Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Angaston are slightly above average based on AreaSearch's ranking of recent, and medium term trends

Based on ABS population updates and AreaSearch validation, as of Nov 2025, Angaston's estimated population is around 2,453. This shows an increase of 251 people since the 2021 Census, which reported a population of 2,202. The change is inferred from AreaSearch's estimate of 2,326 residents following examination of ABS ERP data release in June 2024 and 72 additional validated new addresses since the Census date. This results in a density ratio of 30 persons per square kilometer. Angaston's growth of 11.4% since the 2021 census exceeded the SA4 region's 7.1%. Overseas migration contributed approximately 44.0% of overall population gains, with all drivers being positive factors.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 using 2022 as the base year. For areas not covered and years post-2032, SA State Government's Regional/LGA projections are adopted with adjustments made employing a method of weighted aggregation from LGA to SA2 levels. Population projections indicate an above median growth for Australia's regional areas, with Angaston expected to increase by 431 persons to 2041, reflecting a total increase of 12.2% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Angaston recording a relatively average level of approval activity when compared to local markets analysed countrywide

Angaston has seen approximately 17 new homes approved annually based on AreaSearch analysis of ABS building approval numbers. Over the past five financial years, from FY-21 to FY-25, around 88 homes were approved, with an additional 11 approved so far in FY-26. On average, 1.2 people have moved to the area per dwelling built over these five years, indicating a balanced supply and demand market that supports stable conditions.

The average expected construction cost value of new dwellings is $428,000, suggesting developers target the premium market segment with higher-end properties. This financial year has seen $2.7 million in commercial approvals, reflecting limited focus on commercial development. Compared to the rest of South Australia, Angaston records elevated construction activity, at 29.0% above the regional average per person over the past five years.

This balances buyer choice while supporting current property values. Recent development has been entirely comprised of detached houses, preserving the area's low-density nature and attracting space-seeking buyers. Notably, developers are constructing more detached housing than the existing pattern implies (81.0% at Census), reflecting strong demand for family homes despite densification trends. Angaston shows characteristics of a growth area with around 160 people per dwelling approval. Future projections estimate Angaston adding 300 residents by 2041, based on the latest AreaSearch quarterly estimate. At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Angaston has emerging levels of nearby infrastructure activity, ranking in the 32ndth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified one major project likely affecting this region. Key projects include Barossa Growth and Infrastructure Investment Strategy, Project EnergyConnect, SA Public Housing Maintenance and Services Contracts, and SA Water Capital Work Delivery Contracts. The following details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

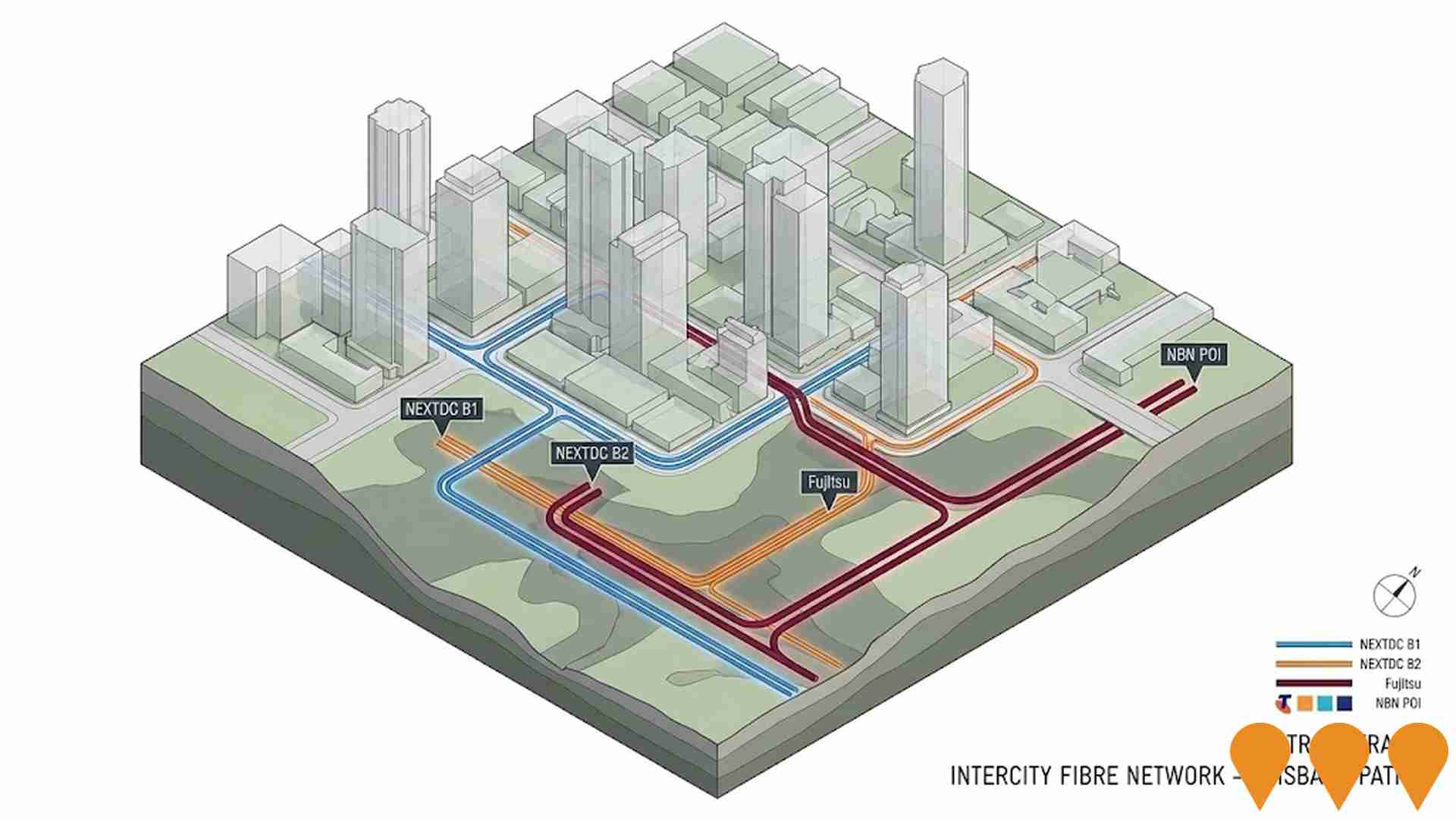

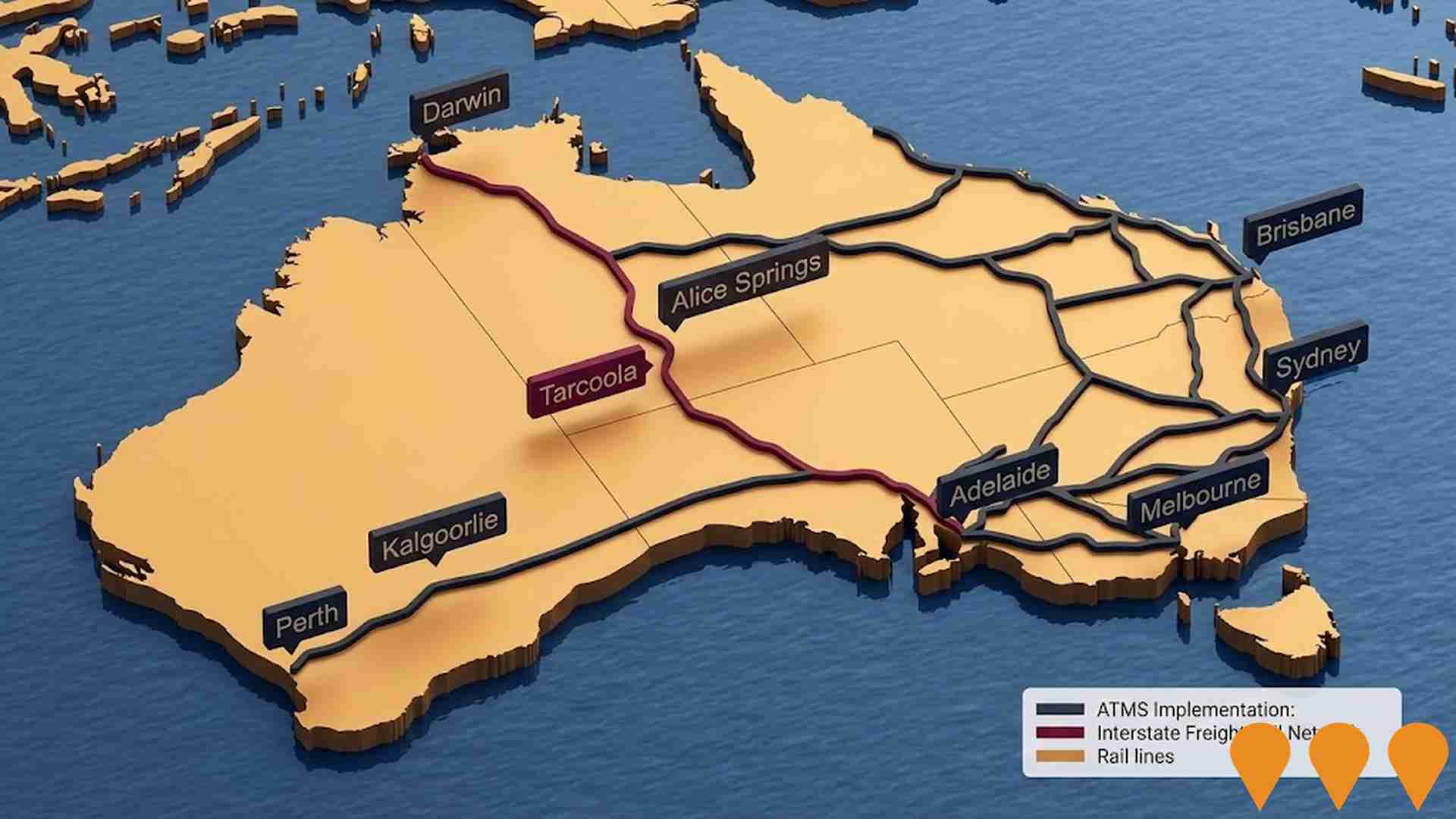

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Enabling Infrastructure for Hydrogen Production

A national initiative to coordinate and deploy infrastructure supporting large-scale renewable hydrogen production. Following the 2024 National Hydrogen Strategy refresh and the National Hydrogen Infrastructure Assessment (NHIA) to 2050, the program focuses on aligning transport, storage, water, and electricity inputs with Renewable Energy Zones and hydrogen hubs. Key financial drivers include the $4 billion Hydrogen Headstart program (with Round 2 EOI launched in October 2025) and the Hydrogen Production Tax Incentive (HPTI) legislated to provide a $2 per kg credit from July 2027 to 2040.

Barossa Growth and Infrastructure Investment Strategy

A strategic plan by The Barossa Council to guide future growth and investment in the Barossa region. It includes proposals for new employment land at Nuriootpa, residential infill in Nuriootpa, Angaston, and Tanunda, and further investigation into tourism development rezoning at Kroemer Crossing.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

EnergyConnect

Australia's largest energy transmission project. A new ~900km interconnector linking the NSW, SA and VIC grids. NSW-West (Buronga to SA border and Red Cliffs spur) was energised in 2024-2025, connecting the three states via the expanded Buronga substation. NSW-East (Buronga-Dinawan-Wagga Wagga) is under active construction with substation upgrades at Wagga Wagga completed in June 2025 and works well advanced at Dinawan and Buronga. Full 800MW transfer capability is targeted after completion of the eastern section and inter-network testing, expected by late 2027.

Network Optimisation Program - Roads

A national program concept focused on improving congestion and reliability on urban road networks by using low-cost operational measures and technology (e.g., signal timing, intersection treatments, incident management) to optimise existing capacity across major city corridors.

Regional North-South Freight Route Upgrade

$12 million upgrade of the freight route between Sedan and Murray Bridge, including 39km of shoulder sealing, bridge widening and strengthening at three locations (Reedy Creek Bridge, Marne River Bridge, Saunders Creek Bridge), barrier upgrades at additional sites, improved road safety, and enhanced heavy vehicle access for agricultural and industrial transport.

Project EnergyConnect

Project EnergyConnect is a new 900-kilometre electricity interconnector (transmission line) to enhance transfer capacity between South Australia and New South Wales, with a connection to Victoria. It is delivered in two stages: SA Section (Stage One, 206 km, 150 MW capacity) and NSW Section (Stage Two, 700 km, 800 MW capacity), including new substations, transmission lines, and upgrades.

SA Public Housing Maintenance and Services Contracts

The South Australian Government has awarded three maintenance service contracts to Spotless Facility Services, RTC Facilities Maintenance, and Torrens Facility Management for the upkeep of over 33,000 public housing properties statewide. Valued at approximately $900 million, the contracts cover reactive maintenance, vacant restorations, and minor works across six regions. Commencing January 2023 for 5.5 years with a two-year extension option, a 2024 review identified issues like trade shortages and below-market rates, leading to an additional $37.1 million funding to accelerate vacancy maintenance.

Employment

Employment conditions in Angaston demonstrate strong performance, ranking among the top 35% of areas assessed nationally

Angaston has a skilled workforce with strong manufacturing and industrial sectors. Its unemployment rate was 2.3% in the past year, with an estimated employment growth of 2.1%.

As of September 2025, 1,177 residents are employed, with an unemployment rate of 3.0%, below Rest of SA's 5.3%. Workforce participation is high at 59.9% compared to Rest of SA's 54.1%. Leading employment industries include manufacturing, health care & social assistance, and agriculture, forestry & fishing. Manufacturing is particularly strong with an employment share 2.8 times the regional level.

However, agriculture, forestry & fishing has a limited presence at 9.2% compared to the regional 14.5%. Employment opportunities locally may be limited as indicated by Census working population vs resident population comparison. Over the year to September 2025, employment increased by 2.1%, while labour force grew by 2.2%, keeping unemployment relatively stable at 3.0%. This contrasts with Rest of SA where employment rose by 0.3%, labour force grew by 2.3%, and unemployment rose to 7.2%. National employment forecasts from Jobs and Skills Australia, issued in May-25, project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Angaston's employment mix suggests local employment should increase by 4.5% over five years and 11.1% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

The suburb of Angaston's income level is below the national average according to ATO data aggregated by AreaSearch for financial year 2023. The median income among taxpayers in Angaston is $47,299 and the average income stands at $57,772, compared to figures for Rest of SA of $48,920 and $58,933 respectively. Based on Wage Price Index growth of 8.8% since financial year 2023, current estimates would be approximately $51,461 (median) and $62,856 (average) as of September 2025. Census data from 2021 shows household, family, and personal incomes in Angaston rank modestly, between the 20th and 35th percentiles. Income distribution data reveals that 27.6% of the population fall within the $800 - 1,499 income range, differing from surrounding regions where $1,500 - 2,999 dominates with 27.5%. Housing costs are modest, with 86.9% of income retained, but total disposable income ranks at just the 25th percentile nationally.

Frequently Asked Questions - Income

Housing

Angaston is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Angaston's dwelling structures, as per the latest Census data, consisted of 81.3% houses and 18.7% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro SA's figures of 94.6% houses and 5.4% other dwellings. Home ownership in Angaston was at 39.5%, with mortgaged dwellings at 34.5% and rented ones at 26.0%. The median monthly mortgage repayment was $1,343, lower than Non-Metro SA's average of $1,400. The median weekly rent in Angaston was recorded as $249, compared to Non-Metro SA's $285. Nationally, Angaston's mortgage repayments were significantly lower at $1,343 versus the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Angaston has a typical household mix, with a lower-than-average median household size

Family households constitute 69.1% of all households, including 26.3% couples with children, 31.6% couples without children, and 10.3% single parent families. Non-family households comprise the remaining 30.9%, with lone person households at 29.1% and group households making up 1.7%. The median household size is 2.3 people, smaller than the Rest of SA average of 2.5 people.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Angaston aligns closely with national averages, showing typical qualification patterns and performance metrics

The area's university qualification rate is 22.8%, exceeding the SA4 region average of 13.8% and Rest of SA's 13.9%. Bachelor degrees are most common at 16.0%, followed by postgraduate qualifications (3.5%) and graduate diplomas (3.3%). Vocational credentials are held by 36.4% of residents aged 15+, with advanced diplomas at 9.8% and certificates at 26.6%.

Educational participation is high, with 26.5% currently enrolled in formal education: 13.2% in primary, 6.4% in secondary, and 2.4% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Angaston is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Angaston faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is relatively low at approximately 50% of the total population (~1,223 people), compared to the national average of 55.7%.

The most common medical conditions in the area are mental health issues (impacting 10.1% of residents) and arthritis (9.8%), while 66.5% declare themselves completely clear of medical ailments, compared to 64.6% across Rest of SA. The area has 24.1% of residents aged 65 and over (591 people), which is higher than the 22.8% in Rest of SA. Health outcomes among seniors are above average, performing better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Angaston placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Angaston's cultural diversity was found to be below average, with 88.6% of its population born in Australia, 92.2% being citizens, and 97.8% speaking English only at home. Christianity is the predominant religion in Angaston, comprising 48.3% of people, compared to 47.1% across Rest of SA. The top three ancestry groups are English (31.3%), Australian (26.1%), and German (17.1%).

Notably, Hungarian (0.6%) is overrepresented in Angaston compared to the regional average of 0.2%, as are Polish (0.8% vs 0.5%) and French (0.5% vs 0.3%).

Frequently Asked Questions - Diversity

Age

Angaston hosts an older demographic, ranking in the top quartile nationwide

Angaston has a median age of 46, close to Rest of SA's figure of 47 and above the national average of 38. The 5-14 age group is strongly represented at 13.1%, higher than Rest of SA, while the 25-34 cohort is less prevalent at 8.5%. Post-2021 Census, the 15 to 24 age group grew from 8.8% to 10.3%, but the 5 to 14 group declined from 14.4% to 13.1% and the 45 to 54 group dropped from 13.8% to 12.5%. By 2041, demographic modeling suggests significant changes in Angaston's age profile. The 75 to 84 cohort is projected to grow by 85 people (42%), from 206 to 292. Notably, combined 65+ age groups will account for 60% of total population growth, reflecting the area's aging demographic trend. Conversely, numbers in the 5 to 14 age range are expected to fall by 4.