Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Redhead are slightly above average based on AreaSearch's ranking of recent, and medium term trends

The population of the Redhead statistical area (Lv2) is estimated to be around 3,756 as of November 2025. This figure represents a decrease of 29 people since the 2021 Census, which recorded a population of 3,785. AreaSearch's analysis of the latest ERP data release by the ABS (June 2024) and validation of new addresses indicates a resident population of 3,746. This level of population results in a density ratio of 1,020 persons per square kilometer, which is relatively consistent with averages observed across other locations assessed by AreaSearch. Interstate migration contributed approximately 52.0% of overall population gains during recent periods for the Redhead (SA2).

AreaSearch's projections for the area are based on ABS/Geoscience Australia projections released in 2024, using 2022 as the base year. For areas not covered by this data, NSW State Government SA2 level projections released in 2022 with a 2021 base year are used. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Population projections indicate an above median growth for regional areas nationally, with the Redhead (SA2) expected to increase by 655 persons to 2041, reflecting a gain of 17.2% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Redhead according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers indicates Redhead averaged approximately 20 new dwelling approvals annually. Between FY-21 and FY-25, around 101 homes were approved, with an additional 5 in FY-26. Over the past five financial years, an average of 0.4 new residents per year arrived for each new home approved.

This suggests that new construction is meeting or exceeding demand, providing buyers with more options and supporting population growth. The average development value was $734,000, indicating a focus on the premium market segment. In FY-26, there have been $1.9 million in commercial approvals, reflecting the area's residential nature.

Compared to Rest of NSW, Redhead has seen slightly more development activity, with 28.0% above the regional average per person over the five-year period. However, development activity has moderated in recent periods. New building activity comprises 95.0% detached houses and 5.0% townhouses or apartments, maintaining the area's suburban identity with a concentration of family homes suited to buyers seeking space. This is further reflected by the low density characteristic, with around 268 people per dwelling approval in Redhead. Looking ahead, AreaSearch's latest quarterly estimate projects Redhead's population to grow by 645 residents through to 2041. Construction activity is maintaining a reasonable pace with projected growth, but buyers may face increasing competition as the population expands.

Frequently Asked Questions - Development

Infrastructure

Redhead has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

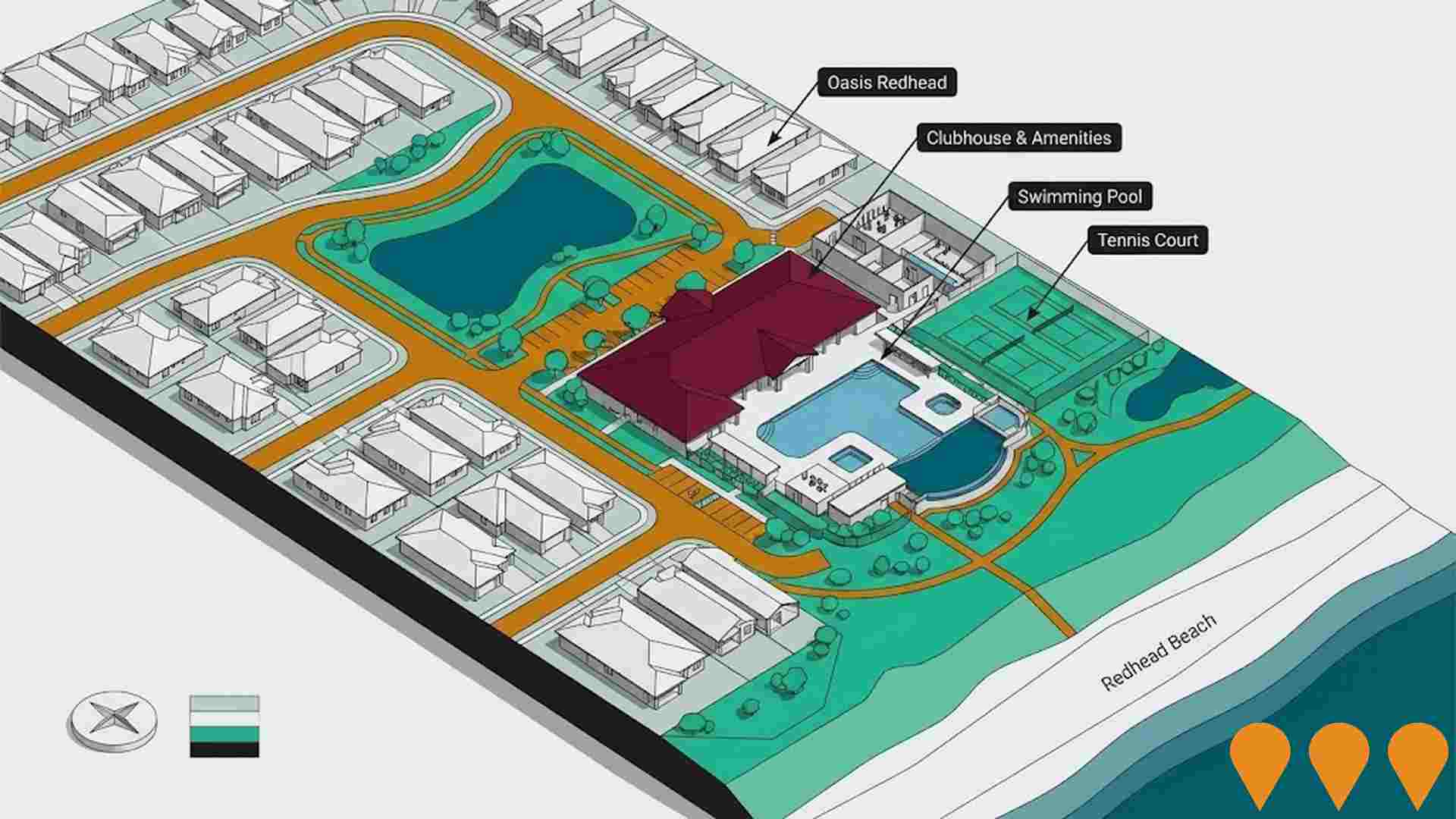

Changes in local infrastructure significantly affect an area's performance. Four projects identified by AreaSearch are expected to impact this region. Notable projects include Oasis Redhead, Redhead Business Park, First Creek Realignment Project, and Redhead Pump Track. The following details the projects likely to have the most relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Lake Macquarie Private Hospital Expansion

A significant redevelopment of Lake Macquarie Private Hospital by Ramsay Health Care. The project involves a nine-storey expansion (SSD-38025700) approved in May 2025, which adds 114 inpatient beds to bring the total to nearly 300. Key features include five new operating theatres, a new main entrance on Casey Street, an expanded emergency department with six bays, six day oncology chairs, ten consulting suites, and enhanced critical care and radiology services. The expansion aims to alleviate capacity strain and create a regionally significant health precinct in the Hunter Region. Construction is phased to ensure clinical services continue throughout the build, with overall completion anticipated in 2027.

Tingira Hills Care Community

Tingira Hills Care Community (formerly Opal Hillside) is a major residential aged care facility in the Lake Macquarie region. It offers 120-128 beds across various room types including single en-suite and companion rooms, catering to permanent, respite, dementia, and palliative care needs. The facility features a dedicated Memory Care Neighborhood, a Wellness Centre for rehabilitation, an on-site cafe, hairdressing salon, and a community bus for outings. Architecturally, it was specifically engineered to manage variable founding conditions and ground movement associated with local mine subsidence.

High Speed Rail - Newcastle to Sydney (Stage 1)

The first stage of Australia's High Speed Rail network involves a 194km dedicated rail line connecting Newcastle to Sydney. The project features trains reaching speeds of 320 km/h on surface sections and 200 km/h in tunnels, aiming to reduce travel time to approximately one hour. Following the 2025 business case evaluation, the project has moved into a two-year Development Phase focusing on design refinement (to 40% maturity), securing planning approvals, and corridor preservation. The route includes approximately 115km of tunneling and six planned stations: Broadmeadow, Lake Macquarie, Gosford, Sydney Central, Parramatta, and Western Sydney International Airport.

Mount Hutton Precinct Area Plan

A comprehensive planning framework integrated into the Lake Macquarie Development Control Plan (DCP) 2014 to manage the growth of the Mount Hutton town centre. The plan facilitates medium-density housing, enhances pedestrian and transport connectivity, and prioritizes ecological rehabilitation. Recent 2024-2025 updates include the rezoning of strategic sites like 1 Progress Road to E1 Local Centre and city-wide Housing Diversity reforms that permit small-lot housing and a broader range of residential types within the precinct to meet growing migration needs.

Lake Macquarie Square

A sub-regional shopping centre located in Mount Hutton, 14km from Newcastle's CBD. The project, originally a $60 million redevelopment completed in 2019 by Charter Hall, consolidated Lake Macquarie Fair and Mount Hutton Plaza into a single, modern retail destination with approximately 24,000 m2 of prime retail space. The centre is anchored by BIG W, Coles, and Woolworths, with over 70 specialty stores, a medical precinct, childcare, and a 24-hour gym. Revelop acquired the asset in February 2025 for $122.5 million.

Swansea Channel Permanent Dredging Solution

A permanent dredging solution for Swansea Channel, the entrance to Lake Macquarie, involving a Beaver 30 dredge vessel and sand transfer system to maintain safe navigation for vessels, with sand pumped to Blacksmiths Beach. The project includes upgrades to the Blacksmiths boat ramp and aims to address ongoing sand accumulation issues.

First Creek Realignment Project

Realignment of First Creek further south at Redhead Beach to reduce scouring of dunes and infrastructure, create a safer flow path, improve emergency and public beach access, and prevent erosion of coastal dunes. The works were undertaken by Lake Macquarie City Council in July 2023 and were expected to take one week to complete.

Newcastle 2040

City of Newcastle's Community Strategic Plan (CSP) setting the shared vision and priorities for the next 10+ years. Originally adopted in 2022 and revised in 2024/25, the updated CSP was endorsed by Council on 15 April 2025. It guides policies, strategies and actions across the LGA and is implemented through the Delivery Program and Operational Plan known as Delivering Newcastle 2040.

Employment

Employment conditions in Redhead demonstrate exceptional strength compared to most Australian markets

Redhead has an educated workforce with essential services sectors well represented. The unemployment rate was 1.6% in the past year, with an estimated employment growth of 3.3%.

As of September 2025, 1,929 residents were employed, with an unemployment rate of 2.2%, below Rest of NSW's rate of 3.8%. Workforce participation was 54.4%, compared to Rest of NSW's 56.4%. Employment was concentrated in health care & social assistance, construction, and education & training, while agriculture, forestry & fishing showed lower representation at 0.0% versus the regional average of 5.3%.

Over the 12 months to September 2025, employment increased by 3.3%, while labour force increased by 3.5%, causing the unemployment rate to rise by 0.2 percentage points. By comparison, Rest of NSW recorded an employment decline of 0.5% and a labour force decline of 0.1%, with unemployment rising by 0.4 percentage points. State-level data to 25-Nov shows NSW employment contracted by 0.03%, losing 2,260 jobs, with the state unemployment rate at 3.9%. National employment forecasts from May-25 suggest national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Redhead's employment mix suggests local employment should increase by 7.0% over five years and 14.4% over ten years.

Frequently Asked Questions - Employment

Income

Income levels align closely with national averages, indicating typical economic conditions for Australian communities according to AreaSearch analysis

According to AreaSearch's aggregation of latest postcode level ATO data released for financial year ended 30 June 2023, Redhead suburb had median taxpayer income of $55,166 and average income of $74,186. These figures are higher than national averages of $52,390 and $65,215 respectively for Rest of NSW. Based on Wage Price Index growth rate of 8.86% from financial year ended 30 June 2023 to September 2025, estimated median income is approximately $60,054 and average income is $80,759 as of that date. According to Australian Bureau of Statistics Census data for 2021, household, family, and personal incomes in Redhead rank modestly, between 41st and 43rd percentiles. Weekly earnings profile shows largest segment at 26.2%, comprising 984 residents earning $400-$799 weekly, unlike regional trends where 29.9% earn $1,500-$2,999 weekly. Redhead exhibits economic diversity with 32.8% in constrained financial circumstances and 30.7% achieving substantial weekly earnings. Housing costs are manageable with 86.7% retained, but disposable income ranks below average at 45th percentile. Area's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Redhead is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Redhead's dwelling structure, as per the latest Census evaluation, consisted of 93.3% houses and 6.7% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro NSW's 82.4% houses and 17.6% other dwellings. Home ownership in Redhead stood at 57.2%, with the remaining dwellings either mortgaged (29.4%) or rented (13.4%). The median monthly mortgage repayment was $2,300, higher than Non-Metro NSW's average of $2,000. The median weekly rent in Redhead was recorded at $420, compared to Non-Metro NSW's $370. Nationally, Redhead's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Redhead features high concentrations of lone person households, with a lower-than-average median household size

Family households make up 65.3% of all households, including 32.2% couples with children, 24.9% couples without children, and 7.8% single parent families. Non-family households account for the remaining 34.7%, with lone person households at 32.7% and group households making up 1.7%. The median household size is 2.4 people, which is smaller than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Redhead shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's educational profile is notable regionally with university qualification rates at 29.2% of residents aged 15+, surpassing the Rest of NSW average of 21.3% and the SA3 area average of 23.5%. Bachelor degrees are most prevalent at 19.6%, followed by postgraduate qualifications (6.1%) and graduate diplomas (3.5%). Vocational credentials are held by 37.5% of residents aged 15+, with advanced diplomas comprising 11.6% and certificates 25.9%.

Educational participation is high, with 30.0% of residents currently enrolled in formal education, including 10.8% in primary, 9.2% in secondary, and 4.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis reveals 37 active transport stops operating within Redhead. These stops serve a mix of bus routes. There are 9 individual routes collectively providing 116 weekly passenger trips.

Transport accessibility is rated excellent, with residents typically located 149 meters from the nearest transport stop. Service frequency averages 16 trips per day across all routes, equating to approximately 3 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Redhead is well below average with a range of health conditions having marked impacts on both younger and older age cohorts

Health data indicates significant health challenges in Redhead, affecting both younger and older age groups.

Private health cover is high, at approximately 56% (~2,112 people). The most prevalent conditions are arthritis (9.9%) and mental health issues (8.9%). A total of 62.0% reported no medical ailments, compared to 62.6% in Rest of NSW. Residents aged 65 and over comprise 29.2% (1,096 people), higher than the 21.4% in Rest of NSW. Senior health outcomes align with general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

Redhead is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Redhead's population showed lower cultural diversity, with 89.5% born in Australia, 93.3% being citizens, and 95.7% speaking English only at home. Christianity was the dominant religion, accounting for 55.6%, compared to 52.5% in Rest of NSW. The top ancestry groups were English (33.1%), Australian (32.3%), and Scottish (9.6%).

Notably, Welsh (0.9%) and Macedonian (0.6%) were overrepresented compared to regional averages of 0.8% and 0.4%, respectively, while Russian was also higher at 0.4%.

Frequently Asked Questions - Diversity

Age

Redhead hosts an older demographic, ranking in the top quartile nationwide

Redhead's median age of 48 years is significantly higher than Rest of NSW's 43 and the Australian median of 38. The age profile shows that 14.9% of Redhead's population is aged between 65-74, which is notably higher than the national average of 9.4%. Post-2021 Census data indicates that the 15 to 24 age group has increased from 10.0% to 12.7%, while the 65 to 74 cohort has risen from 13.2% to 14.9%. Conversely, the 55 to 64 cohort has decreased from 13.6% to 10.9%, and the 85+ group has dropped from 5.9% to 4.1%. Demographic modeling suggests that Redhead's age profile will significantly evolve by 2041, with the 75 to 84 age cohort projected to grow steadily, expanding by 152 people (40%) from 383 to 536. In contrast, population declines are projected for the 55 to 64 and 65 to 74 cohorts.