Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Red Hill are slightly above average based on AreaSearch's ranking of recent, and medium term trends

As of Nov 2025, the estimated population for Red Hill (Brisbane - Qld) statistical area (Lv2) is around 6,532 people. This reflects a growth of 698 individuals since the 2021 Census, which reported a population of 5,834. The increase was inferred from AreaSearch's estimation of 6,523 residents based on latest ERP data release by ABS (June 2024) and additional 28 validated new addresses since the Census date. This results in a density ratio of 4,032 persons per square kilometer, placing Red Hill among the top 10% densely populated areas nationally. The area's 12.0% growth rate surpassed both SA3 area (9.5%) and national average, indicating strong population growth. Overseas migration contributed approximately 59.0% of overall population gains during recent periods, with natural growth and interstate migration also being positive factors.

AreaSearch projects the Red Hill (Brisbane - Qld) (SA2) population to increase by 1,558 persons to 2041, reflecting a total increase of 23.7% over the 17 years based on aggregated SA2-level projections.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Red Hill according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers in Red Hill shows an average of approximately 10 new dwelling approvals per year. Over the past five financial years, from FY21 to FY25, around 53 homes were approved, with a further 4 approved so far in FY26. Each new dwelling is estimated to bring about 9.3 new residents per year on average during this period.

This significant demand outstrips supply, typically leading to price growth and increased buyer competition. The average construction value of new properties is around $1,369,000, indicating a focus on the premium segment with upmarket properties. In FY26, commercial approvals totalled $640,000, suggesting minimal commercial development activity in the area. Compared to Greater Brisbane, Red Hill has seen substantially reduced construction levels, at 65.0% below the regional average per person. This scarcity of new homes can strengthen demand and prices for existing properties.

Nationally, this is also below average, reflecting the area's maturity and possible planning constraints. All new construction in Red Hill has been comprised of detached houses, maintaining the area's traditional suburban character with a focus on family homes appealing to those seeking space. Notably, developers are constructing more detached housing than the existing pattern implies (65.0% at Census), suggesting persistent strong demand for family homes despite densification trends. The location has approximately 758 people per dwelling approval, indicating an established market. Future projections estimate Red Hill will add around 1,547 residents by 2041, based on the latest AreaSearch quarterly estimate. If current construction levels persist, housing supply may lag population growth, potentially intensifying buyer competition and underpinning price growth.

Frequently Asked Questions - Development

Infrastructure

Red Hill has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 18 projects likely impacting the region. Notable initiatives include Ile Ashgrove, Queensland Egg Board Site Redevelopment, Brisbane 2032 Games Venue Infrastructure Program, and New Brisbane Stadium (Victoria Park Olympic Stadium). The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Brisbane 2032 Games Infrastructure Program

A $7.1 billion statewide infrastructure program managed by GIICA to deliver 17 new and upgraded venues for the Brisbane 2032 Games. The flagship project is the new 63,000-seat Brisbane Stadium at Victoria Park (Barrambin), which will host the opening and closing ceremonies and athletics. Other major works include the new National Aquatic Centre at the Centenary Pool site in Spring Hill (Games capacity 25,000) and the Gabba Arena at Woolloongabba. Post-Games, the Gabba will be decommissioned and redeveloped into a residential and entertainment precinct, while Victoria Park becomes the permanent home for AFL and cricket.

Brisbane 2032 Olympic and Paralympic Games Infrastructure Program

A $7.1 billion infrastructure program overseen by the Games Independent Infrastructure and Coordination Authority (GIICA). Key projects include a new 63,000-seat multi-purpose stadium at Victoria Park for ceremonies and athletics, a new National Aquatic Centre, and the Brisbane Athletes Village at the Showgrounds. The program focuses on 17 new and upgraded venues alongside major transport improvements to create a long-term legacy for South East Queensland.

Brisbane 2032 Games Venue Infrastructure Program

A $7.1 billion program managed by the Games Independent Infrastructure and Coordination Authority (GIICA) to deliver 17 new and upgraded venues for the Brisbane 2032 Games. Key projects include the new 63,000-seat Brisbane Stadium at Victoria Park ($3.785 billion) and the National Aquatic Centre at Spring Hill ($1.2 billion). As of early 2026, the program is in the procurement and early works phase, with principal architects being appointed for major venues and the Unite32 consortium serving as the primary delivery partner.

New Brisbane Stadium (Victoria Park Olympic Stadium)

A planned 63,000-seat multi-purpose venue (expandable to 70,000 for concerts) at Victoria Park, serving as the primary stadium for the Brisbane 2032 Olympic and Paralympic Games. The project will host opening and closing ceremonies and athletics events. Post-games legacy includes becoming the home ground for the Brisbane Lions (AFL), Queensland Bulls, and Brisbane Heat (Cricket). The design, led by COX, Hassell, and Azusa Sekkei, is inspired by 'Queenslander' architecture and integrates into the park topography. Recent 2026 legislative amendments have fast-tracked delivery by vesting land tenure to the Games Independent Infrastructure and Coordination Authority (GIICA).

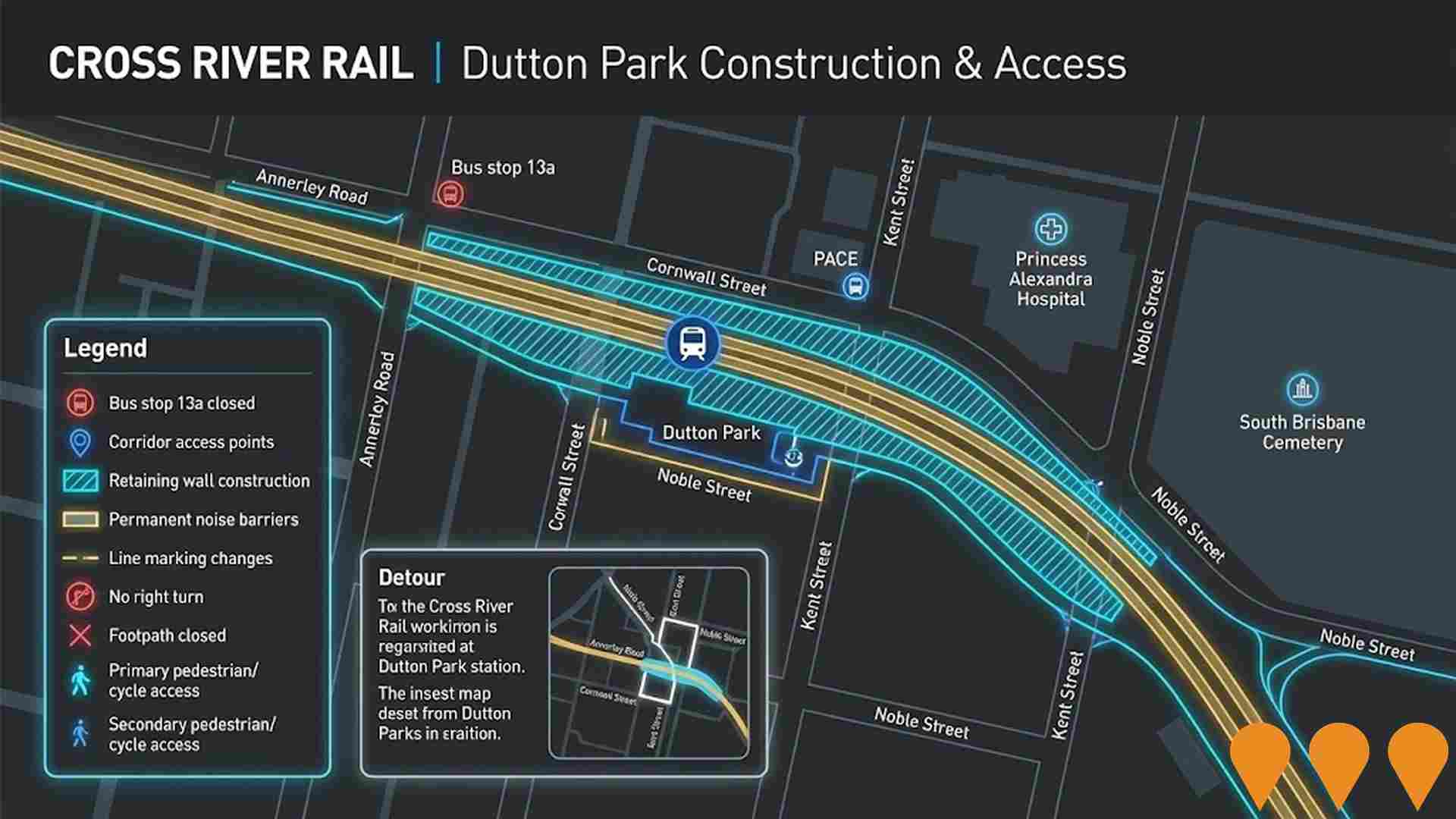

Cross River Rail

A 10.2km rail line including 5.9km of twin tunnels under the Brisbane River and CBD. The project delivers four new underground stations at Boggo Road, Woolloongabba, Albert Street, and Roma Street, plus a new above-ground station at Exhibition. It includes a rebuild of seven suburban stations between Dutton Park and Salisbury and three new Gold Coast stations (Pimpama, Hope Island, and Merrimac). The project features a world-class European Train Control System (ETCS) signalling upgrade. Major construction is progressing through 2026-2027, with first passenger services expected to commence in 2029.

National Aquatic Centre

The National Aquatic Centre (NAC) is a world-class aquatic precinct being developed at the heritage-listed Centenary Pool site in Spring Hill. Serving as a high-performance hub for swimming, diving, water polo, and artistic swimming, the facility will feature a main and secondary indoor arena with large competition pools (50m and 65m), an indoor dive tower, and a 27m outdoor high-diving tower. In Games mode for Brisbane 2032, it will accommodate over 25,000 spectators, transitioning to a legacy capacity of approximately 8,800 to serve as a national elite training base and a modern community fitness hub.

Brisbane Stadium (Victoria Park)

A new world-class 63,000-seat multi-purpose oval stadium (expanding to 70,000 for concerts) to be built at Victoria Park (Barrambin). It will serve as the primary venue for the Brisbane 2032 Olympic and Paralympic Games, hosting the Opening and Closing Ceremonies and athletics. Post-Games, it will become the home for AFL and cricket (Brisbane Lions and Brisbane Heat) while preserving 68% of the parkland as green space.

Brisbane Stadium (Victoria Park)

A new 63,000-seat multi-purpose stadium (expandable to 70,000 for concerts) being developed at Victoria Park for the Brisbane 2032 Olympic and Paralympic Games. The venue will host the Opening and Closing Ceremonies and Athletics. Post-Games, it will serve as the premier home for AFL (Brisbane Lions) and Cricket (Brisbane Heat, Queensland Bulls). The design features 360-degree concourses and balconies inspired by traditional Queenslander homes. The project is managed by the Games Independent Infrastructure and Coordination Authority (GIICA) and is part of a broader masterplan retaining 68% of the parkland as green space.

Employment

The employment landscape in Red Hill shows performance that lags behind national averages across key labour market indicators

Red Hill has an educated workforce with professional services well-represented. Its unemployment rate was 4.9% in the past year, with estimated employment growth of 1.8%.

As of September 2025, 4,375 residents were employed, with an unemployment rate of 4.9%, 0.9% higher than Greater Brisbane's rate of 4.0%. Workforce participation was 76.9%, above Greater Brisbane's 64.5%. Key industries included professional & technical, health care & social assistance, and education & training. Professional & technical employment was notably high at 1.9 times the regional average, while manufacturing was under-represented at 2.4% compared to Greater Brisbane's 6.4%.

Employment opportunities locally may be limited as indicated by Census data. Between September 2024 and September 2025, Red Hill's employment levels increased by 1.8%, labour force by 0.8%, reducing the unemployment rate by 1.0 percentage points. In contrast, Greater Brisbane had employment growth of 3.8% and labour force growth of 3.3%, with a 0.5 percentage point drop in unemployment. State-level data to 25-Nov-25 showed Queensland employment contracted by 0.01%, with an unemployment rate of 4.2%. National employment forecasts from May-25 project national employment growth of 6.6% over five years and 13.7% over ten years, but growth rates vary between sectors. Applying these projections to Red Hill's employment mix suggests local employment should increase by 7.4% over five years and 14.8% over ten years.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2023 shows Red Hill's median income among taxpayers is $55,295, with an average of $82,411. This is among the highest in Australia, compared to Greater Brisbane's median of $58,236 and average of $72,799. Based on Wage Price Index growth of 9.91% since financial year 2023, current estimates for Red Hill would be approximately $60,775 (median) and $90,578 (average) as of September 2025. From the 2021 Census, household, family and personal incomes in Red Hill rank highly nationally, between the 86th and 86th percentiles. The largest income segment comprises 29.2% earning $4000+ weekly (1,907 residents), unlike metropolitan trends where 33.3% fall within the $1,500 - 2,999 range. Higher earners represent a substantial presence with 41.7% exceeding $3,000 weekly. High housing costs consume 17.2% of income, but strong earnings place disposable income at the 83rd percentile nationally. The area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Red Hill displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

The dwelling structure in Red Hill, as per the latest Census, consisted of 65.1% houses and 35.0% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Brisbane metro had 65.1% houses and 43.3% other dwellings. Home ownership in Red Hill was at 20.2%, with the remaining dwellings either mortgaged (33.1%) or rented (46.8%). The median monthly mortgage repayment in Red Hill was $2,700, higher than Brisbane metro's average of $2,513. The median weekly rent figure in Red Hill was recorded at $430, matching Brisbane metro's figure. Nationally, Red Hill's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Red Hill features high concentrations of group households, with a lower-than-average median household size

Family households constitute 60.1% of all households, including 26.7% couples with children, 24.8% couples without children, and 6.2% single parent families. Non-family households account for the remaining 39.9%, with lone person households at 28.2% and group households comprising 11.8%. The median household size is 2.4 people, which is smaller than the Greater Brisbane average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Red Hill exceeds national averages, with above-average qualification levels and academic performance metrics

Red Hill has a notably high level of educational attainment among its residents aged 15 and above, with 55.0% holding university qualifications. This figure exceeds the state average of 25.7% for Queensland and the national average of 30.4%. The area's residents have a substantial educational advantage, with bachelor degrees being the most common at 35.9%, followed by postgraduate qualifications (13.8%) and graduate diplomas (5.3%). Vocational pathways account for 20.8% of qualifications among those aged 15 and above, with advanced diplomas making up 9.0% and certificates accounting for 11.8%.

Educational participation is significantly high in Red Hill, with 32.5% of residents currently enrolled in formal education. This includes 13.4% in tertiary education, 7.0% in secondary education, and 6.9% pursuing primary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Red Hill indicates that there are currently 41 active transport stops operating within the area. These stops offer a mix of bus services, with a total of 12 individual routes in operation. Collectively, these routes provide a weekly passenger trip count of 1,246 trips.

The accessibility of transport in Red Hill is rated as excellent, with residents typically located an average of 112 meters from the nearest transport stop. The service frequency averages at 178 trips per day across all routes, which equates to approximately 30 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Red Hill's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Red Hill demonstrates excellent health outcomes across all age groups, with a very low prevalence of common health conditions. Private health cover is exceptionally high at approximately 60% of the total population (3,910 people), compared to 71.6% across Greater Brisbane as of the latest data (2021).

Mental health issues and asthma are the most common medical conditions in the area, impacting 10.5 and 7.5% of residents respectively, while 74.3% declare themselves completely clear of medical ailments, compared to 74.7% across Greater Brisbane. As of 2021, 9.1% of Red Hill's residents are aged 65 and over (594 people), which is lower than the 11.6% in Greater Brisbane. Health outcomes among seniors are particularly strong, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Red Hill records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Red Hill's population exhibited above-average cultural diversity, with 10.9% speaking a language other than English at home and 22.6% born overseas. Christianity was the predominant religion in Red Hill, comprising 39.6%. Judaism showed notable overrepresentation in Red Hill, making up 0.1%, compared to 0.2% across Greater Brisbane.

In terms of ancestry, the top three groups were English (27.7%), Australian (21.1%), and Irish (12.7%). Some ethnic groups had notable differences: Scottish was overrepresented at 10.1% in Red Hill versus 9.4% regionally, Welsh at 0.8% versus 0.7%, and German at 5.2% versus 4.3%.

Frequently Asked Questions - Diversity

Age

Red Hill's young demographic places it in the bottom 15% of areas nationwide

At 32 years, Red Hill's median age is notably under the Greater Brisbane average of 36 and is significantly lower than the Australian median of 38. Relative to Greater Brisbane, Red Hill has a higher concentration of 25 - 34 residents at 23.6% but fewer 5 - 14 year-olds at 9.7%. This 25 - 34 concentration is well above the national average of 14.5%. In the period from 2021 to present, the 25 to 34 age group has grown from 20.8% to 23.6% of the population. Conversely, the 45 to 54 cohort has declined from 14.5% to 12.7%. Demographic modeling suggests Red Hill's age profile will evolve significantly by the year 2041. The 45 to 54 age cohort is projected to grow steadily, expanding by 252 people (30%) from 829 to 1,082. Meanwhile, the 0 to 4 cohort grows by a modest 8% (20 people).