Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Urunga reveals an overall ranking slightly below national averages considering recent, and medium term trends

Urunga's population was around 4,971 as of November 2025. This reflected an increase of 64 people since the 2021 Census, which reported a population of 4,907. The change was inferred from the estimated resident population of 4,944 in June 2024 and an additional 60 validated new addresses since the Census date. This level of population resulted in a density ratio of 45 persons per square kilometer. Urunga's growth rate of 1.3% since the census was within 2.9 percentage points of the SA3 area's rate of 4.2%, indicating competitive growth fundamentals. Overseas migration contributed approximately 63.8% of overall population gains during recent periods.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch used NSW State Government's SA2 level projections, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations were applied to all areas for years 2032 to 2041. Considering projected demographic shifts, national lower quartile growth of non-metropolitan areas was anticipated, with Urunga expected to grow by 241 persons to 2041 based on the latest annual ERP population numbers, reflecting a total gain of 4.3% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Urunga according to AreaSearch's national comparison of local real estate markets

Urunga has seen approximately 11 new homes approved annually on average over the past five financial years. Specifically, 57 homes were approved between FY21-FY25, with an additional 8 approved so far in FY26. On average, about 2.3 people moved to the area per new home constructed during this period, indicating strong demand which may support property values.

New homes are being built at an average expected construction cost of $367,000. This year has also seen $490,000 in commercial approvals registered, reflecting Urunga's residential nature. Compared to the rest of NSW, Urunga has about half the rate of new dwelling approvals per person, placing it among the 53rd percentile nationally for building activity, though this has accelerated recently. This lower level may indicate market maturity and possible development constraints.

Recent development has consisted solely of standalone homes, maintaining Urunga's traditional low-density character with a focus on family homes appealing to those seeking space. Notably, developers are constructing more traditional houses than the current mix suggests (84.0% at Census), indicating continued strong demand for family homes despite density pressures. The area has approximately 290 people per dwelling approval, suggesting a low-density market. Future projections estimate Urunga will add 212 residents by 2041, based on the latest AreaSearch quarterly estimate. With current construction levels, housing supply should adequately meet demand, creating favorable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

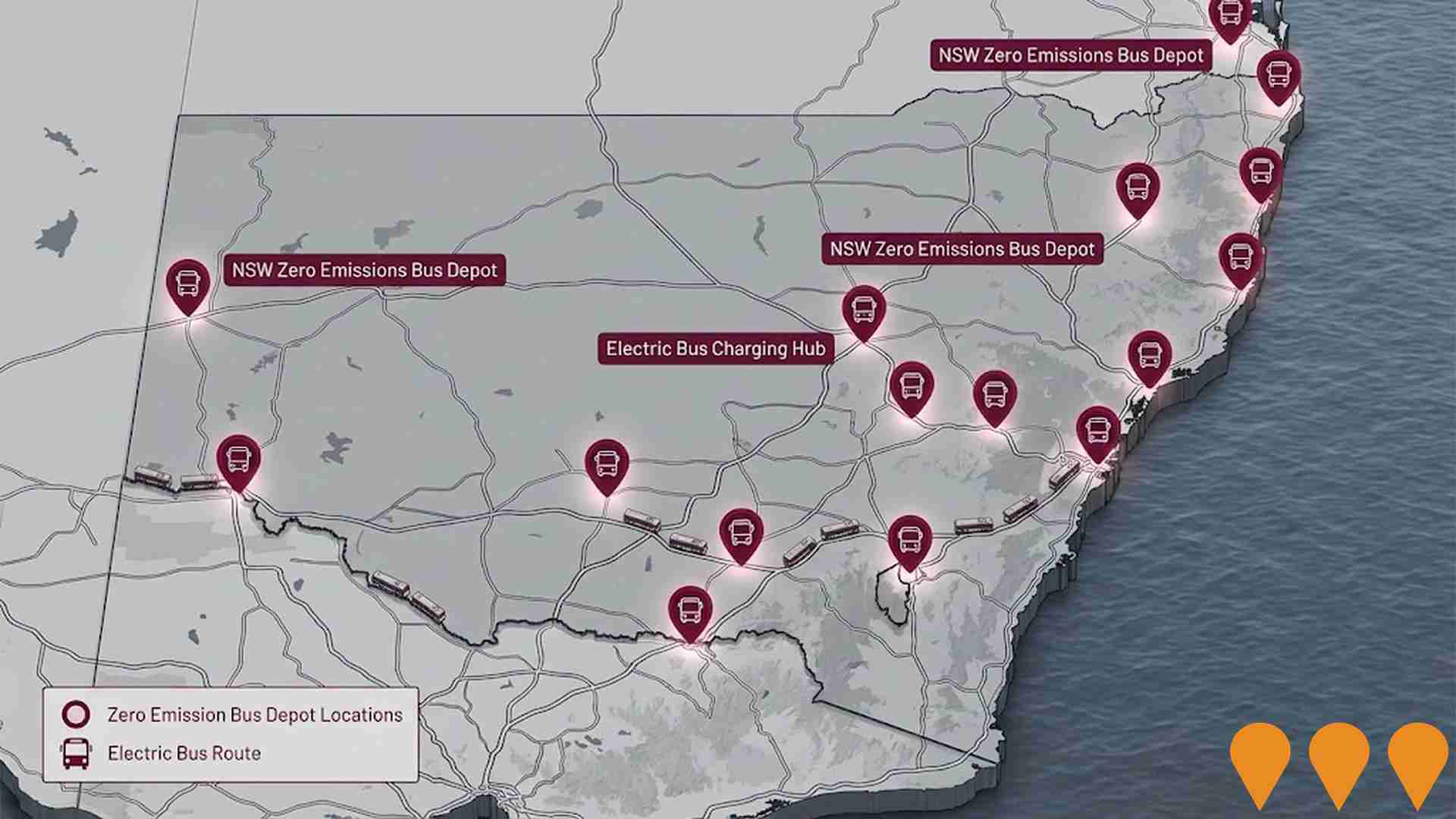

Urunga has emerging levels of nearby infrastructure activity, ranking in the 23rdth percentile nationally

Changes in local infrastructure can significantly affect an area's performance. AreaSearch has identified two projects that may impact this region. Notable projects include Sewering Coastal Villages Project, Urunga Boardwalk Replacement, Waterfall Way Corridor Strategy, and Pacific Highway Upgrade: Hexham To Brisbane. The following list provides details on those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

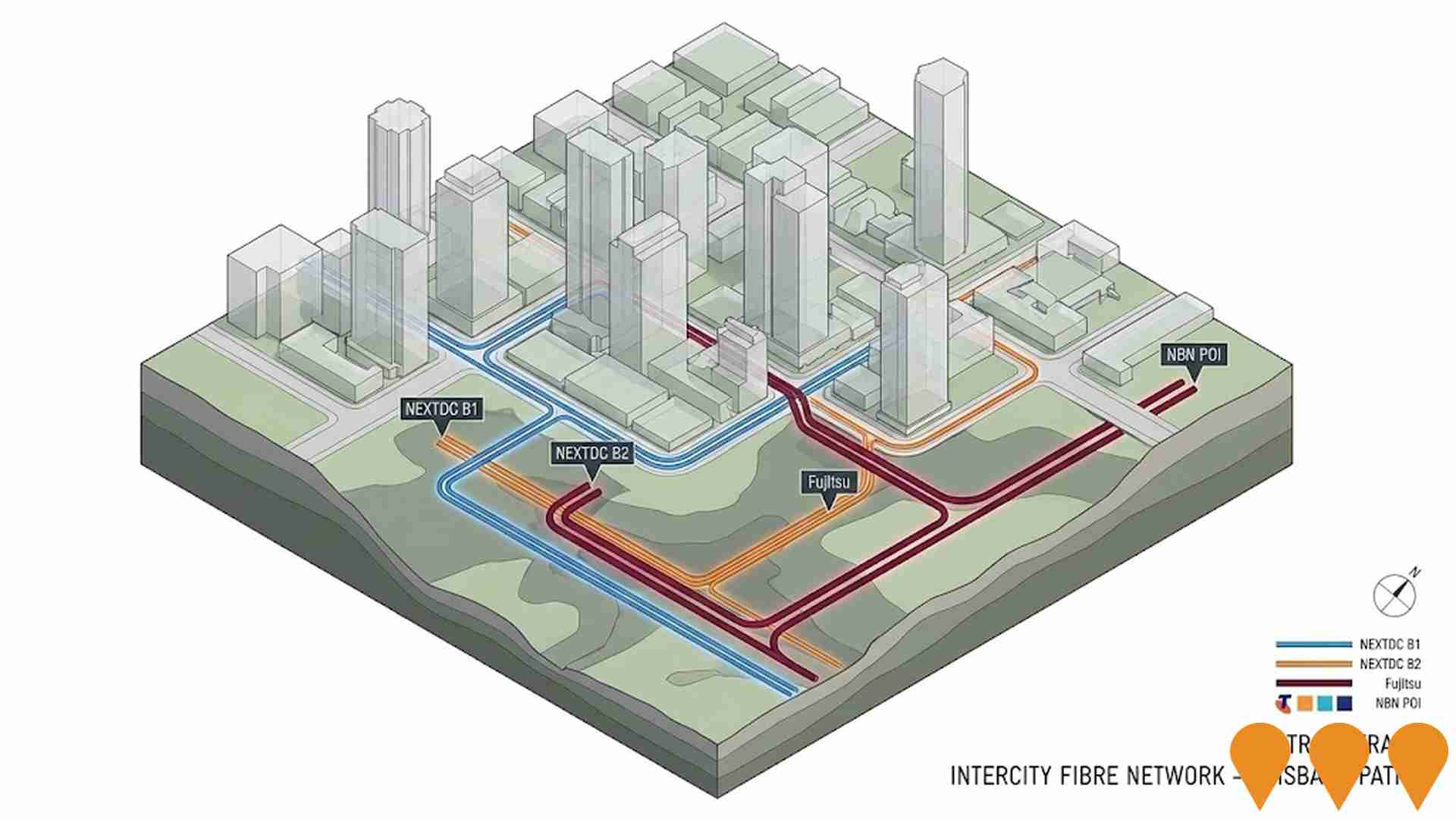

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

Sewering Coastal Villages Project

Multi-phase sewerage network expansion to the coastal villages of Mylestom, Repton, and parts of Raleigh to upgrade the Urunga Sewerage Treatment Plant and connect over 200 properties to a modern, low-pressure sewer system, improving environmental outcomes for the Bellinger and Kalang Rivers and supporting community growth. The project's three phases include: Urunga STP upgrade (completed September 2025), construction of sewer rising mains and pump stations (due December 2025), and installation of the low-pressure sewer reticulation network and property connections (commenced August 2025, overall completion expected October 2026).

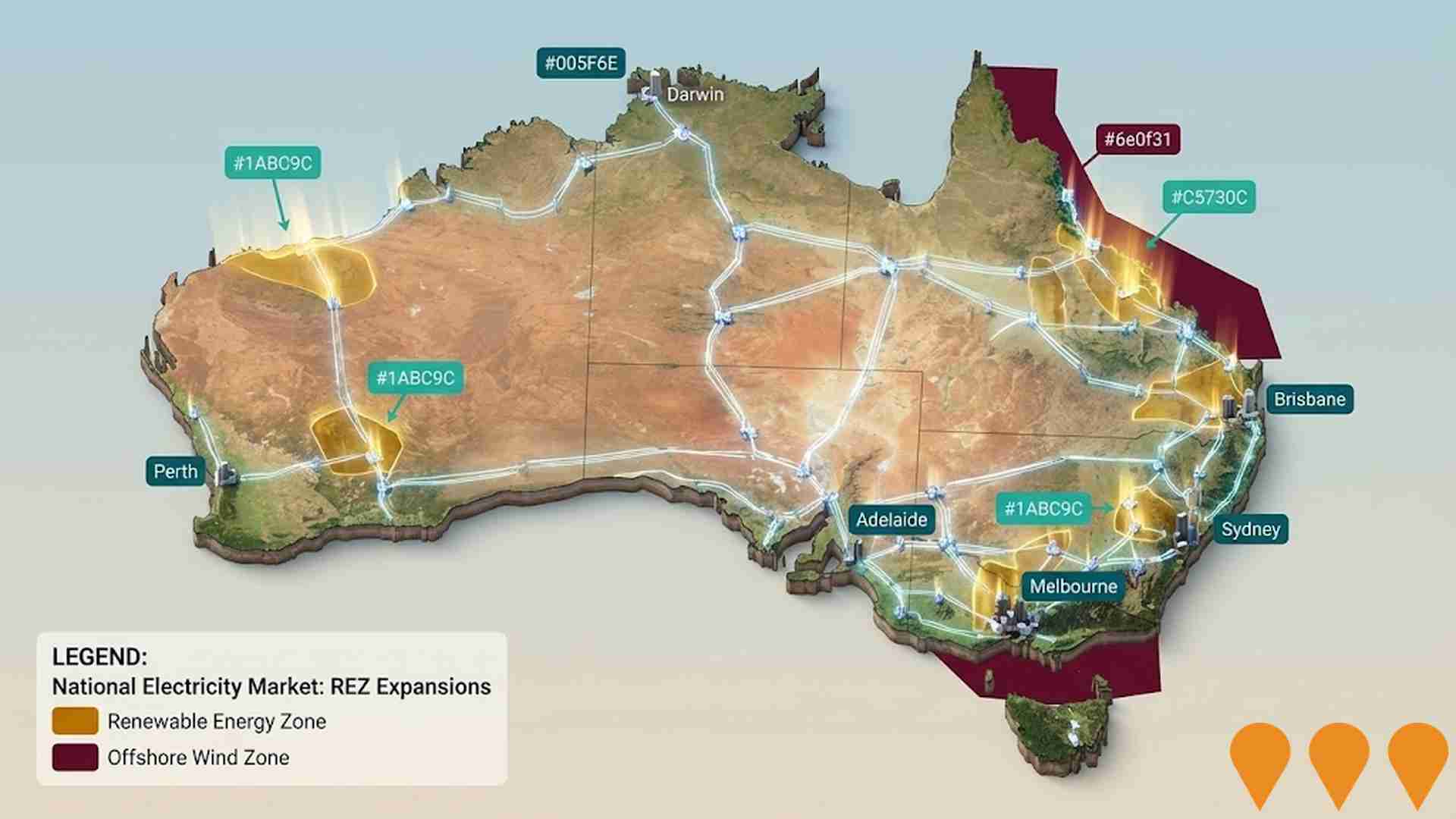

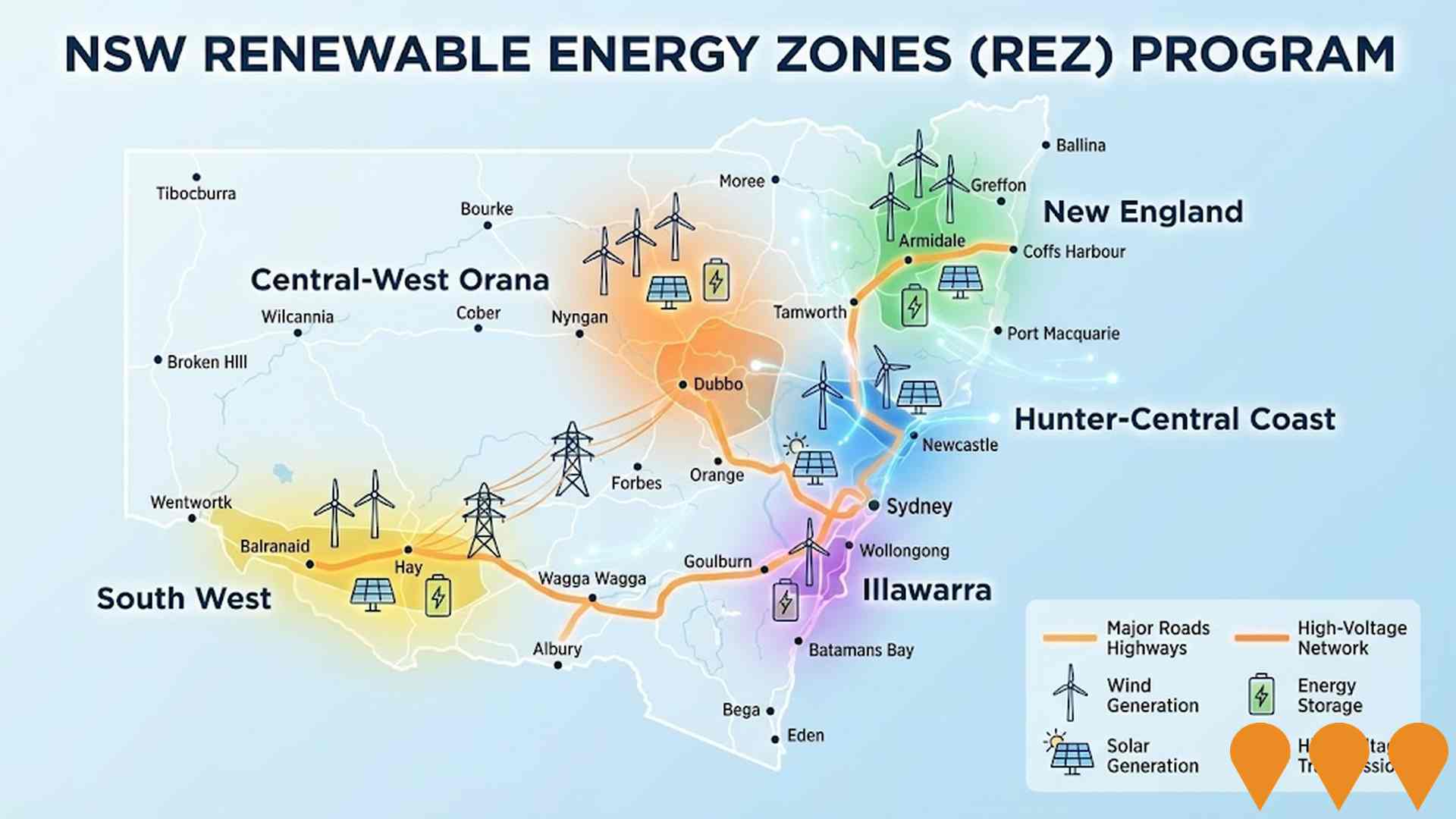

NSW Renewable Energy Zones (REZ) Program

NSW is delivering five Renewable Energy Zones (Central-West Orana, New England, South West, Hunter-Central Coast and Illawarra) to coordinate new wind and solar generation, storage and high-voltage transmission. The program is led by EnergyCo NSW under the Electricity Infrastructure Roadmap. Construction of the first REZ (Central-West Orana) transmission project commenced in June 2025, with staged energisation from 2028. Across the program, NSW targets at least 12 GW of new renewable generation and 2 GW of long-duration storage by 2030.

Enabling Digital Health Services for Regional and Remote Australia

National initiative to expand and improve digital health access for people in regional and remote Australia. Focus areas include enabling telehealth and virtual care, upgrading clinical systems and connectivity, supporting secure information exchange, and building workforce capability in digital health, aligned with the Australian Government's Digital Health Blueprint and Action Plan 2023-2033.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

Urunga Boardwalk Replacement

Major replacement of the iconic 1km Urunga Boardwalk which was damaged in the 2022 flood event, to improve resilience, access, and tourism appeal. The project is part of a broader Urunga Precinct Revitalisation. Construction commenced in June 2025 and is progressing well with piling and substructure work largely completed as of October 2025. Expected completion is in 2026.

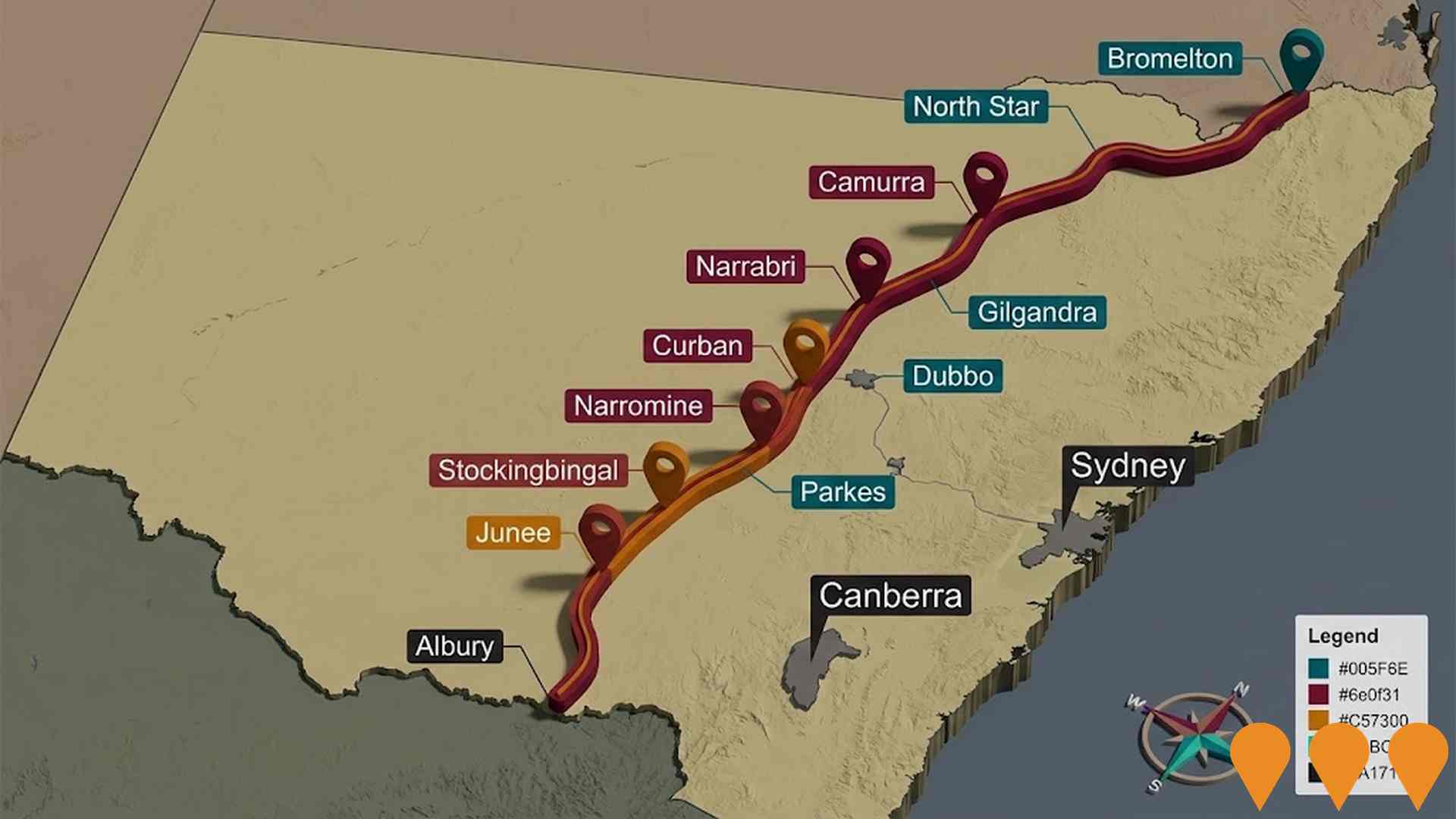

Queensland New South Wales Interconnector

The proposed Queensland New South Wales Interconnector (QNI Connect) aims to link New England's power to Queensland over approx. 600km, enhancing network capacity by up to 1,700 MW, with anticipated completion by FY2030-31.

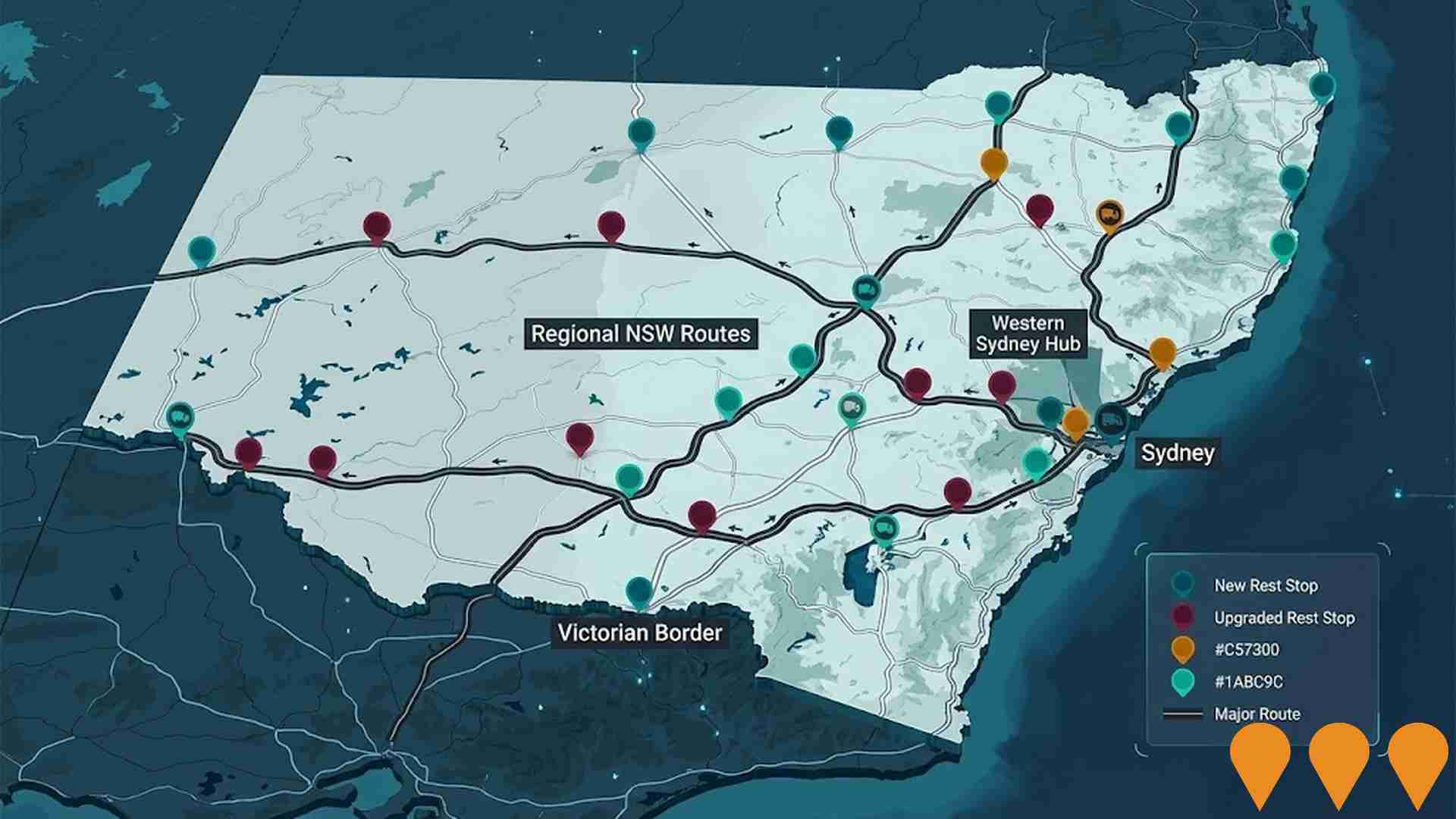

NSW Heavy Vehicle Rest Stops Program (TfNSW)

Statewide Transport for NSW program to increase and upgrade heavy vehicle rest stopping across NSW. Works include minor upgrades under the $11.9m Heavy Vehicle Rest Stop Minor Works Program (e.g. new green reflector sites and amenity/signage improvements), early works on new and upgraded formal rest areas in regional NSW, and planning and site confirmation for a major new dedicated rest area in Western Sydney. The program aims to reduce fatigue, improve safety and productivity on key freight routes, and respond to industry feedback collected since 2022.

Employment

The employment landscape in Urunga shows performance that lags behind national averages across key labour market indicators

Urunga has a skilled workforce with well-represented essential services sectors. The unemployment rate was 4.3% as of September 2021, with an estimated employment growth of 1.7% over the past year.

As of September 2025, there are 1989 residents in work, and the unemployment rate is 4.8%, which is 0.5% higher than Rest of NSW's rate of 3.8%. Workforce participation in Urunga is significantly lower at 48.0%, compared to Rest of NSW's 56.4%. Key industries for employment among residents are health care & social assistance, education & training, and construction. Notably, education & training has employment levels at 1.4 times the regional average.

Agriculture, forestry & fishing employs only 3.0% of local workers, below Rest of NSW's 5.3%. Over the 12 months to September 2025, employment increased by 1.7%, while labour force increased by 3.1%, causing the unemployment rate to rise by 1.3 percentage points. In comparison, Rest of NSW recorded an employment decline of 0.5% and a labour force decline of 0.1%, with unemployment rising by 0.4 percentage points. State-level data as of 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. National employment forecasts from May-25 indicate national employment should expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Urunga's employment mix suggests local employment should increase by 6.6% over five years and 13.8% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not account for localised population projections.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

The Urunga SA2 had a median taxpayer income of $43,117 and an average of $53,205 in the financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This is lower than national averages, contrasting with Rest of NSW's median income of $49,459 and average income of $62,998. By September 2025, estimates based on Wage Price Index growth suggest the median income would be approximately $48,554 and the average income around $59,914. The 2021 Census indicated that household, family, and personal incomes in Urunga all fall between the 11th and 12th percentiles nationally. Income brackets showed that the $800 - 1,499 earnings band captured 27.3% of the community (1,357 individuals), differing from regional levels where the $1,500 - 2,999 bracket led at 29.9%. Housing affordability pressures were severe in Urunga, with only 84.2% of income remaining, ranking at the 13th percentile nationally.

Frequently Asked Questions - Income

Housing

Urunga is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Urunga, as per the latest Census, consisted of 84.3% houses and 15.7% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro NSW's 84.3% houses and 21.6% other dwellings. Home ownership in Urunga stood at 49.5%, with mortgaged dwellings at 25.7% and rented ones at 24.8%. The median monthly mortgage repayment was $1,680, lower than Non-Metro NSW's average of $1,733. The median weekly rent in Urunga was $350, compared to Non-Metro NSW's $370. Nationally, Urunga's mortgage repayments were lower at $1,680 versus the Australian average of $1,863, and rents were also lower at $350 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Urunga features high concentrations of group households, with a lower-than-average median household size

Family households compose 66.9% of all households, including 20.0% couples with children, 33.9% couples without children, and 12.0% single parent families. Non-family households account for the remaining 33.1%, with lone person households at 29.4% and group households comprising 4.0%. The median household size is 2.3 people, which is smaller than the Rest of NSW average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Urunga aligns closely with national averages, showing typical qualification patterns and performance metrics

The area's university qualification rate is 21.3%, significantly lower than the NSW average of 32.2%. Bachelor degrees are most common at 14.9%, followed by postgraduate qualifications (3.5%) and graduate diplomas (2.9%). Vocational credentials are held by 41.7% of residents aged 15+, with advanced diplomas at 10.3% and certificates at 31.4%. A total of 24.9% of the population is actively engaged in formal education, including 9.5% in primary, 6.9% in secondary, and 2.6% in tertiary education.

A substantial 24.9% of the population actively pursues formal education. This includes 9.5% in primary education, 6.9% in secondary education, and 2.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 76 active stops operating in Urunga, offering a mix of train and bus services. These stops are served by 43 individual routes, collectively providing 594 weekly passenger trips. Transport accessibility is rated good, with residents typically located 228 meters from the nearest stop.

Service frequency averages 84 trips per day across all routes, equating to approximately 7 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Urunga is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Health data indicates significant challenges in Urunga with high prevalence of common health conditions across both younger and older age groups. Private health cover rate is low at approximately 47% (around 2,321 people), compared to the national average of 55.3%.

The most prevalent medical conditions are arthritis (affecting 11.6%) and mental health issues (9.4%). About 60.6% of residents report no medical ailments, compared to 63.9% in Rest of NSW. Urunga has a higher proportion of residents aged 65 and over at 32.5% (1,616 people), compared to the 23.9% in Rest of NSW.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Urunga placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Urunga's cultural diversity was found to be below average, with its population comprising 91.0% citizens, 89.5% born in Australia, and 97.1% speaking English only at home. Christianity was the predominant religion in Urunga, accounting for 50.0% of the population, compared to 47.5% across the rest of NSW. The top three ancestry groups were English (32.9%), Australian (30.8%), and Irish (10.4%).

Notably, Scottish ancestry was overrepresented in Urunga at 9.4%, compared to 8.3% regionally, while Australian Aboriginal ancestry was underrepresented at 3.3%, versus 4.0%. French ancestry was evenly represented at 0.5%.

Frequently Asked Questions - Diversity

Age

Urunga ranks among the oldest 10% of areas nationwide

Urunga's median age is 53, which is considerably higher than the Rest of NSW figure of 43 and substantially exceeds the national norm of 38. Compared to Rest of NSW, Urunga has a higher concentration of 65-74 residents at 19.0%, but fewer 25-34 year-olds at 6.5%. This 65-74 concentration is well above the national figure of 9.4%. Between the 2021 Census and present, the 35 to 44 age group has grown from 8.9% to 11.1%, while the 65 to 74 cohort increased from 17.8% to 19.0%. Conversely, the 45 to 54 cohort declined from 12.8% to 10.8%, and the 25 to 34 group dropped from 8.1% to 6.5%. Looking ahead to 2041, demographic projections show significant shifts in Urunga's age structure. The 75 to 84 group is projected to grow by 28%, reaching 625 from 487. Those aged 65 and above will comprise 64% of the projected growth. Conversely, both the 45 to 54 and 65 to 74 age groups are expected to see reduced numbers.