Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Brooklyn lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Brooklyn (Vic.) population estimated at 2,585 as of Nov 2025. This is an increase of 606 people since the 2021 Census, which reported a population of 1,979. The change was inferred from AreaSearch's estimate of 2,254 residents following examination of ABS ERP data release (June 2024) and validation of 113 new addresses. This results in a density ratio of 471 persons per square kilometer. Brooklyn's growth rate of 30.6% since the 2021 Census exceeds the national average of 9.7%. Overseas migration contributed approximately 73.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch uses VIC State Government's Regional/LGA projections from 2023, adjusted employing weighted aggregation method to SA2 levels. Growth rates by age group are applied across all areas for years 2032 to 2041. Future population increase in the top quartile of statistical areas is forecasted, with Brooklyn (Vic.) expected to increase by 631 persons to 2041, reflecting a total increase of 6.9% over 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Brooklyn when compared nationally

AreaSearch analysis of ABS building approval numbers shows Brooklyn recorded approximately 45 residential properties approved annually. Over the past five financial years, from FY21 to FY25, around 228 homes were approved, with a further 20 approved in FY26 so far. On average, 0.3 people per year moved to the area for each dwelling built over these five years, indicating supply meeting or exceeding demand and supporting potential population growth while offering greater buyer choice.

The average construction value of new homes was $392,000. This financial year has seen $52.3 million in commercial approvals, suggesting strong local business investment. New development consists of 21% detached houses and 79% attached dwellings, a shift from the current housing mix of 53% houses, reflecting reduced development site availability and changing lifestyle demands and affordability requirements. Brooklyn has around 51 people per dwelling approval, indicating growth area characteristics.

Population forecasts estimate Brooklyn will gain 179 residents by 2041. Based on current development patterns, new housing supply should meet demand, offering favourable conditions for buyers and potentially facilitating population growth beyond projections.

Frequently Asked Questions - Development

Infrastructure

Brooklyn has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

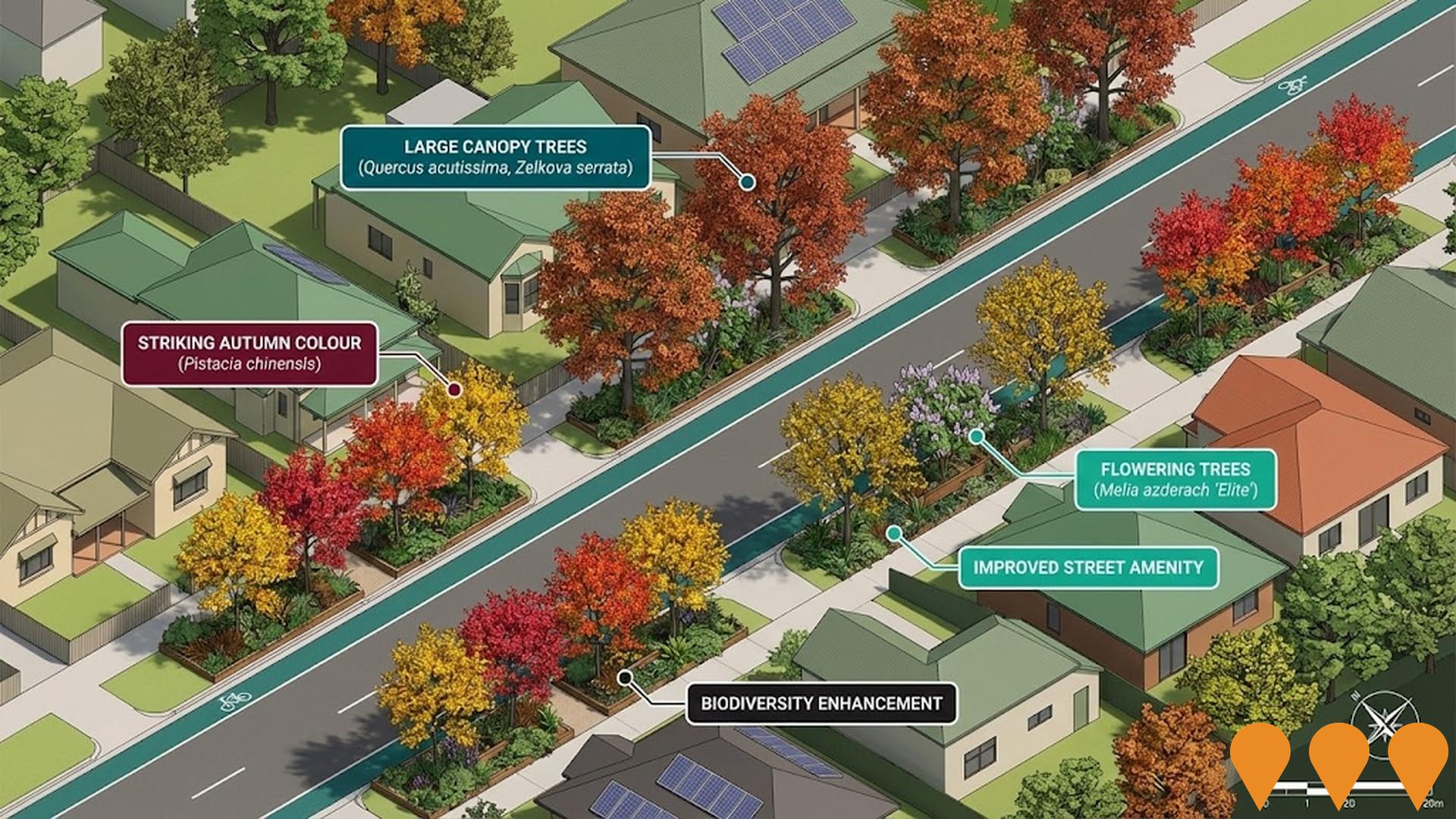

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified eight projects likely to affect the region. Notable ones are The Fabric Altona North, Altona North Strategic Site, RBR Hub Industrial Estate, and Green Streets Program. The following details these projects in order of relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

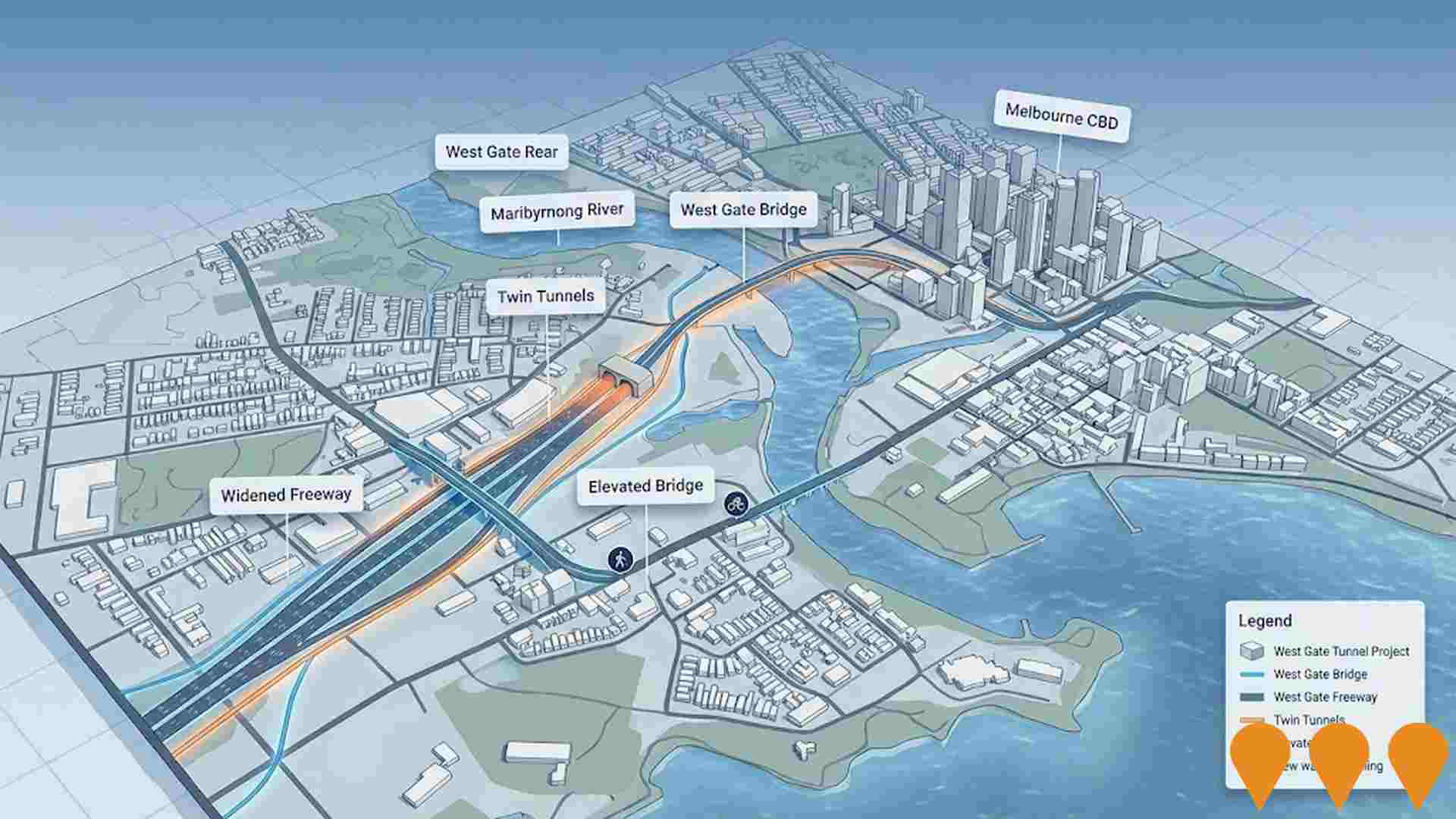

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sunshine Priority Precinct Vision 2050

The Sunshine Priority Precinct Vision 2050 is a major urban renewal strategy to establish Sunshine as the capital of Melbournes west. It leverages over $20 billion in total infrastructure investment, including the $4.1 billion Sunshine Superhub and the Albion Station redevelopment. The vision aims to accommodate 43,000 new residents and up to 50,000 new jobs by 2051, focused on health, education, and manufacturing. Key components include the Sunshine Station Precinct Masterplan ($143 million for stage one works starting in 2026), the Albion Quarter Structure Plan, and the 54-hectare Sunshine Energy Park vision.

Braybrook Activity Centre (Tottenham Station)

The Braybrook Activity Centre planning is a state-led urban renewal initiative focused on the Tottenham Station precinct and its 800m walkable catchment. Integrated into the Victorian Government's expanded Activity Centres Program, the project aims to deliver up to 10,000 new dwellings by 2051. The plan facilitates significant housing growth through new built-form controls, including a 'core' area for taller buildings near the station and lower-scale townhouses in the surrounding catchment. Key objectives include the renewal of public housing stock, improved community facilities, enhanced transport links to the Sunbury Line and Metro Tunnel, and the revitalisation of open spaces like Stony Creek. Phase 2 community consultation for this centre is scheduled from February 11 to March 22, 2026.

West Gate Tunnel Project

A city-shaping infrastructure project delivered as a public-private partnership between the Victorian Government and Transurban. The project features 17km of new road including twin tunnels under Yarraville (2.8km inbound, 4km outbound), a massive widening of the West Gate Freeway from 8 to 12 lanes, and a second river crossing over the Maribyrnong River. It includes an elevated road above Footscray Road with a 2.5km 'veloway' and 14km of total new walking and cycling paths. The project officially opened to traffic on 14 December 2025, providing a vital alternative to the West Gate Bridge and removing over 9,000 trucks daily from local residential streets.

Western Rail Plan

The Western Rail Plan is an umbrella program to deliver a faster, high-capacity rail network for Melbourne's growing western suburbs and regional connections. Key components include the Sunshine Superhub upgrades (realigning tracks from West Footscray to Albion to enable >40 trains/hour), preparation for Melbourne Airport Rail integration, and future electrification/extension of metro services to Melton and Wyndham Vale. Geelong Fast Rail components have been discontinued by the Commonwealth; focus is now on capacity enhancements and electrification planning via ongoing business cases and detailed design (supported by $130m joint funding). Works on the Sunshine Superhub are due to commence early 2026 for completion around 2030.

Whitten Oval Redevelopment

The completed redevelopment of the iconic Whitten Oval, home of the Western Bulldogs, includes a new EJ Whitten Stand, indoor training field, advanced performance centre, broadcast-quality lighting, and community facilities, with a total investment of $77.7 million to support elite sports and community programs.

The Fabric Altona North

The Fabric Altona North is a masterplanned sustainable community by Mirvac on an 11.4-hectare former industrial site, delivering over 550 (primarily 2-, 3- and 4-bedroom fully electric townhomes with future mid-rise apartments). All homes achieve a minimum 7-star NatHERS rating, net-zero energy design with rooftop solar panels, and Livable Housing Australia Silver Certification. Features more than 3.15ha of public open space including Patchwork Park (4,000sqm adventure playground), The Lawn (active park with half-court basketball, opened 2025), Cook's Patch community kitchen garden, tree-lined boulevards, and landscaped courtyards by Eckersley Garden Architecture. Located 9km west of Melbourne CBD with excellent transport links. Construction ongoing in multiple stages, residents already settled, full completion expected FY2029.

Mobil Melbourne Terminal Conversion

Conversion of the former Altona refinery into a large-scale fuel import and storage terminal using existing tanks, pipelines and wharf access at Gellibrand. Initial terminal infrastructure is operating; further decommissioning and demolition of former refinery units is scheduled through 2027 to support long term fuel security for Victoria.

Next Generation Trams

The Victorian Government is investing $1.85 billion to deliver 100 accessible, low-floor Next Generation Trams (G Class) and a new maintenance and stabling facility in Maidstone, improving Melbournes tram network with modern, energy-efficient vehicles that enhance passenger comfort and accessibility. Manufacturing is underway at Dandenong, with the first trams expected to arrive for testing on the network in 2025.

Employment

AreaSearch analysis indicates Brooklyn maintains employment conditions that align with national benchmarks

Brooklyn has a highly educated workforce with professional services well represented. Its unemployment rate was 4.3% in the past year, with estimated employment growth of 4.5%.

As of September 2025, 1,369 residents are employed while the unemployment rate is 0.3% lower than Greater Melbourne's rate of 4.7%. Workforce participation is high at 69.4%, compared to Greater Melbourne's 64.1%. Major employment sectors include construction, health care & social assistance, and retail trade. Brooklyn specializes in transport, postal & warehousing, with an employment share 1.6 times the regional level.

However, health care & social assistance has lower representation at 10.5% compared to the regional average of 14.2%. With a worker-resident ratio of 3.2, Brooklyn functions as an employment hub attracting workers from surrounding areas. Between September 2024 and September 2025, employment levels increased by 4.5%, labour force grew by 5.3%, causing the unemployment rate to rise by 0.7 percentage points. In comparison, Greater Melbourne recorded employment growth of 3.0% with unemployment rising 0.3 percentage points. As of 25-Nov-25, Victoria's employment grew by 1.13% year-on-year, adding 41,950 jobs, with the state unemployment rate at 4.7%. National employment forecasts from May-25 project growth rates of 6.6% over five years and 13.7% over ten years. Applying these projections to Brooklyn's employment mix suggests local employment should increase by 6.4% over five years and 13.1% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

The suburb of Brooklyn shows a median taxpayer income of $81,551 and an average of $99,640 based on the latest postcode level ATO data aggregated by AreaSearch for financial year 2023. This places Brooklyn among the top percentile nationally, contrasting with Greater Melbourne's median income of $57,688 and average income of $75,164 during the same period. By September 2025, based on Wage Price Index growth of 8.25%, current estimates would be approximately $88,279 (median) and $107,860 (average). According to 2021 Census figures, individual earnings in Brooklyn stand out at the 84th percentile nationally with weekly earnings of $1,064. The earnings profile shows that 38.6% of locals (997 people) fall within the $1,500 - 2,999 income category, mirroring the metropolitan region where 32.8% occupy this bracket. High housing costs consume 17.4% of income in Brooklyn, yet strong earnings place disposable income at the 60th percentile nationally. The area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Brooklyn displays a diverse mix of dwelling types

Brooklyn's dwelling structure, as per the latest Census, consisted of 53.3% houses and 46.6% other dwellings including semi-detached homes, apartments, and 'other' dwellings. Home ownership in Brooklyn stood at 21.3%, with 38.0% of dwellings mortgaged and 40.7% rented. The median monthly mortgage repayment was $2,068, and the median weekly rent was $391. Nationally, Brooklyn's mortgage repayments were significantly higher than the Australian average of $1,863, while rents exceeded the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Brooklyn features high concentrations of group households and lone person households, with a median household size of 2.2 people

Family households account for 62.6% of all households, including 21.9% couples with children, 28.0% couples without children, and 9.8% single parent families. Non-family households comprise the remaining 37.4%, with lone person households at 32.5% and group households making up 5.0%. The median household size is 2.2 people.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Brooklyn exceeds national averages, with above-average qualification levels and academic performance metrics

Brooklyn residents aged 15+ with university qualifications (34.0%) exceed the Australian average (30.4%). Bachelor degrees are most prevalent at 24.2%, followed by postgraduate qualifications (6.9%) and graduate diplomas (2.9%). Vocational credentials are held by 31.3% of residents aged 15+, with advanced diplomas at 11.2% and certificates at 20.1%.

In total, 24.8% of the population is actively pursuing formal education, including 6.5% in primary, 5.9% in tertiary, and 4.2% in secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Brooklyn has 27 active public transport stops, all serving buses. These stops are served by 9 different routes, offering a total of 1,860 weekly passenger trips. Residents enjoy excellent transport accessibility, with an average distance of 183 meters to the nearest stop.

The service frequency is 265 trips per day across all routes, translating to about 68 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Brooklyn is notably higher than the national average with prevalence of common health conditions low among the general population though higher than the nation's average across older, at risk cohorts

Brooklyn shows above-average health outcomes with a low prevalence of common health conditions among its general population, although this is higher than the national average in older, at-risk cohorts. Approximately 66% of Brooklyn's total population (1,707 people) has private health cover, compared to the national average of 55.7%.

The most prevalent medical conditions are asthma and mental health issues, affecting 8.7% and 8.5% of residents respectively. Meanwhile, 72.7% of residents report being completely free of medical ailments, compared to 0% in Greater Melbourne. Brooklyn has 9.1% of its population aged 65 and over (235 people). However, health outcomes among seniors require more attention than those of the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Brooklyn is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Brooklyn has a high level of cultural diversity, with 38.2% of its population born overseas and 35.2% speaking a language other than English at home. Christianity is the main religion in Brooklyn, making up 42.2% of people. Islam is overrepresented in Brooklyn compared to Greater Melbourne, comprising 7.7% of the population.

The top three ancestry groups are English (18.7%), Australian (15.1%), and Other (14.5%). Notably, Polish (1.4%), Spanish (0.9%), and Maltese (2.4%) ethnicities are overrepresented in Brooklyn compared to regional averages.

Frequently Asked Questions - Diversity

Age

Brooklyn hosts a young demographic, positioning it in the bottom quartile nationwide

Brooklyn's median age is 34 years, which is lower than Greater Melbourne's average of 37 years and considerably younger than Australia's median age of 38 years. Brooklyn has a higher concentration of residents aged 25-34 (28.4%) compared to Greater Melbourne but fewer residents aged 5-14 (7.3%). This concentration is well above the national average of 14.5%. Between the 2021 Census and the present, the population of residents aged 35-44 has grown from 15.3% to 16.4%, while the population of those aged 75-84 has declined from 3.0% to 2.0%. Population forecasts for Brooklyn in 2041 indicate significant demographic changes, with the strongest projected growth in the 55-64 age group (34%), adding 89 residents to reach a total of 353. Conversely, population declines are projected for the 75-84 and 0-4 age groups.