Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Barmera has shown very soft population growth performance across periods assessed by AreaSearch

Barmera's population, as of November 2025, is approximately 6,674. This figure represents an increase of 273 individuals since the 2021 Census, which reported a population of 6,401. The change is inferred from the estimated resident population of 6,628 in June 2024 and an additional 49 validated new addresses since the Census date. This results in a population density ratio of 7.8 persons per square kilometer. Barmera's growth rate of 4.3% since the census places it within 2.2 percentage points of the SA3 area's growth rate of 6.5%, indicating competitive growth fundamentals. Overseas migration contributed approximately 85.1% of overall population gains in recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, the SA State Government's Regional/LGA projections by age category are adopted, based on 2021 data and released in 2023, with adjustments made using a method of weighted aggregation of population growth from LGA to SA2 levels. Considering projected demographic shifts, lower quartile growth of non-metropolitan areas nationally is anticipated. The area is expected to grow by 297 persons to 2041 based on the latest annual ERP population numbers, reflecting an overall gain of 3.8% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Barmera, placing the area among the bottom 25% of areas assessed nationally

Barmera has seen approximately 12 new homes approved annually. Over the past five financial years, from FY-21 to FY-25, 63 homes were approved, with an additional 5 approved so far in FY-26. On average, about one new resident arrives per year for each new home over these five years, suggesting that new supply is meeting or exceeding demand and providing ample buyer choice while also allowing for potential population growth beyond current forecasts.

The average construction value of these homes is $218,000, which is below the regional average, indicating more affordable housing options for buyers. This financial year has seen $3.2 million in commercial approvals registered, highlighting Barmera's predominantly residential nature. Compared to the Rest of SA, Barmera has significantly less development activity, at 67.0% below the regional average per person. This limited new supply generally supports stronger demand and values for established dwellings. Development activity is also under the national average, suggesting the area's established nature and potential planning limitations.

Recent development has been entirely comprised of detached dwellings, preserving Barmera's low density nature and attracting space-seeking buyers. The estimated population per dwelling approval is 606 people, reflecting its quiet, low activity development environment. According to AreaSearch's latest quarterly estimate, Barmera is forecasted to gain 251 residents by 2041. With current construction levels, housing supply should adequately meet demand, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Barmera has limited levels of nearby infrastructure activity, ranking in the 11thth percentile nationally

The performance of an area can significantly influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified a total of 11 such projects that are expected to impact the area. Notable among these are Bruno Bay Infrastructure Upgrade, Berri Energy Project, McLean Street Residential Estate, and Riverview Drive Reconstruction (Flood Recovery). The following list details those projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

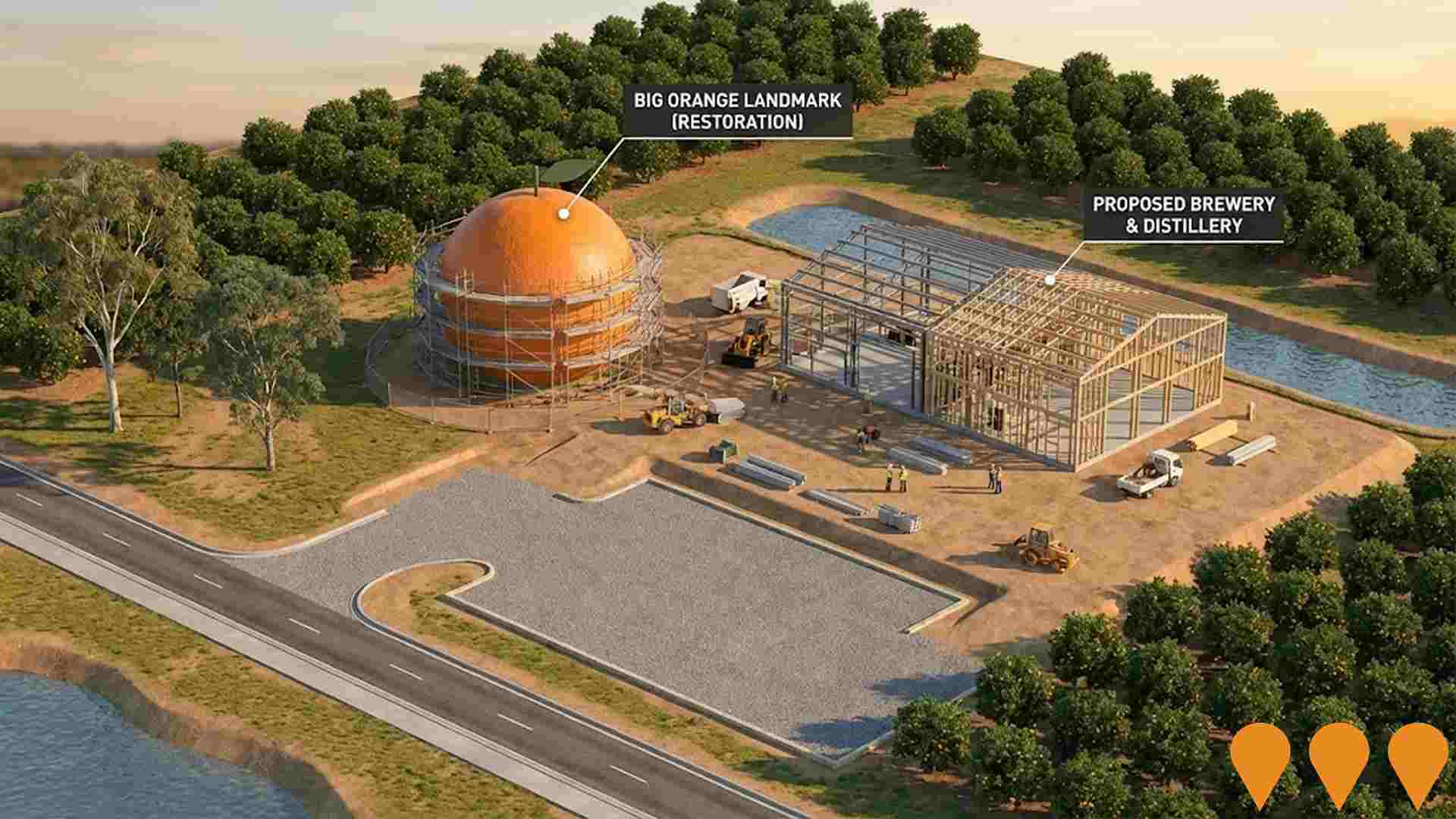

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Big Orange Redevelopment

Revitalisation of the iconic 15-meter tall Big Orange landmark into a $1.5 million multifaceted destination featuring a brewery, distillery, restaurant, bar, and outdoor dining verandah to boost regional tourism and celebrate the region's citrus heritage. Construction was slated to commence in 2024.

Berri Energy Project

Australia's first fully operational utility-scale DC-coupled solar and battery energy storage system. The project, built on a former racecourse, features a 5.8 MWp solar farm (9,800 solar panels) coupled with a 6.7 MWh battery. It commenced full commercial operations in early 2023, generating 11,500 MWh annually, and provides Frequency Control Ancillary Services (FCAS) and voltage control services to the grid. It also has a community fund donating over $190,000 over its lifetime.

Bruno Bay Infrastructure Upgrade

Upgrades to the boat ramp, access road, carpark, barbecue shelters, seating, and toilet facilities at Bruno Bay in Cobdogla. The project aims to improve community resilience, enhancing accessibility and use during periods of high River Murray flows (up to 80GL/day) and is part of the broader South Australia Constraints Measures project. The upgrades will improve environmental outcomes and are scheduled for completion by December 2026.

Loxton District Children's Centre Expansion (Woodleigh)

Construction of a new fit-for-purpose childcare centre to expand services for the Loxton District Children's Centre 'Woodleigh'. The modern, environmentally friendly multi-use facility will include learning hubs, offices, bathrooms, sleep hubs, kitchens, laundries, staff rooms, consulting and program training rooms, outdoor play spaces and carpark. Capacity will accommodate 120 full-time places in the first year, growing to 140 places within three years. The project aims to attract new families to the region and meet the growing demand for childcare services in the Riverland community.

Loxton Swimming Pool Upgrade

The District Council of Loxton Waikerie has commenced concept planning and design work for the potential redevelopment and upgrade of the Loxton Swimming Pool. The pool's aging infrastructure requires upgrading to meet current compliance standards and community expectations. Consultants DesignInc and insideEDGE Sport and Leisure Planning are working with Council and the community to develop options for revitalization of the 50-metre outdoor pool complex, which includes intermediate and toddler pools. Community consultation surveys closed March 10, 2025, with drop-in sessions held in early March to inform the concept design phase.

Loxton Institute

The Loxton Institute is a new library, visitor information and cultural centre developed at the historic former Loxton Council Chamber. The facility features a dedicated local history section, visitor information area with local products and Loxton merchandise, bookable meeting rooms, extensive library services, children's activity room, modern amenities, and an outdoor deck area with breezeway. The building retains part of the original heritage-listed Loxton Institute facade. Construction commenced in June 2023 and was completed in November 2024. The project was delivered by Michael Kregar Building with support from local subcontractors.

McLean Street Residential Estate

Sale of a significant 3.06ha development site (Lot 45 McLean St) in the Riverland town of Berri, which was advertised with two professionally drafted concept plans for a low-density residential estate of up to 34 new homes to address the critical local housing shortage. The site was sold on October 9, 2025.

Billiatt Road Reconstruction - Final Stage

Final stage reconstruction of Billiatt Road involving sealing and widening from 6.2 metres to 7.6 metres to accommodate increased traffic and road trains. As the gateway to Billiatt Conservation Park and the main tourism route in the Riverland region, this project will improve safety for locals, freight, and tourist traffic. Funded through the Australian Government's Special Local Roads Program with $993,000 allocated for this final stage.

Employment

Employment performance in Barmera has been below expectations when compared to most other areas nationally

Barmera has a balanced workforce with both white and blue collar jobs, with strong representation in manufacturing and industrial sectors. The unemployment rate is 4.1%.

Over the past year, employment has been relatively stable. As of September 2025, there are 3,291 residents employed, with an unemployment rate of 1.2% lower than Rest of SA's rate of 5.3%. Workforce participation is similar to Rest of SA at 56.2%. Key industries include health care & social assistance, manufacturing, and agriculture, forestry & fishing.

Manufacturing employment is particularly high, at 1.5 times the regional level. Retail trade, however, is under-represented with only 7.7% of Barmera's workforce compared to 9.9% in Rest of SA. The area may offer limited local employment opportunities based on Census data analysis. Between September 2024 and September 2025, employment levels increased by 0.4%, labour force grew by 1.6%, causing the unemployment rate to rise by 1.1 percentage points. In comparison, Rest of SA had employment growth of 0.3%, labour force growth of 2.3%, with unemployment rising 1.9 percentage points. Jobs and Skills Australia's national employment forecasts from May-25 suggest potential future demand in Barmera. Over five years, national employment is forecast to expand by 6.6% and over ten years by 13.7%. Applying these projections to Barmera's employment mix suggests local employment should increase by 5.3% over five years and 12.0% over ten years.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

AreaSearch's latest postcode level ATO data for financial year 2022 shows median income in Barmera SA2 is $45,608 and average income is $50,530. This is lower than national averages of $51,796 (median) and $62,538 (average). In contrast, Rest of SA has a median income of $46,889 and an average income of $56,582. Based on Wage Price Index growth of 12.83% since financial year 2022, estimated incomes for Barmera as of September 2025 would be approximately $51,460 (median) and $57,013 (average). Census data reveals household, family and personal incomes in Barmera fall between the 16th and 19th percentiles nationally. In Barmera, 28.9% of individuals earn within the $1,500 - 2,999 range, similar to metropolitan regions at 27.5%. Housing costs are modest with 89.0% of income retained, but total disposable income ranks at just the 22nd percentile nationally.

Frequently Asked Questions - Income

Housing

Barmera is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

In Barmera, as per the latest Census evaluation, 91.0% of dwellings were houses, with the remaining 9.0% being semi-detached, apartments, or other types. This is similar to Non-Metro SA's figures of 89.9% houses and 10.1% other dwellings. Home ownership in Barmera stood at 40.7%, mirroring Non-Metro SA's rate. Mortgaged dwellings accounted for 36.8% and rented ones, 22.5%. The median monthly mortgage repayment was $1,083, aligning with the Non-Metro SA average. Weekly rent in Barmera was $200, compared to Non-Metro SA's $220. Nationally, Barmera's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Barmera has a typical household mix, with a fairly typical median household size

Family households constitute 68.8% of all households, including 23.7% couples with children, 33.0% couples without children, and 11.2% single parent families. Non-family households comprise the remaining 31.2%, with lone person households at 29.1% and group households making up 2.1% of the total. The median household size is 2.3 people, which aligns with the average for the Rest of South Africa.

Frequently Asked Questions - Households

Local Schools & Education

Barmera faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 11.5%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 8.9%, followed by postgraduate qualifications (1.6%) and graduate diplomas (1.0%). Vocational credentials are prevalent, with 37.7% of residents aged 15+ holding them, including advanced diplomas (7.9%) and certificates (29.8%). A total of 23.8% of the population is actively pursuing formal education, comprising 11.4% in primary, 7.0% in secondary, and 1.5% in tertiary education.

A substantial 23.8% of the population actively pursues formal education. This includes 11.4% in primary education, 7.0% in secondary education, and 1.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Barmera is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Barmera faces significant health challenges, with various conditions affecting both younger and older residents. Private health cover is low, at approximately 46% (around 3,083 people), compared to the national average of 55.3%.

The most prevalent medical conditions are arthritis and mental health issues, impacting 11.6% and 9.0% of residents respectively. Conversely, 61.0% of residents report no medical ailments, slightly lower than the 61.8% in the rest of South Australia (Rest of SA). The area has a higher proportion of seniors aged 65 and over, at 27.3% (around 1,819 people), compared to 26.2% in Rest of SA. Despite this, health outcomes among seniors are generally positive, performing better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Barmera ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Barmera's cultural diversity was found to be below average, with 88.0% of its population born in Australia, 91.9% being citizens, and 90.3% speaking English only at home. Christianity is the main religion in Barmera, comprising 44.2% of people. The most apparent overrepresentation was in Other religions, which makes up 2.5% of the population compared to 1.5% across Rest of SA.

In terms of ancestry (country of birth of parents), the top three groups in Barmera are English at 30.9%, Australian at 30.7%, and German at 9.1%. Notably, Greek is overrepresented at 4.1% compared to 1.3% regionally, Hungarian at 0.4% compared to 0.2%, and Croatian at 0.7% compared to 0.3%.

Frequently Asked Questions - Diversity

Age

Barmera hosts an older demographic, ranking in the top quartile nationwide

The median age in Barmera is 48 years, similar to the Rest of SA's average of 47, which is well above the national norm of 38. The 65-74 cohort is notably over-represented in Barmera at 16.0%, compared to the Rest of SA average and the national figure of 9.4%. Meanwhile, the 0-4 age group is under-represented at 3.7% locally. Since 2021, the population aged 15 to 24 has grown from 10.2% to 11.8%, while the 75 to 84 cohort increased from 7.1% to 8.6%. Conversely, the 45 to 54 age group declined from 13.2% to 11.8% and the 5 to 14 group dropped from 11.9% to 10.5%. By 2041, population forecasts indicate substantial demographic changes for Barmera. The 75 to 84 cohort is projected to grow by 48%, adding 275 residents to reach 849. Senior residents aged 65 and above will drive 83% of population growth, highlighting demographic aging trends. Conversely, both the 65-74 and 5-14 age groups are expected to see reduced numbers.