Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Tugun are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

As of November 2025, the estimated population of the Tugun statistical area (Lv2) is around 7,616. This figure reflects an increase of 441 people since the 2021 Census, which reported a population of 7,175. The change is inferred from AreaSearch's estimation of the resident population at 7,538 in June 2024, based on examination of the latest ERP data release by the ABS, along with an additional 96 validated new addresses since the Census date. This level of population results in a density ratio of 2,448 persons per square kilometer, placing Tugun (SA2) in the upper quartile relative to national locations assessed by AreaSearch. Over the past decade, ending in 2021, Tugun has demonstrated resilient growth patterns with a compound annual growth rate of 1.5%, outpacing its SA3 area. Population growth for the area was primarily driven by overseas migration, contributing approximately 78.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, Queensland State Government's SA2 area projections are used, released in 2023 based on 2021 data. However, these state projections do not provide age category splits, so AreaSearch applies proportional growth weightings in line with the ABS Greater Capital Region projections for each age cohort, released in 2023 based on 2022 data. Future population trends project an above median growth for Australian non-metropolitan areas. By 2041, the Tugun (SA2) is expected to increase by 1,139 persons, reflecting a total increase of 16.0% over the 17-year period based on aggregated SA2-level projections.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Tugun recording a relatively average level of approval activity when compared to local markets analysed countrywide

Based on AreaSearch analysis of ABS building approval numbers, Tugun has experienced around 35 dwellings receiving development approval each year. Over the past five financial years, from FY-21 to FY-25, approximately 176 homes were approved, with a further 15 approved in FY-26 so far. Each dwelling built over these years has resulted in an average of 3 new residents per year, reflecting robust demand that supports property values.

The average construction cost value for new homes is $1,457,000, indicating a focus on the premium segment with upmarket properties. This financial year alone, there have been $3.3 million in commercial approvals, suggesting the area's residential character. Compared to the rest of Queensland, Tugun records markedly lower building activity, at 51.0% below the regional average per person. This scarcity typically strengthens demand and prices for existing properties. The new development consists of 16.0% detached dwellings and 84.0% attached dwellings, focusing on higher-density living to create more affordable entry points and suit downsizers, investors, and first-home buyers. This represents a significant change from the current housing mix, which is currently 46.0% houses, reflecting reduced availability of development sites and shifting lifestyle demands and affordability requirements.

With around 475 people per dwelling approval, Tugun shows a developed market. According to AreaSearch's latest quarterly estimate, the population is forecasted to gain 1,217 residents through to 2041. Construction maintains a reasonable pace with projected growth, although buyers may encounter growing competition as the population increases.

Frequently Asked Questions - Development

Infrastructure

Tugun has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 13 projects likely affecting this region. Notable ones include Gold Coast Light Rail Stage 4, Admiral Crescent Residential Care and Retirement Facility, Bilinga Residential Estate Stage 2, and Gold Coast Desalination Plant Expansion. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

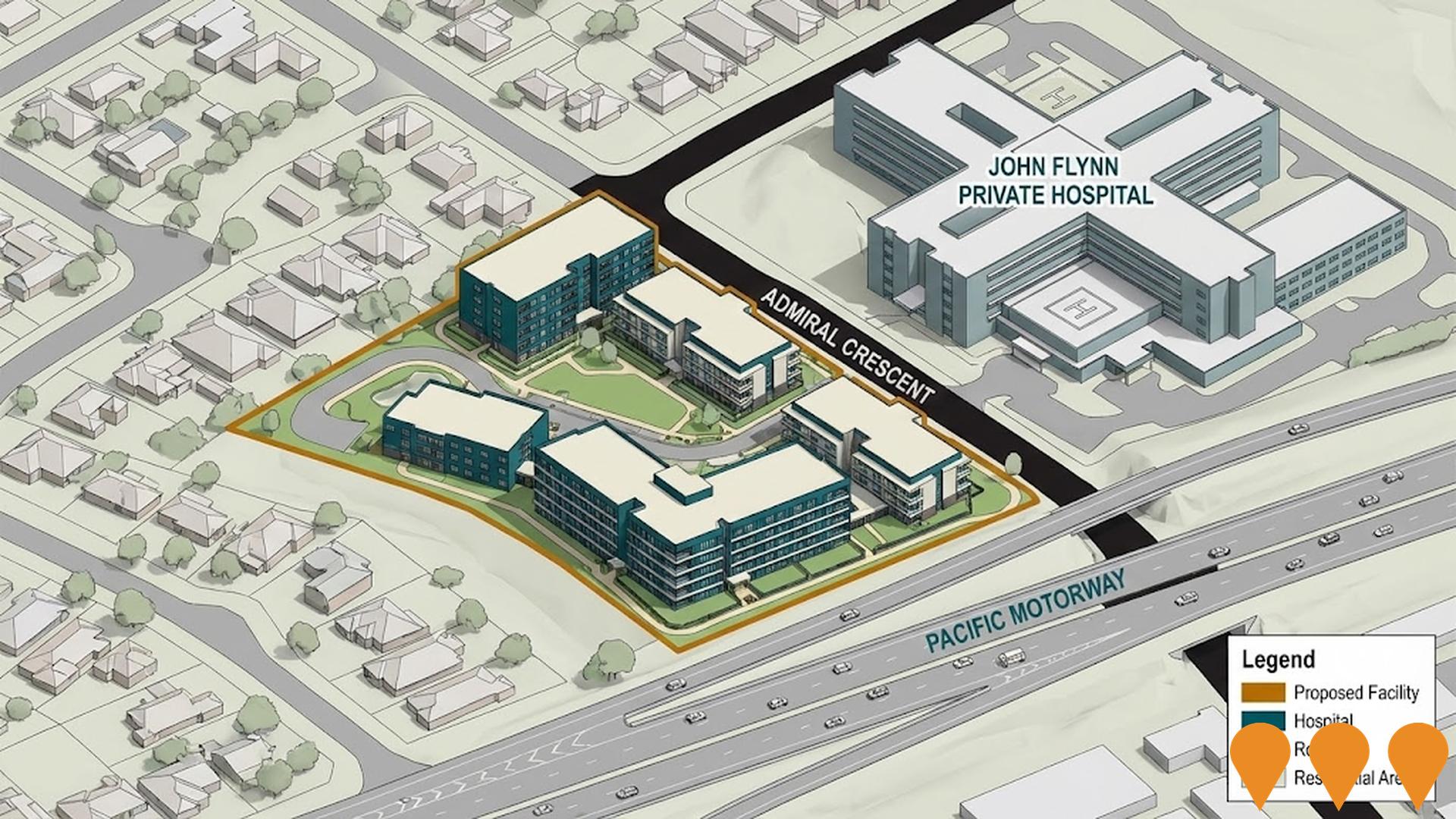

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Gold Coast Light Rail Stage 4

A proposed 13 km extension of the Gold Coast Light Rail from Burleigh Heads to Coolangatta via Gold Coast Airport, designed to include up to 14 stops and a new stabling facility. Following a 2025 independent review by the Queensland Government, planning for the light rail extension was officially stopped on September 1, 2025, due to community opposition and revised cost estimates reaching up to $9.85 billion. The government has shifted focus toward accelerated bus service enhancements and a broader multi-modal regional transport study to address long-term connectivity needs.

Tugun Satellite Health Centre (Banyahrmabah)

The Tugun Satellite Health Centre (Banyahrmabah) supports emergency departments by providing urgent walk-in care for minor injuries and illnesses, kidney dialysis, women's, newborn, and children's clinics, day medical infusions, pharmacy services, and allied health outpatients in a community setting.

Gold Coast Desalination Plant Expansion

Expansion of the existing desalination plant to increase water supply capacity in response to population growth and climate change, including potential booster pump stations.

Tugun Market Co

A complete refurbishment and expansion of a family-owned supermarket into a thriving gourmet marketplace featuring a grocer, butcher, baker, fresh produce stand, cheese deli, cafe, and essential grocery items. The single-level 950m2 space serves the southern Gold Coast community with quality produce, affordable prices, and friendly service.

Southern Cross University Gold Coast Campus Renewal

SCU is progressing a campus renewal (master plan) for its Gold Coast campus at Bilinga/Coolangatta, near North Kirra Beach and adjacent to Gold Coast Airport. Consultation is underway to reconfigure student spaces, staff work areas (homezones), and teaching facilities, with detailed design and planning approvals targeted for 2025 and staged works to follow. This builds on the 2023 engineering program expansion and the university's growth to 5000+ students.

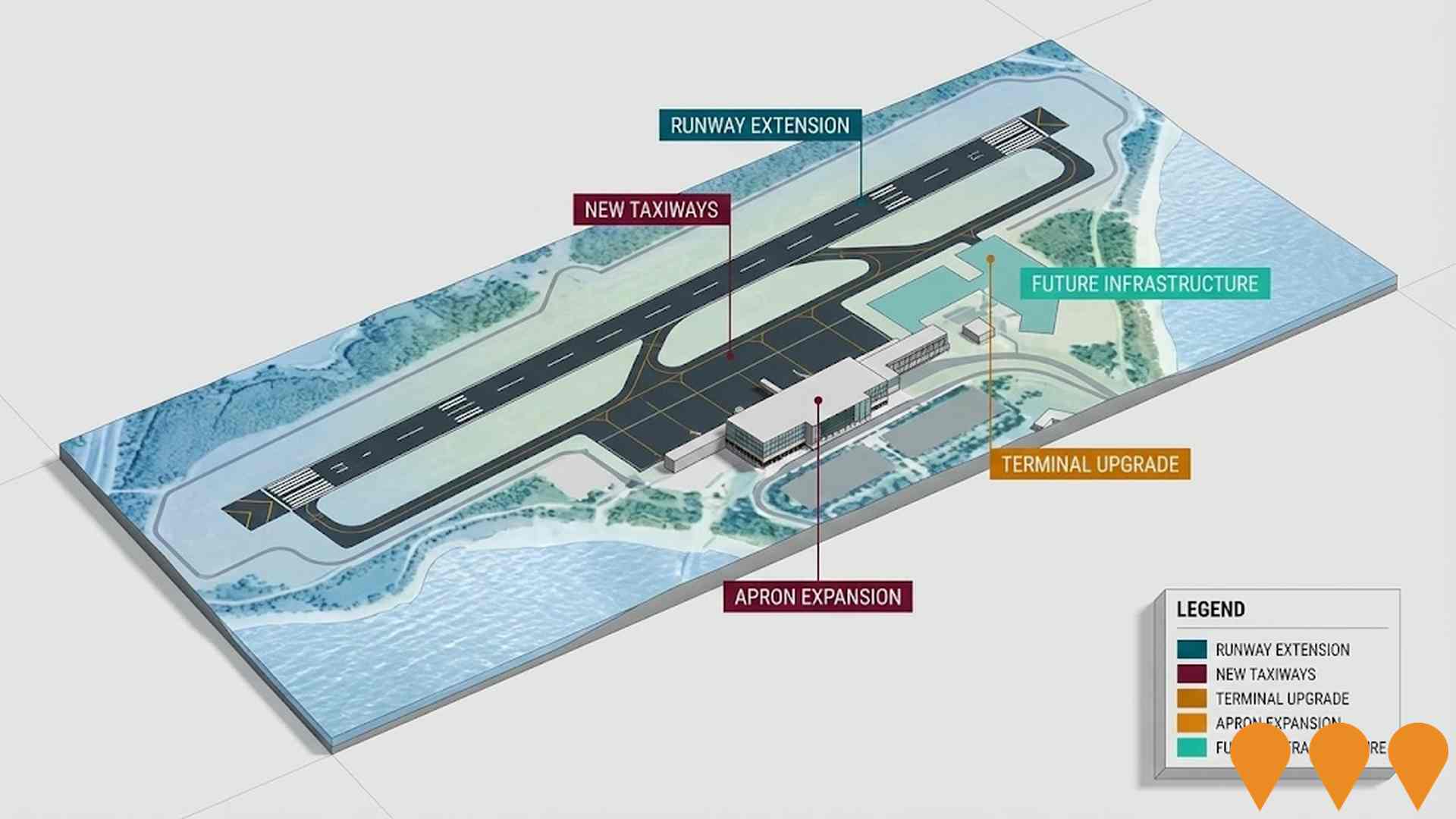

Gold Coast Airport Runway Extension

Extension of Gold Coast Airport's main runway to accommodate larger aircraft and increase international flight capacity, including terminal upgrades and infrastructure improvements.

Admiral Crescent Residential Care and Retirement Facility

Approved development for a residential care facility and retirement village with 154 suites on a 1.48ha site zoned for medium density residential, located opposite John Flynn Hospital. The site was recently sold on May 2, 2025, with development approval in place.

Airport Boulevard Commercial Centre

New commercial centre near Gold Coast Airport featuring office spaces, retail outlets, dining options, and services. Designed to serve airport passengers, local businesses, and the growing Bilinga area.

Employment

Employment conditions in Tugun demonstrate exceptional strength compared to most Australian markets

Tugun has a skilled workforce with significant representation in essential services sectors. The unemployment rate was 2.2% as of the past year, with an estimated employment growth of 2.7%.

As of September 2025, there were 4,523 residents employed, with an unemployment rate of 1.8% below Rest of Qld's rate of 4.1%. Workforce participation was at 64.2%, compared to Rest of Qld's 59.1%. Key industries of employment among residents were health care & social assistance, construction, and education & training. Construction had notably high representation with employment levels at 1.4 times the regional average, while agriculture, forestry & fishing showed lower representation at 0.5% versus the regional average of 4.5%.

The area offered limited local employment opportunities as indicated by Census data comparing working population to resident population. Over a 12-month period ending in September 2025, employment increased by 2.7%, labour force increased by 2.5%, and unemployment rate fell by 0.2 percentage points. This contrasted with Rest of Qld where employment grew by 1.7%, labour force expanded by 2.1%, and unemployment rose by 0.3 percentage points. State-level data to 25-Nov-25 showed Queensland's employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%. National employment forecasts from May-25 projected national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Tugun's employment mix suggested local employment should increase by 6.9% over five years and 14.1% over ten years, though this was a simple weighting extrapolation for illustrative purposes and did not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

According to AreaSearch's aggregation of the latest postcode level ATO data released for financial year 2023, Tugun had a median income among taxpayers of $50,462 and an average income of $68,555. Nationally, the median was $53,146 and the average was $66,593. Based on Wage Price Index growth of 9.91% since financial year 2023, estimated incomes for September 2025 would be approximately $55,463 (median) and $75,349 (average). According to the 2021 Census, household, family, and personal incomes in Tugun were at the 54th percentile nationally. Income distribution showed that 35.4% of Tugun's population earned between $1,500 and $2,999 per year. Housing affordability pressures were severe, with only 81.5% of income remaining after housing costs, ranking at the 47th percentile. The area's SEIFA income ranking placed it in the 6th decile.

Frequently Asked Questions - Income

Housing

Tugun displays a diverse mix of dwelling types, with ownership patterns similar to the broader region

Tugun's dwelling structure, as per the latest Census, consisted of 46.4% houses and 53.6% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro Qld's 49.8% houses and 50.2% other dwellings. Home ownership in Tugun was at 29.4%, with the remaining dwellings either mortgaged (39.8%) or rented (30.8%). The median monthly mortgage repayment in Tugun was $1,950, lower than Non-Metro Qld's average of $2,000. The median weekly rent figure in Tugun was $460, compared to Non-Metro Qld's $450. Nationally, Tugun's mortgage repayments were higher at $1,950 versus the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Tugun features high concentrations of group households, with a fairly typical median household size

Family households make up 67.5% of all households, including 28.5% couples with children, 25.7% couples without children, and 12.0% single parent families. Non-family households account for the remaining 32.5%, with lone person households at 26.7% and group households comprising 6.0%. The median household size is 2.4 people, which matches the average for the Rest of Qld.

Frequently Asked Questions - Households

Local Schools & Education

Tugun demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

The area's educational profile is notable regionally, with university qualification rates at 27.2%, exceeding the Rest of Qld average of 20.6%. Bachelor degrees are most common at 19.5%, followed by postgraduate qualifications (4.9%) and graduate diplomas (2.8%). Trade and technical skills are prominent, with 40.2% of residents aged 15+ holding vocational credentials – advanced diplomas at 13.4% and certificates at 26.8%.

Educational participation is high, with 30.2% currently enrolled in formal education. This includes 10.2% in primary education, 7.5% in secondary education, and 6.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Tugun has 24 active public transport stops operating within its boundaries. These stops are serviced by a mix of buses running along four individual routes. Together, these routes provide 1,309 weekly passenger trips.

The accessibility of the transport system is rated as excellent, with residents typically located just 177 meters from their nearest transport stop. On average, service frequency across all routes amounts to 187 trips per day, which translates to approximately 54 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Tugun's residents are healthier than average in comparison to broader Australia with prevalence of common health conditions quite low across both younger and older age cohorts

Tugun residents show relatively positive health outcomes.

Prevalence of common health conditions is low across both younger and older age cohorts. Approximately 54% (~4,140 people) have private health cover, a figure higher than the Queensland average. The most prevalent medical conditions are arthritis and mental health issues, affecting 7.5% each of residents. Around 71.8% report being completely free from medical ailments, compared to 70.3% in Rest of Qld. As of 2016, 17.7% (1,348 people) are aged 65 and over, lower than the 19.2% Queensland average. Health outcomes among seniors align with those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Tugun ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Tugun's cultural diversity was found to be below average, with 85.6% of its population being citizens, 80.5% born in Australia, and 91.6% speaking English only at home. Christianity was the predominant religion in Tugun, comprising 44.2% of the population. Judaism, however, showed an overrepresentation with 0.1% compared to 0.1% across Rest of Qld.

The top three ancestry groups were English (31.0%), Australian (25.0%), and Irish (10.4%). Notable divergences existed in the representation of New Zealand (1.3% vs regional 1.1%), Welsh (0.7% vs 0.6%), and Spanish (0.6% vs 0.4%) ethnic groups.

Frequently Asked Questions - Diversity

Age

Tugun's population aligns closely with national norms in age terms

The median age in Tugun was 38 years as of the 2021 Census, slightly below Rest of Qld's average of 41 but matching Australia's median age of 38. The 25-34 age group formed 17.9% of Tugun's population compared to Rest of Qld, while the 5-14 cohort made up 9.8%. Post-Census data showed a decrease in median age from 39 years to 38 years between censuses. The 25-34 age group grew from 15.6% to 17.9%, and the 35-44 cohort increased from 14.1% to 15.7%. Conversely, the 55-64 cohort declined from 12.3% to 10.2%, and the 5-14 group dropped from 11.7% to 9.8%. By 2041, Tugun's age composition is projected to shift notably, with the 25-34 age cohort expected to grow by 410 people (30%), reaching 1,774 from its 2021 level of 1,363. Conversely, population declines are projected for the 15-24 and 55-64 cohorts.