Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Light are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Light's population, as per AreaSearch's analysis, was 10,682 by November 2025. This figure reflected an increase of 885 people since the 2021 Census, which reported a population of 9,797. The change was inferred from the estimated resident population of 10,534 in June 2024 and an additional 160 validated new addresses since the Census date. This resulted in a population density ratio of 9.6 persons per square kilometer. Light's growth rate of 9.0% since the 2021 census exceeded both the non-metro area (6.8%) and the state, indicating it as a growth leader in the region. Interstate migration contributed approximately 74.6% of overall population gains during recent periods, although all drivers including overseas migration and natural growth were positive factors.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, the SA State Government's Regional/LGA projections by age category were used, based on 2021 data and released in 2023, with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. According to population projections moving forward, an above median population growth for Australia's regional areas is projected, with the area expected to expand by 1,978 persons to 2041 based on the latest annual ERP population numbers, reflecting a gain of 17.1% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential approval activity sees Light among the top 30% of areas assessed nationwide

Light has recorded approximately 61 residential property approvals per year over the past five financial years, totalling 307 homes. As of FY26, 11 approvals have been recorded. On average, 2.8 people moved to the area per new home constructed between FY21 and FY25, indicating healthy demand for housing in the region. New homes are being built at an average expected construction cost value of $221,000, aligning with regional trends.

In FY26, $29.0 million worth of commercial approvals have been registered, reflecting high levels of local commercial activity. Compared to the rest of South Australia, Light has similar development levels per capita, supporting market stability and mirroring regional patterns, although recent periods have seen a moderation in development activity. All new construction in the area has consisted solely of standalone homes, preserving its low-density nature and attracting space-seeking buyers.

With around 262 people per approval, Light reflects a transitioning market. According to AreaSearch's latest quarterly estimate, Light is expected to grow by 1,830 residents by 2041. Current construction rates appear balanced with future demand, fostering steady market conditions without excessive price pressure.

Frequently Asked Questions - Development

Infrastructure

Light has limited levels of nearby infrastructure activity, ranking in the 8thth percentile nationally

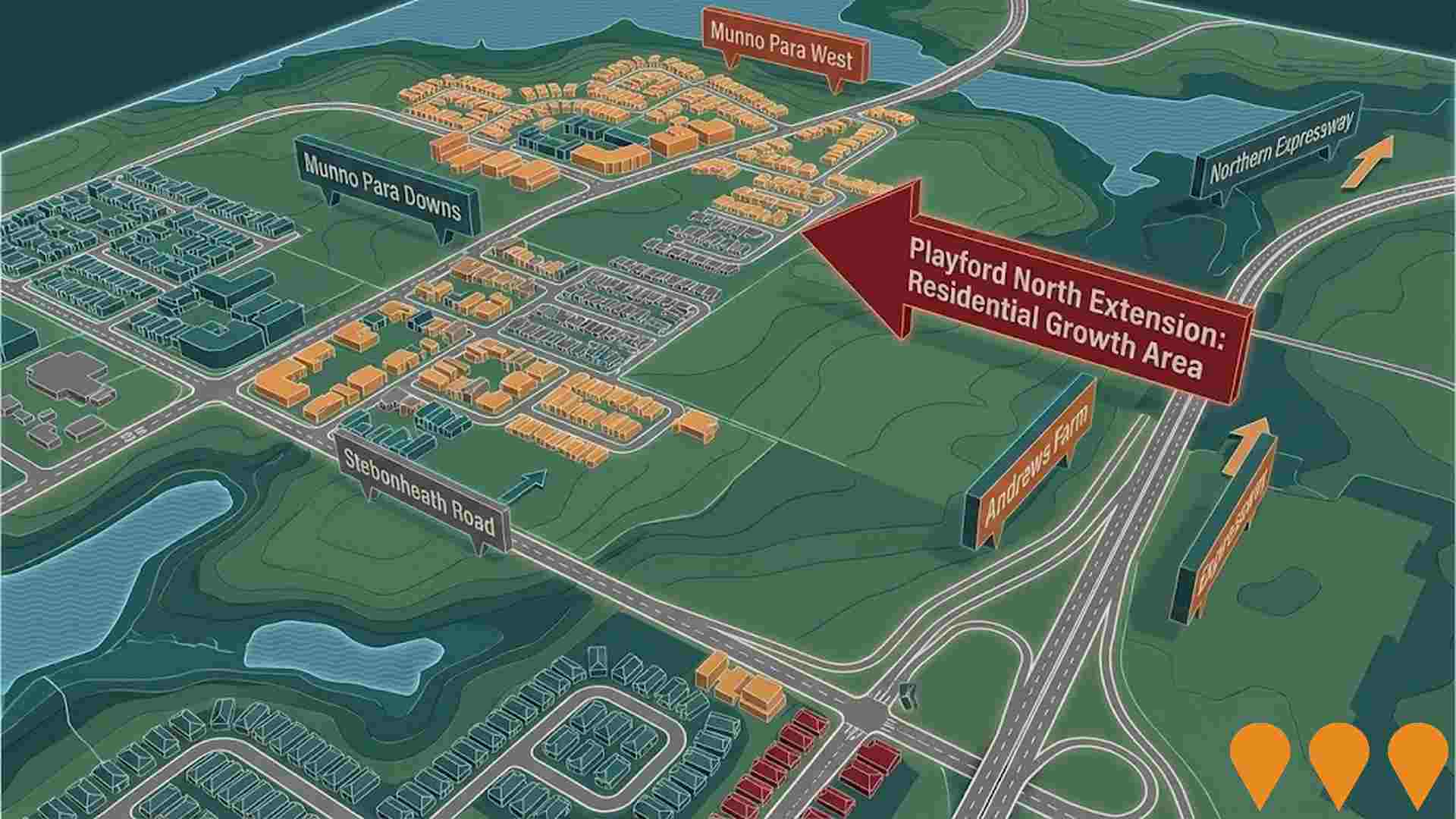

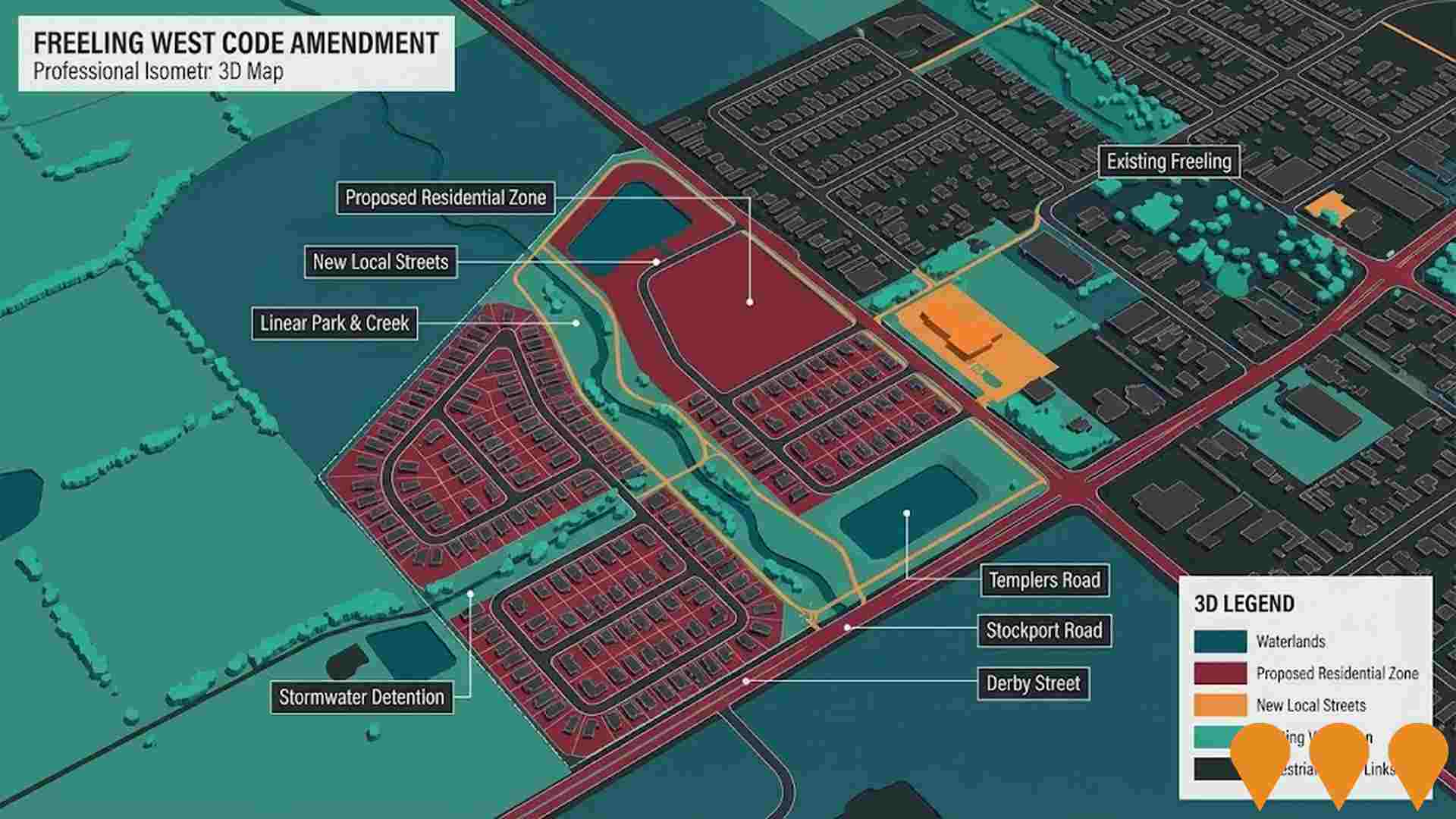

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified 18 projects that could impact the area. Notable ones include Freeling West Code Amendment, Barossa Lifestyle (Barossa Co-op Redevelopment), Barossa Growth and Infrastructure Investment Strategy, and Sovereign Estate. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Tanunda Recreation Park Redevelopment

Comprehensive redevelopment of Tanunda Recreation Park completed in March 2024 as part of The Big Project. The $10.6 million precinct redevelopment includes new 300-seat multi-purpose clubrooms with bar and spectator viewing, six gender-neutral changerooms, junior sports oval, cricket training nets, inclusive playground, LED sports lighting, widened main oval with improved playing surface, and extensive landscaping. Winner of the 2024 SANFL Football Facility of the Year award, the facility serves as a regional-level venue for football, cricket, netball, tennis and community events. The park hosted the 2024 Barossa, Light and Gawler Football and Netball grand finals and will host the 2025 Australian Country Cricket Championships.

Barossa Growth and Infrastructure Investment Strategy

A strategic plan by The Barossa Council to guide future growth and investment in the Barossa region. It includes proposals for new employment land at Nuriootpa, residential infill in Nuriootpa, Angaston, and Tanunda, and further investigation into tourism development rezoning at Kroemer Crossing.

Kroemer Crossing Roundabout Upgrade

Improvement of safety and access at Kroemer's Crossing, Tanunda, by installing a roundabout to improve safety for all road users and allow greater freight access to surrounding businesses. This $6 million project was funded by the Australian and South Australian Governments, The Barossa Council, and Pernod Ricard Winemakers Pty Ltd.

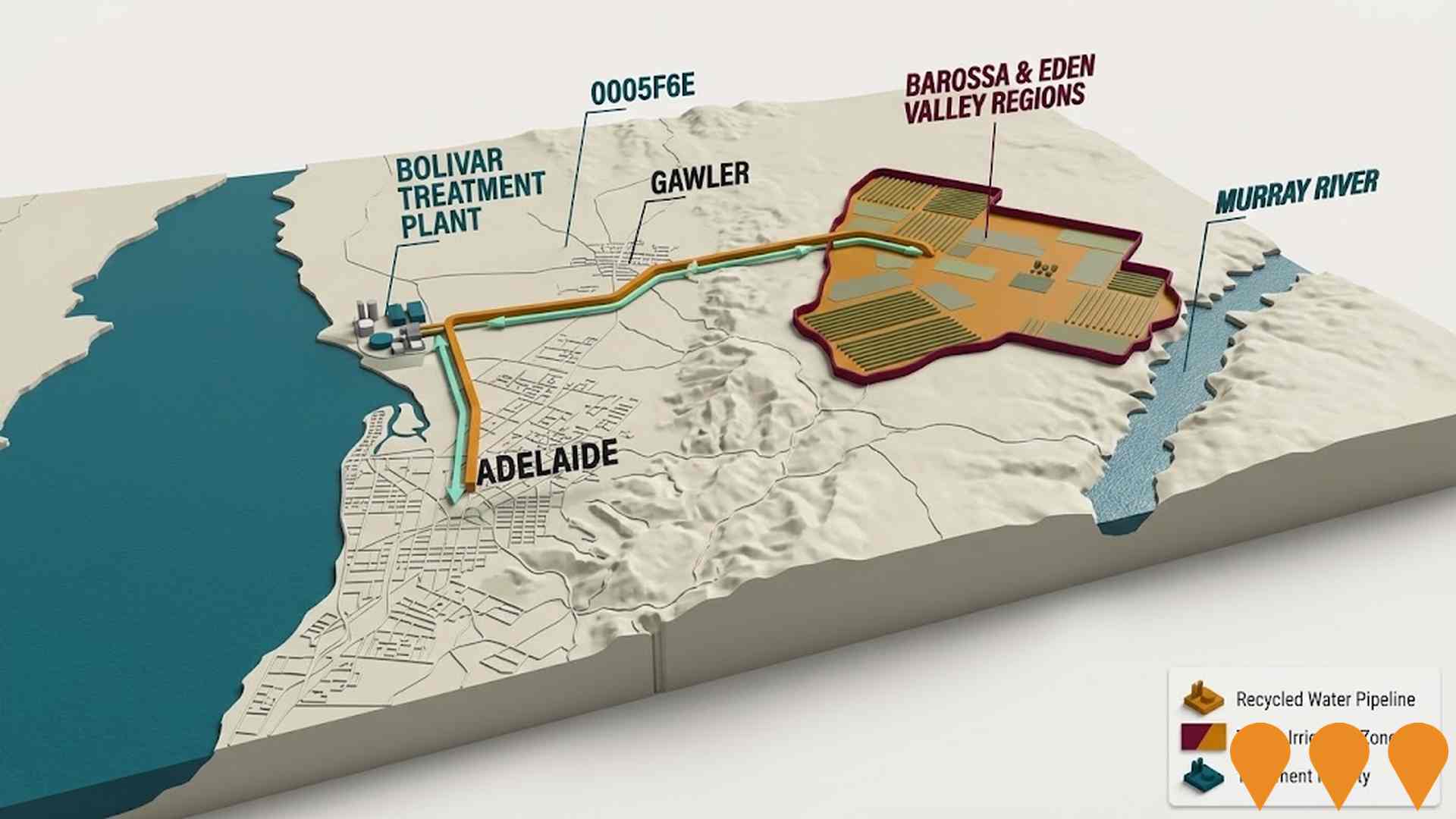

New Water Infrastructure to Barossa (Barossa New Water)

Program investigating delivery of up to ~13 GL per year of climate independent recycled water from the Bolivar Wastewater Treatment Plant to Barossa and Eden Valleys to improve water security for viticulture and agriculture. The detailed business case (completed Nov 2022) identified a preferred option using a direct pipeline from Bolivar and set up further work on affordability, demand commitments and governance. Since Oct 2023 the SA Government, Barossa Infrastructure Limited and Barossa Australia have been progressing a new direction focused on confirming demand volumes (including substitution of River Murray water) and exploring short term solutions for Eden Valley.

Barossa Rugby Precinct

A $5.166 million purpose-built rugby facility featuring gender-neutral changerooms, clubroom, dedicated rugby pitch with LED lighting providing 100 lux, commercial kitchen, bar space for 150 people, sheltered viewing deck, car parking, and internal roads. The facility supports rugby union, touch football, and primary school sporting programs. Officially opened in June 2024, the precinct accommodates three touch football pitches and has become the best rugby playing surface in South Australia. Designed by Dash Architects and built by Bishop Building.

Freeling West Code Amendment

Proposal to rezone approximately 20 hectares of Rural Zoned land on the western side of Freeling, between Templers Road and Stockport Road adjacent to Derby Street, to the Suburban Neighbourhood Zone. The code amendment is intended to enable a new low density residential neighbourhood of around 185 to 250 housing allotments, with a concept plan showing new local streets, linear open space along the existing creek, pedestrian and cycle links, stormwater detention areas and upgraded access to Templers Road and Stockport Road. Walton Rural Pty Ltd is the proponent, with MasterPlan SA engaged to prepare the amendment and lead community consultation.

Sovereign Estate

A land release development in Tanunda, offering various sized allotments for new homes. It is located within walking distance to the town centre and surrounded by vineyards. Multiple stages have been released, with the 'Kindler Release' being the newest.

George Street Estate, Williamstown

George Street Estate is a proposed 6.22 hectare residential subdivision on Lot 9 George Street in Williamstown, within The Barossa Council area. The land has been marketed as one of the last major land development opportunities in the town, with concept plans showing a new house and land estate subject to council approval and planning consent. The site has been sold but remains listed as in planning, with no confirmed named developer; SA Homes & Acreage has acted as the selling and marketing agent for the land.

Employment

The employment environment in Light shows above-average strength when compared nationally

Light's workforce comprises both white and blue-collar jobs, with manufacturing and industrial sectors prominently featured. Its unemployment rate stands at 2.9%, with an employment growth of 1.5% over the past year (September 2024 to September 2025).

As of September 2025, 5,397 residents are employed, with an unemployment rate of 2.4%, below Rest of SA's 5.3%. Workforce participation is high at 62.6% compared to Rest of SA's 54.1%. The key industries for employment among residents are manufacturing (with a share 1.6 times the regional level), health care & social assistance, and agriculture, forestry & fishing (at 11.0%, below Rest of SA's 14.5%). Over the 12 months to September 2025, employment increased by 1.5% while labour force grew by 2.2%, causing unemployment to rise by 0.7 percentage points.

In contrast, Rest of SA saw employment rise by 0.3%, labour force grow by 2.3%, and unemployment increase by 1.9 percentage points. National employment forecasts from Jobs and Skills Australia (May-25) project a 6.6% growth over five years and 13.7% over ten years. Applying these projections to Light's employment mix suggests local employment should increase by 5.1% over five years and 11.7% over ten years, though these are simple extrapolations for illustrative purposes and do not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

The Light SA2's income level was below the national average according to the latest ATO data aggregated by AreaSearch for financial year 2022. The median income among taxpayers in The Light SA2 was $51,282 and the average income stood at $59,125. This compares to figures for Rest of SA's of $46,889 and $56,582 respectively. Based on Wage Price Index growth of 12.83% since financial year 2022, current estimates would be approximately $57,861 (median) and $66,711 (average) as of September 2025. According to the 2021 Census, household, family and personal incomes in Light ranked modestly, between the 34th and 38th percentiles. Income analysis revealed that the $1,500 - $2,999 bracket dominated with 35.7% of residents (3,813 people). Housing costs were manageable with 87.9% retained, but disposable income was below average at the 43rd percentile.

Frequently Asked Questions - Income

Housing

Light is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Light's dwelling structures, as per the latest Census, were 97.3% houses and 2.8% other dwellings (semi-detached, apartments, 'other' dwellings). Non-Metro SA had 94.6% houses and 5.4% other dwellings. Home ownership in Light was 36.8%, with mortgaged dwellings at 48.9% and rented ones at 14.3%. The median monthly mortgage repayment was $1,328, below Non-Metro SA's average of $1,400. Median weekly rent in Light was $260, compared to Non-Metro SA's $285. Nationally, Light's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Light has a typical household mix, with a higher-than-average median household size

Family households constitute 75.2% of all households, including 32.8% couples with children, 31.6% couples without children, and 10.3% single parent families. Non-family households comprise the remaining 24.8%, with lone person households at 22.7% and group households making up 2.0%. The median household size is 2.6 people, larger than the Rest of SA average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Light fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 15.7%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 12.2%, followed by postgraduate qualifications (1.9%) and graduate diplomas (1.6%). Vocational credentials are prevalent, with 41.0% of residents aged 15+ holding them - advanced diplomas at 9.4% and certificates at 31.6%. Educational participation is high, with 29.5% of residents currently enrolled in formal education: 12.6% in primary, 7.6% in secondary, and 4.4% in tertiary education.

Educational participation is notably high, with 29.5% of residents currently enrolled in formal education. This includes 12.6% in primary education, 7.6% in secondary education, and 4.4% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Light is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Light faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is relatively low at approximately 49% of the total population (~5,244 people), compared to the national average of 55.3%.

The most common medical conditions are asthma and mental health issues, impacting 9.8 and 9.5% of residents respectively. 64.8% of residents declare themselves completely clear of medical ailments, similar to the Rest of SA at 64.6%. The area has 19.7% of residents aged 65 and over (2,105 people), which is lower than the 22.8% in Rest of SA.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Light placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Light's cultural diversity was found to be below average. Its population comprised 88.8% born in Australia, with 91.9% being citizens, and 97.8% speaking English only at home. Christianity was the predominant religion in Light, making up 45.1% of its population, compared to 47.1% across the rest of South Australia.

The top three ancestry groups were English (32.5%), Australian (32.3%), and German (12.2%). Notably, Welsh and Dutch ethnicities were overrepresented in Light at 0.5% and 1.2%, respectively, compared to regional averages of 0.5% and 1.3%.

Frequently Asked Questions - Diversity

Age

Light's population is slightly older than the national pattern

Light's median age of 40 years is significantly below Rest of SA's 47 and slightly above the national average of 38 years. Compared to Rest of SA, Light has a higher concentration of 15-24 year-olds at 12.4% but fewer 75-84 year-olds at 5.9%. Between 2021 Census and present, the 65-74 age group has grown from 11.0% to 12.0%, while the 45-54 cohort has declined from 12.9% to 11.7% and the 55-64 group dropped from 14.9% to 13.8%. By 2041, Light is expected to see notable shifts in its age composition with the 75-84 group growing by 81%, adding 512 people to reach 1,143 from 630. The 55-64 group shows more modest growth at 1%, adding only 21 residents.