Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Bonogin are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Based on ABS population updates and AreaSearch validation, Bonogin's population is estimated at around 5,080 as of Nov 2025. This reflects an increase of 184 people since the 2021 Census, which reported a population of 4,896. The change is inferred from AreaSearch's estimate of 5,071 residents following examination of ABS ERP data release in June 2024 and additional validated new addresses since the Census date. This level of population equates to a density ratio of 132 persons per square kilometer. Bonogin's growth rate of 3.8% since census positions it within 2.1 percentage points of its SA3 area (5.9%). Population growth was primarily driven by overseas migration, contributing approximately 56.99999999999999% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. These state projections do not provide age category splits; thus AreaSearch applies proportional growth weightings in line with ABS Greater Capital Region projections for each age cohort released in 2023 based on 2022 data. Looking ahead, an above median population growth is projected for non-metropolitan areas, with Bonogin expected to grow by 853 persons to 2041, reflecting a 16.1% increase over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Bonogin when compared nationally

AreaSearch analysis of ABS building approval numbers shows Bonogin has received approximately 22 dwelling approvals per year on average over the past five financial years, totalling around 113 homes. As of FY-26, there have been three recorded approvals. Each year, about two people move to the area for each dwelling built between FY-21 and FY-25, indicating balanced supply and demand dynamics. The average construction cost value of new homes is $891,000, suggesting a focus on premium properties.

This financial year has seen $5.2 million in commercial approvals, reflecting the area's residential character. Compared to Rest of Qld, Bonogin exhibits 80.0% higher building activity per capita. The dwelling mix consists of approximately 96.0% detached and 4.0% attached dwellings, maintaining the area's low-density character with a focus on family homes. There are roughly 137 people per dwelling approval in Bonogin, indicating a low-density market.

According to AreaSearch's latest quarterly estimate, the population is projected to grow by 819 residents by 2041. With current construction levels, housing supply should meet demand adequately, creating favourable conditions for buyers and potentially enabling growth that may exceed current forecasts.

Frequently Asked Questions - Development

Infrastructure

Bonogin has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly affect an area's performance. AreaSearch has identified nine projects that could impact the region. Notable ones are Wildlife Park Estate, Raba Urban Farm Hub, Reedy Creek West Burleigh Projects, and Austinville Causeway Upgrade. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

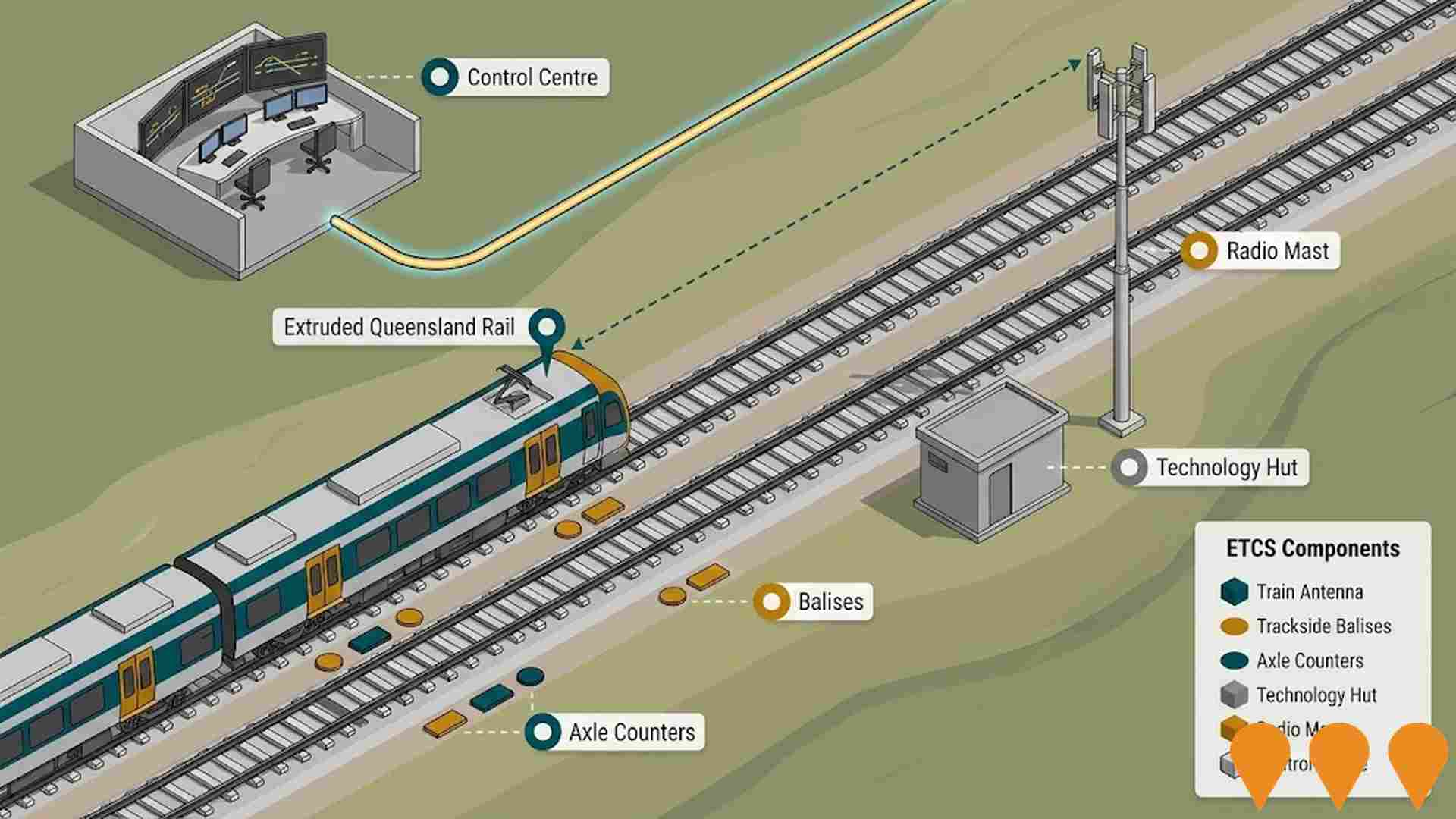

Gold Coast Heavy Rail Extension - Varsity Lakes to Gold Coast Airport

The Gold Coast Heavy Rail Extension involves a 13 km extension of the heavy rail line from Varsity Lakes to the Gold Coast Airport. The project includes four proposed new stations at Tallebudgera, Elanora, Tugun, and the Gold Coast Airport terminal. While the corridor has been preserved since 2008 and is recognized in ShapingSEQ 2023 and SEQ Rail Connect as a long-term priority for the 2032 Olympic Games legacy, it remains in the planning phase. As of early 2026, the project is still undergoing review and detailed business case development, with no committed construction start date. It is intended to integrate with the broader South East Queensland rail network and provide high-speed connectivity to the southern Gold Coast.

Gold Coast Light Rail Stage 3 (Broadbeach South to Burleigh Heads)

A 6.7-kilometre dual-track extension of the G:link light rail network from Broadbeach South to Burleigh Heads. The $1.549 billion project adds eight new stations, five additional light rail vehicles, and involves an upgrade to the existing Southport depot. Major construction commenced in July 2022. As of early 2026, the project has reached significant milestones with tram testing and commissioning underway in the northern sections. Once operational, the total network will span 27km from Helensvale to Burleigh Heads, significantly improving public transport accessibility and supporting the region's growth ahead of the 2032 Olympic Games.

Gold Coast Light Rail Stage 4

Proposed 13km southern extension of the Gold Coast Light Rail from Burleigh Heads to Coolangatta via Gold Coast Airport. The project was intended to include 14 new stations and bridges over Tallebudgera and Currumbin Creeks. Following a Queensland Government review and community consultation in early 2025, official planning for the light rail extension was stopped on 1 September 2025 due to community opposition and escalating cost estimates reaching up to $9.85 billion. The government has shifted focus to a multi-modal regional transport study and accelerated bus service enhancements for the southern Gold Coast.

Raba Urban Farm Hub

A community-driven urban farm and education center featuring permanent farmers market facilities, educational programs, community garden beds, indigenous bush tucker cultivation, and sustainable agriculture demonstrations. The project includes a traditional gathering circle, healing spaces, and comprehensive environmental rehabilitation programs.

Reedy Creek West Burleigh Projects

Combined infrastructure proposal by Boral comprising two integrated components under a single development application: the Reedy Creek Key Resource Area Project (unlocking State Key Resource Area 96 for extraction of up to 1.2 million tonnes per annum of quarry materials) and the West Burleigh Construction Waste and Resource Recovery Project (establishing facilities for non-putrescible construction waste to rehabilitate the existing West Burleigh Quarry void). Only 26% of the 216.7 hectare site is used for operations, with 74% protected and enhanced for environmental outcomes, including habitat corridors and planting of nearly 500,000 trees. Operations expected to commence ~2038 following exhaustion of existing West Burleigh Quarry reserves.

Gold Coast Desalination Plant Expansion

Expansion of the existing desalination plant to increase water supply capacity in response to population growth and climate change, including potential booster pump stations.

M1 Pacific Motorway Varsity Lakes to Tugun Upgrade

$1.5 billion upgrade of 10 km of the M1 to a minimum of three lanes each way, with interchange upgrades at Burleigh (Exit 87), Tallebudgera (Exit 89) and Palm Beach (Exit 92), widening of Tallebudgera and Currumbin Creek bridges, a new two-way western service road between Tallebudgera and Palm Beach, and smart motorway technologies. Package A (Varsity Lakes to Burleigh) completed in 2022; Packages B (Burleigh to Palm Beach) and C (Palm Beach to Tugun) are opening progressively from 2024 through 2025.

Somerset College Expansion

Major expansion of Somerset College completed in 2024 by Hutchinson Builders. The $24.7M project incorporated eight new classrooms, a breakout reading room, flexible indoor/outdoor learning environments, and a new playground added to the Junior School Precinct. The development also includes a new sports facility the size of an international hockey pitch with an underground car park, enhancing the College's educational and sporting capabilities for its 1,480 students from Pre-Prep to Year 12.

Employment

Bonogin ranks among the top 25% of areas assessed nationally for overall employment performance

Bonogin has a skilled workforce with well-represented essential services sectors. Its unemployment rate was 2.4% in the past year, based on AreaSearch data aggregation.

As of September 2025, there were 2,862 employed residents, with an unemployment rate of 1.7%, below Rest of Qld's 4.1%. Workforce participation was high at 69.9% compared to Rest of Qld's 59.1%. Dominant employment sectors included construction, health care & social assistance, and education & training. Construction had a particularly strong presence, with an employment share 1.4 times the regional level.

Agriculture, forestry & fishing was under-represented at 0.9% compared to Rest of Qld's 4.5%. Many residents commute elsewhere for work based on Census data. In the past year, employment increased by 2.4%, labour force by 2.5%, leading to a slight unemployment rise of 0.1 percentage points. By comparison, Rest of Qld had employment growth of 1.7% and unemployment rose by 0.3 percentage points. State-level data to 25-Nov-25 showed QLD employment contracted by 0.01%, with an unemployment rate of 4.2%. Jobs and Skills Australia's national employment forecasts from May-25 project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Bonogin's employment mix suggests local employment should increase by 6.7% over five years and 13.6% over ten years, though this is a simple extrapolation for illustrative purposes only and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

The area exhibits notably strong income performance, ranking higher than 70% of areas assessed nationally through AreaSearch analysis

The latest postcode level ATO data for financial year 2023 shows Bonogin suburb having high national incomes. The median income is $54,492 and the average is $74,499. This contrasts with Rest of Qld's median income of $53,146 and average income of $66,593. Based on Wage Price Index growth of 9.91% since financial year 2023, estimated incomes as of September 2025 are approximately $59,892 (median) and $81,882 (average). The 2021 Census data ranks Bonogin's household incomes at the 93rd percentile ($2,680 weekly), while personal income ranks at the 58th percentile. Predominant income cohort spans 30.2% of locals (1,534 people) in the $1,500 - $2,999 category. Higher earners represent a substantial presence with 43.9% exceeding $3,000 weekly. Housing accounts for 14.8% of income. Residents rank within the 93rd percentile for disposable income and the area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Bonogin is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Bonogin's dwellings, as per the latest Census, were 98.7% houses and 1.4% other dwellings. Non-Metro Qld had 83.1% houses and 16.9% other dwellings. Home ownership in Bonogin was 29.2%, with mortgages at 64.2% and rentals at 6.5%. The median monthly mortgage repayment was $2,392, higher than Non-Metro Qld's average of $2,167. Median weekly rent in Bonogin was $630, compared to Non-Metro Qld's $500. Nationally, Bonogin's mortgage repayments were significantly higher at $2,392 versus Australia's average of $1,863, and rents were substantially higher at $630 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Bonogin features high concentrations of family households, with a higher-than-average median household size

Family households account for 90.5% of all households, including 57.3% couples with children, 25.6% couples without children, and 6.9% single parent families. Non-family households make up the remaining 9.5%, with lone person households at 8.2% and group households comprising 1.7%. The median household size is 3.3 people, larger than the Rest of Qld average of 3.0.

Frequently Asked Questions - Households

Local Schools & Education

Bonogin demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

The region's educational profile is notable with university qualification rates of 27.6%, exceeding the Rest of Qld average of 20.6%. Bachelor degrees are most prevalent at 18.6%, followed by postgraduate qualifications (6.1%) and graduate diplomas (2.9%). Vocational credentials are also prominent, with 39.7% of residents aged 15+ holding such qualifications – advanced diplomas at 13.7% and certificates at 26.0%.

Educational participation is high, with 33.7% currently enrolled in formal education, including 12.0% in primary, 12.0% in secondary, and 4.8% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Bonogin's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Bonogin shows excellent health outcomes across all ages, with very low prevalence of common health conditions.

Approximately 57% (~2,881 people) have private health cover, which is high compared to other areas. The most prevalent medical conditions are asthma and mental health issues, affecting 7.2% and 6.2% of residents respectively. A total of 75.3% report no medical ailments, slightly higher than the Rest of Qld's 73.3%. Bonogin has a lower proportion of seniors aged 65 and over at 11.2% (568 people), compared to Rest of Qld's 14.4%. Despite this, health outcomes among seniors in Bonogin align with the general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Bonogin records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Bonogin's population, as per the census conducted on 29 June 2016, showed cultural diversity roughly in line with the wider region. 74.3% of Bonogin residents were born in Australia, and 90.0% held citizenship. English was spoken at home by 93.5%.

Christianity was the predominant religion, practiced by 50.4% of the population. While Judaism's representation was similar to the regional average (0.2%), it was notable due to its small size. The top three ancestry groups were English (32.8%), Australian (25.9%), and Scottish (8.0%). Some ethnic groups showed significant differences: New Zealanders made up 1.4% of Bonogin's population compared to the regional average, South Africans comprised 1.3%, and Hungarians accounted for 0.4%.

Frequently Asked Questions - Diversity

Age

Bonogin's population is slightly older than the national pattern

Bonogin's median age is 40, close to Rest of Qld's figure of 41 and modestly above Australia's norm of 38. The 45-54 age group has strong representation at 17.9%, compared to Rest of Qld's figure, while the 25-34 cohort is less prevalent at 7.8%. This concentration in the 45-54 age group is well above Australia's national figure of 12.1%. Post the 2021 Census, the 15 to 24 age group has increased from 13.4% to 14.8%, while the 55 to 64 cohort has decreased from 13.8% to 12.7%. By 2041, Bonogin's age profile is expected to evolve significantly. The 35-44 group is projected to grow by 23%, adding 168 people and reaching 895 from the current 726. Conversely, numbers in the 15-24 age range are anticipated to decrease by 3%.