Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Richmond Hill has shown very soft population growth performance across periods assessed by AreaSearch

Based on ABS population updates for the broader area and new addresses validated by AreaSearch, the Richmond Hill (Qld) statistical area (Lv2)'s population is estimated at around 2,439 as of Nov 2025. This reflects a decrease of 14 people since the 2021 Census, which reported a population of 2,453 people in the same area. The change is inferred from AreaSearch's estimate of the resident population at 2,433 following examination of the latest ERP data release by the ABS (June 2024), and an additional 1 validated new address since the Census date. This level of population equates to a density ratio of 580 persons per square kilometer in the Richmond Hill (Qld) SA2. Population growth for this area was primarily driven by overseas migration, which was essentially the sole driver of population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. Looking at population projections moving forward for the Richmond Hill (Qld) SA2, over this period, projections indicate a decline in overall population by 4 persons by 2041. However, growth across specific age cohorts is anticipated, led by the 25 to 34 age group, which is projected to grow by 78 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Richmond Hill is very low in comparison to the average area assessed nationally by AreaSearch

Richmond Hill has had minimal residential development activity with 2 dwelling approvals annually over the past five years (13 dwellings in total). This low level of development is typical of rural areas where housing needs are modest and construction activity is limited by local demand and infrastructure capacity. It should be noted that the small sample size can significantly influence annual growth statistics.

Compared to other regions, Richmond Hill has much lower development activity than the Rest of Qld. Nationally, its activity level is also below average. New developments consist of 67% standalone homes and 33% attached dwellings, with an increasing mix of townhouses and apartments offering options across different price points. This shift marks a significant departure from existing housing patterns, which are currently 87% houses. It suggests diminishing developable land availability and responds to evolving lifestyle preferences and housing affordability needs.

The estimated population per dwelling approval in Richmond Hill is 1635 people, reflecting its quiet development environment. According to AreaSearch's latest quarterly estimate, the area is projected to gain 8 residents by 2041. At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

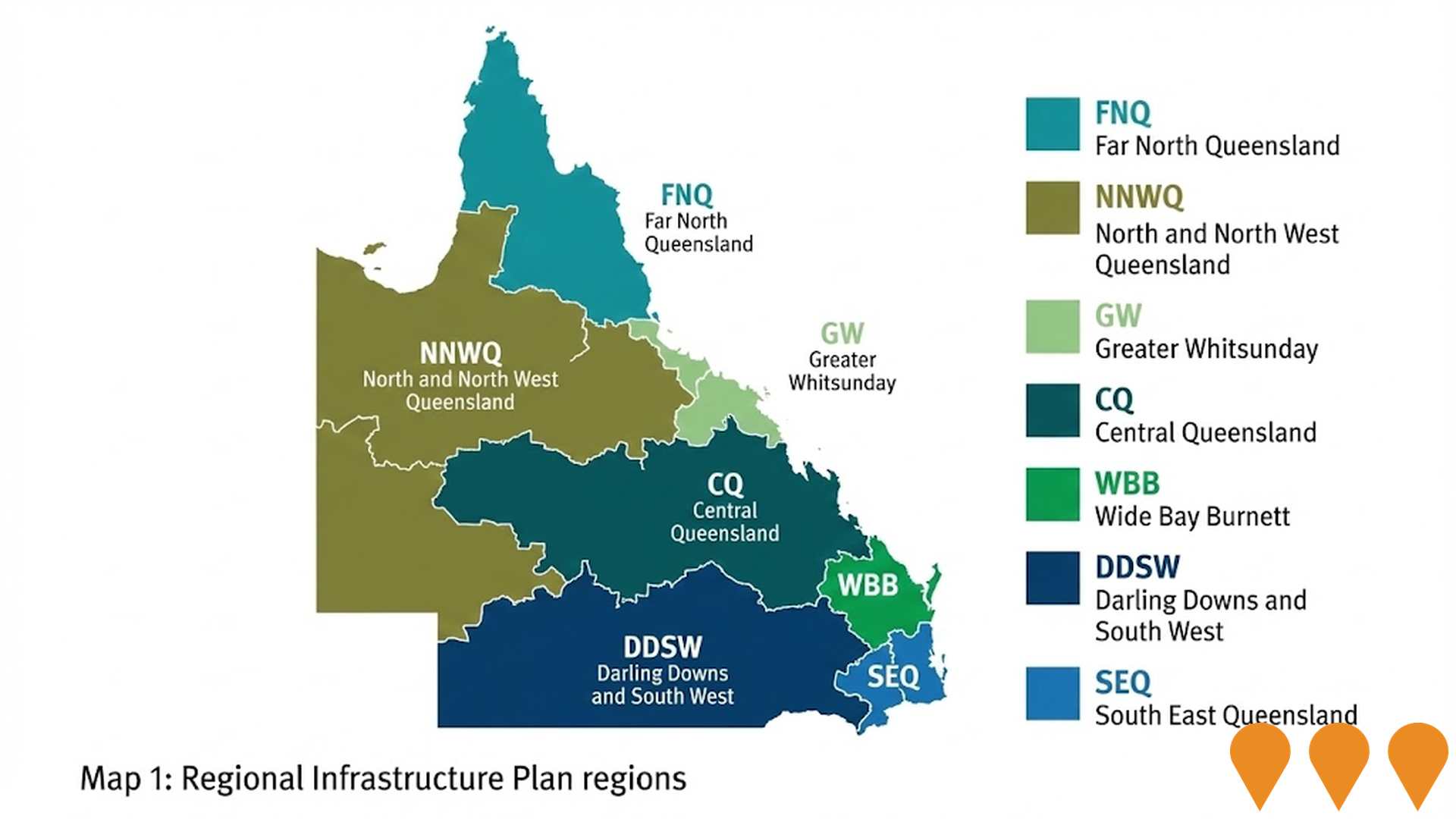

Richmond Hill has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified four projects that may impact this region. Notable projects include Renew Charters Towers, Grand Secret Estate, Queensland Inland Freight Route (Mungindi to Charters Towers), and Goldtower Central. The following details those likely most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

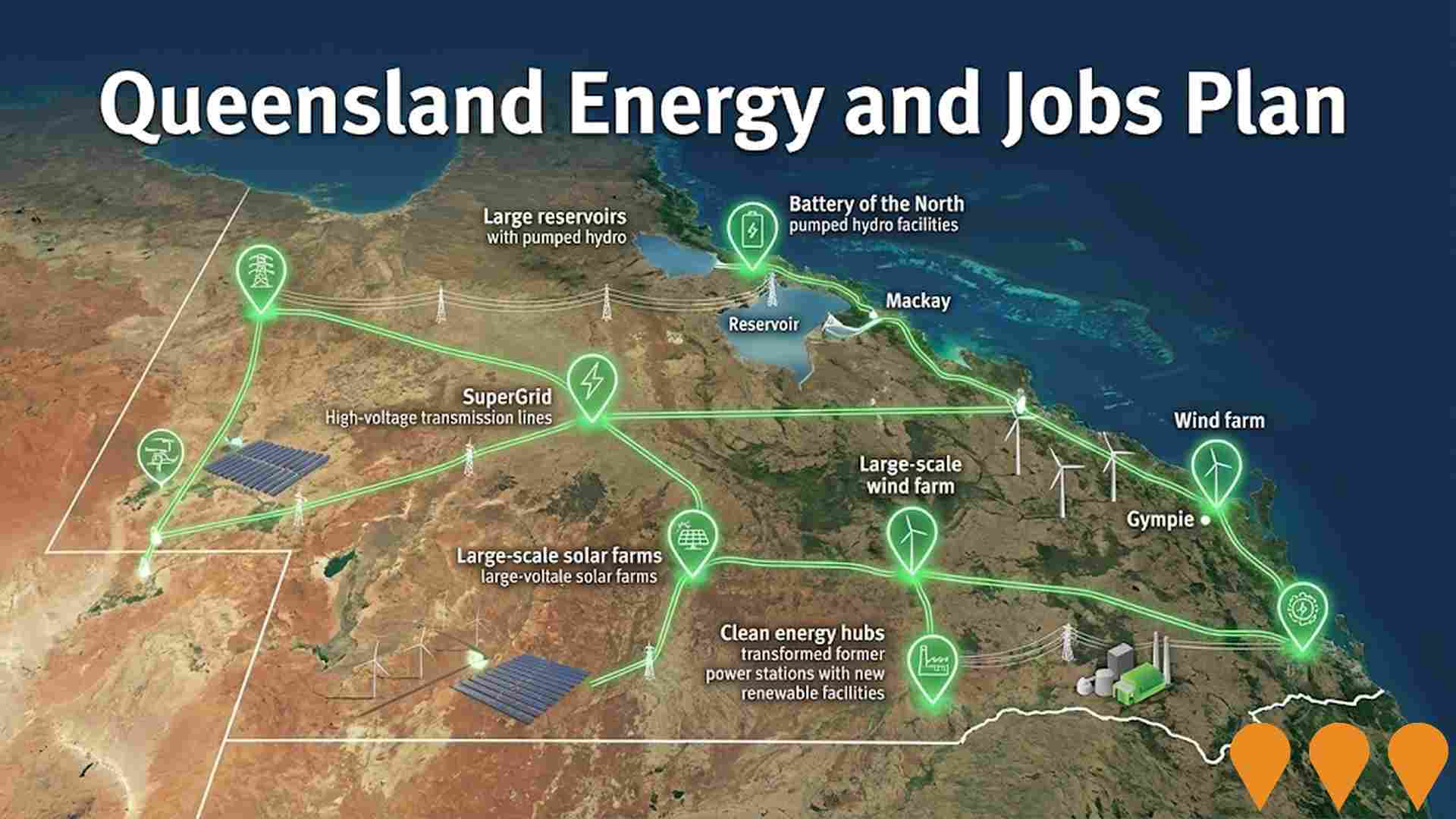

Queensland Energy Roadmap

A statewide energy transformation program following the 2025 pivot from the original Energy and Jobs Plan. The roadmap shifts focus toward a mix of existing coal asset retention until 2046, new gas-fired generation, and private sector-led renewable growth. Key active components include the CopperString transmission line, the Gladstone Grid Reinforcement, and various battery storage projects aimed at maintaining grid reliability and affordability.

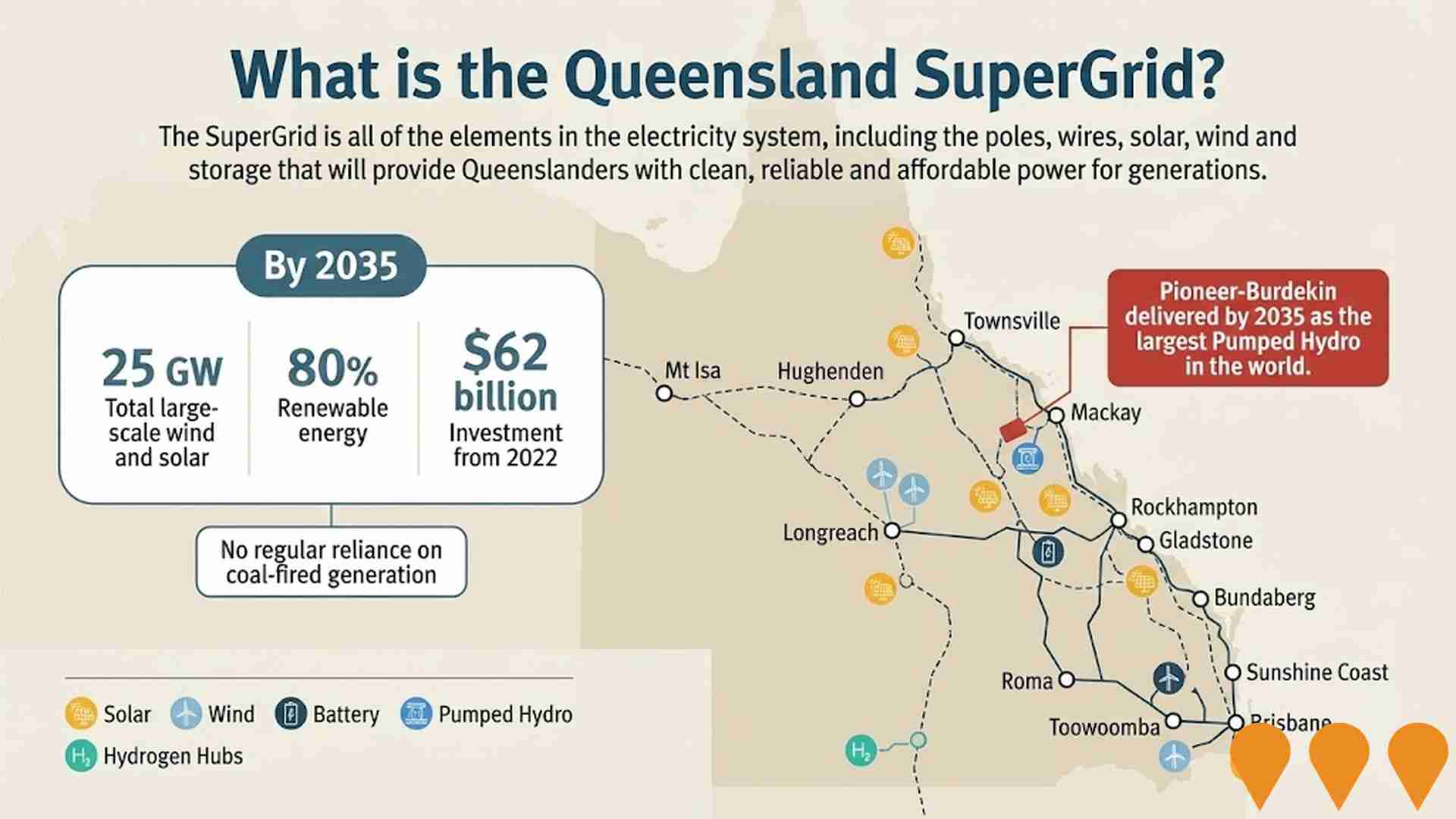

Queensland Energy and Jobs Plan SuperGrid

The Queensland SuperGrid is a high-capacity statewide electricity network connecting renewable energy zones, storage, and demand centers. As of 2026, the program is transitioning under the new Queensland Energy Roadmap, moving from rigid percentage targets to an emission-reduction focus while maintaining critical infrastructure delivery. Major works include the CopperString 2032 link, the Gladstone Grid Reinforcement (Stage 1), and the Borumba Pumped Hydro transmission connections. The plan integrates 22 GW of new renewables through Regional Energy Hubs and state-owned clean energy hubs at repurposed coal-fired power station sites.

Queensland Energy Roadmap

The Queensland Energy Roadmap is the state's revised energy strategy as of 2025-2026, replacing the previous Energy and Jobs Plan. It focuses on a market-based transition to net-zero by 2050 while extending the life of state-owned coal assets until at least 2046. Key components include the delivery of CopperString 2032 (a 1,000km transmission line), the Borumba Pumped Hydro Project, and the conversion of Renewable Energy Zones into Regional Energy Hubs. The plan prioritizes targeted transmission upgrades and gas-fired generation for grid firming.

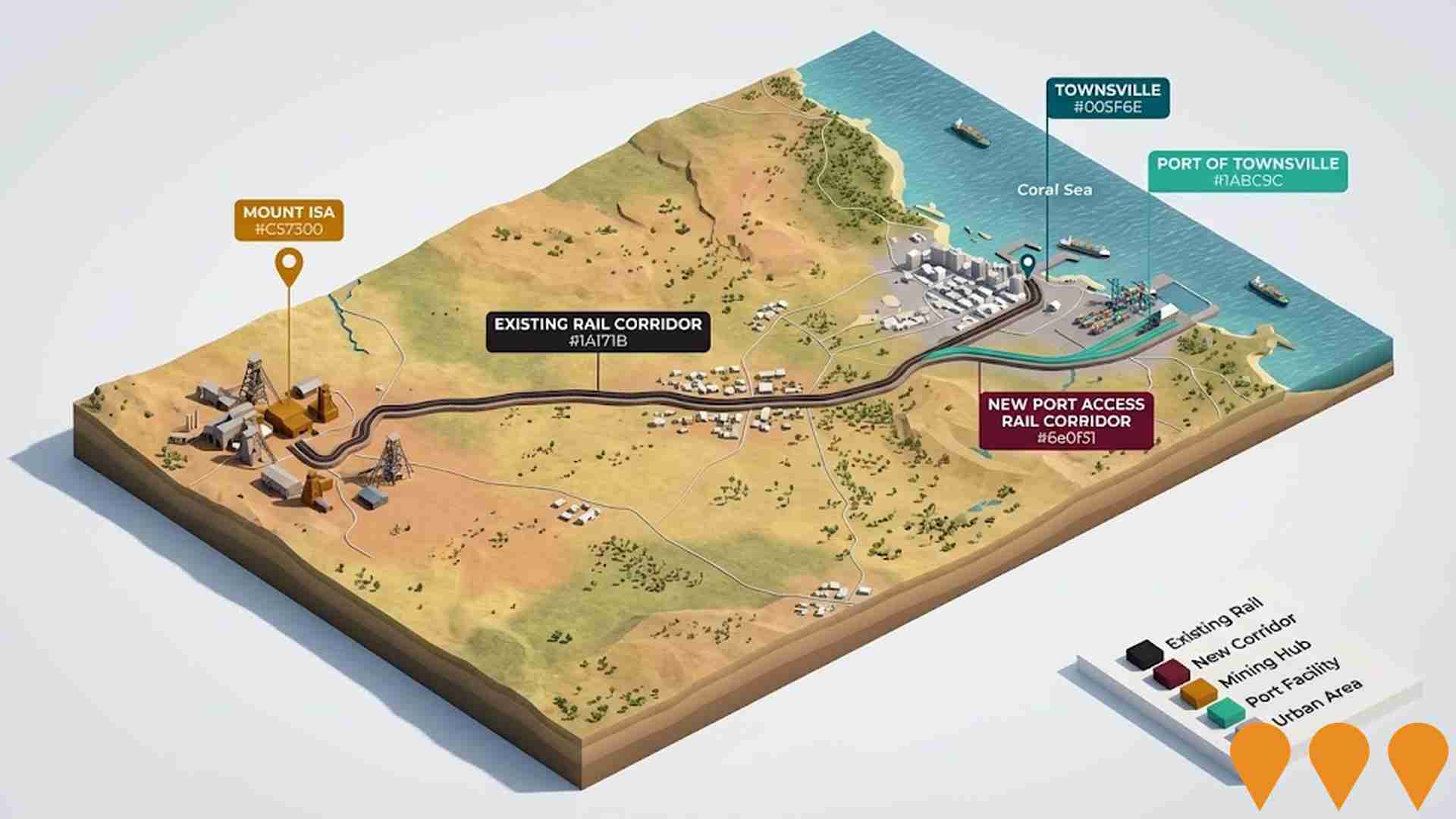

Queensland Energy and Jobs Plan - Northern Queensland SuperGrid (CopperString 2032 & Northern REZ)

A flagship 1,100 km high-voltage transmission project connecting the North West Minerals Province to the National Electricity Market. The project includes a 500kV line from Townsville to Hughenden, a 330kV line to Cloncurry, and a 220kV line to Mount Isa. It establishes the Northern Renewable Energy Zone to unlock large-scale wind and solar potential and supports critical minerals processing. Construction commenced in 2024 with workforce accommodation facilities, while major transmission line works are slated for 2025-2026.

CopperString 2032

The CopperString 2032 project involves constructing approximately 1,000 km of high-voltage transmission lines connecting the North West Minerals Province to the National Electricity Market. The project includes a 500 kV line from Townsville to Hughenden, a 330 kV line from Hughenden to Cloncurry, and a 220 kV line from Cloncurry to Mount Isa. Groundbreaking for workforce accommodation facilities occurred in July 2024, with major transmission line construction scheduled for 2026.

Renew Charters Towers

A Regional Place Activation Program initiative to revitalise the Charters Towers CBD by temporarily activating vacant shopfronts on Gill and Mosman Streets. Eligible creatives, startups, social enterprises and community groups can trial rent-free premises on a 30-day rolling licence, with insurance support via Renew Australia. The program aims to increase foot traffic, support local business growth and help property owners secure long-term tenants.

Queensland National Land Transport Network Maintenance

Program of maintenance and rehabilitation works across Queensland's National Land Transport Network to reduce the significant backlog, improve safety, lift freight efficiency and strengthen network resilience. Focus includes pavement renewal, bridge and culvert repairs, drainage, and road safety treatments delivered under TMR's maintenance programs and QTRIP.

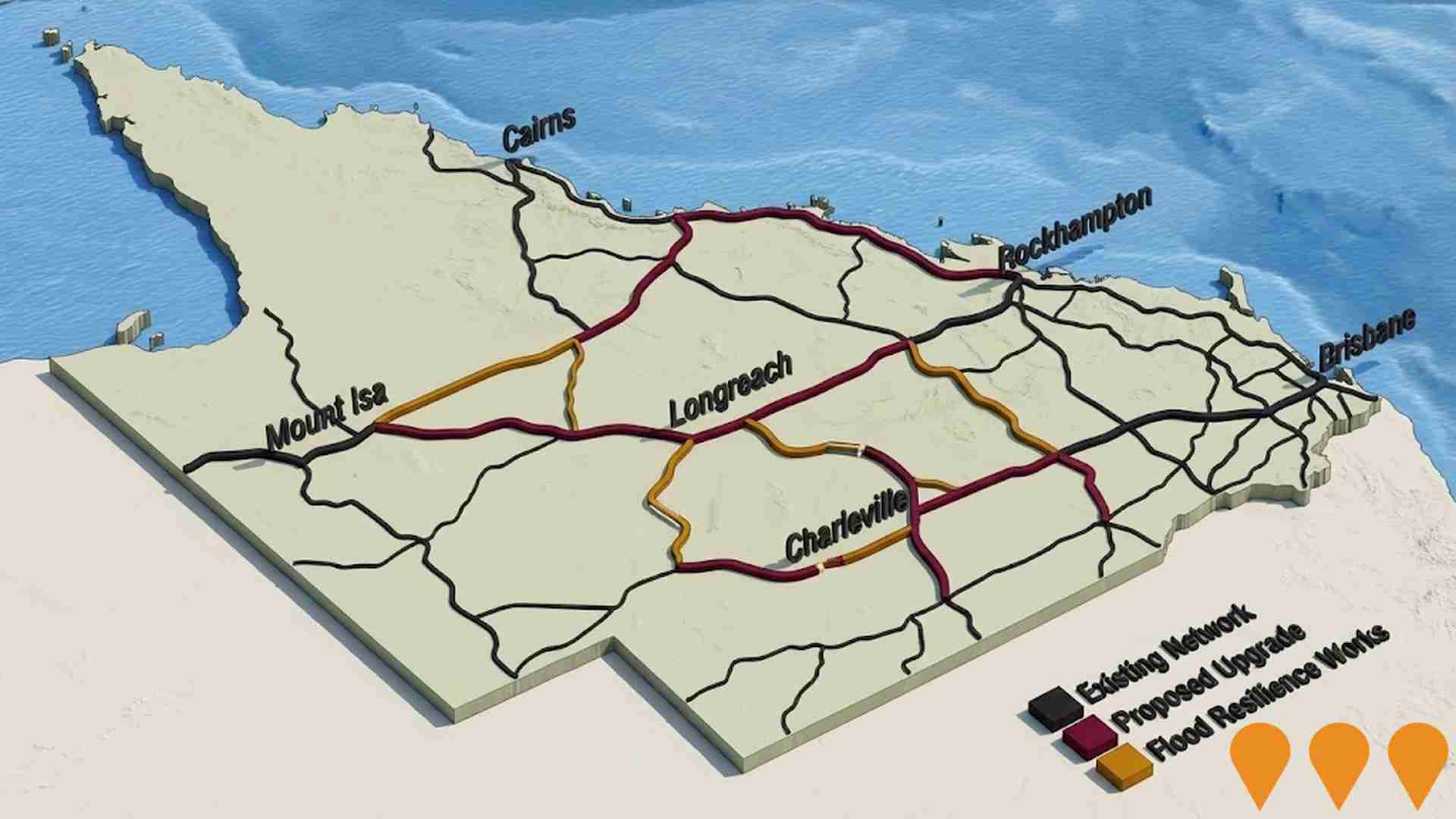

Queensland Inland Road Network Upgrade

An early-stage proposal to upgrade inland Queensland roads, improving safety, productivity, and addressing issues like flooding and deteriorating infrastructure to support regional communities and freight movement.

Employment

The labour market performance in Richmond Hill lags significantly behind most other regions nationally

Richmond Hill has an unemployment rate of 7.6%, as per AreaSearch's aggregation of statistical area data. As of September 2025944 residents are employed while the unemployment rate is 3.6% higher than Rest of Qld's rate of 4.1%.

Workforce participation in Richmond Hill stands at 45.3%, significantly lower than Rest of Qld's 59.1%. The leading employment industries among residents include education & training, health care & social assistance, and mining. Notably, education & training has an employment share 2.3 times the regional level. Conversely, construction shows lower representation at 4.4% compared to the regional average of 10.1%.

The area appears to offer limited local employment opportunities, as indicated by the count of Census working population versus resident population. In a 12-month period ending in September 2025, Richmond Hill's labour force increased by 0.4%, while employment declined by 1.2%, leading to a rise in unemployment of 1.4 percentage points. In contrast, Rest of Qld saw employment grow by 1.7% and labour force expand by 2.1%, with unemployment rising by 0.3 percentage points. State-level data as of 25-Nov-25 shows Queensland's employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that over five years, employment is projected to expand by 6.6%, and by 13.7% over ten years. However, growth rates vary significantly between industry sectors. Applying these projections to Richmond Hill's employment mix indicates local employment should increase by approximately 5.8% over five years and 12.8% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

According to AreaSearch's aggregation of the latest postcode level ATO data released for financial year 2023, Richmond Hill had a median income among taxpayers of $46,722. The average income stood at $56,186. This was below the national average and compared to levels of $53,146 in Rest of Qld respectively. Based on Wage Price Index growth of 9.91% since financial year 2023, current estimates would be approximately $51,352 (median) and $61,754 (average) as of September 2025. Census 2021 income data shows household, family and personal incomes in Richmond Hill all fall between the 8th and 20th percentiles nationally. Distribution data shows 29.0% of the population (707 individuals) fall within the $1,500 - 2,999 income range. Housing costs are modest with 88.6% of income retained, resulting in a total disposable income ranking at just the 26th percentile nationally.

Frequently Asked Questions - Income

Housing

Richmond Hill is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

The latest Census recorded that in Richmond Hill, 87.2% of dwellings were houses with the remaining 12.8% being semi-detached, apartments, or other types. In comparison, Non-Metro Qld had 89.5% houses and 10.5% other dwellings. Home ownership in Richmond Hill was at 37.9%, with mortgaged dwellings at 24.9% and rented ones at 37.2%. The median monthly mortgage repayment was $1,083, lower than Non-Metro Qld's average of $1,213. The median weekly rent in Richmond Hill was $230, compared to Non-Metro Qld's $202. Nationally, Richmond Hill's mortgage repayments were significantly lower at $1,083 versus Australia's average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Richmond Hill features high concentrations of lone person households, with a fairly typical median household size

Family households comprise 64.1% of all households, including 18.6% couples with children, 27.5% couples without children, and 16.8% single parent families. Non-family households make up the remaining 35.9%, with lone person households at 32.9% and group households comprising 2.8% of the total. The median household size is 2.3 people, matching the average for the Rest of Queensland.

Frequently Asked Questions - Households

Local Schools & Education

Richmond Hill faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 17.9%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 11.5%, followed by postgraduate qualifications (3.6%) and graduate diplomas (2.8%). Vocational credentials are held by 33.2% of residents aged 15+, with advanced diplomas at 7.2% and certificates at 26.0%. Educational participation is high, with 37.1% currently enrolled in formal education.

This includes secondary education (22.5%), primary education (9.8%), and tertiary education (1.9%).

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Richmond Hill is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Richmond Hill faces significant health challenges, as indicated by health data. Both younger and older age groups have notable prevalence of common health conditions.

Private health cover is relatively low at approximately 49% (around 1,206 people), compared to the national average of 55.7%. The most prevalent medical conditions are arthritis and asthma, affecting 8.9 and 7.8% of residents respectively. About 64.1% of residents report no medical ailments, slightly lower than the Rest of Qld's 66.2%. Richmond Hill has a higher proportion of seniors aged 65 and over at 24.5% (597 people). Health outcomes among seniors present challenges similar to those faced by the general population.

Frequently Asked Questions - Health

Cultural Diversity

Richmond Hill is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Richmond Hill, surveyed in 2016, had low cultural diversity with 85.7% citizens, 91.4% born in Australia, and 96.0% speaking English only at home. Christianity was the dominant religion at 58.6%, compared to 70.7% regionally. Top ancestral groups were Australian (32.0%), English (28.6%), and Aboriginal Australian (8.9%).

French (0.5%) and German (3.7%) groups were slightly overrepresented, while Welsh (0.5%) was also higher than the regional average of 0.3%.

Frequently Asked Questions - Diversity

Age

Richmond Hill's population aligns closely with national norms in age terms

The median age in Richmond Hill is 38 years, which is slightly below Rest of Queensland's average of 41 but aligns with Australia's median age of 38. The age group of 15-24 years old makes up 17.7% of the population in Richmond Hill, higher than Rest of Queensland but in line with the national average of 12.5%. Conversely, the 55-64 age cohort is less prevalent at 8.5%. According to post-2021 Census data, the 15-24 age group has increased from 15.2% to 17.7%, while the 5-14 age group has declined from 16.8% to 15.5%. Population forecasts for 2041 indicate significant demographic changes in Richmond Hill, with the 25-34 age group expected to grow by 29% (69 people) to reach 306 from 236. Notably, those aged 65 and above will account for half of the total population growth, reflecting the area's aging demographic trend. However, the 65-74 and 55-64 age cohorts are projected to experience population declines.