Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Boulder is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

As of Nov 2025, the estimated population for the Boulder statistical area (Lv2) is around 5,262, reflecting an increase of 390 people since the 2021 Census. This growth represents an 8.0% rise from the previous population count of 4,872. The latest estimate by AreaSearch, following examination of the ABS's ERP data release in June 2024 and validation of new addresses, is 5,255 residents. This results in a density ratio of 1,195 persons per square kilometer, comparable to averages seen across other locations assessed by AreaSearch. The Boulder (SA2) has shown significant growth since the 2021 Census, exceeding both the SA3 area's growth rate of 7.7% and the SA4 region's growth. Natural growth contributed approximately 55.00000000000001% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and to estimate growth post-2032, AreaSearch utilises the growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections, released in 2023 based on 2022 data. Looking ahead, the Boulder statistical area (Lv2) is expected to grow at a rate just below the median of non-metropolitan areas nationally. According to aggregated SA2-level projections, the population is expected to increase by 344 persons to reach 5,606 by 2041, reflecting an overall increase of 6.4% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Boulder according to AreaSearch's national comparison of local real estate markets

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, Boulder has recorded around 5 residential properties granted approval annually. Over the past 5 financial years, between FY-21 and FY-25, approximately 26 homes were approved, with 0 so far in FY-26. On average, over these years, 8.6 new residents arrived per dwelling constructed.

This suggests supply is substantially lagging demand, leading to heightened buyer competition and pricing pressures. Developers target the premium market segment, as new dwellings are developed at an average value of $538,000. In FY-26, $2.0 million in commercial approvals have been registered, indicating a predominantly residential focus. Compared to Rest of WA, Boulder records about 63% of the building activity per person and places among the 16th percentile of areas assessed nationally. This means more limited choices for buyers, supporting demand for existing dwellings.

New building activity shows 60.0% standalone homes and 40.0% medium and high-density housing, indicating an expanding range of medium-density options. This represents a notable shift from the area's existing housing composition (currently 82.0% houses). At around 1043 people per approval, Boulder shows a mature, established area. Future projections show Boulder adding 337 residents by 2041. Should current construction levels persist, housing supply could lag population growth, likely intensifying buyer competition and underpinning price growth.

Frequently Asked Questions - Development

Infrastructure

Boulder has limited levels of nearby infrastructure activity, ranking in the 17thth percentile nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified two projects that could impact this region: Lynas Rare Earths Processing Facility, Goldfields Pipeline Renewal (Stage 1), Kalgoorlie-Boulder Water Bank Project, and Workers Lifestyle Village. The following details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

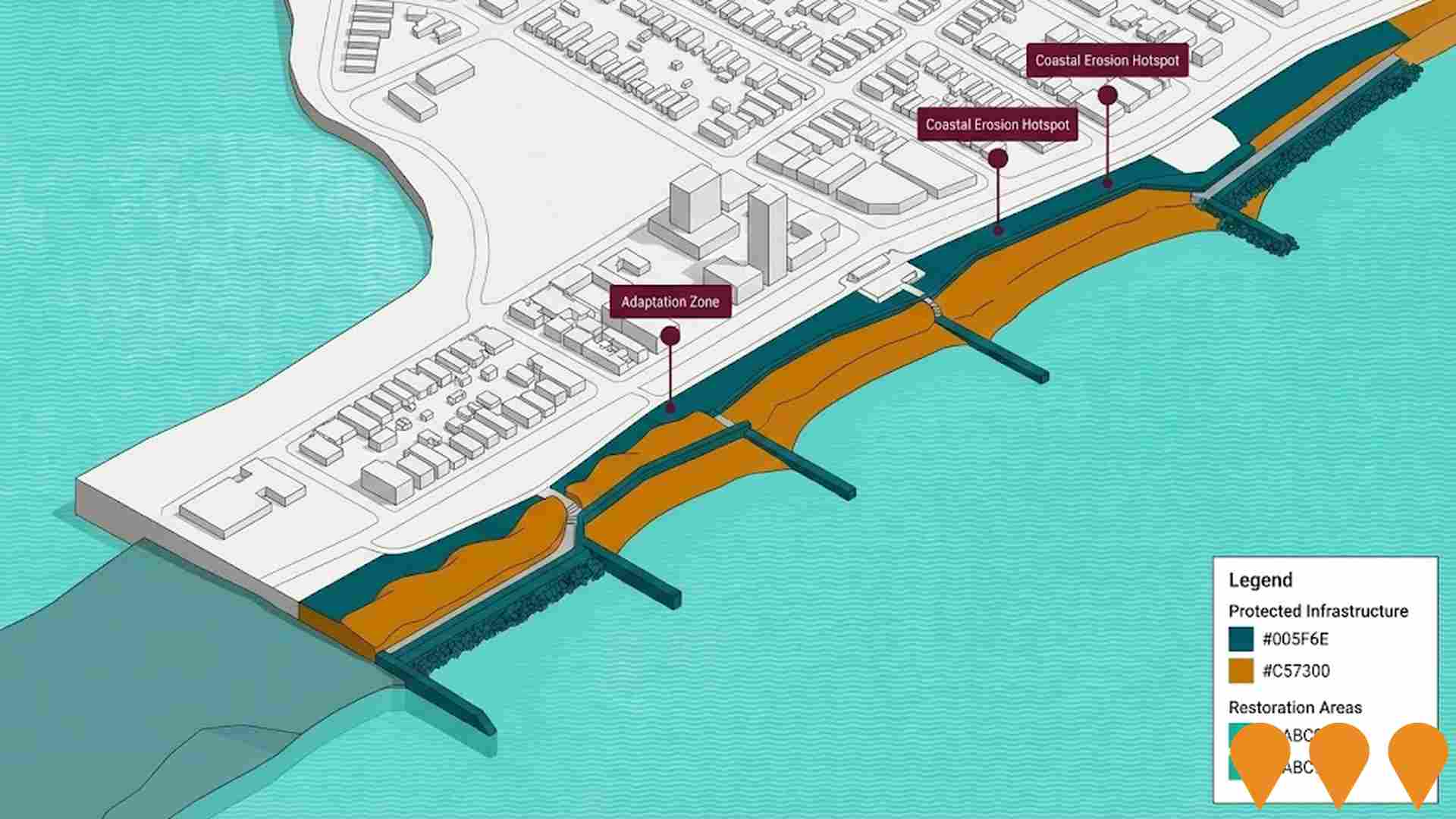

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Resources Community Investment Initiative

A $750 million partnership between the WA Government and major resource companies (Rio Tinto, BHP, Woodside Energy, Chevron, Mineral Resources, Fortescue, Roy Hill) to fund community, social, and regional infrastructure. Key allocated projects include the $150.3 million Perth Concert Hall redevelopment and the $20 million Paraburdoo Hospital upgrade.

Goldfields Pipeline Renewal (Stage 1)

The first stage of a long-term, 70-year renewal of the historic 566km Goldfields Water Supply Scheme. This stage involves replacing 44.5km of ageing locking bar pipe with modern below-ground MSCL sections in the Shires of Merredin, Westonia, and Yilgarn. The project also includes significant valve upgrades and a major expansion of the Binduli Reservoir in Kalgoorlie to double its storage capacity. The upgrades will increase scheme capacity by 7.2 million litres daily by 2027 to support mining and industrial growth while preserving the pipeline's National Heritage values.

Kalgoorlie-Boulder Water Bank Project

A multi-phase initiative by the City of Kalgoorlie-Boulder to enhance non-potable water security through improved stormwater capture and recycled water infrastructure. Stage 1 ($19M) involves constructing a new water recycling dam at the Racecourse Dam site and upgrading the South Boulder Wastewater Treatment Plant. Future stages include additional dams, a desalination pilot plant, and evaporative controls to reduce reliance on the Goldfields Pipeline and support regional growth.

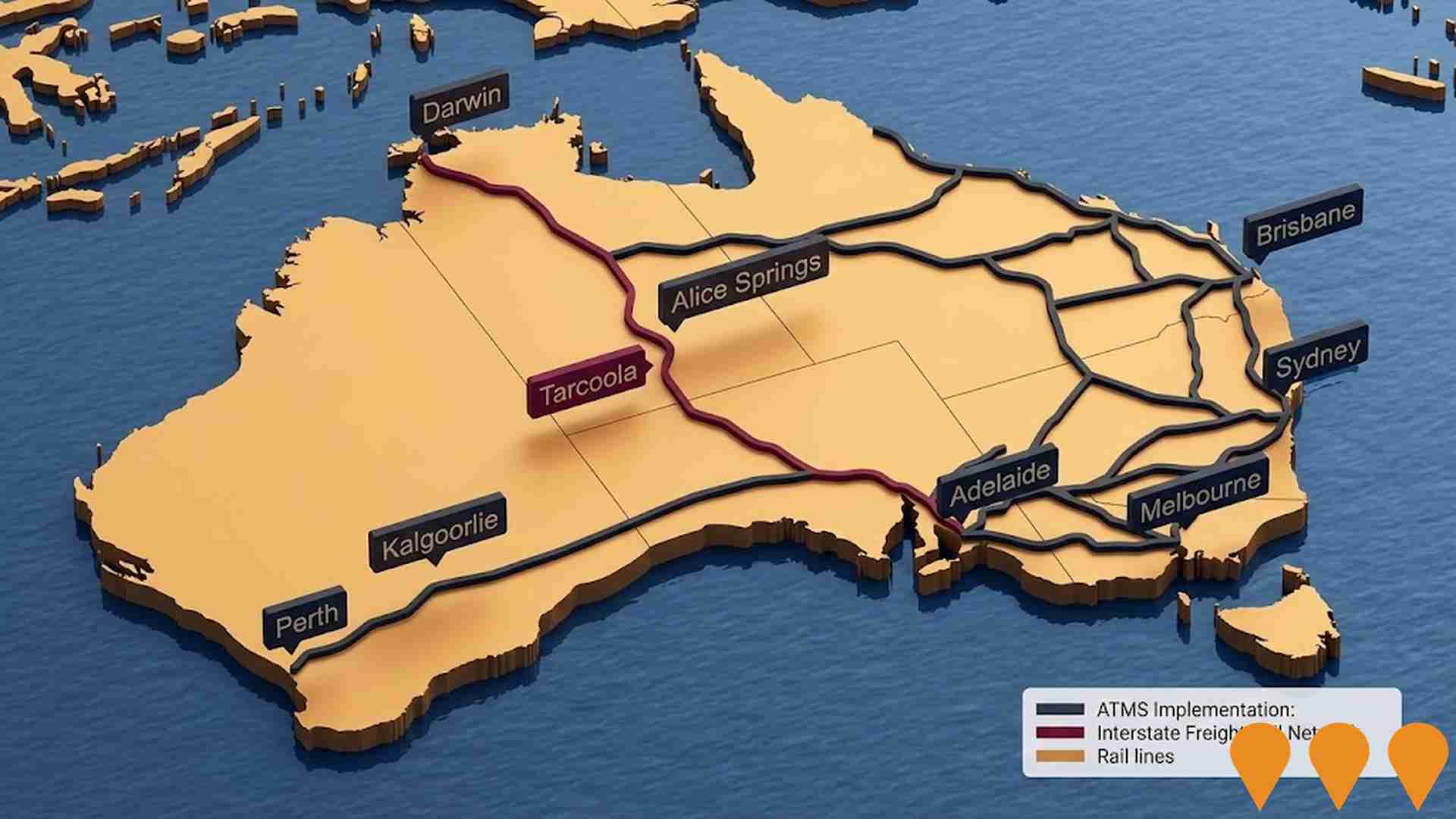

Kalgoorlie Rail Realignment

The project involves developing a business case to realign the rail line through Kalgoorlie to support industrial development and improve freight services. The project is being delivered by the Goldfields-Esperance Development Commission in partnership with the Australian and Western Australian governments.

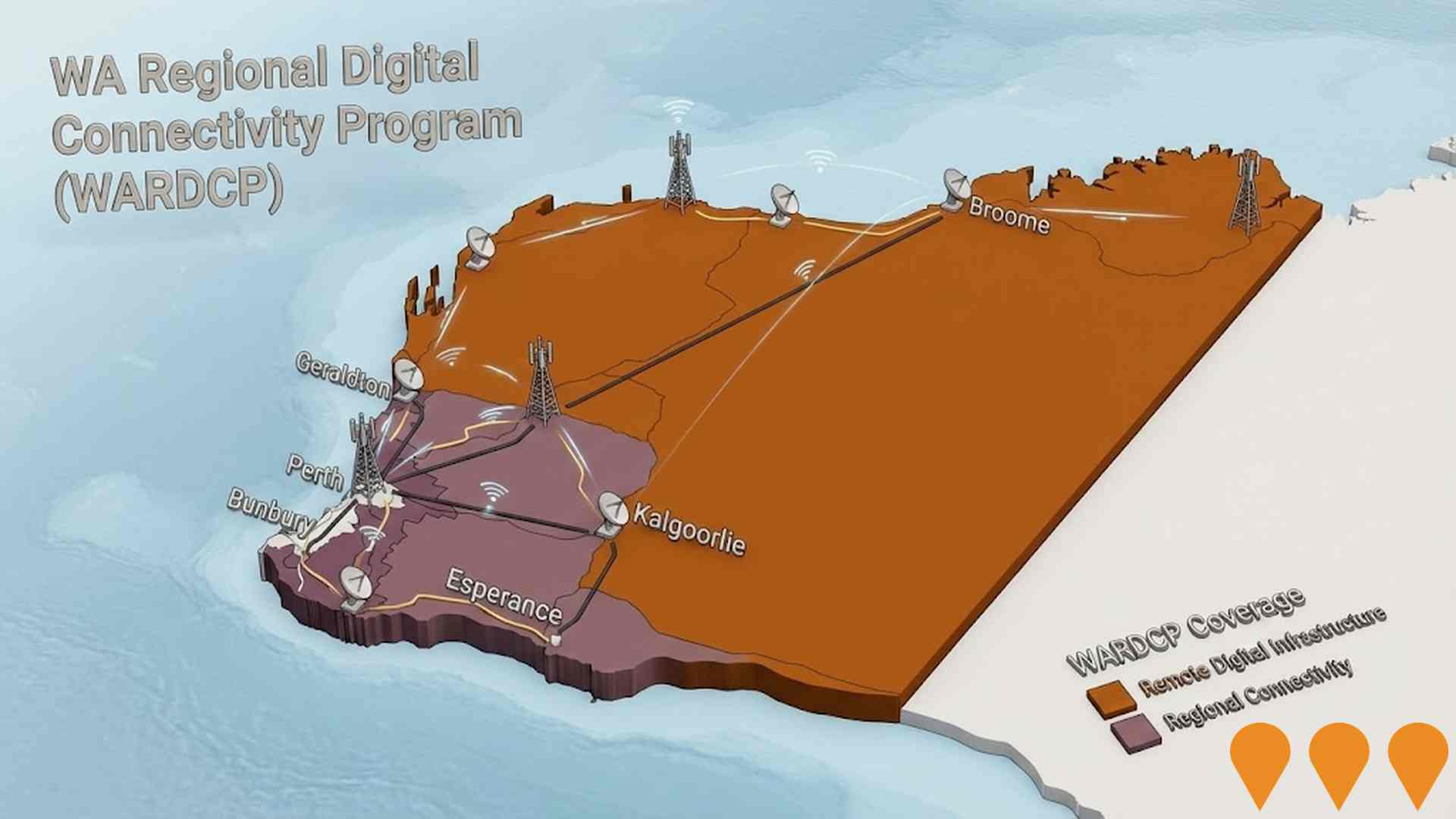

WA Regional Digital Connectivity Program (WARDCP)

Statewide co-investment program delivering new and upgraded mobile, fixed wireless and broadband infrastructure to improve reliability, coverage and performance for regional and remote Western Australia. Current workstreams include the Regional Telecommunications Project, State Agriculture Telecommunications Infrastructure Fund, and the WA Regional Digital Connectivity Program (WARDCP).

Central Regional TAFE - Kalgoorlie Heavy Plant Engineering Trades Workshop

Central Regional TAFE's Kalgoorlie campus is now training students in new $10 million state-of-the-art heavy plant workshops.

Lynas Rare Earths Processing Facility

A new Rare Earths Processing Facility in Kalgoorlie to process the Rare Earth concentrate from the Mt Weld mine. The material produced in Kalgoorlie will be further processed at the Lynas Malaysia advanced materials plant or at the proposed Rare Earths separation facility in the United States.

Workers Lifestyle Village

A modular village with 100 homes for essential workers, easing housing pressures. Includes communal facilities, pool, and caretaker's residence in first stage of 393 total homes.

Employment

While Boulder retains a healthy unemployment rate of 4.0%, recent employment declines have impacted its national performance ranking

Boulder has a diverse workforce with both white and blue collar jobs, notable representation in manufacturing and industrial sectors, an unemployment rate of 4.0%, and stable employment conditions over the past year, according to AreaSearch's aggregation of statistical area data. As of September 2025, there are 2,745 employed residents with an unemployment rate at 3.3% above Rest of WA's rate.

Workforce participation is relatively standard at 62.2%. Key industries include mining, retail trade, and accommodation & food services. Mining employment is particularly high at 2.4 times the regional level, while agriculture, forestry & fishing employs only 0.1% of local workers compared to Rest of WA's 9.3%. The area offers limited local employment opportunities as indicated by Census working population vs resident population counts.

Over the year to September 2025, labour force levels increased by 0.6%, while employment decreased by 0.3%, causing unemployment to rise by 0.8 percentage points. In comparison, Rest of WA saw employment growth of 1.4% and a decrease in unemployment by 0.2 percentage points. National employment forecasts from Jobs and Skills Australia indicate overall growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Boulder's employment mix suggests local employment could increase by 4.9% over five years and 11.3% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2023 shows Boulder had a median income among taxpayers of $66,394 and an average of $78,694. This is higher than the national averages. Rest of WA's median was $59,973 with an average of $74,392. Considering Wage Price Index growth of 9.62% since financial year 2023, estimated incomes for September 2025 would be approximately $72,781 (median) and $86,264 (average). The 2021 Census data indicates individual earnings at the 80th percentile nationally were $1,019 weekly. Income analysis reveals that 38.5% of Boulder residents (2,025 people) fall into the $1,500 - 2,999 income bracket each week, aligning with regional trends where this cohort represents 31.1%. After housing costs, residents retain 88.1% of their income, reflecting strong purchasing power.

Frequently Asked Questions - Income

Housing

Boulder is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Boulder, as per the latest Census evaluation, houses accounted for 81.9% of dwellings, with other types such as semi-detached homes, apartments, and 'other' dwellings making up the remaining 18.1%. This is similar to Non-Metro WA's dwelling structure, which was 82.9% houses and 17.0% other dwellings. Home ownership in Boulder stood at 22.0%, with mortgaged dwellings at 42.8% and rented ones at 35.2%. The median monthly mortgage repayment in Boulder was $1,302, lower than Non-Metro WA's average of $1,517. Weekly rent in Boulder averaged $300, compared to Non-Metro WA's $280. Nationally, Boulder's mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Boulder features high concentrations of group households and lone person households, with a lower-than-average median household size

Family households constitute 65.0% of all households, including 26.8% couples with children, 23.2% couples without children, and 13.3% single parent families. Non-family households account for the remaining 35.0%, with lone person households at 30.2% and group households comprising 4.8%. The median household size is 2.4 people, which is smaller than the Rest of WA average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Boulder fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 9.3%, significantly lower than Australia's average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 7.1%, followed by postgraduate qualifications (1.3%) and graduate diplomas (0.9%). Vocational credentials are prevalent, with 47.2% of residents aged 15+ holding them - advanced diplomas at 7.5% and certificates at 39.7%.

Educational participation is high, with 35.7% currently enrolled in formal education. This includes 16.1% in primary, 9.5% in secondary, and 2.4% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis in Boulder shows 32 active public transport stops operating within the city. These stops are served by a mix of buses along five individual routes. The combined weekly passenger trips across these routes total 132.

Transport accessibility is rated as good, with residents on average located 220 meters from their nearest transport stop. Service frequency averages 18 trips per day across all routes, equating to approximately four weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Boulder's residents are healthier than average in comparison to broader Australia with prevalence of common health conditions quite low among the general population though higher than the nation's average across older, at risk cohorts

Health data shows Boulder residents have relatively positive health outcomes with low prevalence of common conditions among the general population, but higher in older, at-risk cohorts compared to national averages. Private health cover is exceptionally high at approximately 58% of the total population (3,075 people), compared to 63.6% across Rest of WA.

Mental health issues and asthma are the most common medical conditions, affecting 7.7 and 7.4% of residents respectively. 72.0% of residents declare themselves completely clear of medical ailments, compared to 74.9% across Rest of WA. The area has 10.0% of residents aged 65 and over (526 people), requiring more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Boulder records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Boulder's cultural diversity was found to align with the wider region's average. Its population comprises 72.0% citizens, 78.2% born in Australia, and 89.9% speaking English only at home. Christianity is the predominant religion in Boulder, accounting for 40.3% of its population.

Notably, Buddhism is slightly overrepresented in Boulder at 1.3%, compared to 1.2% across Rest of WA. The top three ancestry groups in Boulder are English (27.9%), Australian (27.2%), and Irish (7.0%). There are notable differences in the representation of certain ethnic groups: Maori is overrepresented at 3.5%, New Zealand at 1.6%, and Australian Aboriginal at 6.8%.

Frequently Asked Questions - Diversity

Age

Boulder's population is younger than the national pattern

Boulder's median age is 34, which is younger than the Rest of WA figure of 40 and below Australia's median age of 38 years. The 25-34 age group makes up 16.9% of Boulder's population, compared to the Rest of WA, while the 75-84 cohort comprises 2.4%. Between 2021 and now, the 25-34 age group has increased from 15.2% to 16.9%, and the 15-24 cohort has risen from 11.9% to 13.3%. Conversely, the 45-54 age group has decreased from 13.0% to 10.9%. By 2041, demographic projections indicate significant shifts in Boulder's age structure. The 25-34 age group is projected to grow by 42%, reaching 1,260 people from the current 889. Meanwhile, both the 85+ and 75-84 age groups are expected to see reduced numbers.