Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Adelaide Hills reveals an overall ranking slightly below national averages considering recent, and medium term trends

Adelaide Hills' population was around 7,210 as of Nov 2025. This reflected an increase of 159 people since the 2021 Census, which reported a population of 7,051 people. The change was inferred from the estimated resident population of 7,183 from the ABS in June 2024 and an additional 26 validated new addresses since the Census date. This resulted in a density ratio of 19.8 persons per square kilometer. Population growth was primarily driven by overseas migration, contributing approximately 53.6% of overall population gains during recent periods.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered and years post-2032, the SA State Government's Regional/LGA projections were used, based on 2021 data and adjusted employing a method of weighted aggregation of population growth from LGA to SA2 levels. Demographic trends suggested a population increase just below the median for statistical areas analysed by AreaSearch, with an expected growth of 720 persons to 2041 based on the latest annual ERP population numbers, reflecting a total increase of 9.6% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Adelaide Hills, placing the area among the bottom 25% of areas assessed nationally

Adelaide Hills averaged around 24 new dwelling approvals annually from FY-21 to FY-25. A total of 121 homes were approved during these years, with an additional 5 approved in FY-26. On average, only 1 person moved to the area per dwelling built over this period, indicating that new supply met or exceeded demand.

The average construction value of new dwellings was $287,000. In FY-26, $10.9 million in commercial approvals were registered, suggesting balanced commercial development activity. Compared to Greater Adelaide, Adelaide Hills had 68.0% lower building activity per person as of recent data. This constrained construction typically reinforces demand and pricing for existing dwellings, which is also below the national average, possibly due to planning constraints or area maturity. All recent developments consisted of detached dwellings, preserving the area's low-density nature and attracting space-seeking buyers.

As of now, there are approximately 549 people per dwelling approval in Adelaide Hills. Population forecasts indicate an increase of 693 residents by 2041. Current construction rates appear balanced with future demand, maintaining steady market conditions without excessive price pressure.

Frequently Asked Questions - Development

Infrastructure

Adelaide Hills has emerging levels of nearby infrastructure activity, ranking in the 25thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. Two projects identified by AreaSearch are expected to influence the region: Defence and Aerospace Precinct at Penfield, Angle Vale Residential Growth Area, Northern Adelaide Irrigation Scheme (NAIS) - SA Water, and SA Water Capital Work Delivery Contracts. The following list details those most relevant: Projects: - Defence and Aerospace Precinct at Penfield - Angle Vale Residential Growth Area - Northern Adelaide Irrigation Scheme (NAIS) - SA Water - SA Water Capital Work Delivery Contracts.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

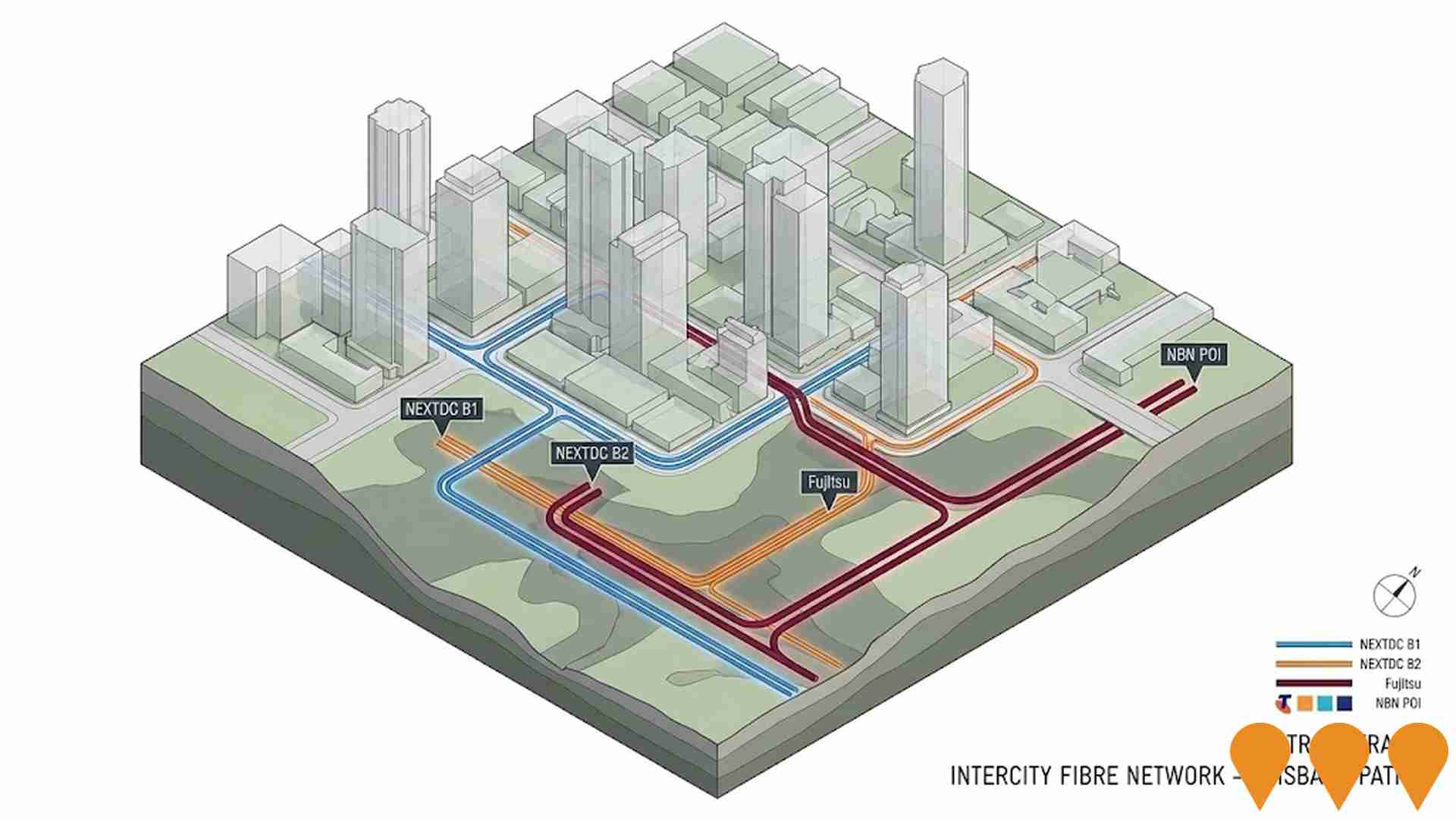

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

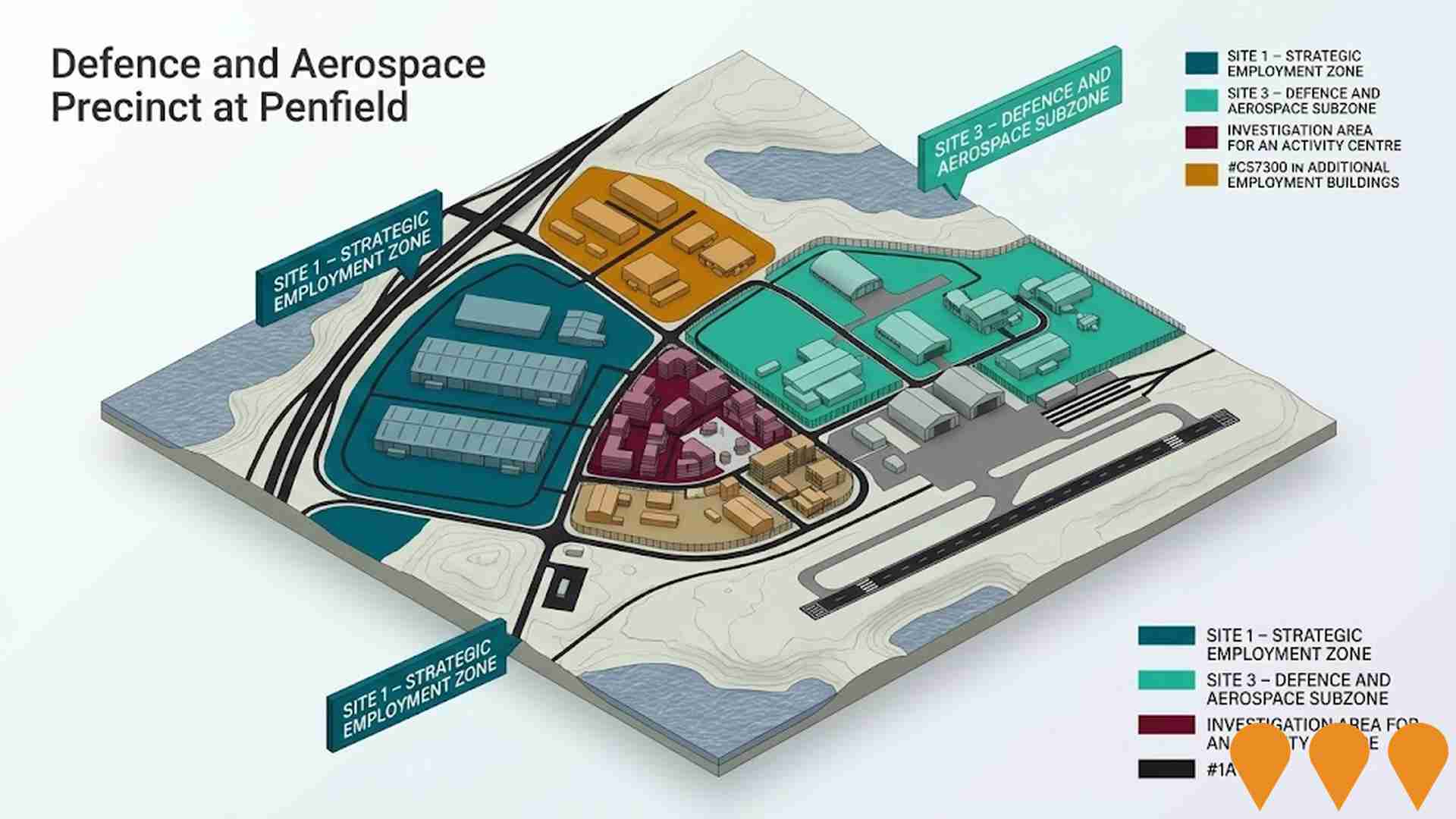

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Northern Adelaide Irrigation Scheme (NAIS) - SA Water

Part of SA Water's $1.5 billion Northern Suburbs Infrastructure Program to deliver critical water and recycled water network upgrades across northern Adelaide. The Northern Adelaide Irrigation Scheme (NAIS) uses recycled water to irrigate 25,000+ homes' open spaces and supports housing growth for over 40,000 new homes by increasing capacity for trunk water mains, pump stations, storage, and recycled water distribution.

Enabling Infrastructure for Hydrogen Production

Australia has completed the National Hydrogen Infrastructure Assessment (NHIA) to 2050 and refreshed its National Hydrogen Strategy (2024). The programmatic focus has shifted to planning and enabling infrastructure through measures such as ARENA's Hydrogen Headstart and the Hydrogen Production Tax Incentive (from April 2025). Round 2 of Hydrogen Headstart consultation occurred in 2025. Collectively these actions aim to coordinate investment in transport, storage, water and electricity inputs linked to Renewable Energy Zones and priority hubs, supporting large-scale renewable hydrogen production and future export supply chains.

Adelaide Public Transport Capacity and Access

State-led program work to increase public transport capacity and access to, through and within central Adelaide. Current work is focused on the City Access Strategy (20-year movement plan for the CBD and North Adelaide) and the State Transport Strategy program, which together will shape options such as bus priority, interchange upgrades, tram and rail enhancements, and better first/last mile access.

Barossa Growth and Infrastructure Investment Strategy

A strategic plan by The Barossa Council to guide future growth and investment in the Barossa region. It includes proposals for new employment land at Nuriootpa, residential infill in Nuriootpa, Angaston, and Tanunda, and further investigation into tourism development rezoning at Kroemer Crossing.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

Defence and Aerospace Precinct at Penfield

Specialized defence and aerospace manufacturing precinct leveraging proximity to RAAF Base Edinburgh. Designed to support advanced manufacturing, research and development, and defence industry supply chains. Features secure facilities and specialized infrastructure for aerospace technologies.

Angle Vale Residential Growth Area

Major residential growth area with multiple developments including Miravale Estate and The Entrance Estate. Key growth corridor supported by new water infrastructure investments.

EnergyConnect

Australia's largest energy transmission project. A new ~900km interconnector linking the NSW, SA and VIC grids. NSW-West (Buronga to SA border and Red Cliffs spur) was energised in 2024-2025, connecting the three states via the expanded Buronga substation. NSW-East (Buronga-Dinawan-Wagga Wagga) is under active construction with substation upgrades at Wagga Wagga completed in June 2025 and works well advanced at Dinawan and Buronga. Full 800MW transfer capability is targeted after completion of the eastern section and inter-network testing, expected by late 2027.

Employment

Employment conditions in Adelaide Hills demonstrate strong performance, ranking among the top 35% of areas assessed nationally

Adelaide Hills has a skilled workforce with an unemployment rate of 2.9% as of September 2025. This is 1.0% lower than Greater Adelaide's rate of 3.9%.

The estimated employment growth over the past year was 3.0%. There are 4,210 residents in work, with workforce participation at 65.1%, compared to Greater Adelaide's 61.7%. Key industries of employment among residents include health care & social assistance, construction, and education & training. The area has a notable concentration in agriculture, forestry & fishing, with employment levels at 4.8 times the regional average.

However, health care & social assistance shows lower representation at 13.4% versus the regional average of 17.7%. Employment opportunities may be limited locally, as indicated by the count of Census working population vs resident population. Between September 2024 and September 2025, employment levels increased by 3.0%, while labour force increased by 3.1%, causing the unemployment rate to rise by 0.1 percentage points. In comparison, Greater Adelaide recorded employment growth of 3.0%, labour force growth of 2.9%, with unemployment falling by 0.1 percentage points. State-level data from 25-Nov shows SA employment grew by 1.19% year-on-year, adding 10,710 jobs, and the state unemployment rate was at 4.0%. This compares favourably to the national unemployment rate of 4.3%, with the state's employment growth outpacing the national average of 0.14%. National employment forecasts from Jobs and Skills Australia project an expansion of 6.6% over five years and 13.7% over ten years. Applying these industry-specific projections to Adelaide Hills' employment mix suggests local employment should increase by 6.0% over five years and 12.8% over ten years, assuming constant population projections for illustrative purposes.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates above-average performance, with income metrics exceeding national benchmarks based on AreaSearch comparative assessment

In financial year 2022, Adelaide Hills SA2 had a median income among taxpayers of $52,363 and an average level of $68,138. Nationally, the median was $52,592 and the average was $64,886. By September 2025, estimates suggest these figures would be approximately $59,081 (median) and $76,880 (average), based on a 12.83% growth in wages since financial year 2022. According to the 2021 Census, incomes in Adelaide Hills cluster around the 53rd percentile nationally. Income distribution shows that 33.1% of residents fall within the $1,500 - 2,999 range, similar to regional levels at 31.8%. After housing costs, residents retain 88.9% of their income, reflecting strong purchasing power. The area's SEIFA income ranking places it in the 6th decile nationally.

Frequently Asked Questions - Income

Housing

Adelaide Hills is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Adelaide Hills, as per the latest Census, consisted of 98.2% houses and 1.7% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Adelaide metro's figure of 95.2% houses and 4.8% other dwellings. Home ownership in Adelaide Hills stood at 44.7%, with mortgaged dwellings at 46.4% and rented ones at 8.9%. The median monthly mortgage repayment was $1,733, aligning with the Adelaide metro average, while the median weekly rent was $300, compared to Adelaide metro's $1,733 and $350 respectively. Nationally, Adelaide Hills' mortgage repayments were lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Adelaide Hills features high concentrations of family households, with a higher-than-average median household size

Family households account for 82.0% of all households, including 38.5% couples with children, 35.9% couples without children, and 7.1% single parent families. Non-family households constitute the remaining 18.0%, with lone person households at 16.7% and group households comprising 1.6%. The median household size is 2.7 people, larger than the Greater Adelaide average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Adelaide Hills performs slightly above the national average for education, showing competitive qualification levels and steady academic outcomes

The area's university qualification rate is 22.1%, significantly lower than the SA4 region average of 42.2%. Bachelor degrees are most prevalent at 15.3%, followed by postgraduate qualifications (4.1%) and graduate diplomas (2.7%). Vocational credentials are held by 42.5% of residents aged 15 and above, with advanced diplomas at 13.0% and certificates at 29.5%. Educational participation is high, with 26.9% of residents currently enrolled in formal education, including 9.6% in primary, 8.2% in secondary, and 4.6% in tertiary education.

Educational participation is notably high, with 26.9% of residents currently enrolled in formal education. This includes 9.6% in primary education, 8.2% in secondary education, and 4.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Adelaide Hills's residents are healthier than average in comparison to broader Australia with a fairly standard level of common health conditions seen across both young and old age cohorts

Adelaide Hills residents exhibit relatively positive health outcomes, with common conditions seen across both young and old age groups at a fairly standard level.

Approximately 53% (~3,850 people) of the total population have private health cover. The most prevalent medical conditions are arthritis (affecting 8.7% of residents) and asthma (7.7%). A significant majority, 68.8%, report being completely free from medical ailments, slightly higher than Greater Adelaide's 68.5%. The area has a higher proportion of seniors aged 65 and over at 21.9% (1,579 people), compared to Greater Adelaide's 19.9%. Health outcomes among seniors in Adelaide Hills are notably strong, outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Adelaide Hills is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Adelaide Hills had a cultural diversity level below average, with 83.8% of its population born in Australia, 92.1% being citizens, and 96.9% speaking English only at home. Christianity was the predominant religion, comprising 43.2% of people in Adelaide Hills. The most notable overrepresentation was in the 'Other' category, which constituted 0.5% of the population compared to 0.6% across Greater Adelaide.

Regarding ancestry (country of birth of parents), English was the top group at 35.4%, followed by Australian at 29.6%, and German at 8.3%. Some ethnic groups showed notable variations: Polish was overrepresented at 1.0% compared to 0.8% regionally, Hungarian at 0.4% versus 0.3%, and Dutch at 1.7% versus 1.8%.

Frequently Asked Questions - Diversity

Age

Adelaide Hills hosts an older demographic, ranking in the top quartile nationwide

Adelaide Hills has a median age of 47, which is higher than Greater Adelaide's figure of 39 and the national average of 38. The age profile shows that those aged 55-64 are particularly prominent at 17.4%, while those aged 25-34 are comparatively smaller at 8.3%. This concentration of those aged 55-64 is well above the national figure of 11.2%. Between the 2021 Census and the present, the population aged 75 to 84 has grown from 5.5% to 7.0%, while the 15 to 24 cohort has increased from 12.3% to 13.3%. Conversely, the 45 to 54 age group has declined from 15.8% to 13.1%. By 2041, demographic projections show significant shifts in Adelaide Hills' age structure. The 85+ age group is projected to grow by 141%, reaching 365 from 151. Notably, the combined 65+ age groups will account for 64% of total population growth, reflecting the area's aging demographic profile. In contrast, the 55-64 cohort is projected to decline by 114 people.