Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Palm Beach lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Based on ABS population updates and AreaSearch validation, as of 1st November 2025, Palm Beach (Qld) statistical area (Lv2)'s estimated population is around 18,454. This reflects a growth of 2,105 people since the 2021 Census, which reported a population of 16,349. The change is inferred from AreaSearch's estimation of resident population at 18,151 in June 2024, following examination of ABS' latest ERP data release, and an additional 640 validated new addresses since the Census date. This results in a population density ratio of 2,915 persons per square kilometer, placing Palm Beach (Qld) (SA2) in the upper quartile relative to national locations assessed by AreaSearch. The area's growth rate of 12.9% since the 2021 Census exceeded both the non-metro area's 8.8% and SA3 area's growth, marking it as a region leader. Overseas migration contributed approximately 48.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. However, these state projections do not provide age category splits; hence AreaSearch applies proportional growth weightings in line with ABS Greater Capital Region projections for each age cohort, released in 2023 based on 2022 data. Looking ahead, a significant population increase is forecast for Palm Beach (Qld) (SA2), expected to grow by 5,479 persons to 2041, reflecting an overall increase of 28.1% over the 17-year period.

Frequently Asked Questions - Population

Development

The level of residential development activity in Palm Beach was found to be higher than 90% of real estate markets across the country

Palm Beach has seen around 269 new homes approved annually. Over the past five financial years, from FY-21 to FY-25, approximately 1,347 homes were approved, with a further 197 approved in FY-26 so far. On average, about 1.7 people move to the area for each dwelling built over these years, indicating a balanced supply and demand market that supports stable conditions.

Developers target the premium segment, with new dwellings valued at an average of $844,000. This year has seen $23.8 million in commercial approvals, reflecting steady investment activity. Compared to the rest of Queensland, Palm Beach records 64.0% more construction activity per person, offering buyers greater choice and indicating strong developer confidence. The area shows a trend towards denser development, with 11.0% detached houses and 89.0% medium and high-density housing. This shift marks a departure from existing patterns of 41.0% houses, suggesting diminishing developable land availability and responding to evolving lifestyle preferences and affordability needs. With around 65 people per dwelling approval, Palm Beach is characterized as a growth area. Future projections estimate an addition of 5,176 residents by 2041, with current development rates comfortably meeting demand and potentially supporting further population growth beyond current projections.

Future projections show Palm Beach adding 5,176 residents by 2041 (from the latest AreaSearch quarterly estimate). At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Palm Beach has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Area infrastructure changes significantly influence local performance. AreaSearch identified 65 potential impact projects in total. Key initiatives include La Belle Palm Beach, Palm Beach Oceanway Extension, Sophia by Mosaic - Palm Beach, and Flourish Ovana Palm Beach. Relevant projects are detailed below.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Gold Coast Heavy Rail Extension - Varsity Lakes to Gold Coast Airport

The Gold Coast Heavy Rail Extension involves a 13 km extension of the heavy rail line from Varsity Lakes to the Gold Coast Airport. The project includes four proposed new stations at Tallebudgera, Elanora, Tugun, and the Gold Coast Airport terminal. While the corridor has been preserved since 2008 and is recognized in ShapingSEQ 2023 and SEQ Rail Connect as a long-term priority for the 2032 Olympic Games legacy, it remains in the planning phase. As of early 2026, the project is still undergoing review and detailed business case development, with no committed construction start date. It is intended to integrate with the broader South East Queensland rail network and provide high-speed connectivity to the southern Gold Coast.

Palm Beach Oceanway Extension

Extension of the beachfront cycling and walking path along Palm Beach, connecting to existing infrastructure to promote active transport and recreation. The project includes new pathways, lighting, and amenities to enhance community access.

Philippine Parade Shopping Centre

A proposed two-storey shopping centre and dining precinct involving the demolition of up to 10 residential houses to create retail, dining, commercial, and office spaces. A development application (MCU/2024/177) was submitted to Gold Coast City Council in May 2024 for Material Change of Use Code Assessment for Office, Shop, and Food & Drink Outlet uses.

Sophia by Mosaic - Palm Beach

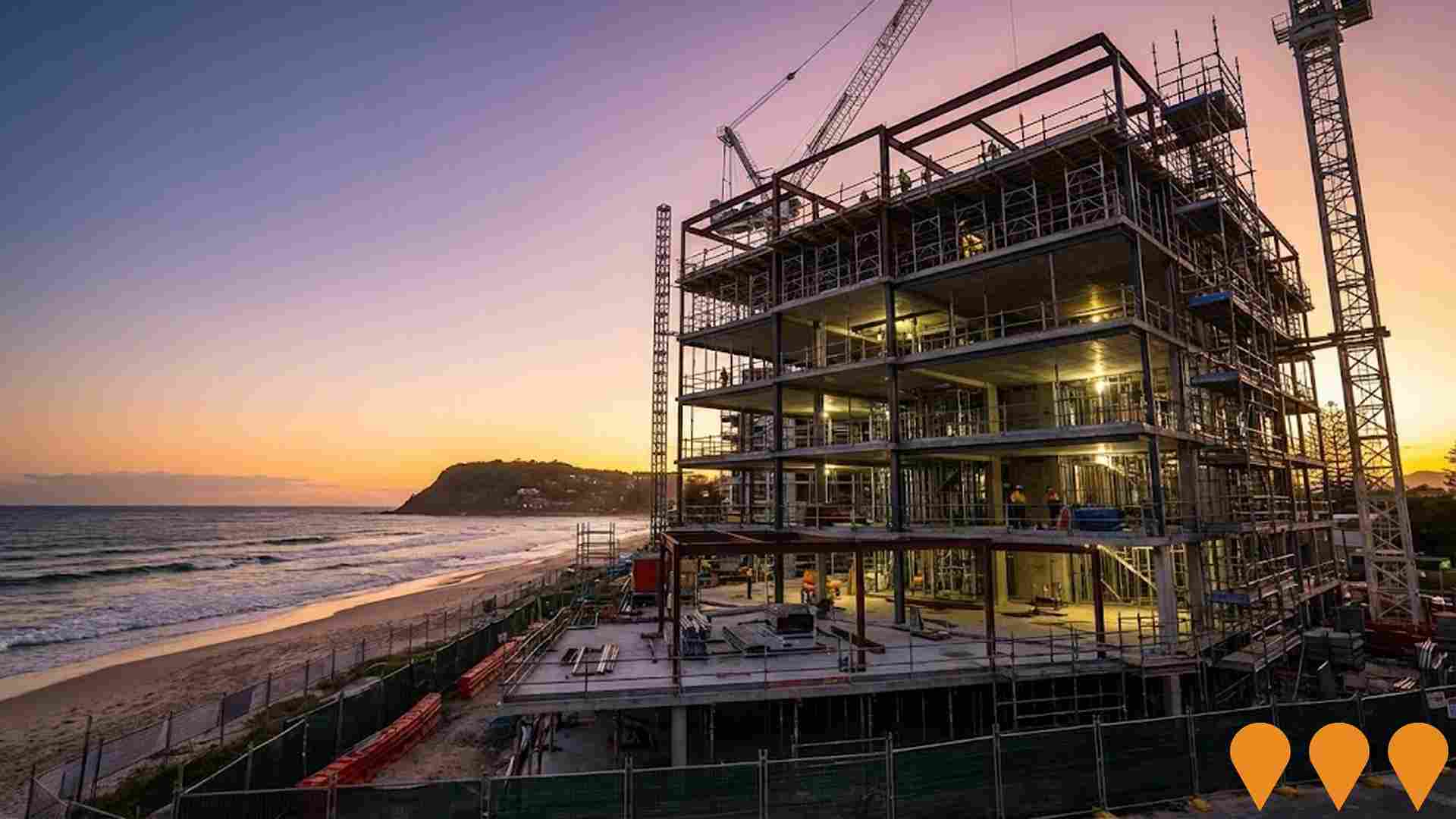

Ultra-luxury beachfront development featuring 32 exclusive residences across 9 levels. Direct beachfront position with full and half-floor apartments, pool, spa, gym and sauna amenities.

La Belle Palm Beach

A luxury beachfront apartment development featuring 75 exclusive residences across 14 levels with panoramic ocean views from Burleigh Headland to Snapper Rocks. Located on the largest remaining absolute beachfront site on the Gold Coast with 40m of beach frontage, the project offers world-class amenities including wellness centre, heated pool and spa, teppanyaki dining bars, and private beach access. Over 80% sold with construction underway and penthouse collection now selling.

Est Palm Beach

Dual-tower residential development featuring two 13-level towers with 98 two, three, and four-bedroom apartments. The west tower includes 72 apartments, while the east tower has 25 three-bedroom apartments and one four-bedroom penthouse. Amenities include ground-level hospitality venues, swimming pools, wellness centres with gym, steam room, and sauna. Designed to maximize ocean and hinterland views with generous private open spaces.

Elevaire Palm Beach

A boutique collection of 40 exclusive residences featuring 2 and 3 bedroom apartments with ocean and hinterland outlooks, resort-inspired wellness amenities including hot and cold magnesium pools, sauna, gym, and outdoor entertainment areas. Construction commenced in 2024 but experienced delays due to builder administration in early 2025.

Gold Coast Highway Palm Beach Improvements

The Gold Coast Highway Palm Beach Improvements project aims to transform the highway into a pedestrian and bike-friendly boulevard. Key features include enhanced walkability, dedicated cycling infrastructure, improved public transport access, and urban design upgrades to support community connectivity and safety.

Employment

Employment conditions in Palm Beach demonstrate strong performance, ranking among the top 35% of areas assessed nationally

Palm Beach has a well-educated workforce with significant representation in essential services sectors. The unemployment rate was 3.0% as of September 2025, with an estimated employment growth of 2.8% over the previous year.

This is based on AreaSearch's aggregation of statistical area data. As of that date, 10,576 residents were employed, with an unemployment rate 1.1% lower than the Rest of Qld's rate of 4.1%. Workforce participation was higher at 65.6%, compared to Rest of Qld's 59.1%. The leading employment industries among residents were health care & social assistance, construction, and retail trade.

Construction particularly showed strong specialization with an employment share 1.4 times the regional level, while agriculture, forestry & fishing had limited presence at 0.4% compared to the regional 4.5%. Over the 12 months to September 2025, employment increased by 2.8% and labour force grew by 2.7%, keeping the unemployment rate relatively stable. In contrast, Rest of Qld saw employment rise by 1.7%, labour force grow by 2.1%, and unemployment increase by 0.3 percentage points. State-level data to 25-Nov-25 showed Queensland's employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 projected a 6.6% increase over five years and 13.7% over ten years nationally. Applying these projections to Palm Beach's employment mix suggested local employment should increase by 6.9% over five years and 14.0% over ten years, though these are simple weighted extrapolations for illustrative purposes and do not account for localized population projections.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

The suburb of Palm Beach had a median income among taxpayers of $51,221 and an average income of $72,295 in the financial year 2023, according to ATO data aggregated by AreaSearch. This compares with figures for Rest of Qld's of $53,146 and $66,593 respectively. Based on a Wage Price Index growth rate of 9.91% since financial year 2023, estimated median income as of September 2025 would be approximately $56,297, with the average being $79,459. Census data from 2021 shows incomes in Palm Beach cluster around the 55th percentile nationally. Income distribution indicates that 31.2% of the population falls within the $1,500 - $2,999 range, with a total of 5,757 individuals. Housing affordability pressures are severe, with only 81.0% of income remaining after housing costs, ranking at the 46th percentile nationally. The area's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Palm Beach displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

In Palm Beach, as per the latest Census evaluation, 41.1% of dwellings were houses while 59.0% consisted of other types such as semi-detached homes, apartments, and 'other' dwellings. This contrasts with Non-Metro Qld's dwelling composition of 49.8% houses and 50.2% other dwellings. Home ownership in Palm Beach stood at 29.3%, with mortgaged dwellings at 33.0% and rented ones at 37.8%. The median monthly mortgage repayment was $2,093, higher than Non-Metro Qld's average of $2,000. Meanwhile, the median weekly rent in Palm Beach was $445, compared to Non-Metro Qld's $450. Nationally, Palm Beach's median monthly mortgage repayment is significantly higher at $2,093 against Australia's average of $1,863, and its median weekly rent figure stands substantially higher at $445 compared to the national average of $375.

Frequently Asked Questions - Housing

Household Composition

Palm Beach features high concentrations of group households, with a lower-than-average median household size

Family households constitute 63.2% of all households, including 24.7% couples with children, 27.2% couples without children, and 10.3% single parent families. Non-family households comprise the remaining 36.8%, with lone person households at 29.8% and group households making up 7.0%. The median household size is 2.3 people, smaller than the Rest of Qld average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Palm Beach exceeds national averages, with above-average qualification levels and academic performance metrics

The area's university qualification rate is 29.5%, higher than the Rest of Qld average of 20.6% and the SA4 region's 25.4%. Bachelor degrees are most common at 21.3%, followed by postgraduate qualifications (5.4%) and graduate diplomas (2.8%). Vocational credentials are held by 38.7% of residents aged 15+, including advanced diplomas (12.8%) and certificates (25.9%).

Educational participation is high, with 27.8% currently enrolled in formal education: 9.0% in primary, 6.9% in secondary, and 5.4% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Palm Beach has 46 active public transport stops operating within the city. These include a mix of train and bus services. There are 11 individual routes serving these stops, collectively providing 2,319 weekly passenger trips.

The transport accessibility is rated as good, with residents typically located 216 meters from the nearest stop. Service frequency averages 331 trips per day across all routes, equating to approximately 50 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Palm Beach is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Palm Beach shows above-average health outcomes for both younger and older residents.

The prevalence of common health conditions is low. Approximately 56% (~10,306 people) have private health cover, which is high compared to other areas. The most prevalent medical conditions are arthritis (7.5%) and mental health issues (7.3%). A total of 72.0% of residents report no medical ailments, higher than the Rest of Qld average of 70.3%. Palm Beach has a lower proportion of seniors aged 65 and over at 17.5% (3,229 people), compared to 19.2% in the Rest of Qld. Health outcomes among seniors are notably strong, outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Palm Beach ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Palm Beach, as per the census data from June 2016, had a lower than average cultural diversity with 86.8% of its population being Australian citizens and 81.3% born in Australia. The majority spoke English at home, with 93.4% doing so. Christianity was the predominant religion, accounting for 47.1%.

However, Judaism was slightly overrepresented compared to the rest of Queensland, making up 0.1% of Palm Beach's population. In terms of ancestry, the top three groups were English (32.1%), Australian (25.4%), and Irish (9.9%). There were notable differences in the representation of certain ethnic groups: New Zealanders made up 1.0%, Scottish 9.0%, and French 0.6%, all slightly higher than their regional counterparts.

Frequently Asked Questions - Diversity

Age

Palm Beach's population aligns closely with national norms in age terms

The median age in Palm Beach is 38 years, which is slightly below Rest of Queensland's average of 41 but aligns with Australia's median age of 38. The 25-34 age group constitutes 18.8% of the population in Palm Beach, higher than Rest of Queensland's figure. Conversely, the 5-14 age group makes up 9.8%, which is less prevalent compared to Rest of Queensland. According to post-2021 Census data, Palm Beach has seen a decrease in median age from 39 years to 38 years. The 25-34 age group has grown from 16.1% to 18.8%, while the 45-54 cohort has decreased from 13.0% to 11.4%. Additionally, the 55-64 age group has dropped from 12.3% to 10.8%. By 2041, Palm Beach's age composition is projected to change significantly. The 25-34 age cohort is expected to grow by 1,364 people (39%), increasing from 3,469 to 4,834. In contrast, the 15-24 age group is projected to grow minimally by just 5% (97 people).