Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Croydon Park is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Based on ABS population updates and AreaSearch validation, as of Nov 2025, Croydon Park (NSW) SA2's estimated population is around 11,348. This reflects a 419 person increase since the 2021 Census, which reported a population of 10,929 people. The change is inferred from AreaSearch's estimated resident population of 11,194 following examination of ABS' June 2024 ERP data release and an additional 68 validated new addresses since the Census date. This results in a population density ratio of approximately 4,450 persons per square kilometer, placing Croydon Park (NSW) SA2 among the top 10% of national locations assessed by AreaSearch. The area's 3.8% growth since census is within 2.5 percentage points of its SA4 region's 6.3%, indicating competitive growth fundamentals. Overseas migration contributed approximately 86.0% of overall population gains during recent periods, primarily driving Croydon Park (NSW) SA2's population growth.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future population trends indicate a just below median increase across statistical areas nationally, with Croydon Park (NSW) SA2 expected to increase by approximately 1,110 persons to 2041, reflecting a total increase of around 10.0% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Croydon Park, placing the area among the bottom 25% of areas assessed nationally

AreaSearch analysis of ABS building approval numbers in Croydon Park shows an average of approximately 23 new dwelling approvals per year over the past five financial years, totalling around 119 homes. As of FY-26, 14 approvals have been recorded. The average number of new residents per year per dwelling constructed between FY-21 and FY-25 is 0.5. This suggests that new construction is meeting or exceeding demand, providing more options for buyers and potentially driving population growth beyond current expectations.

The average value of newly constructed properties is around $672,000, indicating a focus on the premium segment by developers. In FY-26, commercial approvals totalling $18.7 million have been registered, reflecting moderate levels of commercial development in the area. Compared to Greater Sydney, Croydon Park has significantly less development activity, with 57.0% below the regional average per person. This scarcity typically strengthens demand and prices for existing properties, suggesting an established market and potential planning limitations. The breakdown of new building activity shows 46.0% standalone homes and 54.0% attached dwellings, indicating a trend towards denser development that caters to downsizers, investors, and entry-level buyers. With around 1253 people per dwelling approval, Croydon Park reflects a highly mature market.

According to AreaSearch's latest quarterly estimate, Croydon Park is projected to add approximately 1,130 residents by 2041. If current construction levels persist, housing supply may lag behind population growth, potentially intensifying buyer competition and supporting price growth in the area.

Frequently Asked Questions - Development

Infrastructure

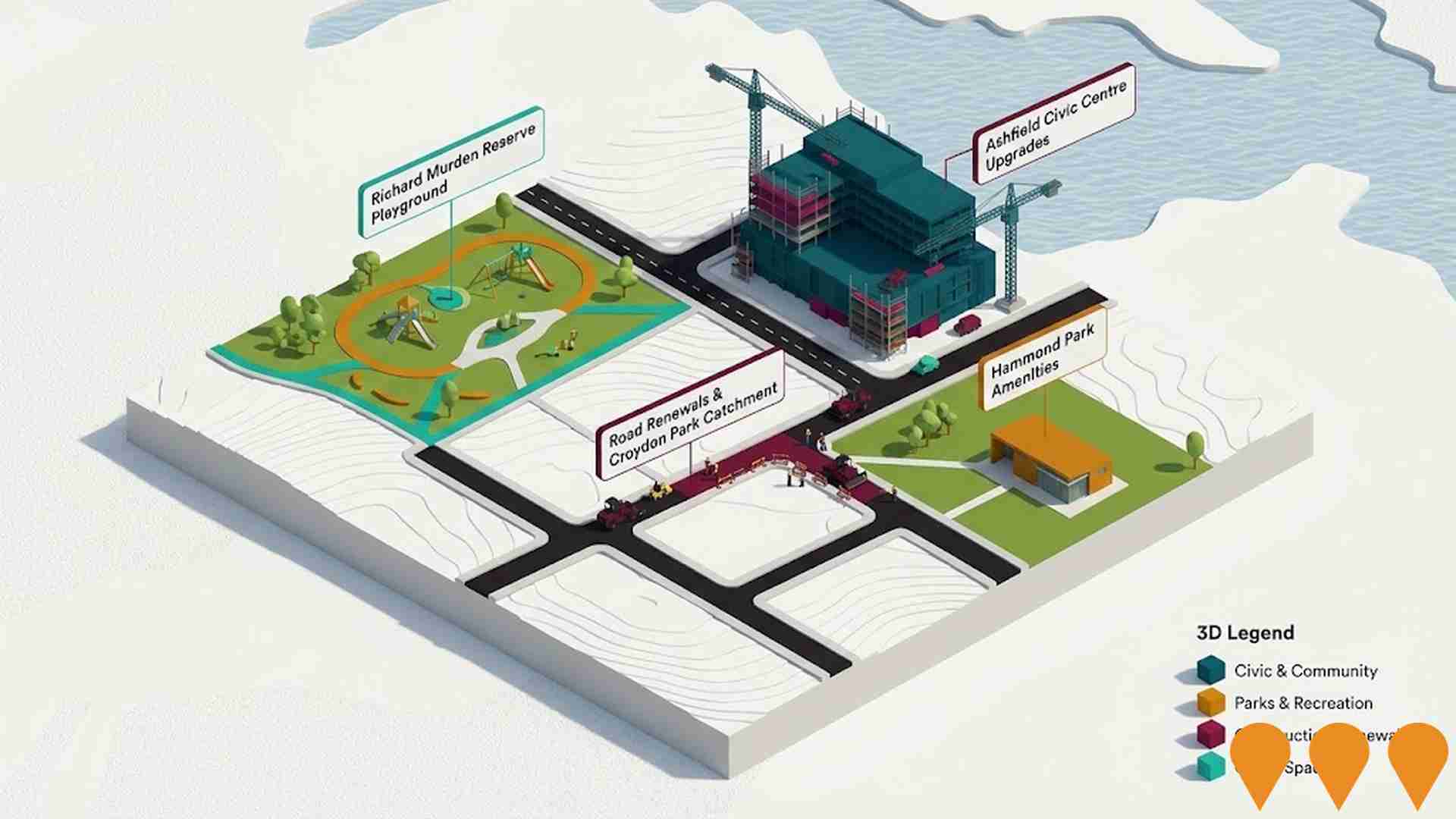

Croydon Park has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

The performance of an area can significantly be influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified a total of twelve projects that are expected to impact the area. Notable among these are Enfield Aquatic Centre Redevelopment, The Carlyle Enfield, Sydney Metro City & Southwest, and 27 Mitchell Street Croydon Park. The following list provides details on those projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro City & Southwest

A 30km metro rail extension connecting Chatswood to Bankstown. The Chatswood to Sydenham section, featuring a new harbour crossing and seven CBD stations, opened in August 2024. The final stage involves converting the 13km T3 Bankstown Line to metro standards, including upgrades to 10 stations with platform screen doors and full accessibility. Following the T3 line closure in late 2024, the project is currently in a rigorous testing and commissioning phase, with trains operating end-to-end at speeds up to 100km/h as of early 2026. The Sydenham to Bankstown section is scheduled to open in the second half of 2026.

Sydney Metro West

Sydney Metro West is a major 24-kilometre underground rail project connecting Greater Parramatta to the Sydney CBD. As of early 2026, the project has transitioned from tunnelling to track laying and station construction following the signing of four major delivery contracts worth $11.5 billion. Tunnelling for the western section is complete, and major works at Hunter Street are slated to begin in late 2026. The project will feature next-generation automated trains and nine new stations, providing a travel time of approximately 20 minutes between the two CBDs.

Canterbury Hospital Redevelopment

The NSW Government is investing $350 million in the Canterbury Hospital Redevelopment, the largest upgrade in over 25 years. The project features a new multi-storey clinical services building including an expanded Emergency Department, a new Intensive Care Unit, additional operating theatres, and purpose-built adult inpatient units. It also includes enhanced maternity and antenatal facilities, a new Diagnostic Services Unit, and improved education and research spaces. As of February 2026, the project is in the detailed design phase with a Social Impact Assessment underway and main works planning applications expected in early-to-mid 2026.

Campsie Station Metro Upgrade

The Campsie Station upgrade is a key component of the Sydney Metro City & Southwest project, converting the T3 Bankstown Line to metro standards. The project includes level access between platforms and trains, installation of platform screen doors, and mechanical gap fillers. As of February 2026, the project has reached 80% completion across the southwest corridor, with high-speed dynamic train testing at 100 km/h and water-loaded simulations currently underway. Final works focus on station signage, platform tiling, and landscaping, with passenger services scheduled to commence in the second half of 2026.

Canterbury Racecourse Place Strategy

A collaborative strategic planning project between the City of Canterbury Bankstown, the NSW Department of Planning, Housing and Infrastructure, and the Australian Turf Club. The strategy establishes a long-term vision for the 35-hectare racecourse site, exploring potential future uses such as high-density residential development, business parks, and expanded public open space, should racing operations cease. The Place Strategy process is active and directly informs the development of the Canterbury Local Centre Master Plan to ensure balanced growth and social infrastructure.

Enfield Aquatic Centre Redevelopment

State-of-the-art redevelopment of Sydney's oldest freshwater Olympic swimming pool (built 1933) featuring a new 50m outdoor pool with heating provisions, children's area, leisure centre, cafe with indoor/outdoor functionality, health and fitness centre, innovative energy-efficient plant equipment, accessible covered walkways, new shading structures and bleachers, fully accessible amenities, landscaping inspired by Aboriginal heritage, multipurpose community room, and upgraded drainage system. Community consultation completed July 2025 with design feedback being incorporated by architects.

Canterbury Leisure & Aquatic Centre

Redevelopment of the 1960s Canterbury Aquatic Centre at Tasker Park into a modern community leisure and aquatic centre. Features include a 50m outdoor heated pool with bleacher seating, 25m indoor heated pool, 20m warm water program/therapy pool with accessible spa, zero-depth children's splash park and water play area, fully equipped gym with two group fitness rooms, allied health suites, sauna, cafe, accessible change facilities including Changing Places facilities, common lawn, and improved connections to surrounding open space. Delivered by Lipman (head contractor) with Williams Ross Architects for Canterbury-Bankstown Council. Construction progressing with piling and major concrete works complete; completion scheduled for late 2026. Project includes expanded car parking and focuses on accessibility and inclusion with easily navigable circulation spaces.

NSW School Infrastructure Program - Inner West

Part of broader NSW school infrastructure program delivering new and upgraded schools across NSW. Includes funding for public school infrastructure improvements in Inner West region serving Croydon Park area students.

Employment

Employment performance in Croydon Park has been below expectations when compared to most other areas nationally

Croydon Park has an educated workforce with professional services well-represented. The unemployment rate was 4.7% in the past year, as per AreaSearch's statistical area data aggregation.

As of September 2025, 5692 residents are employed while the unemployment rate is 0.5% higher than Greater Sydney's rate of 4.2%. Workforce participation is lower at 57.4%, compared to Greater Sydney's 60.0%. Employment is concentrated in health care & social assistance, education & training, and professional & technical services, with notable concentration in education & training (1.4 times the regional average). Manufacturing shows lower representation (4.2% vs regional average of 5.7%).

The area offers limited local employment opportunities. In the year to September 2025, labour force increased by 0.4%, while employment decreased by 0.1%, causing unemployment to rise by 0.5 percentage points. This contrasts with Greater Sydney's growth in employment (2.1%) and labour force (2.4%), and a smaller unemployment increase (0.2%). As of 25-Nov-25, NSW employment contracted by 0.03% (losing 2260 jobs), with the state unemployment rate at 3.9%, lower than the national rate of 4.3%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Croydon Park's employment mix suggests local employment should grow by 6.9% over five years and 14.0% over ten years, based on a simple weighting extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income levels align closely with national averages, indicating typical economic conditions for Australian communities according to AreaSearch analysis

According to AreaSearch's aggregation of latest postcode level ATO data released for financial year ended June 2023, Croydon Park had median taxpayer income of $54,167 and average income of $71,216. These figures are above national averages of $59,827 and $79,735 respectively, and compare to Greater Sydney's levels of $60,817 and $83,003. Based on Wage Price Index growth rate of 8.86% from July 2023 to September 2025, estimated median income is approximately $58,966 and average income is $77,526 as of September 2025. From the 2021 Census, household incomes in Croydon Park are at the 52nd percentile nationally. Income analysis shows that 29.3% of population (3,324 individuals) fall within the $1,500 - $2,999 income range, similar to the region where 30.9% occupy this bracket. High housing costs consume 17.4% of income, but strong earnings place disposable income at the 54th percentile nationally. Croydon Park's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Croydon Park displays a diverse mix of dwelling types, with above-average rates of outright home ownership

Croydon Park's dwelling structures, as per the latest Census, consisted of 47.5% houses and 52.5% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Sydney metro's 33.5% houses and 66.5% other dwellings. Home ownership in Croydon Park stood at 35.0%, with mortgaged dwellings at 32.3% and rented ones at 32.6%. The median monthly mortgage repayment was $2,522, higher than Sydney metro's average of $2,436. Median weekly rent in Croydon Park was $410, compared to Sydney metro's $465. Nationally, Croydon Park's mortgage repayments were significantly higher than the Australian average of $1,863, while rents exceeded the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Croydon Park has a typical household mix, with a higher-than-average median household size

Family households account for 71.1% of all households, including 38.0% couples with children, 19.9% couples without children, and 11.5% single parent families. Non-family households make up the remaining 28.9%, with lone person households at 26.3% and group households comprising 2.7%. The median household size is 2.7 people, larger than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Croydon Park exceeds national averages, with above-average qualification levels and academic performance metrics

The area's university qualification rate is 34.2%, significantly lower than the SA4 region average of 49.5%. Bachelor degrees are most prevalent at 23.2%, followed by postgraduate qualifications (8.7%) and graduate diplomas (2.3%). Vocational credentials are held by 27.4% of residents aged 15+, with advanced diplomas at 11.1% and certificates at 16.3%. Educational participation is high, with 29.5% of residents currently enrolled in formal education: 9.0% in primary, 8.3% in secondary, and 6.5% in tertiary education.

Educational participation is notably high, with 29.5% of residents currently enrolled in formal education. This includes 9.0% in primary education, 8.3% in secondary education, and 6.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Croydon Park has 50 active public transport stops, all of which are bus stops. These stops are served by 28 different routes that together facilitate 3,072 weekly passenger trips. The accessibility of these services is rated as excellent, with residents on average being located just 156 meters from the nearest stop.

On a daily basis, there are an average of 438 trips across all routes, which equates to approximately 61 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Croydon Park is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Croydon Park shows superior health outcomes for both younger and older residents, with low prevalence rates of common health conditions. Private health cover is high here at approximately 55%, affecting around 6250 people, compared to Greater Sydney's 57.8%.

The most prevalent medical conditions are arthritis (6.6%) and asthma (6.4%), while 73% report no medical ailments, slightly lower than Greater Sydney's 77%. The area has a higher proportion of seniors aged 65 and over at 18.3%, or approximately 2076 people, compared to Greater Sydney's 14.5%. Health outcomes among seniors are above average, similar to the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Croydon Park is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Croydon Park has a high level of cultural diversity, with 38.8% of its population born overseas and 45.2% speaking a language other than English at home. Christianity is the predominant religion in Croydon Park, making up 65.2% of the population, compared to 41.2% across Greater Sydney. The top three ancestry groups are Australian (13.9%), Italian (13.9%, significantly higher than the regional average of 5.9%), and Other (12.6%, notably lower than the regional average of 17.6%).

There are notable differences in the representation of certain ethnic groups, with Spanish at 1.2% (vs 0.7% regionally), Lebanese at 7.0% (vs 3.1%), and Korean at 1.5% (vs 2.8%).

Frequently Asked Questions - Diversity

Age

Croydon Park's median age exceeds the national pattern

Croydon Park's median age is 41 years, significantly higher than Greater Sydney's average of 37 and slightly above Australia's median of 38. Compared to Greater Sydney, Croydon Park has a notably higher proportion of 55-64 year-olds (12.9%) and lower proportion of 25-34 year-olds (12.2%). Post the 2021 Census, the population aged 15-24 increased from 11.7% to 13.3%, while those aged 45-54 decreased from 15.2% to 14.0%. By 2041, demographic modeling projects significant changes in Croydon Park's age profile. The 65-74 cohort is projected to grow by 30%, adding 338 residents to reach 1,451. Residents aged 65 and older are expected to represent 63% of the population growth, while declines are projected for the 0-4 and 5-14 cohorts.