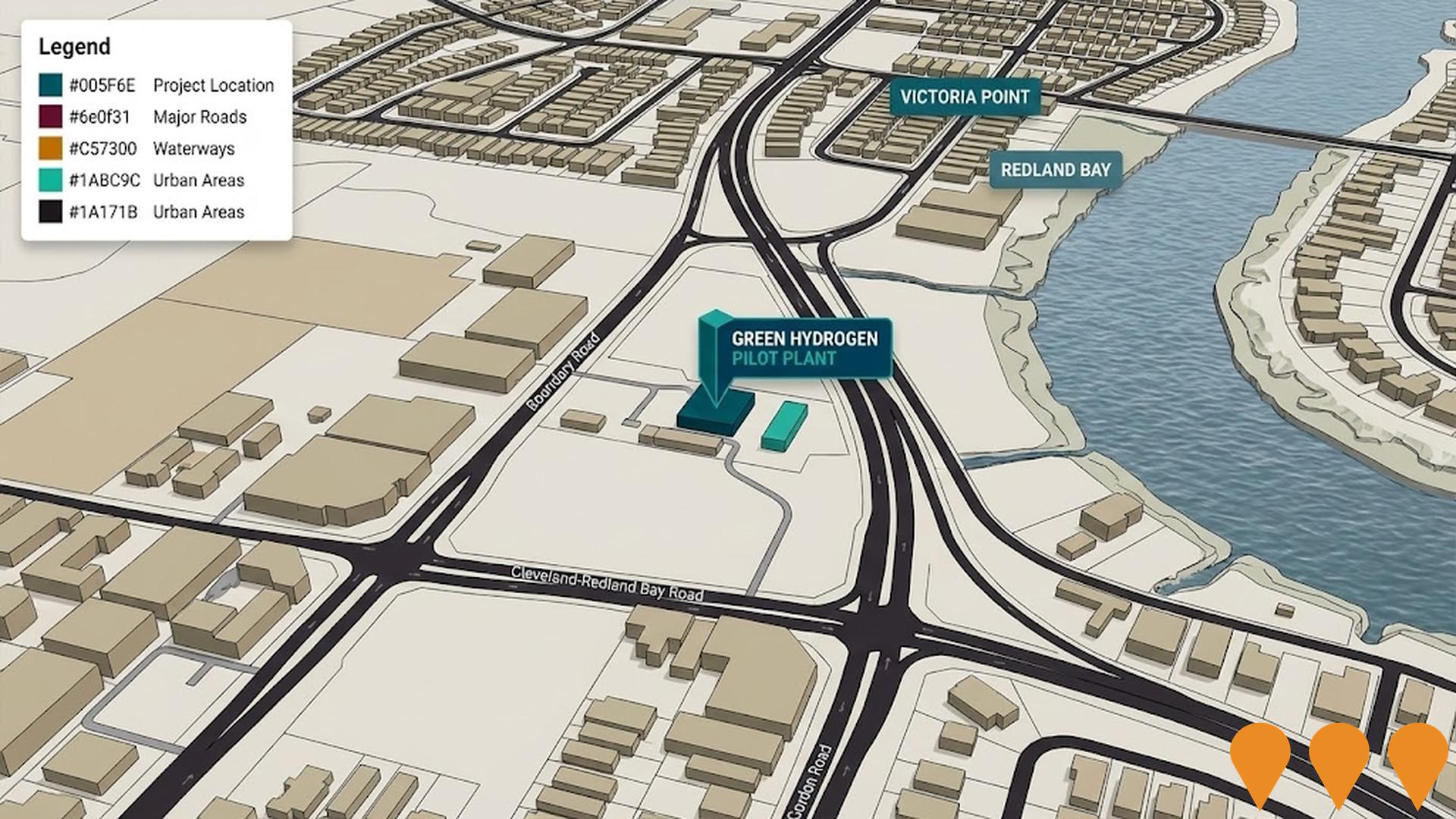

Redlands Research Station - Green Hydrogen Pilot Plant

Queensland University of Technology's cutting-edge green hydrogen research and production facility at the Redlands Research Station. The $7.5 million 50kW H2Xport pilot plant uses locally produced solar energy and battery storage to extract hydrogen from non-treated water through advanced electrolysis technology. It includes renewable energy integration, pilot programs for hydrogen storage and distribution systems, and collaborative research with CSIRO, UQ, government, and industry partners. The facility supports Queensland's renewable energy transition and sustainable hydrogen technologies for export markets.

Employment

AreaSearch analysis places Cleveland well above average for employment performance across multiple indicators

Cleveland has a skilled workforce with well-represented essential services sectors. Its unemployment rate was 2.8% in the past year, with estimated employment growth of 6.1%.

As of September 2025, 8,605 residents were employed while the unemployment rate was 1.2% lower than Greater Brisbane's rate of 4.0%. Workforce participation lagged at 53.2%, compared to Greater Brisbane's 64.5%. Key industries of employment among residents were health care & social assistance, construction, and retail trade. Construction had notable concentration with employment levels at 1.3 times the regional average.

Conversely, professional & technical services showed lower representation at 7.8% versus the regional average of 8.9%. The worker-to-resident ratio was 0.6, indicating above-normal local employment opportunities. Between September 2024 and September 2025, employment levels increased by 6.1% and labour force grew by 5.9%, reducing unemployment by 0.2 percentage points. In comparison, Greater Brisbane recorded employment growth of 3.8%, labour force growth of 3.3%, with unemployment falling 0.5 percentage points. State-level data to November 25 showed Queensland's employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project national employment growth of 6.6% over five years and 13.7% over ten years, with varying rates across industry sectors. Applying these projections to Cleveland's employment mix suggests local employment should increase by 6.6% over five years and 13.6% over ten years, though this is a simple extrapolation for illustrative purposes and does not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

According to AreaSearch's aggregation of the latest postcode level ATO data released for financial year 2023, Cleveland had a median income among taxpayers of $53,426. The average income stood at $83,585. Nationally, these figures are extremely high, with median and average incomes of $58,236 and $72,799 respectively across Greater Brisbane. Based on Wage Price Index growth of 9.91% since financial year 2023, current estimates for Cleveland would be approximately $58,721 (median) and $91,868 (average) as of September 2025. According to the 2021 Census, household, family, and personal incomes in Cleveland rank modestly, between the 31st and 38th percentiles. Income distribution data shows that 26.4% of the population, equating to 4,636 individuals, fall within the $1,500 - $2,999 income range, reflecting regional patterns where 33.3% similarly occupy this range. Housing affordability pressures are severe in Cleveland, with only 82.1% of income remaining after housing costs, ranking at the 28th percentile. The area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Cleveland displays a diverse mix of dwelling types, with above-average rates of outright home ownership

The latest Census evaluation in Cleveland showed that 60.5% of dwellings were houses, with the remaining 39.4% being semi-detached, apartments, or other types. In Brisbane metro, 83.9% were houses and 16.1% were other dwellings. Home ownership in Cleveland was at 40.5%, compared to mortgaged dwellings at 28.9% and rented ones at 30.5%. The median monthly mortgage repayment in Cleveland was $2,000, matching Brisbane metro's average, while the median weekly rent was $400, slightly lower than Brisbane metro's $425. Nationally, Cleveland's mortgage repayments were higher at $2,000 compared to the Australian average of $1,863, and rents were also higher at $400 against the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Cleveland features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 67.0% of all households, including 23.5% couples with children, 31.2% couples without children, and 11.3% single parent families. Non-family households account for the remaining 33.0%, with lone person households at 31.0% and group households comprising 2.1%. The median household size is 2.3 people, which is smaller than the Greater Brisbane average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Cleveland performs slightly above the national average for education, showing competitive qualification levels and steady academic outcomes

Educational qualifications in Cleveland trail regional benchmarks: 22.7% of residents aged 15+ hold university degrees, compared to 30.5% in Greater Brisbane. This gap highlights potential for educational development and skills enhancement. Bachelor degrees lead at 15.8%, followed by postgraduate qualifications (4.4%) and graduate diplomas (2.5%). Trade and technical skills feature prominently: 39.2% of residents aged 15+ hold vocational credentials, with advanced diplomas at 13.4% and certificates at 25.8%.

A substantial 24.3% of the population actively pursues formal education, including 8.3% in secondary education, 7.7% in primary education, and 3.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Public transport analysis reveals 87 active transport stops operating within Cleveland. These comprise a mix of train and bus services. They are serviced by 36 individual routes, collectively providing 2,198 weekly passenger trips.

Transport accessibility is rated as good, with residents typically located 253 meters from the nearest transport stop. Service frequency averages 314 trips per day across all routes, equating to approximately 25 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Cleveland is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Health data indicates significant health challenges in Cleveland, with high prevalence of common conditions across both younger and older age groups. Approximately 60% (10,592 people) have private health cover, compared to 55.4% in Greater Brisbane.

The most prevalent medical conditions are arthritis (11.1%) and mental health issues (8.6%). However, 61.5% of residents report no medical ailments, compared to 64.6% in Greater Brisbane. Cleveland has a higher proportion of seniors aged 65 and over at 33.4% (5,865 people), compared to 25.3% in Greater Brisbane. Despite this, health outcomes among seniors are challenging but perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Cleveland was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Cleveland has a cultural diversity level above average, with 9.1% of its population speaking a language other than English at home and 30.4% born overseas. Christianity is the predominant religion in Cleveland, comprising 55.4% of the population, compared to 52.8% across Greater Brisbane. The top three ancestry groups in Cleveland are English (34.2%), Australian (21.5%), and Irish (9.4%).

Notably, South African ethnicity is overrepresented at 1.0%, New Zealand at 1.1%, and Scottish at 9.1%.

Frequently Asked Questions - Diversity

Age

Cleveland ranks among the oldest 10% of areas nationwide

Cleveland has a median age of 52 years, which is notably higher than Greater Brisbane's median age of 36. This figure is also considerably older than the national norm of 38 years. Comparing Cleveland's age distribution with that of Greater Brisbane, the 75-84 cohort is notably over-represented in Cleveland at 13.1%, while the 25-34 year-olds are under-represented at 5.4%. This concentration of the 75-84 age group is well above the national average of 6.0%. Between 2021 and the present, the percentage of Cleveland's population in the 75 to 84 age group has grown from 10.3% to 13.1%. Conversely, the proportion of 25 to 34 year-olds has declined from 7.4% to 5.4%, and the percentage of the 5-14 age group has dropped from 10.2% to 9.1%. Demographic modeling suggests that Cleveland's age profile will evolve significantly by 2041. The 75 to 84 age cohort is projected to grow significantly, expanding by 1,277 people (56%) from 2,300 to 3,578. Notably, the combined 65+ age groups are projected to account for 89% of total population growth, reflecting the area's aging demographic profile. In contrast, population declines are projected for the 0-4 and 15-24 cohorts.