Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in New Farm reveals an overall ranking slightly below national averages considering recent, and medium term trends

New Farm's population is approximately 13,851 as of November 2025. This figure represents an increase of 1,397 people since the 2021 Census, which recorded a population of 12,454. The growth was inferred from the estimated resident population of 13,753 in June 2024 and an additional 152 validated new addresses since the Census date. This results in a population density ratio of 6,472 persons per square kilometer, placing New Farm among the top 10% of locations assessed by AreaSearch. New Farm's growth rate of 11.2% since the 2021 census exceeds both the national average (8.9%) and state average. Overseas migration was the primary driver behind this population growth.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by these data and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. These state projections do not provide age category splits; hence proportional growth weightings from ABS Greater Capital Region projections (released in 2023, based on 2022 data) are applied where utilized. Future population projections indicate a median increase for the area, with an expected growth of 1,717 persons to 2041, reflecting an overall increase of 11.7% over these 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in New Farm according to AreaSearch's national comparison of local real estate markets

New Farm has seen approximately 45 new homes approved annually over the past five financial years, totalling 225 homes. As of FY-26, six approvals have been recorded. On average, 1.4 new residents arrived per year for each new home between FY-21 and FY-25, indicating a balanced supply and demand with stable market conditions. However, this has accelerated to 15.7 people per dwelling over the past two financial years, suggesting increasing demand and tightening supply. New homes are being built at an average expected construction cost of $574,000, targeting the premium market segment with higher-end properties.

In FY-26, commercial development approvals totalled $21.4 million, indicating steady commercial investment activity in the area. Compared to Greater Brisbane, New Farm has markedly lower building activity, at 77.0% below the regional average per person. This limited new supply generally supports stronger demand and values for established properties. The area's development activity is also below national averages, reflecting its maturity and possible planning constraints. New development consists of 15.0% standalone homes and 85.0% townhouses or apartments, focusing on higher-density living to create more affordable entry points for downsizers, investors, and first-home buyers. With around 527 people per dwelling approval, New Farm shows a developed market with a projected addition of 1,619 residents by 2041, according to the latest AreaSearch quarterly estimate.

Construction is maintaining a reasonable pace with projected growth, although buyers may encounter growing competition as population increases.

Frequently Asked Questions - Development

Infrastructure

New Farm has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified 51 projects that could potentially impact this region. Notable projects include Teneriffe Banks, 424 Bowen Terrace Development Site, Waterfront Brisbane, and James Place. The following details the most relevant ones.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

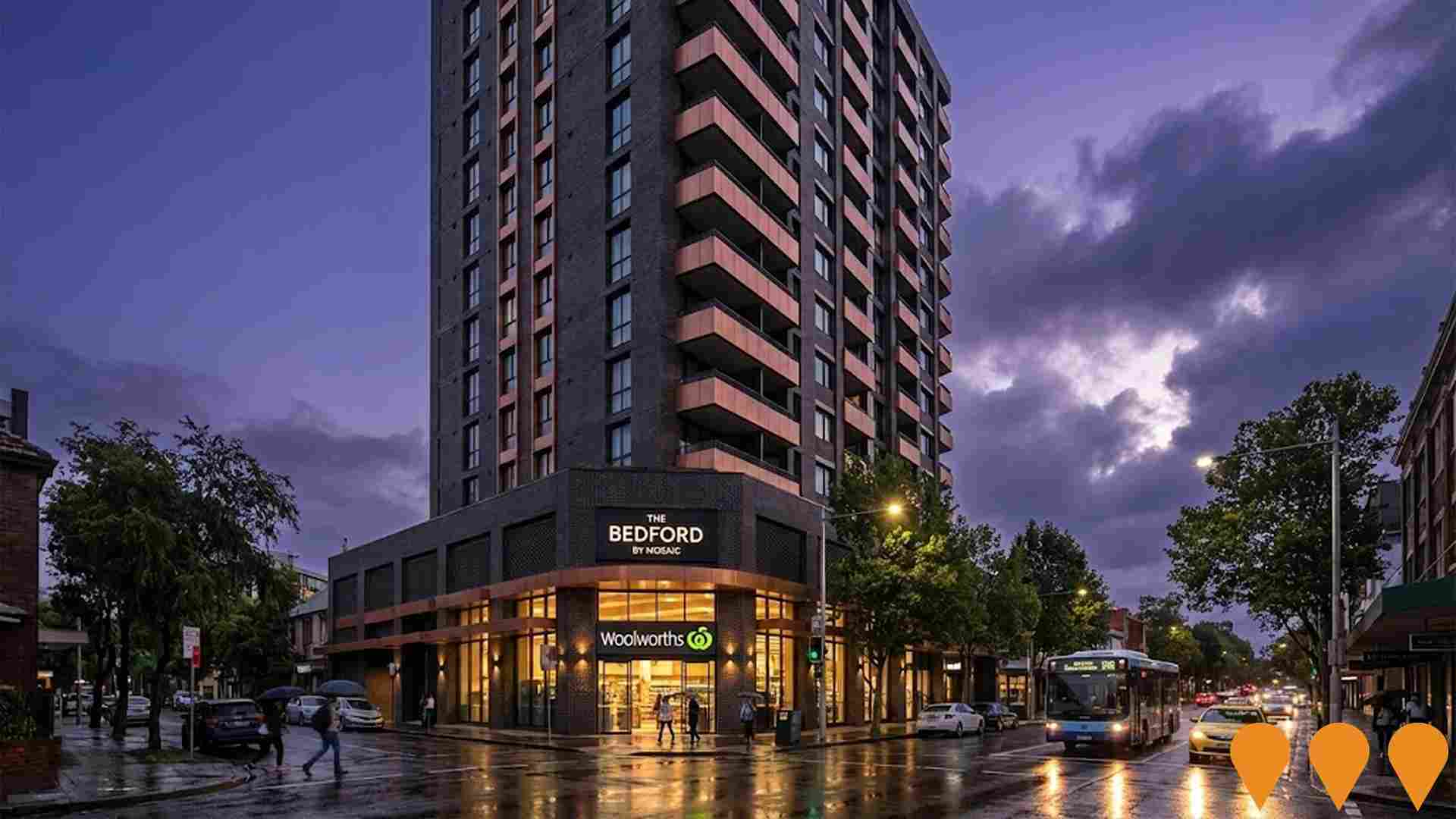

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Brisbane 2032 Games Venue Infrastructure Program

The $7.1 billion Games Venue Infrastructure Program involves the planning and delivery of 17 new and upgraded venues across Queensland, including the new 63,000-seat Brisbane Stadium at Victoria Park and the National Aquatic Centre. Led by the Games Independent Infrastructure and Coordination Authority (GIICA), the program aims to deliver long-term sporting and community legacy benefits for Brisbane and regional Queensland.

Waterfront Brisbane

Major mixed-use redevelopment of the Eagle Street Pier and Waterfront Place precinct by Dexus. Delivers two premium-grade office towers (46 and 49 levels), 14,000 sqm of retail and dining, a new 15-metre-wide Riverwalk, over 9,000 sqm of public open space including waterfront terraces and a large civic plaza, and improved pedestrian connections between the Brisbane CBD and the river.

Teneriffe Banks

Brisbane's largest private mixed-use riverfront development by Kokoda Property. Five towers delivering 213 luxury residential apartments, Brisbane's first Kimpton Hotel (163 keys), commercial office space, riverfront dining, retail and over 4,800 sqm of public waterfront amenities including a 220 m riverwalk extension. Staged construction is underway with first completions expected 2027.

Howard Smith Wharves

Award-winning riverside lifestyle and entertainment precinct under the Story Bridge. Original phase completed 2018. Current expansion includes a new 5-star 77-room boutique hotel with overwater pool deck, day spa, 400-seat music hall, additional restaurants and bars, upgraded public realm and enhanced active transport connections. Development application approved by Brisbane City Council in late 2024, targeting completion in 2027-2028 well ahead of the 2032 Brisbane Olympic and Paralympic Games.

Waterfront Newstead - Mirvac Masterplan

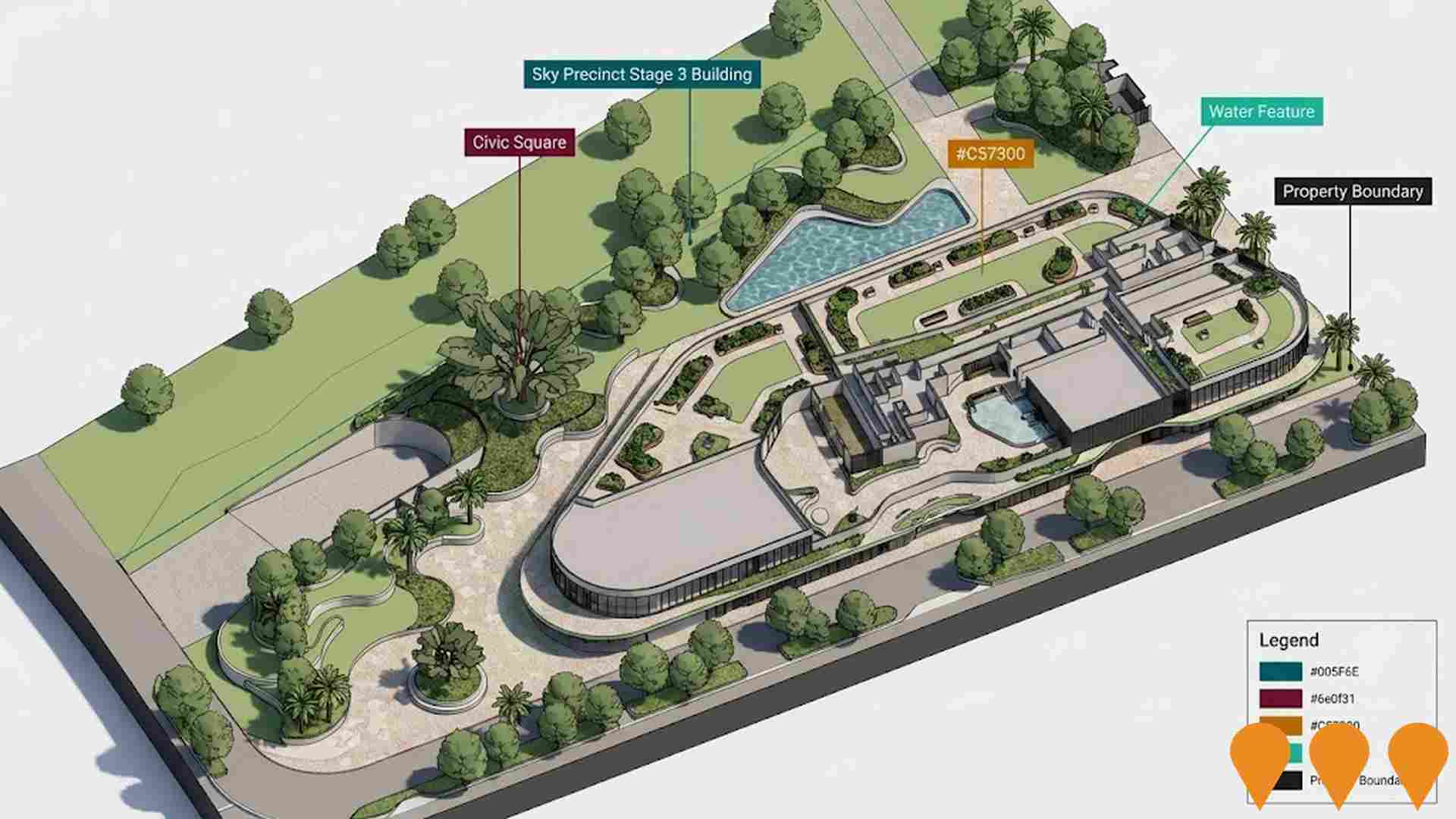

Long-running, $1 billion masterplanned community and urban renewal project by Mirvac along the Brisbane River. The precinct includes luxury apartments, build-to-rent housing (LIV Anura), commercial and retail spaces, and over 50% dedicated public parkland and open space. The 'Sky Precinct' is the latest phase, with Quay (135 apartments) recently completed, Isle (133 apartments) under construction with expected completion in 2026, and the final residential tower (Sky Stage 3, 138 apartments) approved.

James Place

James Place is a landmark mixed-use development by Forme at 75-85 James Street, Fortitude Valley. Designed by Richards & Spence with landscaping by Wild Studio and constructed by Graya, the six-level project features over 8,700sqm of premium boutique retail, hospitality, wellness, and commercial office space, a lush central piazza, dual street frontages, an arcade connecting James Street to Southwick Lane, landscaped terraces, and an elevated rooftop venue with city views. Construction commenced mid-2024, with completion targeted for early 2026.

Brunswick & Co

Queensland's first true Build-to-Rent high-density residential development featuring 366 apartments across 25 storeys, including 144 subsidised affordable housing units. The project showcases resort-style amenities including rooftop pool, dog park, fitness studio, co-working spaces, cinema rooms, and ground-floor retail. Designed by COX Architecture and built by Hutchinson Builders, it targets 5-Star Green Star certification with 100% renewable energy and all-electric design. Part of the Queensland Government's BTR Pilot Project, located adjacent to the $500 million Valley Metro redevelopment in Fortitude Valley's entertainment precinct.

The Bedford by Mosaic

Landmark $310 million 17-storey mixed-use development featuring 128 luxury apartments and ground-floor Woolworths supermarket. First major development in Kangaroo Point in over a decade, designed by BDA Architecture with resort-style amenities and river views. Achieved $210 million in pre-sales within first two weeks. Includes 2,236sqm Woolworths supermarket, cafe, liquor store, and extensive basement parking.

Employment

Employment conditions in New Farm remain below the national average according to AreaSearch analysis

New Farm has a highly educated workforce with strong representation in professional services. The unemployment rate was 4.6% as of September 2025, with an estimated employment growth of 1.1% over the past year.

As of that date, 8,937 residents were employed, with an unemployment rate of 4.6%, which is 0.6% higher than Greater Brisbane's rate of 4.0%. Workforce participation was at 68.0%, slightly higher than Greater Brisbane's 64.5%. Key industries of employment among residents included professional & technical services, health care & social assistance, and accommodation & food. The area showed notable concentration in professional & technical services, with employment levels at 2.2 times the regional average.

However, construction had limited presence, with only 5.4% of employment compared to the regional average of 9.0%. Employment opportunities locally appeared limited based on Census data comparing working population and resident population. Between September 2024 and September 2025, employment levels increased by 1.1%, while labour force grew by 1.0%, causing a slight decrease in unemployment rate by 0.1 percentage points. In contrast, Greater Brisbane saw higher growth rates with employment rising by 3.8% and unemployment falling by 0.5 percentage points. State-level data from QLD as of 25-Nov showed employment contracted slightly by 0.01%, with an unemployment rate of 4.2%. National employment forecasts from Jobs and Skills Australia projected a growth of 6.6% over five years and 13.7% over ten years. Applying these projections to New Farm's employment mix, local employment was estimated to increase by 7.5% over five years and 15.0% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

The New Farm SA2 had a median taxpayer income of $72,742 and an average income of $128,106 in the financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This is notably higher than Greater Brisbane's median income of $55,645 and average income of $70,520 during the same period. By September 2025, estimated incomes would be approximately $82,919 (median) and $146,028 (average), based on a 13.99% growth in wages since financial year 2022. Census data from 2021 shows individual earnings reached the 92nd percentile nationally at $1,220 weekly. In New Farm SA2, 29.1% of residents (4,030 people) earned between $1,500 and $2,999 weekly, which is similar to regional levels where 33.3% fall within this range. A significant portion of households, 33.8%, achieved high weekly earnings exceeding $3,000, indicating strong consumer spending power despite high housing costs consuming 16.0% of income. Despite these expenses, disposable income remains at the 70th percentile, and the area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

New Farm features a more urban dwelling mix with significant apartment living, with above-average rates of outright home ownership

New Farm's dwelling structure, as per the latest Census, consisted of 20.9% houses and 79.1% other dwellings (semi-detached, apartments, 'other' dwellings). Brisbane metro had 12.9% houses and 87.2% other dwellings. Home ownership in New Farm was at 24.6%, with mortgaged dwellings at 20.6% and rented ones at 54.9%. The median monthly mortgage repayment in the area was $2,276, higher than Brisbane metro's average of $2,000. Median weekly rent in New Farm was $405, compared to Brisbane metro's $440. Nationally, New Farm's mortgage repayments were significantly higher than the Australian average of $1,863, while rents exceeded the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

New Farm features high concentrations of lone person households and group households, with a fairly typical median household size

Family households account for 48.9% of all households, including 13.9% couples with children, 28.7% couples without children, and 5.0% single parent families. Non-family households constitute the remaining 51.1%, with lone person households at 42.3% and group households making up 8.8%. The median household size is 1.9 people, which aligns with the Greater Brisbane average.

Frequently Asked Questions - Households

Local Schools & Education

Educational achievement in New Farm places it within the top 10% nationally, reflecting strong academic performance and high qualification levels across the community

New Farm's educational attainment is notably higher than broader benchmarks. Among residents aged 15 and above, 54.2% hold university qualifications, compared to 25.7% in Queensland and 30.4% nationally. Bachelor degrees are the most common at 35.1%, followed by postgraduate qualifications (14.0%) and graduate diplomas (5.1%). Vocational pathways account for 22.5% of qualifications, with advanced diplomas at 10.4% and certificates at 12.1%.

Educational participation is high, with 25.5% of residents currently enrolled in formal education. This includes 9.9% in tertiary education, 5.0% in primary education, and 4.1% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in New Farm shows that there are currently 58 active transport stops operating. These comprise a mix of ferry and bus services. Seven individual routes serve these stops, collectively facilitating 3,864 weekly passenger trips.

The accessibility of transport is rated as excellent, with residents typically situated just 123 meters from the nearest transport stop. On average, service frequency across all routes amounts to 552 trips per day, equating to approximately 66 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in New Farm is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

New Farm shows superior health outcomes with both younger and older age groups having low prevalence of common health conditions. The rate of private health cover is exceptionally high at approximately 81% of the total population (11,247 people), compared to 64.3% across Greater Brisbane and a national average of 55.3%. The most prevalent medical conditions are mental health issues and asthma, affecting 10.3 and 7.2% of residents respectively, while 70.0% report being completely free from medical ailments compared to 75.5% across Greater Brisbane.

As of 2021, 18.8% of residents are aged 65 and over (2,602 people), higher than the 10.5% in Greater Brisbane. Health outcomes among seniors are particularly strong, outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in New Farm was found to be above average when compared nationally for a number of language and cultural background related metrics

New Farm's cultural diversity exceeds most local markets, with 17.0% speaking a language other than English at home and 29.9% born overseas. Christianity is the predominant religion in New Farm, accounting for 43.6%. Notably, Judaism, at 0.4%, is higher than Greater Brisbane's 0.2%.

The top three ancestral groups are English (26.8%), Australian (17.6%), and Irish (12.5%). Some ethnic groups show significant differences: French (1.0% vs regional 0.9%), Scottish (9.3% vs 7.2%), and Spanish (0.7% vs 1.0%) are notably overrepresented in New Farm.

Frequently Asked Questions - Diversity

Age

New Farm's population aligns closely with national norms in age terms

The median age in New Farm is 39 years, which is slightly higher than Greater Brisbane's average of 36 years and close to Australia's median age of 38 years. Compared to Greater Brisbane, New Farm has a higher proportion of residents aged 25-34 (22.6%) but fewer residents aged 5-14 (5.8%). This concentration of 25-34 year-olds is significantly higher than the national average of 14.5%. Between the 2021 Census and now, the proportion of residents aged 75-84 has increased from 5.3% to 6.7%, while the proportion of those aged 35-44 has decreased from 15.6% to 14.4%. By 2041, New Farm's age composition is expected to change significantly. The number of residents aged 75-84 is projected to grow by 73%, reaching 1,604 from 925. This growth will be led by the aging population dynamic, with those aged 65 and above comprising 66% of the projected growth. Conversely, population declines are projected for the 5-14 and 0-4 age groups.