Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Kambah is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Kambah's population, as of November 2025, is approximately 15,749, reflecting a growth of 79 people since the 2021 Census. This increase represents a 0.5% rise from the previous population count of 15,670. The change is inferred from the estimated resident population of 15,731 in June 2024 and an additional 151 validated new addresses since the Census date. This results in a population density ratio of 1,388 persons per square kilometer, which exceeds the average seen across national locations assessed by AreaSearch. Kambah's growth rate of 0.5% since the 2021 census is higher than that of the SA3 area (0.2%), although overall growth remains modest. Natural growth contributed approximately 52.2% of total population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, age group growth rates from the ACT Government's SA2 area projections are adopted, using 2022 as the base year. Future population trends indicate a decline in overall population, with Kambah's population projected to decrease by 1,054 persons by 2041. However, specific age cohorts are anticipated to grow, notably the 85 and over age group, which is expected to increase by 209 people.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Kambah according to AreaSearch's national comparison of local real estate markets

Kambah has recorded approximately 40 residential properties granted approval annually. Over the past five financial years, from FY21 to FY25, around 202 homes were approved, with a further 5 approved so far in FY26. On average, about 1.5 new residents per year have been arriving per new home over these five years, suggesting a balanced supply and demand until recently, when it moderated to -0.7 people per dwelling over the past two financial years. The average construction value of development projects is $364,000, indicating that developers are targeting the premium market segment with higher-end properties.

This year, there have been $831,000 in commercial development approvals, reflecting a predominantly residential focus. Compared to the Australian Capital Territory, Kambah shows comparable construction activity per person, supporting stable market conditions aligned with regional patterns, although recent activity has eased slightly. Nationally, however, construction activity is higher, suggesting market maturity and possible development constraints in Kambah. New building activity comprises 31.0% detached houses and 69.0% townhouses or apartments, promoting affordable entry points and suiting downsizers, investors, and first-home buyers. This shift from the current housing mix of 85.0% houses reflects reduced availability of development sites and addresses changing lifestyle demands and affordability requirements. With around 838 people per approval, Kambah indicates a mature, established area with an expected stable or declining population, potentially reducing pressure on housing and creating opportunities for buyers.

With population expected to remain stable or decline, Kambah should see reduced pressure on housing, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

Kambah has limited levels of nearby infrastructure activity, ranking in the 18thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified eight projects likely to affect the region. Notable ones are Athllon Drive Duplication, Kambah BMX Facility Lighting Upgrade, Kambah Group Centre Expansion, and Marigal Gardens Retirement Village Expansion. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

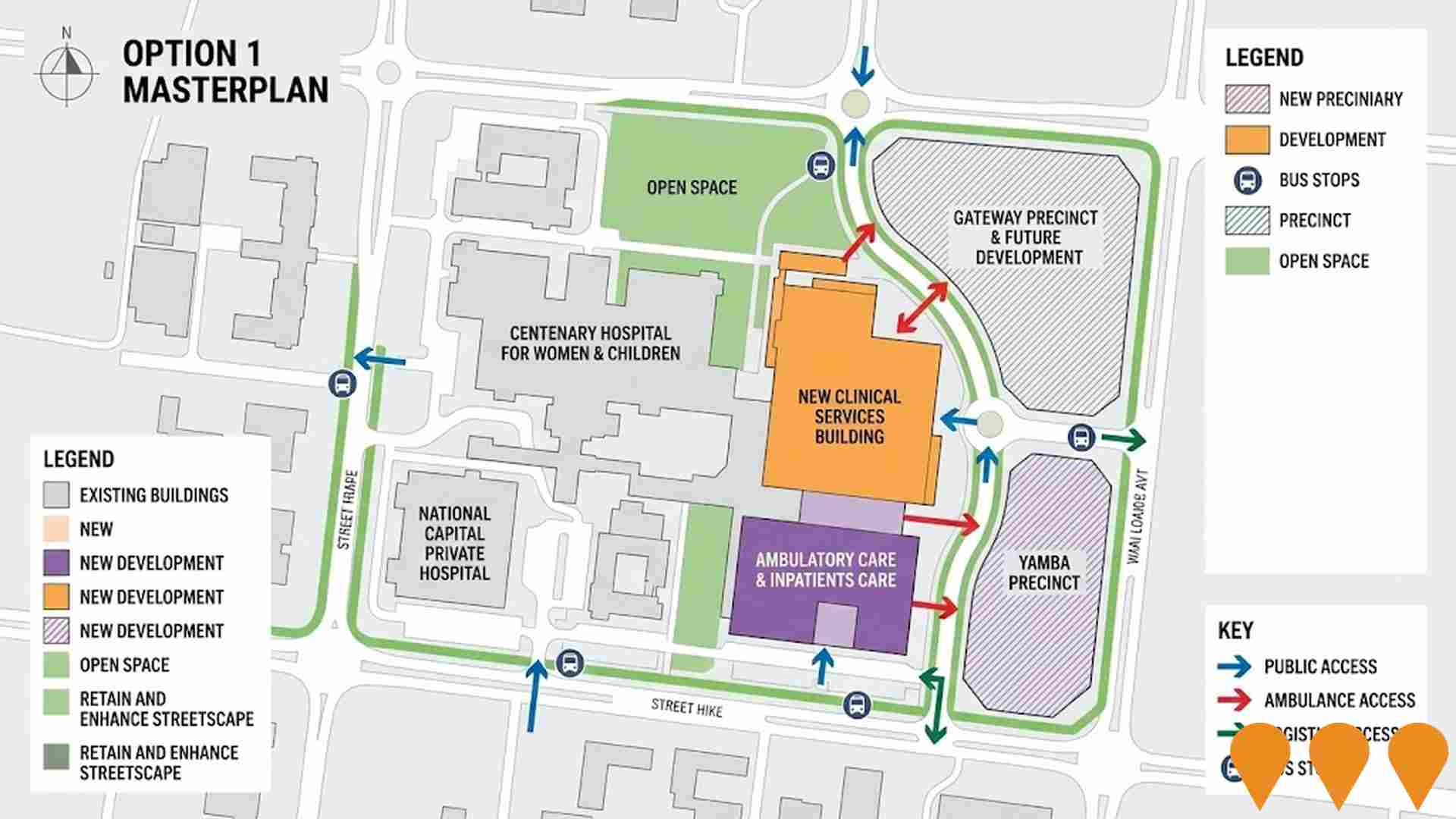

Canberra Hospital Master Plan

Long-term transformation of Canberra Hospital campus (2021-2041). The new Critical Services Building (Building 5) opened in 2023. Multiple stages are now in construction or detailed planning, including SPIRE Stage 1 (new emergency, surgical and intensive care facilities) and ongoing campus renewal works to deliver modern clinical facilities.

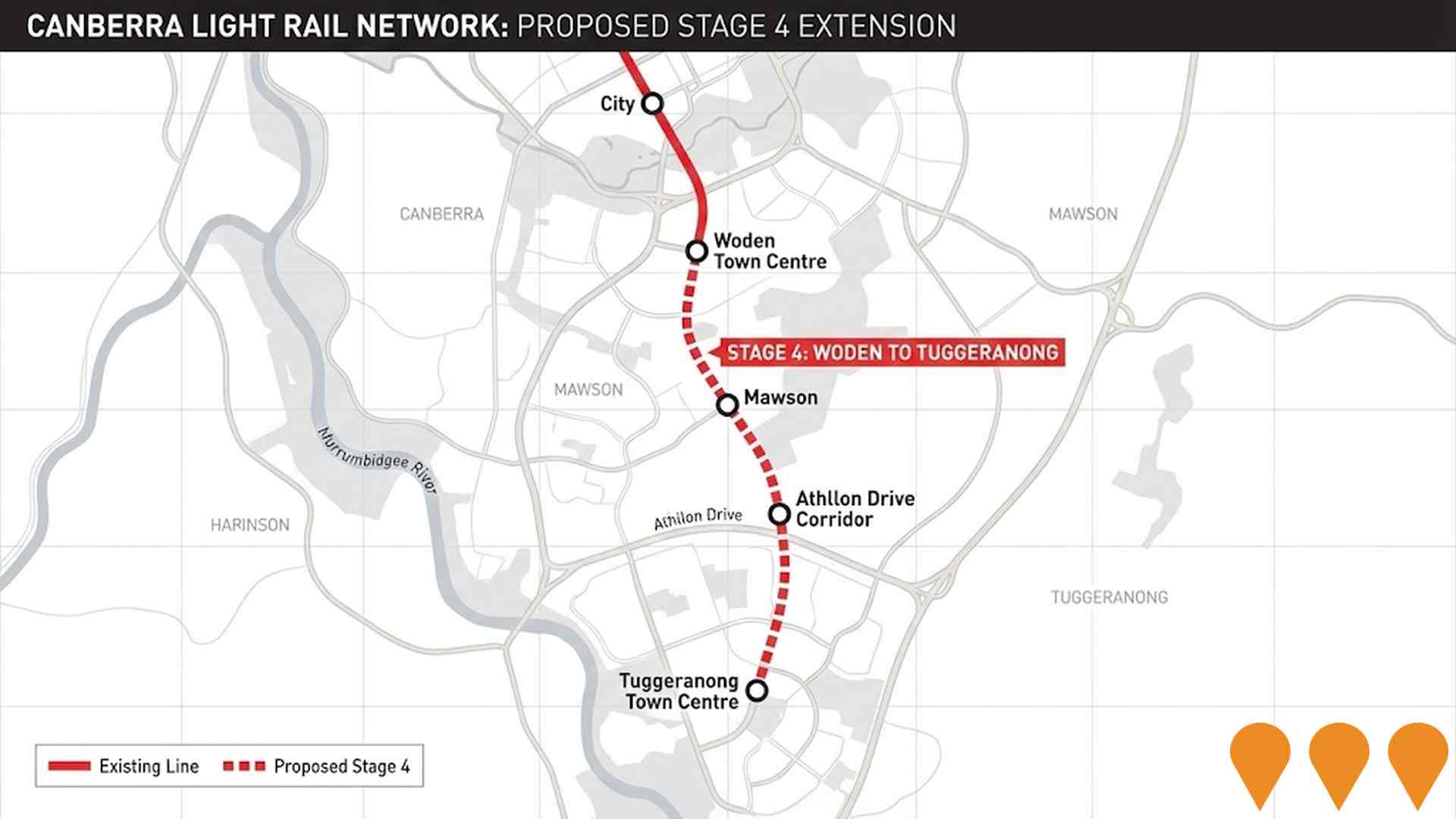

Canberra Light Rail Stage 4 - Woden to Tuggeranong

Proposed extension of Canberra's light rail network from Woden Town Centre south to Tuggeranong Town Centre via Mawson and the Athllon Drive corridor. This future stage aims to complete the north-south radial mass transit spine, connecting major residential, employment and activity centres while supporting bus, cycling, walking and private vehicle integration.

Kambah Group Centre Expansion

$20 million revitalization to double the size of the existing Woolworths supermarket, plus additional specialty retail, food, and medical services.

Erindale Group Centre Master Plan Implementation - Stage 1

Major revitalisation of the Erindale precinct including new community facilities, upgraded public realm, improved active travel links, and preparation for future mixed-use and residential development directly adjoining Wanniassa. The Erindale Group Centre master plan is a non-statutory document that outlines a vision to guide growth and development of the centre over the next 30 years.

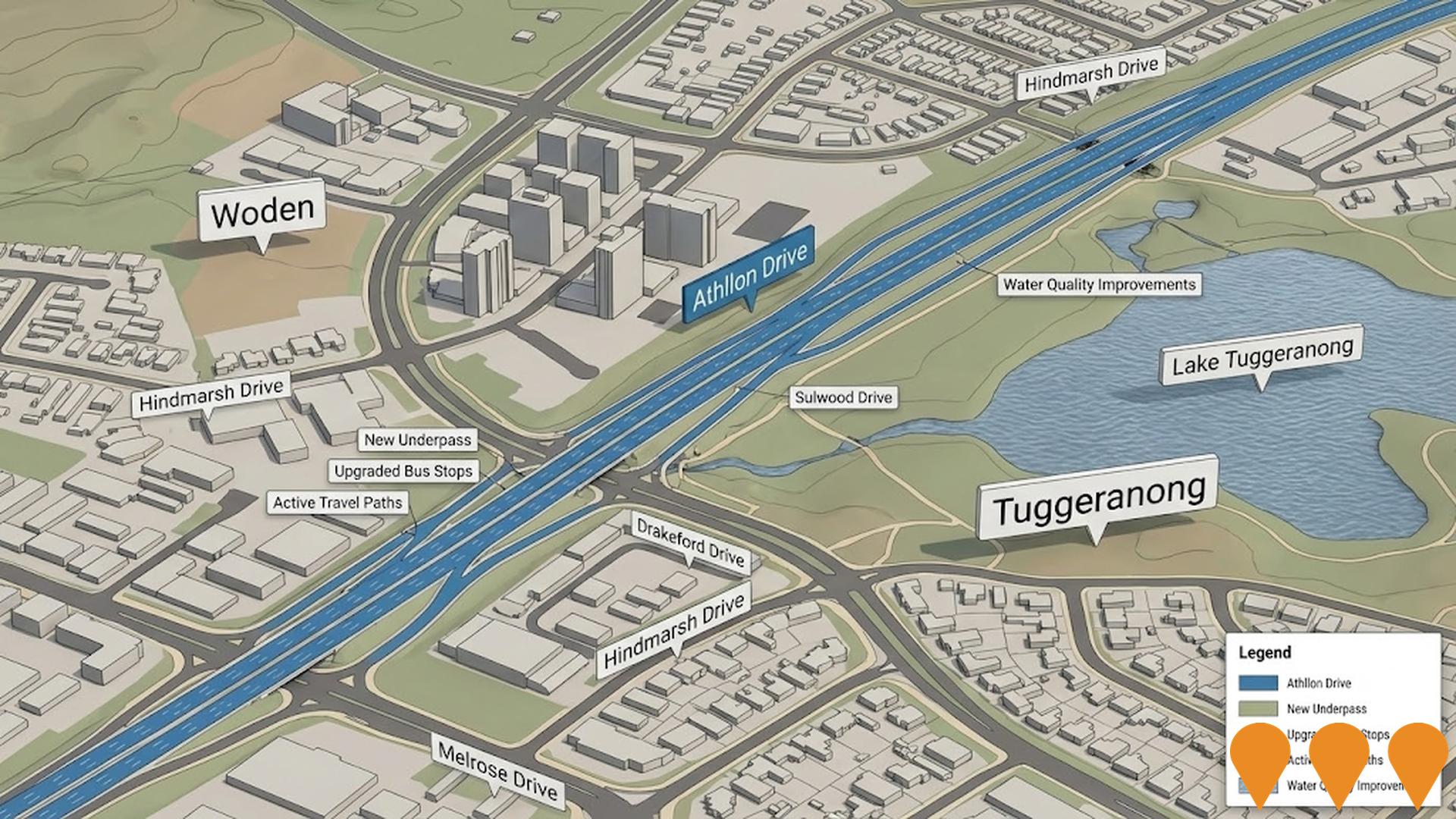

Athllon Drive Duplication

The Athllon Drive duplication project upgrades a key arterial road from Woden to Tuggeranong. It includes duplicating 2.4 km between Sulwood Drive and Drakeford Drive, and 600 m between Hindmarsh Drive and Melrose Drive. Features encompass lane duplication, new traffic lights at multiple intersections, upgraded bus stops, active travel paths for cyclists and pedestrians, water quality improvements for Lake Tuggeranong, and a new underpass under Sulwood Drive. Enabling works commenced in 2024 and continue into 2025, with main construction anticipated to span 2-3 years post-planning approvals. The initiative enhances safety, reduces congestion, and supports public transport and future urban growth.

Kambah Village Stage 2 Improvements

Major works completed at Kambah Group Centre including new playground equipment, basket swing, slides, climbing frame, trampolines, shade sail, additional car parking, public community gathering space with 31 trees and lawn, and Canberra's first splash pad with fountains.

Wanniassa Hills Primary School Modernisation

Modernisation project for Wanniassa Hills Primary School, which includes upgrading the pre-school and replacing existing gas boilers with new electrical heat pumps to improve energy efficiency and thermal performance. The overall modernisation is focused on improving learning environments and building efficiency. The project previously included a major upgrade and modernisation of the primary school including new learning communities, administration refurbishment, hall upgrade and expanded parking and drop-off facilities.

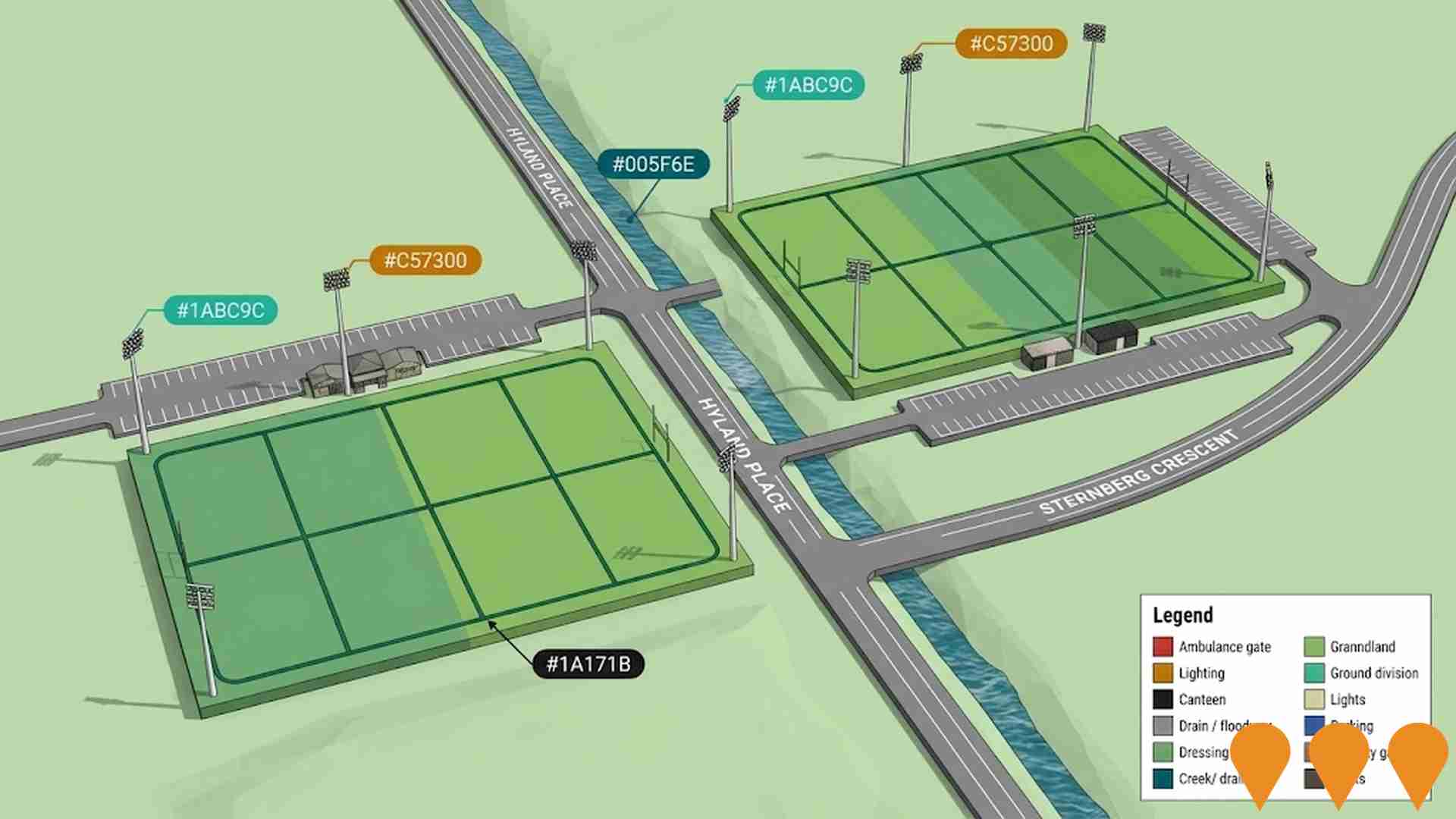

Wanniassa Playing Fields Irrigation & Lighting Upgrade

Installation of automated irrigation system and sports field lighting at Wanniassa District Playing Fields to support increased usage, night use, and drought resilience.

Employment

Kambah shows employment indicators that trail behind approximately 70% of regions assessed across Australia

Kambah has an educated workforce with significant representation in essential services sectors. Its unemployment rate is 5.1%, with an estimated employment growth of 1.6% over the past year.

As of September 2025, 7,947 residents are employed, while the unemployment rate is 1.6% higher than the Australian Capital Territory's (ACT) rate of 3.6%. Workforce participation in Kambah is lower at 63.0%, compared to ACT's 69.6%. Leading employment industries among residents include public administration & safety, health care & social assistance, and professional & technical services.

However, public administration & safety is relatively under-represented in Kambah, with only 28.4% of its workforce compared to ACT's 30.4%. The area offers limited local employment opportunities, as indicated by the difference between Census working population and resident population. Between September 2024 and September 2025, employment increased by 1.6%, labour force grew by 0.9%, resulting in a 0.6 percentage point decrease in unemployment. In comparison, ACT's employment grew by 1.4%, labour force expanded by 1.2%, and unemployment fell by 0.2 percentage points. State-level data from November 25 shows ACT employment grew by 1.19% year-on-year, adding 710 jobs, with the state unemployment rate at 4.5%. National employment forecasts from May-25 indicate a projected growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Kambah's employment mix suggests local employment should increase by 6.5% over five years and 13.4% over ten years, though this is a simplified extrapolation for illustrative purposes and does not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows that income in Kambah SA2 is above average nationally. The median income is $63,895 and the average income stands at $75,656. This contrasts with Australian Capital Territory's figures of a median income of $68,678 and an average income of $83,634. Based on Wage Price Index growth of 13.6% since financial year 2022, current estimates for Kambah SA2 would be approximately $72,585 (median) and $85,945 (average) as of September 2025. Census 2021 income data shows that household, family and personal incomes in Kambah SA2 rank highly nationally, between the 78th and 84th percentiles. The earnings profile indicates that 32.2% of locals (5,071 people) fall into the $1,500 - 2,999 weekly income category, reflecting broader area patterns where 34.3% occupy this range. Notably, 34.4% earn above $3,000 weekly. After housing costs, residents retain 87.3% of their income, indicating strong purchasing power. The area's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Kambah is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Kambah, as per the latest Census evaluation, 84.8% of dwellings were houses while 15.3% consisted of other types such as semi-detached homes, apartments and 'other' dwellings. This contrasts with Australian Capital Territory's figures of 79.6% houses and 20.4% other dwellings. Home ownership in Kambah stood at 36.6%, with mortgaged properties at 41.7% and rented dwellings at 21.7%. The median monthly mortgage repayment in the area was $2,000, aligning with Australian Capital Territory's average, while the median weekly rent was $400 compared to Australian Capital Territory's $2,000 and $425 respectively. Nationally, Kambah's median monthly mortgage repayments exceed the Australian average of $1,863, and rents are higher than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Kambah has a typical household mix, with a fairly typical median household size

Family households constitute 73.8 percent of all households, including 31.9 percent couples with children, 27.8 percent couples without children, and 12.8 percent single parent families. Non-family households account for the remaining 26.2 percent, with lone person households at 23.7 percent and group households comprising 2.5 percent of the total. The median household size is 2.6 people, which matches the Australian Capital Territory average.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Kambah exceeds national averages, with above-average qualification levels and academic performance metrics

The area's university qualification rate is 35.0%, significantly lower than the SA4 region average of 46.8%. This discrepancy presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most prevalent at 21.8%, followed by postgraduate qualifications (8.6%) and graduate diplomas (4.6%). Trade and technical skills are prominent, with 31.2% of residents aged 15+ holding vocational credentials – advanced diplomas (11.7%) and certificates (19.5%).

Educational participation is high, with 29.2% of residents currently enrolled in formal education. This includes 10.2% in primary education, 7.9% in secondary education, and 5.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Kambah has 65 active public transport stops, all of which are bus stops. These stops are served by five different routes that together facilitate 1014 weekly passenger trips. The accessibility of these services is considered good, with residents located an average of 345 meters from the nearest stop.

On average, there are 144 trips per day across all routes, which equates to approximately 15 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Kambah is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Kambah faces significant health challenges with common health conditions prevalent across both younger and older age cohorts.

The rate of private health cover is high at approximately 57%, covering around 8,992 people. Mental health issues impact 9.5% of residents, while arthritis affects 9.0%. About 64.7% of residents declare themselves completely clear of medical ailments, compared to 66.1% across the Australian Capital Territory. The area has 20.2% of residents aged 65 and over (3,179 people), which is higher than the 17.6% in the Australian Capital Territory. Health outcomes among seniors are above average, performing better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Kambah records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Kambah has a higher than average cultural diversity, with 21.4% of its population born overseas and 14.6% speaking a language other than English at home. Christianity is the dominant religion in Kambah, comprising 46.2% of the population. Islam is overrepresented compared to the Australian Capital Territory (ACT), making up 1.8% of Kambah's population versus 2.4% across ACT.

The top three represented ancestry groups are English at 26.5%, Australian at 25.4%, and Irish at 10.1%. Notably, Hungarian is overrepresented in Kambah at 0.4% compared to the regional average of 0.3%, Welsh at 0.7% versus 0.5%, and Spanish at 0.6% versus 0.7%.

Frequently Asked Questions - Diversity

Age

Kambah's population is slightly older than the national pattern

The median age in Kambah is 41 years, which is higher than the Australian Capital Territory's average of 35 years and slightly exceeds the national average of 38 years. Compared to the ACT average, the 65-74 age cohort is notably over-represented at 11.1% locally, while the 25-34 age group is under-represented at 11.4%. Post-2021 Census data shows that the 75 to 84 age group has grown from 5.7% to 7.4% of the population, while the 65 to 74 cohort has declined from 12.9% to 11.1%. Population forecasts for 2041 indicate significant demographic changes in Kambah. Notably, the 85+ age group is expected to grow by 70%, reaching 456 people from 267. This growth will contribute to a higher proportion of residents aged 65 and older representing 79% of anticipated population growth. Conversely, the 15-24 and 45-54 age cohorts are expected to experience population declines.