Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Woodhill lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch, Woodhill's population is estimated at around 1,628 as of Nov 2025. This reflects an increase of 397 people (32.3%) since the 2021 Census, which reported a population of 1,231 people. The change is inferred from the resident population of 1,536 estimated by AreaSearch following examination of the latest ERP data release by the ABS (June 2024) and an additional 106 validated new addresses since the Census date. This level of population equates to a density ratio of 126 persons per square kilometer in Woodhill (Qld) (SA2). The area's growth exceeded national average (8.9%) and state averages, marking it as a growth leader in the region. Population growth was primarily driven by interstate migration contributing approximately 75.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. Future population trends forecast a significant increase in top quartile statistical areas across the nation. The Woodhill (Qld) (SA2) is expected to expand by 505 persons to 2041, reflecting an increase of 16.6% over the 17 years based on aggregated SA2-level projections.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Woodhill when compared nationally

Woodhill has seen approximately 25 residential properties granted approval annually based on AreaSearch analysis. Over the past five financial years, from FY-21 to FY-25, around 129 homes were approved, with a further 12 approved in FY-26 so far. On average, 1.6 new residents arrive per year for each new home built over these five years, indicating a balanced supply and demand market that supports stable conditions.

The average construction value of new dwellings is $361,000. In the current financial year, $312,000 in commercial approvals have been registered, suggesting minimal commercial development activity. Compared to Greater Brisbane, Woodhill has 19.0% less new development per person but ranks among the 96th percentile nationally for development activity, demonstrating strong developer confidence. Recent construction comprises 89.0% detached dwellings and 11.0% medium and high-density housing, maintaining the area's low density character with a focus on family homes.

With around 38 people per dwelling approval, Woodhill displays growth area characteristics. Future projections estimate an addition of 270 residents by 2041, with current construction levels expected to meet demand adequately, creating favourable conditions for buyers and potentially exceeding current forecasted growth.

Frequently Asked Questions - Development

Infrastructure

Woodhill has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

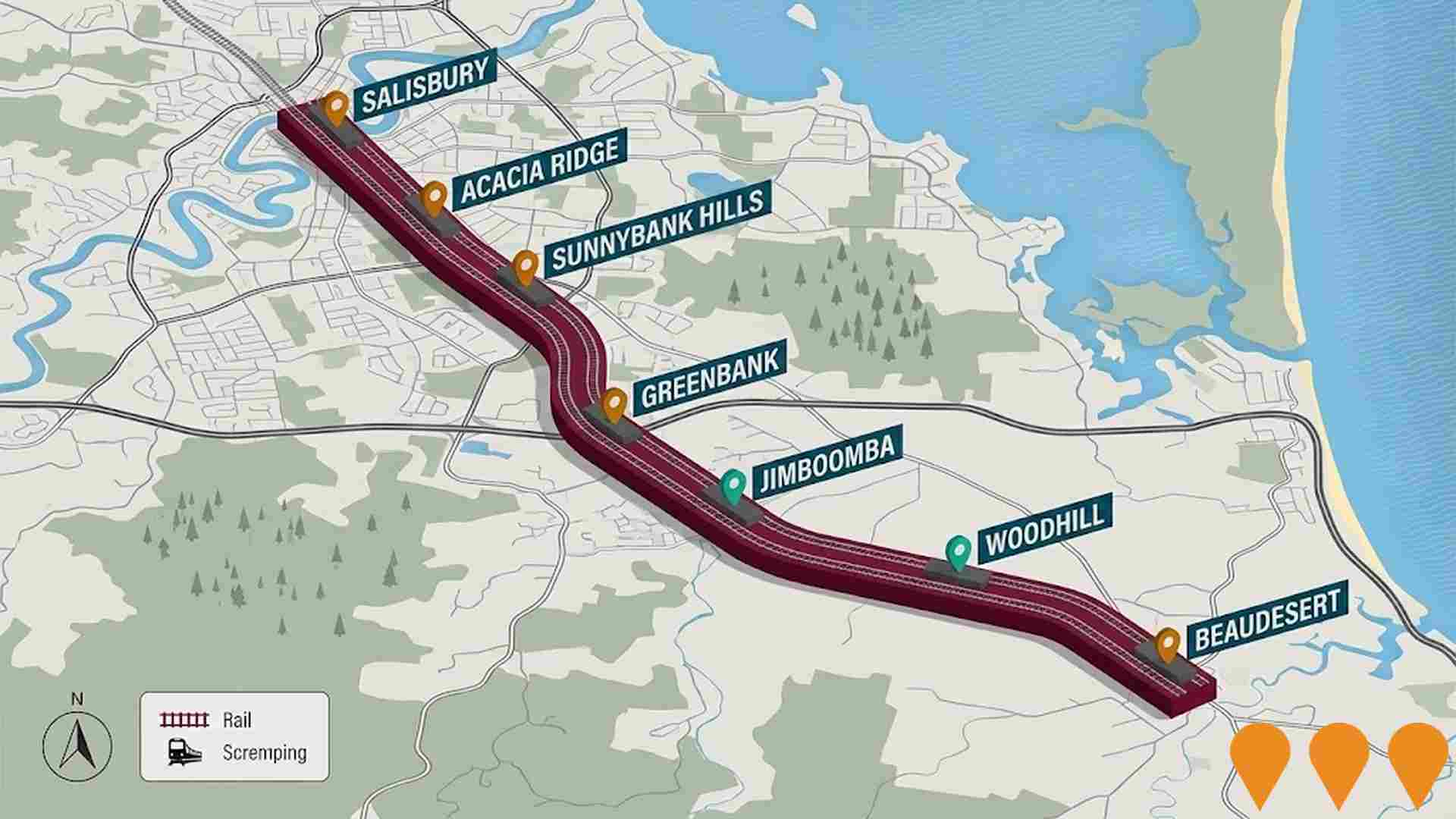

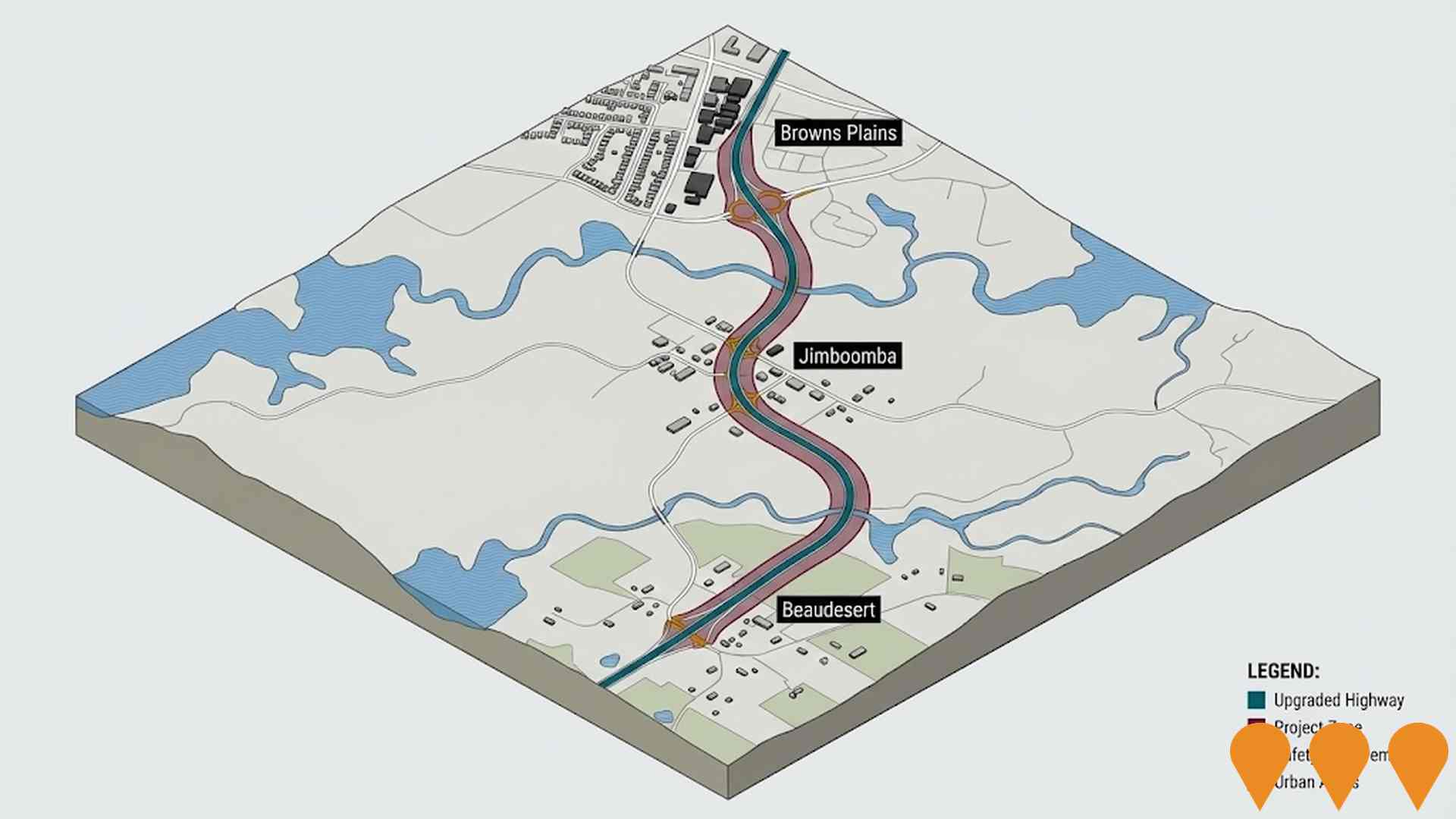

No factors influence a region's performance more than alterations to local infrastructure, major projects, and planning initiatives. AreaSearch has identified zero projects that could potentially impact this area. Notable projects include the Greater Flagstone Priority Development Area, the Salisbury to Beaudesert Passenger Rail project, the Mount Lindesay Highway Upgrade Program, and the Browns Plains To Beaudesert Road Capacity And Safety initiative, with the following list detailing those most likely to be significant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

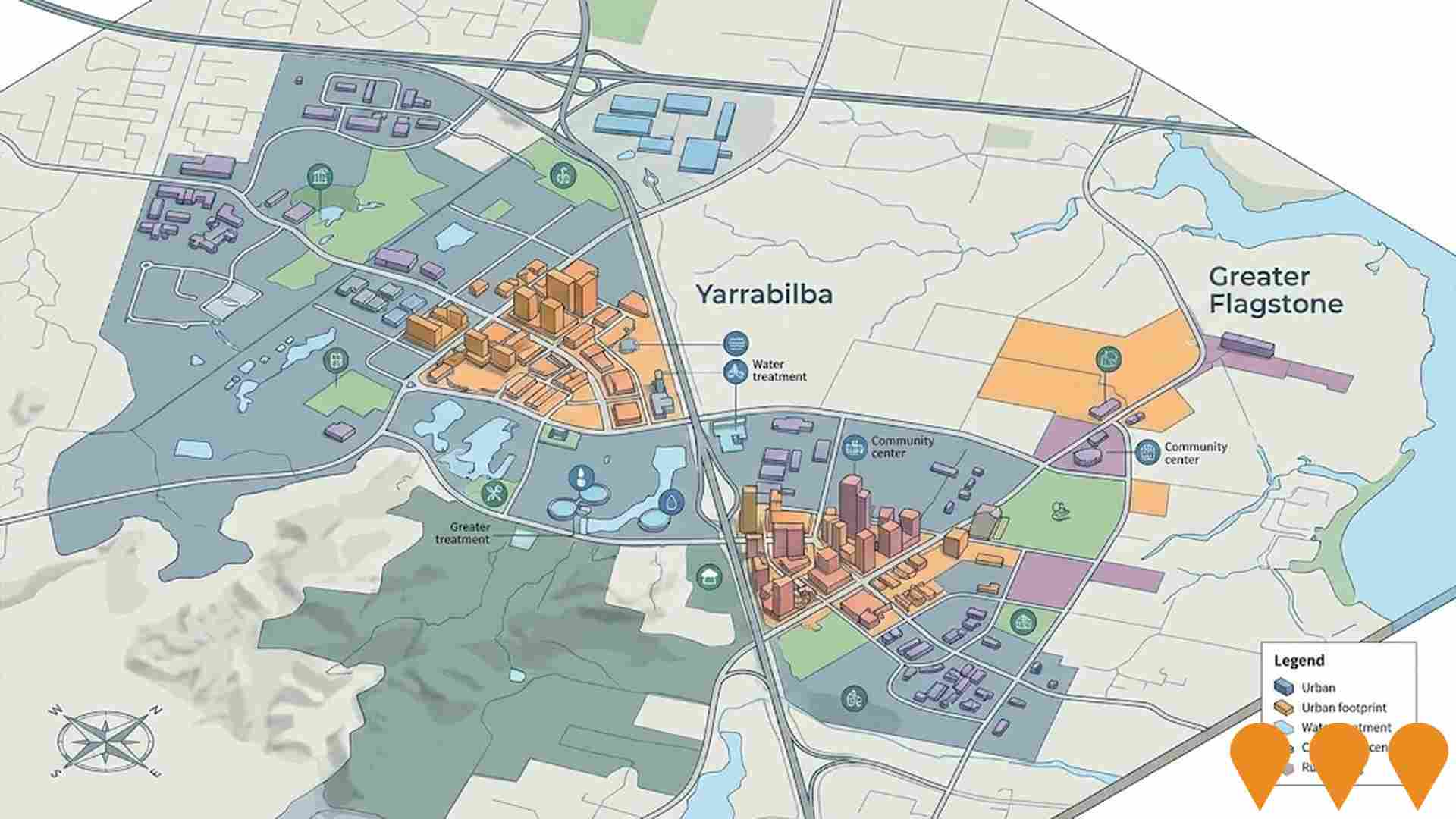

Greater Flagstone Priority Development Area

Queenslands second-largest Priority Development Area (7,188 ha), declared in October 2010. Long-term masterplanned urban growth area between Brisbane and the Gold Coast, ultimately delivering approx. 50,000 dwellings for up to 138,000 residents over 30-40 years. Includes a planned 126-ha city centre, major employment precincts, schools, parks and potential future interstate passenger rail. Managed by Economic Development Queensland (EDQ).

Queensland Energy Roadmap Infrastructure

The Queensland Energy Roadmap 2025 is the State Government's strategic plan to deliver affordable, reliable, and sustainable energy. Replaces the former Energy and Jobs Plan, focusing on extending the life of state-owned coal assets, a $1.6 billion Electricity Maintenance Guarantee, and the $400 million Queensland Energy Investment Fund. Key infrastructure includes the CopperString transmission line and new gas-fired generation, while the Pioneer-Burdekin Pumped Hydro project has been cancelled in favor of smaller storage options.

Queensland Energy and Jobs Plan

The Queensland Energy and Jobs Plan, initially a comprehensive plan for renewable energy and job creation, has been superseded by the Queensland Energy Roadmap 2025 by the new government (October 2025). The Roadmap focuses on energy affordability, reliability, and sustainability by leveraging existing coal and gas assets, increasing private sector investment in renewables and storage (targeting 6.8 GW of wind/solar and 3.8 GW of storage by 2030), and developing a new Regional Energy Hubs framework to replace Renewable Energy Zones. The initial $62 billion investment pipeline is now primarily focused on implementing the new Roadmap's priorities, including an estimated $26 billion in reduced energy system costs compared to the previous plan. The foundational legislation is the Energy Roadmap Amendment Bill 2025, which is currently before Parliament and expected to pass by December 2025, formally repealing the previous renewable energy targets. Key infrastructure projects like CopperString's Eastern Link are still progressing. The overall project is in the planning and legislative amendment phase under the new policy.

Flagstone

Flagstone is one of Queensland's largest masterplanned communities located in the Greater Flagstone Priority Development Area (PDA), south-west of Brisbane. When complete it will be home to around 120,000 people across 7,000 hectares with approximately 50,000 new dwellings, major employment zones, multiple town centres, schools, health facilities, 330 hectares of parks and open space, and extensive active transport networks.

Yarrabilba and Greater Flagstone Infrastructure Funding Agreement

A $1.2 billion, 45-year infrastructure funding and delivery agreement signed in 2019 between Economic Development Queensland (EDQ), Logan City Council and nine private developers to deliver trunk roads, water, sewer, parks and community facilities supporting the Yarrabilba and Greater Flagstone Priority Development Areas. Multiple packages are currently under construction or completed, with works continuing progressively until approximately 2060-2065.

Brisbane to Gold Coast Transport Corridor Upgrades (Corridor Program)

A program of major transport upgrades along the Brisbane to Gold Coast corridor, incorporating multiple individual projects (such as the **Logan and Gold Coast Faster Rail** and the **Coomera Connector (M9)**) to enhance connectivity, reduce congestion, and support population growth. Components are at various stages, with key rail and road projects currently in **Construction** and **Planning** phases.

Building Future Hospitals Program

Queensland's flagship hospital infrastructure program delivering over 2,600 new and refurbished public hospital beds by 2031-32. Includes major expansions at Ipswich Hospital (Stage 2), Logan Hospital, Princess Alexandra Hospital, Townsville University Hospital, Gold Coast University Hospital and multiple new satellite hospitals and community health centres.

Bromelton State Development Area

15,610 hectare State Development Area with 1,800 hectares for industrial development. Major freight and logistics hub with rail connectivity to Sydney-Brisbane line. Key facilities include SCT Logistics $35.2 million intermodal rail freight facility and warehouses (operational since January 2017, providing 75+ local jobs), GELITA Australia gelatine manufacturing plant, A.J. Bush & Sons rendering facility, and Beaudesert Central Waste Management Facility. Future developments include Australian Rail Track Corporation 850-hectare logistics hub. The facility supports strategic freight operations with road-rail intermodal capabilities, 3km double-stacked train capacity, and serves as a critical link in Australia's freight network connecting Melbourne to Brisbane corridor.

Employment

The exceptional employment performance in Woodhill places it among Australia's strongest labour markets

Woodhill has a diverse workforce with both white and blue-collar jobs. The construction sector is prominent, with an unemployment rate of 0.7% and estimated employment growth of 2.8% in the past year, according to AreaSearch data aggregation.

As of September 2025912 residents are employed, with an unemployment rate of 3.3%, below Greater Brisbane's 4.0%. Workforce participation is high at 71.7%. Employment is concentrated in construction, health care & social assistance, and manufacturing. Construction shows strong specialization, with an employment share 2.1 times the regional level.

Conversely, health care & social assistance has lower representation, at 11.2% versus the regional average of 16.1%. The area may offer limited local employment opportunities. Between September 2024 and September 2025, employment levels increased by 2.8%, labour force grew by 2.6%, reducing unemployment by 0.4 percentage points. In contrast, Greater Brisbane had employment growth of 3.8% and a 0.5 percentage point drop in unemployment. Statewide, Queensland's employment contracted slightly by 0.01% (losing 1,210 jobs) as of 25-Nov-25, with an unemployment rate of 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia forecasts national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Woodhill's employment mix suggests local employment should increase by 6.2% over five years and 12.8% over ten years, though this is a simple extrapolation for illustrative purposes and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Woodhill had a median taxpayer income of $59,810 and an average of $69,819. This was above the national average. Greater Brisbane had a median income of $55,645 and an average of $70,520 in the same period. Based on Wage Price Index growth of 13.99% since financial year 2022, current estimates for Woodhill would be approximately $68,177 (median) and $79,587 (average) as of September 2025. According to the 2021 Census, household incomes in Woodhill ranked at the 90th percentile ($2,505 weekly). Income distribution data shows that 40.3% of residents (656 people) fall within the $1,500 - 2,999 weekly income bracket. This is consistent with broader trends across the area showing 33.3% in the same category. A substantial proportion of high earners (33.6%) have incomes above $3,000/week, indicating strong economic capacity throughout the area. High housing costs consume 16.3% of income, but despite this, disposable income ranks at the 89th percentile. The area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Woodhill is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Woodhill's dwelling structure, as per the latest Census, consisted of 99.1% houses and 0.9% other dwellings. In comparison, Brisbane metro had 97.3% houses and 2.8% other dwellings. Home ownership in Woodhill was at 16.2%, with mortgaged dwellings at 74.6% and rented ones at 9.1%. The median monthly mortgage repayment in Woodhill was $2,167, higher than Brisbane metro's $2,000. The median weekly rent in Woodhill was $395, compared to Brisbane metro's $390. Nationally, Woodhill's mortgage repayments were significantly higher at $2,167 versus the Australian average of $1,863, and rents were also higher at $395 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Woodhill features high concentrations of family households, with a higher-than-average median household size

Family households comprise 91.8% of all households, including 54.1% couples with children, 26.6% couples without children, and 11.4% single parent families. Non-family households constitute the remaining 8.2%, with lone person households at 6.1% and group households comprising 0.9%. The median household size is 3.4 people, which is larger than the Greater Brisbane average of 3.2.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Woodhill fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 13.2%, significantly lower than Greater Brisbane's average of 30.5%. Bachelor degrees are the most common at 8.8%, followed by postgraduate qualifications (2.5%) and graduate diplomas (1.9%). Vocational credentials are prevalent, with 45.6% of residents aged 15+ holding them, including advanced diplomas (10.7%) and certificates (34.9%). Educational participation is high, with 34.3% of residents currently enrolled in formal education, comprising 13.0% in primary, 11.1% in secondary, and 2.4% in tertiary education.

Educational participation is notably high, with 34.3% of residents currently enrolled in formal education. This includes 13.0% in primary education, 11.1% in secondary education, and 2.4% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Woodhill has two active public transport stops, both serving buses. These stops are served by one route in total, offering 92 weekly passenger trips combined. The accessibility of these services is limited, with residents generally located 1595 meters away from the nearest stop.

On average, there are 13 trips per day across all routes, which equates to about 46 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Woodhill is notably higher than the national average with prevalence of common health conditions low among the general population though higher than the nation's average across older, at risk cohorts

Woodhill shows better-than-average health outcomes with a low prevalence of common health conditions among its general population. However, this rate is higher than the national average among older and at-risk cohorts.

Approximately 55% (~893 people) have private health cover, compared to Greater Brisbane's 49.8%. Mental health issues and asthma are the most prevalent medical conditions in Woodhill, affecting 9.2 and 8.0% of residents respectively. About 70.7% of residents report no medical ailments, compared to 69.6% across Greater Brisbane. The area has 10.0% (162 people) aged 65 and over, lower than Greater Brisbane's 11.4%. While health outcomes among seniors require more attention than the broader population, they present some challenges in Woodhill.

Frequently Asked Questions - Health

Cultural Diversity

Woodhill ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Woodhill's cultural diversity was found to be below average, with 88.8% of its population being Australian citizens, 84.3% born in Australia, and 95.2% speaking English only at home. Christianity was the main religion in Woodhill, comprising 47.1% of its population. The most notable overrepresentation was in the 'Other' category, which made up 1.1% of Woodhill's population compared to 1.0% across Greater Brisbane.

In terms of ancestry, the top three groups were English (30.8%), Australian (29.8%), and Scottish (6.9%). There were also notable differences in the representation of certain ethnic groups: New Zealand was overrepresented at 2.2%, Russian at 0.6%, and German at 6.0%.

Frequently Asked Questions - Diversity

Age

Woodhill hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Woodhill's median age is 31 years, which is younger than Greater Brisbane's average of 36 years and significantly below Australia's median of 38 years. Compared to Greater Brisbane, Woodhill has a higher proportion of residents aged 5-14 (17.4%) but fewer residents aged 75-84 (2.2%). This 5-14 age group concentration is notably higher than the national average of 12.2%. Post-2021 Census data indicates that the 15 to 24 age group has increased from 12.3% to 13.4%, while the 75 to 84 cohort has risen from 1.2% to 2.2%. Conversely, the 5 to 14 age group has decreased from 18.2% to 17.4%. Demographic projections suggest Woodhill's age profile will change substantially by 2041. The 45 to 54 age cohort is projected to grow steadily, increasing by 57 people (28%) from 205 to 263. Conversely, population declines are forecast for the 35 to 44 and 25 to 34 age groups.