Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Clayfield reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on analysis of ABS population updates for the broader area, as of Nov 2025, Clayfield's estimated population is around 11,801. This reflects an increase of 904 people since the 2021 Census, which reported a population of 10,897. The change was inferred from AreaSearch's resident population estimate of 11,773 following examination of the latest ERP data release by the ABS in June 2024 and an additional 40 validated new addresses since the Census date. This level of population equates to a density ratio of 4,214 persons per square kilometer, placing Clayfield (SA2) within the top 10% nationally assessed by AreaSearch. The area's 8.3% growth since census is within 1.4 percentage points of the national average of 9.7%, indicating competitive growth fundamentals. Population growth was primarily driven by overseas migration contributing approximately 84.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. However, these state projections do not provide age category splits, so AreaSearch applies proportional growth weightings in line with ABS Greater Capital Region projections for each age cohort, released in 2023 using 2022 data. Moving forward, demographic trends suggest a population increase just below the median of Australian statistical areas by 2041. The Clayfield statistical area (Lv2) is expected to increase by 833 persons by this year, reflecting an overall increase of 6.8% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Clayfield recording a relatively average level of approval activity when compared to local markets analysed countrywide

AreaSearch analysis shows Clayfield had approximately 21 residential properties approved annually. From FY-21 to FY-25, around 108 homes were approved, with another 27 in FY-26 so far. Each year, about 5.7 people moved into the area per dwelling built over these five years.

This high demand outpaces supply, likely increasing prices and competition among buyers. New properties are constructed at an average cost of $810,000, indicating a focus on premium developments. In FY-26, there have been $4.5 million in commercial approvals, reflecting the area's primarily residential nature. Compared to Greater Brisbane, Clayfield has significantly lower construction levels (73.0% below average per person), which may strengthen demand and prices for existing properties. This is also lower than national averages, suggesting market maturity and possible development constraints.

New developments consist of 65.0% detached dwellings and 35.0% townhouses or apartments, offering choices across price ranges. Notably, developers are constructing more detached housing (38.0% at Census), reflecting strong demand for family homes despite densification trends. Clayfield has approximately 727 people per dwelling approval, indicating an established market. By 2041, AreaSearch estimates the location will grow by 808 residents. Building activity is keeping pace with growth projections, but buyers may face increased competition as population grows.

Frequently Asked Questions - Development

Infrastructure

Clayfield has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Infrastructure changes significantly influence an area's performance. AreaSearch identified 41 projects likely impacting the region. Notable projects are Clayfield Development Aggregate, Platinum at Hamilton (formerly Icon), Greville, and Northshore Hamilton Street Renewal. The following list details projects of highest relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Northshore Hamilton Priority Development Area (Northshore Brisbane)

Queensland's largest urban renewal project, Northshore Hamilton spans 304 hectares along 2.5km of the Brisbane River. Managed by Economic Development Queensland (EDQ), the project is transforming former industrial port land into a mixed-use precinct. As of early 2026, the Street Renewal Program is active, including major works on MacArthur Avenue and the Wharf Work Zone to unlock six new development lots. The precinct is designed to eventually accommodate 14,000 dwellings and 24,500 residents, with a revised development scheme enacted in late 2025 to fast-track housing delivery ahead of the 2032 Olympic Games.

The Albion - Hudson Road Mixed-Use Development

A major transit-oriented mixed-use development on the former Albion Flour Mill site. The project features two residential towers of 18 to 20 storeys containing 456 build-to-rent apartments. The ground level includes a 4,000 sqm full-line Woolworths supermarket, BWS, and specialty retail tenancies. Key features include an elevated subtropical urban commons and a pedestrian overbridge providing direct access to the adjacent Albion Train Station.

Platinum at Hamilton (formerly Icon)

Three-tower mixed-use development (formerly Icon, now Platinum) by Wentworth Equities with DA approval for up to 433 apartments across towers up to 30 storeys. Tower 1 has final approval (153 units), Towers 2-3 have preliminary approval. Originally $650M project redesigned to $700M. Project redesigned by Fuse Architecture with subtropical feel and sky garden features. Located on 7,637sqm site within Brisbane 2032 Olympic precinct.

Clayfield Villagio Shopping Centre Revitalisation

Approved neighbourhood shopping centre redevelopment and revitalisation featuring demolition of existing single-storey building fronting Sandgate Road and construction of new 1,659sqm three-storey signature building with rooftop deck and pedestrian bridge. Project includes renovation of retained Junction Road building, internal arcade with alfresco dining areas, improved vehicular circulation with new Sandgate Road access, and addition of 50 car parking spaces bringing total to 93 spaces. The design integrates retail, office, food and dining tenancies in an expanded sustainable neighbourhood centre with enhanced landscaping and pedestrian connections.

Northshore Hamilton Social and Affordable Housing

Delivery of 201 social and affordable apartments by Brisbane Housing Company (BHC) in partnership with Economic Development Queensland (EDQ) within the Northshore Hamilton Priority Development Area. The $160 million project provides a mix of 1, 2 and 3-bedroom homes as part of the Queensland Government's Homes for Queenslanders initiative. A development application has been lodged, with construction anticipated to commence mid-2025 subject to approvals.

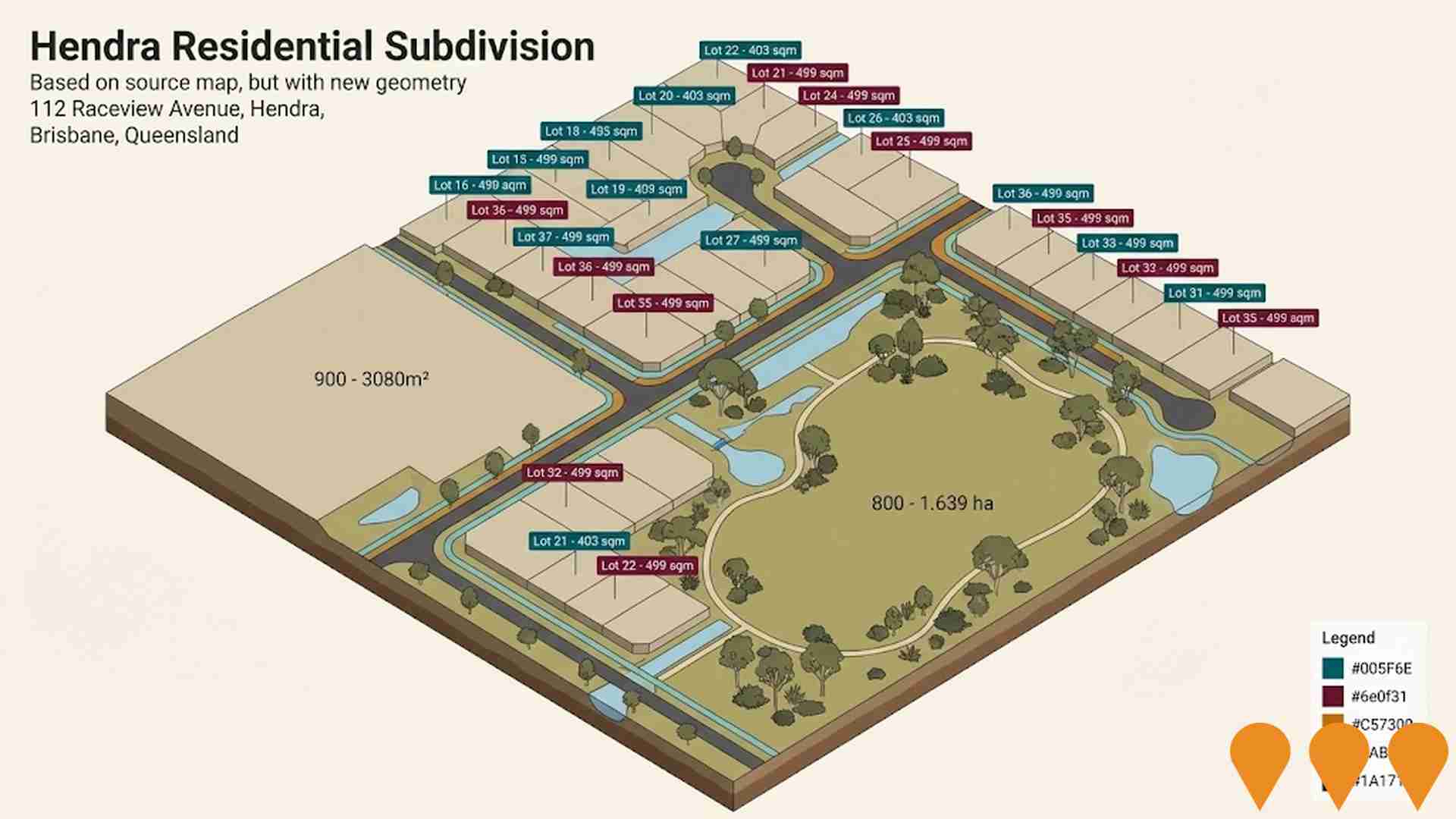

Clayfield Development Aggregate

Comprehensive development program encompassing multiple residential subdivision projects and infrastructure improvements throughout Clayfield. Includes residential developments with townhouses, apartments and single dwellings maintaining suburban character while increasing density, alongside road upgrades, park improvements, and community facility enhancements. Development provides 100+ new housing opportunities across various project sites while supporting infrastructure upgrades to accommodate growth.

Northshore Hamilton Street Renewal

Infrastructure renewal program preparing Northshore Hamilton for Olympic Athletes' Village. Includes road upgrades, utility improvements, and enhanced connectivity. Part of broader urban renewal supporting Brisbane 2032 preparations.

Brookfield BTR - 11-23 MacArthur Avenue

Brookfield's first Australian build-to-rent project featuring dual 23-storey towers with 560 purpose-built rental apartments designed by Fender Katsalidis. Part of Brookfield's $400 million investment and $1.3 billion Portside Wharf precinct expansion. Features concierge, resort-style amenities, co-working spaces, targeting 4 Star Green Star rating with sustainable design and 100% electric, fossil fuel-free operations.

Employment

AreaSearch assessment positions Clayfield ahead of most Australian regions for employment performance

Clayfield has a highly educated workforce with strong representation in professional services. Its unemployment rate is 3.5%, with an estimated employment growth of 0.6% over the past year, according to AreaSearch's aggregation of statistical area data.

As of September 2025, there are 7,393 residents employed, with an unemployment rate of 0.5% lower than Greater Brisbane's rate of 4.0%. Workforce participation in Clayfield is higher at 72.0%, compared to Greater Brisbane's 64.5%. The leading employment industries among residents include health care & social assistance, professional & technical services, and retail trade. Notably, the area has a strong specialization in professional & technical services, with an employment share 1.6 times the regional level.

Conversely, construction has limited presence, with only 5.2% of employment compared to the regional average of 9.0%. Despite being predominantly residential, Clayfield appears to offer limited local employment opportunities, as indicated by the census working population vs resident population count. Between September 2024 and September 2025, employment levels increased by 0.6%, while the labour force grew by 0.7%, resulting in a slight rise in unemployment of 0.1 percentage points. In contrast, Greater Brisbane saw employment rise by 3.8% during this period. State-level data from QLD as of 25-Nov-25 shows employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. Looking ahead, Jobs and Skills Australia's national employment forecasts from May-25 suggest that while overall employment is projected to expand by 6.6% over five years and 13.7% over ten years, growth rates vary significantly across industry sectors. Applying these projections to Clayfield's employment mix indicates a potential local employment increase of 7.2% over five years and 14.6% over ten years, though this is a simple extrapolation for illustrative purposes and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2023 shows Clayfield's median income among taxpayers is $67,341. The average income is $115,617. Nationally, these figures are exceptionally high compared to Greater Brisbane's median of $58,236 and average of $72,799. Based on Wage Price Index growth since financial year 2023, current estimates for Clayfield would be approximately $74,014 (median) and $127,075 (average) as of September 2025. Census data reveals individual earnings at the 85th percentile nationally are $1,102 weekly. In Clayfield, the largest segment comprises 31.1% earning $1,500 - 2,999 weekly, with 3,670 residents in this range. This pattern is similar to the region where 33.3% occupy this earnings range. Economic strength is evident through 30.5% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. High housing costs consume 15.3% of income in Clayfield, but strong earnings place disposable income at the 63rd percentile nationally. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Clayfield features a more urban dwelling mix with significant apartment living, with above-average rates of outright home ownership

As of the latest Census, dwelling structures in Clayfield consisted of 37.8% houses and 62.2% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Brisbane metropolitan area had 36.5% houses and 63.6% other dwellings. Home ownership in Clayfield was at 25.0%, with mortgaged dwellings at 31.2% and rented ones at 43.8%. The median monthly mortgage repayment in the area was $2,000, lower than Brisbane metro's average of $2,167. The median weekly rent figure for Clayfield was $350, compared to Brisbane metro's $410. Nationally, Clayfield's mortgage repayments were higher at $2,000 against the Australian average of $1,863, while rents were lower at $350 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Clayfield features high concentrations of lone person households and group households, with a fairly typical median household size

Family households constitute 56.2% of all households, including 23.4% couples with children, 23.4% couples without children, and 8.0% single parent families. Non-family households make up the remaining 43.8%, with lone person households at 38.2% and group households comprising 5.6%. The median household size is 2.2 people, which aligns with the Greater Brisbane average.

Frequently Asked Questions - Households

Local Schools & Education

Clayfield demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Clayfield's educational attainment notably exceeds broader standards. Among residents aged fifteen years or older, 48.2% possess university qualifications, contrasting with Queensland's 25.7% and Australia's 30.4%. This notable advantage positions Clayfield favourably for knowledge-based prospects. Bachelor degrees are most prevalent at 31.8%, trailed by postgraduate qualifications (11.7%) and graduate diplomas (4.7%).

Vocational pathways account for 24.7% of qualifications among those aged fifteen years or older, with advanced diplomas comprising 11.0% and certificates 13.7%. Educational participation is markedly high in Clayfield, with 29.9% of residents currently enrolled in formal education. This includes 9.1% pursuing tertiary education, 8.0% primary education, and 6.9% secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Clayfield has 52 active public transport stops offering a mix of train and bus services. These stops are served by 167 individual routes, facilitating 8,657 weekly passenger trips in total. Transport accessibility is rated excellent, with residents, on average, located 140 meters from the nearest stop.

Service frequency averages 1,236 trips per day across all routes, equating to approximately 166 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Clayfield's residents are extremely healthy with very low prevalence of common health conditions across all age groups

Analysis of health metrics shows strong performance throughout Clayfield with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 73% of the total population (8615 people), compared to 70.5% across Greater Brisbane and a national average of 55.7%. The most common medical conditions in the area are mental health issues and asthma, impacting 9.4% and 7.4% of residents respectively.

Seventy-two point seven per cent of residents declare themselves completely clear of medical ailments, compared to 73.7% across Greater Brisbane. Fifteen point three per cent of residents are aged 65 and over (1805 people), which is higher than the 12.2% in Greater Brisbane. Health outcomes among seniors are particularly strong, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Clayfield was found to be above average when compared nationally for a number of language and cultural background related metrics

Clayfield's cultural diversity is notable, with 27.8% of its population born overseas and 18.0% speaking a language other than English at home. Christianity is the predominant religion in Clayfield, accounting for 51.1% of the population. Hinduism, however, shows significant overrepresentation, comprising 5.7% compared to Greater Brisbane's 2.7%.

The top three ancestry groups based on parents' country of birth are English (26.8%), Australian (20.8%), and Irish (11.8%). Some ethnic groups show notable divergences: Scottish is overrepresented at 9.1%, French is slightly underrepresented at 0.6% compared to the regional figure of 0.7%, and Welsh also shows a slight underrepresentation at 0.6%.

Frequently Asked Questions - Diversity

Age

Clayfield's population is slightly younger than the national pattern

Clayfield's median age is nearly 37 years, closely matching Greater Brisbane's average of 36 and approaching Australia's median of 38. Compared to Greater Brisbane, Clayfield has a higher proportion of residents aged 25-34 (17.8%) but fewer residents aged 5-14 (10.7%). Between the 2016 and 2021 censuses, the population share of those aged 65-74 increased from 7.5% to 8.3%, while the proportion of those aged 45-54 decreased from 14.0% to 13.2%. By 2041, demographic projections suggest significant changes in Clayfield's age profile, with the strongest growth expected among the 75-84 cohort (60%), adding 353 residents to reach 944. The senior population aged 65 and above will drive 69% of population growth, reflecting broader aging trends. Conversely, the populations aged 5-14 and 0-4 are projected to decline.